UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

Aberdeen Standard Global Infrastructure Income Fund |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee paid previously with preliminary materials. |

|

o |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

ABERDEEN STANDARD GLOBAL INFRASTRUCTURE INCOME FUND

1900 Market Street, Suite 200

Philadelphia, PA 19103

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on May 26, 2022

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting (the "Annual Meeting") of shareholders of Aberdeen Standard Global Infrastructure Income Fund (the "Fund") will be held in a virtual format on Thursday, May 26, 2022 at 11:00 am Eastern time.

The purpose of the Annual Meeting is to consider and act upon the following proposal (the "Proposal") for the Fund, and to consider and act upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof:

To elect two Class II Trustees to serve for a three-year term.

The Proposal is discussed in greater detail in the enclosed Proxy Statement. You are entitled to notice of, and to vote at, the Annual Meeting of the Fund if you owned shares of the Fund at the close of business on April 11, 2022 (the "Record Date"). If you virtually attend the Annual Meeting, you may vote your shares electronically at that time. Even if you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card(s) in the enclosed postage-paid envelope or authorize your proxy by telephone or through the Internet.

Due to the public health impact of the coronavirus pandemic (COVID-19) and to support the health and wellbeing of our stockholders, you will not be able to attend the Annual Meeting in person. All stockholders are requested to vote by proxy over the Internet, by telephone or by completing, dating and signing the enclosed proxy card and returning it promptly. You also may vote at the virtual Annual Meeting if you choose to attend.

This year's Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the Annual Meeting by visiting: www.meetnow.global/MW4M55J at the Annual Meeting date and time described in the accompanying proxy statement. To participate in the Annual Meeting, you will need to log on using the control number from your proxy card or Annual Meeting notice. The control number can be found in the shaded box. There is no physical location for the Annual Meeting.

You may vote electronically during the Annual Meeting by following the instructions available on the Annual Meeting website during the Annual Meeting.

Registering to Attend the Virtual Annual Meeting as a Beneficial Owner

We will admit to the Annual Meeting (1) all shareholders of record on the Record Date, (2) persons holding proof of beneficial ownership at the Record Date, such as a letter or account statement from the person's broker,

(3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the virtual Annual Meeting. To register you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare Fund Services, the Fund's proxy tabulator. You may forward an email from your intermediary or attach an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be labeled as "Legal Proxy" and be received no later than 5:00 p.m., Eastern Time, 3 business days prior to the meeting date. You will receive a confirmation email from Computershare of your registration and a control number that will allow you to vote at the Annual Meeting.

This notice and related proxy materials are first being sent to shareholders on or about April 27, 2022.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 26, 2022: This Notice, the Proxy Statement and the form of proxy cards are available on the Internet at https://www.abrdn.com/en-us/cefinvestorcenter. On this website, you will be able to access the Notice, the Proxy Statement, the form of proxy card(s) and any amendments or supplements to the foregoing materials that are required to be furnished to shareholders.

By order of the Board of Trustees,

Megan Kennedy, Vice President and Secretary

Aberdeen Standard Global Infrastructure Income Fund

TO AVOID THE UNNECESSARY EXPENSE OR FURTHER SOLICITATION, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETING. ACCORDINGLY, YOU ARE REQUESTED TO PLEASE DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD(S) FOR THE ANNUAL MEETING PROMPTLY, OR TO AUTHORIZE THE PROXY VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD(S) BE RETURNED PROMPTLY IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION.

April 27, 2022

Philadelphia, Pennsylvania

ABERDEEN STANDARD GLOBAL INFRASTURCUTE INCOME FUND

(the "Fund")

1900 Market Street, Suite 200

Philadelphia, PA 19103

PROXY STATEMENT

For the Annual Meeting of Shareholders

to be held on May 26, 2022

This Proxy Statement is furnished in connection with the solicitation of proxies by the Fund's Board of Trustees (the "Board," with members of the Board being referred to as "Trustees") to be voted at the Annual Meeting of Shareholders of the Fund (the "Meeting") to be held in a virtual meeting format, on Tuesday, May 26, 2022 and at any adjournments or postponements thereof. A Notice of Annual Meeting of Shareholders and a proxy card (the "Proxy Card") accompany this Proxy Statement. This Proxy Statement is first being sent to shareholders on or about April 27, 2022 to shareholders of record as of April 11, 2022.

The purpose of the Meeting is to seek shareholder approval of the following proposal (the "Proposal"):

To elect two Class II Trustees to serve for a three-year term.

All properly executed proxies received prior to the Meeting will be voted at that Meeting, or at any adjournments or postponements thereof, in accordance with the instructions marked on the Proxy Card. Unless instructions to the contrary are marked on the Proxy Card, proxies received will be voted "FOR" each Proposal (as defined below). The persons named as proxy holders on the Proxy Card will vote in their discretion on any other matters that may properly come before the Meeting or any adjournments or postponements thereof. Any proxy may be revoked at any time prior to its exercise by submitting a properly executed, subsequently dated Proxy Card, giving written notice to Megan Kennedy, Secretary of the Fund, 1900 Market Street, Suite 200, Philadelphia, PA 19103, or by virtually attending the Meeting and voting online. Shareholders may authorize proxy voting by using the enclosed Proxy Card along with the enclosed envelope with pre-paid postage. Shareholders may also authorize proxy voting by telephone or through the internet by following the instructions contained on their Proxy Card. Shareholders do not have dissenter's rights of appraisal in connection with any of the matters to be voted on by the shareholders at the Meeting.

In order to transact business at the Meeting, a "quorum" must be present. Under the Fund's Agreement and Declaration of Trust, a quorum is constituted by the presence in person or by proxy of shareholders representing a majority of the outstanding shares of the Fund on the record date entitled to vote on a matter. Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter at the Meeting.

The election of a Trustee to the Board requires the affirmative vote of a plurality of the shares entitled to vote for the election of any Trustee present in person or represented by proxy at the Meeting with a quorum present. Under a plurality vote, the nominees who receive the highest number of votes will be elected even if they receive less than a majority of the votes. For purposes of the election of Trustees, abstentions and broker non-votes will be counted as shares present for quorum purposes, but will not be treated as votes cast. Abstentions and broker non-votes, therefore, will have no effect on the election of the Class II Trustees. All properly executed proxies received

3

prior to the Meeting will be voted, at the Meeting or at any adjournments or postponements thereof, in accordance with the instructions marked thereon. Proxies received prior to the Meeting on which no vote is indicated will be voted "FOR" the election of the Class II Trustees.

Brokers holding shares of the Fund in "street name" for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares before the Meeting. Under the rules of the New York Stock Exchange ("NYSE"), such brokers may, for certain "routine" matters, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received from their customers and clients prior to the date specified in the brokers' request for voting instructions. The Proposal is a "routine" matter and accordingly beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their shares voted by broker-dealer firms in favor of the Proposal.

The chair of the Meeting shall have the power to adjourn the Meeting without further notice other than announcement at the Meeting. The Board of Trustees also has the power to postpone the Meeting to a later date and/or time in advance of the Meeting. Abstentions and broker non-votes will have the same effect at any adjourned or postponed meeting as noted above. Any business that might have been transacted at the Meeting may be transacted at any such adjourned or postponed session(s) at which a quorum is present.

Written notice of an adjournment of the Meeting, stating the place, date and hour thereof, shall be given to each shareholder entitled to vote thereat at least ten (10) days prior to the Meeting, if the Meeting is adjourned to a date more than one hundred twenty (120) days after the original Record Date set for the Meeting.

We will admit to the Meeting (1) all shareholders of record on April 11, 2022 (the "Record Date"), (2) persons holding proof of beneficial ownership at the Record Date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies, and (4) such other persons that we, in our sole discretion, may elect to admit. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Meeting. To register you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare Fund Services, the Fund's proxy tabulator. You may forward an email from your intermediary or attach an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration for the Meeting must be received no later than 5:00 p.m., Eastern Time, on May 23, 2022. You will receive a confirmation email from Computershare of your registration and a control number that will allow you to vote at the Meeting.

The Board has fixed the close of business on April 11, 2022 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof.

The Fund has one class of shares, par value $0.001 per share. Each share of the Fund is entitled to one vote at the Meeting, and fractional shares are entitled to a proportionate share of one vote. On the Record Date, the following number of shares of the Fund were issued and outstanding:

Important Notice Regarding the Availability of Proxy Materials for the Meeting Being Held on Thursday, May 26, 2022 in a virtual meeting format. The Proxy Materials and the Fund's most recent annual report for the fiscal year ended September 30, 2021 are available on the Internet at http://www.aberdeenasgi.com. The Fund will furnish, without charge, a copy of its annual report for the fiscal year ended September 30, 2021 and any more recent reports, to any Fund shareholder upon request. To request a copy, please write to the Fund c/o abrdn Inc., 1900 Market Street, Suite 200, Philadelphia, PA 19103, or call 1-800-522-5465. You may also call for information on how to obtain directions to be able to register to attend the Meeting.

4

The Election of two Class II Trustees

Pursuant to the Fund's Agreement and Declaration of Trust, the Board is divided into three classes, as nearly equal in number as possible, each of which will serve for three years, with one class being elected each year. If elected, each Trustee is entitled to hold office until the Meeting in the year noted below or until his or her successor is elected and qualifies. Trustees who are deemed "interested persons" (as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940 ("1940 Act")), of a Fund, Aberdeen Asset Managers Limited ("AAML" or the "Investment Adviser), are referred to in this Proxy Statement as "Interested Trustees." Trustees who are not interested persons, as described above, are referred to in this Proxy Statement as "Independent Trustees."

The Fund's Board, including the Independent Trustees, upon the recommendation of the Board's Nominating and Corporate Governance Committee, which is composed entirely of Independent Trustees, has nominated the following nominees as Class II Trustee to its Board as follows:

P. Gerald Malone (Class II Trustee, 3-year term ending 2025)

Todd Reit (Class II Trustee, 3-year term ending 2025)

Each nominee has indicated an intention to serve as a Class II Trustee if elected and has consented to be named in this Proxy Statement.

It is the intention of the persons named as proxies on the enclosed Proxy Card(s) to vote "FOR" the election of the nominee for Class II Trustee to serve for a three-year term. The Fund's Board knows of no reason why the nominee would be unable to serve, but in the event of any such inability, the proxies received will be voted for such substituted nominee as the Fund's Board may recommend.

The following tables set forth certain information regarding the nominees for election to the Board of the Fund, Trustees whose terms of office continue beyond the Meeting, and the principal officers of the Fund.

Name, Address and

Year of Birth |

|

Position(s)

Held with

Fund(s) |

|

Term of Office

and Length of

Time Served |

|

Principal Occupation(s)

During the Past Five Years |

|

Number of

Portfolios

in Fund

Complex*

Overseen by

Trustee |

|

Other

Directorships

Held by Trustee

During the Past

Five Years |

|

|

Independent Nominees for Trustee: |

|

P. Gerald Malone**†

c/o abrdn Inc.

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 196750 |

|

Chair of the Board; Class II Trustee |

|

Term expires 2022

Trustee since 2020 |

|

Mr. Malone is, by profession, a lawyer of over 40 years. Currently, he is a non-executive director of a number of U.S. companies, including Medality Medical (medical technology company) and Bionik Laboratories Corp. (US healthcare company) since 2018. He is also Chair of many of the open and closed end funds in the Fund Complex. He previously served as Independent Chairman of UK companies Crescent OTC Ltd (pharmaceutical services) |

|

|

26 |

|

|

Director of Bionik Laboratories Corporation (US healthcare company) since 2018 |

|

5

Name, Address and

Year of Birth |

|

Position(s)

Held with

Fund(s) |

|

Term of Office

and Length of

Time Served |

|

Principal Occupation(s)

During the Past Five Years |

|

Number of

Portfolios

in Fund

Complex*

Overseen by

Trustee |

|

Other

Directorships

Held by Trustee

During the Past

Five Years |

|

|

|

|

|

|

|

|

until February 2018; and fluidOil Ltd. (oil services) until June 2018; Mr. Malone was previously a Member of Parliament in the U.K. from 1983 to 1997 and served as Minister of State for Health in the U.K. government from 1994 to 1997. |

|

|

|

|

|

Todd Reit**†

c/o abrdn Inc.,

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1968 |

|

Class II Trustee, |

|

Term Expires 2022

Trustee since 2020 |

|

Mr. Reit is a Managing Member of Cross Brook Partners LLC, a real estate investment and management company since 2017. Mr. Reit is also Director and Financial Officer of Shelter Our Soldiers, a charity to support military veterans, since 2016. Mr. Reit was formerly a Managing Director and Global Head of Asset Management Investment Banking for UBS AG, where he was responsible for overseeing all the bank's asset management client relationships globally, including all corporate security transactions, mergers and acquisitions. Mr. Reit retired from UBS in 2017 after an over 25-year career at the company and its predecessor company, PaineWebber Incorporated (merged with UBS AG in 2000). |

|

|

1 |

|

|

None |

|

6

Name, Address and

Year of Birth |

|

Position(s)

Held with

Fund(s) |

|

Term of Office

and Length of

Time Served |

|

Principal Occupation(s)

During the Past Five Years |

|

Number of

Portfolios

in Fund

Complex*

Overseen by

Trustee |

|

Other

Directorships

Held by Trustee

During the Past

Five Years |

|

|

Interested Trustee whose term of office continues beyond the Meeting: |

|

Stephen Bird††

c/o abrdn Inc.

1900 Market St.,

Suite 200,

Philadelphia, PA 19103

Year of Birth: 1967 |

|

Class III Trustee |

|

Term expires 2023

Trustee of Fund since 2021 |

|

Mr. Bird joined the Board of SLA plc in July 2020 as Chief Executive-Designate, and was formally appointed Chief Executive Officer in September 2020. Previously, Mr. Bird served as chief executive officer of global consumer banking at Citigroup from 2015, retiring from the role in November 2019. His responsibilities encompassed all consumer and commercial banking businesses in 19 countries, including retail banking and wealth management, credit cards, mortgages, and operations and technology supporting these businesses. Prior to this, Mr. Bird was chief executive for all of Citigroup's Asia Pacific business lines across 17 markets in the region, including India and China. Mr. Bird joined Citigroup in 1998, and during his 21 years with the company he held a number of leadership roles in banking, operations and technology across its Asian and Latin American businesses. Before this, he held management positions in the UK at GE Capital—where he was director of UK operations from 1996 to 1998—and at British Steel. |

|

|

26 |

|

|

None. |

|

7

Name, Address and

Year of Birth |

|

Position(s)

Held with

Fund(s) |

|

Term of Office

and Length of

Time Served |

|

Principal Occupation(s)

During the Past Five Years |

|

Number of

Portfolios

in Fund

Complex*

Overseen by

Trustee |

|

Other

Directorships

Held by Trustee

During the Past

Five Years |

|

|

Independent Trustees whose terms of office continue beyond the Meeting: |

|

Nancy Yao Maasbach**†

c/o abrdn Inc.,

1900 Market Street,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1972 |

|

Class III Trustee |

|

Term expires 2023

Trustee of Fund since 2018 |

|

Ms. Maasbach is the President of the Museum of Chinese in America since 2015. Ms. Maasbach has also been a member of the Council on Foreign Relations since 2015. Director of The Asia Tigers Fund, Inc. from 2016 to 2018. |

|

|

7 |

|

|

None. |

|

John Sievwright**†

c/o Aberdeen Standard Investments Inc.,

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1955 |

|

Class I Trustee |

|

Term expires 2024

Trustee since 2020 |

|

Mr. Sievwright is a Non-Executive Director of Burford Capital Ltd (since May 2020) and Revolut Limited, a UK-based digital banking firm (since August 2021). Previously he was a Non-Executive Director for the following UK companies: NEX Group plc (2017-2018) (financial); and ICAP plc (2009-2016) (financial). |

|

|

8 |

|

|

Non-Executive Director of Burford Capital Ltd (provider of legal finance, complex strategies, post-settlement finance and asset management services and products) since May 2020. |

|

* The "Fund Complex" consists of: Aberdeen Income Credit Strategies Fund, Aberdeen Asia-Pacific Income Fund, Inc., Aberdeen Global Income Fund, Inc., Aberdeen Australia Equity Fund, Inc., Aberdeen Emerging Markets Equity Income Fund, Inc., The India Fund, Inc., Aberdeen Global Dynamic Dividend Fund, Aberdeen Total Dynamic Dividend Fund, Aberdeen Japan Equity Fund, Inc., Aberdeen Global Premier Properties Fund, Aberdeen Standard Global Infrastructure Income Fund, Aberdeen Funds (which consists of 17 portfolios) and abrdn ETFs (which consists of 3 portfolios).

** Member of the Nominating and Corporate Governance Committee.

† Member of the Audit and Valuation Committee.

†† Deemed to be an Interested Trustee of the Fund because of his position held with the Fund's investment adviser and sub-adviser.

8

ADDITIONAL INFORMATION ABOUT THE TRUSTEES

The Board believes that each Trustee's experience, qualifications, attributes and skills on an individual basis and in combination with those of the other Trustees lead to the conclusion that the Trustees possess the requisite experience, qualifications, attributes and skills to serve on the respective Board. The Board believes that the Trustee's ability to review critically, evaluate, question and discuss information provided to them; to interact effectively with the Investment Adviser, other service providers, counsel and independent auditors; and to exercise effective business judgment in the performance of their duties, support this conclusion. The Board has also considered the contributions that each Trustee can make to the Board on which he or she serves and to the Fund.

A Trustee's ability to perform his or her duties effectively may have been attained through the Trustee's executive, business, consulting, and/or legal positions; experience from service as a Trustee of the Fund and other funds/portfolios in the abrdn complex, other investment funds, public companies, or non-profit entities or other organizations; educational background or professional training or practice; and/or other life experiences. In this regard, the following specific experience, qualifications, attributes and/or skills apply as to each Trustee in addition to the information set forth in the table above: Ms. Maasbach, financial and research analysis experience in and covering the Asia region and experience in world affairs; Mr. Malone, legal background and public service leadership experience, board experience with other public and private companies, and executive and business consulting experience; Mr. Reit banking and asset management experience and experience as a board member; Mr. Sievwright, banking and accounting experience and experience as a board member of public companies; Mr. Bird, Chief Executive Officer of abrdn and prior Chief Executive Officer of other public companies.

The Board believes that the significance of each Trustee's experience, qualifications, attributes or skills is an individual matter (meaning that experience important for one Trustee may not have the same value for another) and that these factors are best evaluated at the Board level, with no single Trustee, or particular factor, being indicative of Board effectiveness. In its periodic self-assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees in the broader context of the Board's overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Fund. References to the qualifications, attributes and skills of Trustees are presented pursuant to disclosure requirements of the Securities and Exchange Commission ("SEC"), do not constitute holding out the Board or any Trustee as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

OFFICERS

Name, Address and

Year of Birth |

|

Position(s) Held

With the Fund |

|

Term of Office*

and Length of

Time Served |

|

Principal Occupation(s) During Past Five Years |

|

Joseph Andolina**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1978 |

|

Chief Compliance Officer and

Vice President, Compliance |

|

Since 2020 |

|

Currently, Chief Risk Officer—Americas for abrdn Inc. and serves as the Chief Compliance Officer for abrdn Inc. Prior to joining the Risk and Compliance Department, he was a member of abrdn Inc.'s Legal Department, where he served as U.S. Counsel since 2012. |

|

9

Name, Address and

Year of Birth |

|

Position(s) Held

With the Fund |

|

Term of Office*

and Length of

Time Served |

|

Principal Occupation(s) During Past Five Years |

|

Chris Demetriou**

c/o abrdn Inc.

1900 Market St.,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1983 |

|

Vice President |

|

Since 2020 |

|

Currently, Chief Executive Officer—UK, EMEA and Americas for abrdn. Mr. Demetriou joined abrdn Inc. in 2013, as a result of the acquisition of SVG, a FTSE 250 private equity investor based in London. |

|

Josh Duitz**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1970 |

|

Vice President |

|

Since 2020 |

|

Currently, Senior Vice President in the Global Equities Team at abrdn Inc. Mr. Duitz is responsible for managing abrdn Standard Global Infrastructure Fund, abrdn Total Dynamic Dividend Fund, abrdn Global Dynamic Dividend Fund and the abrdn Dynamic Dividend Fund (AIFRX, AOD, AGD and ADVDX). He joined abrdn Inc. in 2018 from Alpine Woods Capital Investors LLC where he was a Portfolio Manager. Previously, Mr. Duitz worked for Bear Stearns where he was a Managing Director, Principal and traded international equities. Prior to that, he worked for Arthur Andersen where he was a senior auditor. |

|

Sharon Ferrari**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1977 |

|

Vice President |

|

Since 2020 |

|

Currently, Senior Product Manager—US for abrdn Inc. Ms. Ferrari joined abrdn Inc.as a Senior Fund Administrator in 2008. |

|

Alan Goodson**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1974 |

|

Vice President |

|

Since 2020 |

|

Currently, Director, Vice President and Head of Product & Client Solutions—Americas for abrdn Inc., overseeing Product Management & Governance, Product Development and Client Services for abrdn Inc.'s registered and unregistered investment companies in the U.S., Brazil and Canada. Mr. Goodson is Director and Vice President of abrdn Inc. and joined abrdn Inc.in 2000. |

|

Heather Hasson**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1982 |

|

Vice President |

|

Since 2020 |

|

Currently, Senior Product Manager, Product Governance for abrdn Inc.. Ms. Hasson joined abrdn Inc.as a Fund Administrator in 2006. |

|

Robert Hepp**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1986 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Governance Manager, Product Governance US for abrdn. Mr. Hepp joined abrdn, Inc. in 2016. |

|

Megan Kennedy**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1974 |

|

Vice President and Secretary |

|

Since 2020 |

|

Currently, Senior Director, Product Governance for abrdn Inc. Ms. Kennedy joined abrdn Inc. in 2005. |

|

10

Name, Address and

Year of Birth |

|

Position(s) Held

With the Fund |

|

Term of Office*

and Length of

Time Served |

|

Principal Occupation(s) During Past Five Years |

|

Andrew Kim**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1983 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Governance Manager, Product Governance US for abrdn. Mr. Kim joined abrdn Inc. in 2013. |

|

Brian Kordeck**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1978 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn. Mr. Kordeck joined abrdn in 2013. |

|

Michael Marsico**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1980 |

|

Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn. Mr. Marsico joined abrdn in 2014. |

|

Andrea Melia**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1969 |

|

Treasurer and Chief Financial Officer |

|

Since 2020 |

|

Currently, Vice President and Senior Director, Product Management—Americas for abrdn Inc. Ms. Melia joined abrdn Inc. in 2009. |

|

Christian Pittard**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1973 |

|

Chief Executive Officer and President |

|

Since 2020 |

|

Currently, Group Head of Product Opportunities at abrdn and Director of Aberdeen Asset Management PLC since 2010. Mr. Pittard joined abrdn from KPMG in 1999. |

|

Lucia Sitar**

c/o abrdn Inc.,

1900 Market St,

Suite 200

Philadelphia, PA 19103

Year of Birth: 1971 |

|

Vice President |

|

Since 2020 |

|

Currently, Vice President and Head of Product Management and Governance—Americas since 2021. Previously, Ms. Sitar served as Managing U.S. Counsel for abrdn Inc. Ms. Sitar joined abrdn Inc. as U.S. Counsel in July 2007. |

|

* Officers hold their positions with the Fund until a successor has been duly elected and qualifies. Officers are elected annually at a meeting of the Board of Trustees.

** As of April 27, 2022, each officer may hold officer position(s) in one or more other funds which are part of the Fund Complex.

11

Ownership of Securities

Set forth in the table below is the dollar range of equity securities in the Fund and the aggregate dollar range of equity securities in the Aberdeen Family of Investment Companies (as defined below) beneficially owned by each Trustee or nominee as of April 12, 2022. The following key relates to the dollar ranges in the chart:

A. None

B. $1 — $10,000

C. $10,001 — $50,000

D. $50,001 — $100,000

E. over $100,000

|

Name of Trustee or Nominee |

|

Dollar Range of Equity

Securities Owned in

the Fund(1) |

|

Aggregate Dollar Range of Equity

Securities in All Funds Overseen by

Trustee or Nominee in Family of

Investment Companies(2) |

|

|

Independent Nominees for Trustee: |

|

|

P. Gerald Malone |

|

|

C |

|

|

|

E |

|

|

|

Todd Reit |

|

|

C |

|

|

|

C |

|

|

|

Interested Trustee: |

|

|

Stephen Bird |

|

|

C |

|

|

|

E |

|

|

|

Independent Trustees: |

|

|

Nancy Yao Maasbach |

|

|

C |

|

|

|

D |

|

|

|

John Sievwright |

|

|

C |

|

|

|

E |

|

|

(1) This information has been furnished by each Trustee as of April 12, 2022. "Beneficial ownership" is determined in accordance with Rule 16a-1(a)(2) promulgated under the Securities Exchange Act of 1934, as amended (the "1934 Act").

(2) "Family of Investment Companies" means those registered investment companies that share Aberdeen or an affiliate as the investment adviser and that hold themselves out to investors as related companies for purposes of investment and investor services.

As of April 11, 2022, the Fund's Trustees and officers, in the aggregate, owned less than 1% of the Fund's outstanding equity securities. As of April 11, 2022, none of the Independent Trustees or their immediate family members owned any shares of the Investment Adviser of any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Investment Adviser.

Mr. Pittard and Ms. Melia serve as executive officers of the Fund. As of April 11, 2022, Mr. Pittard and Ms. Melia did not own shares of the Fund.

BOARD AND COMMITTEE STRUCTURE

The Board of Trustees of the Fund is composed of five Trustees, four of whom are Independent Trustees. The Fund divides the Board into three classes, each class having a term of three years. Each year, the term of office of one class will expire and the successor(s) elected to such class will serve for a three year term.

The Board has appointed Mr. Malone, an Independent Trustee, as Chair. The Chair presides at meetings of the Trustees, participates in the preparation of the agenda for meetings of the Board, and acts as a liaison between

12

the Trustees and management between Board meetings. Except for any duties specified herein, the designation of the Chair does not impose on such Trustee any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of the Board, generally.

The Board holds regular quarterly meetings to consider and address matters involving the Fund. The Board also may hold special meetings to address matters arising between regular meetings. The Independent Trustees also meet outside the presence of management in executive session at least quarterly and have engaged separate, independent legal counsel to assist them in performing their oversight responsibilities.

The Board has established a committee structure that includes an Audit and Valuation Committee and a Nominating and Corporate Governance Committee (each discussed in more detail below) to assist the Board in the oversight and direction of the business affairs of the Fund, and from time to time may establish informal ad hoc committees or working groups to review and address the practices of the Fund with respect to specific matters. The Committee system facilitates the timely and efficient consideration of matters by the Trustees, and facilitates effective oversight of compliance with legal and regulatory requirements and of the Fund's activities and associated risks. The standing Committees currently conduct an annual review of their charters, which includes a review of their responsibilities and operations.

The Nominating and Corporate Governance Committee and the Board as a whole also conduct an annual self-assessment of the performance of the Board, including consideration of the effectiveness of the Board's Committee structure. The Committee is comprised entirely of Independent Trustees. The Committee member is also "independent" within the meaning of the NYSE listing standards. The Board reviews its structure regularly and believes that its leadership structure, including having a super-majority of Independent Trustees, coupled with an Independent Trustee as Chair, is appropriate because it allows the Board to exercise informed and independent judgment over the matters under its purview and it allocates areas of responsibility among the Committees and the full Board in a manner that enhances efficient and effective oversight.

Board and Committee Meetings in Fiscal Year 2021

During the fiscal period from October 1, 2020 to September 30, 2021, the Board held four quarterly meetings. During such fiscal year, based on available records, the Trustees serving during that fiscal year attended at least 100% of the aggregate number of meetings of the Board and of the Committees of the Boards on which they served.

Audit and Valuation Committee

The Board has an Audit and Valuation Committee consisting of all the Independent Trustees. In addition, the members of the Audit and Valuation Committee are also "independent," as defined in the Fund's written Audit and Valuation Committee Charter. The members of the Audit and Valuation Committee are Mr. Reit, Ms. Maasbach, Mr. Malone and Mr. Sievwright. Mr. Sievwright serves as the Chair of the Audit and Valuation Committee and the Audit Committee Financial Expert.

The Audit and Valuation Committee oversees the scope of the Fund's audit, the Fund's accounting and financial reporting policies and practices and its internal controls. The Audit and Valuation Committee assists the Board in fulfilling their responsibilities for oversight of the integrity of the Fund's accounting, auditing and financial reporting practices, the qualifications and independence of the Fund's independent registered public accounting firm and the Fund's compliance with legal and regulatory requirements. The Audit and Valuation Committee approves, and recommends to the Board for ratification, the selection, appointment, retention or termination of the Fund's independent registered public accounting firm and approves the compensation of the independent registered public accounting firm. The Audit and Valuation Committee also approves all audit and permissible non- audit services provided to the Fund by the independent registered public accounting firm and all permissible non- audit services

13

provided by the Fund's independent registered public accounting firm to the Investment Adviser and service providers if the engagement relates directly to the Fund's operations and financial reporting. The Audit and Valuation Committee is also responsible for monitoring the valuation of portfolio securities and other investments. The written Charter for the Audit and Valuation Committee is available at the Fund's websites at www.aberdeenasgi.com. During the fiscal period from October 1, 2020 to September 30, 2021, the Audit and Valuation Committee met 3 times.

Service providers to the Fund, primarily the Investment Adviser, have responsibility for the day-to-day management of the Fund, which includes responsibility for risk management. As an integral part of its responsibility for oversight of the Fund, the Board oversees risk management of the Fund's investment program and business affairs. Oversight of the risk management process is part of the Board's general oversight of the Fund and its service providers.

Nominating and Corporate Governance Committee; Consideration of Potential Trustee Nominees

The Board has a Nominating and Corporate Governance Committee (the "Nominating Committee") consisting of all the Independent Trustees. The members of the Nominating Committee are Mr. Reit, Ms. Maasbach, Mr. Malone and Mr. Sievwright. Mr. Malone serves as the Chair of the Nominating Committee.

The Nominating Committee is responsible for overseeing Board governance and related Trustee practices, including selecting and recommending candidates to fill vacancies on the Board. The Nominating Committee will consider Trustee candidates recommended by shareholders of the Fund. Recommendations for consideration by a Nominating Committee should be sent to the Chair of the Nominating Committee in writing together with the appropriate biographical information concerning each such recommended nominee.

In identifying and evaluating nominees for Trustee, the Nominating Committee seeks to ensure that the Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives, and also seeks to ensure that the Board of Trustees is comprised of trustees who have broad and diverse backgrounds. The Nominating Committee looks at each nominee on a case-by-case basis. In looking at the qualification of each candidate to determine if his or her election would further the goals described above, the Nominating Committee takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. However, the Board believes that to be recommended as a nominee, whether by the Nominating Committee or at the suggestion of a shareholder, each candidate must: (1) display the highest personal and professional ethics, integrity and values; (2) have the ability to exercise sound business judgment; (3) be highly accomplished in his or her respective field; (4) have relevant expertise and experience; (5) be able to represent all shareholders and be committed to enhancing long-term shareholder value; and (6) have sufficient time available to devote to activities of the Board and enhance his or her knowledge of the Fund's business. The Nominating Committee met two times during the fiscal period ended September 30, 2021. The Board has adopted a written Charter for the Nominating Committee, which is available at the Fund's websites at www.aberdeenasgi.com.

Board Oversight of Risk Management

The Fund is subject to a number of risks, including, among others, investment, compliance, operational and valuation risks. Risk oversight forms part of the Board's general oversight of the Fund and is addressed as part of various Board and Committee activities. The Board has adopted, and periodically reviews, policies and procedures designed to address these risks. Different processes, procedures and controls are employed with respect to different types of risks. Day-to-day risk management functions are subsumed within the responsibilities of the Fund's Investment Adviser, who carry out the Fund's investment management and business affairs and other service providers in connection with the services they provide to the Fund. The Investment Adviser and other service

14

providers have their own, independent interest in risk management, and their policies and methods of risk management will depend on their functions and business models. As part of its regular oversight of the Fund, the Board, directly and/or through a Committee, interacts with and reviews reports from, among others, the Investment Adviser and the Fund's other service providers (including the Fund's transfer agent), the Fund's Chief Compliance Officer, the Fund's independent registered public accounting firm, legal counsel to the Fund, and internal auditors, as appropriate, relating to the operations of the Fund. The Board also requires the Investment Adviser to report to the Board on other matters relating to risk management on a regular and as-needed basis. The Board recognizes that it may not be possible to identify all of the risks that may affect the Fund or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Communications with the Board of Trustees

Shareholders who wish to communicate with Board members with respect to matters relating to the Fund may address their written correspondence to the Board as a whole or to individual Board members c/o abrdn Inc., (the "Administrator"), the Fund's administrator, at 1900 Market Street, Suite 200, Philadelphia, PA 19103, or via e-mail to the Trustee(s) c/o abrdn Inc. at Investor.Relations@abrdn.com.

Trustees Attendance at Annual Meetings of Shareholders

The Fund has not established a formal policy with respect to Trustee attendance at annual meetings of shareholders.

REPORTS OF THE AUDIT AND VALUATION COMMITTEE; INFORMATION REGARDING THE FUND'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At a meeting held on December 14, 2021, the Board of the Fund, including a majority of the Trustees who are not "interested persons," as defined under the 1940 Act, selected KPMG LLP ("KPMG") to act as the independent registered public accounting firm for the Fund for the fiscal year ending September 30, 2022. Although it is not expected that a representative of KPMG will attend the Meeting, a representative will be available by telephone to make a statement to the shareholders, if the representative wishes to do so, and to respond to shareholder questions, if any.

The Fund's financial statements for the fiscal year ended September 30, 2021 were audited by KPMG. The Audit and Valuation Committee of the Fund has reviewed and discussed the audited financial statements of the Fund with management of the Fund. The Audit and Valuation Committee of the Fund has received the written disclosures and the letter from KPMG required by The Public Company Accounting Oversight Board ("PCAOB") Rule 3526 (PCAOB Rule 1, Communication with Audit Committees Concerning Independence), as may be modified or supplemented, and have discussed with KPMG its independence with respect to the Fund. The Fund knows of no direct financial or material indirect financial interest of KPMG in the Fund. The Audit and Valuation Committee has discussed with KPMG the matters required to be discussed by the applicable requirements of the PCAOB and the SEC. Based on the foregoing review and discussions, the Audit and Valuation Committee of the Fund recommended to the Board that the audited financial statements of the Fund for the fiscal year ended September 30, 2021 be included in the Fund's most recent annual report filed with the SEC.

John Sievwright, Chair of the Audit and Valuation Committee

Nancy Yao Maasbach, Member of the Audit and Valuation Committee

P. Gerald Malone, Member of the Audit and Valuation Committee

Todd Reit, Member of the Audit and Valuation Committee

15

The following table sets forth the aggregate fees billed for professional services rendered by KPMG during the Fund's fiscal years ended September 30, 2021, and September 30, 2020:

|

|

|

2021 |

|

2020 |

|

|

Audit Fees |

|

$ |

68,650 |

|

|

$ |

75,000 |

|

|

|

Audit-Related Fees |

|

|

— |

|

|

$ |

45,000 |

|

|

|

Tax Fees(1) |

|

$ |

18,000 |

|

|

$ |

7,000 |

|

|

|

All Other Fees |

|

|

— |

|

|

|

— |

|

|

|

Total |

|

$ |

86,650 |

|

|

$ |

127,000 |

|

|

(1) Services include tax services in connection with the Fund's excise tax calculations and review of the Fund's tax returns.

The Audit and Valuation Committee is responsible for pre-approving (i) all audit and permissible non-audit services to be provided by the independent registered public accounting firm to the Fund and (ii) all permissible non-audit services to be provided by the independent registered public accounting firm to the Fund's Investment Adviser, and any service provider to the Fund controlling, controlled by or under common control with the Fund's Investment Adviser that provided ongoing services to the Fund ("Covered Service Provider"), if the engagement relates directly to the operations and financial reporting of the Fund. The aggregate fees billed by KPMG for non-audit services rendered to the Fund, the Investment Adviser and any Covered Service Providers for the fiscal years ended September 30, 2021, and September 30, 2020, was $401,745 and $357,225, respectively.

All of the services described in the table above were pre-approved by the Audit and Valuation Committee.

The Audit and Valuation Committee has adopted an Audit Committee Charter that provides that the Audit and Valuation Committee shall annually select, retain or terminate, and recommend to the Independent Trustees and to the full Board of Trustees for their ratification, the selection, retention or termination, the Fund's independent auditor and, in connection therewith, evaluate the terms of the engagement (including compensation of the auditor) and the qualifications and independence of the independent auditor, including whether the independent auditor provides any consulting, auditing or tax services to the Investment Adviser, and receive the independent auditor's specific representations as to its independence, delineating all relationships between the independent auditor and the Fund, consistent with the Independent Standards Board ("ISB") Standard No. 1. The Audit and Valuation Committee Charter also provides that the Committee shall review in advance, and consider approval of, any and all proposals by Fund management or the Investment Adviser that the Fund, Investment Adviser or their affiliated persons, employ the independent auditor to render "permissible non-audit services" to the Fund and to consider whether such services are consistent with the independent auditor's independence.

The Audit and Valuation Committee has considered whether the provision of non-audit services that were rendered to the Investment Adviser and any entity controlling, controlled by, or under common control with these entities that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence and has concluded that it is independent.

COMPENSATION

The following table sets forth information regarding compensation of Trustees from the Fund and by the Fund Complex of which the Fund is a part for the fiscal year ended September 30, 2021. All officers of the Fund are employees of and are compensated by the Fund's Investment Adviser or its affiliates. None of the Fund's executive

16

officers received any compensation from the Fund for such period. The Fund does not have any bonus, profit sharing, pension or retirement plans.

|

Name of Trustee: |

|

Aggregate Compensation

from Fund for

Fiscal Year Ended

September 30, 2021 |

|

Total Compensation

From Fund and Fund

Complex Paid

To Directors* |

|

|

Independent Nominees: |

|

|

P. Gerald Malone |

|

$ |

43,000 |

|

|

$ |

487,092 |

|

|

|

Todd Reit |

|

$ |

44,000 |

|

|

$ |

44,000 |

|

|

|

Interested Nominee: |

|

|

Stephen Bird |

|

$ |

0 |

|

|

$ |

0 |

|

|

|

Independent Trustees: |

|

|

Nancy Yao Maasbach |

|

$ |

28,000 |

|

|

$ |

242,696 |

|

|

|

John Sievwright |

|

$ |

34,000 |

|

|

$ |

150,293 |

|

|

* See the "Trustees" table for the number of Fund within the Fund Complex that each Trustee services.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act, as applied to the Fund, require the Fund's officers and Trustees, certain officers and directors of the investment advisers, affiliates of the investment advisers, and persons who beneficially own more than 10% of the Fund's outstanding securities to electronically file reports of ownership of the Fund's securities and changes in such ownership with the SEC and the NYSE.

Based solely on the Fund's review of such forms filed on EDGAR or written representations from reporting persons that all reportable transactions were reported, to the knowledge of the Fund, during the fiscal period ended September 30, 2021, the Fund's officers, Trustees and greater than 10% owners timely filed all reports they were required to file under Section 16(a).

Relationship of Trustees or Nominees with the Investment Adviser

abrdn Inc., an affiliate of the Investment Manager, serves as the Fund's administrator. ASI is a Delaware corporation with its principal business office located at 1900 Market Street, Suite 200, Philadelphia, PA 19103. ASI also provides investor relations services to the Fund under an investor relations services agreement. Messrs. Andolina, Demetriou, Goodson and Mmes. Kennedy, Melia and Sitar, who serve as officers of the Fund, are also directors and/or officers of abrdn Inc.

AAML serves as Investment Subadviser to the Fund pursuant to a subadvisory agreement dated June 19, 2020. AAML has a registered office at 10 Queen's Terrace, Aberdeen, Scotland AB10 1YG, is a corporation organized under the laws of Scotland and a U.S. registered investment adviser. AAML provides equity, fixed income and real estate advisory services, as well as alternative strategies. Mr. Stephen Bird, a Trustee of the Fund, served as Chairman and an Executive Director of abrdn plc. (formerly Standard Life Aberdeen plc) during the year ended September 30, 2021. Mr. Bird is also a shareholder of abrdn plc.

In rendering investment advisory services, ASII and AAML may use the resources of investment advisor subsidiaries of abrdn. These affiliates have entered into a memorandum of understanding/personnel sharing procedures pursuant to which investment professionals from each affiliate may render portfolio management and research services to US clients of the abrdn affiliates, including the Fund, as associated persons of the Investment

17

Adviser. No remuneration is paid by the Fund with respect to the memorandum of understanding/personnel sharing arrangements.

THE FUND'S BOARD, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE NOMINEES AS CLASS II TRUSTEES.

ADDITIONAL INFORMATION

Sub-Administrator. State Street Bank & Trust Company, located at 1 Heritage Drive, 3rd Floor, North Quincy, MA 02171, serves as administrator to the Fund.

Expenses. The expense of preparation, printing and mailing of the enclosed proxy card and accompanying Notice and Proxy Statement will be borne proportionately by the Fund. The Fund will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of the shares of the Fund. In order to obtain the necessary quorum at the Meeting, supplementary solicitation may be made by mail, telephone, telegraph or personal interview. Such solicitation may be conducted by, among others, officers, Trustees and employees of the Fund, AAML, abrdn Inc. or its affiliates.

AST Fund Solutions, LLC ("AST") has been retained to assist in the solicitation of proxies and will receive an estimated fee of $2,500 and be reimbursed for its reasonable expenses. Total payments for the Fund to AST are expected to be between approximately $3,270 and $3,410. In addition to the solicitation fees, Computershare will charge the Fund $5,000 to hold the meeting virtually.

Solicitation and Voting of Proxies. Solicitation of proxies is being made primarily by the mailing of this Proxy Statement with its enclosures on or about April 21, 2022. As mentioned above, AST has been engaged to assist in the solicitation of proxies. As the date of the Meeting approaches, certain shareholders of the Fund may receive a call from a representative of AST, if the Fund has not yet received their vote. Authorization to permit AST to execute proxies may be obtained by telephonic instructions from shareholders of the Fund. Proxies that are obtained telephonically will be recorded in accordance with procedures that management of the Fund believes are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately determined.

Beneficial Owners. Based upon filings made with the SEC, as of March 31, 2022, there are no persons who may be deemed beneficial owners of 5% or more of the shares of the Fund.

Shareholder Proposals. Any Rule 14a-8 shareholder proposal to be considered for inclusion in the Fund's proxy statement and form of proxy for the annual meeting of shareholders to be held in 2023 should be received by the Secretary of the Fund no later than December 28, 2022. There are additional requirements regarding proposals of shareholders, and a shareholder contemplating submission of a proposal for inclusion in the Fund's proxy materials is referred to Rule 14a-8 under the 1934 Act.

Non-Rule 14a-8 proposals of business to be considered by the Fund's shareholders may be made at an annual meeting of shareholders (1) by or at the direction of the Board of Trustees or (2) by any shareholder of the Fund who was a shareholder of record from the time the shareholder gave notice as provided in the Fund's By-Laws to the time of the annual meeting, who is entitled to vote at the annual meeting on any such business and who has complied with the By-Laws. Pursuant to the Fund's By-Laws, for any such business to be properly brought before an annual meeting by a shareholder, the shareholder must have given timely notice thereof in writing to the Secretary of the Fund and such business must otherwise be a proper matter for action by the shareholders. To be timely, a shareholder's notice shall set forth all information required under the Fund's By-Laws and shall be delivered to the Secretary of the Fund at the principal executive office of the Fund neither earlier than 9:00 a.m., Eastern Time, on

18

the 150th day nor later than 5:00 p.m., Eastern Time, on the 120th day before the first anniversary of the date of the proxy statement for the preceding year's annual meeting; provided, however, that in the event the date of the annual meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year's annual meeting, or in the event that no annual meeting was held the preceding year, notice by the shareholder will be timely if so delivered not later than 5:00 p.m., Eastern Time, on the tenth day following the day on which public announcement of the date of such annual meeting is first made. The public announcement of a postponement or adjournment of an annual meeting shall not commence a new time period for the giving of a shareholder's notice as described above.

In accordance with Rule 14a-4(c), the Fund may exercise discretionary voting authority with respect to any shareholder proposals for this Meeting not included in the proxy statement and form of proxy card which are not submitted to the Fund within the time-frame indicated above. Even if timely notice is received, the Fund may exercise discretionary voting authority in certain other circumstances permitted by Rule 14a-4(c) and SEC guidance related thereto. Discretionary voting authority is the ability to vote proxies that shareholders have executed and returned to the Fund on matters not specifically reflected on the form of proxy card.

SHAREHOLDERS WHO DO NOT EXPECT TO VIRTUALLY ATTEND THE ANNUAL MEETING AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO DATE AND SIGN THE ENCLOSED PROXY CARD(S) AND RETURN THEM IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

Other Business

The Investment Adviser knows of no business to be presented at the Meeting, other than the Proposal set forth in this Proxy Statement, but should any other matter requiring the vote of shareholders arise, the proxies will vote thereon according to their discretion.

By order of the Boards of Trustees,

Megan Kennedy, Secretary

Aberdeen Standard Global Infrastructure Income Fund

19

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

|

|

EASY VOTING OPTIONS: |

|

|

|

|

|

|

|

VOTE ON THE INTERNET

Log on to:

www.proxy-direct.com

or scan the QR code

Follow the on-screen instructions

available 24 hours |

|

|

|

|

|

|

|

VOTE BY PHONE

Call 1-800-337-3503

Follow the recorded instructions

available 24 hours |

|

|

|

|

|

|

|

VOTE BY MAIL

Vote, sign and date this Proxy

Card and return in the

postage-paid envelope |

|

|

|

|

|

|

|

VIRTUAL MEETING

at the following Website:

www.meetnow.global/MW4M55J

on May 26, 2022 at 11:00 a.m.

Eastern Time

To Participate in the Virtual Meeting,

enter the 14-digit control number from

the shaded box on this card. |

Please detach at perforation before mailing.

|

PROXY |

ABERDEEN STANDARD GLOBAL INFRASTRUCTURE INCOME FUND

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 26, 2022 |

THIS PROXY IS BEING SOLICITED BY THE BOARD OF TRUSTEES. The undersigned shareholder(s) of Aberdeen Standard Global Infrastructure Income Fund, revoking previous proxies, hereby appoints Lucia Sitar, Megan Kennedy and Andrew Kim, or any one of them true and lawful attorneys with power of substitution of each, to vote all shares of Aberdeen Standard Global Infrastructure Income Fund which the undersigned is entitled to vote, at the Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MW4M55J on May 26, 2022, at 11:00 a.m. Eastern Time, and at any adjournment thereof as indicated on the reverse side. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. Please refer to the Proxy Statement for a discussion of these matters, including instructions related to meeting attendance.

In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof.

Receipt of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for trustee.

|

|

VOTE VIA THE INTERNET: www.proxy-direct.com |

|

|

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

ASG_32718_032822

PLEASE SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Aberdeen Standard Global Infrastructure Income Fund

Annual Shareholders Meeting to be held virtually on May 26, 2022, at 11:00 a.m. (Eastern Time)

The Notice of Annual Meeting, Proxy Statement and Proxy card for this meeting are available at:

http://www.aberdeenasgi.com

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

In their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Annual Meeting and Proxy Statement dated April 27, 2022 and upon all other such matters as may properly come before the meeting or any adjournment thereof.

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR TRUSTEE IN THE PROPOSAL.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: x

|

|

Proposal |

|

|

|

|

|

|

1. |

To elect two Class II Trustees to the Board of Trustees to serve until the 2025 Annual Meeting of Shareholders. |

|

|

|

FOR |

WHITHOLD |

|

|

|

01. P. Gerald Malone |

o |

o |

|

|

|

|

|

|

|

|

|

|

|

|

FOR |

WHITHOLD |

|

|

|

02. Todd Reit |

o |

o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Signatures — This section must be completed for your vote to be counted. — Sign and Date Below |

|

|

|

|

|

|

|

Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature.

|

Date (mm/dd/yyyy) — Please print date below |

|

Signature 1 — Please keep signature within the box |

|

Signature 2 — Please keep signature within the box |

|

/ / |

|

|

|

|

|

Scanner bar code |

|

xxxxxxxxxxxxxx |

ASG 32718 |

xxxxxxxx |

abrdn Global Infrastruct... (NYSE:ASGI)

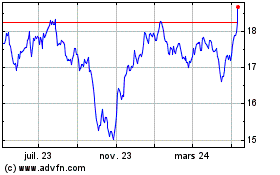

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

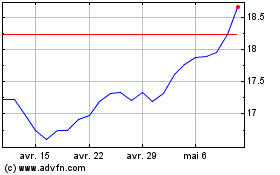

abrdn Global Infrastruct... (NYSE:ASGI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024