Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the

“Company”), a clinical-stage biopharmaceutical company focused on

rare diseases, today announced its financial results for the second

quarter ended June 30, 2024, and provided an update on recent

corporate highlights. The Company reported cash and cash

equivalents of $87.4 million as of June 30, 2024, which includes

the net proceeds of the Company’s $50 million registered direct

offering in June 2024. Mereo expects that this will provide cash

runway into 2027, through multiple key inflection points.

“We continued to make significant progress this

quarter highlighted by additional positive data from the Phase 2

portion of the ongoing Phase 2/3 Orbit study in patients with OI,”

said Dr. Denise Scots-Knight, Chief Executive Officer of Mereo.

“These data showed that the statistically significant annualized

fracture rate reduction of 67% was maintained following treatment

with setrusumab for at least 14 months of follow-up, further

demonstrating the potential of setrusumab to generate long-term,

clinically meaningful benefit for people living with OI. On

alvelestat, we continue to work through the detailed regulatory

submissions to ensure the AATD program is Phase 3-ready by the end

of the year, in parallel with our ongoing discussions with multiple

potential partners. With the proceeds from our June financing, we

are well positioned through our key value inflection milestones and

to support the ongoing pre-commercial activities essential for a

successful launch of setrusumab in Europe following its potential

approval.”

Second Quarter 2024 Highlights, Recent

Developments and Anticipated Milestones

Setrusumab (UX143)

- The Phase 3 Orbit and Cosmic

studies of setrusumab in OI, conducted by our partner Ultragenyx,

were fully enrolled as of April 30, 2024.

- On June 11, 2024, Mereo and Ultragenyx, announced positive

14-month results from the Phase 2 portion of the ongoing Phase 2/3

Orbit study (NCT05125809).

- The results from the Phase 2 portion of the Orbit study

demonstrated that, as of the May 24, 2024 data cut-off date,

treatment with setrusumab continued to significantly reduce

incidence of fractures in patients with OI. Treatment with

setrusumab also resulted in ongoing and meaningful improvements in

lumbar spine bone mineral density (BMD) at month 12 without

evidence of plateau.

- The median annualized rate of radiologically confirmed

fractures across all 24 patients in the 2 years prior to treatment

was 0.72. Following a mean treatment duration period of 16 months,

the median annualized fracture rate was reduced by 67% to 0.00

(p=0.0014; n=24).

- The reduction in annualized fracture rates was associated with

continued, clinically meaningful increases in BMD. At the 12-month

time point, treatment with setrusumab resulted in a mean increase

in lumbar spine BMD from baseline of 22% (p<0.0001, n=19) and an

improvement of the lumbar spine BMD Z-score from a mean baseline of

-1.73 to -0.49 at 12 months. The improvements in BMD and Z-scores

were significant and consistent across all OI sub-types

studied.

- As of the data cut-off date, there were no treatment-related

serious adverse events observed in the study and no reported

hypersensitivity reactions related to setrusumab.

- Research has been published from

our osteogenesis imperfecta program: The 12-month results for the

Phase 2b ASTEROID study in the Journal of Bone and Mineral Research

and the first publication from SATURN (Systematic Accumulation of

Treatment practices and Utilization, Real world evidence, and

Natural history data for OI), which is expected to provide a

coordinated data set across multiple treatment centers for OI

across European countries, to support pricing and reimbursement

decisions.

- More detailed data from the Phase 2

portion of the ongoing Phase 2/3 Orbit study will be presented at

an upcoming scientific meeting

Alvelestat (MPH-966)

- The Company continues to engage

with multiple potential partners for the development and

commercialization for alvelestat in AATD

- At the end of Q2, Mereo submitted

the initial validation work for SGRQ in AATD and the detailed Phase

3 package including the study protocol to the FDA in order to

maintain the potential to start the Phase 3 study around the end of

2024.

Second Quarter 2024 Financial

Results

Total research and development (R&D)

expenses increased by $1.2 million, or 33%, from $3.7 million in

the second quarter of 2023 to $4.9 million in the second quarter of

2024. The increase was primarily due to increases of $1.9 million

and $0.9 million of R&D expenses for alvelestat and setrusumab,

respectively, partially offset by a $1.5 million reduction in

R&D expenses for etigilimab. The increase in the program

expenses for alvelestat primarily relates to preparatory work for

the Phase 3 study, including manufacturing and drug formulation

activities, SGRQ validation activities and regulatory filings and

interactions. The increase in program expenses for setrusumab is

driven by additional activities in Europe and resources for the

input into development, regulatory and manufacturing plans with our

partner, Ultragenyx, as the global development program is funded by

Ultragenyx pursuant to our license and collaboration agreement. The

reduction in etigilimab expenses was primarily due to the winding

down and completion during 2023 of the open label Phase 1b/2 basket

study in combination with an anti-PD-1 in a range of tumor

types.

General and administrative (G&A) expenses

increased by $5.2 million from $2.7 million in the second quarter

of 2023 to $7.9 million in the second quarter of 2024. The increase

is primarily related to: (i) a $3.4 million reduction in expenses

recognized in the second quarter of 2023 for amounts from our

depository to reimburse certain expenses incurred by us in respect

of our ADR program, whereas in 2024, $1.7 million was received from

our depository in the first quarter of 2024; and (ii)

pre-commercial activities to lay the foundation for the commercial

launch of setrusumab in Europe, including those to support pricing

and reimbursement by HTA authorities and payor decision-makers in

Europe of $0.9 million.

Net loss for the second quarter of 2024 was

$12.3 million, compared to $1.8 million during the second quarter

of 2023, driven primarily by a one-time milestone payment of $9.0

million received in the second quarter of 2023, and increases in

R&D expenses and G&A expenses in the second quarter of

2024.

As of June 30, 2024, the Company had cash and

cash equivalents of $87.4 million, compared to $57.4 million as of

December 31, 2023. This includes net proceeds of the $50 million

underwritten registered direct offering priced at-the-market on

June 14, 2024. The Company expects, based on current operational

plans, that its existing cash and cash equivalents balance will

enable it to fund its currently committed clinical trials,

operating expenses including pre-commercial activities for

setrusumab, and capital expenditure requirements into 2027. This

guidance does not include any potential upfront payments associated

with a partnership for alvelestat or business development activity

around any of the Company’s non-core programs.

Total ordinary shares issued as of June 30,

2024, were 768,821,274. Total ADS equivalents as of June 30,

2024, were 153,764,254, with each ADS representing five ordinary

shares of the Company.

About Mereo BioPharma

Mereo BioPharma is a biopharmaceutical company

focused on the development of innovative therapeutics for rare

diseases. The Company has two rare disease product candidates,

setrusumab for the treatment of osteogenesis imperfecta (OI) and

alvelestat primarily for the treatment of severe alpha-1

antitrypsin deficiency-associated lung disease (AATD-LD). The

Company’s partner, Ultragenyx Pharmaceutical, Inc., has completed

enrollment in the Phase 3 portion of a pivotal Phase 2/3 pediatric

study in young adults (5 to 25 years old) for setrusumab in OI and

in the Phase 3 study in pediatric patients (2 to <7 years old)

in the first half of 2024. The partnership with Ultragenyx includes

potential additional milestone payments of up to $245 million and

royalties to Mereo on commercial sales in Ultragenyx territories.

Mereo has retained EU and UK commercial rights and will pay

Ultragenyx royalties on commercial sales in those territories.

Setrusumab has received orphan designation for osteogenesis

imperfecta from the EMA and FDA, PRIME designation from the EMA and

has pediatric disease designation from the FDA. Alvelestat has

received U.S. Orphan Drug Designation for the treatment of AATD and

Fast Track designation from the FDA. Following results from

ASTRAEUS and ATALANTa in AATD-lung disease, the Company has aligned

with the FDA and the EMA on the primary endpoints for a Phase 3

pivotal study which if successful could enable full approval in

both the U.S. and Europe. In addition to the rare disease programs,

Mereo has two oncology product candidates in clinical development.

Etigilimab (anti-TIGIT) has completed a Phase 1b/2 basket study

evaluating its safety and efficacy in combination with an anti-PD-1

in a range of tumor types including three rare tumors and three

gynecological carcinomas – cervical, ovarian, and endometrial and

is an ongoing Phase 1b/2 investigator led study at the MD Anderson

Cancer Center in clear cell ovarian cancer; Navicixizumab, for the

treatment of late line ovarian cancer, has completed a Phase 1

study and has been partnered with Feng Biosciences Inc. in a global

licensing agreement that includes milestone payments and royalties.

Mereo has entered into an exclusive global license agreement with

ReproNovo SA for the development and commercialization of

leflutrozole, a non-steroidal aromatase inhibitor. Under the terms

of the agreement, ReproNovo, a reproductive medicine company, is

responsible for all future development and commercialization of

leflutrozole.

Forward-Looking Statements

This press release contains “forward-looking

statements” that involve substantial risks and uncertainties. All

statements other than statements of historical fact contained

herein are forward-looking statements within the meaning of Section

27A of the United States Securities Act of 1933, as amended, and

Section 21E of the United States Securities Exchange Act of 1934,

as amended. Forward-looking statements usually relate to future

events and anticipated revenues, earnings, cash flows or other

aspects of our operations or operating results. Forward-looking

statements are often identified by the words “believe,” “expect,”

“anticipate,” “plan,” “intend,” “foresee,” “should,” “would,”

“could,” “may,” “estimate,” “outlook” and similar expressions,

including the negative thereof. The absence of these words,

however, does not mean that the statements are not forward-looking.

These forward-looking statements are based on the Company’s current

expectations, beliefs and assumptions concerning future

developments and business conditions and their potential effect on

the Company. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting the Company will be

those that it anticipates.

All of the Company’s forward-looking statements

involve known and unknown risks and uncertainties some of which are

significant or beyond its control and assumptions that could cause

actual results to differ materially from the Company’s historical

experience and its present expectations or projections. Such risks

and uncertainties include, among others, the uncertainties inherent

in the clinical development process; the Company’s reliance on

third parties to conduct and provide funding for its clinical

trials; the Company’s dependence on enrollment of patients in its

clinical trials; and the Company’s dependence on its key

executives. You should carefully consider the foregoing factors and

the other risks and uncertainties that affect the Company’s

business, including those described in the “Risk Factors” section

of its Annual Report on Form 10-K, as well as discussions of

potential risks, uncertainties, and other important factors in the

Company’s subsequent filings with the Securities and Exchange

Commission. The Company wishes to caution you not to place undue

reliance on any forward-looking statements, which speak only as of

the date hereof. The Company undertakes no obligation to publicly

update or revise any of our forward-looking statements after the

date they are made, whether as a result of new information, future

events or otherwise, except to the extent required by law.

|

|

|

Mereo BioPharma Contacts: |

|

|

Mereo |

+44 (0)333 023 7300 |

|

Denise Scots-Knight, Chief Executive Officer |

|

|

Christine Fox, Chief Financial Officer |

|

|

|

|

Burns McClellan (Investor Relations Adviser to

Mereo) |

+01 646 930 4406 |

|

Lee Roth |

|

|

Investors |

investors@mereobiopharma.com |

|

|

|

MEREO BIOPHARMA GROUP PLC CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands, except

share and per share data)

(Unaudited) |

|

|

|

|

June 30, |

|

December 31, |

|

|

2024 |

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

87,431 |

|

|

$ |

57,421 |

|

|

Prepaid expenses and other current assets |

|

4,489 |

|

|

|

5,156 |

|

|

Research and development incentives receivables |

|

2,020 |

|

|

|

1,183 |

|

|

Total current assets |

|

93,940 |

|

|

|

63,760 |

|

|

Property and equipment, net |

|

338 |

|

|

|

405 |

|

|

Operating lease right-of-use assets, net |

|

985 |

|

|

|

1,245 |

|

|

Intangible assets, net |

|

866 |

|

|

|

1,089 |

|

|

Total assets |

$ |

96,129 |

|

|

$ |

66,499 |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

2,700 |

|

|

$ |

2,346 |

|

|

Accrued expenses |

|

3,721 |

|

|

|

5,467 |

|

|

Convertible loan notes – current |

|

4,931 |

|

|

|

— |

|

|

Operating lease liabilities – current |

|

679 |

|

|

|

652 |

|

|

Other current liabilities |

|

3,435 |

|

|

|

1,021 |

|

|

Total current liabilities |

|

15,466 |

|

|

|

9,486 |

|

|

Convertible loan notes – non-current |

|

— |

|

|

|

4,394 |

|

|

Warrant liabilities – non-current |

|

925 |

|

|

|

412 |

|

|

Operating lease liabilities – non-current |

|

552 |

|

|

|

906 |

|

|

Other non-current liabilities |

|

536 |

|

|

|

764 |

|

|

Total liabilities |

|

17,479 |

|

|

|

15,962 |

|

|

Commitments and contingencies (Note 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

|

Ordinary shares, par value £0.003 per share;

768,821,274 shares issued at June 30, 2024 (December 31, 2023:

701,217,089). |

|

3,032 |

|

|

|

2,775 |

|

|

Treasury shares |

|

— |

|

|

|

(1,230 |

) |

|

Additional paid-in capital |

|

534,732 |

|

|

|

486,107 |

|

|

Accumulated deficit |

|

(440,836 |

) |

|

|

(419,630 |

) |

|

Accumulated other comprehensive loss |

|

(18,278 |

) |

|

|

(17,485 |

) |

|

Total shareholders’ equity |

|

78,650 |

|

|

|

50,537 |

|

|

Total liabilities and shareholders’ equity |

$ |

96,129 |

|

|

$ |

66,499 |

|

| |

|

|

|

|

|

|

|

|

MEREO BIOPHARMA GROUP PLC CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS (In thousands, except share and per share

amounts) (Unaudited) |

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

— |

|

|

$ |

9,000 |

|

|

$ |

— |

|

|

$ |

9,000 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

— |

|

|

|

(3,430 |

) |

|

|

— |

|

|

|

(3,083 |

) |

|

Research and development |

|

(4,946 |

) |

|

|

(3,712 |

) |

|

|

(8,939 |

) |

|

|

(9,019 |

) |

|

General and administrative |

|

(7,868 |

) |

|

|

(2,669 |

) |

|

|

(13,777 |

) |

|

|

(9,119 |

) |

|

Loss from operations |

|

(12,814 |

) |

|

|

(811 |

) |

|

|

(22,716 |

) |

|

|

(12,221 |

) |

|

Other income/(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

559 |

|

|

|

373 |

|

|

|

1,175 |

|

|

|

679 |

|

|

Interest expense |

|

(331 |

) |

|

|

(1,029 |

) |

|

|

(641 |

) |

|

|

(1,829 |

) |

|

Changes in the fair value of financial instruments |

|

(69 |

) |

|

|

(102 |

) |

|

|

(517 |

) |

|

|

440 |

|

|

Foreign currency transaction gain/(loss), net |

|

31 |

|

|

|

(803 |

) |

|

|

644 |

|

|

|

(2,010 |

) |

|

Other expenses, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

Benefit from research and development tax credit |

|

369 |

|

|

|

621 |

|

|

|

847 |

|

|

|

1,120 |

|

|

Net loss before income tax |

|

(12,255 |

) |

|

|

(1,751 |

) |

|

|

(21,208 |

) |

|

|

(13,827 |

) |

|

Income tax benefit |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss |

$ |

(12,255 |

) |

|

$ |

(1,751 |

) |

|

$ |

(21,208 |

) |

|

$ |

(13,827 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – basic and diluted |

$ |

(0.02 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

Weighted average shares outstanding – basic and diluted |

|

711,770,804 |

|

|

|

628,421,064 |

|

|

|

706,407,371 |

|

|

|

626,185,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(12,255 |

) |

|

$ |

(1,751 |

) |

|

$ |

(21,208 |

) |

|

$ |

(13,827 |

) |

|

Other comprehensive (loss)/income – Foreign currency translation

adjustments, net of tax |

|

5 |

|

|

|

1,400 |

|

|

|

(793 |

) |

|

|

3,678 |

|

|

Total comprehensive loss |

$ |

(12,250 |

) |

|

$ |

(351 |

) |

|

$ |

(22,001 |

) |

|

$ |

(10,149 |

) |

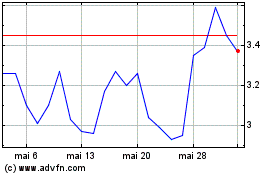

Mereo BioPharma (NASDAQ:MREO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Mereo BioPharma (NASDAQ:MREO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024