ContextLogic Inc. (d/b/a Wish) (Nasdaq: WISH) (“ContextLogic,” the

“Company,” “we” or “our”), one of the largest mobile ecommerce

platforms, today reported its financial results for the quarter and

fiscal year ended December 31, 2023.

Fourth-Quarter Fiscal 2023 Financial

Highlights

- Revenues: Revenues

were $53 million, a decrease of 57% YoY

- Core Marketplace

revenues were $15 million, down 58% YoY

- Product Boost

revenues were $5 million, down 50% YoY

- Logistics revenues

were $33 million, down 57% YoY

- Net Loss: Net Loss

was $68 million, compared to a net loss of $110 million in the

fourth quarter of fiscal 2022

- Net Loss per share

was $2.82, compared to a loss of $4.80 per share in the fourth

quarter of fiscal 2022

- Adjusted EBITDA:

Adjusted EBITDA(1) was a loss of $54 million, compared to a loss of

$95 million in the fourth quarter of fiscal 2022

- Cash Flow: Cash

flows used in operating activities were $75 million

- Free Cash Flow(1)

was $(75) million, compared to $(109) million in the fourth quarter

of fiscal 2022

Preliminary January 2024 Financial Results

- Revenues: Revenues were $14

million.

- Adjusted EBITDA: Adjusted EBITDA was a

loss of $13 million.

This information reflects our preliminary

estimates with respect to such results based on currently available

information, is not a comprehensive statement of our financial

results and is subject to completion of our financial closing

procedures. Our actual results may differ materially from these

estimates. See “Forward-Looking Statements” for additional

information.

Fourth Quarter and Fiscal Year Ended 2023 Consolidated

Financials

The following tables include unaudited GAAP and non-GAAP

financial highlights for the periods presented:

Revenue(in millions, except percentages;

unaudited)

| |

Three Months Ended |

|

|

|

|

|

Year Ended |

|

|

|

|

| |

December 31, |

|

|

|

|

|

December 31, |

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

YoY% |

|

|

2023 |

|

|

2022 |

|

|

YoY% |

|

|

Core marketplace revenue |

$ |

15 |

|

|

$ |

36 |

|

|

|

(58 |

)% |

|

$ |

86 |

|

|

$ |

220 |

|

|

|

(61 |

)% |

|

ProductBoost revenue |

|

5 |

|

|

|

10 |

|

|

|

(50 |

)% |

|

|

24 |

|

|

|

46 |

|

|

|

(48 |

)% |

|

Marketplace revenue |

|

20 |

|

|

|

46 |

|

|

|

(57 |

)% |

|

|

110 |

|

|

|

266 |

|

|

|

(59 |

)% |

|

Logistics revenue |

|

33 |

|

|

|

77 |

|

|

|

(57 |

)% |

|

|

177 |

|

|

|

305 |

|

|

|

(42 |

)% |

|

Revenue |

$ |

53 |

|

|

$ |

123 |

|

|

|

(57 |

)% |

|

$ |

287 |

|

|

$ |

571 |

|

|

|

(50 |

)% |

Other Financial Data(in millions, except

percentages; unaudited)

| |

Three Months Ended |

|

|

Year Ended |

|

| |

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net loss |

$ |

(68 |

) |

|

$ |

(110 |

) |

|

$ |

(317 |

) |

|

$ |

(384 |

) |

|

% of Revenue |

|

(128 |

)% |

|

|

(89 |

)% |

|

|

(110 |

)% |

|

|

(67 |

)% |

| Adjusted

EBITDA(1) |

$ |

(54 |

) |

|

$ |

(95 |

) |

|

$ |

(236 |

) |

|

$ |

(288 |

) |

|

% of Revenue |

|

(102 |

)% |

|

|

(77 |

)% |

|

|

(82 |

)% |

|

|

(50 |

)% |

|

(1) |

Indicates

non-GAAP metric. See below for more information regarding our

presentation of non-GAAP metrics in the section titled: “Use of

Non-GAAP Financial Measures.” |

Previously Announced

Transaction

On February 12, 2024, ContextLogic Inc.

announced that its Board of Directors (the “Board”) had unanimously

approved an agreement to sell substantially all of its operating

assets and liabilities, principally comprising its Wish ecommerce

platform (the “Asset Sale”), to Qoo10, an ecommerce platform

operating localized online marketplaces in Asia, for approximately

$173 million in cash, subject to certain purchase price

adjustments. The purchase price represents approximately $6.50 per

share and an approximately 44% premium to ContextLogic’s closing

stock price on February 9, 2024, the last trading day prior to

announcing the transaction.

Following closing of the transaction,

ContextLogic will have limited operating expenses and a balance

sheet that will be debt-free and will include net cash proceeds

from the asset sale, approximately $2.7 billion of Net Operating

Loss (“NOL”) carryforwards and certain retained assets. The Board

intends to use the proceeds from the transaction to help monetize

its NOLs. The Board also intends to explore the opportunity for a

financial sponsor to help ContextLogic realize the value of its tax

assets.

The Company expects to complete the transaction

in the second quarter of 2024, subject to the approval of

ContextLogic’s shareholders and other customary closing conditions.

The transaction is not subject to any financing contingency. As

part of the agreement, ContextLogic will begin trading under a new

ticker symbol within 30 days of the closing of the transaction.

In light of the pending transaction,

ContextLogic will not host a conference call or live webcast to

discuss these financial results.

First Quarter Fiscal 2024 Financial

Guidance

Due to the pending transaction, ContextLogic has

discontinued providing guidance.

About Wish

Wish brings an affordable and entertaining

shopping experience to millions of consumers around the world.

Since our founding in San Francisco in 2010, we have become one of

the largest global ecommerce platforms, connecting millions of

value-conscious consumers to hundreds of thousands of merchants

globally. Wish combines technology and data science capabilities

and an innovative discovery-based mobile shopping experience to

create a highly-visual, entertaining, and personalized shopping

experience for its users. For more information about the company or

to download the Wish mobile app, visit www.wish.com or follow @Wish

on Facebook, Instagram and TikTok or @WishShopping on X (formerly

Twitter) and YouTube.

Use of Non-GAAP Financial

Measures

We provide Adjusted EBITDA, a non-GAAP financial

measure that represents our net income (loss) adjusted to exclude:

interest and other income (expense), net (which includes foreign

exchange gain or loss, foreign exchange forward contracts gain or

loss and gain or loss on one-time non-operating transactions);

provision or benefit for income taxes; depreciation and

amortization; stock-based compensation expense and related payroll

taxes; lease impairment related expenses; and other items.

Additionally, in this news release, we present Adjusted EBITDA

Margin, a non-GAAP financial measure that represents Adjusted

EBITDA divided by revenue. The reconciliation between historical

GAAP and non-GAAP results of operations is provided below. Our

management uses Adjusted EBITDA in conjunction with GAAP and other

operating performance measures as part of its overall assessment of

the company’s performance for planning purposes, including the

preparation of its annual operating budget, to evaluate the

effectiveness of its business strategies and to communicate with

its board of directors concerning its financial performance.

Adjusted EBITDA should not be considered as an alternative

financial measure to net loss, which is the most directly

comparable financial measure calculated in accordance with GAAP, or

any other measure of financial performance calculated in accordance

with GAAP. We also provide Free Cash Flow, a non-U.S. GAAP

financial measure that represents net cash used in operating

activities less purchases of property and equipment. We believe

that Free Cash Flow is an important measure since we use third

parties to host our services and therefore we do not incur

significant capital expenditures to support revenue generating

activities. The reconciliation between net cash used in operating

activities and Free Cash Flow is provided below. Free Cash Flow has

limitations as an analytical measure, and you should not consider

it in isolation or as a substitute for analysis of our net cash

used in operating activities, which is the most directly comparable

financial measure calculated in accordance with GAAP, or any other

measure of financial performance calculated in accordance with

GAAP.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the Safe Harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact could be deemed

forward-looking, including, but not limited to, statements

regarding the completion and timing of the Asset Sale, the amount

of net proceeds from the Asset Sale, the amount of NOLs Wish will

have after the Asset Sale, Wish’s ability to identify and realize

business opportunities following the Asset Sale, Wish’s ability to

utilize its NOLs and other tax attributes following the Asset Sale,

expectations regarding new business strategies, the anticipated

return on our investments and their ability to drive future growth

and capitalize on related opportunities, and Wish’s expectations

regarding its preliminary unaudited financial results. In some

cases, forward-looking statements can be identified by terms such

as “anticipates,” “believes,” “could,” “estimates,” “expects,”

“foresees,” “forecasts,” “guidance,” “intends” “goals,” “may,”

“might,” “outlook,” “plans,” “potential,” “predicts,” “projects,”

“seeks,” “should,” “targets,” “will,” “would” or similar

expressions and the negatives of those terms. These forward-looking

statements are subject to risks, uncertainties, and assumptions. If

the risks materialize or assumptions prove incorrect, actual

results could differ materially from the results implied by these

forward-looking statements. Risks include, but are not limited to:

our ability to acquire new users and engage existing users; our

ability to promote, maintain, and protect our brand and reputation

and offer a compelling user experience; the effectiveness of our

CEO transition; the continued services of members of our senior

management team; our ability to offer and promote our app on the

Apple App Store and the Google Play Store; the risk of merchants on

our platform using unethical or illegal business practices or if

our policies and practices with respect to such sales are perceived

or found to be inadequate; the success of our execution on new

business strategies; competition in our market and industry; the

ongoing COVID-19 pandemic; global conflicts, including the Russian

invasion of Ukraine; economic tension between the United States and

China; supply chain issues; increasing requirements on collection

of sales and value added taxes; significant disruption in service

on our platform or in our computer systems; litigation matters;

material weaknesses in our internal control over financial

reporting and the effectiveness of our internal controls generally;

our ability to complete the Asset Sale on the anticipated timeline,

or at all, and restrictions imposed on our business under the asset

purchase agreement with Qoo10 while the Asset Sale is pending; the

satisfaction or waiver of the closing conditions to the Asset Sale,

including the approval of the Asset Sale by our stockholders;

disruptions to our business while the proposed Asset Sale is

pending; risks associated with our ability to identify and realize

business opportunities following the Asset Sale; risks associated

with our ability to utilize our NOLs and other tax attributes

following the Asset Sale; the occurrence of any event, change or

other circumstances that could give rise to the termination of the

asset purchase agreement with Qoo10; the impact of management’s

time and attention being focused on consummation of the proposed

Asset Sale; costs associated with the proposed Asset Sale; the

scope, timing and outcome of any potential stockholder litigation

related to the Asset Sale; and risks affecting Wish’s preliminary

unaudited financial results. New risks emerge from time to time. It

is not possible for our management to predict all risks, nor can we

assess the impact of all factors on our business or the extent to

which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements we may make. Further information on

these and additional risks that could affect Wish’s results is

included in its filings with the Securities and Exchange Commission

(“SEC”), including its most recent Annual Report on Form 10-K and

Quarterly Report on Form 10-Q, and future reports that Wish may

file with the SEC from time to time, which could cause actual

results to vary from expectations. Any forward-looking statement

made by Wish in this news release speaks only as of the day on

which Wish makes it. Wish assumes no obligation to, and does not

currently intend to, update any such forward-looking statements

after the date of this release.

The unaudited financial results in this news

release are estimates based on information currently available to

Wish. While Wish believes these estimates are meaningful, they

could differ from the actual amounts that the company ultimately

reports in its Annual Report on Form 10-K for the fiscal year ended

December 31, 2023. Wish assumes no obligation and does not intend

to update these estimates prior to filing its Annual Report on Form

10-K for the fiscal year ended December 31, 2023.

The preliminary unaudited information relating

to our financial results for the month ended January 31, 2024

reflects Wish’s preliminary estimates with respect to such results

based on currently available information, is not a comprehensive

statement of Wish’s financial results and is subject to completion

of Wish’s financial closing procedures. Wish’s actual results may

differ materially from these estimates. These estimates should not

be viewed as a substitute for our full interim or annual financial

statements prepared in accordance with U.S. generally accepted

accounting principles, or GAAP. Further, Wish’s preliminary

estimated results are not necessarily indicative of the results to

be expected for the remainder of the first quarter of 2024, the

full year 2024, or any future period as a result of various

factors.

A Note About Metrics

The numbers for some of our metrics, including

MAUs and LTM Active Buyers, are calculated and tracked with

internal tools, which are not independently verified by any third

party. We use these metrics to assess the growth and health of our

overall business. While these numbers are based on what we believe

to be reasonable estimates of our user or merchant base for the

applicable period of measurement, there are inherent challenges in

measurement as the methodologies used require significant judgment

and may be susceptible to algorithm or other technical errors. In

addition, we regularly review and adjust our processes for

calculating metrics to improve their accuracy, and our estimates

may change due to improvements or changes in technology or our

methodology.

ContextLogic

Inc.Consolidated Balance

Sheets(in

millions)(unaudited)

|

|

|

As of December 31, |

|

|

As of December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

238 |

|

|

$ |

506 |

|

|

Marketable securities |

|

|

144 |

|

|

|

213 |

|

|

Funds receivable |

|

|

7 |

|

|

|

14 |

|

|

Prepaid expenses and other current assets |

|

|

21 |

|

|

|

44 |

|

|

Total current assets |

|

|

410 |

|

|

|

777 |

|

| Property

and equipment, net |

|

|

4 |

|

|

|

9 |

|

|

Right-of-use assets |

|

|

5 |

|

|

|

9 |

|

| Other

assets |

|

|

4 |

|

|

|

4 |

|

| Total

assets |

|

$ |

423 |

|

|

$ |

799 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

30 |

|

|

$ |

53 |

|

|

Merchants payable |

|

|

74 |

|

|

|

120 |

|

|

Refunds liability |

|

|

2 |

|

|

|

6 |

|

|

Accrued liabilities |

|

|

90 |

|

|

|

130 |

|

|

Total current liabilities |

|

|

196 |

|

|

|

309 |

|

| Lease

liabilities, non-current |

|

|

6 |

|

|

|

13 |

|

| Other

liabilities, non-current |

|

|

4 |

|

|

|

— |

|

| Total

liabilities |

|

|

206 |

|

|

|

322 |

|

|

Stockholders’ equity |

|

|

217 |

|

|

|

477 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

423 |

|

|

$ |

799 |

|

| |

|

|

|

|

|

|

ContextLogic

Inc.Consolidated Statements of

Operations(in millions, except per share

data)(unaudited)

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

$ |

53 |

|

|

$ |

123 |

|

|

$ |

287 |

|

|

$ |

571 |

|

| Cost of

revenue(1) |

|

44 |

|

|

|

97 |

|

|

|

228 |

|

|

|

405 |

|

|

Gross profit |

|

9 |

|

|

|

26 |

|

|

|

59 |

|

|

|

166 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing(1) |

|

32 |

|

|

|

73 |

|

|

|

143 |

|

|

|

254 |

|

|

Product development(1) |

|

25 |

|

|

|

40 |

|

|

|

152 |

|

|

|

194 |

|

|

General and administrative(1) |

|

24 |

|

|

|

30 |

|

|

|

92 |

|

|

|

116 |

|

|

Total operating expenses |

|

81 |

|

|

|

143 |

|

|

|

387 |

|

|

|

564 |

|

| Loss

from operations |

|

(72 |

) |

|

|

(117 |

) |

|

|

(328 |

) |

|

|

(398 |

) |

| Other

income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

3 |

|

|

|

5 |

|

|

|

16 |

|

|

|

15 |

|

| Loss

before provision for income taxes |

|

(69 |

) |

|

|

(112 |

) |

|

|

(312 |

) |

|

|

(383 |

) |

|

Provision for income taxes |

|

(1 |

) |

|

|

(2 |

) |

|

|

5 |

|

|

|

1 |

|

| Net

loss |

|

(68 |

) |

|

|

(110 |

) |

|

|

(317 |

) |

|

|

(384 |

) |

| Net loss

per share, basic and diluted |

$ |

(2.82 |

) |

|

$ |

(4.80 |

) |

|

$ |

(13.36 |

) |

|

$ |

(17.13 |

) |

| Weighted-average shares used

in computing net loss per share, basic and diluted |

|

24,119 |

|

|

|

22,933 |

|

|

|

23,732 |

|

|

|

22,415 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) Includes the following stock-based compensation expense:

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Cost of revenue |

|

$ |

- |

|

|

$ |

3 |

|

|

$ |

3 |

|

|

$ |

7 |

|

| Sales

and marketing |

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

6 |

|

| Product

development |

|

|

5 |

|

|

|

9 |

|

|

|

36 |

|

|

|

50 |

|

| General

and administrative |

|

|

4 |

|

|

|

6 |

|

|

|

21 |

|

|

|

9 |

|

|

Total stock-based compensation |

|

$ |

10 |

|

|

$ |

19 |

|

|

$ |

64 |

|

|

$ |

72 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

ContextLogic

Inc.Consolidated Statements of Cash

Flows(in

millions)(unaudited)

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(68 |

) |

|

$ |

(110 |

) |

|

$ |

(317 |

) |

|

$ |

(384 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Noncash inventory write downs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

Depreciation and amortization |

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

6 |

|

|

Noncash lease expense |

|

— |

|

|

|

1 |

|

|

|

3 |

|

|

|

6 |

|

|

Impairment of lease assets and property and equipment |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

11 |

|

|

Stock-based compensation expense |

|

10 |

|

|

|

19 |

|

|

|

64 |

|

|

|

72 |

|

|

Net (accretion) amortization of discounts and premiums on

marketable securities |

|

(1 |

) |

|

|

— |

|

|

|

(7 |

) |

|

|

— |

|

|

Other |

|

— |

|

|

|

3 |

|

|

|

1 |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Funds receivable |

|

(2 |

) |

|

|

(1 |

) |

|

|

6 |

|

|

|

3 |

|

|

Prepaid expenses, other current and noncurrent assets |

|

— |

|

|

|

(3 |

) |

|

|

16 |

|

|

|

(1 |

) |

|

Accounts payable |

|

(5 |

) |

|

|

(3 |

) |

|

|

(22 |

) |

|

|

(13 |

) |

|

Merchants payable |

|

(3 |

) |

|

|

(1 |

) |

|

|

(46 |

) |

|

|

(65 |

) |

|

Accrued and refund liabilities |

|

(6 |

) |

|

|

(13 |

) |

|

|

(38 |

) |

|

|

(49 |

) |

|

Lease liabilities |

|

(2 |

) |

|

|

(2 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

|

Other current and noncurrent liabilities |

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

(3 |

) |

| Net cash used in operating

activities |

|

(75 |

) |

|

|

(109 |

) |

|

|

(341 |

) |

|

|

(422 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment and development of internal-use

software |

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

(2 |

) |

|

Purchases of marketable securities |

|

(74 |

) |

|

|

(65 |

) |

|

|

(313 |

) |

|

|

(368 |

) |

|

Maturities of marketable securities |

|

73 |

|

|

|

103 |

|

|

|

390 |

|

|

|

321 |

|

|

Other |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Net cash provided by (used) in

investing activities |

|

(1 |

) |

|

|

38 |

|

|

|

74 |

|

|

|

(47 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock through employee equity

incentive plans |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

Payments of taxes related to RSU settlement and cashless exercise

of stock options |

|

— |

|

|

|

(13 |

) |

|

|

(5 |

) |

|

|

(23 |

) |

| Net cash used in financing

activities |

|

— |

|

|

|

(13 |

) |

|

|

(5 |

) |

|

|

(22 |

) |

| Foreign currency effects on

cash, cash equivalents and restricted cash |

|

4 |

|

|

|

3 |

|

|

|

(3 |

) |

|

|

(14 |

) |

| Net decrease in cash, cash

equivalents and restricted cash |

|

(72 |

) |

|

|

(81 |

) |

|

|

(275 |

) |

|

|

(505 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

310 |

|

|

|

594 |

|

|

|

513 |

|

|

|

1,018 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

238 |

|

|

$ |

513 |

|

|

$ |

238 |

|

|

$ |

513 |

|

| Reconciliation of

cash, cash equivalents, and restricted cash to the consolidated

balance sheets: |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

238 |

|

|

$ |

506 |

|

|

$ |

238 |

|

|

$ |

506 |

|

| Restricted cash included in

prepaid and other current assets in the consolidated balance

sheets |

|

— |

|

|

|

7 |

|

|

|

— |

|

|

|

7 |

|

| Total cash, cash equivalents

and restricted cash |

$ |

238 |

|

|

$ |

513 |

|

|

$ |

238 |

|

|

$ |

513 |

|

| Supplemental cash flow

disclosures: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net of refunds |

$ |

— |

|

|

$ |

— |

|

|

$ |

1 |

|

|

$ |

6 |

|

ContextLogic

Inc.Reconciliation of GAAP Net Loss to Non-GAAP

Adjusted EBITDA(in millions, except

percentages)(unaudited)

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

53 |

|

|

$ |

123 |

|

|

$ |

287 |

|

|

$ |

571 |

|

| Net

loss |

|

|

(68 |

) |

|

|

(110 |

) |

|

|

(317 |

) |

|

|

(384 |

) |

| Net loss

as a percentage of revenue |

|

|

(128 |

)% |

|

|

(89 |

)% |

|

|

(110 |

)% |

|

|

(67 |

)% |

|

Excluding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

|

(3 |

) |

|

|

(5 |

) |

|

|

(16 |

) |

|

|

(15 |

) |

|

Provision for income taxes |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

5 |

|

|

|

1 |

|

|

Depreciation and amortization |

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

6 |

|

|

Stock-based compensation expense and related employer payroll

taxes(1)(2) |

|

|

14 |

|

|

|

19 |

|

|

|

68 |

|

|

|

74 |

|

|

Restructuring and other discrete items(3) |

|

|

— |

|

|

|

— |

|

|

|

13 |

|

|

|

29 |

|

|

Impairment of lease assets and property and equipment(4) |

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

Strategic alternatives expenses(5) |

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

|

— |

|

|

Recurring other items |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

1 |

|

|

Adjusted EBITDA |

|

|

(54 |

) |

|

|

(95 |

) |

|

|

(236 |

) |

|

|

(288 |

) |

|

Adjusted EBITDA margin |

|

|

(102 |

)% |

|

|

(77 |

)% |

|

|

(82 |

)% |

|

|

(50 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Total amount

for the year ended December 31, 2023 consisted of $64 million of

stock-based compensation expense and $4 million of related employer

payroll taxes. Total amount for the year ended December 31, 2022

consisted of $72 million of stock-based compensation expense and $2

million of related employer payroll taxes. |

| (2) |

Total stock-based compensation related employer payroll taxes

for the year ended December 31, 2023 increased by $2 million

compared to the year ended December 31, 2022 primarily due to a

catchup payroll tax adjustment related to employees that resided in

Nevada during 2021. |

| (3) |

Total amount for the year ended December 31, 2023 consisted of

approximately $13 million of employee severance and other personnel

reduction costs. Total amount for the year ended December 31, 2022

included a $15 million one-time discretionary cash bonus paid to

select employees to cover their respective tax obligations

triggered by the settlement of their RSUs that vested upon the

Company’s initial public offering ("IPO") as well as restructuring

charges consisting of $3 million of severance and other personnel

reduction costs and $11 million in impairment of lease assets and

property and equipment. |

| (4) |

Impairment of lease assets and property and equipment unrelated

to restructuring activities. |

| (5) |

Our Board has initiated a process to explore a range of

strategic alternatives to maximize value for our stockholders as

disclosed in our 8-K filed with the SEC on November 7, 2023. These

are the third-party expenses incurred in the relevant period

related to the evaluation of strategic alternatives. |

ContextLogic

Inc.Reconciliation of GAAP Net Cash Used in

Operating Activities to Non-GAAP Free Cash Flow(in

millions)(unaudited)

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

December 31 |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net cash used operating activities |

|

$ |

(75 |

) |

|

$ |

(109 |

) |

|

$ |

(341 |

) |

|

$ |

(422 |

) |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment and development of internal-use

software |

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

2 |

|

|

Free Cash Flow |

|

$ |

(75 |

) |

|

$ |

(109 |

) |

|

$ |

(344 |

) |

|

$ |

(424 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Contacts

Investor Relations:Ralph Fong,

Wishir@wish.com

Media contacts:Carys Comerford-Green,

Wishpress@wish.com

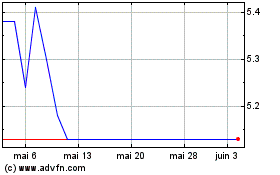

ContextLogic (NASDAQ:WISH)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ContextLogic (NASDAQ:WISH)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025