FALSE000111192800011119282024-08-292024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 27, 2024

Date of Report (Date of earliest event reported)

IPG PHOTONICS CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

Delaware (State or Other Jurisdiction of Incorporation) | | 001-33155 (Commission File No.) | | 04-3444218 (IRS Employer Identification No.) |

377 Simarano Drive

Marlborough, Massachusetts 01752

(Address of Principal Executive Offices, including Zip Code)

(508) 373-1100

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | IPGP | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Principal Officers.

As previously reported in a Current Report on Form 8-K filed by IPG Photonics Corporation (the "Company") on February 21, 2024, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company and the Board approved performance measures and target incentive payouts for the Company's executive officers under the Company’s Senior Executive Annual Incentive Plan for fiscal year 2024 (the “AIP”).

The Committee recently undertook a review of the AIP as approved in February and determined that financial performance measures and targets adopted in February 2024 were no longer appropriate to incentivize management to create long-term stockholder value in light of macroeconomic uncertainty, which is impacting industrial and e-mobility markets and outside of management's control. This uncertainty weighs on demand, leading to substantially lower revenue compared to the Company's 2024 annual operating plan earlier approved by the Board.

In making this determination, the Committee considered, among other factors, the challenging demand environment across the Company's key economic regions and that uncertainty across all major geographies is likely to weigh on demand for the remainder of the year. The Committee also noted the management’s strong financial and operational execution in fiscal year 2024, which best positions the Company for improved performance as the global demand environment recovers, and the need to retain and motivate the management in a year of leadership transition. Accordingly, on August 28, 2024, the Committee approved a revised AIP (the “Revised AIP”) to align it more closely with the Company's current goals and annual operating plan for 2024.

The financial performance measure under the Revised AIP is net sales for the second half of 2024 and payout for financial and personal performance is capped at 62.5% of the original target payout, which corresponds to payout at threshold performance under the AIP approved in February. As disclosed in the Current Report on Form 8-K filed by the Company on April 30, 2024, pursuant to the terms of his employment agreement, Dr. Mark Gitin, who commenced employment as CEO in June 2024, will receive a guaranteed bonus for fiscal year 2024 and will not be impacted by the Revised AIP. Dr. Eugene Scherbakov and Dr. Alexander Ovtchinnikov, previously disclosed as named executive officers of the Company, will not participate in the Revised AIP as a result of no longer being executive officers of the Company.

Under the Revised AIP, the executive officers listed below can receive cash incentive payments listed in the following table as a percentage of base salaries based upon achievement of the minimum to maximum objectives for both financial performance measures and for individual performance.

| | | | | | | | | | | | | | | | | | | | |

Name | Target (Financial plus Individual)(1) | Financial Performance Minimum(1) | Financial Performance Maximum(1) | Individual Performance Maximum(1) | Maximum Award Payout(1)(2) |

| Timothy P.V. Mammen | 50% | 15% | 30% | 20% | 50% |

| Angelo P. Lopresti | 50% | 15% | 30% | 20% | 50% |

| Trevor Ness | 50% | 15% | 30% | 20% | 50% |

| (1) | As a percentage of base salary. |

| (2) | Maximum award payout is 62.5% of the target award (financial plus individual) approved by the Committee in February 2024. |

Item 8.01. Other Events.

On August 29, 2024, the Company and its wholly owned subsidiary, IPG Laser GmbH & Co. KG, completed the sale of the Company’s Russian subsidiary, Scientific and Technical Association “IRE-Polus”, pursuant to a share purchase agreement with a purchaser entity associated with Softline Projects LLC and current management of IRE-Polus. The proceeds from the transaction are $51 million before advisory and other fees.

The sale of IRE-Polus includes the entirety of the Company’s operations in Russia, including the Company’s manufacturing sites in Fryazino, Russia.

The Company expects to record total estimated charges of $195 million to $210 million. Of these total estimated charges, $60 million to $65 million relates to the carrying value of net assets of IRE-Polus that is in excess of net proceeds received on the sale and $135 million to $145 million relates to the cumulative translation adjustment component of other comprehensive income that is included in shareholders equity. These losses will be recorded during the third quarter of 2024 in connection with the transaction.

As previously disclosed, as a result of the Russia-Ukraine conflict and related sanctions, the Company’s ability to ship and receive components from its Russian operations was significantly curtailed. In response, the Company expanded its manufacturing capacity in Germany, the United States and Italy, and added new manufacturing capacity in Poland which effectively offset its inability to utilize the Russian operations.

The Company expects that this sale will reduce third quarter revenue as compared to previously provided guidance by approximately $5 million. IRE-Polus revenue accounts for less than 5% of the Company’s full-year revenue. The Company does not expect to provide any further information regarding the transaction until it reports earnings results for the third quarter.

On August 29, 2024, the Company issued a press release announcing the sale of IRE-Polus. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1 referenced herein, shall not be deemed "filed" for purposes of Section 18 of the Securities Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

| | |

| Exhibit | | Exhibit Description |

| Exhibit 99.1 | | |

| Exhibit 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K. |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | IPG PHOTONICS CORPORATION |

| | |

| August 29, 2024 | | By: | | /s/ Angelo P. Lopresti |

| | | | Angelo P. Lopresti |

| | | | Senior Vice President, General Counsel & Secretary |

IPG Photonics Announces Sale of its Russian Operations

MARLBOROUGH, Mass. – August 29, 2024 - IPG Photonics Corporation (NASDAQ: IPGP) today announced that it has sold its entire interest in its Russian subsidiary, IRE-Polus. The purchaser is a group led by Softline Projects LLC and current management of IRE-Polus. The sale marks the finalization of IPG’s exit from all facilities in Russia, following imposed sanctions on trade after the start of the war with Ukraine. The proceeds from the transaction are $51 million before advisory and other fees.

“Our team executed flawlessly to transition our manufacturing operations after the war’s outbreak without any impact to our customers. Our ability to respond to adverse events out of our control highlights the resilience of the company as we were able to lean on our global manufacturing capabilities to increase production in Germany, the United States and Italy and start production in Poland,” said Dr. Mark Gitin, IPG Photonics’ Chief Executive Officer. “Today, with the sale of our Russian operations now behind us, we are focusing on optimizing our operations to drive improved productivity.”

The Company expects that the sale will reduce third quarter revenue as compared to previously provided guidance by approximately $5 million. IRE-Polus revenue accounts for less than 5% of IPG’s full-year revenue. Related to the transaction, the Company expects to record total estimated charges of $195 million to $210 million. Of these total estimated charges, $60 million to $65 million relates to the carrying value of net assets of IRE-Polus that is in excess of net proceeds received on the sale and $135 million to $145 million relates to the cumulative translation adjustment component of other comprehensive income that is included in shareholders equity. The Company does not expect to provide any further information regarding the transaction until it reports earnings results for the third quarter.

Contact

Eugene Fedotoff

Senior Director, Investor Relations

IPG Photonics Corporation

508-597-4713

efedotoff@ipgphotonics.com

About IPG Photonics Corporation

IPG Photonics Corporation is the leader in high-power fiber lasers and amplifiers used primarily in materials processing and other diverse applications. The Company’s mission is to develop innovative laser solutions making the world a better place. IPG accomplishes this mission by delivering superior performance, reliability and usability at a lower total cost of ownership compared with other types of lasers and non-laser tools, allowing end users to increase productivity and decrease costs. IPG is headquartered in Marlborough, Massachusetts and has more than 30 facilities worldwide. For more information, visit www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by IPG and its employees, including statements in this press release, that relate to future plans, events or performance are forward-looking statements. These statements involve risks and uncertainties. Any statements in this press release that are not statements of historical fact are forward-looking statements. These include but are not limited to the reduction in third quarter revenue as compared to previously provided guidance, the impairment charge related to the carrying value of net assets of IRE-Polus and the charge related to the cumulative translation adjustment component of other comprehensive income that is included in shareholders equity. Factors that could cause actual results to differ materially include risks and uncertainties, including risks associated with the strength or weakness of the business conditions in industries and geographic markets that IPG serves, particularly the effect of downturns in the markets IPG serves; uncertainties and adverse changes in the general economic conditions of markets; inability to manage risks associated with international customers and operations; changes in trade controls and trade policies; IPG's ability to penetrate new applications for fiber lasers and increase market share; the rate of acceptance and penetration of IPG's products; foreign currency fluctuations; high levels of fixed costs from IPG's vertical integration; the appropriateness of IPG's manufacturing capacity for the level of demand; competitive factors, including declining average selling prices; the effect of acquisitions and investments; inventory write-downs; asset impairment charges; intellectual property infringement claims and litigation; interruption in supply of key components; manufacturing risks; government regulations and trade sanctions; and other risks identified in IPG's SEC filings. Readers are encouraged to refer to the risk factors described in IPG's Annual Report on Form 10-K (filed with the SEC on February 21, 2024) and IPG's reports filed with the SEC, as applicable. Actual results, events and performance may differ materially. Readers are cautioned not to rely on the forward-looking statements, which speak only as of the date hereof. IPG undertakes no obligation to update the forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

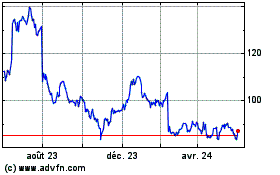

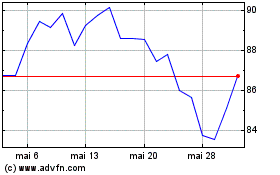

IPG Photonics (NASDAQ:IPGP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

IPG Photonics (NASDAQ:IPGP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025