EXHIBIT

99.1

JOINT

FILING AGREEMENT

UXIN

LIMITED

In

accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned hereby confirm the agreement by

and among them to the joint filing on behalf of them of the Statement on Schedule 13D and any and all further amendments thereto, with

respect to the securities of the above referenced issuer, and that this Agreement be included as an Exhibit to such filing. This Agreement

may be executed in any number of counterparts each of which shall be deemed to be an original and all of which together shall be deemed

to constitute one and the same Agreement.

IN

WITNESS WHEREOF, the undersigned hereby execute this Agreement as of January 15, 2025.

| |

Joy

Capital Opportunity, L.P. |

| |

|

|

| |

By:

|

Joy

Capital Opportunity GP, L.P. |

| |

Its:

|

general

partner |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital Opportunity GP, L.P. |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

Joy

Capital II, L.P. |

| |

|

|

| |

By:

|

Joy

Capital II GP, L.P. |

| |

Its:

|

general

partner |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital II GP, L.P. |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital III, L.P. |

| |

|

|

| |

By:

|

Joy

Capital III GP, L.P. |

| |

Its:

|

general

partner |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital III GP, L.P. |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

Joy

Capital GP, Ltd. |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Astral

Success Limited |

| |

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital IV, L.P. |

| |

|

| |

By:

|

Joy

Capital IV GP, L.P. |

| |

Its:

|

general

partner |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

Joy

Capital IV GP, L.P. |

| |

|

|

| |

By:

|

Joy

Capital GP, Ltd. |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

| |

|

|

| |

BRIGHTEST

SKY LIMITED |

| |

|

| |

By: |

/s/

Erhai Liu |

| |

|

Erhai

Liu, Director |

EXHIBIT 99.2

THIS

DOCUMENT IS A FREE TRANSLATION ONLY. DUE TO THE COMPLEXITIES OF LANGUAGE TRANSLATION, TRANSLATIONS ARE NOT ALWAYS PRECISE. THE ORIGINAL

DOCUMENT WAS PREPARED IN CHINESE, AND IN CASE OF ANY DIVERGENCE, DISCREPANCY OR DIFFERENCE BETWEEN THIS VERSION AND THE CHINESE VERSION,

THE CHINESE VERSION SHALL PREVAIL. THE CHINESE VERSION IS THE ONLY VALID AND COMPLETE VERSION AND SHALL PREVAIL FOR ANY AND ALL PURPOSES.

THERE IS NO ASSURANCE AS TO THE ACCURACY, RELIABILITY OR COMPLETENESS OF THE TRANSLATION. ANY PERSON READING THIS TRANSLATION AND RELYING

ON IT SHOULD DO SO AT HIS OR HER OWN RISK.

SPECIFIC

TERMS IN THIS EXHIBIT HAVE BEEN REDACTED BECAUSE THEY ARE BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

THE REDACTED TERMS HAVE BEEN MARKED AT THE APPROPRIATE PLACE WITH THREE ASTERISKS [***].

SHARE

TRANSFER AGREEMENT

Between

Abundant

Grace Investment Limited

And

BRIGHTEST

SKY LIMITED

January

11, 2025

SHARE

TRANSFER AGREEMENT

This

SHARE TRANSFER AGREEMENT (this “Agreement”) is entered into as of January 11, 2025 (the “Signing Date”),

by and between the following Parties:

Abundant

Grace Investment Limited, a company limited by shares incorporated and existing under the Laws of the British Virgin Islands (the “Seller”);

and

BRIGHTEST

SKY LIMITED, a company incorporated and existing under the Laws of the British Virgin Islands (the “Buyer”).

The

above parties are referred to individually as the “Party” and collectively as the “Parties”.

RECITALS

WHEREAS,

the Seller proposes to transfer to the Buyer, and the Buyer proposes to acquire from the Seller 1,029,230,136 Class A Ordinary Shares

(the “Target Shares”) of Uxin Limited (an exempted company incorporated and existing under the Laws of the Cayman

Islands) (the “Target Company”).

AGREEMENT

In

consideration of the foregoing recitals and the mutual promises and covenants contained herein, the Parties hereto, intending to be legally

bound, agree as follows:

Article

1 Definitions and Interpretations

Section

1.1 Definitions

“Rule

144” means Rule 144 promulgated by the United States Securities and Exchange Commission (U.S. Securities and Exchange Commission)

under the U.S. Securities Act, as amended or interpreted from time to time, or any similar rule or regulation thereafter adopted by the

U.S. Securities and Exchange Commission that has substantially the same purpose and effect.

“Class

A Ordinary Share” means Class A Ordinary Share of the Target Company, with a par value of $0.0001 per share,

“Law”

means any domestic or foreign, federal, state, municipal or local laws, regulations, ordinances, codes, common law principles, acts,

treaties or any generally applicable rules of any applicable Regulatory Authority, including rules or regulations promulgated thereunder.

“Share

Transfer” has the meaning ascribed to it in Section 2.1.

“Related

Party” means, in relation to any Person, any other Person who, directly or indirectly, Controls, is Controlled by, or is under

common Control with, such Person.

“Consideration”

has the meaning ascribed to it in Section 2.1.

“Business

Day” means any day other than a Saturday, Sunday or a day on which commercial banking institutions in the United States, the

Cayman Islands or China are authorized to be closed.

“Closing”

has the meaning ascribed to it in Section 2.2.

“Closing

Date” has the meaning ascribed to it in Section 2.2.

“Regulatory

Authority” means any governmental, regulatory or administrative body, specialized agency or institution, any court or judicial

body, any arbitral tribunal, any relevant stock exchange or any public, private or industry regulatory body, whether international, national,

federal, state or local.

“Control”

means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of any Person,

whether through the ownership of voting securities, by contract or otherwise; “Controlled” and “Controlling”

shall have the corresponding meanings as set forth.

“Target

Shares” has the meaning ascribed to it in the Recitals.

“Target

company” has the meaning ascribed to it in the Recitals.

“Buyer”

has the meaning ascribed to it in the Preamble.

“Seller”

has the meaning ascribed to it in the Preamble.

“U.S.

Securities Act” means the U.S. Securities Act of 1933, as amended from time to time, and any rules and regulations promulgated

thereunder.

“Order”

means any decree, order, judgment, writ, ruling, injunction, rule or approval of any Regulatory Authority.

“Encumbrance”

means, with respect to any asset, any mortgage, lien, pledge, charge, security interest or other types of encumbrance created over such

asset, provided that, in relation to the Target Shares, the fact that the Target Shares constitute “restricted securities”

as defined under Rule 144 shall not constitute an Encumbrance in respect of the Target Shares.

“Signing

Date” has the meaning ascribed to it in the Preamble.

“day-to-day

operations” means, with respect to actions taken or not taken by any Person, such actions or omissions are taken or not taken

in the ordinary and usual course of such Person’s operations.

“Person”

means an individual, corporation, partnership (including a general partnership, limited partnership, or limited liability partnership),

limited liability company, association, trust, or other entity or organization, including a domestic or foreign government or political

subdivision thereof, or agency or department thereof.

“Permit”

means any permit, license, approval, certificate, qualification, endorsement or authorization issued by the Regulatory Authority.

“Material

Adverse Effect” means an event, fact, condition or change that has a material adverse change or a material adverse effect on

any Person or its overall the assets, liabilities, condition (financial or otherwise), business or results of operations, whether or

not arising from transactions in the day-to-day operations, provided that “Material Adverse Effect” shall not include any

event, fact, condition or change arising directly or indirectly arising from the following matters and these matters shall not be taken

into account in determining whether a “Material Adverse Effect” has occurred: (a) general economic or political changes;

(b) conditions generally affecting the industry in which such Person and its subsidiaries operate; (c) any general change in the financial,

banking or securities markets, including any disruption, any decline in the price of any security or any market index or any change in

prevailing interest rates; (d) acts of war (whether declared or undeclared), armed hostilities or terrorism, or any escalation or aggravation

thereof; (e) any action required or permitted by this Agreement or any action taken (or not taken) by any Party at the written request

or with the written consent of the other Party; (f) any change in applicable Laws or accounting standards, or in the enforcement, implementation

or interpretation thereof; (g) any natural or man-made catastrophe or force majeure event, or the escalation or aggravation thereof;

or (h) the failure to realize any projections, forecasts, or projections of revenues, earnings, or other financial indicators for any

period; provided, however, that if the foregoing (a), (b), (c), (d), (f) and (g) have a significantly disproportionate impact on such

Person as a whole as compared to other participants in the same industry, such disproportionate impact portion will not be deeded as

an exception to the definition of Material Adverse Effect.

“Arbitration

Rules” has the meaning ascribed to it in Section 8.8.

“China”

means the People’s Republic of China and, for the purposes of this Agreement, excludes the Hong Kong Special Administrative Region

of the People’s Republic of China, the Macao Special Administrative Region of the People’s Republic of China and Taiwan.

“Charter

Documents” means, with respect to any Person, the certificate of incorporation and by-laws, as amended, or similar organizational

or governance documents.

Article

2 Purchase and Sale

Section

2.1 Purchase and Sale of Target Shares

(a)

Subject to the terms and conditions of this Agreement, the Seller agrees to sell, transfer and deliver to the Buyer the Target Shares

free from any Encumbrances for a total consideration of US$5,000,000 (the “Consideration”), and the Buyer agrees to

purchase and accept such Target Shares from the Seller at the foregoing price (the transaction described herein is the “Share

Transfer”).

(b)

Subject to the terms and conditions of this Agreement, the Parties shall use their reasonable best efforts to take or cause to be taken

any and all actions to complete or facilitate the completion of all matters that are necessary or appropriate under applicable Laws,

and shall cooperate as reasonably requested by the other Party, including but not limited to executing and delivering such other documents,

certificates, agreements, and other written instruments and fulfilling any statutory and/or required governmental approval, filing or

reporting procedure to promptly complete and implement the Share Transfer.

(c)

The Buyer irrevocably undertakes that within six (6) months following the Closing Date (as defined below), the Buyer shall not, directly

or indirectly, sell, gift, grant options, transfer proceeds, create trusts or otherwise dispose of (including any other form of transfer

of shares or change of control) all or part of the Target Shares held by the Buyer, or any interests therein, or create any Encumbrances

such as pledge of shares thereon.

Section

2.2 Closing

The

completion of the Share Transfer (the “Closing”) shall take place electronically within two (2) Business Days after

all the conditions set forth in Article 5 have been met or waived. The date of the actual occurrence of the Closing is hereinafter

referred to as the “Closing Date”. At the Closing:

(a)

The Buyer shall

(i)

pay the total Consideration in cash by wire transfer of immediately available U.S. dollar to the Seller’s account as set forth

on Schedule A hereto; and

(ii)

deliver to the Seller of an instrument of transfer duly executed by the Buyer, consenting to the purchase of the Target Shares.

(b)

Within two (2) Business Days upon receipt of the total Consideration required to be paid by the Buyer pursuant to Section 2.2(a)(i),

the Seller shall

(i)

deliver to the Target Company the share certificate representing the Target Shares it holds for cancellation and annulment;

(ii)

deliver to the Buyer an instrument of transfer with respect to transfer of the Target Shares to the Buyer duly executed by the Seller;

(iii)

procure the Target Company to deliver to the Buyer and the Seller an updated register of members of the Target Company reflecting the

Share Transfer, certified by the agent of the Target Company as being a true and complete copy as of the Closing Date; and

(iv)

procure the Target Company to issue to the Buyer a signed share certificate evidencing that the Buyer is the holder of the Target Shares.

Article

3 Representations and Warranties of the Seller

The

Seller hereby represents and warrants to the Buyer that, as of the Signing Date and as of the Closing Date (or, if such representations

and warranties are made with respect to a certain date, as of such date):

Section

3.1 Existence and Power

The

Seller is duly organized, validly existing and in good standing under the Laws of the jurisdiction in which it is incorporated, registered

or established.

Section

3.2 Authorization

The

execution, delivery and performance by the Seller of this Agreement and the consummation of the transactions hereunder are within the

Seller’s authority and have been duly authorized, if required, by the Seller’s Charter Documents, applicable Laws or corporate

actions required by any contract to which it is a Party or by which its securities are bound. This Agreement has been duly executed and

delivered by the Seller and, upon execution and delivery by the Buyer, will constitute a valid and legally binding agreement on the part

of the Seller and will be enforceable in accordance with its terms, subject to applicable bankruptcy, reorganization, moratorium and

similar Laws affecting the rights of creditors and general principles of equity.

Section

3.3 Regulatory Authorization

No

consent, approval or authorization of any Regulatory Authority or other Person is required for the Seller with respect to the execution,

delivery and performance of this Agreement or the consummation of the transactions hereunder.

Section

3.4 No conflict

The

execution, delivery or performance of this Agreement by the Seller has not (a) violated its organizational or governance documents, (b)

violated any Law or Order applicable to it, (c) violated (whether or not requiring notice or the passage of time, or both) or triggered

any right of termination, cancellation, modification or acceleration or led to any obligations for payment or compensation and (d) resulted

in the creation of any Encumbrance on the Target Shares, except for circumstances described in (a) through (c) that, individually or

in the aggregate, would not reasonably be expected to have a Material Adverse Effect on the Seller nor would have adverse effect on the

validity of this Agreement or the Seller’s power or ability to perform its obligations under this Agreement.

Section

3.5 Target Shares

As

of the Signing Date and until the Closing, the Seller is the sole registered and beneficial owner of the Target Shares, which are fully

paid and free from any Encumbrances. The Seller has the right, authority and power to sell, cede and transfer the Target Shares to the

Buyer. At the Closing and against the payment of the Consideration by the Buyer, the Buyer will acquire good, valid and marketable title

to the Target Shares and there shall be no Encumbrances or transfer restrictions (except for those under applicable securities Laws)

on the Target Shares, and the Target Shares will be fully paid and non-assessable and the Buyer will enjoy all the rights of the owner

of the Target Shares.

Section

3.6 No “Directed Selling Efforts”

No

“directed selling efforts” (as defined in Regulation S under the U.S. Securities Act) has been made by the Seller, any affiliate

of Seller or any person acting on behalf of Seller with respect to any Target Share under this Agreement, and none of such persons has

taken any actions that would result in the sale of the Target Shares to the Buyer under this Agreement requiring registration under the

U.S. Securities Act.

Article

4 Representations and Warranties of the Buyer

The

Buyer hereby represents and warrants to the Seller that, as of the Signing Date and as of the Closing Date (or, if such representations

and warranties are made with respect to a certain date, as of such date):

Section

4.1 Existence and Power

If

the Buyer is not a natural person, it is duly organized, validly existing and in good standing under the Laws of the jurisdiction in

which it is incorporated, registered or established.

Section

4.2 Authorization

The

execution, delivery and performance of this Agreement by the Buyer and the consummation of the transactions hereunder are within the

Buyer’s authority and have obtained all necessary corporate authorizations required by its Charter Documents (if applicable), applicable

Laws or by corporate action required by any contract to which it is a Party or by which its securities are bound. This Agreement has

been duly executed and delivered by the Buyer and, upon execution and delivery by the Seller, will constitute a valid and legally binding

agreement on the part of the Buyer and will be enforceable in accordance with its terms, subject to applicable bankruptcy, reorganization,

moratorium and similar Laws affecting the rights of creditors and general principles of equity.

Section

4.3 Regulatory Authorization

No

consent, approval or authorization of any Regulatory Authority or other Person, no filing, declaration or submission of notice to any

Regulatory Authority or other Person, and no other action with respect to any Regulatory Authority or other Person is required by the

Buyer in connection with the execution, delivery and performance of this Agreement, or the consummation of the transactions hereunder.

Section

4.4 No Conflict

The

execution, delivery or performance of this Agreement by the Buyer has not (a) violated its organizational or governance documents, (b)

violated any Law or Order applicable to it, (c) violated (whether or not requiring notice or the passage of time, or both) or triggered

any right of termination, cancellation, modification or acceleration or led to any obligations for any payment or compensation and (d)

resulted in the creation of any Encumbrance on its equity interests or material assets, except for the circumstances in (a) through (d),

which, individually or in the aggregate, would not reasonably be expected to have a Material Adverse Effect on the Buyer.

Section

4.5 Legal Sources of Funds

The

source of funds for the Consideration to be paid by the Buyer to the Seller pursuant to this Agreement is not in violation of any Law

applicable thereto, and the Buyer has sufficient capability to pay the Consideration to the Seller in accordance with the terms and conditions

of this Agreement.

Section

4.6 Securities Law Matters

The

Buyer is purchasing the Target Shares for its own account and not in violation of any applicable Laws (including applicable securities

Laws). The Buyer acknowledges that the Target Shares are “restricted securities” as defined under Rule 144 and have not been

registered under the U.S. Securities Act or any applicable state securities Laws. The Buyer further acknowledges that, in the absence

of effective registration under the U.S. Securities Act, the Target Shares may only be issued, sold or transferred in compliance with

applicable Laws.

Section

4.7 Investment Experience and Independent Decision-making

The

Buyer is a sophisticated investor with financial and commercial knowledge and experience, capable of assessing the advantages and risks

of the Target Shares. The Buyer confirms that it is able to bear the economic risks of acquiring the Target Shares. Except as provided

in Article 3 of this Agreement, the Buyer has made the decision to enter into this Agreement and purchase the Target Shares based

on its own knowledge and investigation and has not relied on any representations or warranties made by the Seller.

Section

4.8 Status of the Buyer

The

Buyer falls under at least one of the following two situations: (i) the Buyer is not a “U.S. person” within the meaning of

Regulation S under the U.S. Securities Act and is acquiring the Target Shares in an “offshore transaction” under Rule 903

of Regulation S under the U.S. Securities Act, or (ii) the Buyer is an “accredited investor” within the meaning of Rule 501

of Regulation D under the U.S. Securities Act.

Section

4.9 Material Non-public Information

The

Buyer is aware that the Seller may be in possession of material non-public information about the Target Shares or the Target Company,

which information (if any) has not been disclosed to the Buyer. The Buyer acknowledges that it has not requested such information and

agrees to purchase the Target Shares without receiving such information. The Buyer acknowledges that it waives any claims or demands

that it may have against the Seller or its Affiliates (whether based on applicable securities Laws or other grounds) relating to the

non-disclosure of any material non-public information, provided that such non-disclosure does not affect the truthfulness of the Seller’s

representations and warranties set forth in Article 3 of this Agreement.

Article

5 Closing Conditions

Section

5.1 Buyer’s Conditions Precedent to the Closing

The

Buyer’s obligation to consummate the Share Transfer shall be conditioned upon the fulfillment of each of the following conditions

at or prior to the Closing, and the Buyer may, in its sole discretion, waive any of the following conditions in writing:

(a)

no provision or Order of any applicable Law shall prohibit or prevent the completion of the Share Transfer;

(b)

the Seller has duly performed all of its obligations hereunder required to be performed on or prior to the Closing Date; and

(c)

the representations and warranties of the Seller under Article 3 of this Agreement are true and accurate as of the Signing Date

and as of the Closing Date (unless the representations and warranties are made with respect to a particular date, in which case such

representations and warranties shall be true and accurate only as of such date).

Section

5.2 Seller’s Conditions Precedent to the Closing

The

Seller’s obligation to complete the Share Transfer shall be conditioned upon the fulfillment of each of the following conditions

at or prior to the Closing, and the Seller may, in its sole discretion, waive any of the following conditions in writing:

(a)

no provision or Order of any applicable Law shall prohibit or prevent the completion of the Share Transfer;

(b)

the Buyer has duly performed all of its obligations hereunder required to be performed on or before the Closing Date; and

(c)

the representations and warranties of the Buyer under Article 4 of this Agreement are true and accurate as of the Signing Date

and as of the Closing Date (unless the representations and warranties are made with respect to a particular date, in which case such

representations and warranties need only be true and accurate as of such date).

Article

6 Termination

Section

6.1 Termination

This

Agreement may be terminated at any time prior to Closing under the following terms:

(a)

by mutual written consent of both Parties;

(b)

the Buyer may unilaterally terminate this Agreement upon written notice to the Seller in the event that the Buyer is not then in material

breach of its obligations hereunder and the Seller breaches or defaults in any material respect of any of its representations, warranties

or undertakings hereunder that (i) cannot be, or has not been, cured within five (5) days after the Seller’s receipt by the Buyer

of written notice of such breach or default and (ii) is not waived by the Buyer; or

(c)

the Seller may unilaterally terminate this Agreement upon written notice to the Buyer, in the event that the Seller is not then in material

breach of its obligations hereunder and the Buyer breaches or defaults in any material respect of any of its representations, warranties

or undertakings hereunder that (i) cannot be, or has not been, cured within five (5) days after the Buyer’s receipt by the Seller

of written notice of such breach or default and (ii) is not waived by the Seller.

Section

6.2 Effect of Termination

If

this Agreement is terminated pursuant to Section 6.1, the other provisions of this Agreement shall immediately expire as between

the relevant Parties, except that (a) the provisions of Article 7 hereof shall survive, and (b) nothing herein shall relieve any

of the foregoing relevant Parties from liability for any breach hereof or of any agreement entered into on or after the Signing Date.

Article

7 General Provisions

Section

7.1 Amendment; No Exemption; Relief

(a)

This Agreement may not be amended or terminated (other than termination pursuant to Section 6.1 of this Agreement) unless by the

Parties in writing. No provision of this Agreement shall be waived unless the Party granting the waiver has signed a writing to that

effect, and such waiver shall apply only in the specific circumstances agreed to therein.

(b)

No failure or delay by either Party in exercising any right hereunder shall constitute a waiver of that right. The fact that either Party

has exercised or partially exercised any right hereunder shall not preclude it from any further exercising that or any other right. No

notice or demand to a Party shall constitute a waiver of, or otherwise affect, any of the obligations of that Party or prejudice any

rights of the Party giving such notice or making such demand, notwithstanding that this Agreement does not expressly require notice or

measures to be taken for the exercise of such rights. The exercise of any right or remedy with respect to a breach of this Agreement

shall not preclude the exercise of any other right or remedy to indemnify the aggrieved Party with respect to such breach or the subsequent

exercise of any right or remedy with respect to any other breach.

(c)

Notwithstanding any other provision herein, neither Party shall seek punitive damages or compensation based on any tort, contract law,

equity or other legal theory for any breach (or purported breach) hereof, or any provision hereof, or any matter related thereto.

Section 7.2 Notice

All

notices and other communications hereunder shall be in writing and shall be deemed to be duly delivered (a) if delivered personally,

on the date of delivery, or if delivered by facsimile or email, upon written confirmation of receipt by facsimile, email, or otherwise;

(b) if delivered by a recognized overnight courier service, on the first Business Day following the date of dispatch; or (c) if delivered

by registered or certified mail, return receipt requested, or postage prepaid, on the earlier of the date of confirmed receipt or the

fifth Business Day after the date of mailing. All notices hereunder shall be sent to the following address or email addresses, or to

such other address as designated by prior written notice by a Party:

If

to the Seller:

[***]

If

to the Buyer:

[***]

Section

7.3 Arm’s Length Transaction; No Presumption Against Drafting Party

This

Agreement has been fairly negotiated at arm’s length between the Parties, each of whom has been represented by counsel or has knowingly

and voluntarily declined to retain counsel where representation was available and has participated in the drafting hereof. This Agreement

does not create a fiduciary or other special relationship between the Parties, and no such relationship exists. In interpreting this

Agreement or any provision hereof, no presumption shall be drawn in favor of or against either Party based on the fact that such Party

may have drafted this Agreement or such provision.

Section

7.4 Publicity and Announcements

(a)

All press releases, public disclosures or other disclosures in connection with the Share Transfer, and the manner in which such disclosures

are made, shall be subject to the prior mutual consent of the Parties prior to public release or disclosure; provided, however, that

the foregoing consent shall not be required in the case of any proposed disclosure that is materially consistent with public information

that is not in violation of this Section.

(b)

The foregoing restrictions do not apply to any disclosures required by applicable securities Laws, any Regulatory Authority or stock

exchange rules.

Section

7.5 Costs

Unless

otherwise provided herein, all costs and expenses incurred by this Agreement and pursuant to, or in connection with, the Share Transfer,

whether or not the Share Transfer is consummated, shall be borne solely by the Party incurring such transaction costs and expenses.

The

Seller hereby undertakes and agrees, if any applicable laws and regulations require the Seller to fulfill any tax filings, disclosures

and/or tax payment with respect to the Share Transfer, the Seller shall promptly fulfill such tax filings and disclosures and timely

pay any such tax amount due in full in accordance with the legal requirements at its own expense. If the Buyer incurs any losses or liabilities

due to any failure of the Seller to comply with any of its obligations regarding tax filings, disclosures or payment with respect to

the Share Transfer, the Seller shall fully indemnify the Buyer and hold the Buyer harmless from and against any such losses or liabilities

incurred by the Buyer.

Section

7.6 No Assignment or Delegation

No

Party may assign or delegate, by operation of law or otherwise, in whole or in part, any of its rights, interests or obligations hereunder

without the prior written consent of the other Party, and any assignment or delegation without such prior written consent shall be null

and void; and no assignment or delegation shall relieve an assignor or delegate of its obligations hereunder. Subject to the preceding

sentence, this Agreement shall be binding upon, inure to the benefit of, and be enforceable by the Parties and their respective successors

and assigns.

Section

7.7 Governing Law

This

Agreement (including the arbitration clause under Section 7.8) and all disputes arising out of or in connection with the Share

Transfer shall be governed by and construed in accordance with the Laws of Hong Kong, without regard to its conflict of laws principles.

Section

7.8 Arbitration

(a)

Each Party irrevocably agrees that any dispute, controversy, difference or claim arising out of or in connection with this Agreement,

including the existence, validity, interpretation, performance, breach or termination thereof, or any non-contractual dispute arising

out of or in connection with this Agreement, shall be submitted to and finally resolved by arbitration by the Hong Kong International

Arbitration Center (“HKIAC”) in accordance with the HKIAC Institutional Arbitration Rules (the “Arbitration

Rules”) in effect at the time of the submission of Arbitration. Each Party hereby irrevocably submits generally and unconditionally

to the exclusive jurisdiction of the HKIAC with respect to any such legal dispute or proceeding arising out of or relating to this Agreement

or the transactions contemplated hereby. Each Party agrees that it will not institute any suit or proceeding in connection therewith

other than an arbitration initiated at the HKIAC, except for an application for injunctive relief in any court of competent jurisdiction

prior to the completion of the establishment of an arbitral tribunal, or an action to enforce any judgment, decree or award rendered

by any of the HKIAC pursuant to this Agreement in any court of competent jurisdiction.

(b)

To commence the arbitration, either Party shall deliver a notice of arbitration in accordance with the Arbitration Rules to the HKIAC

and the other Party to the address for notice set forth in Section 7.2 of this Agreement. The seat or legal venue of the arbitration

shall be Hong Kong; the arbitral proceedings shall be conducted in Chinese. The arbitral tribunal shall consist of one (1) arbitrator

appointed by the HKIAC. The award rendered by the arbitral tribunal shall be final and binding on the Parties. The Parties hereby agree,

to the extent permitted by applicable Law, not to resort to any judicial proceedings in any jurisdiction seeking to set aside, modify

or reduce or impair the terms or effect of the arbitral award. Either Party may apply to any court of competent jurisdiction to enforce

the arbitral award or seek a confirmation order.

(c)

Each Party further agrees that the manner of notice provided for herein shall constitute due and sufficient service of legal documents,

and the Parties further waive any argument that such service of legal documents is insufficient.

(d)

This arbitration provision shall survive the termination of this Agreement.

Section

7.9 Counterpart; Facsimile Signature

This

Agreement may be executed in two or more counterparts, each of which shall be deemed an original, and all of which shall constitute one

and the same instrument. This Agreement shall become effective on the Signing Date upon delivery by the Parties to each other of the

executed copies or earlier delivery to the Parties of an original, photocopy, or electronically transmitted signature page bearing the

signatures of both Parties jointly (but not necessarily separately). This Agreement may be signed by the parties jointly or separately

(including by means of electronic signatures), and the Parties agree that neither this Agreement nor any part thereof shall be challenged

or denied as to its legal effect, validity and/or enforceability solely by reason of its being in electronic form.

Section

7.10 Entire Agreement

This

Agreement (including the schedules and exhibits hereto) constitutes the entire agreement of the Parties with respect to the Share Transfer

and supersedes all prior written agreements, arrangements, communications and understandings between the Parties and all prior and contemporaneous

oral agreements, arrangements, communications and understandings. Whether or not any oral agreement or course of conduct by or on behalf

of the Parties indicates to the contrary, no Party hereto shall have any legal obligation to enter into or consummate the transactions

contemplated by this Agreement unless and until this Agreement has been executed and delivered by the Parties.

Section

7.11 Severability

If

any provision of this Agreement is held to be invalid or unenforceable, the Parties agree to fully enforce such provision permissible

in order to accomplish the intent of the Parties, and the validity, legality or enforceability of the remaining provisions of this Agreement

shall not be impaired in any way as a result. If necessary, the Parties shall negotiate in good faith to amend this Agreement to replace

such unenforceable provisions with provisions that best reflect the relevant intent and are enforceable. If this Agreement is unenforceable

against one Party, it shall not affect its enforceability against the other Party.

Section

7.12 No Third-party Beneficiaries

Neither

this Agreement nor any provision of this Agreement confers any benefit or right on, or is enforceable by, any Person who is not a signatory

to this Agreement.

Section

7.13 Specific Performance

(a)

The Parties hereby agree that if any of the provisions of this Agreement (including the failure to take actions required herein to effectuate

the Share Transfer) are not performed in accordance with its specific terms or are otherwise breached, irreparable harm will occur and

that even monetary damages would not be an appropriate remedy. Accordingly, the Parties agree that each Party shall be entitled to obtain

one or more injunctive, or any other appropriate form of specific performance or equitable relief to prevent a breach of this Agreement

and to specifically enforce the terms and provisions of this Agreement in any court of competent jurisdiction pursuant to this Agreement

in addition to any other relief to which such Party may be entitled at law (and the Parties hereby waive any requirement of security

or posting of any bond or security in connection with such relief);

(b)

The Parties agree that they will not oppose the granting of injunctive, specific performance and other equitable relief expressly provided

under the terms of this Agreement on the ground that the other Party has adequate relief at law or that a judgment for specific performance

is not an adequate remedy at law or in equity. Any Party seeking an injunction to prevent a default or potential default or seeking to

comply with this Agreement under its terms is not required to post any bond or other security in connection with such order or injunction.

Section

7.14 Interpretation

In

this Agreement:

(a)

The section headings in this Agreement are for convenience and reference purposes only and shall not affect the meaning or interpretation

of the text of the Agreement.

(b)

The words “including” and similar expressions are not intended to be restrictive and shall be construed as “including

but not limited to”.

(c)

Unless otherwise stated, references to applicable Laws and regulations in this Agreement include amendments, modifications, supplements,

or re-enactments thereof from time to time.

[The

Signature Pages Follow]

IN

WITNESS WHEREOF, this Agreement has been executed by the duly authorized representatives of each Party as of the date first above written.

| Seller: |

|

|

| |

|

|

| Abundant

Grace Investment Limited |

|

| |

|

|

| Signature:

|

/s/

Mao Wei |

|

| Name:

|

Mao

Wei |

|

| Title:

|

Director |

|

Signature

Page to the Share Transfer Agreement

IN

WITNESS WHEREOF, this Agreement has been executed by the duly authorized representatives of each Party as of the date first above written.

| Buyer |

|

|

| |

|

|

| BRIGHTEST

SKY LIMITED |

|

| |

|

|

| Signature:

|

/s/

Erhai Liu |

|

| Name:

|

Erhai

Liu |

|

| Title:

|

Authorized

Signatory |

|

Signature Page to the Share Transfer Agreement

Schedule A

Seller’s

Bank Account

[***]

Schedule A

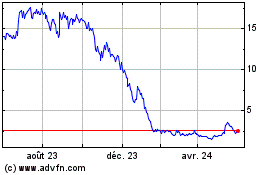

Uxin (NASDAQ:UXIN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

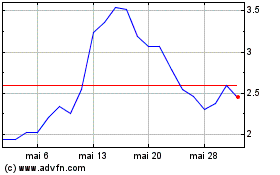

Uxin (NASDAQ:UXIN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025