The collaboration leverages Boost’s patented

Straight-Through Processing (STP) solution to address supplier

challenges with manual processing of virtual Card payments

As part of its ongoing investment in its B2B

(business-to-business) network and in enhancing buyer and supplier

capabilities, American Express (NYSE: AXP) today announced a new

offering by Boost Payment Solutions, a global leader in B2B

payments, to provide commercial virtual Card processing services to

U.S. merchants who accept American Express. Qualified American

Express merchants will now have access to Boost Intercept®, Boost’s

patented Straight-Through Processing (STP) solution, at no

additional cost. This collaboration will enable suppliers to

streamline acceptance of American Express virtual Cards and

minimize the challenges associated with manual processing of

virtual Cards.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241001493531/en/

(Photo: Business Wire)

While virtual cards offer a dynamic payment option that replaces

a physical card number with a tokenized, one-time-use digital

version, in B2B payments, some suppliers are still processing

virtual card payments manually, including the opening of each email

and copying the tokenized card number in their Point-of-Sale (POS)

terminal. The increasing volume of virtual card transactions is

making automation even more essential for suppliers, as 52% of U.S.

commercial card spend is estimated to be on virtual cards by

2025.*

Now, with Boost Intercept® for qualified American Express

merchants, the end-to-end process is entirely automated,

eliminating the manual work previously associated with processing

virtual Card payments via e-mail. The automated process can shorten

the time between when a payment is authorized and when funds

settle, potentially leading to better cash-flow management. By

automating each step -- receiving, parsing and processing –

suppliers don’t just save time, they also help their business run

more efficiently and safely: as virtual Cards are generated with

unique details for a specific transaction, merchants do not have to

worry about handling sensitive payment and Card data from

buyers.

Provided at no additional cost to qualified American Express

merchants , Boost Intercept® brings the positive impact of

end-to-end automation to businesses of all sizes, and helps

suppliers enjoy similar benefits that buyers do when it comes to

virtual Cards: faster, more efficient payments.

- From delayed payments to timely payments. Automating virtual

Card payments with Boost Intercept® can help reduce payment cycles

and improve cash flow management, helping suppliers receive the

funds more quickly.

- From data entry errors to reliable information. Boost

Intercept® automates and therefore simplifies reconciliation

efforts, with detailed transaction data accompanying each payment,

making it easier for suppliers to match payments with

invoices.

And from a supplier staffing perspective, data shows that

automating digital payments can save precious time compared to

manual processes: According to the Amex Trendex B2B Edition**, of

the U.S. businesses who said that payments automation is saving

their finance team’s time (36%), the average reportedly saved was

9.9 hours per week, or more than 500 hours per year.

This new collaboration with Boost aims to empower American

Express suppliers with enhanced efficiency, accelerated payment

processing, and an improved customer experience.

American Express

On-the-Record:

“American Express is always working to increase support for our

network of merchants, as backing businesses has been core to our

strategy for decades. We invest in proprietary supplier

capabilities, as well as partnerships to improve supplier

experiences,” said Colleen Taylor, President, Merchant Services –

U.S., at American Express. “That’s why we’re excited to partner

with Boost to extend the benefits of straight-through processing,

as virtual card transactions are on the rise. This collaboration

benefits businesses on both sides of a B2B transaction because the

process needs to work seamlessly for everyone involved.”

Boost Payment Solutions

On-the-Record:

“This collaboration underscores our commitment to empowering

suppliers with payment tools that can help them thrive in today's

fast-paced business environment,” said Dean M. Leavitt, Founder and

CEO of Boost Payment Solutions. “We admire American Express’

commitment to providing innovative and comprehensive payment

solutions for their clients and are thrilled to team up with them

to provide a simpler, smarter and safer option for accepting

American Express B2B virtual Cards.”

Learn More

American Express has both proprietary and partner virtual Card

solutions to meet all of its customers' needs, and American

Express’ collaboration with Boost Payment Solutions is the most

recent example of how the company is bringing automated accounts

payable (AP) and accounts receivable (AR) solutions to its network.

American Express One AP®, American Express’

proprietary accounts payable solution, which allows businesses to

pay their suppliers via multiple different payment rails, including

virtual Cards, which can bring enhanced security to payments

processes.

For more information on the American Express and Boost Payment

Solutions partnership visit www.boostb2b.com/americanexpress.

*Mercator Advisory Group, February 2023. **Amex Trendex: B2B

Edition, 2023.

About American Express

American Express is a globally integrated payments company,

providing customers with access to products, insights and

experiences that enrich lives and build business success. Learn

more at americanexpress.com and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express, X.com/americanexpress, and

youtube.com/americanexpress.

Key links to products, services and corporate sustainability

information: personal cards, business cards and services, travel

services, gift cards, prepaid cards, merchant services, Business

Blueprint, Resy, corporate card, business travel, diversity and

inclusion, corporate sustainability and Environmental, Social, and

Governance reports.

About Boost Payment Solutions

Boost Payment Solutions is the global leader in B2B payments

with a technology platform that seamlessly serves the needs of

today’s commercial trading partners. Our patented technology

solutions bridge the needs of buyers and suppliers around the

world, eliminating friction and delivering process efficiency,

payment security, data insights, and revenue optimization. Boost

was founded in 2009 and operates in 180+ countries.

Please visit us at http://www.boostb2b.com

Location: U.S.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001493531/en/

Media American Express Meg Martin meg.martin@aexp.com

Boost Payment Solutions Tara Lefave Stred (Three Rings Inc)

tstred@threeringsinc.com

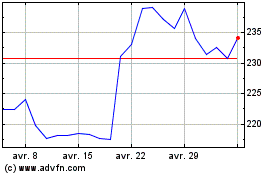

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

American Express (NYSE:AXP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024