Capital Returns’ Claims Do Not Reflect the

Reality of Argo’s Actions

Urges Shareholders to Continue to Support

Argo’s Positive Momentum by Voting “FOR” All Argo’s Highly

Qualified Director Nominees on the BLUE Proxy Card Today

Argo Group International Holdings, Ltd. (NYSE: ARGO) (“Argo” or

“the Company”) today announced that it is mailing a letter to

shareholders in connection with its 2022 Annual Meeting of

Shareholders urging all Argo shareholders to vote the BLUE proxy

card “FOR” ALL seven of Argo’s highly qualified director nominees.

The Annual Meeting will be held on December 15, 2022, and

shareholders of record as of October 26, 2022 are entitled to vote

at the meeting.

The full text of the letter follows and can be found at the

investor relations section of the Company’s website.

November 29, 2022

Dear Fellow Shareholders,

As we approach our 2022 Annual Meeting of Shareholders on

December 15, 2022, you face an important and time sensitive

decision regarding your investment in Argo.

Your Board of Directors has undertaken actions to successfully

transform Argo into a leading U.S. specialty insurer, and as a

result of these actions:

- Our stock has outperformed our insurance peers since we

announced the sale of our Lloyd’s Syndicate 1200 in September 2022,

which we believe indicates the stability of our reshaped business

and confidence in our improved operating model.

- We have progressed into the later stages of our ongoing

strategic review process to evaluate a range of alternatives,

including a potential sale of the whole Company.

- The Board remains open to considering any and all credible

proposals to maximize shareholder value, and Argo’s financial

advisor has conducted exhaustive outreach to more than 80

parties.

- The Board has ensured shareholder alignment in the boardroom

with our appointment of J. Daniel Plants, Chief Investment Officer

of Voce Capital Management LLC, Argo’s largest shareholder with

approximately 9.5% of the Company’s shares, to the Board and as

Chair of the Strategic Review Committee.

Despite these actions, one of our shareholders, Capital Returns

Master, Ltd., has initiated a proxy contest to replace two of

Argo’s directors – Bernard Bailey and Al-Noor Ramji – with its own

candidates, Ronald Bobman and David Michelson. Over the past year

of interactions between Argo and Capital Returns, Capital Returns

has only proposed that Argo commence a strategic review process and

appoint its nominees to the Board. As Argo shareholders are well

aware, the Board is already undertaking a strategic review, and we

are continuing to explore other value maximizing alternatives,

including a sale of the whole Company.

Your Board and management team have engaged with Capital Returns

multiple times, including in meetings with the Board Chairman. In

addition, the Board’s Nominating and Corporate Governance Committee

has formally interviewed both of Capital Returns’ candidates and

unanimously determined that neither Bobman nor Michelson would be

additive to your Board’s collective skillset, and worse, if either

one of them were to be exchanged for an existing director, that

outcome would diminish the level of expertise and diversity on your

Board and could delay or hinder the strategic review just as it

enters its most critical phase.

- Mr. Bobman has no public company board

experience, and any insurance background he may possess is

already well represented on the Board. In stark contrast to Argo’s

current directors, it is evident from Mr. Bobman’s claims that he

lacks a fundamental understanding of the fiduciary duties that a

board has to all its shareholders. In addition, Argo’s recent

appointment of Mr. Plants, Chief Investment Officer of Voce

Capital, Argo’s largest active shareholder, ensures shareholder

views are well represented in the boardroom.

- Mr. Michelson serves as an advisor or director of at least six

other companies. One of these companies,

FedNat Insurance, has suffered a ~98% stock price decline, been

delisted from Nasdaq and defaulted on senior notes during Mr.

Michelson’s tenure as a director. Given Mr. Michelson’s

demanding ongoing commitments and his dismal track record at

FedNat, the Board is rightfully skeptical of Mr. Michelson’s

ability to dedicate the necessary time to the Argo Board.

Our Board is highly engaged, having met more than 60 times in

2022 and more than 30 times since publicly announcing our strategic

review process, and is laser-focused on ensuring the Company is on

the right path to maximizing value for shareholders. We believe

this is contrary to Mr. Bobman’s actions. It is our strong view

that the ongoing strategic review process is best overseen by the

current Argo Board of Directors and its Strategic Review Committee,

not Capital Returns’ nominees.

We encourage you to protect the value of your investment by

voting “FOR” Argo’s nominees on the BLUE proxy card prior to the deadline of 9:00

a.m. local Bermuda time (8:00 a.m. Eastern Time) on December 13,

2022.

SETTING THE RECORD STRAIGHT

The Board and management team have met with Mr. Bobman several

times to discuss his views. Despite repeated invitations, Mr.

Bobman has failed to offer any tangible recommendation or

suggestion for creating shareholder value beyond launching a

strategic alternatives process – which the Board already publicly

announced and is now in the latter stages of conducting.

We want to ensure you have the correct facts before you make

important decisions about the future of your investment in Argo.

Below are just a few examples of Mr. Bobman’s naïve, and in many

cases factually false, claims that do not reflect the reality of

Argo’s actions.

Claim

REALITY

Errors in judgment

- Citing Mr. Bradley’s appointment as CEO as an example of a lack

of succession planning is misleading given the Board had that

succession plan in place long before its prior CEO Kevin Rehnberg

departed Argo for health reasons.

- Argo is fortunate to have a CEO and Chair as experienced as Mr.

Bradley step into this role and lead the Board during the ongoing

strategic review process. Previously, Mr. Bradley served as Chief

Financial Officer and Vice President of Allied World Assurance

Company Holdings, including at the time of its sale to Fairfax

Financial Holdings Ltd. He was also formerly Executive Vice

President & Chief Financial Officer at Fair Isaac Corporation

and at the St. Paul Companies and held senior operating roles at

Zurich Insurance Group. Mr. Bradley’s deep financial acumen and

understanding of the insurance industry, as well as his highly

relevant operational experience having held executive positions at

a number of public companies, have provided him with keen strategic

insight to manage a leading U.S. specialty underwriter. His

knowledge and leadership have been critical in steadying the

organization and executing its transformation.

- Furthermore, if Mr. Bobman was so adamant about the Board

pursuing a strategic review, would he have preferred that the Board

pause its ongoing review process to run an executive search rather

than proceed with Mr. Bradley as CEO? How would the Board have

successfully recruited a credible external CEO candidate amidst an

ongoing review process?

- Additionally, if Mr. Bobman is so concerned with Mr. Bradley

not having previously served as a public company CEO, shareholders

might equally wonder if they should be concerned with Mr. Bobman’s

lack of experience on ANY public company board.

Delay in acceding to Capital Returns’

logic

- The hubris of Capital Returns’ statements claiming to have

motivated Argo’s announcement of its strategic review demonstrate

the level of detachment from reality that the Nominating and

Corporate Governance Committee experienced when interviewing

Capital Returns’ nominees.

- For example, Capital Returns professed in its calls for a

strategic review that it was aware of bidders willing to pay $70 -

$80 per share.1 Argo welcomed then, as it does now, any such

bidders. Unfortunately, Mr. Bobman couldn’t procure any $70 - $80

per share bidder then, and now is hardly the time to disrupt the

review process by adding misinformed individuals so detached from

reality to the Board.

- While Capital Returns would like to portray Argo as shunning

its “help,” the reality is that Mr. Bobman, after repeated

interaction with management and directors, demonstrated that he

could offer no real insight or assistance either in the form of

original ideas or concrete actions.

- Capital Returns’ claim that the Board dallied rather than

immediately accede to its public demand for a sale process ignores

the fact that the Board was engaged in dialogue with several

long-term shareholders during this period (including, but not

limited to, Voce Capital) before taking the significant step of

publicly announcing the strategic review in April 2022.

Piecemeal asset sales

- What Capital Returns would attempt to portray as “piecemeal”

asset sales is actually a direct result of a thorough and probing

review process where Argo listened carefully to bidders and its

advisors; the result of those transactions allowed Argo to restart

a more robust strategic review process in September, which is

ongoing.

- After our initial outreach to bidders in April and May, we

received feedback that we would need to further advance the

simplification of Argo’s portfolio and exit international business

lines in order for suitors to seriously consider a potential

strategic transaction or acquisition of the whole Company.

- Argo took action to respond to this feedback throughout the

ongoing strategic review process, entering into the LPT with Enstar

and entering into a definitive agreement for the sale of Argo

Underwriting Agency Limited and its Lloyd’s Syndicate 1200 to

Westfield. And, these strategic transactions follow the significant

divestitures Argo has made over the last two years to exit

international businesses, including businesses in Italy, Brazil,

Malta and most recently the United Kingdom, to focus on its most

attractive business lines. Now, Argo is better positioned to

entertain bids for the remaining U.S. specialty insurance

business.

- Your Board also finds it characteristically inconsistent of Mr.

Bobman to claim credit for the idea of asset divestitures,

including the pending sale of Syndicate 1200, and then to criticize

the Board for executing the same “piecemeal” sales for which he

advocated.

Delayed the annual meeting

- Argo’s Board is highly engaged, having met more than 60 times

in 2022 and more than 30 times since publicly announcing our

strategic review process, and is laser-focused on ensuring the

Company is on the right path to maximizing value for

shareholders.

- Argo’s management team has devoted a very significant portion

of their time to the strategic review process.

- We delayed our Annual Meeting in order to focus on the very

issue which Mr. Bobman wanted the Board and management team to

address – a strategic review.

- Mr. Bobman’s problem is not with the delay. His problem is with

the Board’s assessment that he and Mr. Michelson are unfit to be on

the Board – in temperament, judgment and relevant experience.

Mr. Bailey had never purchased any Argo

shares in the open market

- Despite Capital Returns’ false claims, SEC filings show that

Mr. Bailey invested almost $100,000 of his own capital in open

market purchases at the time he joined the Board.

- As reported in its own filings, Capital Returns has been

regularly selling blocks of Argo stock since April 2022. In fact,

during the period from Argo’s strategic process update on September

8, 2022 to October 31, 2022, Capital Returns reduced its position

in Argo by almost 95,000 shares, which equated to a 24% reduction

in its Argo holdings during such period.

- Unlike Capital Returns, Mr. Bailey has never sold a single Argo

share.

- Capital Returns’ ongoing sales of Argo shares lead the Board to

seriously question whether Capital Returns is a long-term investor

and if its nominees have the best interests of Argo’s shareholders

in mind.

Questionable nominee skillsets

- Mr. Bailey and Mr. Ramji bring expertise important to the

Company’s business, including significant operational M&A

experience, and they have been instrumental in overseeing the

execution of the Company’s transformation.

- Mr. Bailey, the Board’s Lead Independent Director, brings

extensive prior public board and CEO experience; he is a recognized

national expert in corporate governance and an integral member of

the Strategic Review Committee.

- Mr. Bailey has served as a director at nine public companies,

and of the nine, four of them were ultimately acquired while Mr.

Bailey was a serving director.

- Contrary to Capital Returns’ claim that Mr. Bailey was a

director at Point Blank Solutions at the time it filed for

bankruptcy, Mr. Bailey resigned from the board due to concerns over

the governance of the company a year prior to the bankruptcy

filing.2

- Mr. Ramji, as the Chair of the Risk and Capital Committee, has

played a critical role in the reduction of the Company’s

catastrophe risk exposures and overall reduction of volatility

through lowering of its probable maximum losses (PMLs).

- Mr. Ramji has also served on the management teams and boards of

both public companies and private equity-backed investments,

overseeing multiple sale processes, including at Prudential plc,

Northgate Capital, Calypso Technology, Virtusa, MISYS plc and

iSoftStone Information Service Corporation.

ACT TODAY—VOTE THE BLUE PROXY CARD TODAY TO ENSURE SHAREHOLDERS

RECEIVE MAXIMUM VALUE FOR THEIR INVESTMENT

We urge you not to be distracted by Capital Returns’

self-serving agenda and steady drumbeat of naïve or false claims

made in an attempt to disrupt the positive momentum your Board and

management team have developed, particularly with respect to our

strategic review process.

This is a critical moment in Argo’s history. It is imperative

that we continue the process we have underway to maximize value for

shareholders.

We encourage you to vote the BLUE proxy card “FOR” ALL of Argo’s

seven highly qualified director nominees at the upcoming 2022

Annual Meeting. Your Board does NOT endorse either of

Capital Returns’ nominees and strongly urges you to disregard

any white proxy card you receive from Capital Returns.

Thank you for your continued support.

Sincerely,

The Board of Directors of Argo Group

YOUR VOTE IS EXTREMELY

IMPORTANT—NO MATTER HOW MANY SHARES YOU OWN!

Please submit your

BLUE proxy card prior to the deadline

of 9:00 a.m. local Bermuda time (8:00 a.m. Eastern Time) on

December 13, 2022.

If you have any questions, or

need assistance in voting

your shares on the

BLUE proxy card,

please call our proxy

solicitor:

INNISFREE M&A

INCORPORATED

Shareholders in the U.S. and

Canada Call Toll-Free at +1 (877) 750-9496

Banks and Brokers Call Collect

at +1 (212) 750-5833

ABOUT ARGO GROUP INTERNATIONAL HOLDINGS, LTD.

Argo Group International Holdings, Ltd. (NYSE: ARGO) is an

underwriter of specialty insurance products in the property and

casualty market. Argo offers a full line of products and services

designed to meet the unique coverage and claims-handling needs of

businesses in two primary segments: U.S. Operations and

International Operations. Argo Group and its insurance subsidiaries

are rated ‛A-’ by Standard & Poor’s. Argo’s insurance

subsidiaries are rated ‛A-’ by A.M. Best. More information on Argo

and its subsidiaries is available at argogroup.com.

FORWARD-LOOKING STATEMENTS

This press release and any related oral statements may include

forward-looking statements that reflect our current views with

respect to future events and financial and operational performance.

Forward-looking statements include all statements that do not

relate solely to historical or current facts, and can be identified

by the use of words such as “positioning,” “expect,” “intend,”

“plan,” “believe,” “do not believe,” “aim,” “project,”

“anticipate,” “confident,” “seek,” “will,” “likely,” “assume,”

“estimate,” “may,” “continue,” “create,” “maximize,” “guidance,”

“objective,” “outcome,” remain optimistic,” “outlook,” “trends,”

“future,” “could,” “would,” “should,” “target,” “on track,”

“simplifies” and similar expressions of a future or forward-looking

nature. Such statements are subject to certain risks and

uncertainties that could cause actual events or results to differ

materially. For a more detailed discussion of such risks and

uncertainties, see Item 1A, “Risk Factors” in Argo’s Annual Report

on Form 10-K and Form 10-K/A for the fiscal year ended December 31,

2021, as supplemented in Argo’s subsequent Quarterly Reports on

Form 10-Q, and in other filings with the U.S. Securities and

Exchange Commission. The inclusion of a forward-looking statement

herein should not be regarded as a representation by Argo that

Argo’s objectives will be achieved. Argo undertakes no obligation

to publicly update forward-looking statements, whether as a result

of new information, future events or otherwise. You should not

place undue reliance on any such statements. Each of the

transactions referenced in this press release is subject to risks

and uncertainties, including, but not limited to, that the

transactions may be unable to be completed because of the failure

to obtain required regulatory approvals or satisfy (or obtain

waivers of) the closing conditions and uncertainty as to the timing

of completion of the transactions.

_________

1 Per Capital Returns’ letter to Argo’s Board of Directors on

September 13, 2021. 2 Point Blank Solutions Form 8-K/A filing on

June 15, 2009.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221128005908/en/

Investors: Andrew Hersom Head of Investor Relations

860-970-5845 andrew.hersom@argogroupus.com

Gregory Charpentier AVP, Investor Relations and Corporate

Finance 978-387-4150 gregory.charpentier@argogroupus.com

Media: David Snowden Senior Vice President, Group

Communications 210-321-2104 david.snowden@argogroupus.com

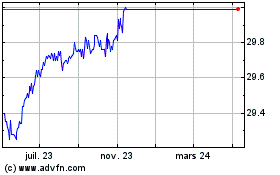

Argo (NYSE:ARGO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

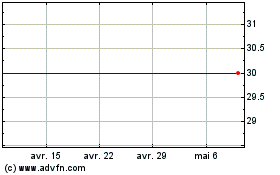

Argo (NYSE:ARGO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025