Flywire’s ongoing commitment to its large and growing footprint of

U.S. education clients was showcased this week in Phoenix, Arizona,

where more than 100 leading U.S. colleges and universities came

together to tackle some of the most pressing issues facing the

higher education industry today, from rising tuition costs, to

international student recruitment, to the looming enrollment cliff.

At its inaugural conference for U.S. higher education

clients

, Flywire Corporation

(Flywire) (Nasdaq: FLYW) a global payments enablement and software

company, detailed the critical way its software and payments

capabilities are unifying the student journey for international and

domestic students to boost enrollment, drive retention and optimize

cash flow for institutions.

Building on strengths in cross-border payments,

Flywire’s full-suite solution delivers meaningful ROI

Nearly 1,000 institutions in the U.S. rely on Flywire to

streamline the cross-border tuition payment experience for their

international students and automate reconciliation for the finance

office. Building on this momentum, Flywire has also accelerated its

ability to solve some of the most challenging issues in domestic

(U.S. - U.S.) payments, such as managing dynamic payment plans and

past-due collections, and driving even greater value to its growing

client base.

The excitement over Flywire's unique expertise in solving both

international and domestic payments was a key takeaway the Flywire

Fusion conference, where Rob Orgel, Flywire’s COO, unveiled a

number of key ROI metrics of its Student Financial Software (SFS)

platform, including:

- 100+ institutions in the U.S. are powered by

the SFS platform and solutions, which manages billing, payments and

payment plans, and past-due tuition collection from within a single

platform;

- 620+ thousand payment plans have been

activated to make education more affordable;

- $276+ million has been collected in past-due

tuition by institutions run on Flywire;

- $55+ million has been achieved in

pre-collection savings for partner institutions.

“Flywire has been critical in enhancing the payment options we

can offer for the University of Connecticut’s students and

families,” said Alyse Kwapien, Director of Cash

Management & University Bursar,

UConn. “Since partnering with Flywire in 2022 to

streamline our cross-border and domestic payments, my department

has been able to double the number of students enrolled in

interest-free payment plans. This has not only helped drive

affordability but also cut down on my team’s admin time.”

Flywire supports the entire student financial journey,

from enrollment to endowment

Among the key topics discussed at Flywire Fusion was the

mounting headwinds institutions are facing to do more with fewer

people, time and resources, as well as the pressure to combat the

looming enrollment cliff.

During the product keynote, Flywire CTO David King reiterated

Flywire’s commitment to enhancing the SFS platform and rolled out a

comprehensive strategy with these themes in mind, highlighting the

software and payments capabilities purpose-built to support a

student’s entire financial journey. Among the new product

enhancements Flywire showcased include:

- Flywire’s third-party invoicing solution,

saving institutions time with an automated invoice-to-payment

process and providing effortless tracking and reconciliation for

both the institution and vendors;

- Flywire’s international recruitment platform of

agents, enhancing engagement between institutions,

international students and education agents and streamlining

application processes to help reduce impact of the enrollment

cliff;

- Flywire’s StudyLink solution, maximizing

international application conversion rates and helping institutions

pre-screen, prioritize and fast-track admissions decisions;

- Flywire’s continued strength in integrations and

partnerships with leading software services and ERPs,

including those with PeopleSoft, Banner and Ellucian and many

more.

“Institutions are under immense pressure to adapt to a shifting

recruitment landscape, a tight competitive market, and with fewer

resources,” said David King, Flywire CTO. “What we showcased this

week reflects our commitment to helping our clients not only

mitigate these pressures but stay one step ahead of them, with

software and payment experiences that are purpose-built to help

them at every stage of the student payment journey - from

enrollment to endowment.”

Resources

- Flywire Fusion took place September 23 - September 25 in

Phoenix, Arizona. American Express (NYSE: AXP) and Citi (NYSE: C)

were Platinum Sponsors. GradGuard and ITC Systems were Gold

sponsors. ConServe, Discover Global Network (NYSE: DFS), MPower

Financing and Thesis were Silver Sponsors.

- For more takeaways from Flywire Fusion, please visit this

microsite: https://flywire.com/fusion

- To learn more about Flywire’s

solutions for the U.S. higher education industry, visit here

About Flywire

Flywire is a global payments enablement and software company. We

combine our proprietary global payments network, next-gen payments

platform and vertical-specific software to deliver the most

important and complex payments for our clients and their

customers.

Flywire leverages its vertical-specific software and payments

technology to deeply embed within the existing A/R workflows for

its clients across the education, healthcare and travel vertical

markets, as well as in key B2B industries. Flywire also integrates

with leading ERP systems, such as NetSuite, so organizations can

optimize the payment experience for their customers while

eliminating operational challenges.

Flywire supports more than 4,000 clients with diverse payment

methods in more than 140 currencies across more than 240 countries

and territories around the world. The company is headquartered in

Boston, MA, USA with global offices. For more information, visit

www.flywire.com. Follow Flywire on

X , LinkedIn

and Facebook.

Safe Harbor Statement

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including, but not limited to, statements regarding Flywire’s

expectations regarding the benefits of its third-party invoicing

solution, Flywire’s business strategy and plans, market growth and

trends. Flywire intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

In some cases, you can identify forward-looking statements by terms

such as, but not limited to, “believe,” “may,” “will,”

“potentially,” “estimate,” “continue,” “anticipate,” “intend,”

“could,” “would,” “project,” “target,” “plan,” “expect,” or the

negative of these terms, and similar expressions intended to

identify forward-looking statements. Such forward-looking

statements are based upon current expectations that involve risks,

changes in circumstances, assumptions, and uncertainties. Important

factors that could cause actual results to differ materially from

those reflected in Flywire's forward-looking statements include,

among others, the factors that are described in the "Risk Factors"

and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" sections of Flywire's Annual Report on

Form 10-K for the year ended December 31, 2023, and Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024, which are

on file with the Securities and Exchange Commission (SEC) and

available on the SEC's website at

https://www.sec.gov/. The information in this

release is provided only as of the date of this release, and

Flywire undertakes no obligation to update any forward-looking

statements contained in this release on account of new information,

future events, or otherwise, except as required by law.

Contacts

Media Contact:

Sarah Kingmedia@flywire.com

Investor Relations Contact:

ICRflywireir@icrinc.com

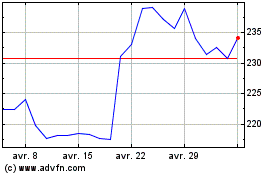

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024