Intercontinental Exchange, Inc. (NYSE: ICE) and Black Knight,

Inc. (NYSE: BKI) announced today that, amid progress toward a

potential resolution, they have jointly stipulated, along with the

Federal Trade Commission (FTC), to dismiss the preliminary

injunction proceeding in the United States District Court seeking

to block the close of ICE’s previously announced acquisition of

Black Knight.

The joint stipulation dismisses the federal court complaint and

dissolves the temporary restraining order that was previously in

place, allowing ICE, Black Knight and the FTC to continue working

toward a final settlement agreement resolving the FTC’s challenge

to the acquisition.

In connection with the stipulation, ICE and Black Knight have

entered into an agreement with the FTC staff (the “Timing

Agreement”) to refrain from closing ICE’s acquisition of Black

Knight before 11:59 p.m. EDT on the tenth calendar day after the

parties sign an Agreement Containing Consent Order (ACCO) for

submission to the FTC. The Timing Agreement provides certain

deadlines and milestones for a mutually acceptable ACCO by August

25, 2023 (subject to extension in certain circumstances); if the

parties do not sign an ACCO by that time, any party may

unilaterally terminate the Timing Agreement with three calendar

days written notice to all other parties.

The agreement follows the announced divestiture agreements for

Black Knight’s Optimal Blue business and Empower loan origination

system (LOS) business, which were announced earlier this year in

July and March, respectively. ICE and Black Knight entered into the

divestiture agreements in connection with efforts to secure

regulatory clearance for ICE’s proposed acquisition of Black

Knight.

The divestiture transactions are subject to the closing of ICE’s

acquisition of Black Knight and other customary closing

conditions.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks to

connect people to opportunity. We provide financial technology and

data services across major asset classes that offer our customers

access to mission-critical workflow tools that increase

transparency and operational efficiencies. We operate exchanges,

including the New York Stock Exchange, and clearing houses that

help people invest, raise capital and manage risk across multiple

asset classes. Our comprehensive fixed income data services and

execution capabilities provide information, analytics and platforms

that help our customers capitalize on opportunities and operate

more efficiently. At ICE Mortgage Technology, we are transforming

and digitizing the U.S. residential mortgage process, from consumer

engagement through loan registration. Together, we transform,

streamline and automate industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

About Black Knight

Black Knight, Inc. (NYSE: BKI) is an award-winning software,

data and analytics company that drives innovation in the mortgage

lending and servicing and real estate industries, as well as the

capital and secondary markets. Businesses leverage our robust,

integrated solutions across the entire homeownership life cycle to

help retain existing customers, gain new customers, mitigate risk

and operate more effectively.

Our clients rely on our proven, comprehensive, scalable products

and our unwavering commitment to delivering superior client support

to achieve their strategic goals and better serve their customers.

For more information on Black Knight, please visit

www.blackknightinc.com.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder, which involve inherent risks and

uncertainties. Any statements about Black Knight’s or ICE’s plans,

objectives, expectations, strategies, beliefs, or future

performance or events constitute forward-looking statements. Such

statements are identified as those that include words or phrases

such as “believes,” “expects,” “anticipates,” “plans,” “trend,”

“objective,” “continue,” or similar expressions or future or

conditional verbs such as “will,” “would,” “should,” “could,”

“might,” “may,” or similar expressions. Forward-looking statements

involve known and unknown risks, uncertainties, assumptions,

estimates, and other important factors that change over time and

could cause actual results to differ materially from any results,

performance, or events expressed or implied by such forward-looking

statements. Such forward-looking statements include but are not

limited to statements about the benefits of the proposed

acquisition of Black Knight by ICE (the “Transaction”), including

future financial and operating results, Black Knight’s or ICE’s

plans, objectives, expectations and intentions, the expected timing

of completion of the Transaction, the expected form and timing of

debt financing to fund the Transaction and other statements that

are not historical facts.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. In addition to factors previously disclosed

in Black Knight’s and ICE’s reports filed with the U.S. Securities

and Exchange Commission (the “SEC”) and those identified elsewhere

in this communication, the following factors, among others, could

cause actual results to differ materially from forward-looking

statements or historical performance: the occurrence of any event,

change, or other circumstance that could give rise to the right of

Black Knight or ICE to terminate the definitive merger agreement

governing the terms and conditions of the Transaction, as amended

by the parties on March 7, 2023; the possibility that the Federal

Trade Commission, Black Knight and ICE do not reach a mutually

acceptable consent order that would allow the Transaction to close

in a timely manner or at all; the outcome of any legal proceedings

that may be instituted against Black Knight or ICE, including any

further litigation by the Federal Trade Commission; the possibility

that the Transaction (or the proposed divestiture of Black Knight’s

Optimal Blue business or its Empower loan origination system (LOS))

does not close when expected or at all because required regulatory

or other approvals and other conditions to closing are not received

or satisfied on a timely basis or at all (and the risk that such

approvals may result in the imposition of conditions that could

adversely affect Black Knight or ICE or the expected benefits of

the Transaction); the risk that the benefits from the Transaction

may not be fully realized or may take longer to realize than

expected, including as a result of changes in, or problems arising

from, general economic, political and market conditions, interest

and exchange rates, laws and regulations and their enforcement, and

the degree of competition in the geographic and business areas in

which Black Knight and ICE operate; the ability to promptly and

effectively integrate the businesses of Black Knight with those of

ICE; the possibility that the Transaction may be more expensive to

complete than anticipated, including as a result of unexpected

factors or events; reputational risk and potential adverse

reactions of Black Knight’s or ICE’s customers, employees or other

business partners, including those resulting from the announcement

or completion of the Transaction; the diversion of management’s

attention and time from ongoing business operations and

opportunities on merger-related matters; ICE’s ability to complete

the contemplated debt financing on a timely basis, on favorable

terms or at all; and the impact of the global COVID-19 pandemic on

Black Knight’s or ICE’s businesses, the ability to complete the

Transaction or any of the other foregoing risks.

These factors are not necessarily all of the factors that could

cause Black Knight’s or ICE’s actual results, performance, or

achievements to differ materially from those expressed in or

implied by any of the forward-looking statements. Other unknown or

unpredictable factors also could harm Black Knight’s or ICE’s

results.

All forward-looking statements attributable to Black Knight or

ICE, or persons acting on Black Knight’s or ICE’s behalf, are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date they are made and Black Knight and ICE do not undertake or

assume any obligation to update publicly any of these statements to

reflect actual results, new information or future events, changes

in assumptions, or changes in other factors affecting

forward-looking statements, except to the extent required by

applicable law. If Black Knight or ICE update one or more

forward-looking statements, no inference should be drawn that Black

Knight or ICE will make additional updates with respect to those or

other forward-looking statements. Further information regarding

Black Knight, ICE and factors which could affect the

forward-looking statements contained herein can be found in Black

Knight’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 and its other filings with the SEC, and in ICE’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022 and its other filings with the SEC.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Agreement and Plan of Merger, dated as of

May 4, 2022, as amended by Amendment No. 1 to the Agreement and

Plan of Merger, dated as of March 7, 2023, among Black Knight, ICE

and Sand Merger Sub Corporation (the “Amended Merger Agreement”),

ICE has filed with the SEC a post-effective amendment to the

Registration Statement on Form S-4 (as amended by the

post-effective amendment, the “Amended Registration Statement”).

The Amended Registration Statement includes an updated proxy

statement of Black Knight that also constitutes a prospectus of

ICE. The Amended Registration Statement was declared effective by

the SEC on March 30, 2023, and Black Knight commenced mailing the

updated definitive proxy statement/prospectus to its stockholders

on or about March 31, 2023.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE AMENDED

REGISTRATION STATEMENT ON FORM S-4 AND THE UPDATED PROXY

STATEMENT/PROSPECTUS INCLUDED WITHIN THE AMENDED REGISTRATION

STATEMENT, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE

INTO THE UPDATED PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION REGARDING BLACK KNIGHT, ICE, THE TRANSACTION

AND RELATED MATTERS.

Investors and security holders may obtain free copies of these

documents and other documents filed with the SEC by Black Knight or

ICE through the website maintained by the SEC at http://www.sec.gov

or from Black Knight at its website, www.blackknightinc.com, or

from ICE at its website, www.theice.com. Documents filed with the

SEC by Black Knight will be available free of charge by accessing

Black Knight’s website at www.blackknightinc.com under the tab

“Investors” and then under the heading “Financials—SEC Filings” or,

alternatively, by directing a request by mail or telephone to Black

Knight, Inc., 601 Riverside Avenue, Jacksonville, Florida 32204,

Attention: Investor Relations, (904) 854-5100, and documents filed

with the SEC by ICE will be available free of charge by accessing

ICE’s website at www.theice.com and following the link for

“Investor Relations” or, alternatively, by directing a request by

mail or telephone to Intercontinental Exchange, Inc., 5660 New

Northside Drive, Third Floor, Atlanta, Georgia 30328, Attention:

Investor Relations, (770) 857-4700, or by email to

investors@ice.com.

NO OFFER OR SOLICITATION

This communication is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote of approval, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended.

Category: Mortgage Technology

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230807499578/en/

ICE Media Contact:

Josh King (212) 656 2490 josh.king@ice.com

Damon Leavell damon.leavell@ice.com (212) 323-8587

media@ice.com

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882 investors@ice.com

Black Knight Media Contact:

Michelle Kersch michelle.kersch@bkfs.com (904) 854-5043

Black Knight Investor Contact:

Steve Eagerton steven.eagerton@bkfs.com (904) 854-3683

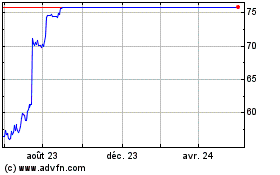

Black Knight (NYSE:BKI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Black Knight (NYSE:BKI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025