OptimumBank Holdings, Inc. (OPHC-NASDAQ) Chairman Gubin’s comments pertaining to the Board’s strategic planning - “A successful roadmap for growing our Bank”

06 Octobre 2023 - 7:00PM

OptimumBank, a Florida banking corporation (the “Bank”) and

wholly-owned subsidiary of OptimumBank Holdings, Inc., ended the

third quarter of 2023 with assets exceeding $712 million. Relieved

from certain regulatory constraints in 2019, the Board and

Management created a Strategic Plan which provided the roadmap for

growing the size and profitability of OptimumBank and developing

strong and lasting customer relationships along the way. In the

last five years beginning with $99.45 million in assets, the Board

and Management have grown our Bank by $612 million in additional

assets, predominantly with loyal customers having long term

relationships with the Bank, its directors, or

employees. Through September 30, 2023, the Bank’s assets have

grown close to $127 million. As the Bank grows, the Board and

Management remain focused on maintaining our well capitalized

status under regulatory guidelines, enhancing our reputation for

consistent and stellar customer service, and performing better than

most of our peers in many banking metrics.

Growing the asset size of the Bank for the

remainder 2023 and into 2024 is facilitating our goal to provide

greater shareholder returns. Growth in our earning as the Bank has

been and will continue to be our main focus. The Board and

Management are working hard to improve on our results and truly

succeed in bringing returns to all of our shareholders.

OptimumBank’s Strategic Plan also encompasses

expanding lending capabilities, increasing the Bank’s core deposit

base primarily with fee-based income businesses and by evaluating

opportunities to engage in M&A activity as a buyer. The Board

and Management remain focused on increasing the Loan-to-Deposit

ratio by maintaining competitive pricing of the Bank’s products to

improve the Net Interest Margin (NIM) to reach its potential. The

Bank continues to focus on its customers on our path to grow larger

and stronger while still achieving community banking at its best,

where customers are a name, not a number.

About OptimumBank Holdings, Inc.

OptimumBank Holdings, Inc. operates as the bank

holding company for OptimumBank that provides a range of consumer

and commercial banking services to individuals and businesses. The

company accepts demand interest-bearing and noninterest-bearing,

savings, money market, NOW, and time deposit accounts, as well as

certificates of deposit; and offers residential and commercial real

estate, commercial, and consumer loans, as well as lending lines

for working capital needs. It also provides debit and ATM cards;

investment, cash management, and notary and night depository

services; and direct deposits, money orders, cashier's checks,

domestic collections, drive-in tellers, and banking by mail, as

well as Internet banking services. In addition, the company engages

in holding, managing, and disposing foreclosed real estate. It

operates through banking offices located in Broward County,

Florida. OptimumBank Holdings, Inc. was founded in 2000 and is

based in Fort Lauderdale, Florida.

Safe Harbor Statement:

This press release contains forward-looking

statements that can be identified by terminology such as

"believes," "expects," "potential," "plans," "suggests," "may,"

"should," "could," "intends," or similar expressions. Many

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results or implied by such

statements. These factors include, but are not limited to, our

limited operating history, managing our expected growth, risks

associated with integration of acquired websites, possible

inadvertent infringement of third-party intellectual property

rights, our ability to effectively compete, our acquisition

strategy, and a limited public market for our common stock, among

other risks. OptimumBank Holdings, Inc.'s future results may also

be impacted by other risk factors listed from time-to-time in its

SEC filings. Many factors are difficult to predict accurately and

are generally beyond the company's control. Forward looking

statements speak only as to the date they are made and OptimumBank

Holdings, Inc. does not undertake to update forward-looking

statements to reflect circumstances or events that occur after the

date the forward-looking statements are made.

Investor Relations: OptimumBank Holdings.

Inc.investor@optimumbank.com+1.954.900.2850

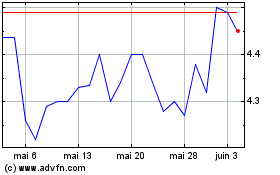

OptimumBank (NASDAQ:OPHC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

OptimumBank (NASDAQ:OPHC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025