Defers principal payments of $8.0 million up

to three years, reduces Rockwell's need for additional operating

capital, and enhances the Company's cash balance

Rockwell Medical provides preliminary

projected fourth quarter and full-year 2023 financial

results

Rockwell Medical, Inc. (the "Company") (Nasdaq: RMTI), a

healthcare company that develops, manufactures, commercializes, and

distributes a portfolio of hemodialysis products to dialysis

providers worldwide, today announced that the Company amended its

loan and security agreement with Innovatus Life Sciences Lending

Fund I, LP ("Innovatus").

Rockwell Medical and its wholly owned subsidiary, Rockwell

Transportation, Inc., initially entered into a loan and security

agreement with Innovatus on March 16, 2020 under which Innovatus

agreed to make certain term loans to the Company, of which the

Company drew down approximately $21.0 million. At December 31,

2023, the Company's outstanding balance under those term loans was

$8.0 million (the "Term Loans").

Under the terms of the third amended and restated loan and

security agreement (the "Amendment"), Rockwell Medical reduced the

interest rate on, and extended the loan maturity date for, the Term

Loans from March 2025 to January 2029. The Company will make

interest-only payments for thirty months, or up to thirty-six

months if certain conditions are met. In connection with the

execution of the Amendment, the Company issued to Innovatus a

warrant to purchase 191,096 shares of the Company's common stock

with an exercise price of $1.83 per share. The warrant is

immediately exercisable through January 2, 2029.

"Over the past 18 months, we significantly reduced the leverage

on our business," said Mark Strobeck, Ph.D., President and CEO of

Rockwell Medical. "As we work towards sustained profitability and

positive cash flow, we continue to seek ways to enhance our

financial stability and our cash balance. Based on the amortization

schedule under the loan and security agreement prior to the

Amendment, we would have been required to pay off $6.0 million of

the outstanding debt in 2024 and $2.0 million in 2025, which would

have significantly reduced our cash balance during this period.

While the Amendment extends the maturity date of the Term Loans out

to January 2029, it offers us a better interest rate and the

financial flexibility we need to help ensure long-term viability

and sustainability of our business."

For more details about the Amendment, please reference the

Current Report on Form 8-K filed by the Company on January 8,

2024.

Rockwell Medical Preliminary Fourth Quarter and Full-Year

2023 Projected Results

Rockwell Medical projects net sales in the fourth quarter of

2023 to be between $21.3 million and $22.3 million, a 10% to 16%

increase over net sales of $19.3 million for the same period in

2022; gross profit for the fourth quarter of 2023 to be between

$1.6 million and $2.6 million, similar to gross profit of $2.3

million for the same period in 2022; and projects that the Company

will report adjusted EBITDA between $(0.9) million and $0.1 million

in the fourth quarter of 2023.

Rockwell Medical is narrowing its full-year 2023 guidance and

projects net sales for the twelve months ended December 31, 2023 to

be between $82.8 million and $83.8 million, a 14% to 15% increase

over net sales of $72.8 million in 2022, and gross profit for the

full-year 2023 to be between $7.4 million and $8.4 million, an 80%

to 105% increase over gross profit of $4.1 million in 2022. The

Company projects adjusted EBITDA for the full-year 2023 to be

between $(5.5) million and $(4.5) million. Rockwell Medical

projects cash, cash equivalents and investments available-for-sale

at December 31, 2023 to be $11.0 million compared to $11.7 million

at September 30, 2023.

The fourth quarter 2023 and full-year 2023 net sales, gross

profit and adjusted EBITDA and December 31, 2023 cash balance

included in this release are preliminary and are therefore subject

to adjustment. The preliminary results are based on management’s

initial analysis of operations for the quarter and year ended

December 31, 2023. The Company expects to report fourth quarter and

full-year 2023 financial and operational results in March 2024.

Three Months Ended December

31, 2023

Twelve Months Ended

December 31, 2023

(In Millions)

Low

High

Low

High

Net Sales

$

21.3

$

22.3

$

82.8

$

83.8

Gross Profit

1.6

2.6

7.4

8.4

Net Loss

(2.2

)

(1.2

)

(9.1

)

(8.1

)

Adjusted EBITDA*

(0.9

)

0.1

(5.5

)

(4.5

)

* See reconciliation to GAAP financial

measures in the tables below.

About Rockwell Medical

Rockwell Medical, Inc. (Nasdaq: RMTI) is a healthcare company

that develops, manufactures, commercializes, and distributes a

portfolio of hemodialysis products for dialysis providers

worldwide. Rockwell Medical's mission is to provide dialysis

clinics and the patients they serve with the highest quality

products supported by the best customer service in the industry.

Rockwell is focused on innovative, long-term growth strategies that

enhance its products, its processes, and its people, enabling the

Company to deliver exceptional value to the healthcare system and

provide a positive impact on the lives of hemodialysis patients.

Hemodialysis is the most common form of end-stage kidney disease

treatment and is typically performed at freestanding outpatient

dialysis centers, hospital-based outpatient centers, skilled

nursing facilities, or in a patient’s home. Rockwell Medical's

products are vital to vulnerable patients with end-stage kidney

disease, and the Company is relentless in providing unmatched

reliability and customer service. Rockwell Medical is the second

largest supplier of acid and bicarbonate concentrates for dialysis

patients in the United States and has the vision of becoming the

leading global supplier of hemodialysis concentrates. Certified as

a Great Place to Work® in 2023, Rockwell Medical is Driven to

Deliver Life-Sustaining Dialysis SolutionsTM. For more information,

visit www.RockwellMed.com.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the federal

securities laws. Words such as, "may," "might," "will," "should,"

"believe," "expect," "anticipate," "estimate," "continue," "could,"

"can," "would," "develop," "plan," "potential," "predict,"

"forecast," "project," "intend," "look forward to," "remain

confident," “are determined,” “are on track,” “has the vision,”

"work to," "drive towards," “focused on,” or the negative of these

terms, and similar expressions, or statements regarding intent,

belief, or current expectations, are forward looking statements.

These statements include, but are not limited to, Rockwell

Medical’s expectations regarding its reduced need for additional

operating capital and enhanced cash balance, the Company’s ability

to achieve profitability and positive cash flow, Rockwell Medical’s

expectations and projections regarding its future operating results

and financial performance, and the Company’s vision of becoming the

leading global provider of hemodialysis concentrates. While

Rockwell Medical believes these forward-looking statements are

reasonable, undue reliance should not be placed on any such

forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are based upon current estimates and assumptions and are

subject to various risks and uncertainties (including, without

limitation, those set forth in Rockwell Medical's SEC filings),

many of which are beyond our control and subject to change. Actual

results could be materially different. Risks and uncertainties

include, but are not limited to those risks more fully discussed in

the "Risk Factors" section of our Annual Report on Form 10-K for

the year ended December 31, 2022, as such description may be

amended or updated in any future reports we file with the SEC.

Rockwell Medical expressly disclaims any obligation to update our

forward-looking statements, except as may be required by law.

Financial Tables Follow

Reconciliation to GAAP Financial Measures Estimated Adjusted

EBITDA

Three Months Ended 12 Months Ended December

31, 2023 December 31, 2023 (in millions)

Low

High Low High Net Loss

$

(2.2

)

$

(1.2

)

$

(9.1

)

$

(8.1

)

Income taxes

—

—

—

—

Interest expense, net

0.3

0.3

1.2

1.2

Depreciation and amortization

0.8

0.8

1.8

1.8

EBITDA

(1.1

)

(0.1

)

(6.1

)

(5.1

)

One time severance costs

-

-

0.8

0.8

Stock-based compensation

0.2

0.2

0.9

0.9

Wanbang deferred revenue

-

-

(2.2

)

(2.2

)

Wanbang inventory reserve

-

-

1.1

1.1

Adjusted EBITDA

$

(0.9

)

$

0.1

$

(5.5

)

$

(4.5

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240108150334/en/

Heather R. Hunter SVP, Chief Corporate Affairs Officer (248)

432-1362 IR@RockwellMed.com

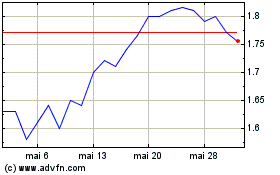

Rockwell Medical (NASDAQ:RMTI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Rockwell Medical (NASDAQ:RMTI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025