Winmark Corporation (Nasdaq: WINA) announced today net income

for the year ended December 30, 2023 of $40,178,100 or $11.04 per

share diluted compared to net income of $39,424,900 or $10.97 per

share diluted in 2022. The fourth quarter 2023 net income was

$9,716,800 or $2.64 per share diluted, compared to net income of

$10,176,600 or $2.86 per share diluted, for the same period last

year. Revenues for the year ended December 30, 2023 were

$83,243,500, up from $81,410,800 in 2022. 2023 results were

impacted by the Company’s decision in May 2021 to run-off its

leasing portfolio. Additionally, financial performance for the

fourth quarter and full year 2022 included an extra week of

operations due to the Company’s fiscal year ending on the last

Saturday of December.

“Our 2023 results reflected positive performance by our

franchise partners; however, growth was lower in the second half of

the year,” commented Brett D. Heffes, Chair and Chief Executive

Officer.

Winmark - the Resale Company®, is a nationally recognized

franchisor focused on sustainability and small business formation.

We champion and guide entrepreneurs interested in operating one of

our award winning resale franchises: Plato’s Closet®, Once Upon A

Child®, Play It Again Sports®, Style Encore® and Music Go Round®.

At December 30, 2023, there were 1,319 franchises in operation and

over 2,800 available territories. An additional 71 franchises have

been awarded but are not open.

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

relating to future events or the future financial performance of

the Company. Such forward-looking statements are only predictions

or statements of intention subject to risks and uncertainties and

actual events or results could differ materially from those

anticipated. Because actual result may differ, shareholders and

prospective investors are cautioned not to place undue reliance on

such forward-looking statements.

WINMARK CORPORATION

CONDENSED BALANCE

SHEETS

(Unaudited)

December 30, 2023

December 31, 2022

ASSETS

Current Assets:

Cash and cash equivalents

$

13,361,500

$

13,615,600

Restricted cash

25,000

65,000

Receivables, net

1,475,300

1,438,600

Net investment in leases -

current

75,100

344,900

Income tax receivable

31,400

558,700

Inventories

386,100

770,600

Prepaid expenses

1,392,100

1,310,400

Total current assets

16,746,500

18,103,800

Net investment in leases –

long-term

—

5,400

Property and equipment, net

1,669,800

1,704,600

Operating lease right of use

asset

2,425,900

2,716,000

Intangible assets, net

2,994,300

3,348,300

Goodwill

607,500

607,500

Other assets

471,300

429,700

Deferred income taxes

4,052,400

3,540,400

$

28,967,700

$

30,455,700

LIABILITIES AND SHAREHOLDERS’

EQUITY (DEFICIT)

Current Liabilities:

Notes payable, net

$

4,217,900

$

4,217,900

Accounts payable

1,719,400

2,122,000

Accrued liabilities

2,858,200

2,611,700

Deferred revenue

1,666,100

1,643,900

Total current liabilities

10,461,600

10,595,500

Long-Term Liabilities:

Line of credit/Term loan

30,000,000

30,000,000

Notes payable, net

34,848,800

39,066,700

Deferred revenue

7,657,500

6,974,200

Operating lease liabilities

3,715,800

4,287,000

Other liabilities

1,440,100

1,164,400

Total long-term liabilities

77,662,200

81,492,300

Shareholders’ Equity

(Deficit):

Common stock, no par, 10,000,000

shares authorized, 3,496,977 and 3,459,673 shares issued and

outstanding

7,768,800

1,806,700

Retained earnings (accumulated

deficit)

(66,924,900

)

(63,438,800

)

Total shareholders’ equity

(deficit)

(59,156,100

)

(61,632,100

)

$

28,967,700

$

30,455,700

WINMARK CORPORATION

CONDENSED STATEMENTS OF

OPERATIONS

(Unaudited)

Quarter Ended

Fiscal Year Ended

December 30, 2023

December 31, 2022

December 30, 2023

December 31, 2022

Revenue:

Royalties

$

17,167,200

$

17,917,700

$

70,230,700

$

67,148,100

Leasing income

817,600

1,091,900

4,766,200

6,937,700

Merchandise sales

1,159,200

1,234,100

4,761,100

3,921,600

Franchise fees

378,600

415,200

1,512,000

1,575,400

Other

517,300

466,800

1,973,500

1,828,000

Total revenue

20,039,900

21,125,700

83,243,500

81,410,800

Cost of merchandise sold

1,091,100

1,160,500

4,461,500

3,712,800

Leasing expense

16,600

92,800

398,300

984,700

Provision for credit losses

(1,000

)

(11,300

)

(5,600

)

(57,900

)

Selling, general and

administrative expenses

6,414,400

6,485,300

25,108,700

23,158,400

Income from operations

12,518,800

13,398,400

53,280,600

53,612,800

Interest expense

(751,100

)

(869,300

)

(3,091,000

)

(2,914,900

)

Interest and other income

368,300

78,600

1,171,700

85,600

Income before income taxes

12,136,000

12,607,700

51,361,300

50,783,500

Provision for income taxes

(2,419,200

)

(2,431,100

)

(11,183,200

)

(11,358,600

)

Net income

$

9,716,800

$

10,176,600

$

40,178,100

$

39,424,900

Earnings per share - basic

$

2.78

$

2.95

$

11.55

$

11.30

Earnings per share - diluted

$

2.64

$

2.86

$

11.04

$

10.97

Weighted average shares

outstanding - basic

3,494,544

3,452,399

3,479,936

3,487,732

Weighted average shares

outstanding - diluted

3,679,444

3,556,190

3,640,524

3,592,456

WINMARK CORPORATION

CONDENSED STATEMENTS OF CASH

FLOWS

(Unaudited)

Year Ended

December 30, 2023

December 31, 2022

OPERATING ACTIVITIES:

Net income

$

40,178,100

$

39,424,900

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation and amortization

772,700

603,100

Provision for credit losses

(5,600

)

(57,900

)

Compensation expense related to

stock options

1,952,400

1,652,400

Deferred income taxes

(512,000

)

(287,700

)

Gain from disposal of property

and equipment

—

(9,400

)

Operating lease right of use

asset amortization

290,100

266,000

Tax benefits on exercised stock

options

1,138,500

858,300

Change in operating assets and

liabilities:

Receivables

(36,700

)

(335,200

)

Principal collections on lease

receivables

556,000

3,646,700

Income tax receivable/payable

(611,200

)

(749,500

)

Inventories

384,500

(445,400

)

Prepaid expenses

(81,700

)

(301,800

)

Other assets

(41,600

)

(11,400

)

Accounts payable

(402,600

)

23,000

Accrued and other liabilities

(16,900

)

222,800

Rents received in advance and

security deposits

(275,200

)

(819,200

)

Deferred revenue

705,500

109,600

Net cash provided by operating

activities

43,994,300

43,789,300

INVESTING ACTIVITIES:

Proceeds from sales of property

and equipment

9,400

Purchase of property and

equipment

(383,900

)

(139,100

)

Reacquired franchise rights

—

(3,540,000

)

Net cash used for investing

activities

(383,900

)

(3,669,700

)

FINANCING ACTIVITIES:

Proceeds from borrowings on line

of credit/term loan

—

33,700,000

Payments on line of credit/term

loan

—

(3,700,000

)

Payments on notes payable

(4,250,000

)

(4,250,000

)

Repurchases of common stock

—

(49,119,800

)

Proceeds from exercises of stock

options

4,009,700

4,751,700

Dividends paid

(43,664,200

)

(19,257,900

)

Net cash used for financing

activities

(43,904,500

)

(37,876,000

)

NET INCREASE (DECREASE) IN CASH,

CASH EQUIVALENTS AND RESTRICTED CASH

(294,100

)

2,243,600

Cash, cash equivalents and

restricted cash, beginning of period

13,680,600

11,437,000

Cash, cash equivalents and

restricted cash, end of period

$

13,386,500

$

13,680,600

SUPPLEMENTAL DISCLOSURES:

Cash paid for interest

$

3,049,400

$

2,722,500

Cash paid for income taxes

$

10,874,300

$

11,308,800

The following table provides a

reconciliation of cash, cash equivalents and restricted cash

reported within the Condensed Balance Sheets to the total of the

same amounts shown above:

Year Ended

December 30, 2023

December 31, 2022

Cash and cash equivalents

$

13,361,500

$

13,615,600

Restricted cash

25,000

65,000

Total cash, cash equivalents and

restricted cash

$

13,386,500

$

13,680,600

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221814233/en/

Anthony D. Ishaug 763/520-8500

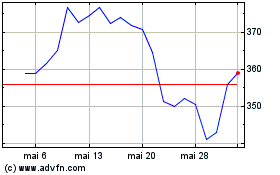

Winmark (NASDAQ:WINA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Winmark (NASDAQ:WINA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025