An actively-managed ETF that has the potential to profit from

both rising and falling commodity price trends

First Trust Advisors L.P. (“First Trust”), a leading ETF

provider, has launched a new exchange-traded fund (“ETF”), the

First Trust Alternative Absolute Return Strategy ETF (Nasdaq:

FAAR). The fund is actively managed and seeks to provide investors

with long-term total return by investing primarily in

exchange-listed commodity futures contracts through a wholly-owned

subsidiary of the fund.

The fund’s investment process involves taking long and short

positions in commodity futures contracts through its subsidiary.

Historically, returns within the different commodity markets have

varied greatly allowing for many opportunities to employ the

long/short strategy. Futures contracts are contractual agreements

to buy or sell a particular commodity or financial instrument at a

predetermined price and date in the future. Taking a “long”

position means purchasing a futures contract. The owner of a “long”

position in a futures contract may profit from an increase in the

price of the underlying commodity, and conversely, will incur a

loss if the underlying commodity declines in price. Taking a

“short” position means selling a futures contract. The owner of a

“short” position in a futures contract may profit from a decrease

in the price of the underlying commodity, and conversely, will

incur a loss if the underlying commodity increases in price. The

ability to take long and short positions provides the potential to

generate positive returns over time in both rising and falling

markets.

“Absolute return offers the potential to provide long-term total

return in a variety of market environments. Additionally, the

strategy may offer low or no correlation to equities, bonds, real

estate and long-only commodities,” said John Gambla, CFA, FRM, PRM

and Senior Portfolio Manager for the Alternatives Investment Team

at First Trust. Combining uncorrelated asset classes in an overall

portfolio—that is, those that have performed differently over

varying market conditions—increases diversification. “Global

capital markets are increasingly integrated, correlations are

rising among the major asset classes, and volatility is reverting

back to long-term norms. In such an environment, absolute return

strategies with lower correlation profiles can provide the robust

diversification that is a cornerstone of modern portfolio theory,”

Gambla said. Although diversification does not guarantee a profit

or protect against a loss, including an investment strategy that is

not available in traditional investment portfolios, may help to

generate more consistent returns and may potentially smooth out

volatility.

Typically, ETFs that invest in commodity futures contracts

generate a form K-1 for tax reporting, which may create

complications for investors at tax time. The fund, on the other

hand, does not issue K-1s for tax purposes. Instead investors will

receive a Form 1099 with distributions reported as ordinary income,

avoiding the potential complications of K-1 reporting.

Along with John Gambla, Rob Guttschow, CFA, will also

serve as Senior Portfolio Manager of the fund. The two will

primarily be responsible for daily investment decisions under the

direction of an Investment Committee which includes four other

individuals with extensive investment experience.

For more information about First Trust, please contact Ryan

Issakainen of First Trust at (630) 765-8689 or

RIssakainen@FTAdvisors.com.

About First Trust

First Trust Advisors L.P., along with its affiliate First Trust

Portfolios L.P., are privately held companies which provide a

variety of investment services, including asset management and

financial advisory services, with collective assets under

management or supervision of approximately $97.03 billion as of

April 29, 2016 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts. First Trust is based in Wheaton, Illinois. For more

information, visit http://www.ftportfolios.com.

You should consider the fund’s investment objectives, risks,

and charges and expenses carefully before investing. Contact First

Trust Portfolios L.P. at 1-800-621-1675 to obtain a prospectus or

summary prospectus which contains this and other information about

the fund. The prospectus or summary prospectus should be read

carefully before investing.

ETF Characteristics

The fund lists and principally trades its shares on The Nasdaq

Stock Market LLC.

Investors buying or selling fund shares on the secondary market

may incur customary brokerage commissions. Market prices may differ

to some degree from the net asset value of the shares. Investors

who sell fund shares may receive less than the share's net asset

value. Shares may be sold throughout the day on the exchange

through any brokerage account. However, unlike mutual funds, shares

may only be redeemed directly from the fund by authorized

participants, in very large creation/redemption units.

Risks

The fund's shares will change in value, and you could lose money

by investing in the fund. One of the principal risks of investing

in the fund is market risk. Market risk is the risk that a

particular security owned by the fund or shares of the fund in

general, may fall in value.

The trading prices of commodities futures, fixed income

securities and other instruments fluctuate in response to a variety

of factors. The fund's net asset value and market price may

fluctuate significantly in response to these factors. As a result,

an investor could lose money over short or long periods of time. In

addition, the net asset value of the fund may be more volatile over

short-term periods than other investment options because of the

fund's significant use of financial instruments that have a

leveraging effect.

The fund is subject to management risk because it is an actively

managed portfolio. In managing the fund’s investment portfolio, the

advisor will apply investment techniques and risk analyses that may

not have the desired result. There can be no guarantee that the

fund will meet its investment objective.

The fund does not invest directly in futures instruments.

Rather, it invests in a wholly owned subsidiary, which will have

the same investment objective as the fund, but unlike the fund, it

may invest without limitation in futures instruments. The

subsidiary is not registered under the 1940 Act and is not subject

to all the investor protections of the 1940 Act. Thus, the fund, as

an investor in the subsidiary, will not have all the protections

offered to investors in registered investment companies.

The failure or bankruptcy of the fund's and the subsidiary's

clearing broker could result in a substantial loss of fund

assets.

The value of commodities and commodity-linked instruments

typically is based upon the price movements of a physical commodity

or an economic variable linked to such price movements. The prices

of commodities and commodities-linked instruments may fluctuate

quickly and dramatically and may not correlate to price movements

in other asset classes. An active trading market may not exist for

certain commodities. Each of these factors and events could have a

significant negative impact on the fund.

All futures and futures-related products are highly volatile.

Price movements are influenced by a variety of factors, including:

changes in overall economic conditions, changes in interest rates,

or factors affecting a particular commodity or industry, such as

production, supply, demand, drought, floods, weather, political,

economic and regulatory developments. Futures contracts may be less

liquid than other types of investments.

The fund regularly purchases and sells commodity futures

contracts to maintain a fully invested position. This frequent

trading may increase the amount of commissions or mark-ups to

broker-dealers that the fund pays when it buys and sells contracts,

which may detract from the fund's performance.

The fund currently intends to effect most creations and

redemptions, in whole or in part for cash, rather than in-kind

securities. As a result, the fund may be less tax-efficient.

The fund, through the subsidiary, will engage in trading on

commodity markets outside the U.S. Trading on such markets is not

regulated by any U.S. government agency and may involve certain

risks not applicable to trading on U.S. exchanges. The subsidiary

is subject to portfolio turnover risk, which may result in the fund

paying higher levels of transaction costs and generating greater

tax liability for shareholders, with the potential to lessen

performance. The fund holds investments that are denominated in

non-U.S. currencies, or in securities that provide exposure to such

currencies, currency exchange rates or interest rates denominated

in such currencies. Changes in currency exchange rates and the

relative value of non-U.S. currencies may affect the value of the

fund's investments and the value of the fund's shares. Commodity

futures contracts traded on non-U.S. exchanges or with non-U.S.

counterparties present risks because they may not be subject to the

same degree of regulation as their U.S. counterparts. The fund

intends to treat any income it may derive from commodity futures

contracts received by the subsidiary as qualified income, subject

to regulatory rules and annual re-examination.

The fund may be subject to the forces of "whipsaw" markets (as

opposed to choppy or stable markets), in which significant price

movements develop but then repeatedly reverse, which could cause

substantial losses.

The fund is classified as "non-diversified" and may invest a

relatively high percentage of its assets in a limited number of

issuers. As a result, the fund may be more susceptible to a single

adverse economic or regulatory occurrence affecting one or more of

these issuers, experience increased volatility and be highly

concentrated in certain issuers.

Alternative investments may employ complex strategies, have

unique investment and risk characteristics and may not be suitable

for all investors.

Shorting may result in greater gains or greater losses. Short

selling creates special risks which could result in increased

volatility of returns. Because losses on short sales arise from

increases in the value of the security sold short, such losses are

theoretically unlimited.

Certain securities in the fund are subject to credit risk,

interest rate risk, and income risk. Credit risk is the risk that

an issuer of a security will be unable or unwilling to make

dividend, interest and/or principal payments when due and that the

value of a security may decline as a result. Interest rate risk is

the risk that the value of the fixed income securities in the fund

will decline because of rising market interest rates. Income risk

is the risk that income from the fund’s fixed income investments

could decline during periods of falling interest rates.

The fund currently has fewer assets than larger funds, and like

other relatively new funds, large inflows and outflows may impact

the fund's market exposure for limited periods of time.

The fund is subject to gap risk, which is the risk that a

commodity price will change from one level to another with no

trading in between.

The fund is subject to regulatory risk, which may result in

commodity contract positions requiring liquidation at

disadvantageous times or prices.

The fund’s investment in repurchase agreements may be subject to

market and credit risk with respect to the collateral securing the

repurchase agreements.

The fund may invest in U.S. government obligations, including

U.S. Treasury obligations and securities. Securities issued or

guaranteed by federal agencies and U.S. government sponsored

instrumentalities may or may not be backed by the full faith and

credit of the U.S. government.

First Trust Advisors L.P. is the adviser to the fund. First

Trust Advisors L.P. is an affiliate of First Trust Portfolios L.P.,

the fund's distributor.

First Trust Advisors L.P. is registered as a commodity pool

operator and commodity trading advisor and is also a member of the

National Futures Association.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160519005822/en/

First TrustRyan

Issakainen630-765-8689RIssakainen@FTAdvisors.com

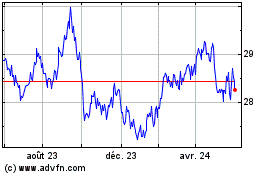

First Trust Alternative ... (NASDAQ:FAAR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

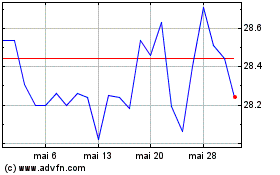

First Trust Alternative ... (NASDAQ:FAAR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025