Assure Holdings Corp. Announces Closing Of $6 Million Underwritten Public Offering

16 Mai 2023 - 5:04PM

Assure Holdings Corp. (NASDAQ: IONM) (“

Assure

Holdings” or the “

Company”), a provider

of intraoperative neuromonitoring and remote neurology services,

today announced the closing of an underwritten public offering of

5,000,000 shares of its common stock (or prefunded warrants in lieu

thereof) at an offering price to the public of $1.20 per share (or

$1.199 per pre-funded warrant). The pre-funded warrants are

immediately exercisable at a nominal exercise price of $0.001 or on

a cashless basis and may be exercised at any time until all of the

pre-funded warrants are exercised in full.

Joseph Gunnar & Co., LLC acted as the sole book-running

manager for the offering.

The gross proceeds to the Company from the offering are

approximately $6 million, before deducting the underwriters’

fees and other offering expenses payable by Assure. The Company

intends to use the net proceeds from the offering for general

corporate purposes, including working capital, marketing, product

development and capital expenditures.

The Company has granted the underwriters in the offering a

45-day option to purchase up to 750,000 additional shares of the

Company’s common stock and/or pre-funded warrants, in any

combination thereof, from the Company at the public offering price,

less underwriting discounts and commissions, solely to cover

over-allotments, if any.

The securities were offered pursuant to the Company’s

registration statement on Form S-1 (File No. 333-269438), which was

declared effective by the United States Securities and

Exchange Commission (“SEC”) on May 11,

2023. The offering was made only by means of a

prospectus which is a part of the effective registration statement.

A copy of the final prospectus relating to the offering was with

the SEC and is available on the SEC’s website at www.sec.gov.

Electronic copies of the final prospectus may also be obtained,

when available, from Joseph Gunnar & Co., LLC, 30 Broad Street,

11th Floor, New York, NY 10004, Attn: Syndicate Department, by

phone (212) 440-9600.

This press release shall not constitute an offer to sell

or the solicitation of an offer to buy these securities, nor shall

there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About Assure Holdings

Assure Holdings Corp. is a best-in-class provider of

outsourced intraoperative neuromonitoring and remote neurology

services. The Company delivers a turnkey suite of clinical and

operational services to support surgeons and medical facilities

during invasive procedures that place the nervous system at risk

including neurosurgery, spine, cardiovascular, orthopedic and ear,

nose and throat surgeries. Assure employs highly trained

technologists that provide a direct point of contact in the

operating room. Physicians employed through Assure subsidiaries

simultaneously monitor the functional integrity of patients’ neural

structures throughout the procedure communicating in real-time with

the surgeon and technologist. Accredited by The Joint

Commission, Assure’s mission is to provide exceptional surgical

care and a positive patient experience. For more information, visit

the Company’s website at www.assureneuromonitoring.com.

Forward-Looking Statements

This news release may contain “forward-looking statements”

within the meaning of applicable securities laws. Such statements

include, but are not limited to, statements regarding the intended

use of proceeds from offering and statements concerning the

anticipated closing and closing date of the offering and may

generally be identified by the use of the words “anticipates,”

“expects,” “intends,” “plans,” “should,” “could,” “would,” “may,”

“will,” “believes,” “estimates,” “potential,” “target,” or

“continue” and variations or similar expressions. Forward-looking

statements include, but are not limited to, the financial results

presented herein which are subject to final review procedures and

subsequent events. These statements are based upon the current

expectations and beliefs of management and are subject to certain

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

These risks include risks regarding (i) our patient volume or cases

not growing as expected, or decreasing, which could impact revenue

and profitability; (ii) unfavorable economic conditions could have

an adverse effect on our business; (iii) risks related to increased

leverage resulting from incurring additional debt; (iv) the

policies of health insurance carriers may affect the amount of

revenue we receive; (v) our ability to successfully market and sell

our products and services; (vi) we may be subject to competition

and technological risk which may impact the price and amount of

services we can sell and the nature of services we can provide;

(vii) regulatory changes that are unfavorable in the states where

our operations are conducted or concentrated; (viii) our ability to

comply and the cost of compliance with extensive existing

regulation and any changes or amendments thereto; (ix) changes

within the medical industry and third-party reimbursement policies

and our estimates of associated timing and costs with the same; (x)

our ability to adequately forecast expansion and the Company’s

management of anticipated growth; and (xi) risks and uncertainties

discussed in preliminary prospectus included in our Registration

Statement on Form S-1 for this offering and our most recent annual

and quarterly reports filed with the United States Securities

and Exchange Commission, including our annual report for the fiscal

year ended December 1, 2022 on Form 10-K filed with

the Securities and Exchange Commission on March 31,

2023, and with the Canadian securities regulators and available on

the Company’s profiles on EDGAR at www.sec.gov and SEDAR

at www.sedar.com, which risks and uncertainties are

incorporated herein by reference. The Company assumes no obligation

to publicly update or revise its forward-looking statements as a

result of new information, future events or otherwise, except as

required by law.

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended

and Section 21E of the Securities Exchange Act of 1934, as amended.

All forward-looking statements are inherently uncertain as they are

based on current expectations and assumptions concerning future

events or future performance of the Company. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which are only predictions and speak only as of the date hereof. In

evaluating such statements, prospective investors should review

carefully various risks and uncertainties identified in this

release and matters set in the Company’s SEC filings. These risks

and uncertainties could cause the Company’s actual results to

differ materially from those indicated in the forward-looking

statements.

Investor Relations

Brett MaasManaging Principal, Hayden IRT:

646-536-7331ionm@haydenir.com

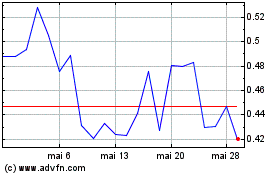

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025