Filed Pursuant to Rule 424(b)(3)

Registration File No.: 333-263527

BLACKROCK HEALTH SCIENCES TRUST

Supplement dated June 26, 2023 to the

Prospectus and Statement of Additional Information (“SAI”),

each dated April 25, 2022, as supplemented on July 18, 2022 and January 3, 2023

This supplement amends certain information in the Prospectus and SAI, each dated April 25, 2022, as supplemented on July 18, 2022 and

January 3, 2023, of BlackRock Health Sciences Trust (the “Trust”). Unless otherwise indicated, all information included in the Prospectus and SAI that is not inconsistent with the information set forth in this supplement remains

unchanged. Capitalized terms not otherwise defined in this supplement have the same meanings as in the Prospectus and SAI, as applicable.

Effective

June 27, 2023, the following changes are made to the Fund’s Prospectus and SAI:

The section of the Prospectus entitled “Management

of the Trust — Portfolio Managers” is deleted in its entirety and replaced with the following:

Portfolio Managers

The members of the portfolio management team who are primarily responsible for

the day-to-day management of the Trust’s portfolio are as follows:

Erin Xie, PhD, MBA, Managing Director and portfolio manager, is the head of the Health Sciences team, part of BlackRock’s Active Equity Group. She

is the portfolio manager for the Health Sciences equity portfolios. Ms. Xie’s service with the firm dates back to 2001, including her years with State Street Research & Management (SSRM), which merged with BlackRock in 2005. At

SSRM, she was a Senior Vice President and portfolio manager responsible for managing the State Street Health Sciences Fund. Prior to joining SSRM in 2001, Ms. Xie was a research associate with Sanford Bernstein covering the pharmaceutical

industry from 1999. From 1994 until 1997, she was a post doctoral research scientist at Columbia University. Ms. Xie earned a BS degree in chemistry from Beijing University in 1988, a PhD degree in Biochemistry from the University of

California, Los Angeles, in 1993 and a MBA degree from the Massachusetts Institute of Technology Sloan School of Management in 1999.

Kyle G.

McClements, CFA, Managing Director, is Head of the Equity Derivatives team within BlackRock’s Fundamental Equity division. He is a portfolio manager for equity derivatives overlay and hedging assignments, including BlackRock’s closed-end funds. Mr. McClements’ service with the firm dates back to 2004, including his years with State Street Research & Management (SSRM), which merged with

BlackRock in 2005. At SSRM, Mr. McClements was a Vice President and senior derivatives strategist responsible for equity derivative strategy and trading in the Quantitative Equity Group at State Street Research. Prior to joining State Street

Research in 2004, Mr. McClements was a senior trader/analyst at Deutsche Asset Management, responsible for derivatives, equity program, technology and energy sector, and foreign exchange trading. Mr. McClements began his career in 1994 as

a derivatives analyst with Donaldson Lufkin & Jenrette responsible for pricing and performance analytics for the derivatives trading desk. Mr. McClements earned a BA degree in economics and political science from the University of

Pennsylvania in 1993 and an MBA degree in finance and corporate accounting from the University of Rochester in 1998.

Christopher M. Accettella,

Director, is a member of the Equity Derivatives team within BlackRock’s Fundamental Active Equity division. He is a portfolio manager for equity derivatives overlay and hedging assignments, including BlackRock’s equity closed-end funds. Prior to joining BlackRock in 2005, Mr. Accettella was an institutional sales trader with American Technology Research. From 2001 to 2003, he was with Deutsche Asset

Management where he was responsible for derivatives and program trading. Prior to that, he was a senior associate in the Pacific Basin Equity Group at Scudder Investments Singapore Limited. Mr. Accettella began his

investment career in 1997 as a portfolio analyst in the European Equity group of Scudder Kemper Investments, Inc. Mr. Accettella earned a BA degree in economics and Asian studies from

Colgate University in 1997.

Xiang Liu, PhD, Director, is a member of the Health Sciences team, part of Blackrock’s Active Equity Group. He is

a co-portfolio manager for the Health Sciences equity portfolios and is responsible for coverage of the medical devices sector. Prior to joining BlackRock in 2008, Mr. Liu was a partner and biotech

analyst at Mehta Partners. From 2002 to 2005, he was a Director in the corporate development department at Cubist Pharmaceuticals. Mr. Liu began his investment career in 2000 at the Boston Consulting Group as a health care consultant.

Mr. Liu earned a BS degree in Chemistry from the University of Science & Technology, China in 1993, a PhD degree in Chemistry from Yale University in 1997, and a MBA degree in finance, strategy, and accounting from the University of

Chicago in 2000.

The SAI provides additional information about each portfolio manager’s compensation, other accounts managed by the portfolio

management team and the ownership of the Trust’s securities by each portfolio manager.

The section of the SAI entitled “Management of the

Trust — Portfolio Management” is deleted in its entirety and replaced with the following:

Portfolio Management

Portfolio Manager Assets Under Management

The following

table sets forth information about funds and accounts other than the Trust for which the portfolio managers are primarily responsible for the day-to-day portfolio

management as of December 31, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(ii) Number of Other Accounts

Managed and Assets by Account Type |

|

(iii) Number of Other Accounts and

Assets for Which Advisory Fee is

Performance-Based |

(i) Name of

Portfolio Manager |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

|

Other

Registered

Investment

Companies |

|

Other

Pooled

Investment

Vehicles |

|

Other

Accounts |

| Erin Xie, PhD, MBA |

|

5

$14.98 Billion |

|

3

$15.02 Billion |

|

1

$1.95 Billion |

|

0

$0 |

|

1

$54.29 Million |

|

1

$1.95 Billion |

| Kyle G. McClements, CFA |

|

12

$18.55 Billion |

|

7

$1.36 Billion |

|

0

$0 |

|

0

$0 |

|

0

$0 |

|

0

$0 |

| Christopher Accettella |

|

12

$18.55 Billion |

|

4

$742.2 Million |

|

0

$0 |

|

0

$0 |

|

0

$0 |

|

0

$0 |

| Xiang Liu |

|

5

$14.98 Billion |

|

2

$14.96 Billion |

|

1

$1.95 Billion |

|

0

$0 |

|

0

$0 |

|

1

$1.95 Billion |

Portfolio Manager Compensation Overview

The discussion below describes the portfolio managers’ compensation as of December 31, 2021.

The Advisor’s financial arrangements with its portfolio managers, its competitive compensation and its career path emphasis at all levels reflect the

value senior management places on key resources. Compensation may include a variety of components and may vary from year to year based on a number of factors. The principal components of compensation include a base salary, a performance-based

discretionary bonus, participation in various benefits programs and one or more of the incentive compensation programs established by the Advisor.

- 2 -

Base Compensation. Generally, portfolio managers receive base compensation based on their position

with the firm.

Discretionary Incentive Compensation.

Ms. Xie and Mr. Liu

Generally, discretionary

incentive compensation for Active Equity portfolio managers is based on a formulaic compensation program. BlackRock’s formulaic portfolio manager compensation program is based on team revenue and pre-tax

investment performance relative to appropriate competitors or benchmarks over 1-, 3- and 5-year performance periods, as

applicable. In most cases, these benchmarks are the same as the benchmark or benchmarks against which the performance of the funds or other accounts managed by the portfolio managers are measured. BlackRock’s Chief Investment Officers determine

the benchmarks or rankings against which the performance of funds and other accounts managed by each portfolio management team is compared and the period of time over which performance is evaluated. With respect to the portfolio manager, such

benchmarks for the Trust and other accounts are: FTSE 3-month T-bill Index; MSCI ACWI 25% Call Overwrite Index; MSCI All Country World Index (Net Total Return); MSCI

WRLD HealthCare ND; Russell 3000 HealthCare Index.

A smaller element of portfolio manager discretionary compensation may include consideration of:

financial results, expense control, profit margins, strategic planning and implementation, quality of client service, market share, corporate reputation, capital allocation, compliance and risk control, leadership, technology and innovation. These

factors are considered collectively by BlackRock management and the relevant Chief Investment Officers.

Messrs. Accettella and McClements

Discretionary incentive compensation is a function of several components: the performance of BlackRock, the performance of the portfolio manager’s group

within the Advisor, the investment performance, including risk-adjusted returns, of the firm’s assets or strategies under management or supervision by that portfolio manager, and/or the individual’s performance and contribution to the

overall performance of these portfolios and the Advisor. Among other things, BlackRock’s Chief Investment Officers make a subjective determination with respect to each portfolio manager’s compensation based on the performance of the Funds,

other accounts or strategies managed by each portfolio manager. Performance is generally measured on a pre-tax basis over various time periods including 1-, 3- and 5- year periods, as applicable. The performance of some funds, other accounts or strategies may not be measured against a specific benchmark.

Distribution of Discretionary Incentive Compensation. Discretionary incentive compensation is distributed to portfolio managers in a combination

of cash, deferred BlackRock stock awards, and/or deferred cash awards that notionally track the return of certain Advisor investment products.

Portfolio

managers receive their annual discretionary incentive compensation in the form of cash. Portfolio managers whose total compensation is above a specified threshold also receive deferred BlackRock stock awards annually as part of their discretionary

incentive compensation. Paying a portion of discretionary incentive compensation in the form of deferred BlackRock stock puts compensation earned by a portfolio manager for a given year “at risk” based on the Advisor’s ability to

sustain and improve its performance over future periods. In some cases, additional deferred BlackRock stock may be granted to certain key employees as part of a long-term incentive award to aid in retention, align interests with long-term

shareholders and motivate performance. Deferred BlackRock stock awards are generally granted in the form of BlackRock restricted stock units that vest pursuant to the terms of the applicable plan and, once vested, settle in BlackRock common stock.

The portfolio managers of this Trust have deferred BlackRock stock awards.

- 3 -

For certain portfolio managers, a portion of the discretionary incentive compensation is also distributed in the

form of deferred cash awards that notionally track the returns of select Advisor investment products they manage, which provides direct alignment of portfolio manager discretionary incentive compensation with investment product results. Deferred

cash awards vest ratably over a number of years and, once vested, settle in the form of cash. Only portfolio managers who manage specified products and whose total compensation is above a specified threshold are eligible to participate in the

deferred cash award program.

Other Compensation Benefits. In addition to base salary and discretionary incentive compensation,

portfolio managers may be eligible to receive or participate in one or more of the following:

Incentive Savings Plans — BlackRock

has created a variety of incentive savings plans in which BlackRock employees are eligible to participate, including a 401(k) plan, the BlackRock Retirement Savings Plan (RSP), and the BlackRock Employee Stock Purchase Plan (ESPP). The employer

contribution components of the RSP include a company match equal to 50% of the first 8% of eligible pay contributed to the plan capped at $5,000 per year, and a company retirement contribution equal to

3-5% of eligible compensation up to the Internal Revenue Service (“IRS”) limit ($290,000 for 2021). The RSP offers a range of investment options, including registered investment companies and

collective investment funds managed by the firm. BlackRock contributions follow the investment direction set by participants for their own contributions or, absent participant investment direction, are invested into a target date fund that

corresponds to, or is closest to, the year in which the participant attains age 65. The ESPP allows for investment in BlackRock common stock at a 5% discount on the fair market value of the stock on the purchase date. Annual participation in the

ESPP is limited to the purchase of 1,000 shares of common stock or a dollar value of $25,000 based on its fair market value on the purchase date. All of the eligible portfolio managers are eligible to participate in these plans.

Securities Ownership of Portfolio Managers

As of

December 31, 2021, the end of the Trust’s most recently completed fiscal year end, the dollar range of securities beneficially owned by each portfolio manager in the Trust is shown below:

|

|

|

|

|

|

| Portfolio Manager |

|

Dollar Range of Equity Securities

of the Trust Beneficially Owned |

| Erin Xie, PhD, MBA |

|

Over $1,000,000 |

| Kyle G. McClements, CFA |

|

$100,001-$500,000 |

| Christopher Accettella |

|

$50,001-$100,000 |

| Xiang Liu |

|

None |

Potential Material Conflicts of Interest

The Advisor has built a professional working environment, firm-wide compliance culture and compliance procedures and systems designed to protect against

potential incentives that may favor one account over another. The Advisor has adopted policies and procedures that address the allocation of investment opportunities, execution of portfolio transactions, personal trading by employees and other

potential conflicts of interest that are designed to ensure that all client accounts are treated equitably over time. Nevertheless, the Advisor furnishes investment management and advisory services to numerous clients in addition to the Trust, and

the Advisor may, consistent with applicable law, make investment recommendations to other clients or accounts (including accounts which are hedge funds or have performance or higher fees paid to the Advisor, or in which portfolio managers have a

personal interest in the receipt of such fees), which may be the same as or different from those made to the Trust. In addition, BlackRock, its affiliates and significant shareholders and any officer, director, shareholder or employee may or may not

have an interest in the securities whose purchase and sale the Advisor recommends to the Trust. BlackRock, or any of its affiliates or significant shareholders, or any officer, director,

- 4 -

shareholder, employee or any member of their families may take different actions than those recommended to the Trust by the Advisor with respect to the same securities. Moreover, the Advisor may

refrain from rendering any advice or services concerning securities of companies of which any of BlackRock’s (or its affiliates’ or significant shareholders’) officers, directors or employees are directors or officers, or companies as

to which BlackRock or any of its affiliates or significant shareholders or the officers, directors and employees of any of them has any substantial economic interest or possesses material non-public

information. Certain portfolio managers also may manage accounts whose investment strategies may at times be opposed to the strategy utilized for a fund. It should also be noted that Ms. Xie and Mr. Liu may be managing hedge fund and/or

long only accounts, or may be part of a team managing hedge fund and/or long only accounts, subject to incentive fees. Ms. Xie and Mr. Liu may therefore be entitled to receive a portion of any incentive fees earned on such accounts.

As a fiduciary, the Advisor owes a duty of loyalty to its clients and must treat each client fairly. When the Advisor purchases or sells securities for more

than one account, the trades must be allocated in a manner consistent with its fiduciary duties. The Advisor attempts to allocate investments in a fair and equitable manner among client accounts, with no account receiving preferential treatment. To

this end, BlackRock has adopted policies that are intended to ensure reasonable efficiency in client transactions and provide the Advisor with sufficient flexibility to allocate investments in a manner that is consistent with the particular

investment discipline and client base, as appropriate.

Shareholders should retain this Supplement for future reference.

- 5 -

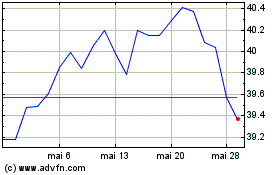

BlackRock Health Sciences (NYSE:BME)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

BlackRock Health Sciences (NYSE:BME)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024