ARMOUR Residential REIT, Inc. Announces One-for-Five Reverse Stock Split, Continued Dividend Rate per Common Share for September 2023 and Stable Q4 Dividend Guidance

29 Août 2023 - 10:15PM

ARMOUR Residential REIT, Inc. (NYSE: ARR and ARR-PRC) (“ARMOUR” or

the “Company”) today announced that its Board of Directors has

approved a reverse stock split of ARMOUR's outstanding shares of

common stock at a ratio of one-for-five and the September 2023

dividend for the Company's Common Stock. The Company today also

announced guidance on common stock dividends for the fourth quarter

of 2023.

One-for-Five Reverse Stock

Split

The reverse stock split is scheduled to take

effect at about 5:00 p.m. Eastern Time on September 29, 2023 (the

"Effective Time"). At the Effective Time, every five issued and

outstanding shares of common stock of the Company will be converted

into one share of common stock of the Company. In addition, at the

Effective Time, the number of authorized shares of common stock

will also be reduced on a one-for-five basis. The par value of each

share of common stock will remain unchanged. Trading in ARMOUR's

common stock on a split adjusted basis is expected to begin at the

market open on October 2, 2023. ARMOUR's common stock will continue

trading on the NYSE under the symbol "ARR" but will be assigned a

new CUSIP number. The Company believes that existing stockholders

will benefit from the ability to attract a broader range of

investors as a result of the reverse stock split and a higher per

share stock price.

As a result of the reverse stock split, the

number of outstanding shares of ARMOUR's common stock as of August

29, 2023, will be reduced from approximately 237,356,720 to

approximately 47,471,344. As discussed further below, the monthly

common dividend rate is expected to remain stable at an adjusted

rate of $0.40 per share. Concurrently, the authorized number of

shares of common stock will be reduced from 450,000,000 to

90,000,000. The number of shares of ARMOUR’s Series C Preferred

Stock outstanding, their preference amount and dividend rate are

not affected by this reverse stock split.

No fractional shares will be issued in

connection with the reverse stock split. Instead, each stockholder

holding fractional shares will be entitled to receive, in lieu of

such fractional shares, cash in an amount determined on the basis

of the average closing price of ARMOUR's common stock on the NYSE

for the three consecutive trading days ending on September 29,

2023. The reverse stock split will apply to all of ARMOUR's

authorized and outstanding shares of common stock as of the

Effective Time. Stockholders of record will be receiving

information from Continental Stock Transfer & Trust Company,

ARMOUR's transfer agent, regarding their stock ownership following

the reverse stock split and cash in lieu of fractional share

payments, if applicable. Stockholders who hold their shares in

brokerage accounts or "street name" are not required to take any

action in connection with the reverse stock split.

September 2023 Common

Stock Dividend Information

The table below contains the information on the

Company’s common stock dividend for September 2023, which continues

the current dividend rate before the reverse stock split becomes

effective.

|

Month |

|

Dividend |

|

Holder of Record Date |

|

Payment Date |

|

September 2023 |

|

$0.08 |

|

September 15, 2023 |

|

September 28, 2023 |

| |

|

|

|

|

|

|

Q4 2023 Common Stock Dividend

Guidance

The table below contains the Company's guidance

on common stock dividends currently expected following the reverse

stock split.

|

Month |

|

Dividend |

|

Holder of Record Date |

|

Payment Date |

|

October 2023 |

|

$0.40 |

|

October 16, 2023 |

|

October 30, 2023 |

|

November 2023 |

|

$0.40 |

|

November 15, 2023 |

|

November 29, 2023 |

|

December 2023 |

|

$0.40 |

|

December 15, 2023 |

|

December 28, 2023 |

|

|

|

|

|

|

|

|

Certain Tax Matters

ARMOUR has elected to be taxed as a real estate

investment trust (“REIT”) for U.S. Federal income tax purposes. In

order to maintain this tax status, ARMOUR is required to timely

distribute substantially all of its ordinary REIT taxable income.

Dividends paid in excess of current tax earnings and profits for

the year will generally not be taxable to common stockholders.

Actual dividends are determined at the discretion of the Company’s

board of directors, which may consider additional factors including

the Company’s results of operations, cash flows, financial

condition and capital requirements as well as current market

conditions, expected opportunities and other relevant factors.

About ARMOUR Residential REIT,

Inc.

ARMOUR invests primarily in fixed rate

residential, adjustable rate and hybrid adjustable rate residential

mortgage-backed securities issued or guaranteed by U.S.

Government-sponsored enterprises or guaranteed by the Government

National Mortgage Association. ARMOUR is externally managed and

advised by ARMOUR Capital Management LP, an investment advisor

registered with the Securities and Exchange Commission (“SEC”).

Safe Harbor

This press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Actual results may differ from expectations, estimates and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results. The Company disclaims

any obligation to release publicly any updates or revisions to any

forward-looking statement to reflect any change in its expectations

or any change in events, conditions or circumstances on which any

such statement is based, except as required by law.

Additional Information and Where to Find

It

Investors, security holders and other interested

persons may find additional information regarding the Company at

the SEC’s internet site at www.sec.gov, or the Company website at

www.armourreit.com, or by directing requests to: ARMOUR Residential

REIT, Inc., 3001 Ocean Drive, Suite 201, Vero Beach, Florida 32963,

Attention: Investor Relations.

Investor Contact:

James R. MountainChief Financial OfficerARMOUR

Residential REIT, Inc.(772) 617-4340

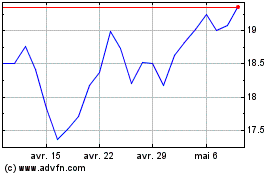

ARMOUR Residential REIT (NYSE:ARR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

ARMOUR Residential REIT (NYSE:ARR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025