Current Report Filing (8-k)

14 Avril 2023 - 11:29PM

Edgar (US Regulatory)

0001798270

false

0001798270

2023-04-11

2023-04-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest event reported): April 11, 2023

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40785 |

|

82-2726719 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7887 East Belleview Avenue, Suite 500

Denver, CO |

|

80111 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IONM |

|

NASDAQ Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 4.01 | Changes in Registrant’s Certifying Accountant. |

On April 11, 2023, Baker Tilly US, LLP (“Baker

Tilly”) informed Assure Holdings Corp. (the “Company”) and the Audit Committee of the Company that Baker Tilly would

not stand for re-election as the Company’s certifying accountant for the fiscal year ended December 31, 2023.

Baker Tilly’s reports on our financial statements

for the years ended December 31, 2022 and 2021 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or

modified as to uncertainty, audit scope, or accounting principles, except for an explanatory paragraph regarding existence of substantial

doubt about the Company’s ability to continue as a going concern in the report for the year ended December 31, 2022.

During our two most recent fiscal years ended

December 31, 2022 and 2021 and the subsequent interim period through April 14, 2023, there were no disagreements, within the meaning of

Item 304(a)(1)(iv) of Regulation S-K promulgated under the Securities Exchange Act of 1934 (“Regulation S-K”) and the related

instructions thereto, with Baker Tilly on any matter of accounting principles or practices, financial statement disclosure, or auditing

scope or procedure, which disagreements, if not resolved to the satisfaction of Baker Tilly, would have caused it to make reference to

the subject matter of the disagreements in connection with its reports. Also during this same period, there were no reportable events

within the meaning of Item 304(a)(1)(v) of Regulation S-K and the related instructions thereto.

We provided Baker Tilly

with the disclosures under this Item 4.01, and requested Baker Tilly to furnish us with a letter addressed to the United States Securities

and Exchange Commission stating whether it agrees with the statements made by us in this Item 4.01 and, if not, stating the respects in

which it does not agree. We will furnish the letter from Baker Tilly as an exhibit to an amendment to this report promptly upon receipt

and in no event later than 10 business days from the date hereof.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective April 11, 2023,

Martin Burian voluntarily resigned from his position as a member of the Company’s Board of Directors. Mr. Burian did not resign

as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

| Exhibit No. |

|

Name |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ASSURE HOLDINGS CORP. |

| |

|

|

| Date: April 14, 2023 |

By: |

/s/ John Price |

| |

Name: |

John Price |

| |

Title: |

Chief Financial Officer |

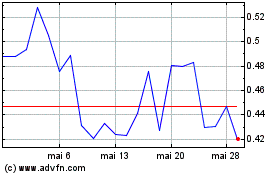

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025