0000920112false00009201122023-07-312023-07-310000920112us-gaap:CommonClassAMember2023-07-312023-07-310000920112us-gaap:NoncumulativePreferredStockMember2023-07-312023-07-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 of 15(d) of The Securities Exchange Act of 1934 | | | | | |

| Date of Report (Date of earliest event reported) | July 31, 2023 |

Heartland Financial USA, Inc.

| | | | | |

| Commission File Number: | 001-15393 |

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 42-1405748 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

| 1800 Larimer Street |

| Suite 1800 |

| Denver, | Colorado | 80202 |

(Address of principal executive offices, including zip code)

(303) 285-9200

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | HTLF | Nasdaq Stock Market |

| Depositary Shares (each representing 1/400th interest in a share of 7.00% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series E) | HTLFP | Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2023, Heartland Financial USA, Inc. ("HTLF") issued a news release announcing its earnings for the quarter ended June 30, 2023. A copy of the news release is attached as Exhibit 99.1 and is incorporated by reference in this Item 2.02. The information furnished in Item 2.02 and in Exhibit 99.1 shall not be deemed filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 7.01 Regulation FD Disclosure.

For the benefit of its investors, HTLF is also furnishing an Investor Presentation attached as Exhibit 99.2 and incorporated herein by reference in this Item 7.01. The information furnished in this Item 7.01 and Exhibit 99.2 shall not be deemed filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: July 31, 2023 | | HEARTLAND FINANCIAL USA, INC. |

| | | |

| | By: | /s/ Bryan R. McKeag |

| | | Bryan R. McKeag |

| | | Executive Vice President |

| | | Chief Financial Officer |

| | | | | |

| CONTACT: | FOR IMMEDIATE RELEASE |

| Bryan R. McKeag | July 31, 2023 |

| Executive Vice President | |

| Chief Financial Officer | |

| (563) 589-1994 | |

| BMcKeag@htlf.com | |

HEARTLAND FINANCIAL USA, INC. ("HTLF") REPORTS QUARTERLY AND YEAR TO DATE RESULTS AS OF JUNE 30, 2023

Highlights and Developments | | | | | | | | |

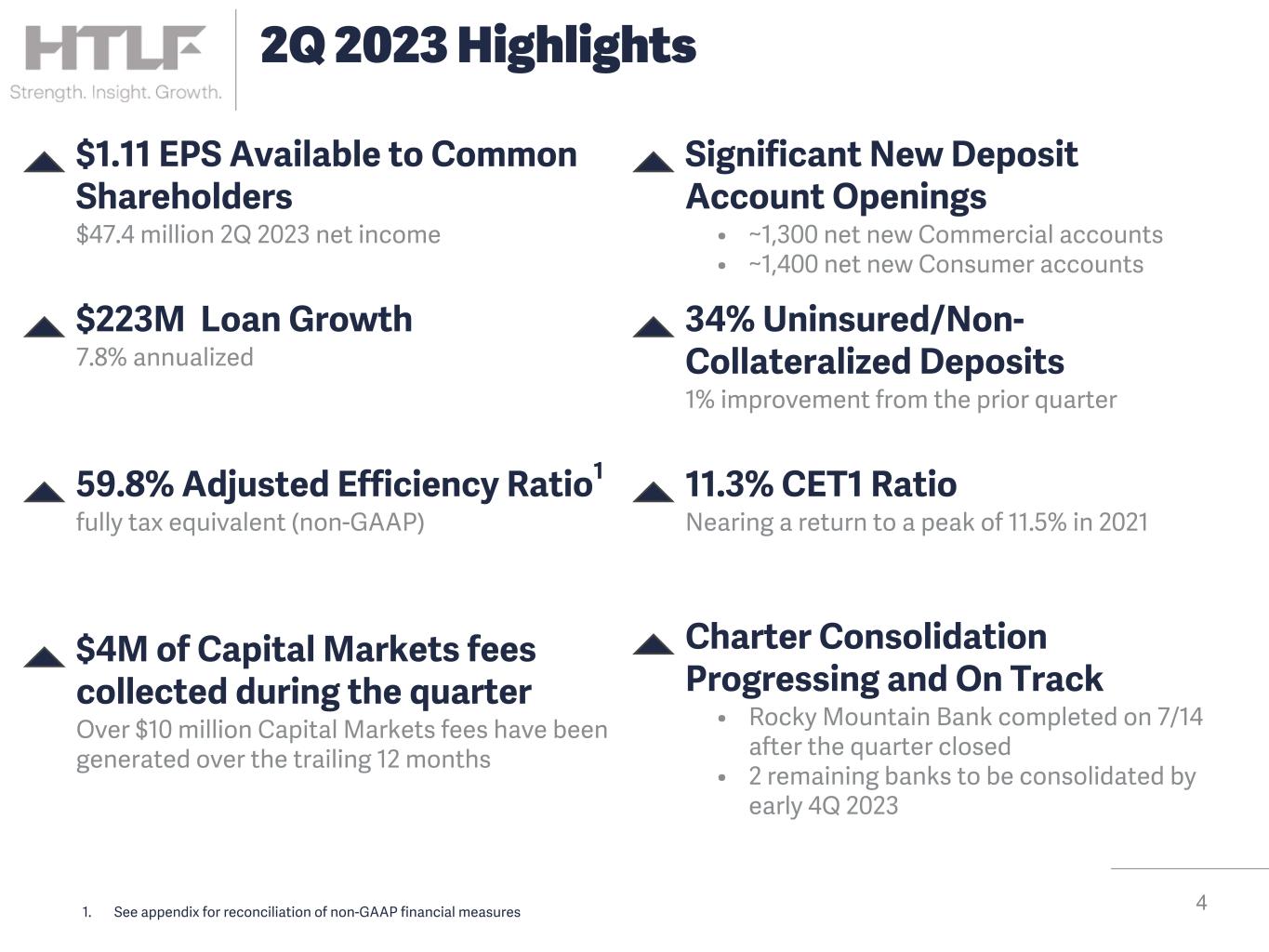

| § | Quarterly net income available to common stockholders of $47.4 million |

| § | Quarterly diluted earnings per common share of $1.11 |

| § | Total revenue growth of $2.6 million or 1% from the second quarter of 2022, and $15.6 million or 5% from the first six months of 2022 |

| |

| § | Quarterly loan growth of $222.6 million or 2% |

| § | Nearly 1,300 net new commercial deposit accounts and over 1,400 net new consumer deposit accounts opened in the quarter |

| |

| |

| |

| |

| § | Completed the consolidation of two bank charters during the quarter, and one charter consolidation completed subsequent to the end of the quarter |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income available to common stockholders (in millions) | $ | 47.4 | | | $ | 49.9 | | | $ | 98.2 | | | $ | 90.9 | |

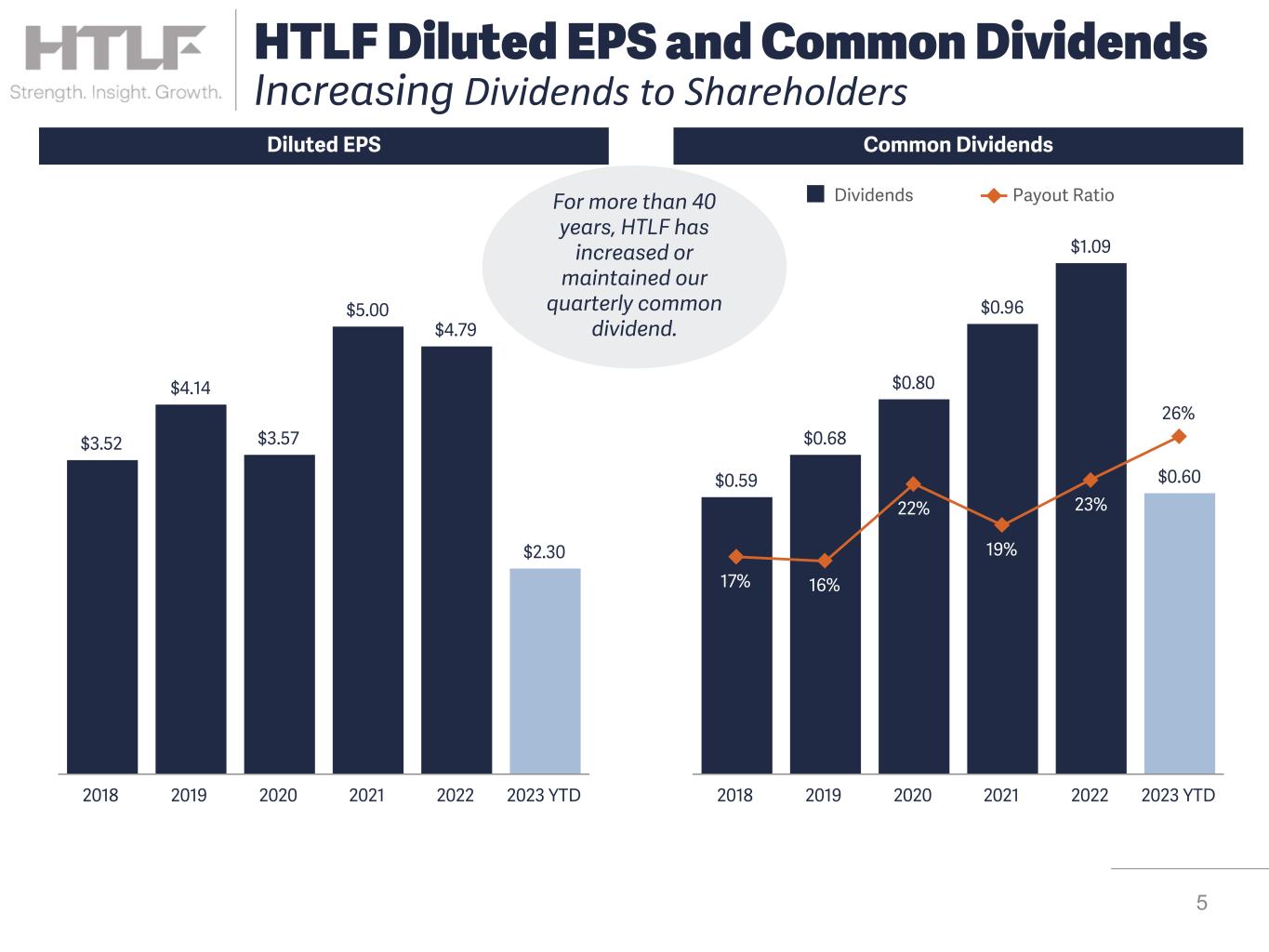

| Diluted earnings per common share | 1.11 | | | 1.17 | | | 2.30 | | | 2.14 | |

| | | | | | | |

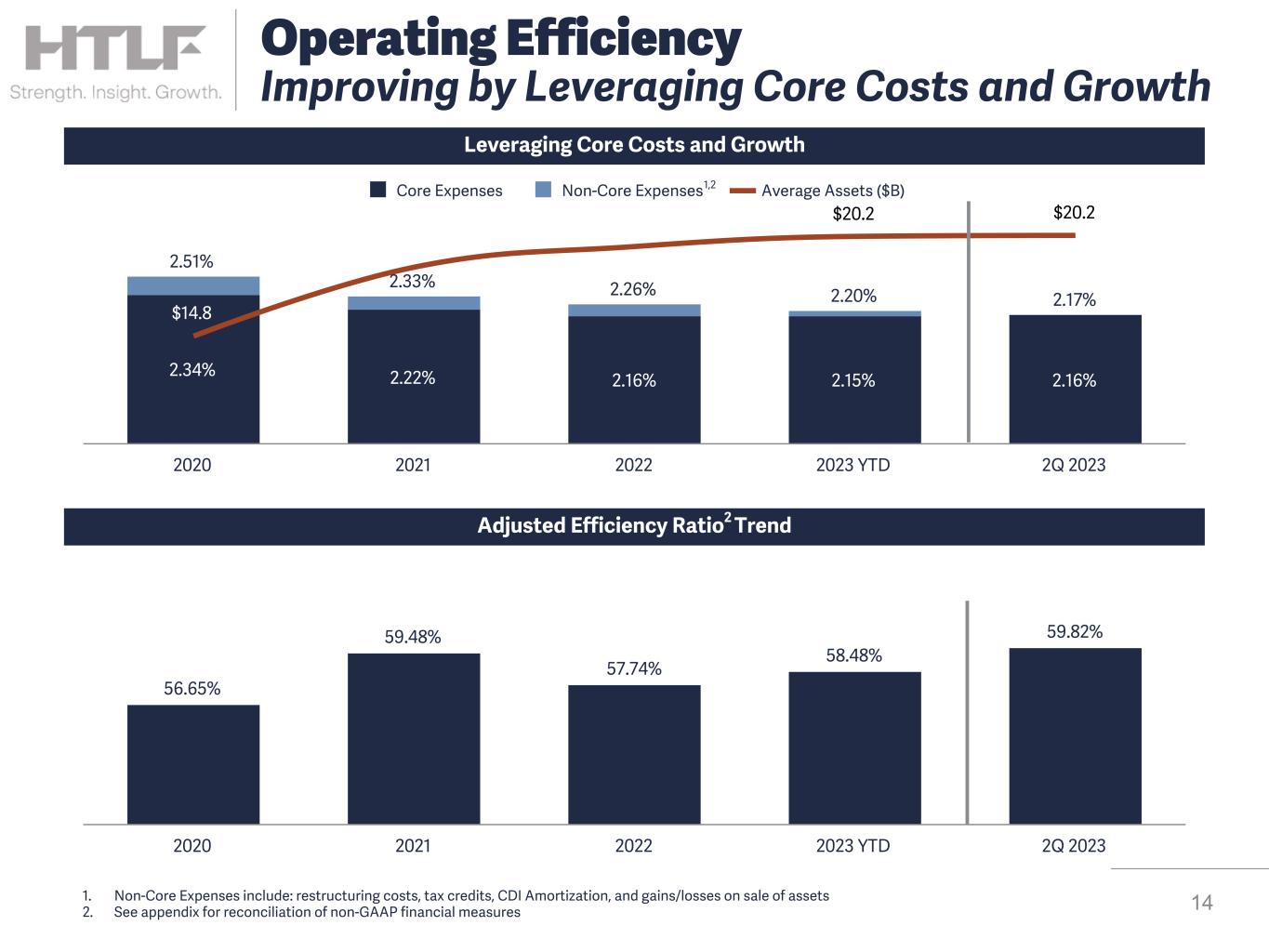

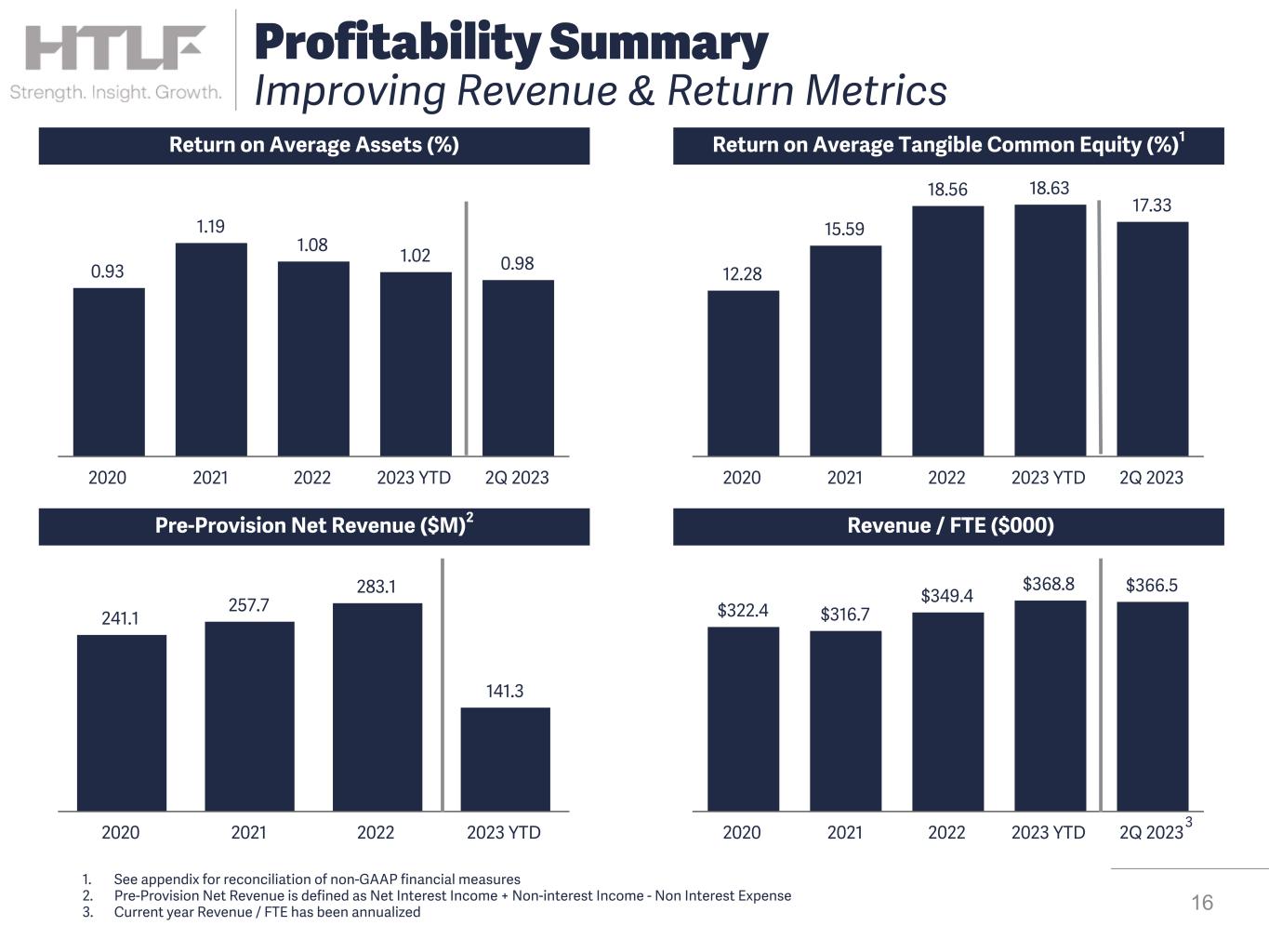

| Return on average assets | 0.98 | % | | 1.06 | % | | 1.02 | % | | 0.99 | % |

| | | | | | | |

| Return on average common equity | 11.01 | | | 11.55 | | | 11.70 | | | 9.82 | |

Return on average tangible common equity (non-GAAP)(1) | 17.33 | | | 18.35 | | | 18.63 | | | 15.08 | |

| Net interest margin | 3.19 | | | 3.18 | | | 3.27 | | | 3.13 | |

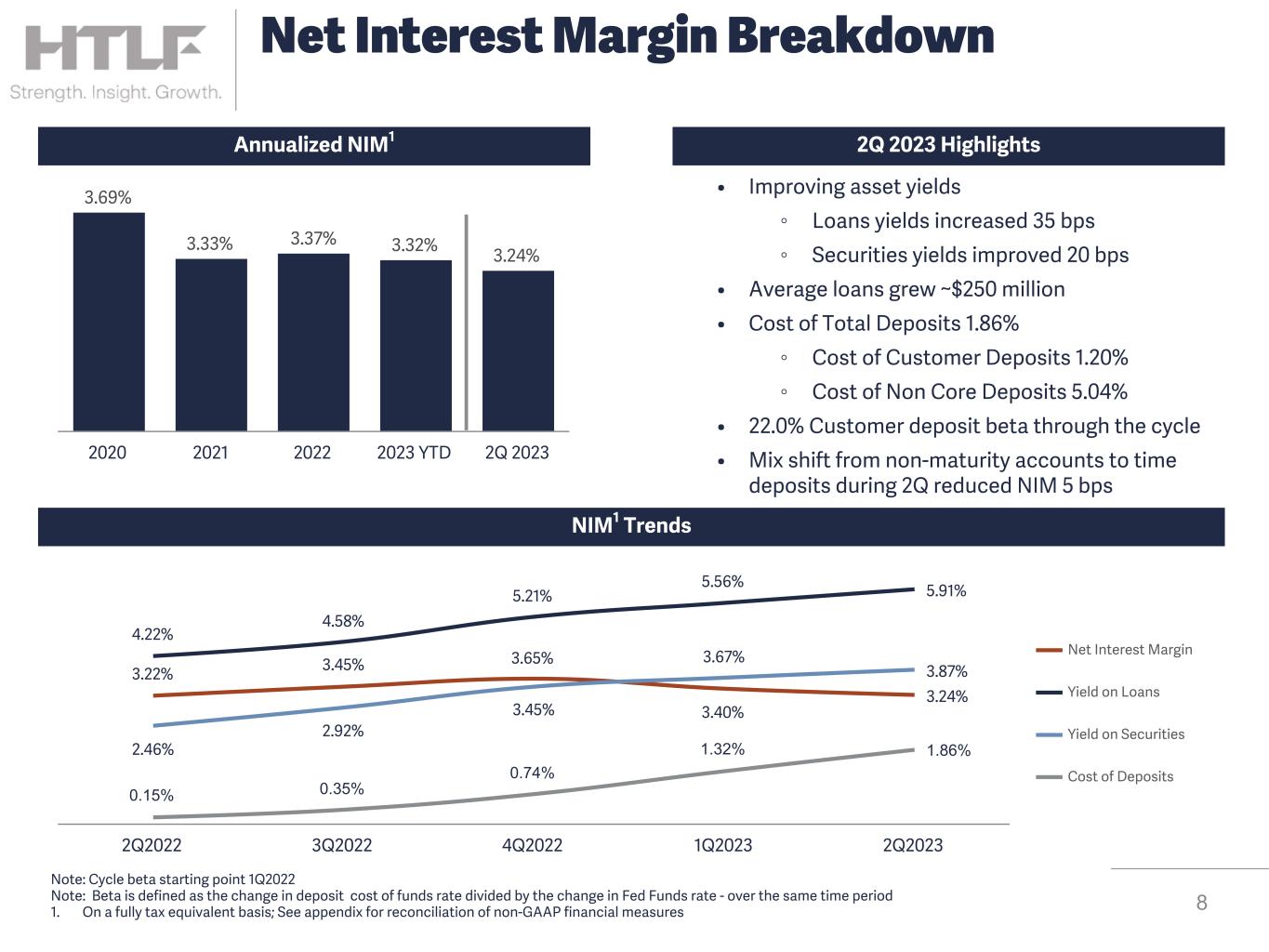

Net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.24 | | | 3.22 | | | 3.32 | | | 3.17 | |

| Efficiency ratio | 60.93 | | | 60.16 | | | 60.94 | | | 62.75 | |

Adjusted efficiency ratio, fully-tax equivalent (non-GAAP)(1) | 59.82 | | | 57.66 | | | 58.48 | | | 61.02 | |

(1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to the financial tables for reconciliations to the most directly comparable GAAP measures.

| | |

"HTLF's strength and diverse geography enabled us to continue executing on our strategic priorities despite recent industry challenges. We were pleased with our strong loan growth and new customer relationships. Our stable deposit base and growth strategies give us momentum heading into the second half of the year. " |

| Bruce K. Lee, President and Chief Executive Officer, HTLF |

Denver, Monday, July 31, 2023-Heartland Financial USA, Inc. (NASDAQ: HTLF) today reported the following results for the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022:

•Net income available to common stockholders of $47.4 million compared to $49.9 million, a decrease of $2.5 million or 5%.

•Earnings per diluted common share of $1.11 compared to $1.17, a decrease of $0.06 or 5%.

•Net interest income of $147.1 million compared to $142.5 million, an increase of $4.7 million or 3%.

•Total revenue growth of $2.6 million or 1% to $179.6 million compared to $177.0 million.

•Return on average assets was 0.98% compared to 1.06%.

•Return on average common equity was 11.01% compared to 11.55%.

•Return on average tangible common equity (non-GAAP) was 17.33% compared to 18.35%.

"HTLF's strength and diverse geography enabled us to continue executing on our strategic priorities despite recent industry challenges. We were pleased with our strong loan growth and new customer relationships. Our stable deposit base and growth strategies give us momentum heading into the second half of the year," said Bruce K. Lee, president and chief executive officer of HTLF.

HTLF report the following results for the six months ended June 30, 2023, compared to the six months ended June 30, 2022:

•Net income available to common stockholders of $98.2 million compared to $90.9 million, an increase of $7.2 million or 8%.

•Earnings per diluted common share of $2.30 compared to $2.14, an increase of $0.16 or 7%.

•Net interest income of $299.3 million compared to $277.1 million, an increase of $22.2 million or 8%.

•Total revenue of $361.8 million compared to $346.2 million, an increase of $15.6 million or 5%.

•Return on average assets was 1.02% compared to 0.99%.

•Return on average common equity was 11.70% compared to 9.82%.

•Return on average tangible common equity (non-GAAP) was 18.63% compared to 15.08%.

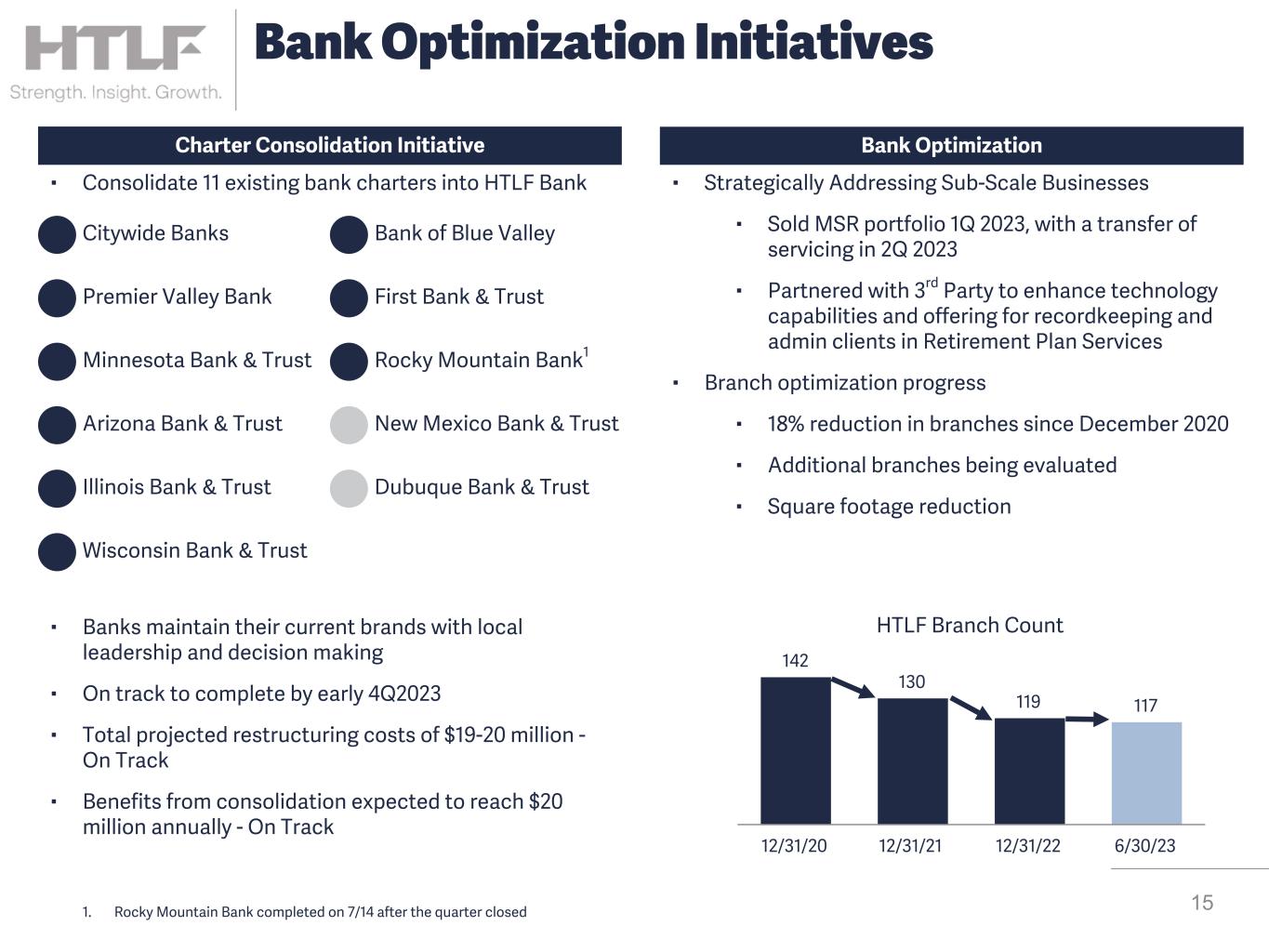

Charter Consolidation Update

During the second quarter of 2023, Bank of Blue Valley and First Bank & Trust were consolidated into HTLF Bank. Subsequent to June 30, 2023, Rocky Mountain Bank was consolidated into HTLF Bank. Citywide Banks, Premier Valley Bank, Minnesota Bank & Trust, Arizona Bank & Trust, Illinois Bank & Trust, Wisconsin Bank & Trust, Bank of Blue Valley, First Bank & Trust and Rocky Mountain Bank are now operating as divisions of HTLF Bank. The two remaining charters are expected to be consolidated by the end of October 2023. Charter consolidation follows a template that retains the current brands, local leadership and local decision making.

Total consolidation restructuring costs are projected to be $19-$20 million with approximately $6-$7 million of expenses remaining to be incurred in 2023. Charter consolidation is designed to eliminate redundancies and improve HTLF’s operating efficiency and capacity to support ongoing product and service enhancements, as well as current and future growth. HTLF realized some operating efficiency and financial benefits in the second half of 2022 and first half of 2023 with the completion of nine charter consolidations, and total benefits are estimated to be approximately $20 million annually after the project is completed.

Recent Developments

As of March 29, 2023, HTLF's subsidiary, Dubuque Bank & Trust, entered into an agreement to sell and transfer the recordkeeping and administration services component of HTLF’s Retirement Plan Services business to July Business Services ("July"). Through the new partnership with July, HTLF will augment the comprehensive retirement plan solutions offered to clients with enhanced technology and an expanded suite of product offerings that clients expect from a top retirement services provider. The transaction was completed and recordkeeping and administration services were transferred in the second quarter of 2023. The transaction resulted in a gain of $4.3 million.

On March 31, 2023, HTLF's division, First Bank & Trust, closed on the sale of its mortgage servicing rights portfolio, which consisted of approximately 4,500 loans serviced for others with an unpaid principal balance of approximately

$700 million. In the agreement, which includes customary terms and conditions, First Bank & Trust provided interim servicing of the loans until the transfer date in May 2023.

Net Interest Income and Net Interest Margin

Net interest margin, expressed as a percentage of average earning assets, was 3.19% (3.24% on a fully tax-equivalent basis, non-GAAP) for the second quarter of 2023 compared to 3.36% (3.40% on a fully tax-equivalent basis, non-GAAP) for the first quarter of 2023, and 3.18% (3.22% on a fully tax-equivalent basis, non-GAAP) for the second quarter of 2022.

Total interest income and average earning asset changes for the second quarter of 2023 compared to the second quarter of 2022 were:

•Total interest income was $235.5 million compared to $152.9 million, an increase of $82.6 million or 54% primarily attributable to an increase in average earning assets and higher yields.

•Total interest income on a tax-equivalent basis (non-GAAP) was $237.8 million, an increase of $83.0 million or 54% from $154.9 million.

•Average earning assets increased $535.8 million or 3% to $18.52 billion compared to $17.99 billion.

•The average rate on earning assets increased 170 basis points to 5.15% from 3.45%, primarily due to recent interest rate increases.

Total interest expense and average interest bearing liability changes for the second quarter of 2023 compared to the second quarter of 2022 were:

•Total interest expense was $88.4 million, an increase of $77.9 million from $10.4 million, due to increases in the average interest rate paid and average interest bearing liabilities.

•The average interest rate paid on interest bearing liabilities increased 232 basis points to 2.68% compared to 0.36%.

•Average interest bearing deposits increased $1.66 billion or 15% to $12.75 billion from $11.08 billion, primarily due to an increase of $1.94 billion in wholesale deposits.

•The average interest rate paid on interest bearing deposits increased 234 basis points to 2.58% compared to 0.24%.

•Average borrowings decreased $29.4 million or 6% to $461.7 million from $491.1 million, and the average interest rate paid on borrowings was 5.55% compared to 3.18%.

Net interest income changes for the second quarter of 2023 compared to the second quarter of 2022 were:

•Net interest income totaled $147.1 million compared to $142.5 million, an increase of $4.7 million or 3%.

•Net interest income on a tax-equivalent basis (non-GAAP) totaled $149.4 million compared to $144.4 million, an increase of $5.0 million or 3%.

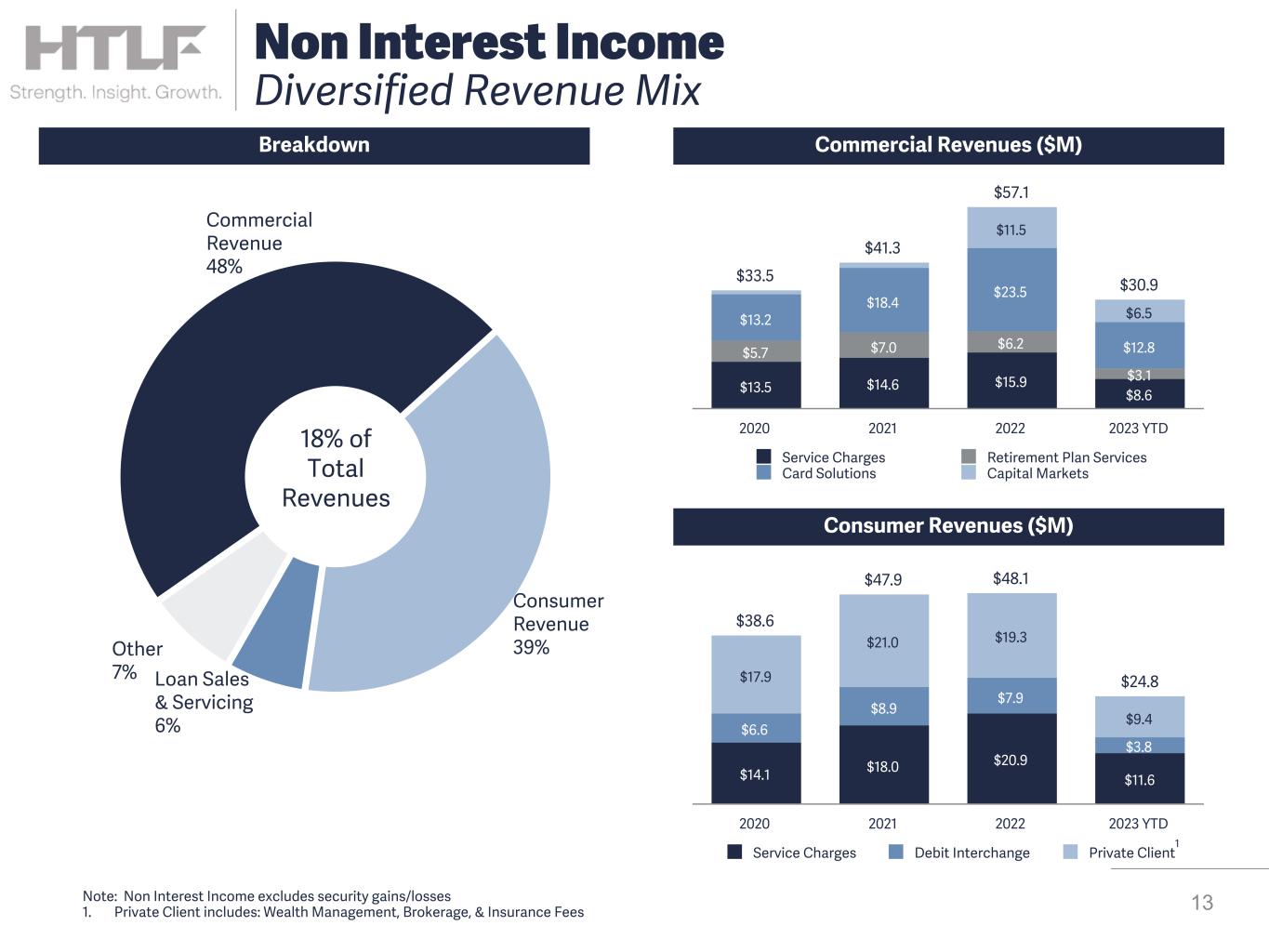

Noninterest Income and Noninterest Expense

Total noninterest income was $32.5 million during the second quarter of 2023 compared to $34.5 million during the second quarter of 2022, a decrease of $2.0 million or 6%. Significant changes within the noninterest income category for the second quarter of 2023 compared to the second quarter of 2022 were:

•Service charges and fees increased $1.6 million or 9% to $19.6 million from $18.1 million.

•Net security losses totaled $314,000 compared to net losses of $2.1 million.

•Net gains on sales of loans held for sale decreased $1.9 million or 64% to $1.1 million from $2.9 million, primarily attributable to a decrease in loans sold to the secondary market.

•Other noninterest income decreased $2.6 million or 87% to $407,000 compared to $3.0 million. Included in other noninterest income for the second quarter of 2022 was a gain of $1.9 million on the sale of VISA Class B shares.

Total noninterest expense was $109.4 million during the second quarter of 2023 compared to $106.5 million during the second quarter of 2022, which was an increase of $3.0 million or 3%. Significant changes within the noninterest expense category for the second quarter of 2023 compared to the second quarter of 2022 were:

•Salaries and employee benefits totaled $62.1 million compared to $64.0 million, a decrease of $1.9 million or 3%. The decrease was primarily due to a reduction of full-time equivalent employees and lower incentive

compensation expense. Full-time equivalent employees totaled 1,966 compared to 2,087, a decrease of 121 or 6%.

•Other noninterest expenses totaled $15.6 million compared to $13.0 million, an increase of $2.6 million or 20%. Credit card expenses increased $909,000 or 27% to $4.3 million from $3.4 million. Fraud losses increased $739,000 to $948,000 from $209,000.

•FDIC insurance assessments totaled $3.0 million compared to $1.5 million, an increase of $1.5 million due to assessment rate changes that were effective with the first quarter 2023 assessment.

•Acquisition, integration and restructuring costs totaled $1.9 million compared to $2.4 million, a decrease of $520,000 primarily due to reduced charter consolidation expenses.

The effective tax rate was 23.74% for the second quarter of 2023 compared to 22.89% for the second quarter of 2022. The following items impacted the second quarter 2023 and 2022 tax calculations:

•Various tax credits of $568,000 compared to $975,000.

•Tax expense of $1,086,000 compared to $109,000 resulting from the disallowed interest expense related to tax-exempt loans and securities, aligning with increases in total interest expense.

•Tax-exempt interest income as a percentage of pre-tax income of 12.40% compared to 11.05%.

Total Assets, Total Loans and Total Deposits

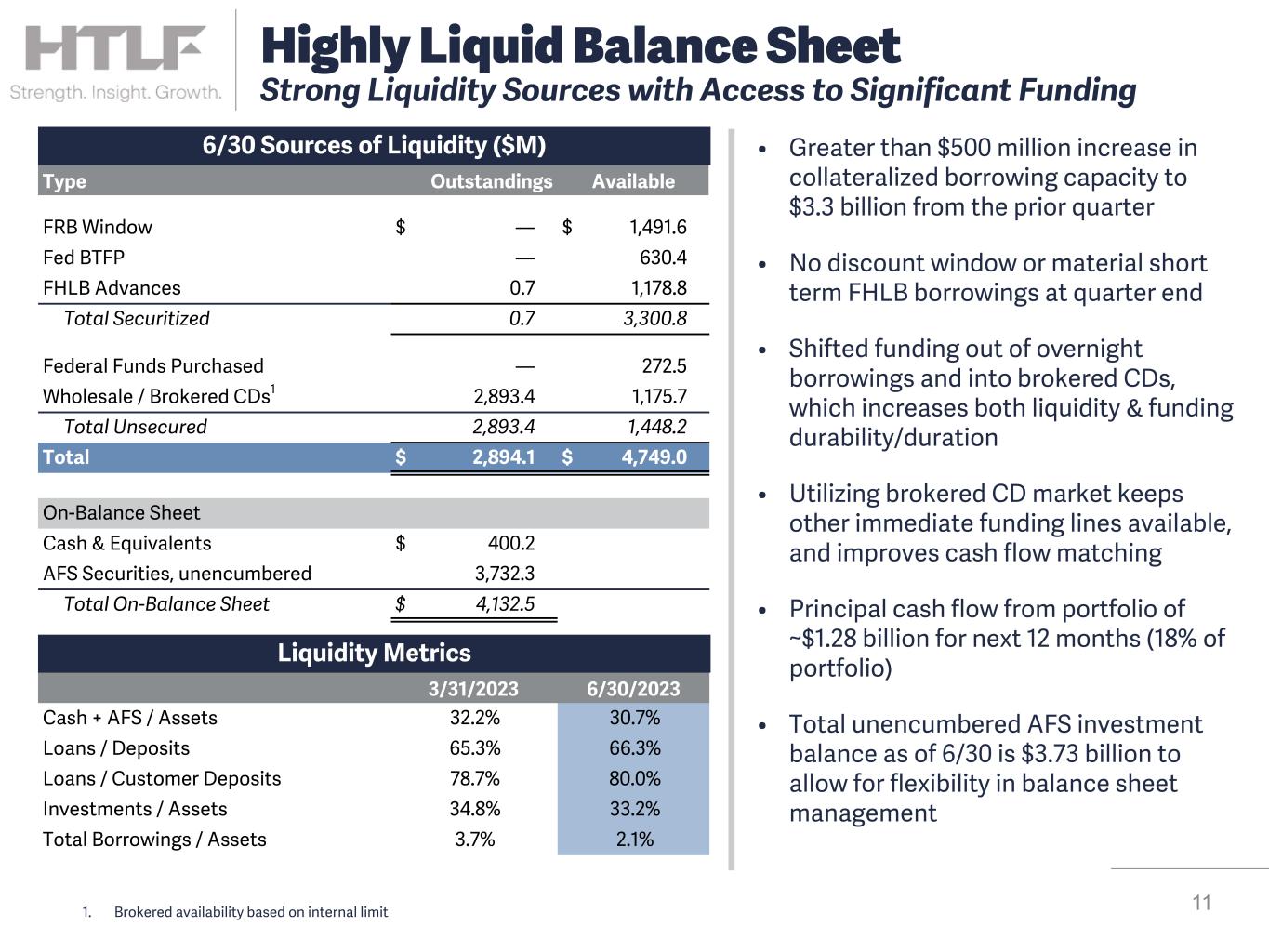

Total assets were $20.22 billion at June 30, 2023, a decrease of $19.5 million or less than 1% from $20.24 billion at year-end 2022. Securities represented 33% and 35% of total assets at June 30, 2023, and December 31, 2022, respectively.

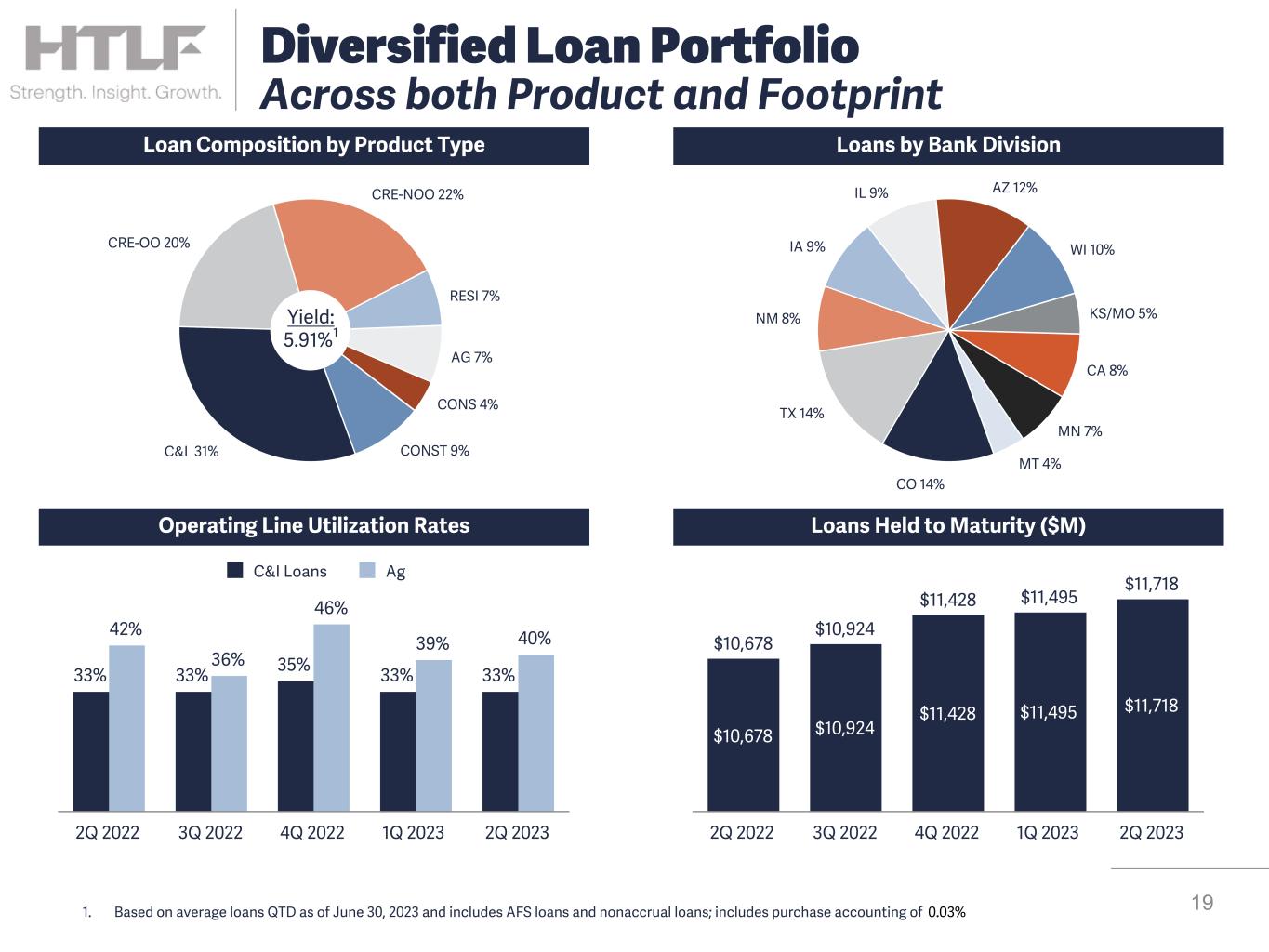

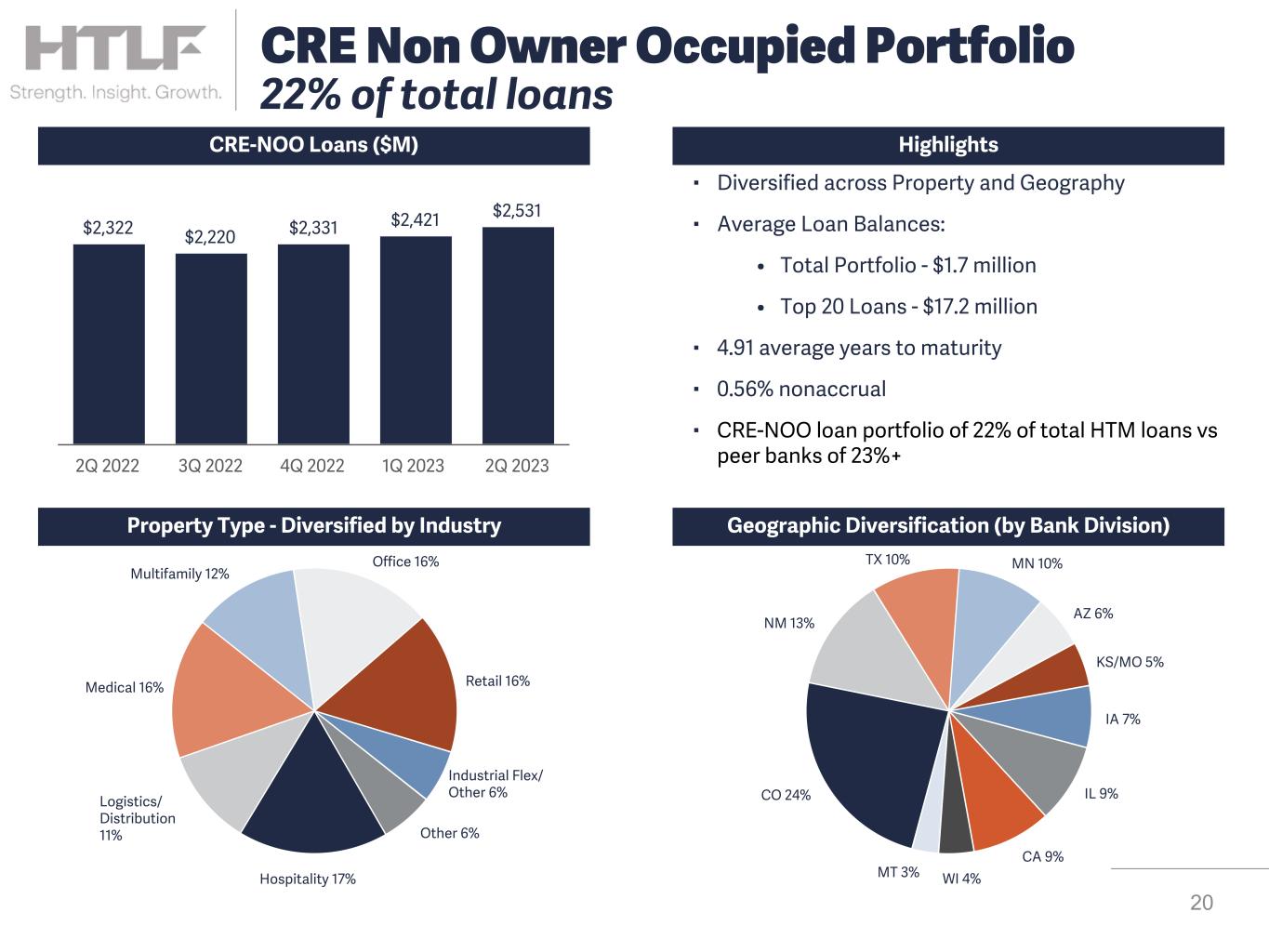

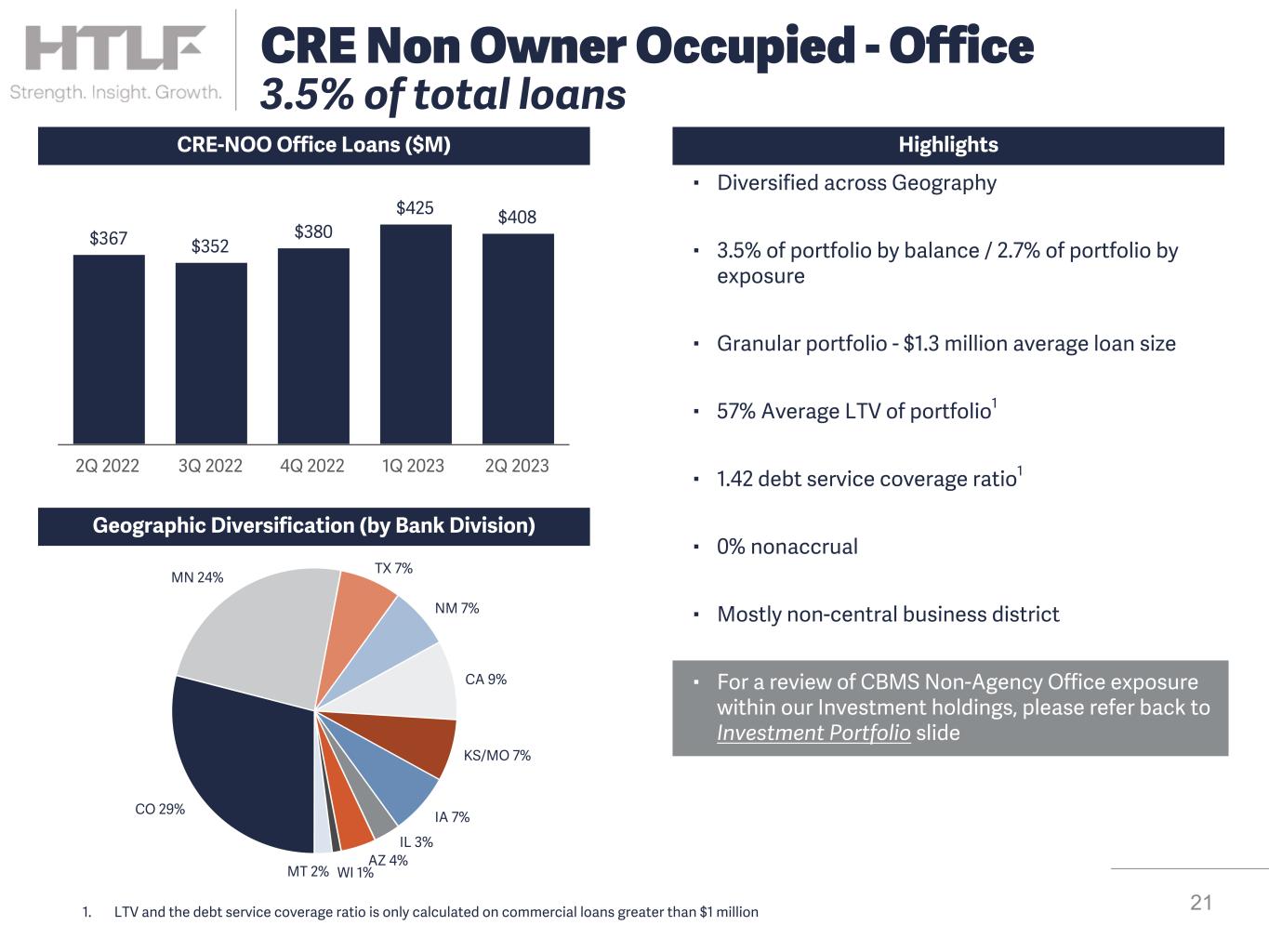

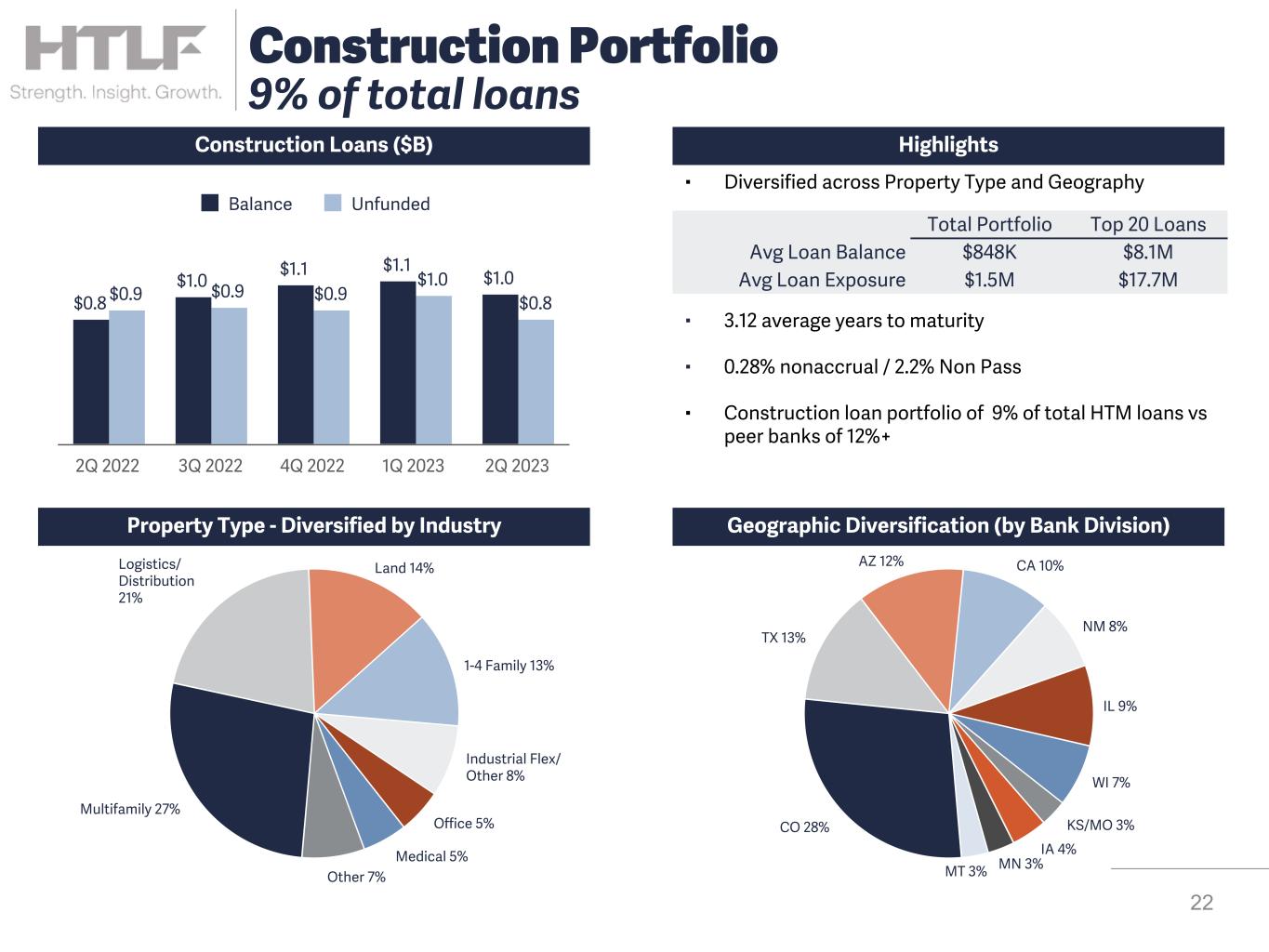

Total loans held to maturity were $11.72 billion at June 30, 2023, compared to $11.50 billion at March 31, 2023, and $11.43 billion at December 31, 2022, representing increases of $222.6 million or 2%, and $289.6 million or 3%, respectively.

Significant changes by loan category at June 30, 2023 compared to March 31, 2023 included:

•Commercial and business lending, which includes commercial and industrial, PPP and owner occupied commercial real estate loans, increased $174.4 million or 3% to $5.99 billion compared to $5.82 billion.

•Commercial real estate lending, which includes non-owner occupied commercial real estate and construction loans, increased $20.3 million or 1% to $3.54 billion compared to $3.52 billion.

•Agricultural and agricultural real estate loans increased $29.6 million or 4% to $839.8 million from $810.2 million.

Significant changes by loan category at June 30, 2023 compared to December 31, 2022 included:

•Commercial and business lending, which includes commercial and industrial, PPP and owner occupied commercial real estate loans, increased $252.8 million or 4% to $5.99 billion compared to $5.74 billion.

•Commercial real estate lending, which includes non-owner occupied commercial real estate and construction loans, increased $136.8 million or 4% to $3.54 billion compared to $3.41 billion.

•Agricultural and agricultural real estate loans decreased $80.7 million or 9% to $839.8 million compared to $920.5 million.

•Residential real estate loans decreased $24.9 million or 3% to $828.4 million compared to $853.4 million.

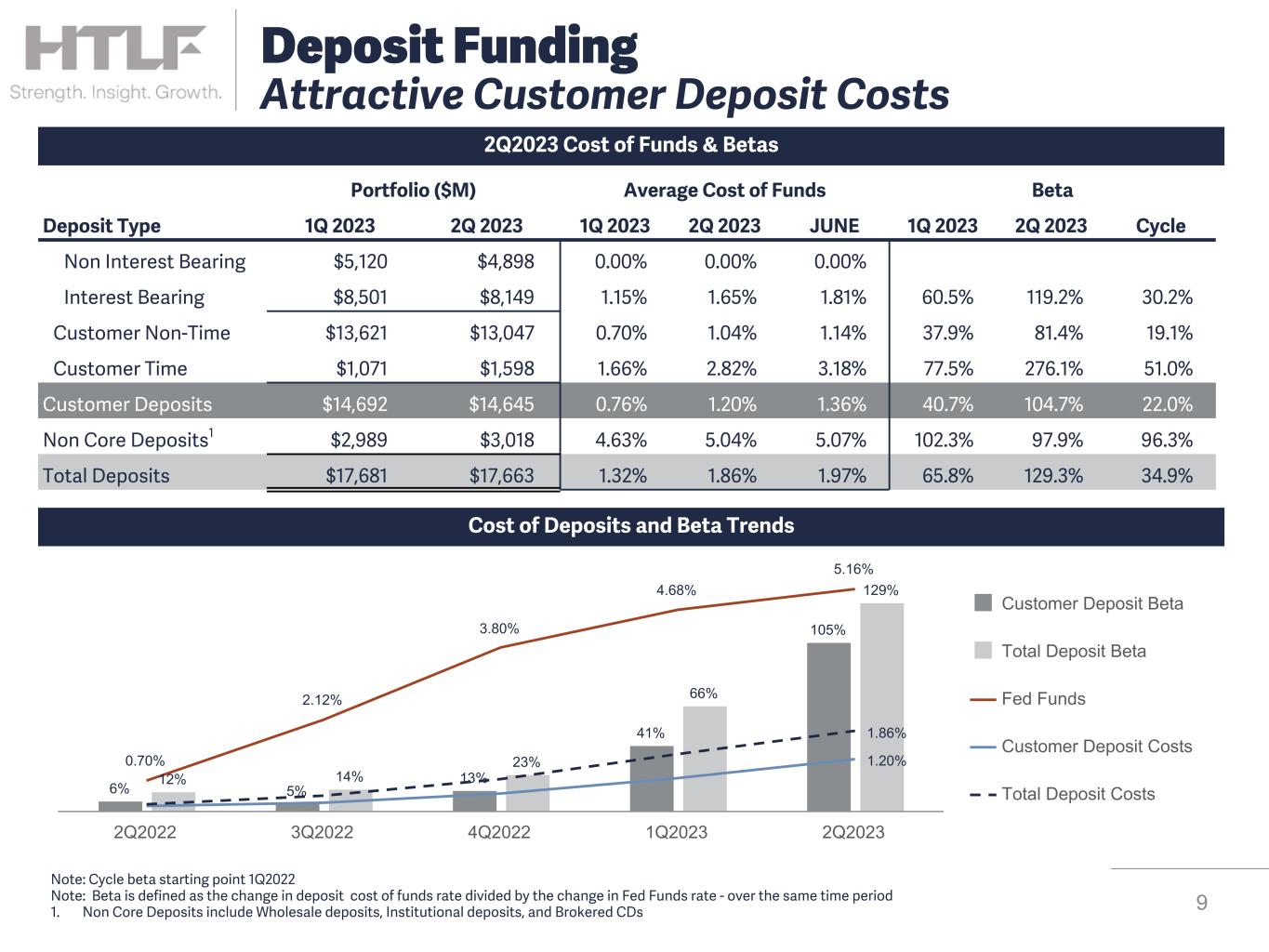

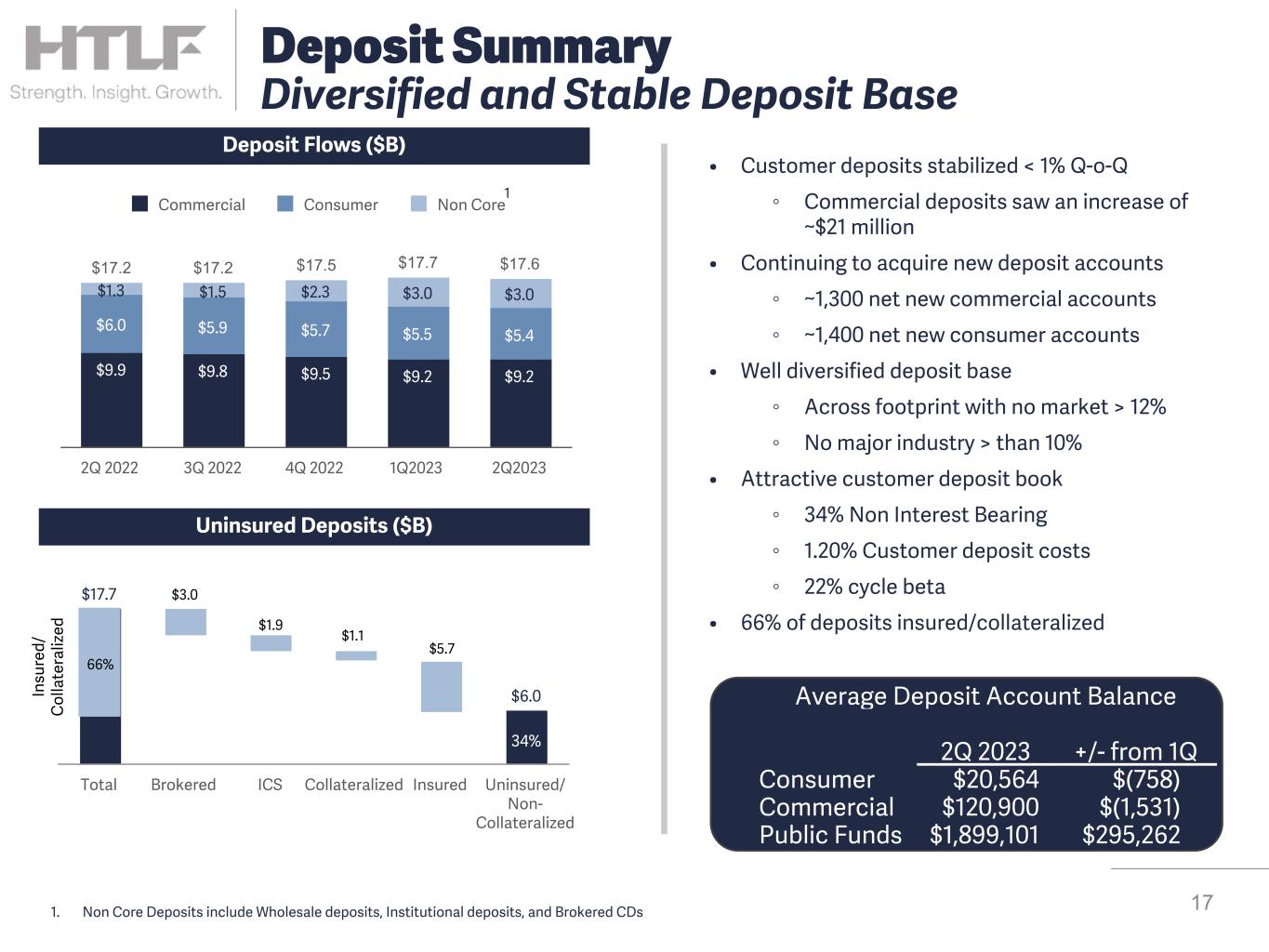

Total deposits were $17.66 billion as of June 30, 2023, compared to $17.68 billion at March 31, 2023, which was a decrease of $17.8 million or less than 1%. Total deposits were $17.66 billion as of June 30, 2023, compared to $17.51 billion at December 31, 2022, an increase of $150.5 million or 1%.

Total customer deposits were $14.65 billion as of June 30, 2023 compared to $14.69 billion at March 31, 2023, which was a decrease of $47.1 million or less than 1%. During the second quarter of 2023, nearly 1,300 net new commercial deposit accounts and over 1,400 net new consumer deposit accounts were opened. Significant deposit changes by category at June 30, 2023, compared to March 31, 2023, included:

•Customer demand deposits decreased $221.7 million or 4% to $4.90 billion compared to $5.12 billion.

•Customer savings deposits decreased $351.7 million or 4% to $8.15 billion compared to $8.50 billion.

•Customer time deposits increased $526.4 million or 49% to $1.60 billion compared to $1.07 billion.

Total customer deposits were $14.65 billion at June 30, 2023 compared to $15.22 billion at December 31, 2022, which was a decrease of $578.5 million or 4%. Significant deposit changes by category at June 30, 2023 compared to December 31, 2022, included:

•Customer demand deposits decreased $803.5 million or 14% to $4.90 billion compared to $5.70 billion.

•Customer savings deposits decreased $521.3 million or 6% to $8.15 billion compared to $8.67 billion.

•Customer time deposits increased $746.3 million or 88% to $1.60 billion compared to $851.5 million.

Total wholesale and institutional deposits were $3.02 billion as of June 30, 2023, which was an increase of $29.3 million or 1% from $2.99 billion at March 31, 2023. Significant deposit changes by category at June 30, 2023, compared to March 31, 2023, included:

•Wholesale and institutional savings deposits decreased $132.3 million or 18% to $623.0 million compared to $755.3 million.

•Wholesale time deposits increased $161.5 million or 7% to $2.40 billion compared to $2.23 billion.

Total wholesale deposits were $3.02 billion as of June 30, 2023, which was an increase of $729.0 million or 32% from $2.29 billion at December 31, 2022. Significant deposit changes by category at June 30, 2023 compared to December 31, 2022 included:

•Wholesale and institutional savings deposits decreased $700.5 million or 53% to $623.0 million compared to $1.32 billion.

•Wholesale time deposits increased $1.43 billion to $2.40 billion compared to $965.7 million.

Provision and Allowance

Provision and Allowance for Credit Losses for Loans

Provision for credit losses for loans for the second quarter of 2023 was $7.8 million, which was an increase of $6.3 million from $1.5 million recorded in the second quarter of 2022. The provision expense for the second quarter of 2023 was impacted by a $5.3 million charge-off related to an overdraft, the result of a fraud incident impacting the account of a single long-term customer.

The allowance for credit losses for loans totaled $111.2 million and $109.5 million at June 30, 2023, and December 31, 2022, respectively. Management continued to utilize a macroeconomic outlook which anticipated a moderate recession developing within the next twelve months. The following items impacted the allowance for credit losses for loans at June 30, 2023:

•Provision expense for the six months ended June 30, 2023, totaled $10.0 million.

•Net charge-offs of $8.3 million were recorded for the first six months of 2023.

Provision and Allowance for Credit Losses for Unfunded Commitments

The allowance for unfunded commitments decreased $1.6 million or 8% to $18.6 million at June 30, 2023, from $20.2 million at December 31, 2022, primarily due to a reduction of $164.2 million in unfunded commitments for construction loans, which carry the highest loss rate. Total unfunded commitments increased $175.5 million or 4% to $4.91 billion at June 30, 2023 compared to $4.73 billion at December 31, 2022.

Total Provision and Allowance for Lending Related Credit Losses

The total provision expense for lending related credit losses was $5.4 million for the second quarter of 2023 compared to $3.2 million for the second quarter of 2022. The total allowance for lending related credit losses was $129.8 million or 1.11% of total loans at June 30, 2023, compared to $129.7 million or 1.13% of total loans as of December 31, 2022.

Nonperforming Assets

Nonperforming assets decreased $834,000 or 1% to $66.1 million or 0.33% of total assets at June 30, 2023, compared to $66.9 million or 0.33% of total assets at December 31, 2022. Nonperforming loans were $63.4 million or 0.54% of total loans at June 30, 2023, compared to $58.5 million or 0.51% of total loans at December 31, 2022. At June 30, 2023, loans delinquent 30-89 days were 0.12% of total loans compared to 0.04% of total loans at December 31, 2022.

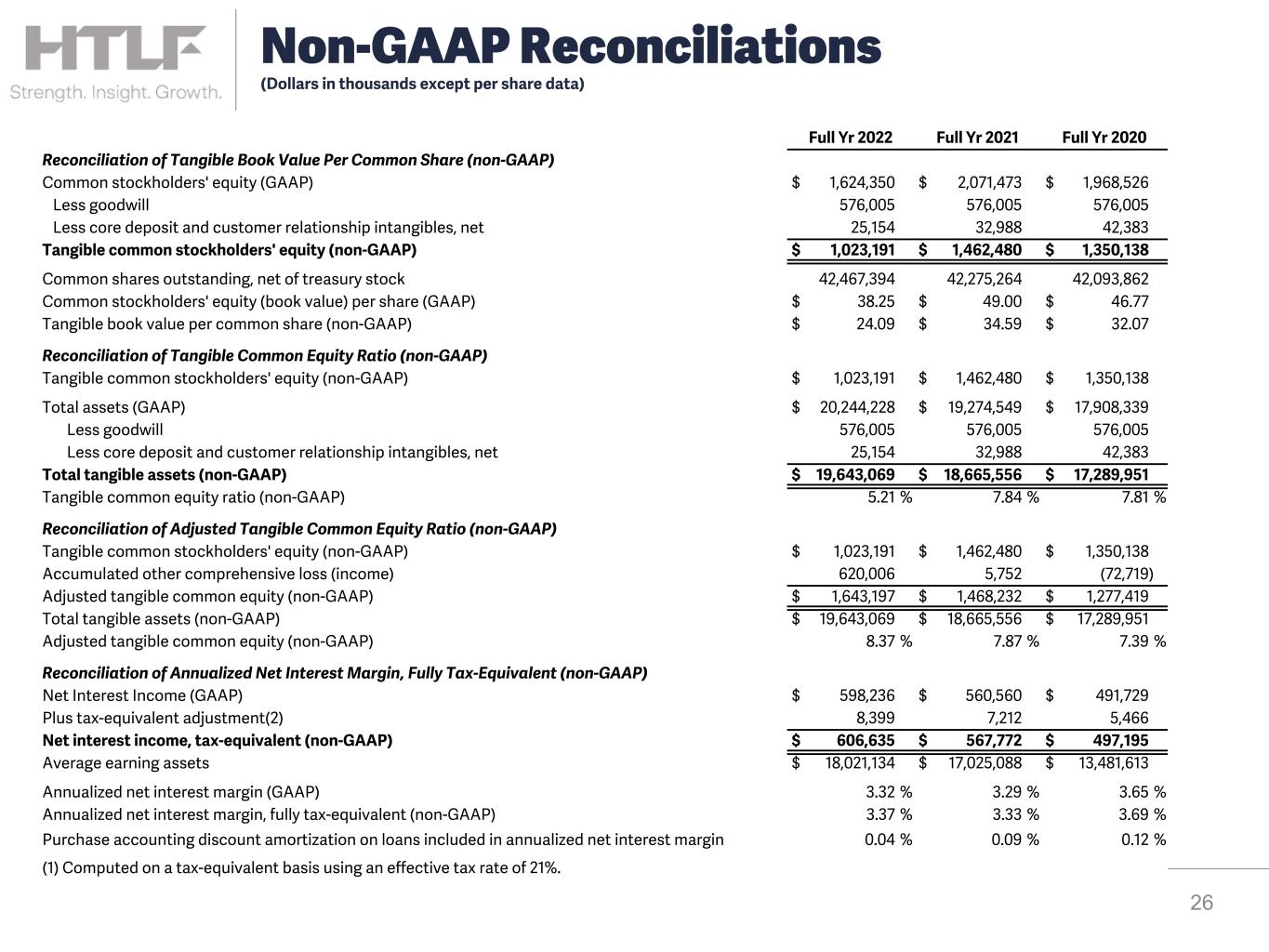

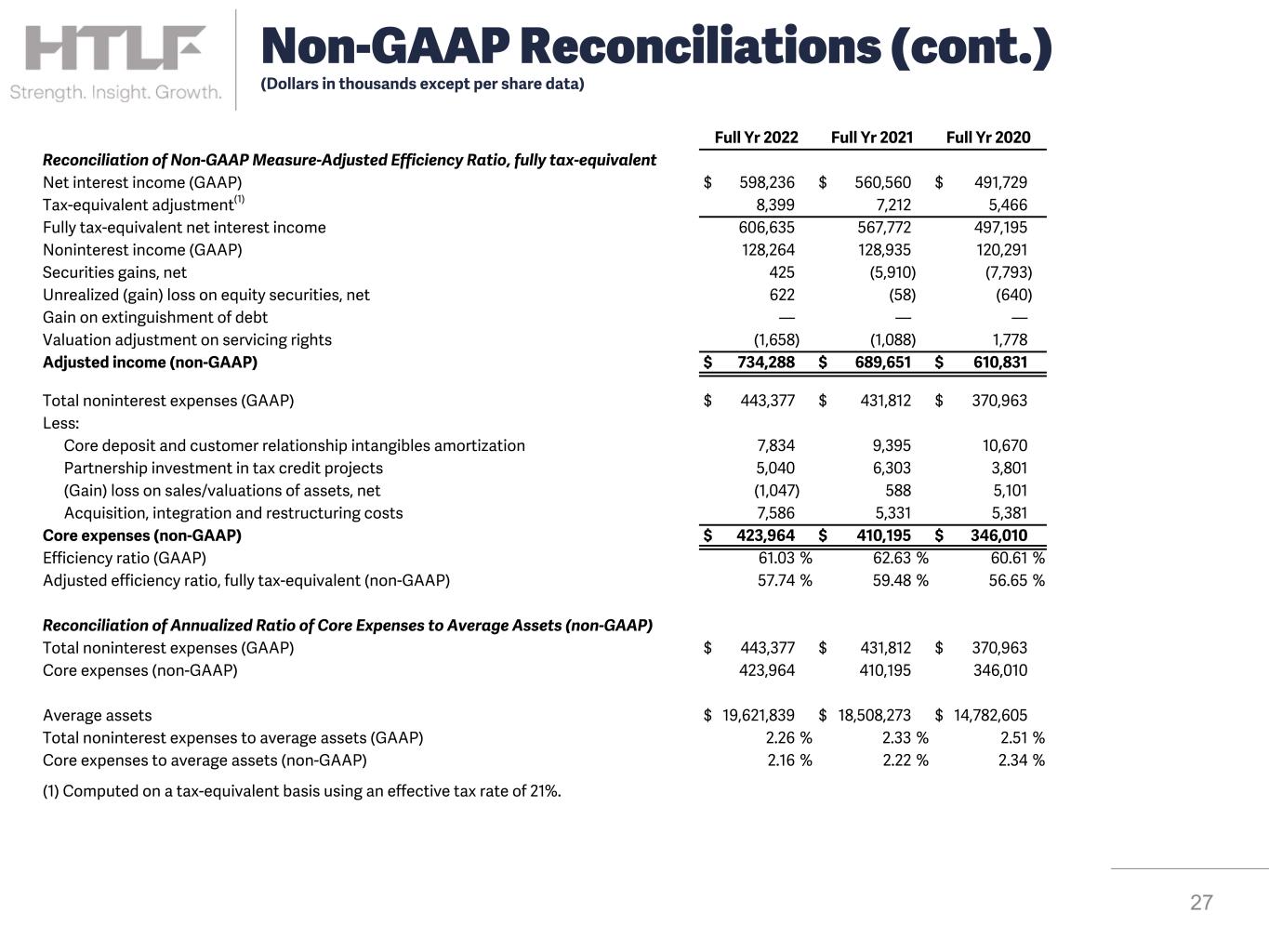

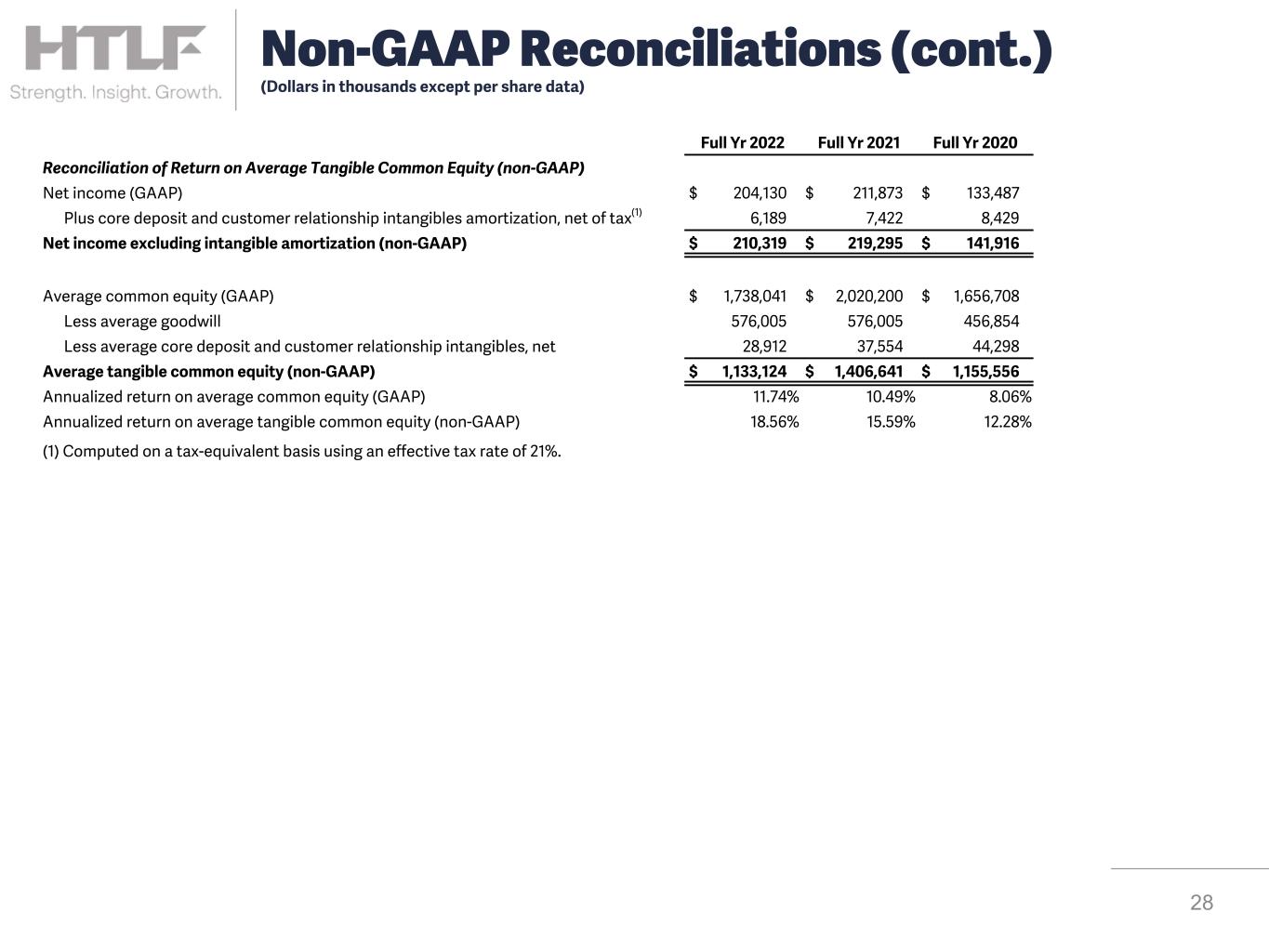

Non-GAAP Financial Measures

This earnings release contains references to financial measures which are not defined by generally accepted accounting principles ("GAAP"). Management believes the non-GAAP measures are helpful for investors to analyze and evaluate the company's financial condition and operating results. However, these non-GAAP measures have inherent limitations and should not be considered a substitute for operating results determined in accordance with GAAP. Because non-GAAP measures are not standardized, it may not be possible to compare the non-GAAP measures in this earnings release with other companies' non-GAAP measures. Reconciliations of each non-GAAP measure to the most directly comparable GAAP measure may be found in the financial tables in this earnings release.

Below are the non-GAAP measures included in this earnings release, management's reason for including each measure and the method of calculating each measure:

•Annualized net interest margin, fully tax-equivalent, adjusts net interest income for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

•Adjusted efficiency ratio, fully tax equivalent, expresses noninterest expenses as a percentage of fully tax-equivalent net interest income and noninterest income. This efficiency ratio is presented on a tax-equivalent basis which adjusts net interest income and noninterest expenses for the tax favored status of certain loans, securities, and tax credit projects. Management believes the presentation of this non-GAAP measure provides supplemental useful information for proper understanding of the financial results as it enhances the comparability of income and expenses arising from taxable and nontaxable sources and excludes specific items as noted in reconciliation contained in this earnings release.

•Net interest income, fully tax equivalent, is net income adjusted for the tax-favored status of certain loans and securities. Management believes this measure enhances the comparability of net interest income arising from taxable and tax-exempt sources.

•Tangible book value per common share is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by common shares outstanding, net of treasury. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

•Tangible common equity ratio is total common equity less goodwill and core deposit and customer relationship intangibles, net, divided by total assets less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate financial condition and capital strength.

•Adjusted tangible common equity ratio is total common equity less goodwill, core deposit and customer relationship intangibles, net, and accumulated other comprehensive loss divided by total assets less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate financial condition and capital strength excluding the variability of accumulated other comprehensive income (loss).

•Annualized return on average tangible common equity is net income excluding intangible amortization calculated as (1) net income excluding tax-effected core deposit and customer relationship intangibles amortization, divided by (2) average common equity less goodwill and core deposit and customer relationship intangibles, net. This measure is included as it is considered to be a critical metric to analyze and evaluate use of equity, financial condition and capital strength.

•Annualized ratio of core expenses to average assets adjusts noninterest expenses to exclude specific items noted in the reconciliation. Management includes this measure as it is considered to be a critical metric to analyze and evaluate controllable expenses related to primary business operations.

Conference Call Details

HTLF will host a conference call for shareholders, analysts and other interested parties at 5:00 p.m. EDT today. To join via webcast, please visit https://ir.htlf.com/news-and-events/event-calendar/default.aspx 10 minutes prior to the call. A replay will be available until July 30, 2024, by logging on to www.htlf.com.

About HTLF

Heartland Financial USA, Inc., is a Denver, Colorado-based bank holding company operating under the brand name HTLF, with assets of $20.22 billion as of June 30, 2023. HTLF's banks serves communities in Arizona, California, Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Montana, New Mexico, Texas and Wisconsin. HTLF is committed to its core commercial business, supported by a strong retail operation, and provides a diversified line of

financial services including treasury management, wealth management, investments and residential mortgage. Additional information is available at www.htlf.com.

Safe Harbor Statement

This release (including any information incorporated herein by reference) and future oral and written statements of HTLF and its management, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the business, financial condition, results of operations, plans, objectives and future performance of HTLF.

Any statements about HTLF's expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements may include information about possible or assumed future results of HTLF's operations or performance, and may be based upon beliefs, expectations and assumptions of HTLF's management. These forward-looking statements are generally identified by the use of the words such as "believe", "expect", "anticipate", "plan", "intend", "estimate", "project", "may", "will", "would", "could", "should", "view", "opportunity", "potential", or similar or negative expressions of these words or phrases that are used in this release, and future oral and written statements of HTLF and its management. Although HTLF may make these statements based on management’s experience, beliefs, expectations, assumptions and best estimate of future events, the ability of HTLF to predict results or the actual effect or outcomes of plans or strategies is inherently uncertain, and there may be events or factors that management has not anticipated. Therefore, the accuracy and achievement of such forward-looking statements and estimates are subject to a number of risks, many of which are beyond the ability of management to control or predict, that could cause actual results to differ materially from those in its forward-looking statements. These factors, which HTLF currently believes could have a material effect on its operations and future prospects, are detailed below and in the risk factors in HTLF's reports filed with the Securities and Exchange Commission ("SEC"), including the "Risk Factors" section under Item 1A of Part I of HTLF’s Annual Report on Form 10-K for the year ended December 31, 2022, include, among others:

•Economic and Market Conditions Risks, including risks related to the deterioration of the U.S. economy in general and in the local economies in which HTLF conducts its operations and future civil unrest, natural disasters, pandemics, such as the COVID-19 pandemic or future pandemics and governmental measures addressing them, climate change and climate-related regulations, persistent inflation, higher interest rates, recession, supply chain issues, labor shortages, terrorist threats or acts of war;

•Credit Risks, including risks of increasing credit losses due to deterioration in the financial condition of HTLF's borrowers, changes in asset and collateral values and climate and other borrower industry risks which may impact the provision for credit losses and net charge-offs;

•Liquidity and Interest Rate Risks, including the impact of capital market conditions, rising interest rates and changes in monetary policy on our borrowings and net interest income;

•Operational Risks, including processing, information systems, cybersecurity, vendor, business interruption, and fraud risks;

•Strategic and External Risks, including economic, political and competitive forces impacting our business;

•Legal, Compliance and Reputational Risks, including regulatory and litigation risks; and

•Risks of Owning Stock in HTLF, including stock price volatility and dilution as a result of future equity offerings and acquisitions.

There can be no assurance that other factors not currently anticipated by HTLF will not materially and adversely affect HTLF's business, financial condition and results of operations. Additionally, all statements in this release, including forward-looking statements speak only as of the date they are made. HTLF does not undertake and specifically disclaims any obligation to publicly release the results of any revisions which may be made to any forward-looking statement to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events or to otherwise update any statement in light of new information or future events. Further information concerning HTLF and its business, including additional factors that could materially affect HTLF’s financial results, is included in HTLF's filings with the Securities and Exchange Commission (the "SEC").

-FINANCIAL TABLES FOLLOW-

###

| | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| For the Quarter Ended

June 30, | | For the Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Interest Income | | | | | | | |

| Interest and fees on loans | $ | 168,899 | | | $ | 108,718 | | | $ | 322,742 | | | $ | 211,087 | |

| Interest on securities: | | | | | | | |

| Taxable | 58,172 | | | 38,098 | | | 114,148 | | | 70,718 | |

| Nontaxable | 6,378 | | | 5,508 | | | 12,406 | | | 11,710 | |

| Interest on federal funds sold | — | | | — | | | — | | | — | |

| Interest on deposits with other banks and short-term investments | 2,051 | | | 563 | | | 3,182 | | | 634 | |

| Total Interest Income | 235,500 | | | 152,887 | | | 452,478 | | | 294,149 | |

| Interest Expense | | | | | | | |

| Interest on deposits | 81,975 | | | 6,530 | | | 138,873 | | | 9,507 | |

| Interest on short-term borrowings | 848 | | | 88 | | | 3,270 | | | 134 | |

| Interest on other borrowings | 5,545 | | | 3,808 | | | 10,991 | | | 7,368 | |

| Total Interest Expense | 88,368 | | | 10,426 | | | 153,134 | | | 17,009 | |

| Net Interest Income | 147,132 | | | 142,461 | | | 299,344 | | | 277,140 | |

| Provision for credit losses | 5,379 | | | 3,246 | | | 8,453 | | | 6,491 | |

| Net Interest Income After Provision for Credit Losses | 141,753 | | | 139,215 | | | 290,891 | | | 270,649 | |

| Noninterest Income | | | | | | | |

| Service charges and fees | 19,627 | | | 18,066 | | | 36,763 | | | 33,317 | |

| Loan servicing income | 411 | | | 834 | | | 1,125 | | | 1,120 | |

| Trust fees | 5,419 | | | 5,679 | | | 11,076 | | | 11,758 | |

| Brokerage and insurance commissions | 677 | | | 839 | | | 1,373 | | | 1,708 | |

| Capital markets fees | 4,037 | | | 4,871 | | | 6,486 | | | 7,910 | |

| Securities gains/(losses), net | (314) | | | (2,089) | | | (1,418) | | | 783 | |

| Unrealized gain/(loss) on equity securities, net | (41) | | | (121) | | | 152 | | | (404) | |

| | | | | | | |

| Net gains on sale of loans held for sale | 1,050 | | | 2,901 | | | 2,881 | | | 6,312 | |

| Valuation adjustment on servicing rights | — | | | — | | | — | | | 1,658 | |

| Income on bank owned life insurance | 1,220 | | | 523 | | | 2,184 | | | 1,047 | |

| Other noninterest income | 407 | | | 3,036 | | | 1,870 | | | 3,899 | |

| Total Noninterest Income | 32,493 | | | 34,539 | | | 62,492 | | | 69,108 | |

| Noninterest Expense | | | | | | | |

| Salaries and employee benefits | 62,099 | | | 64,032 | | | 124,248 | | | 130,206 | |

| Occupancy | 6,691 | | | 7,094 | | | 13,900 | | | 14,456 | |

| Furniture and equipment | 3,063 | | | 3,033 | | | 5,978 | | | 6,552 | |

| Professional fees | 15,194 | | | 14,457 | | | 27,991 | | | 27,997 | |

| FDIC insurance assessments | 3,035 | | | 1,530 | | | 6,314 | | | 3,146 | |

| Advertising | 3,052 | | | 1,283 | | | 5,037 | | | 2,838 | |

| Core deposit and customer relationship intangibles amortization | 1,715 | | | 2,083 | | | 3,503 | | | 4,137 | |

| Other real estate and loan collection expenses, net | 348 | | | 78 | | | 503 | | | 273 | |

| (Gain)/loss on sales/valuations of assets, net | (3,372) | | | (3,230) | | | (2,257) | | | (3,184) | |

| Acquisition, integration and restructuring costs | 1,892 | | | 2,412 | | | 3,565 | | | 2,988 | |

| Partnership investment in tax credit projects | 154 | | | 737 | | | 692 | | | 814 | |

| Other noninterest expenses | 15,575 | | | 12,970 | | | 31,015 | | | 27,053 | |

| Total Noninterest Expense | 109,446 | | | 106,479 | | | 220,489 | | | 217,276 | |

| Income Before Income Taxes | 64,800 | | | 67,275 | | | 132,894 | | | 122,481 | |

| Income taxes | 15,384 | | | 15,402 | | | 30,702 | | | 27,519 | |

| Net Income | 49,416 | | | 51,873 | | | 102,192 | | | 94,962 | |

| | | | | | | |

| | | | | | | |

| Preferred dividends | (2,012) | | | (2,012) | | | (4,025) | | | (4,025) | |

| | | | | | | |

| Net Income Available to Common Stockholders | $ | 47,404 | | | $ | 49,861 | | | $ | 98,167 | | | $ | 90,937 | |

| Earnings per common share-diluted | $ | 1.11 | | | $ | 1.17 | | | $ | 2.30 | | | $ | 2.14 | |

| Weighted average shares outstanding-diluted | 42,757,603 | | | 42,565,391 | | | 42,753,197 | | | 42,562,639 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| For the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

| Interest Income | | | | | | | | | |

| Interest and fees on loans | $ | 168,899 | | | $ | 153,843 | | | $ | 143,970 | | | $ | 122,913 | | | $ | 108,718 | |

| Interest on securities: | | | | | | | | | |

| Taxable | 58,172 | | | 55,976 | | | 53,178 | | | 45,648 | | | 38,098 | |

| Nontaxable | 6,378 | | | 6,028 | | | 6,132 | | | 6,164 | | | 5,508 | |

| Interest on federal funds sold | — | | | — | | | 11 | | | — | | | — | |

| Interest on deposits with other banks and short-term investments | 2,051 | | | 1,131 | | | 1,410 | | | 1,081 | | | 563 | |

| Total Interest Income | 235,500 | | | 216,978 | | | 204,701 | | | 175,806 | | | 152,887 | |

| Interest Expense | | | | | | | | | |

| Interest on deposits | 81,975 | | | 56,898 | | | 32,215 | | | 15,158 | | | 6,530 | |

| Interest on short-term borrowings | 848 | | | 2,422 | | | 2,223 | | | 360 | | | 88 | |

| Interest on other borrowings | 5,545 | | | 5,446 | | | 5,043 | | | 4,412 | | | 3,808 | |

| Total Interest Expense | 88,368 | | | 64,766 | | | 39,481 | | | 19,930 | | | 10,426 | |

| Net Interest Income | 147,132 | | | 152,212 | | | 165,220 | | | 155,876 | | | 142,461 | |

| Provision for credit losses | 5,379 | | | 3,074 | | | 3,387 | | | 5,492 | | | 3,246 | |

| Net Interest Income After Provision for Credit Losses | 141,753 | | | 149,138 | | | 161,833 | | | 150,384 | | | 139,215 | |

| Noninterest Income | | | | | | | | | |

| Service charges and fees | 19,627 | | | 17,136 | | | 17,432 | | | 17,282 | | | 18,066 | |

| Loan servicing income | 411 | | | 714 | | | 790 | | | 831 | | | 834 | |

| Trust fees | 5,419 | | | 5,657 | | | 5,440 | | | 5,372 | | | 5,679 | |

| Brokerage and insurance commissions | 677 | | | 696 | | | 629 | | | 649 | | | 839 | |

| Capital markets fees | 4,037 | | | 2,449 | | | 1,824 | | | 1,809 | | | 4,871 | |

| Securities gains/(losses), net | (314) | | | (1,104) | | | (153) | | | (1,055) | | | (2,089) | |

| Unrealized gain/(loss) on equity securities, net | (41) | | | 193 | | | (7) | | | (211) | | | (121) | |

| | | | | | | | | |

| Net gains on sale of loans held for sale | 1,050 | | | 1,831 | | | 888 | | | 1,832 | | | 2,901 | |

| Valuation adjustment on servicing rights | — | | | — | | | — | | | — | | | — | |

| Income on bank owned life insurance | 1,220 | | | 964 | | | 600 | | | 694 | | | 523 | |

| Other noninterest income | 407 | | | 1,463 | | | 2,532 | | | 1,978 | | | 3,036 | |

| Total Noninterest Income | 32,493 | | | 29,999 | | | 29,975 | | | 29,181 | | | 34,539 | |

| Noninterest Expense | | | | | | | | | |

| Salaries and employee benefits | 62,099 | | | 62,149 | | | 61,611 | | | 62,661 | | | 64,032 | |

| Occupancy | 6,691 | | | 7,209 | | | 6,905 | | | 6,794 | | | 7,094 | |

| Furniture and equipment | 3,063 | | | 2,915 | | | 3,019 | | | 2,928 | | | 3,033 | |

| Professional fees | 15,194 | | | 12,797 | | | 16,320 | | | 14,289 | | | 14,457 | |

| FDIC insurance assessments | 3,035 | | | 3,279 | | | 1,866 | | | 1,988 | | | 1,530 | |

| Advertising | 3,052 | | | 1,985 | | | 1,829 | | | 1,554 | | | 1,283 | |

| Core deposit and customer relationship intangibles amortization | 1,715 | | | 1,788 | | | 1,841 | | | 1,856 | | | 2,083 | |

| Other real estate and loan collection expenses, net | 348 | | | 155 | | | 373 | | | 304 | | | 78 | |

| (Gain)/loss on sales/valuations of assets, net | (3,372) | | | 1,115 | | | 2,388 | | | (251) | | | (3,230) | |

| Acquisition, integration and restructuring costs | 1,892 | | | 1,673 | | | 2,442 | | | 2,156 | | | 2,412 | |

| Partnership investment in tax credit projects | 154 | | | 538 | | | 3,247 | | | 979 | | | 737 | |

| Other noninterest expenses | 15,575 | | | 15,440 | | | 15,377 | | | 13,625 | | | 12,970 | |

| Total Noninterest Expense | 109,446 | | | 111,043 | | | 117,218 | | | 108,883 | | | 106,479 | |

| Income Before Income Taxes | 64,800 | | | 68,094 | | | 74,590 | | | 70,682 | | | 67,275 | |

| Income taxes | 15,384 | | | 15,318 | | | 13,936 | | | 14,118 | | | 15,402 | |

| Net Income | 49,416 | | | 52,776 | | | 60,654 | | | 56,564 | | | 51,873 | |

| | | | | | | | | |

| | | | | | | | | |

| Preferred dividends | (2,012) | | | (2,013) | | | (2,012) | | | (2,013) | | | (2,012) | |

| | | | | | | | | |

| Net Income Available to Common Stockholders | $ | 47,404 | | | $ | 50,763 | | | $ | 58,642 | | | $ | 54,551 | | | $ | 49,861 | |

| Earnings per common share-diluted | $ | 1.11 | | | $ | 1.19 | | | $ | 1.37 | | | $ | 1.28 | | | $ | 1.17 | |

| Weighted average shares outstanding-diluted | 42,757,603 | | | 42,742,878 | | | 42,699,752 | | | 42,643,940 | | | 42,565,391 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| As of |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

| Assets | | | | | | | | | |

| Cash and due from banks | $ | 317,303 | | | $ | 274,354 | | | $ | 309,045 | | | $ | 250,394 | | | $ | 221,077 | |

| Interest bearing deposits with other banks and short-term investments | 82,884 | | | 87,757 | | | 54,042 | | | 149,466 | | | 163,717 | |

| Cash and cash equivalents | 400,187 | | | 362,111 | | | 363,087 | | | 399,860 | | | 384,794 | |

| Time deposits in other financial institutions | 1,490 | | | 1,740 | | | 1,740 | | | 1,740 | | | 1,855 | |

| Securities: | | | | | | | | | |

| | | | | | | | | |

| Carried at fair value | 5,798,041 | | | 6,096,657 | | | 6,147,144 | | | 6,060,331 | | | 7,106,218 | |

| Held to maturity, at cost, less allowance for credit losses | 834,673 | | | 832,098 | | | 829,403 | | | 830,247 | | | 81,939 | |

| Other investments, at cost | 72,291 | | | 72,364 | | | 74,567 | | | 80,286 | | | 85,899 | |

| Loans held for sale | 14,353 | | | 10,425 | | | 5,277 | | | 9,570 | | | 18,803 | |

| Loans: | | | | | | | | | |

| Held to maturity | 11,717,974 | | | 11,495,353 | | | 11,428,352 | | | 10,923,532 | | | 10,678,218 | |

| | | | | | | | | |

| Allowance for credit losses | (111,198) | | | (112,707) | | | (109,483) | | | (105,715) | | | (101,353) | |

| Loans, net | 11,606,776 | | | 11,382,646 | | | 11,318,869 | | | 10,817,817 | | | 10,576,865 | |

| Premises, furniture and equipment, net | 190,420 | | | 191,267 | | | 197,330 | | | 203,585 | | | 206,818 | |

| Goodwill | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | |

| Core deposit and customer relationship intangibles, net | 21,651 | | | 23,366 | | | 25,154 | | | 26,995 | | | 28,851 | |

| Servicing rights, net | — | | | — | | | 7,840 | | | 8,379 | | | 8,288 | |

| Cash surrender value on life insurance | 195,793 | | | 194,419 | | | 193,403 | | | 193,184 | | | 192,474 | |

| Other real estate, net | 2,677 | | | 7,438 | | | 8,401 | | | 8,030 | | | 4,528 | |

| | | | | | | | | |

| Other assets | 510,359 | | | 432,008 | | | 496,008 | | | 466,921 | | | 385,062 | |

| Total Assets | $ | 20,224,716 | | | $ | 20,182,544 | | | $ | 20,244,228 | | | $ | 19,682,950 | | | $ | 19,658,399 | |

| Liabilities and Equity | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Demand | $ | 4,897,858 | | | $ | 5,119,554 | | | $ | 5,701,340 | | | $ | 6,083,563 | | | $ | 6,087,304 | |

| Savings | 8,772,596 | | | 9,256,609 | | | 9,994,391 | | | 10,060,523 | | | 10,059,678 | |

| Time | 3,993,089 | | | 3,305,183 | | | 1,817,278 | | | 1,123,035 | | | 1,078,568 | |

| Total deposits | 17,663,543 | | | 17,681,346 | | | 17,513,009 | | | 17,267,121 | | | 17,225,550 | |

| | | | | | | | | |

| Short-term borrowings | 44,364 | | | 92,337 | | | 376,117 | | | 147,000 | | | 97,749 | |

| Other borrowings | 372,403 | | | 372,097 | | | 371,753 | | | 371,446 | | | 372,538 | |

| Accrued expenses and other liabilities | 285,416 | | | 207,359 | | | 248,294 | | | 241,425 | | | 188,494 | |

| Total Liabilities | 18,365,726 | | | 18,353,139 | | | 18,509,173 | | | 18,026,992 | | | 17,884,331 | |

| Stockholders' Equity | | | | | | | | | |

| Preferred equity | 110,705 | | | 110,705 | | | 110,705 | | | 110,705 | | | 110,705 | |

| Common stock | 42,645 | | | 42,559 | | | 42,467 | | | 42,444 | | | 42,439 | |

| Capital surplus | 1,087,358 | | | 1,084,112 | | | 1,080,964 | | | 1,079,277 | | | 1,076,766 | |

| Retained earnings | 1,193,522 | | | 1,158,948 | | | 1,120,925 | | | 1,074,168 | | | 1,031,076 | |

| Accumulated other comprehensive loss | (575,240) | | | (566,919) | | | (620,006) | | | (650,636) | | | (486,918) | |

| | | | | | | | | |

| Total Equity | 1,858,990 | | | 1,829,405 | | | 1,735,055 | | | 1,655,958 | | | 1,774,068 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Liabilities and Equity | $ | 20,224,716 | | | $ | 20,182,544 | | | $ | 20,244,228 | | | $ | 19,682,950 | | | $ | 19,658,399 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA |

| For the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

| Average Balances | | | | | | | | | |

| Assets | $ | 20,221,511 | | | $ | 20,118,005 | | | $ | 19,913,849 | | | $ | 19,775,341 | | | $ | 19,559,091 | |

| Loans, net of unearned | 11,625,442 | | | 11,378,078 | | | 11,117,513 | | | 10,783,135 | | | 10,477,368 | |

| Deposits | 17,689,138 | | | 17,505,867 | | | 17,319,218 | | | 17,282,289 | | | 17,044,479 | |

| Earning assets | 18,523,552 | | | 18,392,649 | | | 18,175,838 | | | 18,157,795 | | | 17,987,734 | |

| Interest bearing liabilities | 13,209,794 | | | 12,582,234 | | | 11,980,032 | | | 11,723,026 | | | 11,575,319 | |

| Common equity | 1,727,013 | | | 1,655,860 | | | 1,548,739 | | | 1,674,306 | | | 1,731,393 | |

| Total stockholders' equity | 1,837,718 | | | 1,766,565 | | | 1,659,444 | | | 1,785,011 | | | 1,842,098 | |

Tangible common equity (non-GAAP)(1) | 1,128,527 | | | 1,055,617 | | | 946,688 | | | 1,070,399 | | | 1,125,543 | |

| | | | | | | | | |

| Key Performance Ratios | | | | | | | | | |

| Annualized return on average assets | 0.98 | % | | 1.06 | % | | 1.21 | % | | 1.13 | % | | 1.06 | % |

| | | | | | | | | |

| Annualized return on average common equity (GAAP) | 11.01 | | | 12.43 | | | 15.02 | | | 12.93 | | | 11.55 | |

Annualized return on average tangible common equity (non-GAAP)(1) | 17.33 | | | 20.05 | | | 25.19 | | | 20.76 | | | 18.35 | |

| | | | | | | | | |

| Annualized ratio of net charge-offs/(recoveries) to average loans | 0.32 | | | (0.04) | | | (0.06) | | | 0.00 | | | 0.03 | |

| Annualized net interest margin (GAAP) | 3.19 | | | 3.36 | | | 3.61 | | | 3.41 | | | 3.18 | |

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.24 | | | 3.40 | | | 3.65 | | | 3.45 | | | 3.22 | |

| Efficiency ratio (GAAP) | 60.93 | | | 60.94 | | | 60.05 | | | 58.84 | | | 60.16 | |

Adjusted efficiency ratio, fully tax-equivalent (non-GAAP)(1) | 59.82 | | | 57.16 | | | 54.33 | | | 55.26 | | | 57.66 | |

| Annualized ratio of total noninterest expenses to average assets (GAAP) | 2.17 | | | 2.24 | | | 2.34 | | | 2.18 | | | 2.18 | |

Annualized ratio of core expenses to average assets (non-GAAP)(1) | 2.16 | | | 2.14 | | | 2.14 | | | 2.09 | | | 2.14 | |

| | | | | | | | | |

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. |

| | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| For the Quarter Ended

June 30, | | For the Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Average Balances | | | | | | | |

| Assets | $ | 20,221,511 | | | $ | 19,559,091 | | | $ | 20,170,044 | | | $ | 19,395,391 | |

| Loans, net of unearned | 11,625,442 | | | 10,477,368 | | | 11,502,443 | | | 10,261,679 | |

| Deposits | 17,689,138 | | | 17,044,479 | | | 17,598,009 | | | 16,753,544 | |

| Earning assets | 18,523,552 | | | 17,987,734 | | | 18,458,462 | | | 17,873,037 | |

| Interest bearing liabilities | 13,209,794 | | | 11,575,319 | | | 12,897,747 | | | 11,017,459 | |

| Common equity | 1,727,013 | | | 1,731,393 | | | 1,691,633 | | | 1,866,657 | |

| Total stockholders' equity | 1,837,718 | | | 1,842,098 | | | 1,802,338 | | | 1,977,362 | |

| Tangible common stockholders' equity | 1,128,527 | | | 1,125,543 | | | 1,092,273 | | | 1,259,769 | |

| | | | | | | |

| Key Performance Ratios | | | | | | | |

| Annualized return on average assets | 0.98 | % | | 1.06 | % | | 1.02 | % | | 0.99 | % |

| Annualized return on average common equity (GAAP) | 11.01 | | | 11.55 | | | 11.70 | | | 9.82 | |

Annualized return on average tangible common equity (non-GAAP)(1) | 17.33 | | | 18.35 | | | 18.63 | | | 15.08 | |

| | | | | | | |

| Annualized ratio of net charge-offs/(recoveries) to average loans | 0.32 | | | 0.03 | | | 0.15 | | | 0.25 | |

| Annualized net interest margin (GAAP) | 3.19 | | | 3.18 | | | 3.27 | | | 3.13 | |

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) | 3.24 | | | 3.22 | | | 3.32 | | | 3.17 | |

| Efficiency ratio (GAAP) | 60.93 | | | 60.16 | | | 60.94 | | | 62.75 | |

Adjusted efficiency ratio, fully tax-equivalent (non-GAAP)(1) | 59.82 | | | 57.66 | | | 58.48 | | | 61.02 | |

| Total noninterest expenses to average assets (GAAP) | 2.17 | | | 2.18 | | | 2.20 | | | 2.26 | |

Core expenses to average assets (non-GAAP)(1) | 2.16 | | | 2.14 | | | 2.15 | | | 2.21 | |

| | | | | | | |

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE AND FULL TIME EQUIVALENT EMPLOYEE DATA |

| As of and for the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

| Common Share Data | | | | | | | | | |

| Book value per common share | $ | 41.00 | | | $ | 40.38 | | | $ | 38.25 | | | $ | 36.41 | | | $ | 39.19 | |

Tangible book value per common share (non-GAAP)(1) | $ | 26.98 | | | $ | 26.30 | | | $ | 24.09 | | | $ | 22.20 | | | $ | 24.94 | |

| ASC 320 effect on book value per common share | $ | (14.04) | | | $ | (13.35) | | | $ | (14.58) | | | $ | (15.31) | | | $ | (11.43) | |

| Common shares outstanding, net of treasury stock | 42,644,544 | | | 42,558,726 | | | 42,467,394 | | | 42,444,106 | | | 42,439,439 | |

Tangible common equity ratio (non-GAAP)(1) | 5.86 | % | | 5.72 | % | | 5.21 | % | | 4.94 | % | | 5.56 | % |

Adjusted tangible common equity ratio (non-GAAP)(1) | 8.79 | % | | 8.61 | % | | 8.37 | % | | 8.35 | % | | 8.11 | % |

| | | | | | | | | |

| Other Selected Trend Information | | | | | | | | | |

| Effective tax rate | 23.74 | % | | 22.50 | % | | 18.68 | % | | 19.97 | % | | 22.89 | % |

| Full time equivalent employees | 1,966 | | | 1,991 | | | 2,002 | | | 2,020 | | | 2,087 | |

| | | | | | | | | |

| Loans Held to Maturity | | | | | | | | | |

| Commercial and industrial | $ | 3,590,680 | | | $ | 3,498,345 | | | $ | 3,464,414 | | | $ | 3,278,703 | | | $ | 3,059,519 | |

| Paycheck Protection Program ("PPP") | 4,139 | | | 8,258 | | | 11,025 | | | 13,506 | | | 23,031 | |

| Owner occupied commercial real estate | 2,398,698 | | | 2,312,538 | | | 2,265,307 | | | 2,285,973 | | | 2,282,833 | |

| Commercial and business lending | 5,993,517 | | | 5,819,141 | | | 5,740,746 | | | 5,578,182 | | | 5,365,383 | |

| Non-owner occupied commercial real estate | 2,530,736 | | | 2,421,341 | | | 2,330,940 | | | 2,219,542 | | | 2,321,718 | |

| Real estate construction | 1,013,134 | | | 1,102,186 | | | 1,076,082 | | | 996,017 | | | 845,045 | |

| Commercial real estate lending | 3,543,870 | | | 3,523,527 | | | 3,407,022 | | | 3,215,559 | | | 3,166,763 | |

| Total commercial lending | 9,537,387 | | | 9,342,668 | | | 9,147,768 | | | 8,793,741 | | | 8,532,146 | |

| Agricultural and agricultural real estate | 839,817 | | | 810,183 | | | 920,510 | | | 781,354 | | | 836,703 | |

| Residential mortgage | 828,437 | | | 841,084 | | | 853,361 | | | 852,928 | | | 845,270 | |

| Consumer | 512,333 | | | 501,418 | | | 506,713 | | | 495,509 | | | 464,099 | |

| Total loans held to maturity | $ | 11,717,974 | | | $ | 11,495,353 | | | $ | 11,428,352 | | | $ | 10,923,532 | | | $ | 10,678,218 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total unfunded loan commitments | $ | 4,905,147 | | | $ | 4,867,925 | | | $ | 4,729,677 | | | $ | 4,664,379 | | | $ | 4,458,874 | |

| | | | | | | | | |

| Deposits | | | | | | | | | |

| Demand-customer | $ | 4,897,858 | | | $ | 5,119,554 | | | $ | 5,701,340 | | | $ | 6,083,563 | | | $ | 6,087,304 | |

| Savings-customer | 8,149,596 | | | 8,501,337 | | | 8,670,898 | | | 8,691,545 | | | 8,852,602 | |

| Savings-wholesale and institutional | 623,000 | | | 755,272 | | | 1,323,493 | | | 1,368,978 | | | 1,207,076 | |

| Total savings | 8,772,596 | | | 9,256,609 | | | 9,994,391 | | | 10,060,523 | | | 10,059,678 | |

| Time-customer | 1,597,849 | | | 1,071,476 | | | 851,539 | | | 973,035 | | | 1,003,568 | |

| Time-wholesale | 2,395,240 | | | 2,233,707 | | | 965,739 | | | 150,000 | | | 75,000 | |

| Total time | 3,993,089 | | | 3,305,183 | | | 1,817,278 | | | 1,123,035 | | | 1,078,568 | |

| Total deposits | $ | 17,663,543 | | | $ | 17,681,346 | | | $ | 17,513,009 | | | $ | 17,267,121 | | | $ | 17,225,550 | |

| | | | | | | | | |

| Total customer deposits | $ | 14,645,303 | | | $ | 14,692,367 | | | $ | 15,223,777 | | | $ | 15,748,143 | | | $ | 15,943,474 | |

| Total wholesale and institutional deposits | 3,018,240 | | | 2,988,979 | | | 2,289,232 | | | 1,518,978 | | | 1,282,076 | |

| Total deposits | $ | 17,663,543 | | | $ | 17,681,346 | | | $ | 17,513,009 | | | $ | 17,267,121 | | | $ | 17,225,550 | |

| | | | | | | | | |

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| As of and for the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

| Allowance for Credit Losses-Loans | | | | | | | | | |

| Balance, beginning of period | $ | 112,707 | | | $ | 109,483 | | | $ | 105,715 | | | $ | 101,353 | | | $ | 100,522 | |

| | | | | | | | | |

| Provision for credit losses | 7,829 | | | 2,184 | | | 2,075 | | | 4,388 | | | 1,545 | |

| Charge-offs | (9,613) | | | (2,151) | | | (2,668) | | | (938) | | | (1,473) | |

| Recoveries | 275 | | | 3,191 | | | 4,361 | | | 912 | | | 759 | |

| Balance, end of period | $ | 111,198 | | | $ | 112,707 | | | $ | 109,483 | | | $ | 105,715 | | | $ | 101,353 | |

| | | | | | | | | |

| Allowance for Unfunded Commitments | | | | | | | | | |

| Balance, beginning of period | $ | 21,086 | | | $ | 20,196 | | | $ | 18,884 | | | $ | 17,780 | | | $ | 16,079 | |

| | | | | | | | | |

| Provision for credit losses | (2,450) | | | 890 | | | 1,312 | | | 1,104 | | | 1,701 | |

| Balance, end of period | $ | 18,636 | | | $ | 21,086 | | | $ | 20,196 | | | $ | 18,884 | | | $ | 17,780 | |

| | | | | | | | | |

| Allowance for lending related credit losses | $129,834 | | $133,793 | | $129,679 | | $124,599 | | $119,133 |

| | | | | | | | | |

| Provision for Credit Losses | | | | | | | | | |

| Provision for credit losses-loans | $ | 7,829 | | | $ | 2,184 | | | $ | 2,075 | | | $ | 4,388 | | | $ | 1,545 | |

| Provision (benefit) for credit losses-unfunded commitments | (2,450) | | | 890 | | | 1,312 | | | 1,104 | | | 1,701 | |

| | | | | | | | | |

| Total provision for credit losses | $ | 5,379 | | | $ | 3,074 | | | $ | 3,387 | | | $ | 5,492 | | | $ | 3,246 | |

| | | | | | | | | |

| Asset Quality | | | | | | | | | |

| | | | | | | | | |

| Nonaccrual loans | $ | 61,956 | | | $ | 58,066 | | | $ | 58,231 | | | $ | 64,560 | | | $ | 62,909 | |

| Loans past due ninety days or more | 1,459 | | | 174 | | | 273 | | | 678 | | | 95 | |

| Other real estate owned | 2,677 | | | 7,438 | | | 8,401 | | | 8,030 | | | 4,528 | |

| Other repossessed assets | 5 | | | 24 | | | 26 | | | — | | | — | |

| Total nonperforming assets | $ | 66,097 | | | $ | 65,702 | | | $ | 66,931 | | | $ | 73,268 | | | $ | 67,532 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Nonperforming Assets Activity | | | | | | | | | |

| Balance, beginning of period | $ | 65,702 | | | $ | 66,931 | | | $ | 73,268 | | | $ | 67,532 | | | $ | 65,876 | |

| Net loan (charge-offs)/recoveries | (9,338) | | | 1,040 | | | 1,693 | | | (26) | | | (714) | |

| New nonperforming loans | 19,805 | | | 4,626 | | | 1,439 | | | 8,388 | | | 8,590 | |

| | | | | | | | | |

Reduction of nonperforming loans(1) | (5,253) | | | (5,711) | | | (8,875) | | | (2,015) | | | (5,244) | |

| Net OREO/repossessed assets sales proceeds and losses | (4,819) | | | (1,184) | | | (594) | | | (611) | | | (976) | |

| | | | | | | | | |

| | | | | | | | | |

| Balance, end of period | $ | 66,097 | | | $ | 65,702 | | | $ | 66,931 | | | $ | 73,268 | | | $ | 67,532 | |

| | | | | | | | | |

| Asset Quality Ratios | | | | | | | | | |

| Ratio of nonperforming loans to total loans | 0.54 | % | | 0.51 | % | | 0.51 | % | | 0.60 | % | | 0.59 | % |

| | | | | | | | | |

| Ratio of nonperforming assets to total assets | 0.33 | | | 0.33 | | | 0.33 | | | 0.37 | | | 0.34 | |

| Annualized ratio of net loan charge-offs/(recoveries) to average loans | 0.32 | | | (0.04) | | | (0.06) | | | 0.00 | | | 0.03 | |

| Allowance for loan credit losses as a percent of loans | 0.95 | | | 0.98 | | | 0.96 | | | 0.97 | | | 0.95 | |

| Allowance for lending related credit losses as a percent of loans | 1.11 | | | 1.16 | | | 1.13 | | | 1.14 | | | 1.12 | |

| Allowance for loan credit losses as a percent of nonperforming loans | 175.35 | | | 193.52 | | | 187.14 | | | 162.05 | | | 160.87 | |

| Loans delinquent 30-89 days as a percent of total loans | 0.12 | | | 0.10 | | | 0.04 | | | 0.10 | | | 0.06 | |

| | | | | | | | | |

| (1) Includes principal reductions, transfers to performing status and transfers to OREO. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. | | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS |

| For the Quarter Ended |

| June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| Average

Balance | | Interest | | Rate | | Average

Balance | | Interest | | Rate | | Average

Balance | | Interest | | Rate |

| Earning Assets | | | | | | | | | | | | | | | | | |

| Securities: | | | | | | | | | | | | | | | | | |

| Taxable | $ | 5,962,207 | | | $ | 58,172 | | | 3.91 | % | | $ | 6,096,888 | | | $ | 55,976 | | | 3.72 | % | | $ | 6,419,615 | | | $ | 38,098 | | | 2.38 | % |

Nontaxable(1) | 895,458 | | | 8,074 | | | 3.62 | | | 922,676 | | | 7,630 | | | 3.35 | | | 915,880 | | | 6,972 | | | 3.05 | |

| Total securities | 6,857,665 | | | 66,246 | | | 3.87 | | | 7,019,564 | | | 63,606 | | | 3.67 | | | 7,335,495 | | | 45,070 | | | 2.46 | |

| Interest on deposits with other banks and short-term investments | 153,622 | | | 2,051 | | | 5.41 | | | 105,400 | | | 1,131 | | | 4.35 | | | 277,773 | | | 563 | | | 0.81 | |

| Federal funds sold | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Loans:(2) | | | | | | | | | | | | | | | | | |

Commercial and industrial(1) | 3,565,449 | | | 56,644 | | | 6.37 | | | 3,459,317 | | | 49,907 | | | 5.85 | | | 3,002,822 | | | 30,441 | | | 4.07 | |

| PPP loans | 6,302 | | | 24 | | | 1.53 | | | 9,970 | | | 26 | | | 1.06 | | | 41,370 | | | 1,801 | | | 17.46 | |

| Owner occupied commercial real estate | 2,366,107 | | | 28,031 | | | 4.75 | | | 2,289,002 | | | 26,769 | | | 4.74 | | | 2,294,524 | | | 22,863 | | | 4.00 | |

| Non-owner occupied commercial real estate | 2,462,098 | | | 35,583 | | | 5.80 | | | 2,331,318 | | | 30,749 | | | 5.35 | | | 2,179,048 | | | 22,871 | | | 4.21 | |

| Real estate construction | 1,028,109 | | | 18,528 | | | 7.23 | | | 1,099,026 | | | 18,131 | | | 6.69 | | | 878,555 | | | 10,015 | | | 4.57 | |

| Agricultural and agricultural real estate | 848,554 | | | 12,256 | | | 5.79 | | | 835,648 | | | 11,353 | | | 5.51 | | | 782,610 | | | 7,933 | | | 4.07 | |

| Residential mortgage | 840,741 | | | 9,383 | | | 4.48 | | | 852,561 | | | 9,273 | | | 4.41 | | | 849,174 | | | 8,358 | | | 3.95 | |

| Consumer | 508,082 | | | 9,068 | | | 7.16 | | | 501,236 | | | 8,242 | | | 6.67 | | | 449,265 | | | 4,949 | | | 4.42 | |

| Less: allowance for credit losses-loans | (113,177) | | | — | | | — | | | (110,393) | | | — | | | — | | | (102,902) | | | — | | | — | |

| Net loans | 11,512,265 | | | 169,517 | | | 5.91 | | | 11,267,685 | | | 154,450 | | | 5.56 | | | 10,374,466 | | | 109,231 | | | 4.22 | |

| Total earning assets | 18,523,552 | | | 237,814 | | | 5.15 | % | | 18,392,649 | | | 219,187 | | | 4.83 | % | | 17,987,734 | | | 154,864 | | | 3.45 | % |

| Nonearning Assets | 1,697,959 | | | | | | | 1,725,356 | | | | | | | 1,571,357 | | | | | |

| Total Assets | $ | 20,221,511 | | | | | | | $ | 20,118,005 | | | | | | | $ | 19,559,091 | | | | | |

| Interest Bearing Liabilities | | | | | | | | | | | | | | | | | |

| Savings | $ | 8,935,775 | | | $ | 41,284 | | | 1.85 | % | | $ | 9,730,494 | | | $ | 37,893 | | | 1.58 | % | | $ | 9,995,497 | | | $ | 5,372 | | | 0.22 | % |

| Time deposits | 3,812,330 | | | 40,691 | | | 4.28 | | | 2,257,047 | | | 19,005 | | | 3.41 | | | 1,088,765 | | | 1,158 | | | 0.43 | |

| Short-term borrowings | 89,441 | | | 848 | | | 3.80 | | | 222,772 | | | 2,422 | | | 4.41 | | | 118,646 | | | 88 | | | 0.30 | |

| Other borrowings | 372,248 | | | 5,545 | | | 5.97 | | | 371,921 | | | 5,446 | | | 5.94 | | | 372,411 | | | 3,808 | | | 4.10 | |

| Total interest bearing liabilities | 13,209,794 | | | 88,368 | | | 2.68 | % | | 12,582,234 | | | 64,766 | | | 2.09 | % | | 11,575,319 | | | 10,426 | | | 0.36 | % |

| Noninterest Bearing Liabilities | | | | | | | | | | | | | | | | | |

| Noninterest bearing deposits | 4,941,033 | | | | | | | 5,518,326 | | | | | | | 5,960,217 | | | | | |

| Accrued interest and other liabilities | 232,966 | | | | | | | 250,880 | | | | | | | 181,457 | | | | | |

| Total noninterest bearing liabilities | 5,173,999 | | | | | | | 5,769,206 | | | | | | | 6,141,674 | | | | | |

| Equity | 1,837,718 | | | | | | | 1,766,565 | | | | | | | 1,842,098 | | | | | |

| Total Liabilities and Equity | $ | 20,221,511 | | | | | | | $ | 20,118,005 | | | | | | | $ | 19,559,091 | | | | | |

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) | | | $ | 149,446 | | | | | | | $ | 154,421 | | | | | | | $ | 144,438 | | | |

Net interest spread(1) | | | | | 2.47 | % | | | | | | 2.74 | % | | | | | | 3.09 | % |

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets | | | | | 3.24 | % | | | | | | 3.40 | % | | | | | | 3.22 | % |

| Interest bearing liabilities to earning assets | 71.31 | % | | | | | | 68.41 | % | | | | | | 64.35 | % | | | | |

| | | | | | | | | | | | | | | | | |

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | | |

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. |

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. | | | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | | | |

| DOLLARS IN THOUSANDS | | | |

| For the Six Months Ended | | | |

| June 30, 2023 | | June 30, 2022 | | | |

| Average

Balance | | Interest | | Rate | | Average

Balance | | Interest | | Rate | | | |

| Earning Assets | | | | | | | | | | | | | | |

| Securities: | | | | | | | | | | | | | | |

| Taxable | $ | 6,029,175 | | | $ | 114,148 | | | 3.82 | % | | $ | 6,460,412 | | | $ | 70,718 | | | 2.21 | % | | | |

Nontaxable(1) | 908,992 | | | 15,704 | | | 3.48 | | | 1,010,888 | | | 14,823 | | | 2.96 | | | | |

| Total securities | 6,938,167 | | | 129,852 | | | 3.77 | | | 7,471,300 | | | 85,541 | | | 2.31 | % | | | |

| Interest bearing deposits with other banks and other short-term investments | 129,645 | | | 3,182 | | | 4.95 | | | 247,281 | | | 634 | | | 0.52 | | | | |

| Federal funds sold | — | | | — | | | — | | | 6 | | | — | | | — | | | | |

Loans:(2) | | | | | | | | | | | | | | |

Commercial and industrial(1) | 3,512,807 | | | 106,551 | | | 6.12 | % | | 2,874,694 | | | 57,494 | | | 4.03 | | | | |

| PPP loans | 8,126 | | | 50 | | | 1.24 | | | 86,460 | | | 6,124 | | | 14.28 | | | | |

| Owner occupied commercial real estate | 2,327,702 | | | 54,800 | | | 4.75 | | | 2,268,963 | | | 44,141 | | | 3.92 | | | | |

| Non-owner occupied commercial real estate | 2,397,004 | | | 66,332 | | | 5.58 | | | 2,119,925 | | | 44,034 | | | 4.19 | | | | |

| Real estate construction | 1,063,372 | | | 36,659 | | | 6.95 | | | 862,989 | | | 19,291 | | | 4.51 | | | | |

Agricultural and agricultural real estate | 842,136 | | | 23,609 | | | 5.65 | | | 764,082 | | | 14,939 | | | 3.94 | | | | |

| Residential mortgage | 846,618 | | | 18,656 | | | 4.44 | | | 846,542 | | | 16,443 | | | 3.92 | | | | |

| Consumer | 504,678 | | | 17,310 | | | 6.92 | | | 438,024 | | | 9,604 | | | 4.42 | | | | |

| Less: allowance for credit losses-loans | (111,793) | | | — | | | — | | | (107,229) | | | — | | | — | | | | |

| Net loans | 11,390,650 | | | 323,967 | | | 5.74 | | | 10,154,450 | | | 212,070 | | | 4.21 | | | | |

| Total earning assets | 18,458,462 | | | 457,001 | | | 4.99 | % | | 17,873,037 | | | 298,245 | | | 3.37 | % | | | |

| Nonearning Assets | 1,711,582 | | | | | | | 1,522,354 | | | | | | | | |

| Total Assets | $ | 20,170,044 | | | | | | | $ | 19,395,391 | | | | | | | | |

Interest Bearing Liabilities | | | | | | | | | | | | | | |

| Savings | $ | 9,330,939 | | | $ | 79,177 | | | 1.71 | % | | $ | 9,445,778 | | | $ | 7,766 | | | 0.17 | % | | | |

| Time deposits | 3,038,985 | | | 59,696 | | | 3.96 | | | 1,080,267 | | | 1,741 | | | 0.32 | | | | |

| Short-term borrowings | 155,738 | | | 3,270 | | | 4.23 | | | 119,115 | | | 134 | | | 0.23 | | | | |

| Other borrowings | 372,085 | | | 10,991 | | | 5.96 | | | 372,299 | | | 7,368 | | | 3.99 | | | | |

| Total interest bearing liabilities | 12,897,747 | | | 153,134 | | | 2.39 | % | | 11,017,459 | | | 17,009 | | | 0.31 | % | | | |

Noninterest Bearing Liabilities | | | | | | | | | | | | | | |

| Noninterest bearing deposits | 5,228,085 | | | | | | | 6,227,499 | | | | | | | | |

| Accrued interest and other liabilities | 241,874 | | | | | | | 173,071 | | | | | | | | |

| Total noninterest bearing liabilities | 5,469,959 | | | | | | | 6,400,570 | | | | | | | | |

| Stockholders' Equity | 1,802,338 | | | | | | | 1,977,362 | | | | | | | | |

| Total Liabilities and Stockholders' Equity | $ | 20,170,044 | | | | | | | $ | 19,395,391 | | | | | | | | |

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) | | | $ | 303,867 | | | | | | | $ | 281,236 | | | | | | |

Net interest spread(1) | | | | | 2.60 | % | | | | | | 3.06 | % | | | |

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets | | | | | 3.32 | % | | | | | | 3.17 | % | | | |

| Interest bearing liabilities to earning assets | 69.87 | % | | | | | | 61.64 | % | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | | | | | |

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | | | |

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA |

| For the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |

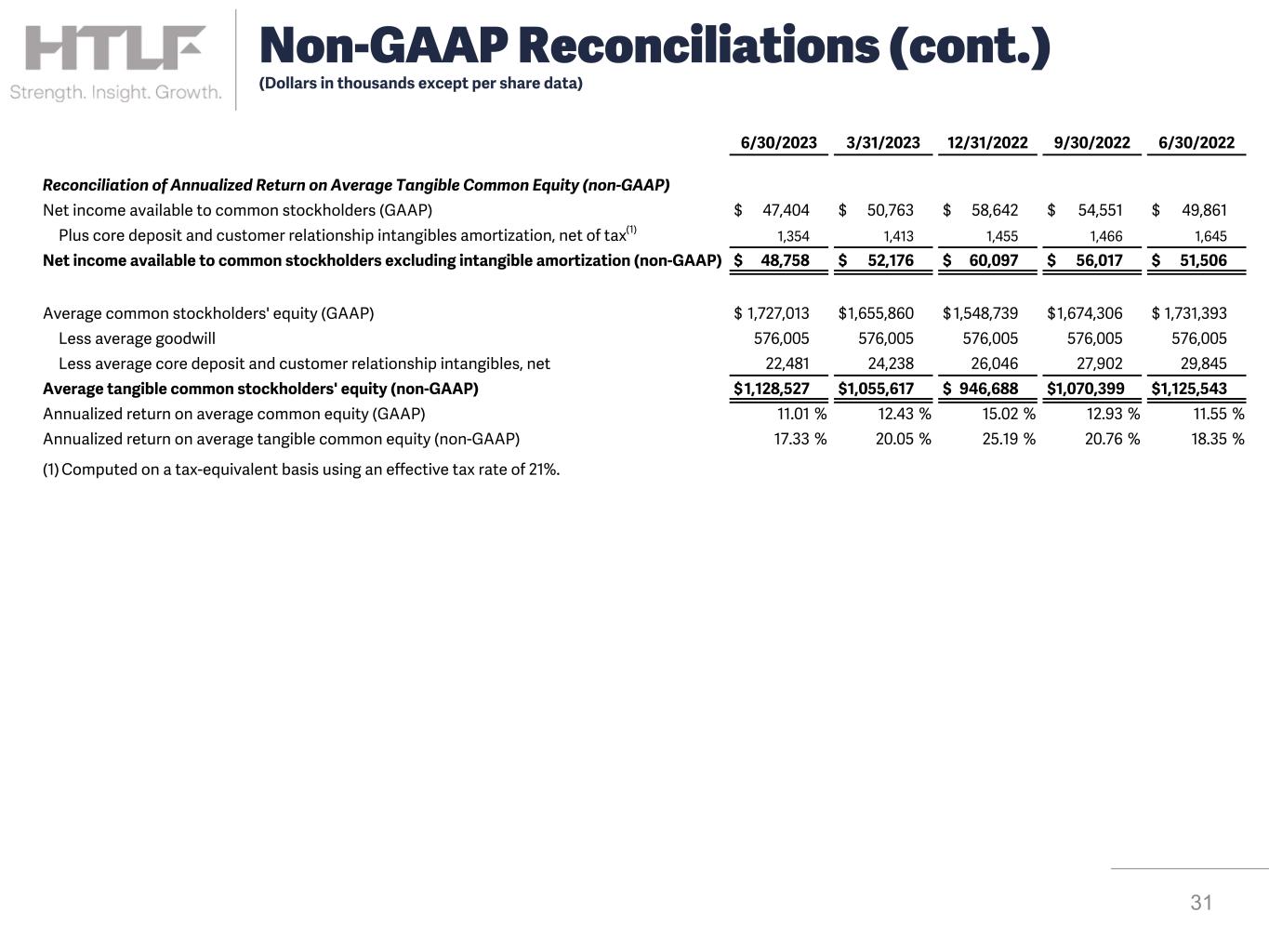

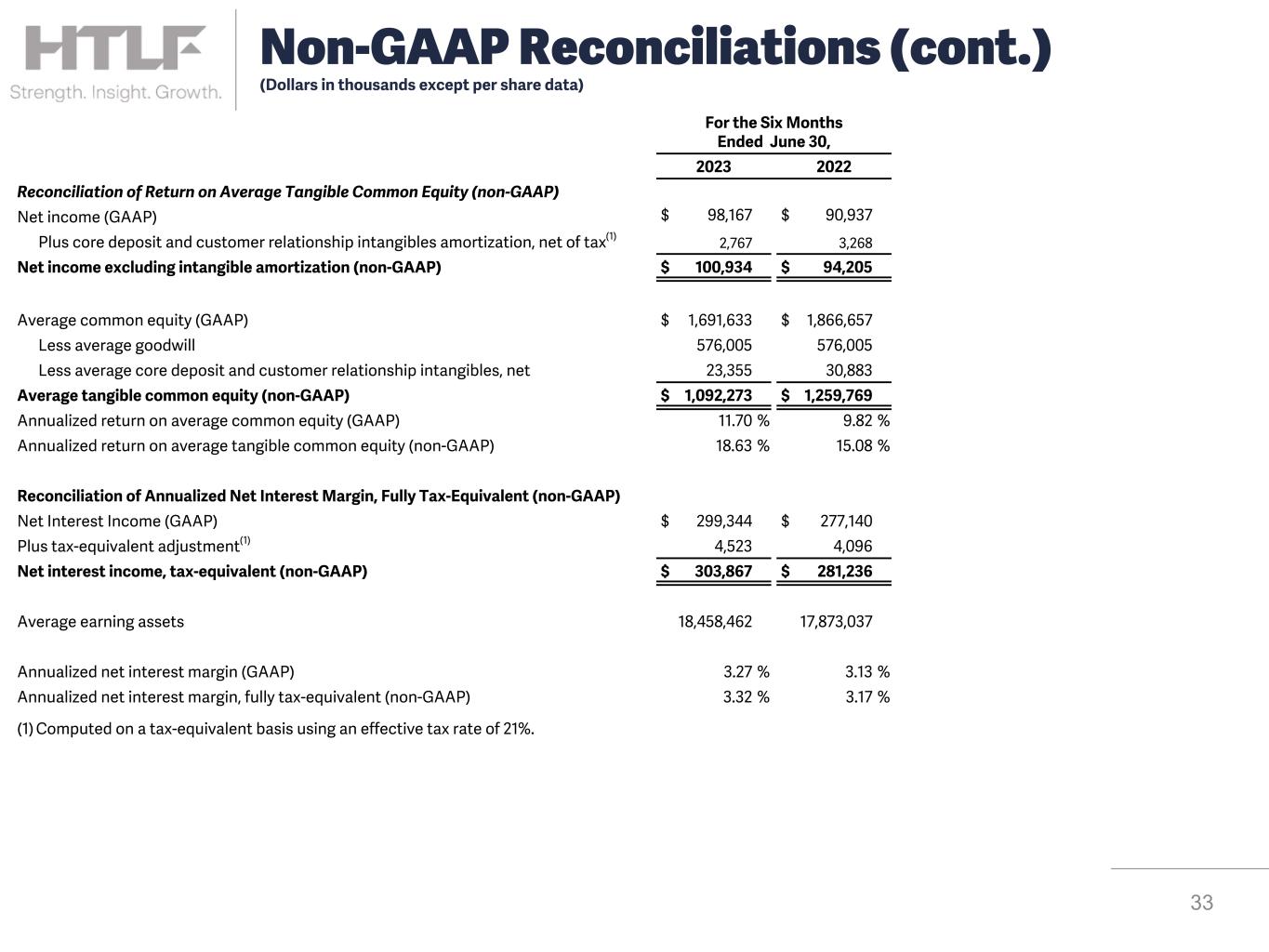

| Reconciliation of Annualized Return on Average Tangible Common Equity (non-GAAP) | | | | | | | | | |

| Net income available to common stockholders (GAAP) | $ | 47,404 | | | $ | 50,763 | | | $ | 58,642 | | | $ | 54,551 | | | $ | 49,861 | |

Plus core deposit and customer relationship intangibles amortization, net of tax(1) | 1,354 | | | 1,413 | | | 1,455 | | | 1,466 | | | 1,645 | |

| Net income available to common stockholders excluding intangible amortization (non-GAAP) | $ | 48,758 | | | $ | 52,176 | | | $ | 60,097 | | | $ | 56,017 | | | $ | 51,506 | |

| | | | | | | | | |

| Average common equity (GAAP) | $ | 1,727,013 | | | $ | 1,655,860 | | | $ | 1,548,739 | | | $ | 1,674,306 | | | $ | 1,731,393 | |

| Less average goodwill | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | |

| Less average core deposit and customer relationship intangibles, net | 22,481 | | | 24,238 | | | 26,046 | | | 27,902 | | | 29,845 | |

| Average tangible common equity (non-GAAP) | $ | 1,128,527 | | | $ | 1,055,617 | | | $ | 946,688 | | | $ | 1,070,399 | | | $ | 1,125,543 | |

| Annualized return on average common equity (GAAP) | 11.01 | % | | 12.43 | % | | 15.02 | % | | 12.93 | % | | 11.55 | % |

| Annualized return on average tangible common equity (non-GAAP) | 17.33 | % | | 20.05 | % | | 25.19 | % | | 20.76 | % | | 18.35 | % |

| | | | | | | | | |

| Reconciliation of Annualized Net Interest Margin, Fully Tax-Equivalent (non-GAAP) | | | | | | | | | |

| Net Interest Income (GAAP) | $ | 147,132 | | | $ | 152,212 | | | $ | 165,220 | | | $ | 155,876 | | | $ | 142,461 | |

Plus tax-equivalent adjustment(1) | 2,314 | | | 2,209 | | | 2,152 | | | 2,151 | | | 1,977 | |

| Net interest income, fully tax-equivalent (non-GAAP) | $ | 149,446 | | | $ | 154,421 | | | $ | 167,372 | | | $ | 158,027 | | | $ | 144,438 | |

| | | | | | | | | |

| Average earning assets | $ | 18,523,552 | | | $ | 18,392,649 | | | $ | 18,175,838 | | | $ | 18,157,795 | | | $ | 17,987,734 | |

| | | | | | | | | |

| | | | | | | | | |

| Annualized net interest margin (GAAP) | 3.19 | % | | 3.36 | % | | 3.61 | % | | 3.41 | % | | 3.18 | % |

| Annualized net interest margin, fully tax-equivalent (non-GAAP) | 3.24 | | | 3.40 | | | 3.65 | | | 3.45 | | | 3.22 | |

| Net purchase accounting discount amortization on loans included in annualized net interest margin | 0.03 | | | 0.02 | | | 0.03 | | | 0.03 | | | 0.07 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Tangible Book Value Per Common Share (non-GAAP) | | | | | | | | | |

| Common equity (GAAP) | $ | 1,748,285 | | | $ | 1,718,700 | | | $ | 1,624,350 | | | $ | 1,545,253 | | | $ | 1,663,363 | |

| Less goodwill | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | |

| Less core deposit and customer relationship intangibles, net | 21,651 | | | 23,366 | | | 25,154 | | | 26,995 | | | 28,851 | |

| Tangible common equity (non-GAAP) | $ | 1,150,629 | | | $ | 1,119,329 | | | $ | 1,023,191 | | | $ | 942,253 | | | $ | 1,058,507 | |

| | | | | | | | | |

| Common shares outstanding, net of treasury stock | 42,644,544 | | | 42,558,726 | | | 42,467,394 | | | 42,444,106 | | | 42,439,439 | |

| Common equity (book value) per share (GAAP) | $ | 41.00 | | | $ | 40.38 | | | $ | 38.25 | | | $ | 36.41 | | | $ | 39.19 | |

| Tangible book value per common share (non-GAAP) | $ | 26.98 | | | $ | 26.30 | | | $ | 24.09 | | | $ | 22.20 | | | $ | 24.94 | |

| | | | | | | | | |

| Reconciliation of Tangible Common Equity Ratio (non-GAAP) | | | | | | | | | |

| Tangible common equity (non-GAAP) | $ | 1,150,629 | | | $ | 1,119,329 | | | $ | 1,023,191 | | | $ | 942,253 | | | $ | 1,058,507 | |

| | | | | | | | | |

| Total assets (GAAP) | $ | 20,224,716 | | | $ | 20,182,544 | | | $ | 20,244,228 | | | $ | 19,682,950 | | | $ | 19,658,399 | |

| Less goodwill | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | | | 576,005 | |

| Less core deposit and customer relationship intangibles, net | 21,651 | | | 23,366 | | | 25,154 | | | 26,995 | | | 28,851 | |

| Total tangible assets (non-GAAP) | $ | 19,627,060 | | | $ | 19,583,173 | | | $ | 19,643,069 | | | $ | 19,079,950 | | | $ | 19,053,543 | |

| Tangible common equity ratio (non-GAAP) | 5.86 | % | | 5.72 | % | | 5.21 | % | | 4.94 | % | | 5.56 | % |

| | | | | | | | | |

| Reconciliation of Adjusted Tangible Common Equity Ratio (non-GAAP) | | | | | | | | | |

| Tangible common equity (non-GAAP) | $ | 1,150,629 | | | $ | 1,119,329 | | | $ | 1,023,191 | | | $ | 942,253 | | | $ | 1,058,507 | |

| Accumulated other comprehensive loss | 575,240 | | | 566,919 | | | 620,006 | | | 650,636 | | | 486,918 | |

| Adjusted tangible common equity (non-GAAP) | $ | 1,725,869 | | | $ | 1,686,248 | | $ | — | | $ | 1,643,197 | | | $ | 1,592,889 | | | $ | 1,545,425 | |

| | | | | | | | | |

| Total tangible assets (non-GAAP) | $ | 19,627,060 | | | $ | 19,583,173 | | | $ | 19,643,069 | | | $ | 19,079,950 | | | $ | 19,053,543 | |

| Adjusted tangible common equity ratio (non-GAAP) | 8.79 | % | | 8.61 | % | | 8.37 | % | | 8.35 | % | | 8.11 | % |

| | | | | | | | | |

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HEARTLAND FINANCIAL USA, INC. |

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) |

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

| Reconciliation of Adjusted Efficiency Ratio, fully tax-equivalent (non-GAAP) | For the Quarter Ended |

| 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | 9/30/2022 | | 6/30/2022 |