Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 Octobre 2023 - 3:30PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2023

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

3Q23

Earnings Call October 31 st , 2023

This presentation

was prepared by Ambev S A ..(“ or “ for the exclusive use in the earnings conference call of the third quarter of 2023 3

Q 23 This presentation should not be considered as a complete document and should be analyzed together with the Company’s quarterly

information form ( for the third quarter and the respective press release, both available on the U S Securities and Exchange Commission

SEC and the CVM website This presentation was prepared for informational purposes only and should not be considered as a solicitation

or offer to buy or sell any securities of the Company, or as advice or recommendation of any nature This presentation is not intended

to be comprehensive, or to contain all the information that Ambev’s shareholders might need No decisions on investment, disposal

or any other financial decisions or actions shall be made solely on the basis of the information contained herein This presentation segregates

the impact of organic changes from those arising from changes in scope or currency translation Scope changes represent the impact of

acquisitions and divestitures, the start up or termination of activities or the transfer of activities between segments, curtailment

gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of

the underlying performance of the business Organic growth and normalized numbers are presented applying constant year over year exchange

rates to exclude the impact of the movement of foreign exchange rates Unless stated, percentage changes in this press release are both

organic and normalized in nature Whenever used in this document, the term “ refers to performance measures EBITDA and Operating

Profit before exceptional items and share of results of joint ventures and to performance measures Profit and EPS before exceptional

items adjustments Exceptional items are either income or expenses which do not occur regularly as part of the normal activities of the

Company They are presented separately because they are important for the understanding of the underlying sustainable performance of the

Company due to their size or nature Normalized measures are additional measures used by management and should not replace the measures

determined in accordance with IFRS as indicators of the Company’s performance Comparisons, unless otherwise stated, refer to the

third quarter of 2022 3 Q 22 Values in this release may not add up due to rounding

2Q23 Recap

Continued focus on operational leverage in H2 Short term points of attention: Brazil industry evolution & Argentina operating environment

1 2

Continued

focus on operational leverage in H2 Short term points of attention: Brazil industry evolution & Argentina operating environment

3Q23 Highlights

3Q23 (org vs 9M23 (org vs +19% +44% +210 bps +560 bps Cash Flow from Operating Activities +R$1.8b (nominal) +31% ex-ARG Norm. EBITDA

Net Revenue Gross Margin EBITDA Margin +22% +40% +230 bps +400 bps +R$1.9b (nominal)

Beer Premium

and super premium volume + low teens vs LY Value volume - 40’s% Premium and super premium market share

Beer Volume

NR/hl EBITDA - 1.1% +6.8% +34.7% EBITDA Mg% +720 bps

NAB Volume

NR/hl EBITDA +2.8% +2.3% +0.9% EBITDA Mg% - 100 bps

Volume

NR/hl EBITDA +13.6% +7.6% +62.3% EBITDA Mg% +940 bps vs LY (org) CAC

Volume

NR/hl EBITDA - 9.4% +91.4% +93.9% EBITDA Mg% +360 bps vs LY (org) LAS

Volume

NR/hl EBITDA EBITDA Mg% vs LY (org) - 13.1% +6.7% +3.5% CANADA +310 bps

Annualized

GMV +30% vs LY BEES customer on marketplace +80% SKU / POC +21% vs LY Awareness +25% vs LY MAU 4.7 M GMV +8% vs LY

Historic

Net Revenue organic growth 28% 36% 21% 16% 19% 20% 19% 22% 26% 20% 19% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 24% 24%

9% -2% 10% 18% 11% 27% 40% 34% 44% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Historic EBITDA organic growth

Historic

EBITDA Margin organic growth -110 bps -260 bps -310 bps -570 bps -220 bps -40 bps -210 bps 160 bps 310 bps 300 bps 560 bps 1Q21 2Q21

3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23

Normalized

Profit Normalized Profit 3Q22 1.0 Normalized EBITDA - 0.1 D&A 0.4 Financial Results - 0.5 Income Taxes 0.0 Others Normalized Profit

3Q23 3.2 4.0 +25.1% R$ billions

Cash Flow

from Operating Activities 3Q22 1.0 Before change in Working Capital 0.5 Change Working Capital Cash Generated from Operations 0.3 Income

Tax and Social Cont. 0.0 Others 3Q23 6.1 7.6 7.9 +30% R$ billions

Q&A

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 31, 2023

| |

|

|

| |

AMBEV S.A. |

| |

|

|

| |

By: |

/s/ Lucas Machado Lira |

| |

Lucas Machado Lira

Chief Financial and Investor Relations Officer |

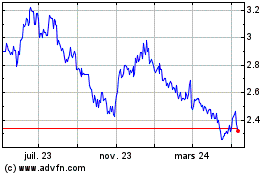

Ambev (NYSE:ABEV)

Graphique Historique de l'Action

De Mar 2024 à Mai 2024

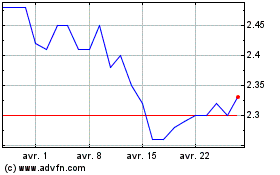

Ambev (NYSE:ABEV)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024