Filed Pursuant to Rule 424(b)(3)

Registration No. 333-281987

1,299,999 Shares of Common Stock

Elevai

Labs Inc.

This prospectus relates to the resale of 1,299,999

shares of common stock, par value $0.0001 per share, by the selling stockholders (the “Selling Stockholders”) of Elevai Labs

Inc. We will not receive any proceeds from the sale or other disposition of shares by the Selling Stockholders.

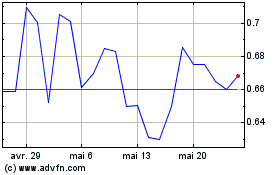

Our common stock is listed on The Nasdaq Capital

Market under the symbol “ELAB.” The closing price of our common stock on September 10, 2024 was $0.282 per share.

Any shares sold by the Selling Stockholders will

occur at prevailing market prices or in privately negotiated prices. The distribution of securities offered hereby may be effected in

one or more transactions that may take place in ordinary brokers’ transactions, privately negotiated transactions or through sales

to one or more dealers for resale of such securities as principals. Usual and customary or specifically negotiated brokerage fees or

commissions may be paid by the Selling Stockholders.

On September 20, 2024, a registration

statement under the Securities Act of 1933, as amended (the “Securities Act”) with respect to a public offering of

common stock, was declared effective by the Securities and Exchange Commission (the “SEC”). We will receive

approximately $7.0 million in net proceeds from the offering, which will terminate on September 24, 2024, after payment of placement agent fees

and other expenses of the offering assuming that we sold 100% of the securities offered in the offering (or approximately $5.2

million, $3.3 million and $1.5 million if we sold 75%, 50% and 25% of the securities offered in the primary offering,

respectively).

Investing in our common stock involves a high

degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 22 of the

primary offering prospectus contained in the registration statement of which this prospectus forms a part, to read about factors you

should consider before buying our common stock.

Neither the SEC nor any state securities commission

nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is September 20, 2024

PROSPECTUS

SUMMARY

This summary highlights selected information

from this prospectus and does not contain all of the information that you need to consider in making your investment decision. You should

carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks

of investing in our securities discussed under the heading “Risk Factors” contained in the applicable prospectus supplement

and any related free writing prospectus.

The Company

Elevai Labs Inc. manages and operates a diverse

portfolio of three wholly owned subsidiaries across the medical aesthetics and biopharmaceutical sectors:

| ● | Elevai Skincare Inc.

specializes in developing and commercializing innovative skincare products, catering to both

business to business (“B2B”) and business to consumer (“B2C”) markets

in the US and internationally. Please visit our website at www.elevaiskincare.com (which

website is not incorporated by reference herein or made a part hereof). |

| ● | Elevai Biosciences Inc.

is a biopharmaceutical company focusing on the development and acquisition of cutting-edge

aesthetic medicines and therapeutic products. Our lead asset, EL-22, is leveraging a first-in-class

engineered probiotic approach to address obesity’s pressing issue of preserving muscle

while on weight loss treatments, including GLP-1 receptor agonists. Please visit our website

at www.elevaibio.com. |

| ● | Elevai Research Inc.,

based in Canada, is currently dedicated to medical scientific research and development efforts,

utilizing Canadian research grants and partnering with leading Canadian Universities to push

the boundaries of innovation. |

As of June 30, 2024, all of the Company’s

revenue has been derived from the sales of skincare products through our Elevai Skincare business.

Elevai Labs Inc. is committed to expanding its

portfolio by acquiring operating companies and biotech assets that have high market potential while also exploring strategic spin-off

opportunities to support our growth and advance our cutting-edge initiatives.

Elevai Skincare Inc.

Elevai Skincare Inc. is a physician-dispensed

skincare company with a focus on modernizing aesthetic skincare. We conduct research and development to advance innovative

and science-driven topical skincare that complements the medical aesthetics industry. Upon our founding in 2020, we initiated our research

and development phase for our current product formulations. Since 2022, we have principally employed a business-to-business model in

which we produce and commercialize a new generation of topical skincare products that contain our proprietary stem cell-derived

Elevai Exosomes™ designed to enhance the appearance of skin. Elevai Skincare is now preparing to expand its marketing efforts and

is pursuing a focused online e-commerce sales model into its sales approach. This includes diversifying marketing channels and implementing

360-degree marketing tactics to reach a broader audience. While these efforts are to broaden its customer reach, Elevai Skincare remains

committed to maintaining the core relationships with medical aesthetic professionals and physicians that have been fundamental to the

brand’s initial success. These physician customer relationships continue to be the cornerstone of Elevai Skincare’s brand identity

and a key priority for the company.

Our exosome manufacturing process from source

to skin is known as ‘Precision Regenerative Exosome Technology™’ or ‘PREx™’. PREx™ utilizes

advanced patented stem cell processing technology as part of our cohesive production process involving carefully controlled stem cell

culture to produce stem cell derived factors that are featured in our patented topical exosome products. Specifically, as referenced

herein “exosomes” are small membrane-bound vesicles that are released by cells that are involved in intercellular communication.

They contain various types of biomolecules such as proteins, lipids, and nucleic acids, which can be transferred between cells and may

modulate and support these natural cellular processes.

Our proprietary

PREx™ biotechnology process yields exosome lots from human umbilical cord-derived

mesenchymal stem cells (“hUMSC”) for our specialty physician-dispensed skincare

products. hUMSC are adult stem cells that can differentiate into various cell types. hUMSCs

can be isolated from the Wharton’s Jelly portion of the umbilical cord and have shown

therapeutic potential in various diseases such as osteoarthritis, myocardial infarction,

and neurodegenerative diseases. Our cosmetic products are comprised of topical cosmetic solutions

to enhance the appearance of skin. Our cosmetic products are not drug products or considered

regenerative medicine, nor have any of our products received U.S. Food and Drug Administration

(“FDA”) approval. Our cosmetic products are not intended to prevent, treat or

cure diseases or medical conditions. Moreover, our cosmetic products are not intended to

be injected or delivered intravenously. Instead, our exosome-infused skincare products are

topically applied to the skin to aid in the reduction of the appearance of a range of the

most common cosmetic skin conditions, including the appearance of skin firmness, oxidative

stress, photodamage, hyperpigmentation, and texture of soft tissue deficits, such as reducing

the appearance of fine lines and wrinkles.

Elevai Biosciences Inc.

Elevai Biosciences Inc. is a biopharmaceutical

company focusing on the development and acquisition of cutting-edge aesthetic medicines and therapeutic products. Currently, more than

40% of adults in the United States live with obesity - a figure predicted to rise to approximately 50% by 2030. Obesity is a leading

risk factor for the development of serious health conditions, including Type 2 diabetes and heart failure. Goldman Sachs predicts that

this epidemic will create a $100 billion market for anti-obesity players.

Our lead asset, EL-22, is leveraging a first-in-class

engineered probiotic approach to address obesity’s pressing issue of preserving muscle while on weight loss treatments, including

GLP-1 receptor agonists. EL-22 has completed a Phase 1 clinical trial in South Korea, demonstrating it was generally well tolerated and

safe in healthy volunteers. Elevai intends to evaluate EL-22 for efficacy and safety in combination with popular weight-loss therapeutics

currently on the market, with the goal of decreasing fat mass while preventing the muscle wasting that commonly occurs with weight-loss

drugs. Our second asset, EL-32, is a preclinical engineered probiotic expressing dual myostatin & activin-A and also being positioned

for the muscle preservation space as a combination to weight loss treatments, including GLP-1 receptor agonists. In a preclinical healthy

mouse model, EL-32 demonstrated a statistically significant increase in Activin-A and myostatin antibodies, confirming the efficacy using

the ELISA test.

Elevai Research Inc.

Elevai Research Inc., an Elevai Labs company

is a Canadian company focused on research and development activities in Canada utilizing available grants.

On April 26, 2023, Elevai announced its stem

cell exosome research partnership with Dr. Stanislav Sokolenko’s Lab at Dalhousie University and a non-repayable Grant from the

Mitacs Accelerate Grants Program (“Mitacs”). Mitacs is an organization that funds projects intended to grow research and

development initiatives between industry and institutions.

ELV3000 is a two-year research collaboration

between Dr. Sokolenko’s Lab and ELEVAI LABS. The primary aim of this research project is to establish novel techniques for characterizing

the bioactive ‘payload’ of ELEVAI LABS’ exosomes and provide ELEVAI with a greater understanding of how specific exosome

contents may be attributable to positive skincare outcomes.

The secondary goal of the project is to further

optimize the ELEVAI Exosome™ production process which may improve product efficacy through exerting greater control over exosome

payloads subject to obtaining sufficient funds to pursue these efforts. The ELEVAI E-Series™ is currently the first-to-market

patented topical exosome product series intentionally developed to support skin before and after energy-based procedures to optimize

aesthetic outcomes and elevate the patient experience. The resulting process improvements are expected to result in new and improved

products designed to markedly improve the appearance of the skin, scalp, and hair.

Initial

research from this collaboration has shown the potential of our proprietary Precision Regenerative

Exosome Technology™ (PREx) in skin health, skin remodeling and wound healing in a pre-clinical

study done in partnership with Dalhousie University. The research was done in tandem with

Stanislav Sokolenko’s lab focusing on cell culture and chemical processes to further

understand the protein dynamics of our stem cell exosomes.

Elevai exosomes were found to contain over

800 proteins, these proteins were identified to be involved in skin longevity, many of which are associated with wound healing, immunomodulation,

and remodeling of the skin’s extracellular matrix. Elevai exosomes, made using Elevai’s PREx platform, represent a distinct

profile of exosomes with more proteins detected as compared to exosomes from other mesenchymal stem cells sourced from older donors,

implying that Elevai’s age-zero exosomes may provide distinct advantages over exosomes sourced from older cells or other sources

of cells.

Elevai and partner Dalhousie University are in

the process of planning additional experiments that will expand the existing scope protein research, dig deeper into the key factors

contained in Elevai exosomes, and be the basis of creation of synthetic exosomes, enabling the Elevai PREx protein profile to be

used in broader applications, including potentially medicinal indications such as wound healing and chronic wounds, and potentially create

a safe and reproducible source of encapsulated proteins that can mimic the benefits of Elevai’s cell derived exosomes. Studies

are ongoing and the Company intends to update the public over news releases as progress develops and pre-clinical data becomes available.

Market, Industry and Other Research-Based

Data

Elevai Skincare Inc.

We currently distribute

our cosmetics products through two distinct channels, including a business-to-business sales channel where we sell our products directly

within the United States and through our distribution sales channel where we sell our products directly to distributors with international

or regional reach under exclusive and non-exclusive territorial agreements. We have employed a combination of both distribution channels

via distribution agreements and directed business-to-business channels to optimize our sales reach and strategy.

The term ‘physician-dispensed’ refers

to a sales channel where cosmetics products are exclusively sold in physician clinics or medically directed businesses by licensed medical

professionals or that have a medical professional on staff, such as medical spas. Our products are only available through a medically-directed

business and are geared towards nourishing, protecting and supporting healthy looking skin. These types of cosmetics products (which

includes our Elevai Skincare products) are highly sought after by consumers making them one of the fastest growing segments of the personal

care market.1 Consumers turn to cosmetics to enhance the appearance of dull or aging skin and to brighten the skin by lessening

the appearance of a myriad of aesthetics concerns such as unwanted pigmentation, acne, melasma and rosacea. We believe that they view

these products as alternatives to medications and may try cosmetics products before using medicinal products. Physicians also value well

designed topical skincare products formulated and manufactured with our biotechnology for their complementary aesthetic effects in conjunction

with medications to improve skin appearance and to enhance the benefits of in-office procedures.

Our business-to-business model channel within

the physician-dispensed cosmetics skincare market utilizes both online sales, and our trained direct sales force comprised of employed,

and independently contracted aesthetic account managers. This business-to-business sales channel is distinct from our leverage of non-exclusive

distribution agreements with third-party distributors or resellers, who in turn sell our products to end customers. Under distribution

agreements our relationship between the seller and the buyer is more indirect, because our distributors serve as intermediaries. We believe

scaling our product lines through larger distribution sales channels may lead to faster brand expansion, recognition and market reach.

| 1 |

U.S. Beauty

& Personal Care 2023-2026 | Statista. |

The

skincare segment within the physician-dispensed market is projected to grow by a 9.6% CAGR

to reach $37.3 billion by 2030 with the US physician-dispensed cosmetics market valued at

$19.6 billion in 2023 alone.2 Outside the United States, the physician-dispensed

skincare market varies by country due to cultural differences and regulatory requirements.

Cultural desires for skin with lighter and more of an even pigmentation have created large

and growing aesthetic skincare demands throughout Asia, particularly in Japan, China, Korea,

and India. European and certain South American countries, such as Brazil, also present large

skincare markets due to the complementary growth in cosmetic procedures and willingness on

the part of their consumers to spend discretionary income on aesthetic enhancements. The

global physician-dispensed cosmeceuticals market size was valued at $9.59 billion in 2024

and is projected to reach $19.08 billion by 2031, growing at a CAGR of 8.98% from 2024 to

2031.3

Elevai Biosciences

Inc.

Currently, more than 40% of adults in the United

States live with obesity - a figure predicted to rise to approximately 50% by 2030.1 Obesity is a leading risk factor

for the development of serious health conditions, including Type 2 diabetes and heart failure. Goldman Sachs predicts that this epidemic

will create a $100 billion market for anti-obesity players.2

Approved GLP-1 drugs used in weight loss, such

as Novo Nordisk’s Ozempic® (semaglutide) & Wegovy®(semaglutide) and Eli Lilly’s Zepbound (tirzepatide), and Mounjaro®

(tirzepatide) have transformed the obesity treatment landscape. However, past studies of these highly effective drugs show that up to

20-50% of the weight loss is due to loss of lean muscle.3

Muscle is necessary for metabolism, strength, and physical function. As a result, we believe that one of the key unmet needs in the current

obesity landscape is the avoidance of muscle loss while on weight loss treatments. Elevai is developing EL-22, an engineered probiotic

with myostatin antigens, to elicit an immune response that could help people achieve substantial fat loss while preserving muscle mass.

Based on the generated preclinical data and the

mechanism of the myostatin-activin signaling pathway effect on muscle wasting, Elevai believes that EL-22 has the potential to treat

obesity in combination with GLP-1 receptor agonists by preserving muscle mass while decreasing fat mass. In the preclinical studies4,

| ● | EL-22

showed a statistically significant increase in anti-myostatin IgG antibody concentration,

where myostatin is a key negative regulator of muscle growth. |

| ● | EL-22

showed a statistically significant decrease in creatine kinase levels, which indicates a

decrease of muscle destruction. |

| ● | EL-22

administered to mdx mice, a mouse model of Duchenne muscular dystrophy,

had improved physical activity and gross motor function, as demonstrated by a longer duration

during rotarod tests. |

Based on the generated preclinical data and the

mechanism of the myostatin-activin signaling pathway effect on muscle wasting, Elevai believes that EL-22 has the potential to treat

obesity in combination with GLP-1 by preserving muscle mass while decreasing fat mass. The Company intends to complete an IND submission

in 2025 and to initiate clinical trials in the U.S. to evaluate the myostatin approach in combination with one or more GLP-1 receptor

agonists in obesity.

References:

| 1 | Ward ZJ, BleichSN, Cradock AL, Barrett

JL, Giles CM, Flax CN, Long MW, GortmakerSL. Projected U.S. State-Level

Prevalence of Adult Obesity and Severe Obesity. N Engl J Med 2019;381:2440-2450. https://www.nejm.org/doi/full/10.1056/NEJMsa1909301. |

| 2 | Why the anti-obesity drug market

could grow to $100 billion by 2030. https://www.goldmansachs.com/insights/articles/anti-obesity-drug-market.html. |

| 3 | Sargeant JA, Henson J, King JA, Yates

T, Khunti K, Davies MJ. A Review of the Effects of Glucagon-Like Peptide-1 Receptor Agonists

and Sodium-Glucose Cotransporter 2 Inhibitors on Lean Body Mass in Humans. Endocrinol Metab

(Seoul). 2019 Sep;34(3):247-262. doi: 10.3803/EnM.2019.34.3.247. PMID: 31565876; PMCID: PMC6769337. |

| 4 | Sung DK, Kim H, Park SE, Lee J, Kim

JA, Park YC, Jeon HB, Chang JW, Lee J. A New Method of Myostatin Inhibition in Mice via Oral

Administration of Lactobacillus casei Expressing Modified Myostatin Protein, BLS-M22,

Int. J. Mol. Sci. 2022, 23, 9059. https://doi.org/10.3390/ijms23169059. |

| 2 |

Physician-dispensed

Cosmeceuticals - Global Market Trajectory & Analytics | Research & Markets |

| 3 |

Physician-dispensed

Cosmeceuticals Market Size, Share & Forecast | Verified Market Research. |

Current

Products and Products in Development

Elevai Skincare Inc.

Our cosmetics products

rely on Elevai Exosomes™ that are derived from, ethically sourced and thoroughly tested, human umbilical mesenchymal stem cells

(“hUMSCs”) originating from umbilical cord tissue. We purchase our hUMSCs from third parties that source umbilical tissue

from consenting donors and are manufactured under current Good Manufacturing Practices (“cGMP”) conditions. We infuse our

product lines with exosomes derived from these hUMSCs which are replete with growth factors. Our cosmetic topical products do not contain

any living cells but do include our Elevai Exosomes™. Our cosmetics products and their safety are regulated by the FDA, however

our products, and all cosmetics generally, do not require FDA approval before being sold. Nonetheless, the FDA may pursue enforcement

action against products on the market that it deems are not in compliance with applicable laws. See “Business Regulations”

beginning at page 85 for more information.

We have integrated the

use of stem cell exosomes into our initial product line: our Elevai Post Treatment E-Series™. The E-Series™ is comprised

of two post-skincare procedure care products that target the face and neck, and upper chest regions. Our products include Empower™,

and Enfinity™ serums, which are sold exclusively through our business-to-business model channel and via our distribution agreements

channel.

Empower™ is our

after-treatment topical product that supports the appearance of healthy skin and promotes an even toned complexion. Empower™ serum

is a concentrated serum, designed specifically for application post ablative procedures and treatments such as such as energy device

treatments, mid-depth chemical peels, micro needling, or injectables. Enfinity™ is our continuing care product that we recommend

for daily use. Our Enfinity™ daily serum is a stable serum for at-home daily use that contains a blend of Elevai Exosomes™

combined with complementary stem cell growth factors. This daily product contains complimentary skincare ingredients available to support

the appearance of healthy skin including Elevai Exosomes™, vitamin C, hyaluronic acid, and copper peptides. Our exosome-based products,

Enfinity™ are designed to remain shelf stable, are subject to minimal degradation over time when used and stored as directed, and

do not require freezing or reconstitution prior to each use.

On June 26, 2024, Elevai Skincare announced its

intention to launch the Elevai S-Series Root Renewal System™, which is a three-part hair and scalp care system that utilizes

a first-in-class dual mechanism powered by exosomes and mitochondrial technology that incorporates Elevai’s proprietary PREx™

and Yuva Bioscience’s Y100 mitochondrial technology. This innovative combination is designed to address common scalp and hair care

concerns, such as the appearance of thinning hair, by promoting scalp and hair vitality. The product line is formulated to be easy to

use, cost-effective, and scientifically backed, offering a new solution for men and women experiencing hair loss and thinning hair. Marketing

is expected to begin when the Company has at least $600,000 available to complete the full product launch.

Initial Exploration

into Hair and Scalp Health

In 2022, Elevai Skincare

initiated a study to explore the application of its proprietary exosome technology, originally developed for skin care, in the realm

of hair and scalp health. This study, conducted in collaboration with the National Hair Loss Medical Aesthetics under the leadership

of Carly Klein, aimed to assess the potential of topical Elevai Exosomes™ in addressing hair loss and improving scalp health.

Details of the

Study

The study involved ten

patients suffering from androgenetic alopecia, a common cause of hair loss. The treatment protocol included an initial in-office evaluation

where baseline measurements and photos were taken followed by a scalp microneedling procedure administered by NHLMA professionals. After

microneedling, Elevai empower™, a topical exosome serum, was topically applied to the scalp. This was repeated every 4-8 weeks

for 12 months, and in between in-office treatments, a daily regimen of Elevai enfinity™, another topical exosome-based product,

was used once daily at-home on problem areas.

The results were promising:

patients experienced reduced crown inflammation, reversal of miniaturized hair, and significant recovery of hair from follicles that

appeared to be stuck in the dormant phase. These outcomes validated the potential of our exosome technology in promoting hair growth

and improving scalp conditions, setting the foundation for further advancements in the field.

Synergistic Partnership

with Yuva Biosciences

We were honored with

the People’s Choice Award at the 2022 Octane Aesthetic Technology Forum, then in 2023, Yuva Biosciences won the 2023 People’s

Choice Award at the same event. This recognition catalyzed a discussion on shared vision, leading to a partnership with Yuva, and the

collaboration was seen as a “1+1=3” scenario, where the combined power of our exosome technology and Yuva Biosciences’

Y100 mitochondrial technology seemed likely to exceed the benefits of each technology when used alone.

Yuva Biosciences had

already demonstrated the safety and efficacy of their Y100 technology in promoting hair growth, reducing signs of skin aging and supporting

mitochondrial health, a critical factor in cellular vitality and combating the effects of aging. They performed a 54 participant safety

trial with no adverse reaction or side effects reported. Then looked at twice daily application of Y100 on the scalps of women with androgenic

alopecia and 82% of participants had a measured improvement in hair growth after only 90 days. Taking this further, they also performed

a placebo controlled split face study in which YuvaBio®️ Y100™️ beat the placebo product by 57% for

smoothness/wrinkles and performed better than placebo in all other skin aging parameters assessed.

The Y100 mitochondrial

technology was identified using Yuva’s AI platform, “MitoGPT” which was co-developed by Yuva Biosciences’s Chief

Scientific Officer, Keshav K. Singh, PhD and key advisor for AI, Jeb Linton, an IBM data scientist. Dr. Singh is known for studies he

published on mitochondria, most notably his 2018 research demonstrating mitochondrial dysfunction is a key cause of aging for hair

and skin in mice, and can be reversed.

Development

of the ELEVAI S-Series Root Renewal System™

Recognizing the potential

synergy between their two technologies, we partnered with Yuva Biosciences partnered to develop the Elevai S-Series, also known as the

Elevai Root Renewal System™ (RRS). This innovative product line is designed for individuals experiencing hair loss and thinning

hair, offering a comprehensive solution for scalp and hair care.

The Elevai S-Series

Root Renewal System™ includes a shampoo, conditioner and scalp serum. The shampoo and conditioner are formulated to cleanse and

nourish the scalp, preparing it for the active treatment provided by the scalp serum. The serum, which is the cornerstone of the system,

combines nourishing Elevai Exosomes™ with the mitochondrial-supporting benefits of YuvaBio’s Y100TM technology. This

dual-action serum is designed to rejuvenate the scalp, promote healthy follicle activity, and help to address the cellular causes of

hair thinning and loss.

Ongoing Research

and Future Prospects

As part of their strategic

collaboration, ELAB and Yuva Biosciences have jointly filed two key patents that underpin the groundbreaking technologies incorporated

into the Elevai S-Series Root Renewal System™. These patents, titled “Compositions and Methods for the Treatment of Skin,

Scalp, and Hair Improvement” (Patent Application Serial No. 63/664,517) and “Preparations Including Lipid Bilayer

Nanoparticles” (Patent Application Serial No. 63/664,526), represent a significant leap forward in the science of hair and

scalp care.

While both Elevai Exosomes™

and Yuva’s Y100 technology have demonstrated positive results individually, further studies are underway to evaluate the full impact

of the combined technologies within the Elevai S-Series Root Renewal System™. These studies, conducted in collaboration with NHLMA

and other leading scalp and hair care professionals, aim to provide comprehensive data on the effectiveness of the complete system.

We expect to release

the results of these studies in the future, offering further validation of the system’s efficacy in promoting scalp health and

reversing hair loss. The upcoming findings are anticipated to reinforce our position at the forefront of innovation in the hair and scalp

care market.

The Value of Combined

Technologies

The decision to file

these patents jointly reflects the strong belief of both ELAB and Yuva Biosciences in the combined power of their respective technologies.

The synergies between our exosome technology and Yuva’s Y100 mitochondrial innovation create a comprehensive approach to scalp

and hair care that is more effective than either technology on its own. These patents not only protect the intellectual property of the

combined solution but also pave the way for future innovations that may arise from this ongoing partnership.

Our evolution from initial

research into exosome applications for hair and scalp health to the development of the Elevai S-Series Root Renewal System™ underscores

its commitment to advancing the field of skin and hair care through scientific innovation. The strategic partnership with Yuva Biosciences

has enabled the creation of a product line that combines the best of exosome and mitochondrial technologies, offering a unique, synergistic

approach to hair and scalp rejuvenation. With ongoing studies and a market launch on the horizon, the Elevai S-Series is poised to set

a new standard in the treatment of hair loss and scalp health.

Elevai Biosciences

Inc.

Elevai Biosciences Inc. has two assets in development

- EL-22 and EL-32. The lead asset, EL-22, is leveraging a first-in-class engineered probiotic approach to address obesity’s

pressing issue of preserving muscle while on weight loss treatments, including GLP-1 receptor agonists. EL-22 has completed a Phase 1

clinical trial in South Korea, demonstrating it was generally well tolerated and safe in healthy volunteers. Elevai intends to evaluate

EL-22 for efficacy and safety in combination with popular weight-loss therapeutics currently on the market, with the goal of decreasing

fat mass while preventing the muscle wasting that commonly occurs with weight-loss drugs. We are working towards filing an IND with the

FDA to test EL-22 in human subjects. Our second asset, EL-32, is a preclinical engineered probiotic expressing dual myostatin & activin-A

and also being positioned for the muscle preservation space as a combination to weight loss treatments, including GLP-1 receptor agonists.

In a preclinical healthy mouse model, EL-32 demonstrated a statistically significant increase in Activin-A and myostatin antibodies,

confirming the efficacy using the ELISA test.

Competition

The market for medical aesthetic skincare products

is highly competitive, and we expect the intensity of competition to increase in the future. Our principal competitors are large, well-established

companies in the fields of pharmaceuticals, cosmetics, medical devices and health care with greater financial and marketing resources.

Our largest direct competitors in the physician-dispensed

cosmetic skincare market, inclusive of both distribution and business-to-business market channels for our medical aesthetics cosmetics

products include SkinCeuticals, a division of L’Oréal S.A., Skinbetter Science LLC, a division of L’Oréal S.A.,

SkinMedica, Inc., a division of Allergan, Inc., ZO Skin Health, 51% owned by BlackStone, PCA Skin, EltaMD, each a division of Colgate-Palmolive,

Dermalogica, Murad, each a division of Unilever, and Alastin Skincare, a division of Galderma.

Our competitors strictly

in the business-to-business channels for medical aesthetics skincare products include The Beauty Company (Nasdaq:SKIN), Waldencast (Nasdaq:WALD),

Inmode (Nasdaq: INMD, Evolus (Nasdaq: EOLS), Revance (Nasdaq: RVNC), and Cynosure.

Several key companies are actively developing

GLP-1 drugs for obesity and complementary treatments to address associated conditions such as muscle wasting:

Versanis:

A company of Eli Lilly, Versanis’ bimagrumab, is a monoclonal antibody that blocks

activin type II receptors, directly targeting fat and muscle tissue in patients with obesity

and cardiometabolic diseases.

Biohaven (NYSE: BHVN): Biohaven’t taldefgrobep

is an investigational fusion protein targeting myostatin to impact skeletal muscle growth relevant to individuals living with overweight

and obesity.

Scholar Rock (NASDAQ: SRRK): Scholar Rock’s

apitegromab is an inhibitor of the activation of latent myostatin, with the aim of improving patients’ motor function. Scholar

Rock is assessing apitegromab’s ability to preserve lean muscle mass in individuals on GLP-1 receptor agonist therapy for obesity.

Keros (NASDAQ: KROS): Keros’ KER-065 is

an investigational activin receptor ligand trap being developed for the treatment of obesity and neuromuscular disorders. KER-065 acts

as a ligand trap and inhibit the biological effects of myostatin and activin A to increase skeletal muscle and bone mass, increase fat

metabolism and reduce fibrosis.

Veru (NASDAQ: VERU): Veru’s enobosarm is

an androgen receptor modulator, also known as a SARM, to address the loss of muscle in patients undergoing weight loss therapy with GLP-1

drugs.

Operational and Competitive Strengths

We face competition from both traditional cosmetics

brands, such as retail-focused products, as well as other high-end cosmetics brands in the physician-dispensed cosmetics space. We believe

the primary competitive factors in our favor is our Elevai Exosomes™ though our company exhibits the following additional operational

and competitive strengths:

Our Next Generation Technology and Early

Results

Elevai Exosomes™ remain our key ingredient

and main competitive strength, which is produced under proprietary and cGMP-compliant conditions in our state-of-the-art laboratory.

We have a proprietary process to stimulate our ethically sourced cGMP grade hUMSCs to produce stem-cell derived exosomes. This process

is designed to ensure that our customers consistently receive a stable, and potent product using strict standard operating procedures

under laboratory controlled in-vitro culture conditions. Thereafter, we work closely with our formulation partners so that each batch

of product is mixed according to our strict specifications. We believe we are one of the few in the physician-dispensed aesthetics industry

to incorporate next generation biotechnology into its product lines. We believe that many of our competitors market products that contain

inferior synthetic exosomes, exosomes from inferior sources, or ingredients that can be purchased anywhere. We are conducting ongoing

sponsored validation studies involving individuals with noticeable skin pigmentation and redness to determine if there is an improvement

in the appearance of skin pigmentation and redness issues when our topical products containing our Elevai Exosomes™ are applied

daily.

We continue to sponsor validation studies involving

individuals with various aesthetic skin imperfections, including skin pigmentation issues or unwanted signs of inflammation or redness,

to determine if there is an improvement in the appearance of their skin when our topical products are applied daily.

Subjects in one of our validation studies were

analyzed by an advanced imaging and analysis device called “VISIA” (manufactured by Canfield) to determine what percentage

of those subjects’ facial skin showed evidence of a change in detected levels of hyperpigmentation after twice-daily application

of our Enfinity™ daily serum over the course of approximately 12 weeks. After twelve weeks of twice daily topical application of

our Enfinity™ daily serum, follow up VISIA scans showed a six to twenty percent reduction in the area of facial skin recorded with

hyperpigmentation as compared to their initial VISIA scans. There we found that after multiple-week application of our products, those

hyperpigmented regions appeared less dark, less pronounced or noticeable, and the skin appeared to display a more balanced skin tone

and texture. This early positive assessment is based on our comparing quantified values of image data that are taken at multiple time

points throughout the validation study in order make our well quantified comparison of skin quality at the timepoints recorded. There,

the imaging data showed the intensity of the remaining hyperpigmentation on those subjects’ facial skin was visibly reduced as

compared to initial VISIA scans. However, we note that we continue to determine if we can better quantify this reduction in pigmentation

intensity as further evidence of performance is analyzed over the course of our validation studies. At this early stage, the continued

success of positive results of our products is highly subjective to consumers and we have yet to complete formal clinical validation

studies with a large cohort to demonstrate support for the performance claims of our products, such as their ability to aesthetically

improve the skin. Furthermore, any statements contained herein regarding our topical cosmetic and exosome-containing serums have not

been reviewed or approved by the FDA. Similarly, the United States FDA has relatively limited experience regulating cosmetics derived

from stem cells, and as of the date of this prospectus, there are no FDA approved medical products utilizing exosomes.

Our Product Quality, Ongoing Research and

Seamless Production Process

Many of our early-stage competitors employ contract

manufacturers and labs to handle all portions their production. Our California-based laboratory and production facility helps us protect

our trade secrets by keeping our core processes for exosome production in-house and eliminates our need to rely on contractors that may

use damaged products of inferior quality, or dangerous/unstable ingredients solely for the purpose of manufacturing our Elevai Exosomes™.

Our streamlined commercialization process is quality controlled from stem cell acquisition, through exosome production, to specifying

our standards to our contractors for formulation and bottling, ensuring continuity across the process to limit damage to our product’s

exosomes and actives. Additionally, our aesthetic account managers and senior-level staff are highly supportive of our physician clients

who rely on the quality of our product literature and educational material. This literature allows our physician clients to provide the

best information to their clients whose experience may be ultimately enhanced by choosing to use our product lines post-procedure.

Although

we are an early-stage company, we have integrated the production of our Elevai Exosomes™

with our general production process. We do not outsource any aspect of our exosome production

process or license any core technology with the exception of the Licensed Products which

we license from MOA in connection with our Elevai Biosciences business. We also have the

capability to commercialize a variety of products derived from stem cells containing innovative

encapsulated stem cell produced factors and quickly introduce new competitive products and

existing product enhancements. This capability is harnessed by our ability to produce unique

ingredients in our own lab like Elevai Exosomes™. These natural stem cell factors are

a core ingredient, and an ingredient that we believe few others can commercialize or approximate.

We maintain the ability and know-how to modulate the way the stem cells are cultured in our

laboratory space. Through modulation, we are able to produce different versions of our stem

cell exosomes, and tailor them for different purposes, such as potentially supporting and

promoting a healthy hair growth cycle. As we continue to grow our production outputs, we

expect to multiply our modalities and deliver newly and more narrowly tailored versions of

exosomes to the market in the form of our cosmetic products.

Although our ultimate goal is to achieve vertical

integration, our current focus is on promoting the manufacture of our top-quality products and reducing our costs to produce next-generation

cosmetics for the physician-dispensed cosmetic skincare market at favorable price points while generating healthy margins. We believe

our products will remain attractive to most consumers by pricing them at rates that are competitive with existing and emerging post-care

and aesthetics cosmetics companies while remaining below a pricing tier reserved for more top-end direct-to-consumer products like those

from La Mer Technology, Inc. Similarly, we believe that our pricing strategy is competitive with other competing physician dispensed

skincare brands that do not contain exosomes. We believe this price point is still attainable for consumers in the physician-dispensed

cosmetic skincare market even though our products employ the integration of patented topical exosomes that is in a similar class as existing

skincare products, but through a newer manufacturing process which we believe allows our brand to market better quality and more purified

extracellular vesicles in our products. Thus, we chose to favorably price ourselves at the top of the range that we believe the physician-dispensed

cosmetic skincare market will positively respond to.

Our Products Ease of Use, Quality Ingredients,

and Post-Procedure Benefits

We believe our products often complement the

experience- and improve the results-of most physician in-office or medical spa aesthetic face and body treatments that include laser

treatment, microneedling and ablative surgical procedures. We designed our products to provide benefits without any blood draw or needling.

Our products may also ease uneven looking or puffy skin texture associated with the post-procedure healing process by including ingredients

that assist in soothing and supporting the skin for the appearance of a more even skin tone.

To attain customer satisfaction with our products

after aesthetic face and body treatments, we carefully select high-quality active ingredients to aid in the healing process. These includes

hydrating hyaluronic acid and ceramides, to support skin health for any skin type. Alongside our Elevai Exosomes™, our products

are packed with bioavailable forms of vitamin C, and skin-restoring copper peptides. Our products are integrated into post-procedure

or treatment protocols and have achieved positive results under third-party dermal safety evaluations. Each of our products underwent

clinical dermal safety evaluations and there was no skin reactivity observed at any time over the multi-week study.

We culture our hUMSCs under carefully controlled

conditions in our lab without the use of animal components or byproducts, such as Fetal Bovine Serum (“FBS”). Aside from

our moral compass, there are many reasons to avoid animal components in our production process in particular. While this includes safety

to avoid animal borne viruses, there is more consistency and predictability for high quality exosomes when culturing hUMSCs. Although

there is much variability in any animal-derived component, they remain the primary way that most scientists around the world grow cells

in laboratories. We aim to ensure that our products do not contain any parabens, phthalates, or animal byproducts, and we never test

on animals.

We believe the application of our topical products

can reduce redness, brighten skin, improve wrinkles and skin texture to promote healthy looking skin and the appearance of rejuvenation.

Depending on consumer needs, our skin products are designed to either be directly applied topically after an aesthetics or ablative procedure

or applied daily. At this preliminary stage, the continued success of the early positive results of our products is highly subjective

to consumers and we have yet to complete clinical validation studies to demonstrate support for any performance claims of our products,

such as their ability to aesthetically improve the skin. Furthermore, any statements contained herein regarding our topical cosmetic

and exosome-containing serums have not been reviewed or approved by the FDA.

Established

Partnerships with Major Industry Players and Our Local Community

Our position as an early mover in utilizing patented

topical exosome skincare technology in the physician-dispensed markets has attracted various industry leaders to become our non-exclusive

or exclusive partners, creating an extensive network for us to leverage. We believe the expertise and market coverage of both our exclusive

and non-exclusive distribution agreements with channel partners broaden our executional capability, reduce our execution risk, and provide

immediate market access to increase the speed at which our products can reach the market. These partnerships solidify our position as

a smaller company with substantial technological expertise. Additionally, our exclusive and non-exclusive distribution partnerships have

allowed our products to enter Asian and Canadian international markets via our third-party distributors, in a capital efficient manner.

However, following regulatory action taken by Health Canada we terminated our international agreement in Canada and suspended marketing

and sales efforts in Canada. See the Risk Factor titled “We have suspended sales in Canada beginning in March 2024 after receiving

correspondence from Health Canada indicating that our products are not compliant with applicable Canadian laws and regulations, and no

assurances can be made that we will be able to resolve this issue with Health Canada and re-commence sales there, or that similar or

related issues will not arise in other jurisdictions, any of which would materially harm our business and operating results”

on page 29 of the primary offering prospectus. In addition to our white-label distribution agreement, we may plan to pursue strategic

co-development opportunities and arrangements that further enhance our product pipeline to create effective synergies to supplement our

product offerings in the physician-dispensed market. Our current collaboration with many high-volume distributors provides valuable knowledge

that we believe will enhance our early mover advantage.

On April 1, 2023, the

Mitacs-Accelerate Grants Program via the Office of Commercialization and Industry Engagement (OCIE) Dalhousie University in Nova Scotia,

Canada awarded our team $90,000 Canadian Dollars under a two-year research grant in relation to a project entitled “Multiomic characterization

of stem cell derived extracellular vesicles for supporting the skin.” Under this project, we will engage an intern from Dalhousie

University’s Department of Process Engineering & Applied Science under the tutelage of Dr. Stansislav Sokolenko who is responsible

for completing a report about the project that is reviewed by their faculty supervisor and presented to our team. The primary aim of

this research project, called “ELV3000”, is to establish new and novel techniques for characterizing the bioactive ‘payload’

of our Elevai Exosomes™ in order to provide us with a greater understanding of how specific exosome contents may be attributable

to positive skincare outcomes. The secondary aim of the research project will be to further optimize our Elevai Exosomes™ production

process to eventually improve our products by exerting greater control over exosome payloads subject to obtaining sufficient funds to

pursue these efforts. This detailed characterization will be conducted using a combination of traditional and advanced techniques and

will build on other work currently being performed by us and our contract research partners.

Additionally, we partner with local California

universities through a federally funded program called “CareerCONNECTED” Federal Work Study (“CCFWS”) to maintain

roots in the surrounding area. The CareerCONNECTED program provides low-income students an opportunity to learn real world skills they

would not traditionally receive in an academic setting. 60% of the interns’ pay is federally funded and we pay the other 40% of

their salary. We benefit immensely from these interns and believe it is mutually beneficial to our growth to work with eager, academic

minded individuals who can help us with our more time intensive tasks that slow down our general operations. This in turn helps our lab

team reduce production time to make our exosome enriched media. Along with the interns assisting the lab team, we in turn teach them

essential lab skills that will benefit them going forward in their science careers. We believe the program gives us an advantage in training

future scientists to our specifications and potentially selecting future employees from the intern pool that are already received high

quality training that can meet our lab specifications. Any future opportunity to hire our trained interns reduces the time and the opportunity

costs that we would normally incur with training a newly hired, full time lab tech.

We continue to grow through allying with channel

partners, local universities, and strategic investors globally and expect these relationships will enhance our credibility, relationship

with the surrounding community, generate better leads, and future conversion of customers. These investments will ultimately enable us

to be more agile in achieving our goals in the shortest time and leverage further investment into our technological strengths alongside

our partners’ connections and relationships.

Our

Well Recognized and Award-winning Team and Brand

We produce our Elevai Exosomes™ using

a proprietary process called Precision Regenerative Exosome Technology, or PREx™, which has been developed and perfected by Jordan

R. Plews, PhD. Dr. Plews is a published biochemical engineer with expertise in molecular biology and stem cells, which we believe will

enable our ability to scale our concepts as we develop other novel product lines. We believe we can efficiently bridge the knowledge-gap

between engineering and processing because of our research and aptitude in both fields. Using both vocations improves our ability to

isolate re-agents and stem-cell material to identify novel proof of concepts on a biochemical and molecular level while efficiently harnessing

processes to produce and market those concepts at scale.

Under Dr. Plews and our other founder and former

director and Chief Medical Officer, Dr. Hatem Abou-Sayed (known professionally as “Tim Sayed MD”), a double board-certified

plastic surgeon with nearly two decades of experience in the medical aesthetics market, we have made a number of strategic hires to assemble

our management heads who in turn have recruited an experienced sales and marketing team. Together, our team has demonstrated its ability

to identify new business opportunities and to develop our business by growing our global distribution networks. Similarly, we are privileged

to include a number of strategic advisors and consultants as members of our team including NorthStrive Companies Inc., Kevin Green, Roger

A. Fielding, PhD, Eduardo Grunvald, MD and Orian Shirihai, MD, PhD.

To that end, our brand has received a number

of awards and accreditations, and we have been featured in exposés in recognition of our products and innovation. Those awards

and recognitions include the People’s Choice Award after presenting at the Octane Aesthetics Tech Summit annual event, as part

of the small business accelerator called the LaunchPad SBDC (Small Business Development Center). Additionally, we have been featured

in the Aesthetic Guide Magazine, New Beauty Magazine, Grazia Magazine and MedEsthetics Magazine, among others.

Strategy

We believe we have the potential to be one of

the most disruptive brands in the physician-dispensed cosmetics skincare market. We are in the early stages of new product development

and believe we have significant room to grow by attracting more consumers to the brand, making our current products more widely available

and offering more innovative products to our consumers. We expect the United States to be the largest source of our growth over the next

few years and see ample opportunity to expand in select international markets. We also believe we have an opportunity to improve our

margins through greater operating leverage and efficiency once we begin distributing our product more widely.

In addition, we plan to strategize on acquiring

operating entities and/or assets with high potential, financing their growth, and identifying potential spin-off opportunities. Through

acquisitions, we aim to integrate businesses that can benefit from our resources and expertise, thereby accelerating their growth trajectories.

We intend to support the growth of acquired entities through a mix of equity and debt financing and by leveraging any available grants,

fostering innovation, expanding market reach, and improving operational efficiencies. As part of our growth strategy, we continuously

evaluate opportunities to spin off entities or specific assets, which will allow us to add value and strategically align our overall

portfolio by creating independent and focused companies. This strategic approach positions us to leverage advanced research and development

across various industries and address significant market needs.

Our Technology and Research

We believe we are one of the first to adapt stem

cell technology from cGMP grade hUMSCs to produce purified extracellular vesicles, also referred to as exosomes into topical skincare

products to capture market share in the high growth physician-dispensed cosmetics skincare market. This strategy is not only based on

our understanding of consumers’ interest in the appearance of a quicker post-procedure recovery, but our research into what the

physician-dispensed cosmetics skincare market is currently lacking and our belief in our products’ ability-based on early

imaging data leveraging quantitative analysis and visual assessments of photographic progress photos. Our imaging study data is gathered

utilizing an advanced imaging and analysis device made by Canfield Scientific, called “VISIA”. This complexion analysis system

captures high-quality, standardized images that are monitored following a medical aesthetic procedure at regular intervals to assess

redness, discomfort, tone, texture, wrinkles, and other measures of skin appearance.

Since

2020, we have invested in the creation of a commercial process that began in 2022 which leverages

the use of hUMSCs to produce extracellular vesicles, or exosomes in our products because

not only do these factors have the ability to enhance the appearance of the skin, but they

can do so without the tumorigenic or ethical concerns associated with the use of embryonic

stem cells or induced pluripotent stem cells.4 Because we recognized the potential

of utilizing hUMSCs for the skin, it was natural for us to utilize them as the basis for

formulating our products. This is founded on our belief that our products can improve the

appearance of skin prone to appearing temporarily red and puffy that is normally experienced

by consumers while attending to their aesthetics needs in physicians’ offices or medical

spas.

On January 16, 2024, we entered into the License

Agreement (the “INmune License Agreement”) with INmune Bio, Inc. (“INmune”), of which INmune granted us certain

worldwide exclusive and non-exclusive license rights to develop, manufacture, and commercialize INmunes’s EMx technology, a proprietary

equipment, processes and consumables useful for isolation and current Good Manufacturing Practice manufacture of human umbilical cord

derived mesenchymal stromal cells for a period of ten years from the effective date of the INmune License Agreement. This technology

enables the efficient production of cGMP grade mesenchymal stromal cells (hucMSCs) from human umbilical cords, which can be incorporated

into Elevai Labs’ licensed topical cosmetic products. The adoption of this technology is expected to lower production costs and

enhance product quality, supporting Elevai’s goal of vertical integration in manufacturing.

The financial terms of the INmune License Agreement

include a tech transfer fee of $1,000,000, which we agreed to pay in installments over two years, with the final payment of $600,000

subject to potential acceleration on the successful transfer of the technology, marked by the first GMP manufactured batch of a licensed

product. Additionally, Elevai Labs will pay royalties on sales of products utilizing the “Mx” technology. For cosmetic products,

there is an option to buy out the royalty after five years or once a specified royalty threshold is met. For potential drug products,

royalties will be negotiated based on sales. The INmune License Agreement emphasizes compliance with ethical standards and cGMP regulations,

ensuring that all products are sourced ethically and manufactured to high standards. Elevai Labs is required to provide annual sales

and royalty reports to INmune Bio, with INmune Bio retaining audit rights every two years. Strategically, the INmune License Agreement

aligns with Elevai Labs’ mission to lead innovation in stem cell exosome products, bolstering manufacturing capabilities and expanding

product offerings in the medical aesthetics market.

A Visionary and Experienced Management Team

We have made significant investments in our business

over the past three years by building our own exosome manufacturing lab, hiring top talent to help us build functional and streamlined

capabilities in our commercialization process. Our management team comes from leading international skincare companies, with world-class

research, marketing, and e-commerce experience to implement growth strategies and drive operational improvements.

Brand and Product Expansion

We plan to continue to grow our young brand’s

reputation. We plan to continue to expand our brand by attending events, presenting at scientific and medical aesthetic and cosmetic

skincare conferences, and conducting clinical validation studies to further validate the aesthetic results of our products. We believe

what differentiates us from many traditional cosmetics companies is our lean, but aggressive ability to make fast market-driven decisions

and execute with quality control standards. We believe we have a major speed-to-market advantage over many other companies

because of our size and aptitude in bioprocessing. Similarly, we are highly responsive to market-trends alongside physician and aesthetics

consumer needs alike. We will continue to leverage our executional excellence as we combine our aptitude in stem cell research and bioprocessing

while seeking to become the preferred partner of our key customers. Additionally, we have a robust product pipeline that we believe is

likely to address the many evolving needs of customers, physicians, and clinicians in the aesthetic and cosmetics market ultimately increasing

our branding and the number of customers we serve.

Channel Expansion, Production Capacity, and

International Growth

While our current focus is on the physician-dispensed

market, we intend to expand into other sales channels including e-commerce by growing the information available on our website and making

our products available for purchase through our medical-spa, physician and physician group partners’ websites. We believe being

featured on a variety of partner websites will strengthen our brand and provide a unique direct-to-consumer e-commerce model via our

business-to-business relationships where our e-commerce partners receive a share of product purchase revenue. Ultimately, our business-to-business

model will strengthen our relationships with our physician partners, while an eventual e-commerce model broadens our market exposure

and drive traffic and conversion to our other social media profiles. Additionally, we expect our current and prospective exclusive and

non-exclusive distribution agreements to penetrate global markets and pique consumer interest not typically within our current reach.

We believe both our products and white-label products can drive new market demand for our brand in those international markets that our

distribution partners sell our products in.

| 4 |

Gao, F.,

et al., Mesenchymal stem cells and immunomodulation: current status and future prospects. Cell Death Dis, 2016. 7: p. e2062. |

We

intend to expand the production capacity of our products and to develop new pipeline products

in response to a number of potential growth factors, including: our organic growth, the development

of research and development of pipeline products, and the expected increase in our product

popularity, expansions of our distributor networks and channels through exclusive and non-exclusive

international distributional agreements, and other potential strategic partnerships with

industry leaders. Moreover, in addition to and as a result of the foregoing growth factors

we expect an increase in orders for our products and a continuous rise in sales volume in

the future based on our market research and estimates. To keep pace with this rise in sales

volume, we anticipate the need to expand our production capacity by March 31, 2025. This

expansion will enable us to meet our projected demand and we anticipate doubling our production

capacity would cost between $1,500,000 and $2,000,000. This additional capital would cover

our expenses relating to expanded capacity, including increased rent, additional lab equipment,

and an increase to our overall headcount. We expect a production capacity expansion will

lower manufacturing costs through economies of scale and improve overall cost-efficiency

and profit margins. Ultimately, by expanding our capacity we believe we can provide our products

at a competitive price, especially to cost-sensitive physicians or medical spa owners, and

consumers in the skincare aesthetics market, who may be relatively new to the concept of

medical aesthetics cosmetic skincare.

If we achieve this estimated growth, we will

incur additional costs. To expand a single pipeline product, we currently estimate capital requirements of approximately $250,000 for

equipment to support the initial development of that product. We further estimate needing an additional $100,000 worth of funds to arrange

for the testing protocol, clinical validations and to fully launch any product at scale. We estimate the operational framework to prepare

for the launch of a pipeline product such as a topical haircare product, would take six to twelve months of development work with an

additional four to six months to fully scale such product before an official product launch. These estimates depend on whether we may

need to expand our operations and development work of any new pipeline product, which is dependent on the results of the development

work, continued research and initial rounds of validation testing.

Currently, we distribute our products both directly

and indirectly. We distribute directly in the United States through both our business-to-business sales channel and indirectly through

our sales distribution channel via licensing and manufacturing agreements with third-party distributors. Under our distribution agreements,

third party distributors include our products in their suite of domestic and international sales. Under this sales distribution channel,

we sell our products to a distributor, who resells our products to the physician practice customers after placing their order in a designated

territory that is either exclusive or non-exclusive to that distributor. We have broadened our sales channel to include our cosmetic

product offerings at medical spa locations.

To bolster our regional sales, we entered into

a non-exclusive authorized distribution agreement in August 2022 with Refine USA, LLC (“Refine”), one of the preeminent manufacturers

and distributors of innovative aesthetic medical device technologies and clinical grade skincare. Under the agreement, Refine may purchase

unlimited quantities of our topical cosmetics subject to minimum order size limits and distribute them throughout the United States to

their network of consumers and physicians. As we continue to enhance our own United States sales channels, we are focused on bringing

on third-party distributors in key large international markets, such as Europe, Brazil, Southeast Asia and the Middle East. We also plan

to drive the distribution of our products through strategic relationships in specific countries, such as Japan. To continue growing in

the physician-dispensed market, we intend to onboard more direct sales representatives that can reach geographic markets we currently

do not have a presence in and partner with cosmetic device companies to co-market and sell our products.

Research

and Development

Elevai Skincare

Research and Development

Our research and development

efforts are focused on improving and enhancing our existing products as well as developing new products. We undertake research and development

on new product formulations and execute studies on existing products and future products that demonstrate what we believe to be the high-quality

design of our formulas and the powerful performance of our products.

While we currently primarily focus on bringing

physician-dispensed cosmetic aesthetics products to market and supporting the skin, we are in the process of researching and developing

applications for hair, both on the face and head, and have ongoing research into additional, customized applications. Currently, many

companies and competitors alike talk about exosomes as though they are one single ingredient with the innate ability to do many different

jobs. However, research shows that certain exosomes released by certain cells are directly correlated with the cells they originate from

and those particular exosomes’ capabilities and contents vary based on the cell type used and the way those cells have been treated

or cultured.5 Thus, this research shows the contents of exosomes vary widely depending on the cell type used to generate them,

their culture conditions, their processing and storage conditions, and how they are applied or used. Knowing this, we use highly-trained

professionals to isolate and culture our hUMSCs and the resulting secreted exosomes are produced using strict protocols.

After formulation, all

pipeline products are tested for integrity, safety, and performance. Prior to launch, our pipeline products undergo several safety tests,

including, but not limited to, human repeat insult patch tests, used to help predict the likelihood of induced allergic contact dermatitis,

comedogenicity tests, to prevent the product clogging pores, and cumulative irritation tests, to evaluate the skin irritation potential

and safety of individual ingredients or cosmetic compounds. Our products and their ingredients are also tested at multiple steps in the

process to avoid any microbial contamination.

We currently work with Radyus Research to utilize

a number of advanced analytical techniques that we believe will help us improve our current processes and keep our brand at the forefront

of exosome product production. To analyze our exosomes, we and Radyus Research leverage NanoSight, a nanoparticle tracking analysis instrument

so we may evaluate the proteomic characteristics (or characterization of the protein makeup) of our exosomes. Through this thorough process

we access the make-up of our finalized exosomes while balancing the efficiency of different adjustments to our cell-culturing production

process.

| 5 |

Kugeratski,

Fernanda G., and Raghu Kalluri. “Exosomes as mediators of immune regulation and immunotherapy in cancer.” The FEBS

journal 288.1 (2021): 10-35; Lobb, Richard J., et al. “Oncogenic transformation of lung cells results in distinct exosome protein

profile similar to the cell of origin.” Proteomics 17.23-24 (2017): 1600432; Camussi, Giovanni, et al. “Exosome/microvesicle-mediated

epigenetic reprogramming of cells.” American journal of cancer research 1.1 (2011): 98. |

Elevai

Biosciences Research and Development

Elevai Biosciences leverages a first-in-class

engineered probiotic approach to address obesity’s pressing issue of preserving muscle while on weight loss treatments, including

GLP-1 receptor agonists. Our lead asset, EL-22, has completed a Phase 1 clinical trial in South Korea, demonstrating it was generally

well tolerated and safe in healthy volunteers. No subjects dropped out due to adverse events and no statistically significant difference

was found between the intervention groups in the incidence of treatment emergent adverse events.

Preclinical results of EL-22 from a 2022 study

demonstrated physiological (serum creatine kinase level), physical (body weight change), and functional (rotarod test) improvements in

the dystrophic features of mdx mice, a mouse model of Duchenne muscular dystrophy (DMD).6 Elevai believes

that EL-22 has the potential to treat obesity in combination with popular weight loss therapeutics, including GLP-1 receptor agonists,

by preserving muscle mass while decreasing fat mass. We plan to submit an Investigational New Drug (IND) application in 2025 that utilizes

the licensed asset EL-22 for efficacy and safety in combination with popular weight-loss therapeutics currently on the market, with the

goal of decreasing fat mass while preventing the muscle wasting that commonly occurs with weight-loss drugs. Regulatory bodies might

require us to conduct preclinical bridge studies in order to pivot EL-22 from DMD to obesity indications.

Our second asset, EL-32, is a preclinical engineered

probiotic expressing dual myostatin & activin-A and also positioned for the muscle preservation space as a combination to weight

loss treatments, including GLP-1 receptor agonists. In a preclinical healthy mouse model, EL-32 demonstrated a statistically significant

increase in Activin-A and myostatin antibodies, confirming the efficacy using the ELISA test.

Manufacturing

We have exclusively

developed our manufacturing process through our management team’s experience in formulating robust skin care products, which we

believe provides us with a competitive edge. Success in manufacturing our exosomes requires refined processes that are reliable,

scalable, and economical. In our lab, we grow our ethically sourced stem cells and trigger the cells with a method so that they produce

exosomes under our proprietary method.

As of the date of this prospectus, we own or

have an agreement in principle for the right to purchase the related manufacturing processes, methods, and formulations pursuant to the

INmune License Agreement. Moreover, we also oversee our leased laboratory space in California which operate under Good Laboratory Practices

(“GLP”) and adhere to Good Manufacturing Practices (“GMP”) for the production of our cosmetic products. Moreover,

our products are formulated by a third-party in an FDA inspected facility that adheres to GMP guidelines because GMP guidelines promote

the manufacture of our products at the highest recommended safety and quality standards for cosmetic products.

Our facility contains multiple cell and tissue

culture suites containing biosafety cabinets and cell culture incubators. Not only does our facility provide a significant amount of

cold storage and processing space that permit large-scale culture of hUMSCs and the ability to mass produce of stem cell-derived exosomes

but allows us to perform cryo-preservation, cryo-storage, various forms of microscopy and cell analysis. Some additional key features

of our facility include 24/7 security, advanced climate control, increased cold storage, additional cell culture and R&D suites to

perform supplemental in-house research.

Going Concern

As of June 30, 2024, management has determined

there is substantial doubt about the Company’s ability to continue as a going concern. The Company may need to obtain funds to

support its working capital, the methods of which include, without limitation, the following:

| |

● |

other

available sources of financing (including debt) from banks and other financial institutions; and |

| |

● |

financial

support from the Company’s related parties. |

There can be no assurance that the Company will

be successful in securing sufficient funds to sustain its operations.

| 6 | Sung

DK, Kim H, Park SE, Lee J, Kim JA, Park YC, Jeon HB, Chang JW, Lee J. A New Method of Myostatin

Inhibition in Mice via Oral Administration of Lactobacillus casei Expressing Modified

Myostatin Protein, BLS-M22, Int. J. Mol. Sci. 2022, 23, 9059. https://doi.org/10.3390/ijms23169059. |

Recent

Developments

| ● | On

August 30, 2024, we issued a press release announcing that Elevai Skincare Inc., one of our

subsidiaries, obtained results from an on-going research study conducted in partnership with

the National Hair Loss Medical Aesthetics, demonstrating the potential of its proprietary

Elevai exosomes in hair restoration. The research study assessed the application of topical

Elevai exosomes, in clinic and at home, on participants experiencing hair loss or hair thinning.

Study participants were given in-office treatment consisting of scalp microneedling, then

Elevai empower™, a topical exosome serum designed specifically for single use in-office

application was applied, followed by at-home use of Elevai enfinity™, a topical exosome

product, on the areas of concern. Results were assessed using imaging analysis up to 12 months,

showing ceased crown inflammation, reversal of miniaturized hairs and recovered hair from

the dormant phase, among other benefits. This study is a precursor to ongoing research that

Elevai is conducting on the new hair and scalp care product line, Elevai S-Series Root Renewal

SystemTM. |

| ● | On

August 26, 2024, we issued a press release announcing that Elevai Skincare Inc., one of our

subsidiaries, completed a clinical study examining the effectiveness of Elevai enfinity™

exosomes on facial appearance. The data, pending peer review, from the clinical study was

internally reviewed by us, and the results show Elevai enfinity™ to be safe and tolerable.

We aim to publish the full study results in the near future. |

| |

● |

On August 22, 2024, our Board of Directors (“Board”) and

our majority shareholders, respectively, approved an amendment (the “Split Amendment”) to our third amended and restated

certificate of incorporation (“Certificate of Incorporation”) to effect a reverse stock split of our common stock at

a reverse stock split ratio ranging from 1:2 to 1:200 inclusive, as determined by our Board in its sole discretion and an amendment