Form 425 - Prospectuses and communications, business combinations

12 Février 2024 - 11:20PM

Edgar (US Regulatory)

Filed by Assure Holdings Corp.

(Commission File No.: 001-40785)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Assure Holdings Corp.

(Commission File No.: 001-40785)

The following communication was sent to Assure Holdings Corp.

employees via electronic mail on February 12, 2024

Team,

I am excited to share an update on our business and our approach in

our strategic initiatives plan.

We have just signed and announced a merger agreement

with Danam Health, Inc.. Pursuant to the merger agreement, Danam will merge

with a wholly-owned subsidiary of Assure. In exchange for their stock in Danam Health, Assure will issue stockholders of Danam shares

of common stock of Assure. As a result, on closing of the transaction, Danam stockholders will own approximately 90%

of Assure and current Assure stockholders will own approximately 10% of Assure, on a fully diluted basis. Assure will change its name

to Danam Health Holdings Corp.. The transaction allows Danam and its stockholders a pathway to becoming a public

company and, it is anticipated, that the combined company will continue to list on the NASDAQ. This means,

essentially, Danam Health will now become a public company, continue to use our listing on NASDAQ and gain access to public

funding on the closing of this transaction. This is a great opportunity for Danam Health, an up-and-coming innovator

in the pharmacy space, and we are excited to support them in this transition. Additionally, this is a great opportunity for Assure

Holdings stockholders as we anticipate they will see upside following this transition based on the performance of Danam post-closing. You

can find out more about Danam Health by clicking here.

Please note that the signing

of the Danam Health transaction does not

impact our day to day clinical IONM business.

We are still engaged in our review of strategic initiatives

for our IONM business as we move forward with our obligations under the merger agreement.

We will be hosting a team meeting this

week (please be on the lookout for the invitation) to go into more detail about this agreement and what it means for each of you.

I’m sure you have many questions, so please hold

them and we will go through on our team meeting.

Thank you for your continued patience

as we work through these exciting changes. I look forward to seeing you all at our upcoming meeting.

Best,

John

Additional Information

and Where to Find It

This communication may

be deemed to be solicitation material with respect to the proposed transactions between Assure and Danam. In connection with the

proposed transaction, Assure intends to file relevant materials with the United States Securities and Exchange Commission, or the SEC,

including a registration statement on Form S-4 that will contain a prospectus and a proxy statement. Assure will mail the proxy

statement/prospectus to the Assure and Danam stockholders, and the securities may not be sold or exchanged until the registration

statement becomes effective.

Investors and securityholders of Assure

and Danam are urged to read these materials when they become available because they will contain important information about Assure, Danam and

the proposed transactions. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus

or any other documents that Assure may file with the SEC or send to securityholders in connection with the proposed transactions. Investors

and securityholders may obtain free copies of the documents filed with the SEC, once available, on Assure’s website at www.assureneuromonitoring.com,

on the SEC’s website at www.sec.gov or by directing a request to Assure at 7887 E. Belleview Ave., Suite 240,

Denver, Colorado, USA 80111, Attention: John Farlinger, Chief Executive Officer; or by email at ir@assureiom.com.

This communication shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the

Solicitation

Each of Assure and Danam and

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders

of Assure in connection with the proposed transaction. Information about the executive officers and directors of Assure are set forth

in Assure’s Definitive Proxy Statement on Schedule 14A relating to the 2023 Annual Meeting of Stockholders of Assure,

filed with the SEC on December 5, 2023. Other information regarding the interests of such individuals, who may be deemed to be participants

in the solicitation of proxies for the stockholders of Assure will be set forth in the proxy statement/prospectus, which will be included

in Assure’s registration statement on Form S-4 when it is filed with the SEC. You may obtain free copies of

these documents as described above.

Cautionary Statements Regarding Forward-Looking Statements

This press release contains forward-looking statements

based upon the current expectations of Assure and Danam. Forward-looking statements involve risks and uncertainties and include,

but are not limited to, statements about the structure, timing and completion of the proposed transactions; the listing of the combined

company on Nasdaq after the closing of the proposed merger; expectations regarding the ownership structure of the combined company after

the closing of the proposed merger; the expected executive officers and directors of the combined company; the expected cash position

of each of Assure and Danam and the combined company at the closing of the proposed merger; the future operations of the combined

company; and other statements that are not historical fact. Actual results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation: (i) the

risk that the conditions to the closing of the proposed transaction are not satisfied, including the failure to timely obtain stockholder

approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed transaction and the

ability of each of Assure and Danam to consummate the proposed merger, as applicable; (iii) risks related to Assure’s ability

to manage its operating expenses and its expenses associated with the proposed transactions pending closing; (iv) risks related to the

failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed

transactions; (v) the risk that as a result of adjustments to the exchange ratio, Assure stockholders and Danam stockholders

could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Assure’s common

stock; (vii) unexpected costs, charges or expenses resulting from either or both of the proposed transaction; (viii) potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the proposed transactions; (ix) risks

related to the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan; and

(x) risks associated with the possible failure to realize certain anticipated benefits of the proposed transactions, including with respect

to future financial and operating results. Actual results and the timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully

described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in Assure’s Annual

Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed

with the SEC, and in other filings that Assure makes and will make with the SEC in connection with the proposed transaction, including

the proxy statement/prospectus described under “Additional Information and Where to Find It.” You should not place undue

reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking

statements. Except as required by law, Assure expressly disclaims any obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

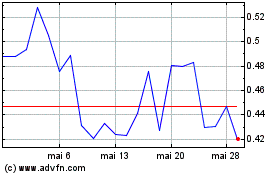

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025