Ebang International Holdings Inc. (Nasdaq: EBON, the “Company,”

“we” or “our”), a blockchain technology company in the global

market, today announced its financial results for the fiscal year

ended December 31, 2020.

Operational and Financial Highlights for

Fiscal Year 2020

Total computing power sold in

fiscal year 2020 was 0.50 million TH/s, representing a

year-over-year decrease of 91.64% from 5.97 million TH/s in fiscal

year 2019.

Total net revenues in fiscal

year 2020 were US$19.00 million representing an 82.57%

year-over-year decrease from US$109.06 million in fiscal year

2019.

Gross loss in fiscal year 2020

was US$2.90 million representing a 90.51% year-over-year decrease

from US$30.56 million in fiscal year 2019.

Net loss in fiscal year 2020

was US$32.11 million compared to US$41.07 million in fiscal year

2019.

Mr. Dong Hu, Chairman and Chief Executive

Officer of the Company, commented, “The negative impact and

unprecedented challenges caused by COVID-19 on businesses around

the world is well documented, and we are not immune to them. Our

chip suppliers have reduced their production capacity, resulting in

our shortage of raw materials during the fiscal year of 2020. To

ensure the resilience of our business operations and deliver solid

performance after the market condition resumes normal, we have been

actively optimizing our revenue structure based on the productivity

ratio and strategically exploring expansion into blockchain-enabled

financial services. For example, we positioned our overseas

expansion by establishing subsidiaries globally and acquiring

relevant licenses or authorizations for our cryptocurrency exchange

business.”

Continued Hu, “We are committed to our mission

in strengthening the technological innovation in our products and

services to ensure their competitiveness in the global

cryptocurrency market. As previously noted, in 2021, we will

increase investments in high performance ASIC chips and mining

machines. Our abundant cash reserve allows us to expand the revenue

sources from our current business and optimize the development of

our blockchain industry chain. We believe our current businesses

have solid potential and we are working hard to deliver results

going forward that will demonstrate sequential improvement in

operating and financial metrics.”

Financial Results for Fiscal Year

2020

Total net revenues in fiscal

year 2020 were US$19.00 million representing an 82.57%

year-over-year decrease from US$109.06 million in fiscal year 2019.

The year-over-year decrease in total net revenues was primarily due

to the combined impact of COVID-19 such as travel restrictions,

mandatory quarantines and suspension of business activities, which

have caused severe disruptions and uncertainties to the Company’s

business operations and adversely affected the Company’s results of

operations and financial condition. For instance, the Company’s

chip suppliers have reduced their production capacity due to the

impact of the COVID-19, resulting in the Company’s shortage of raw

materials during the first half of 2020. And together with the

Bitcoin halving event, which significantly affected the expected

returns on Bitcoin related activities such as mining, and in turn

resulted in a much lower demand and average selling price of the

Company’s Bitcoin mining machines.

Cost of revenues in fiscal year

2020 was US$21.90 million compared to US$139.62 million in fiscal

year 2019. The year-over-year decrease in cost of revenues was in

line with the changes in the Company’s sales and the decrease in

inventory write-down.

Gross loss in fiscal year 2020

were US$2.90 million representing a 90.51% year-over-year decrease

from US$30.56 million in fiscal year 2019.

Total operating expenses in

fiscal year 2020 were US$23.75 million compared to US$20.08 million

in fiscal year 2019.

-

Selling expenses in fiscal year 2020 were US$0.93

million compared to US$1.21 million in fiscal year 2019. The

year-over-year decrease in selling expenses was in line with the

decrease in the Company’s sales as well as reduced salary and bonus

expenses relating to selling activities.

-

General and administrative expenses in fiscal year

2020 were US$22.82 million compared to US$18.87 million in fiscal

year 2019. The year-over-year increase in general and

administrative expenses was primarily due to increase in

professional fee related to the IPO process.

Loss from operations in fiscal

year 2020 was US$26.65 million compared to US$50.65 million in

fiscal year 2019.

Interest income in fiscal

year 2020 was US$0.82 million compared to US$0.22 million in fiscal

year 2019. The year-over-year increase in interest income was

primarily due to the increase in the interest income from our

investments in bonds after our IPO in 2020 and there was no bond

investment in 2019.

Government grants in

fiscal year 2020 were US$4.01 million compared to US$6.30 million

in fiscal year 2019. The year-over-year decrease in government

grants was primarily due to the decrease of non-recurring rebates

from local government.

Net loss in fiscal year 2020

was US$32.11 million compared to US$41.07 million in fiscal year

2019.

Net loss attributable to Ebang

International Holdings Inc. in fiscal year 2020 was

US$30.67 million compared to US$42.40 million in fiscal year

2019.

Basic and diluted net loss per

shares in fiscal year 2020 were both US$0.25 compared to

US$0.38 in fiscal year 2019.

Cash and cash equivalents were

US$13.67 million as of December 31, 2020, compared with US$3.46

million as of December 31, 2019.

About Ebang International Holdings

Inc.

Ebang International Holdings Inc. is a

blockchain technology company with strong application-specific

integrated circuit (ASIC) chip design capability. With years of

industry experience and expertise in ASIC chip design, it has

become a leading bitcoin mining machine producer in the global

market with steady access to wafer foundry capacity. With its

licensed or registered entities in various jurisdictions, the

Company seeks to launch a professional, convenient and innovative

digital asset financial service platform to expand into the

upstream and the downstream of blockchain and cryptocurrency

industry value chain. For more information, please visit

https://ir.ebang.com.cn/.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, the

Company’s development plans and business outlook, which can be

identified by terminology such as “may,” “will,” “expects,”

“anticipates,” “aims,” “potential,” “future,” “intends,” “plans,”

“believes,” “estimates,” “continue,” “likely to” and other similar

expressions. Such statements are not historical facts, and are

based upon the Company’s current beliefs, plans and expectations,

and the current market and operating conditions. Forward-looking

statements involve inherent known or unknown risks, uncertainties

and other factors, all of which are difficult to predict and many

of which are beyond the Company’s control, which may cause the

Company’s actual results, performance and achievements to differ

materially from those contained in any forward-looking statement.

Further information regarding these and other risks, uncertainties

or factors is included in the Company's filings with the U.S.

Securities and Exchange Commission. These forward-looking

statements are made only as of the date indicated, and the Company

undertakes no obligation to update or revise the information

contained in any forward-looking statements as a result of new

information, future events or otherwise, except as required under

applicable law.

Investor Relations Contact

For investor and media inquiries, please

contact:

Ebang International Holdings Inc.Email:

ir@ebang.com.cn

Ascent Investor Relations LLCMs. Tina XiaoTel:

(917) 609-0333Email: tina.xiao@ascent-ir.com

EBANG INTERNATIONAL HOLDINGS

INC.CONSOLIDATED BALANCE SHEETS

(Stated in US dollars)

|

|

December 31,2020 |

|

|

December 31,2019 |

|

| ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

13,669,439 |

|

|

$ |

3,464,262 |

|

|

Restricted cash, current |

|

406,857 |

|

|

|

2,270,588 |

|

|

Debt investments |

|

40,835,000 |

|

|

|

- |

|

|

Accounts receivable, net |

|

7,205,113 |

|

|

|

8,128,178 |

|

|

Notes receivable |

|

765,967 |

|

|

|

- |

|

|

Advances to suppliers |

|

221,186 |

|

|

|

1,062,049 |

|

|

Inventories, net |

|

3,845,091 |

|

|

|

13,088,542 |

|

|

Prepayments |

|

522,808 |

|

|

|

591,031 |

|

|

Other current assets, net |

|

1,128,599 |

|

|

|

224,452 |

|

|

Total current assets |

|

68,600,060 |

|

|

|

28,829,102 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

29,123,243 |

|

|

|

13,224,761 |

|

|

Intangible assets, net |

|

23,077,435 |

|

|

|

3,784,153 |

|

|

Operating lease right-of-use assets |

|

898,335 |

|

|

|

1,280,076 |

|

|

Operating lease right-of-use assets - related party |

|

17,701 |

|

|

|

37,266 |

|

|

Restricted cash, non-current |

|

47,455 |

|

|

|

43,317 |

|

|

Deferred tax assets |

|

- |

|

|

|

8,542,715 |

|

|

VAT recoverable |

|

21,897,063 |

|

|

|

21,954,169 |

|

|

Other assets |

|

538,934 |

|

|

|

4,915,487 |

|

|

Total non-current assets |

|

75,600,166 |

|

|

|

53,781,944 |

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

144,200,226 |

|

|

$ |

82,611,046 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,762,187 |

|

|

$ |

11,832,003 |

|

|

Notes payable |

|

1,087,673 |

|

|

|

- |

|

|

Accrued liabilities and other payables |

|

21,921,614 |

|

|

|

13,739,041 |

|

|

Loans due within one year, less unamortized debt issuance

costs |

|

765,967 |

|

|

|

4,864,697 |

|

|

Operating lease liabilities, current |

|

659,807 |

|

|

|

793,521 |

|

|

Operating lease liabilities – related party, current |

|

17,701 |

|

|

|

37,266 |

|

|

Income taxes payable |

|

556,137 |

|

|

|

521,648 |

|

|

Due to related party |

|

5,652,833 |

|

|

|

6,242,824 |

|

|

Advances from customers |

|

832,842 |

|

|

|

1,015,675 |

|

|

Total current liabilities |

|

34,256,761 |

|

|

|

39,046,675 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Long-term loans – related party |

|

- |

|

|

|

17,632,000 |

|

|

Deferred tax liabilities |

|

872 |

|

|

|

- |

|

|

Operating lease liabilities, non-current |

|

118,827 |

|

|

|

361,747 |

|

|

Total non-current liabilities |

|

119,699 |

|

|

|

17,993,747 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

34,376,460 |

|

|

|

57,040,422 |

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

Ordinary share, HKD0.001 par value, 380,000,000 shares authorized,

nil and 111,771,000 shares issued and outstanding at December 31,

2020 and 2019, respectively |

|

- |

|

|

|

14,330 |

|

|

Class A ordinary share, HKD0.001 par value, 333,374,217 shares

authorized, 89,009,554 and nil shares issued and outstanding as of

December 31, 2020 and 2019, respectively |

|

11,411 |

|

|

|

- |

|

|

Class B ordinary share, HKD0.001 par value, 46,625,783 shares

authorized, 46,625,783 and nil shares issued and outstanding as of

December 31, 2020 and 2019, respectively |

|

5,978 |

|

|

|

- |

|

|

Additional paid-in capital |

|

138,288,921 |

|

|

|

23,888,023 |

|

|

Statutory reserves |

|

11,049,847 |

|

|

|

11,049,847 |

|

|

Accumulated deficit |

|

(38,581,419 |

) |

|

|

(7,905,999 |

) |

|

Accumulated other comprehensive loss |

|

(7,648,332 |

) |

|

|

(9,066,842 |

) |

|

Total Ebang International Holdings Inc. shareholders’

equity |

|

103,126,406 |

|

|

|

17,979,359 |

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

6,697,360 |

|

|

|

7,591,265 |

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

109,823,766 |

|

|

|

25,570,624 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

$ |

144,200,226 |

|

|

$ |

82,611,046 |

|

|

|

|

|

EBANG INTERNATIONAL HOLDINGS

INC.CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS(Stated in US

dollars)

|

|

For the year ended December 31,

2020 |

|

|

For the year ended December 31,

2019 |

|

|

For the year ended

December 31,2018 |

|

|

Product revenue |

$ |

9,677,278 |

|

|

$ |

93,255,813 |

|

|

$ |

310,856,407 |

|

|

Service revenue |

|

9,327,023 |

|

|

|

15,804,253 |

|

|

|

8,185,386 |

|

|

Total revenues |

|

19,004,301 |

|

|

|

109,060,066 |

|

|

|

319,041,793 |

|

|

Cost of revenues |

|

21,903,644 |

|

|

|

139,623,799 |

|

|

|

294,596,001 |

|

|

Gross profit (loss) |

|

(2,899,343 |

) |

|

|

(30,563,733 |

) |

|

|

24,445,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

925,373 |

|

|

|

1,213,294 |

|

|

|

4,095,835 |

|

|

General and administrative expenses |

|

22,822,085 |

|

|

|

18,870,794 |

|

|

|

51,410,864 |

|

|

Total operating expenses |

|

23,747,458 |

|

|

|

20,084,088 |

|

|

|

55,506,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(26,646,801 |

) |

|

|

(50,647,821 |

) |

|

|

(31,060,907 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

824,435 |

|

|

|

217,200 |

|

|

|

453,991 |

|

|

Interest expenses |

|

(728,346 |

) |

|

|

(2,041,491 |

) |

|

|

(921,047 |

) |

|

Other income |

|

81,733 |

|

|

|

84,992 |

|

|

|

1,139,514 |

|

|

Exchange gain (loss) |

|

(288,346 |

) |

|

|

5,693,798 |

|

|

|

(403,544 |

) |

|

Government grants |

|

4,006,567 |

|

|

|

6,298,893 |

|

|

|

798,680 |

|

|

VAT refund |

|

- |

|

|

|

9,138 |

|

|

|

27,368,030 |

|

|

Other expenses |

|

(108,624 |

) |

|

|

(287,530 |

) |

|

|

(8,289,391 |

) |

|

Total other income |

|

3,787,419 |

|

|

|

9,975,000 |

|

|

|

20,146,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes provision |

|

(22,859,382 |

) |

|

|

(40,672,821 |

) |

|

|

(10,914,674 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes provision |

|

9,251,542 |

|

|

|

400,311 |

|

|

|

899,586 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

|

(32,110,924 |

) |

|

|

(41,073,132 |

) |

|

|

(11,814,260 |

) |

|

Less: net income (loss) attributable to non-controlling

interest |

|

(1,435,504 |

) |

|

|

1,330,237 |

|

|

|

494,234 |

|

|

Net loss attributable to Ebang International Holdings

Inc. |

$ |

(30,675,420 |

) |

|

$ |

(42,403,369 |

) |

|

$ |

(12,308,494 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(32,110,924 |

) |

|

$ |

(41,073,132 |

) |

|

$ |

(11,814,260 |

) |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

1,960,109 |

|

|

|

(1,188,488 |

) |

|

|

(11,363,682 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss |

|

(30,150,815 |

) |

|

|

(42,261,620 |

) |

|

|

(23,177,942 |

) |

|

Less: comprehensive income (loss) attributable to

non-controlling interest |

|

(893,905 |

) |

|

|

1,330,237 |

|

|

|

494,234 |

|

|

Comprehensive loss attributable to Ebang

International Holdings Inc. |

$ |

(29,256,910 |

) |

|

$ |

(43,591,857 |

) |

|

$ |

(23,672,176 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share attributable to Ebang

International Holdings Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.25 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.36 |

) |

|

Diluted |

$ |

(0.25 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.36 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

121,941,226 |

|

|

|

111,771,000 |

|

|

|

33,808,506 |

|

|

Diluted |

|

121,941,226 |

|

|

|

111,771,000 |

|

|

|

33,808,506 |

|

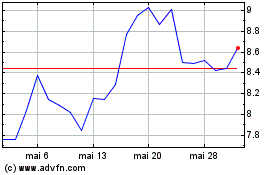

Ebang (NASDAQ:EBON)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Ebang (NASDAQ:EBON)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024