0000038777false00000387772024-11-042024-11-04

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2024

FRANKLIN RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09318 | 13-2670991 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One Franklin Parkway, San Mateo, CA 94403

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (650) 312-2000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | BEN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2024, Franklin Resources, Inc. (the “Company”) issued a press release announcing the preliminary financial results for the Company’s fourth fiscal quarter and fiscal year ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The Company also posted a fourth quarter and fiscal year earnings commentary on its internet website, available via investors.franklinresources.com.

The contents of the Company’s website referenced herein and in the exhibit are not incorporated into this Current Report on Form 8-K.

The information in these Items 2.02 and 7.01, including the exhibits hereto, (x) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and (y) shall not be incorporated by reference into any filing of the Company with the Securities and Exchange Commission, whether made before or after the date hereof, regardless of any general incorporation language in such filings (unless the Company specifically states that the information or exhibits in this particular report with respect to Item 2.02 or Item 7.01, as the case may be, are incorporated by reference).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibits listed on the Exhibit Index are incorporated herein by reference.

Exhibit Index

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FRANKLIN RESOURCES, INC. |

| | |

| | |

| Date: | November 4, 2024 | /s/ Matthew Nicholls |

| | Matthew Nicholls |

| | Executive Vice President, Chief Financial Officer and Chief Operating Officer (Principal Financial Officer) |

| | |

| | |

| Date: | November 4, 2024 | /s/ Lindsey H. Oshita |

| | Lindsey H. Oshita |

| | Chief Accounting Officer (Principal Accounting Officer) |

EXHIBIT 99.1

| | | | | |

| Contact: | Franklin Resources, Inc. |

| Investor Relations: Selene Oh (650) 312-4091, selene.oh@franklintempleton.com |

| Media Relations: Jeaneen Terrio (212) 632-4005, jeaneen.terrio@franklintempleton.com |

| investors.franklinresources.com |

FOR IMMEDIATE RELEASE

Franklin Resources, Inc. Announces Preliminary Fourth Quarter and Fiscal Year Results

San Mateo, CA, November 4, 2024 – Franklin Resources, Inc. (the “Company”) [NYSE: BEN] today announced preliminary net loss of $84.7 million or $0.19 per diluted share for the quarter ended September 30, 2024, as compared to net income of $174.0 million or $0.32 per diluted share for the previous quarter, and $295.5 million or $0.58 per diluted share for the quarter ended September 30, 2023. Preliminary net income1 for the fiscal year ended September 30, 2024 was $464.8 million or $0.85 per diluted share, as compared to $882.8 million or $1.72 per diluted share for the prior fiscal year. Preliminary operating loss was $150.7 million for the quarter ended September 30, 2024, as compared to operating income of $222.5 million for the previous quarter and $338.3 million for the prior year. During the quarter ended September 30, 2024, the Company impaired its indefinite-lived intangible asset related to certain mutual fund contracts managed by Western Asset Management by $389.2 million.

As supplemental information, the Company is providing certain adjusted performance measures which are based on methodologies other than generally accepted accounting principles. Preliminary adjusted net income2 was $315.2 million and adjusted diluted earnings per share2 was $0.59 for the quarter ended September 30, 2024, as compared to $326.4 million and $0.60 for the previous quarter, and $427.0 million and $0.84 for the quarter ended September 30, 2023. Preliminary adjusted net income2 was $1,276.7 million and adjusted diluted earnings per share2 was $2.39 for the fiscal year ended September 30, 2024, as compared to $1,332.2 million and $2.60 for the prior fiscal year. Preliminary adjusted operating income2 was $451.6 million for the quarter ended September 30, 2024, as compared to $424.9 million for the previous quarter and $511.7 million for the prior year.

“Franklin Templeton is one of the most comprehensive global asset managers with investment management capabilities across public and private markets and a distribution reach with clients in over 150 countries,” said Jenny Johnson, President and CEO of Franklin Resources, Inc. “Over the past several years, we have successfully grown and further diversified our business by investment team, asset class, investment vehicle and geography.

“As we reflect on our fiscal year, global markets rallied significantly, despite ongoing geopolitical complexity and uncertainty. Against this backdrop, we reached record AUM of $1.68 trillion and saw a 25% increase from the prior year in long-term inflows to $319 billion. Long-term net outflows were $32.6 billion, including $20.7 billion of reinvested distributions. Excluding Western Asset Management, our long-term net inflows were $16.0 billion.

“During the fiscal year, we continued to increase our presence in our key focus areas which reflect areas of long-term client demand. Client interest in alternative and multi-asset investment strategies generated positive flows for the year. Private markets fundraising totaled $14.8 billion with flagship funds in secondary private equity and alternative credit exceeding fund targets. We saw strong growth across a broad range of investment vehicles with retail SMA, ETF and Canvas® AUM increasing by 29%, 89% and 94% year-over-year, respectively – all to record highs. From a regional perspective, our international business continued to be a strength of the firm and experienced positive long-term net flows for the year, culminating in over $500 billion in AUM.

“Our acquisition of Putnam Investments has exceeded our expectations. Since closing on January 1, Putnam’s AUM has grown 21% to $180 billion and Franklin Templeton has generated positive net flows of approximately $11 billion in Putnam strategies,

benefiting from our global distribution platform. The transaction has also exceeded our annual run-rate cost savings target of $150 million. We have returned $946 million to shareholders through dividends and share repurchases.

“We remain committed to our vision of building innovative and collaborative relationships with our clients and look forward to unlocking new opportunities that reflect the high standards that have defined Franklin Templeton as a trusted partner over 75 years. I would like to thank our employees around the world for their dedication and commitment to always putting our clients first.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | % Change | | Quarter Ended | | % Change | Fiscal Year Ended September 30, | | | | | | | | | | |

| | 30-Sep-24 | | 30-Jun-24 | | Qtr. vs. Qtr. | 30-Sep-23 | | Year vs. Year | 2024 | | 2023 | | % Change | | | | | | | | | | |

| Financial Results | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenues | | $ | 2,211.2 | | | $ | 2,122.9 | | | 4 | % | $ | 1,986.1 | | | 11 | % | $ | 8,478.0 | | | $ | 7,849.4 | | | 8 | % | | | | | | | | | | | | |

Operating income (loss) | | (150.7) | | | 222.5 | | | NM | 338.3 | | | NM | 407.6 | | | 1,102.3 | | | (63 | %) | | | | | | | | | | | | |

| Operating margin | | (6.8 | %) | | 10.5 | % | | | 17.0 | % | | | 4.8 | % | | 14.0 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss)¹ | | $ | (84.7) | | | $ | 174.0 | | | NM | $ | 295.5 | | | NM | $ | 464.8 | | | $ | 882.8 | | | (47 | %) | | | | | | | | | | | | |

Diluted earnings (loss) per share | | (0.19) | | | 0.32 | | | NM | 0.58 | | | NM | 0.85 | | | 1.72 | | | (51 | %) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

As adjusted (non-GAAP):2 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted operating income | | $ | 451.6 | | | $ | 424.9 | | | 6 | % | $ | 511.7 | | | (12 | %) | $ | 1,713.1 | | | $ | 1,823.8 | | | (6 | %) | | | | | | | | | | | | |

| Adjusted operating margin | | 26.3 | % | | 25.7 | % | | | 32.4 | % | | | 26.1 | % | | 29.9 | % | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted net income | | $ | 315.2 | | | $ | 326.4 | | | (3 | %) | $ | 427.0 | | | (26 | %) | $ | 1,276.7 | | | $ | 1,332.2 | | | (4 | %) | | | | | | | | | | | | |

| Adjusted diluted earnings per share | | 0.59 | | | 0.60 | | | (2 | %) | 0.84 | | | (30 | %) | 2.39 | | | 2.60 | | | (8 | %) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets Under Management | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ending | | $ | 1,678.6 | | | $ | 1,646.6 | | | 2 | % | $ | 1,374.2 | | | 22 | % | $ | 1,678.6 | | | $ | 1,374.2 | | | 22 | % | | | | | | | | | | | | |

Average3 | | 1,667.5 | | | 1,632.6 | | | 2 | % | 1,419.1 | | | 18 | % | 1,565.8 | | | 1,400.4 | | | 12 | % | | | | | | | | | | | | |

| Long-term net flows | | (31.3) | | | (3.2) | | | | (6.9) | | | | (32.6) | | | (21.3) | | | | | | | | | | | | | | | |

Total assets under management (“AUM”) were $1,678.6 billion at September 30, 2024, up $32.0 billion or 2% during the quarter due to the positive impact of $63.5 billion of net market change, distributions, and other, partially offset by $31.3 billion of long-term net outflows, inclusive of $37.0 billion of long-term net outflows at Western Asset Management, and $0.2 billion of cash management net outflows. AUM increased $304.4 billion or 22% during the fiscal year due to the positive impact of $186.0 billion of net market change, distributions and other, $148.3 billion from the acquisition of Putnam, and $2.7 billion of cash management net inflows, partially offset by $32.6 billion of long-term net outflows, inclusive of $48.6 billion of long-term net outflows at Western Asset Management.

Cash and cash equivalents and investments were $5.6 billion and, including the Company’s direct investments in consolidated investment products (“CIPs”), were $6.7 billion4 at September 30, 2024. Total stockholders’ equity was $13.3 billion and the Company had 523.6 million shares of common stock outstanding at September 30, 2024. The Company repurchased 4.9 million shares of its common stock for a total cost of $102.4 million during the quarter ended September 30, 2024.

Conference Call Information

A written commentary on the results by Jenny Johnson, President and CEO; Matthew Nicholls, Executive Vice President, CFO and COO; and Adam Spector, Executive Vice President, Head of Global Distribution will be available via investors.franklinresources.com today at approximately 8:30 a.m. Eastern Time.

Ms. Johnson and Messrs. Nicholls and Spector will also lead a live teleconference today at 11:00 a.m. Eastern Time to answer questions. Access to the teleconference will be available via investors.franklinresources.com or by dialing (+1) (877) 407-0989 in North America or (+1) (201) 389-0921 in other locations. A replay of the teleconference can also be accessed by calling (+1) (877) 660-6853 in North America or (+1) (201) 612-7415 in other locations using access code 13749455 after 2:00 p.m. Eastern Time on November 4, 2024 through November 10, 2024, or via investors.franklinresources.com.

Analysts and investors are encouraged to review the Company’s recent filings with the U.S. Securities and Exchange Commission and to contact Investor Relations at investorrelations@franklintempleton.com before the live teleconference for any clarifications or questions related to the earnings release or written commentary.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FRANKLIN RESOURCES, INC. CONSOLIDATED STATEMENTS OF INCOME Unaudited |

| (in millions, except per share data) | | Three Months Ended September 30, | | %

Change | | Twelve Months Ended September 30, | | %

Change |

| 2024 | | 2023 5 | | | 2024 | | 2023 5 | |

| Operating Revenues | | | | | | | | | | | | |

| Investment management fees | | $ | 1,766.2 | | | $ | 1,634.4 | | | 8 | % | | $ | 6,822.2 | | | $ | 6,452.9 | | | 6 | % |

| Sales and distribution fees | | 368.0 | | | 306.4 | | | 20 | % | | 1,381.0 | | | 1,203.7 | | | 15 | % |

| Shareholder servicing fees | | 67.0 | | | 37.2 | | | 80 | % | | 229.3 | | | 152.7 | | | 50 | % |

| Other | | 10.0 | | | 8.1 | | | 23 | % | | 45.5 | | | 40.1 | | | 13 | % |

| Total operating revenues | | 2,211.2 | | | 1,986.1 | | | 11 | % | | 8,478.0 | | | 7,849.4 | | | 8 | % |

| Operating Expenses | | | | | | | | | | | | |

| Compensation and benefits | | 940.8 | | | 826.3 | | | 14 | % | | 3,831.1 | | | 3,494.0 | | | 10 | % |

| Sales, distribution and marketing | | 496.9 | | | 411.1 | | | 21 | % | | 1,863.1 | | | 1,613.1 | | | 15 | % |

| Information systems and technology | | 177.4 | | | 128.3 | | | 38 | % | | 620.1 | | | 505.0 | | | 23 | % |

| Occupancy | | 77.7 | | | 57.8 | | | 34 | % | | 325.4 | | | 228.9 | | | 42 | % |

| Amortization of intangible assets | | 83.8 | | | 86.5 | | | (3 | %) | | 338.2 | | | 341.1 | | | (1 | %) |

Impairment of intangible assets | | 389.2 | | | — | | | NM | | 389.2 | | | — | | | NM |

| General, administrative and other | | 196.1 | | | 137.8 | | | 42 | % | | 703.3 | | | 565.0 | | | 24 | % |

| Total operating expenses | | 2,361.9 | | | 1,647.8 | | | 43 | % | | 8,070.4 | | | 6,747.1 | | | 20 | % |

Operating Income (Loss) | | (150.7) | | | 338.3 | | | NM | | 407.6 | | | 1,102.3 | | | (63 | %) |

| Other Income (Expenses) | | | | | | | | | | | | |

| Investment and other income, net | | 95.3 | | | 62.0 | | | 54 | % | | 395.5 | | | 262.3 | | | 51 | % |

Interest expense | | (25.0) | | | (24.4) | | | 2 | % | | (97.2) | | | (123.7) | | | (21 | %) |

| Investment and other income of consolidated investment products, net | | 46.2 | | | 40.5 | | | 14 | % | | 149.9 | | | 115.8 | | | 29 | % |

Expenses of consolidated investment products | | (12.0) | | | (3.0) | | | 300 | % | | (32.6) | | | (18.7) | | | 74 | % |

| Other income, net | | 104.5 | | | 75.1 | | | 39 | % | | 415.6 | | | 235.7 | | | 76 | % |

Income (loss) before taxes | | (46.2) | | | 413.4 | | | NM | | 823.2 | | | 1,338.0 | | | (38 | %) |

| Taxes on income | | 9.5 | | | 75.0 | | | (87 | %) | | 215.3 | | | 312.3 | | | (31 | %) |

| Net income (loss) | | (55.7) | | | 338.4 | | | NM | | 607.9 | | | 1,025.7 | | | (41 | %) |

| Less: net income (loss) attributable to | | | | | | | | | | | | |

| Redeemable noncontrolling interests | | 32.6 | | | 27.0 | | | 21 | % | | 127.9 | | | 135.5 | | | (6 | %) |

| Nonredeemable noncontrolling interests | | (3.6) | | | 15.9 | | | NM | | 15.2 | | | 7.4 | | | 105 | % |

| Net Income (Loss) Attributable to Franklin Resources, Inc. | | $ | (84.7) | | | $ | 295.5 | | | NM | | $ | 464.8 | | | $ | 882.8 | | | (47 | %) |

| | | | | | | | | | | | |

| Earnings (Loss) per Share | | | | | | | | | | | | |

| Basic | | $ | (0.19) | | | $ | 0.58 | | | NM | | $ | 0.85 | | | $ | 1.72 | | | (51 | %) |

| Diluted | | (0.19) | | | 0.58 | | | NM | | 0.85 | | | 1.72 | | | (51 | %) |

| Dividends Declared per Share | | $ | 0.31 | | | $ | 0.30 | | | 3 | % | | $ | 1.24 | | | $ | 1.20 | | | 3 | % |

| | | | | | | | | | | | |

| Average Shares Outstanding | | | | | | | | | | | | |

| Basic | | 516.2 | | | 489.2 | | | 6 | % | | 509.5 | | | 490.0 | | | 4 | % |

| Diluted | | 516.2 | | | 490.0 | | | 5 | % | | 510.3 | | | 490.8 | | | 4 | % |

| | | | | | | | | | | | |

| Operating Margin | | (6.8 | %) | | 17.0 | % | | | | 4.8 | % | | 14.0 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

FRANKLIN RESOURCES, INC. CONSOLIDATED STATEMENTS OF INCOME Unaudited |

| (in millions, except per share data) | | Three Months Ended | | %

Change | | Three Months Ended 5 |

| 30-Sep-24 | | 30-Jun-24 | | | 31-Mar-24 | | 31-Dec-23 | | 30-Sep-23 |

| Operating Revenues | | | | | | | | | | | | |

| Investment management fees | | $ | 1,766.2 | | | $ | 1,689.9 | | ` | 5 | % | | $ | 1,713.9 | | | $ | 1,652.2 | | | $ | 1,634.4 | |

| Sales and distribution fees | | 368.0 | | | 358.3 | | | 3 | % | | 358.3 | | | 296.4 | | | 306.4 | |

| Shareholder servicing fees | | 67.0 | | | 61.8 | | | 8 | % | | 68.0 | | | 32.5 | | | 37.2 | |

| Other | | 10.0 | | | 12.9 | | | (22 | %) | | 12.6 | | | 10.0 | | | 8.1 | |

| Total operating revenues | | 2,211.2 | | | 2,122.9 | | | 4 | % | | 2,152.8 | | | 1,991.1 | | | 1,986.1 | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation and benefits | | 940.8 | | | 893.8 | | | 5 | % | | 1,028.2 | | | 968.3 | | | 826.3 | |

| Sales, distribution and marketing | | 496.9 | | | 481.1 | | | 3 | % | | 484.3 | | | 400.8 | | | 411.1 | |

| Information systems and technology | | 177.4 | | | 156.6 | | | 13 | % | | 155.1 | | | 131.0 | | | 128.3 | |

| Occupancy | | 77.7 | | | 104.8 | | | (26 | %) | | 76.2 | | | 66.7 | | | 57.8 | |

| Amortization of intangible assets | | 83.8 | | | 84.0 | | | 0 | % | | 84.6 | | | 85.8 | | | 86.5 | |

Impairment of intangible assets | | 389.2 | | | — | | | NM | | — | | | — | | | — | |

| General, administrative and other | | 196.1 | | | 180.1 | | | 9 | % | | 195.1 | | | 132.0 | | | 137.8 | |

| Total operating expenses | | 2,361.9 | | | 1,900.4 | | | 24 | % | | 2,023.5 | | | 1,784.6 | | | 1,647.8 | |

Operating Income (Loss) | | (150.7) | | | 222.5 | | | NM | | 129.3 | | | 206.5 | | | 338.3 | |

| Other Income (Expenses) | | | | | | | | | | | | |

| Investment and other income, net | | 95.3 | | | 74.5 | | | 28 | % | | 52.5 | | | 173.2 | | | 62.0 | |

| Interest expense | | (25.0) | | | (25.7) | | | (3 | %) | | (27.7) | | | (18.8) | | | (24.4) | |

| Investment and other income (losses) of consolidated investment products, net | | 46.2 | | | 37.6 | | | 23% | | 89.9 | | | (23.8) | | | 40.5 | |

Expenses of consolidated investment products | | (12.0) | | | (8.8) | | | 36 | % | | (5.9) | | | (5.9) | | | (3.0) | |

| Other income, net | | 104.5 | | | 77.6 | | | 35 | % | | 108.8 | | | 124.7 | | | 75.1 | |

Income (loss) before taxes | | (46.2) | | | 300.1 | | | NM | | 238.1 | | | 331.2 | | | 413.4 | |

| Taxes on income | | 9.5 | | | 68.1 | | | (86 | %) | | 62.8 | | | 74.9 | | | 75.0 | |

| Net income (loss) | | (55.7) | | | 232.0 | | | NM | | 175.3 | | | 256.3 | | | 338.4 | |

| Less: net income (loss) attributable to | | | | | | | | | | | | |

| Redeemable noncontrolling interests | | 32.6 | | | 43.0 | | | (24 | %) | | 42.8 | | | 9.5 | | | 27.0 | |

| Nonredeemable noncontrolling interests | | (3.6) | | | 15.0 | | | NM | | 8.3 | | | (4.5) | | | 15.9 | |

| Net Income (Loss) Attributable to Franklin Resources, Inc. | | $ | (84.7) | | | $ | 174.0 | | | NM | | $ | 124.2 | | | $ | 251.3 | | | $ | 295.5 | |

| | | | | | | | | | | | |

| Earnings (Loss) per Share | | | | | | | | | | | | |

| Basic | | $ | (0.19) | | | $ | 0.32 | | | NM | | $ | 0.23 | | | $ | 0.50 | | | $ | 0.58 | |

| Diluted | | (0.19) | | | 0.32 | | | NM | | 0.23 | | | 0.50 | | | 0.58 | |

| Dividends Declared per Share | | $ | 0.31 | | | $ | 0.31 | | | 0% | | $ | 0.31 | | | $ | 0.31 | | | $ | 0.30 | |

| | | | | | | | | | | | |

| Average Shares Outstanding | | | | | | | | | | | | |

| Basic | | 516.2 | | | 516.5 | | | 0 | % | | 518.4 | | | 487.0 | | | 489.2 | |

| Diluted | | 516.2 | | | 517.2 | | | 0 | % | | 519.2 | | | 487.9 | | | 490.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Margin | | (6.8) | % | | 10.5 | % | | | | 6.0 | % | | 10.4 | % | | 17.0 | % |

AUM AND FLOWS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | Three Months Ended September 30, | | %

Change | | Twelve Months Ended September 30, | | %

Change |

| 2024 | | 2023 | | | 2024 | | 2023 | |

| Beginning AUM | | $ | 1,646.6 | | | $ | 1,431.5 | | | 15 | % | | $ | 1,374.2 | | | $ | 1,297.4 | | | 6 | % |

| Long-term inflows | | 82.5 | | | 55.2 | | | 49 | % | | 319.0 | | | 254.9 | | | 25 | % |

| Long-term outflows | | (113.8) | | | (62.1) | | | 83 | % | | (351.6) | | | (276.2) | | | 27 | % |

| Long-term net flows | | (31.3) | | | (6.9) | | | 354% | | (32.6) | | | (21.3) | | | 53% |

| Cash management net flows | | (0.2) | | | (1.6) | | | (88%) | | 2.7 | | | 4.3 | | | (37%) |

| Total net flows | | (31.5) | | | (8.5) | | | 271% | | (29.9) | | | (17.0) | | | 76% |

Acquisition | | — | | | — | | | NM | | 148.3 | | | 34.9 | | | NM |

Net market change, distributions and other6 | | 63.5 | | | (48.8) | | | NM | | 186.0 | | | 58.9 | | | 216% |

| Ending AUM | | $ | 1,678.6 | | | $ | 1,374.2 | | | 22 | % | | $ | 1,678.6 | | | $ | 1,374.2 | | | 22 | % |

| Average AUM | | $ | 1,667.5 | | | $ | 1,419.1 | | | 18 | % | | $ | 1,565.8 | | | $ | 1,400.4 | | | 12 | % |

AUM BY ASSET CLASS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | 30-Sep-24 | | 30-Jun-24 | | % Change | | 31-Mar-24 | | 31-Dec-23 | | 30-Sep-23 |

Equity | | $ | 632.1 | | | $ | 595.0 | | | 6 | % | | $ | 592.7 | | | $ | 467.5 | | | $ | 430.4 | |

| Fixed Income | | 556.4 | | | 564.5 | | | (1 | %) | | 571.4 | | | 511.7 | | | 483.1 | |

| Alternative | | 249.9 | | | 254.5 | | | (2 | %) | | 255.5 | | | 256.2 | | | 254.9 | |

| Multi-Asset | | 176.2 | | | 168.1 | | | 5 | % | | 163.4 | | | 154.6 | | | 145.0 | |

| Cash Management | | 64.0 | | | 64.5 | | | (1 | %) | | 61.7 | | | 65.5 | | | 60.8 | |

| Total AUM | | $ | 1,678.6 | | | $ | 1,646.6 | | | 2 | % | | $ | 1,644.7 | | | $ | 1,455.5 | | | $ | 1,374.2 | |

| Average AUM for the Three-Month Period | | $ | 1,667.5 | | | $ | 1,632.6 | | | 2 | % | | $ | 1,581.1 | | | $ | 1,394.2 | | | $ | 1,419.1 | |

AUM BY SALES REGION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | 30-Sep-24 | | 30-Jun-24 | | % Change | | 31-Mar-24 | | 31-Dec-23 | | 30-Sep-23 |

| United States | | $ | 1,177.1 | | | $ | 1,155.0 | | | 2 | % | | $ | 1,155.9 | | | $ | 1,019.4 | | | $ | 979.9 | |

| International | | | | | | | | | | | | |

Europe, Middle East and Africa7 | | 209.1 | | | 205.8 | | | 2 | % | | 206.3 | | | 180.6 | | | 165.1 | |

| Asia-Pacific | | 178.0 | | | 174.1 | | | 2 | % | | 170.4 | | | 150.5 | | | 117.6 | |

| Americas, excl. U.S. | | 114.4 | | | 111.7 | | | 2 | % | | 112.1 | | | 105.0 | | | 111.6 | |

| Total international | | 501.5 | | | 491.6 | | | 2 | % | | 488.8 | | | 436.1 | | | 394.3 | |

| Total | | $ | 1,678.6 | | | $ | 1,646.6 | | | 2 | % | | $ | 1,644.7 | | | $ | 1,455.5 | | | $ | 1,374.2 | |

AUM AND FLOWS BY ASSET CLASS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | | | | | | | | | | | | | |

for the three months ended

September 30, 2024 | | Equity | | Fixed

Income | | Alternative | | Multi-Asset | | | | Cash

Management | | Total |

| AUM at July 1, 2024 | | $ | 595.0 | | | $ | 564.5 | | | $ | 254.5 | | | $ | 168.1 | | | | | $ | 64.5 | | | $ | 1,646.6 | |

Long-term inflows | | 36.8 | | | 33.0 | | | 4.0 | | | 8.7 | | | | | — | | | 82.5 | |

Long-term outflows | | (36.0) | | | (66.9) | | | (5.0) | | | (5.9) | | | | | — | | | (113.8) | |

| Long-term net flows | | 0.8 | | | (33.9) | | | (1.0) | | | 2.8 | | | | | — | | | (31.3) | |

Cash management net flows | | — | | | — | | | — | | | — | | | | | (0.2) | | | (0.2) | |

Total net flows | | 0.8 | | | (33.9) | | | (1.0) | | | 2.8 | | | | | (0.2) | | | (31.5) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net market change, distributions and other6 | | 36.3 | | | 25.8 | | | (3.6) | | | 5.3 | | | | | (0.3) | | | 63.5 | |

| AUM at September 30, 2024 | | $ | 632.1 | | | $ | 556.4 | | | $ | 249.9 | | | $ | 176.2 | | | | | $ | 64.0 | | | $ | 1,678.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | | | | | | | | | | | | | |

for the three months ended

June 30, 2024 | | Equity | | Fixed

Income | | Alternative | | Multi-Asset | | | | Cash

Management | | Total |

| AUM at April 1, 2024 | | $ | 592.7 | | | $ | 571.4 | | | $ | 255.5 | | | $ | 163.4 | | | | | $ | 61.7 | | | $ | 1,644.7 | |

Long-term inflows | | 32.0 | | | 37.4 | | | 3.4 | | | 9.9 | | | | | — | | | 82.7 | |

Long-term outflows | | (33.6) | | | (42.2) | | | (2.0) | | | (8.1) | | | | | — | | | (85.9) | |

| Long-term net flows | | (1.6) | | | (4.8) | | | 1.4 | | | 1.8 | | | | | — | | | (3.2) | |

Cash management net flows | | — | | | — | | | — | | | — | | | | | 3.0 | | | 3.0 | |

Total net flows | | (1.6) | | | (4.8) | | | 1.4 | | | 1.8 | | | | | 3.0 | | | (0.2) | |

| | | | | | | | | | | | | | |

Net market change, distributions and other6 | | 3.9 | | | (2.1) | | | (2.4) | | | 2.9 | | | | | (0.2) | | | 2.1 | |

| AUM at June 30, 2024 | | $ | 595.0 | | | $ | 564.5 | | | $ | 254.5 | | | $ | 168.1 | | | | | $ | 64.5 | | | $ | 1,646.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in billions) | | | | | | | | | | | | | | |

for the three months ended

September 30, 2023 | | Equity | | Fixed

Income | | Alternative | | Multi-Asset | | | | Cash

Management | | Total |

| AUM at July 1, 2023 | | $ | 458.0 | | | $ | 505.1 | | | $ | 257.2 | | | $ | 148.3 | | | | | $ | 62.9 | | | $ | 1,431.5 | |

Long-term inflows | | 17.1 | | | 26.2 | | | 3.9 | | | 8.0 | | | | | — | | | 55.2 | |

Long-term outflows | | (24.8) | | | (27.8) | | | (3.1) | | | (6.4) | | | | | — | | | (62.1) | |

| Long-term net flows | | (7.7) | | | (1.6) | | | 0.8 | | | 1.6 | | | | | — | | | (6.9) | |

Cash management net flows | | — | | | — | | | — | | | — | | | | | (1.6) | | | (1.6) | |

Total net flows | | (7.7) | | | (1.6) | | | 0.8 | | | 1.6 | | | | | (1.6) | | | (8.5) | |

| | | | | | | | | | | | | | |

Net market change, distributions and other6 | | (19.9) | | | (20.4) | | | (3.1) | | | (4.9) | | | | | (0.5) | | | (48.8) | |

| AUM at September 30, 2023 | | $ | 430.4 | | | $ | 483.1 | | | $ | 254.9 | | | $ | 145.0 | | | | | $ | 60.8 | | | $ | 1,374.2 | |

Supplemental Non-GAAP Financial Measures

As supplemental information, we are providing performance measures for “adjusted operating income,” “adjusted operating margin,” “adjusted net income” and “adjusted diluted earnings per share,” each of which is based on methodologies other than generally accepted accounting principles (“non-GAAP measures”). Management believes these non-GAAP measures are useful indicators of our financial performance and may be helpful to investors in evaluating our relative performance against industry peers.

“Adjusted operating income,” “adjusted operating margin,” “adjusted net income” and “adjusted diluted earnings per share” are defined below, followed by reconciliations of operating income (loss), operating margin, net income attributable to Franklin Resources, Inc. and diluted earnings per share on a U.S. GAAP basis to these non-GAAP measures. Non-GAAP measures should not be considered in isolation from, or as substitutes for, any financial information prepared in accordance with U.S. GAAP, and may not be comparable to other similarly titled measures of other companies. Additional reconciling items may be added in the future to these non-GAAP measures if deemed appropriate.

Adjusted Operating Income

We define adjusted operating income as operating income (loss) adjusted to exclude the following:

•Elimination of operating revenues upon consolidation of investment products.

•Acquisition-related items:

◦Acquisition-related retention compensation.

◦Other acquisition-related expenses including professional fees, technology costs and fair value adjustments related to contingent consideration assets and liabilities.

◦Amortization of intangible assets.

◦Impairment of intangible assets and goodwill, if any.

•Special termination benefits related to workforce optimization initiatives related to past acquisitions and certain initiatives undertaken by the Company.

•Impact on compensation and benefits expense from gains and losses on investments related to deferred compensation plans, which is offset in investment and other income (losses), net.

•Impact on compensation and benefits expense related to minority interests in certain subsidiaries, which is offset in net income (loss) attributable to redeemable noncontrolling interests.

Adjusted Operating Margin

We calculate adjusted operating margin as adjusted operating income divided by adjusted operating revenues. We define adjusted operating revenues as operating revenues adjusted to exclude the following:

•Elimination of operating revenues upon consolidation of investment products.

•Acquisition-related performance-based investment management fees which are passed through as compensation and benefits expense.

•Sales and distribution fees and a portion of investment management fees allocated to cover sales, distribution and marketing expenses paid to the financial advisers and other intermediaries who sell our funds on our behalf.

Adjusted Net Income and Adjusted Diluted Earnings Per Share

We define adjusted net income as net income attributable to Franklin Resources, Inc. adjusted to exclude the following:

•Activities of CIPs.

•Acquisition-related items:

◦Acquisition-related retention compensation.

◦Other acquisition-related expenses including professional fees, technology costs and fair value adjustments related to contingent consideration assets and liabilities.

◦Amortization of intangible assets.

◦Impairment of intangible assets and goodwill, if any.

◦Write off of noncontrolling interests related to the wind down of an acquired business.

◦Interest expense for amortization of Legg Mason debt premium from acquisition-date fair value adjustment.

•Special termination benefits related to workforce optimization initiatives related to past acquisitions and certain initiatives undertaken by the Company.

•Net gains or losses on investments related to deferred compensation plans which are not offset by compensation and benefits expense.

•Net compensation and benefits expense related to minority interests in certain subsidiaries not offset by net income (loss) attributable to redeemable noncontrolling interests.

•Unrealized investment gains and losses.

•Net income tax expense of the above adjustments based on the respective blended rates applicable to the adjustments.

We define adjusted diluted earnings per share as diluted earnings per share adjusted to exclude the per share impacts of the adjustments applied to net income in calculating adjusted net income.

In calculating our non-GAAP measures, we adjust for the impact of CIPs because it is not considered reflective of our underlying results of operations. Acquisition-related items and special termination benefits are excluded to facilitate comparability to other asset management firms. We adjust for compensation and benefits expense related to funded deferred compensation plans because it is partially offset in other income (expense), net. We adjust for compensation and benefits expense and net income (loss) attributable to redeemable noncontrolling interests to reflect the economics of certain profits interest arrangements. Sales and distribution fees and a portion of investment management fees generally cover sales, distribution and marketing expenses and, therefore, are excluded from adjusted operating revenues. In addition, when calculating adjusted net income and adjusted diluted earnings per share we exclude unrealized investment gains and losses included in investment and other income (losses) because the related investments are generally expected to be held long term.

The calculations of adjusted operating income, adjusted operating margin, adjusted net income and adjusted diluted earnings per share are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended | | Twelve Months Ended |

| 30-Sep-24 | | 30-Jun-24 | | 30-Sep-23 | | 30-Sep-24 | | 30-Sep-23 |

Operating income (loss) | | $ | (150.7) | | | $ | 222.5 | | | $ | 338.3 | | | $ | 407.6 | | | $ | 1,102.3 | |

Add (subtract): | | | | | | | | | | |

Elimination of operating revenues upon consolidation of investment products* | | 12.7 | | | 12.3 | | | 11.2 | | | 47.4 | | | 37.5 | |

Acquisition-related retention | | 46.3 | | | 43.7 | | | 56.8 | | | 263.6 | | | 164.9 | |

Compensation and benefits expense from gains (losses) on deferred compensation, net | | 15.7 | | | 1.8 | | | (6.0) | | | 50.5 | | | 20.3 | |

| Other acquisition-related expenses | | 31.8 | | | 33.6 | | | 4.9 | | | 97.4 | | | 50.2 | |

Amortization of intangible assets | | 83.8 | | | 84.0 | | | 86.5 | | | 338.2 | | | 341.1 | |

Impairment of intangible assets | | 389.2 | | | — | | | — | | | 389.2 | | | — | |

Special termination benefits | | 12.0 | | | 16.7 | | | 8.3 | | | 75.8 | | | 63.2 | |

| Compensation and benefits expense related to minority interests in certain subsidiaries | | 10.8 | | | 10.3 | | | 11.7 | | | 43.4 | | | 44.3 | |

| Adjusted operating income | | $ | 451.6 | | | $ | 424.9 | | | $ | 511.7 | | | $ | 1,713.1 | | | $ | 1,823.8 | |

| | | | | | | | | | |

| Total operating revenues | | $ | 2,211.2 | | | $ | 2,122.9 | | | $ | 1,986.1 | | | $ | 8,478.0 | | | $ | 7,849.4 | |

Add (subtract): | | | | | | | | | | |

Acquisition-related pass through performance fees | | (10.5) | | | — | | | (5.6) | | | (97.5) | | | (169.7) | |

Sales and distribution fees | | (368.0) | | | (358.3) | | | (306.4) | | | (1,381.2) | | | (1,203.7) | |

Allocation of investment management fees for sales, distribution and marketing expenses | | (128.9) | | | (122.8) | | | (104.7) | | | (481.9) | | | (409.4) | |

Elimination of operating revenues upon consolidation of investment products* | | 12.7 | | | 12.3 | | | 11.2 | | | 47.4 | | | 37.5 | |

| Adjusted operating revenues | | $ | 1,716.5 | | | $ | 1,654.1 | | | $ | 1,580.6 | | | $ | 6,564.8 | | | $ | 6,104.1 | |

| | | | | | | | | | |

| Operating margin | | (6.8 | %) | | 10.5 | % | | 17.0 | % | | 4.8 | % | | 14.0 | % |

| Adjusted operating margin | | 26.3 | % | | 25.7 | % | | 32.4 | % | | 26.1 | % | | 29.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | | Three Months Ended | | Twelve Months Ended |

| 30-Sep-24 | | 30-Jun-24 | | 30-Sep-23 | | 30-Sep-24 | | 30-Sep-23 |

Net income (loss) attributable to Franklin Resources, Inc. | | $ | (84.7) | | | $ | 174.0 | | | $ | 295.5 | | | $ | 464.8 | | | $ | 882.8 | |

Add (subtract): | | | | | | | | | | |

Net (income) loss of consolidated investment products* | | (2.8) | | | (2.4) | | | 1.6 | | | (3.9) | | | 8.0 | |

Acquisition-related retention | | 46.3 | | | 43.7 | | | 56.8 | | | 263.6 | | | 164.9 | |

| Other acquisition-related expenses | | 32.0 | | | 34.9 | | | 8.9 | | | 107.0 | | | 70.4 | |

Amortization of intangible assets | | 83.8 | | | 84.0 | | | 86.5 | | | 338.2 | | | 341.1 | |

Impairment of intangible assets | | 389.2 | | | — | | | — | | | 389.2 | | | — | |

Special termination benefits | | 12.0 | | | 16.7 | | | 8.3 | | | 75.8 | | | 63.2 | |

| Net gains on deferred compensation plan investments not offset by compensation and benefits expense | | (2.9) | | | (1.1) | | | (1.4) | | | (13.9) | | | (15.5) | |

| Unrealized investment (gains) losses | | (23.9) | | | 31.0 | | | 20.6 | | | (51.5) | | | (2.6) | |

Interest expense for amortization of debt premium | | (5.2) | | | (6.4) | | | (6.4) | | | (24.4) | | | (25.4) | |

| Net compensation and benefits expense related to minority interests in certain subsidiaries not offset by net income attributable to redeemable noncontrolling interests | | 2.3 | | | 2.8 | | | 1.0 | | | 3.5 | | | 0.1 | |

| Net income tax expense of adjustments | | (130.9) | | | (50.8) | | | (44.4) | | | (271.7) | | | (154.8) | |

| Adjusted net income | | $ | 315.2 | | | $ | 326.4 | | | $ | 427.0 | | | $ | 1,276.7 | | | $ | 1,332.2 | |

| | | | | | | | | | |

Diluted earnings (loss) per share | | $ | (0.19) | | | $ | 0.32 | | | $ | 0.58 | | | $ | 0.85 | | | $ | 1.72 | |

Adjusted diluted earnings per share | | 0.59 | | | 0.60 | | | 0.84 | | | 2.39 | | | 2.60 | |

__________________

* The impact of CIPs is summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended | | Twelve Months Ended |

| 30-Sep-24 | | 30-Jun-24 | | 30-Sep-23 | | 30-Sep-24 | | 30-Sep-23 |

Elimination of operating revenues upon consolidation | | $ | (12.7) | | | $ | (12.3) | | | $ | (11.2) | | | $ | (47.4) | | | $ | (37.5) | |

Other income, net | | 32.5 | | | 42.0 | | | 21.4 | | | 104.5 | | | 88.8 | |

Less: income attributable to noncontrolling interests | | 17.0 | | | 27.3 | | | 11.8 | | | 53.2 | | | 59.3 | |

| Net income (loss) | | $ | 2.8 | | | $ | 2.4 | | | $ | (1.6) | | | $ | 3.9 | | | $ | (8.0) | |

| | | | | | | | | | |

Notes

1.Net income (loss) represents net income (loss) attributable to Franklin Resources, Inc.

2.“Adjusted net income,” “adjusted diluted earnings per share,” “adjusted operating income” and “adjusted operating margin” are based on methodologies other than generally accepted accounting principles. See “Supplemental Non-GAAP Financial Measures” for definitions and reconciliations of these measures.

3.Average AUM represents monthly average AUM.

4.Includes our direct investments in CIPs of $1.1 billion, approximately $355 million of employee-owned and other third-party investments made through partnerships, approximately $289 million of investments that are subject to long-term repurchase agreements and other net financing arrangements, and approximately $441 million of cash and investments related to deferred compensation plans.

5.During the quarter ended March 31, 2024, the Company identified that it did not eliminate the investment income from certain consolidated limited partnerships for the fiscal year ended September 30, 2023, resulting in offsetting adjustments to investment and other income, net and net income attributable to nonredeemable noncontrolling interest. For comparability, the Company has revised the comparative prior period amounts in the Consolidated Statements of Income. There was no impact to operating income, net income attributable to Franklin Resources, Inc. or earnings per share.

6.Net market change, distributions and other includes appreciation (depreciation), distributions to investors that represent return on investments and return of capital, and foreign exchange revaluation.

7.India region is included in Europe, Middle East and Africa.

Franklin Resources, Inc. (NYSE: BEN) is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 150 countries. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the Company offers specialization on a global scale, bringing extensive capabilities in equity, fixed income, alternatives and multi-asset solutions. With more than 1,500 investment professionals, and offices in major financial markets around the world, the California-based company has over 75 years of investment experience and over $1.6 trillion in AUM as of September 30, 2024. The Company posts information that may be significant for investors in the Investor Relations and News Center sections of its website, and encourages investors to consult those sections regularly. For more information, please visit investors.franklinresources.com.

Forward-Looking Statements

Some of the statements herein may include forward-looking statements that reflect our current views with respect to future events, financial performance and market conditions. Such statements are provided under the “safe harbor” protection of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and generally can be identified by words or phrases written in the future tense and/or preceded by words such as “anticipate,” “believe,” “could,” “depends,” “estimate,” “expect,” “intend,” “likely,” “may,” “plan,” “potential,” “seek,” “should,” “will,” “would,” or other similar words or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors that may cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements, including market and volatility risks, investment performance and reputational risks, global operational risks, competition and distribution risks, third-party risks, technology and security risks, human capital risks, cash management risks, and legal and regulatory risks. While forward-looking statements are our best prediction at the time that they are made, you should not rely on them and are cautioned against doing so. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other possible future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. They are neither statements of historical fact nor guarantees or assurances of future performance. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them.

These and other risks, uncertainties and other important factors are described in more detail in our recent filings with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 and our subsequent Quarterly Reports on Form 10-Q. If a circumstance occurs after the date of this press release that causes any of our forward-looking statements to be inaccurate, whether as a result of new information, future developments or otherwise, we undertake no obligation to announce publicly the change to our expectations, or to make any revision to our forward-looking statements, to reflect any change in assumptions, beliefs or expectations, or any change in events, conditions or circumstances upon which any forward-looking statement is based, unless required by law.

# # #

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

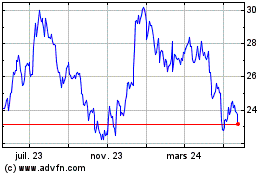

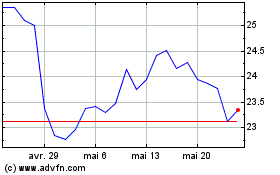

Franklin Resources (NYSE:BEN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Franklin Resources (NYSE:BEN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024