Notice Of

Exempt Solicitation: (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT:

Berkshire Hathaway Inc.

NAME OF PERSON

RELYING ON EXEMPTION: Majority Action

ADDRESS OF

PERSON RELYING ON EXEMPTION: PO Box 4831, Silver Spring, MD 20914

Written materials

are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this

filer under the terms of the Rule but is made voluntarily. |

|

Berkshire

Hathaway Inc. NYSE:BRK: Due to the company’s

FAILURE to:

| ● | Commit

to implementing the recommendations of the Task Force on Climate-Related Financial Disclosures

(TCFD) framework, |

| ● | Announce

a full phase-out of coal-fired generation or the end of unrestricted coal underwriting from

its insurance business in a manner that is consistent with the IEA’s Below 2°C

Scenario, and |

| ● | Set

a company-wide ambition to achieve net zero greenhouse gas (GHG) emissions by 2050; |

Vote

AGAINST:

| ● | Warren

E. Buffett (Item 1.1), |

| ● | Charles

T. Munger (Item 1.2), |

| ● | Gregory

E. Abel (Item 1.3), |

| ● | Howard

G. Buffett (1.4), |

| ● | Kenneth

I. Chenault (1.7), |

| ● | Christopher

C. Davis (1.8), |

| ● | Susan

L. Decker (Item 1.9), |

| ● | Charlotte

Guyman (1.10), |

| ● | Thomas

S. Murphy, Jr. (Item 1.12), |

| ● | Ronald

L. Olson (Item 1.13), |

| ● | Wallace

R. Weitz (Item 1.14), |

| ● | Meryl

B. Witmer (Item 1.15). |

The

physical and financial risks posed by climate change to long-term investors are systemic, portfolio-wide, unhedgeable and undiversifiable.

Therefore, the actions of companies that fail to align to limiting

warming to 1.5°C pose risks to the financial system as a whole, and to investors’ entire portfolios. See www.proxyvoting.majorityaction.us

for more information regarding Majority Action’s Proxy Voting for a 1.5°C World initiative and the transformation

required in key industries.

Berkshire

Hathaway Inc. is a holding company owning subsidiaries engaged in numerous diverse business activities. Among

Berkshire Hathaway’s most important subsidiaries are insurance businesses conducted on both a primary basis and a reinsurance basis

and a group of utility and energy generation and gas distribution businesses, organized under Berkshire Hathaway Energy, of which Berkshire

Hathaway currently has a 92% ownership interest.1

Berkshire

Hathaway Energy (BHE) had the fourth-highest CO2 emission (CO2 MT) among electric power producers in the U.S.2

while generating the ninth-most electricity.3

BHE’s generation mix is primarily coal-fueled,

and in 2022 BHE relied on fossil fuel sources for 58% of its total generation.4

The company is among the 166 target companies named by Climate Action 100+ as the most significant global emitters and “key

to driving the global net zero emissions transition.”5

Berkshire

Hathaway’s insurance operation was recently identified as a top provider of insurance coverage to the coal industry

by Insure Our Future.6

Insurance companies are in a unique position to accelerate the transition to a renewable energy future. Fossil fuel projects

and operations require insurance to initiate and operate. Many major insurance companies have backed away from insuring new coal projects.7

A critical mass of insurers have begun limiting coverage for conventional oil and gas projects,8

including Chubb Limited,9

one of the world's most significant publicly-traded property and casualty insurers.

Investors

should hold the entire board of directors accountable at companies that have failed to set a net zero ambition that

covers corporate-wide GHG emissions and disclose the impacts of climate-related risks and opportunities on the organization’s businesses

and strategy.

In

2023, we have updated our metrics to more closely align with the Climate Action 100+ Net Zero Benchmark Indicators,

while still focusing on the core pillars of target setting, disclosure and measurement, capital allocation, and policy influence. This

allows for a more standardized assessment across companies that is broadly accepted by investors.

Target

setting

| Climate

Action 100+ Net Zero Benchmark Indicators |

|

| Disclosure

Indicator 1.1 |

The

company has set an ambition to achieve net zero GHG emissions by 2050 or sooner. |

X |

| |

Disclosure

Indicator 1.1A |

The

company has made a qualitative net zero GHG emissions ambition statement that explicitly includes at least 95% of its scope 1 and

2 emissions. |

X |

| |

Disclosure

Indicator 1.1B |

The

company’s net zero GHG emissions ambition covers the most relevant scope 3 GHG emissions categories for the company’s

sector, where applicable. |

X |

| Disclosure

Indicator 3.1 |

The

company has set a target for reducing its GHG emissions by between 2026 and 2035 on a clearly defined scope of emissions. |

X |

| Disclosure

Indicator 3.2 |

The

medium-term (2026 to 2035) GHG reduction target covers at least 95% of scope 1 & 2 emissions and the most relevant scope 3 emissions

(where applicable). |

X |

| |

Disclosure

Indicator 3.2A |

The

company has specified that this target covers at least 95% of its total scope 1 and 2 emissions. |

X |

| |

Disclosure

Indicator 3.2B |

If

the company has set a scope 3 GHG emissions target, it covers the most relevant scope 3 emissions categories for the company’s

sector (for applicable sectors), and the company has published the methodology used to establish any scope 3 target. |

X |

| Disclosure

Indicator 3.3 |

The

target (or, in the absence of a target, the company’s latest disclosed GHG emissions intensity) is aligned with the goal of

limiting global warming to 1.5°C. |

X |

Berkshire

Hathaway has not announced a net zero by 2050 ambition for its insurance operations. A crucial step for any insurer in aligning its activities

to limiting warming to 1.5°C is committing to reducing its scope 3 insured emissions to net zero by 2050 at the latest. BHE’s

2021 statement of “striving to achieve net zero greenhouse gas emissions by 2050 in a manner our customers can afford, our regulators

will allow and technology advances support”10

does not apply to the company as a whole, making Berkshire Hathaway one of the few Climate Action 100+ U.S.-based companies

without a net zero ambition.11

BHE’s

medium-term target is only a 50% reduction in CO2 emissions by 2030 from 2005 levels.12

When applied to the company’s U.S. utilities, its decarbonization trajectory does not

align with the IEA’s 2035 deadline for net zero emissions from electricity generation in advanced economies.13

Furthermore, according to its most recent CDP disclosure, BHE does not account for its scope

3 emissions.14

As a result, BHE’s U.S. utilities15

lag behind its vertically integrated electric and gas utilities peers that have incorporated

certain scope 3 carbon emissions, such as upstream methane and carbon emissions related to purchased fossil gas and downstream carbon

emissions from customers’ consumption, within net zero goals.16

17

BHE

Pipeline Group transported approximately 15% of the total fossil gas consumed in the U.S. in 2021.18 That

same year, BHE’s natural gas transmission and storage operations reported 396,155 metric tons of methane expressed as CO2 equivalence/year

combined.19 Methane

emissions significantly contribute to global temperature rise,20 and

transmission and storage operators must disclose targets that account for methane emissions aligned with the goal of limiting global

warming to 1.5°C.

Disclosure

and Measurement

| Climate

Action 100+ Net Zero Benchmark Indicators |

| Disclosure

Indicator 10.1 |

The

company has committed to implement the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). |

X |

Berkshire Hathaway

has not committed to implementing the recommendations of the TCFD framework. Among the 45 U.S.-based Climate Action 100+ focus

companies, Berkshire Hathaway is the only one that has failed to take the initial step of disclosing the impacts of climate-related risk

and opportunities on the organization’s businesses and strategy.21

In response to a shareholder proposal requesting the publication of an annual physical and transitional climate-related

risk and opportunities assessment in accordance with TCFD recommendations,” the company’s Board recommended against the proposal

and referred shareholders to operating company reports that are linked on its website.22

Capital

allocation and investment plans

| Climate

Action 100+ Net Zero Benchmark Indicators |

| Capital

Allocation Alignment Assessment (Carbon Tracker) 1: Coal Phase-Out |

Has

the company announced a full phase-out of coal units by 2040 that is consistent with Carbon Tracker Initiative's (CTI’s) interpretation

of the International Energy Agency’s (IEA’s) Beyond 2°C Scenario (B2DS)? |

X |

| Capital

Allocation Alignment Assessment (Carbon Tracker) 2: Gas Phase-Out |

Has

the company announced a full phase-out of gas units by 2050 that is consistent with CTI's interpretation of the IEA’s B2DS? |

X |

BHE has not

announced a full phase-out of its coal units. In fact, the company plans to generate electricity from coal-fired plants through 2049.23

According to Carbon Tracker data within the Climate Action 100+ Benchmark, 42% of BHE’s operating and planned coal

capacity is misaligned with the IEA’s B2DS, let alone a 1.5°C scenario which would require even faster closure timelines.24

Additionally,

BHE projects fossil gas will account for more than 20% of its power generation capacity in 2030,25

and it will remain a part of the company’s energy mix through 2050.26

Consequently, 42% of BHE’s operating and planned gas capacity is misaligned with the IEA’s B2DS, let alone a

1.5°C scenario.27

Fossil

fuel exclusion policies

| Insure

Our Future 2022 Scorecard Indicator |

| Fossil

fuel exclusion policies |

Robust

exclusion policies and exit strategies to immediately end all insurance coverage for coal projects and companies, end insurance for

new oil or gas expansion projects, and begin phasing out support for oil and gas companies, in line with a 1.5°C pathway |

X |

Berkshire Hathaway’s

insurance operations continue to underwrite and invest in fossil fuels without restrictions. In contrast to most major global insurers,

Berkshire placed no limits on insuring new coal projects.28

In 2022 two of Berkshire’s U.S.-based peers, AIG and Travelers, committed to ruling out the underwriting of new coal

projects.29

Moreover, as of March 2023, Chubb announced that it would implement stricter exclusion policies and underwriting criteria for oil and

gas projects.30

Berkshire’s absolute lack of policy to phase out the provision of insurance and investment in fossil fuels puts it out of step

with its U.S.-based peers and severely misaligned with a 1.5°C pathway.

Policy

influence

| Climate

Action 100+ Net Zero Benchmark Indicators |

| Climate

Policy Engagement Alignment (InfluenceMap) 1: Organization Score |

The

level of company support for (or opposition to) Paris Agreement-aligned climate policy. |

32% |

| Climate

Policy Engagement Alignment (InfluenceMap) 2: Relationship Score |

The

level of a company’s industry associations’ support for (or opposition to) Paris Agreement-aligned climate policy. |

31% |

BHE’s

engagement with U.S. climate policy has been negative. Specifically, there is an increasingly significant misalignment between BHE’s

climate policy engagement and the goals of the Paris Agreement. Though BHE does not disclose its positions on climate-related policy,

as of 2021, the company’s leadership had gone so far as to publicly advocate for the role of coal in the nation's energy mix.31

BHE does not

publicly disclose its memberships to industry associations.32

However, BHE appears to be a member of several groups that actively oppose U.S. climate policy, such as the American Gas

Association33

- which has coordinated multiple efforts to preempt building electrification mandates.34

Conclusion:

Berkshire Hathaway has failed to set a company-wide ambition to achieve net zero GHG emissions by 2050, commit to implementing the recommendations

of the TCFD framework, and announce a full phase-out of coal-fired generation units or the end of coal underwriting for its insurance

business in a manner that is consistent with the IEA’s B2DS. Therefore, we recommend that shareholders vote AGAINST the entire

slate of management-sponsored directors at the company’s annual meeting on May 6, 2023.

1

Berkshire Hathaway Inc. SEC Filing on Form 10-K for fiscal year ended Dec 31, 2022, https://www.sec.gov/ix?doc=/Archives/edgar/data/1067983/000095017023004451/brka-20221231.htm,

p. K-1 and p. K-7.

2

Ceres, et al., Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States, September 2022,

https://www.sustainability.com/globalassets/sustainability.com/thinking/pdfs/2022/benchmarking-air-emissions-2022.pdf,

p. 14

3

Ceres, et al., Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States, September 2022,

https://www.sustainability.com/globalassets/sustainability.com/thinking/pdfs/2022/benchmarking-air-emissions-2022.pdf,

p. 9

4

Berkshire Hathaway, EEI Financial Conference, November 2022, https://www.brkenergy.com/assets/pdf/eei-presentations/2022-eei-presentation.pdf,

p. 21

5

Climate Action 100+, “Companies,” https://www.climateaction100.org/whos-involved/companies/,

accessed April 10, 2023

6

Insure Our Future, 2022 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, October 2022, https://insure-our-future.com/wp-content/uploads/2023/02/SP-IOF-2022-Scorecard-v0.8-online-3.pdf,

p. 15

7

Insure Our Future, 2022 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, October 2022, https://insure-our-future.com/wp-content/uploads/2023/02/SP-IOF-2022-Scorecard-v0.8-online-3.pdf,

p. 15

8

Insure Our Future, “With new coal uninsurable, insurers start to move on oil and gas,” press release, October 19, 2022,

https://global.insure-our-future.com/with-new-coal-uninsurable-insurers-start-to-move-on-oil-and-gas/

9

Leslie Scism and Rhiannon Hoyle, “Insurer Chubb Demands Energy Producers Cut Methane Emissions for Coverage,” Wall

Street Journal, March 22, 2023, https://www.wsj.com/articles/insurer-chubb-demands-energy-producers-cut-methane-emissions-for-coverage-52251222

10

Berkshire Hathaway, “Environmental Respect” About Us, https://www.brkenergy.com/about-us/environmental-respect.aspx,

accessed April 10 2023

11

Climate Action 100+, Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

12

Berkshire Hathaway, EEI Financial Conference, November 2022, https://www.brkenergy.com/assets/pdf/eei-presentations/2022-eei-presentation.pdf,

p. 10

13

IEA, Achieving Net Zero Electricity Sectors in G7 Members, October 2021, https://iea.blob.core.windows.net/assets/9a1c057a-385a-4659-80c5-3ff40f217370/AchievingNetZeroElectricitySectorsinG7Members.pdf,

p. 38 (pertaining to the IEA Net Zero by 2050 scenario)

14

CDP, “Berkshire Hathaway Energy CDP Responses”, (website), https://www.cdp.net/en/responses/862633/Berkshire-Hathaway-Energy,

accessed April 10, 2023

15

MidAmerican Energy, Iowa Homeland Security ConferenceGrid Operation and Event Response, October 2022, https://homelandsecurity.iowa.gov/wp-content/uploads/2022/11/108-109-D-Custer_MidAmerican.pdf,

p. 2 (MidAmerican services 1.6 million electric and natural gas customers in four Midwestern states); NV Energy, “Service Territory,”

(website), https://www.nvenergy.com/about-nvenergy/our-company/territory, accessed April 10,

2023 (NV Energy provides electric and gas services to Northern Nevada)

16

Duke Energy, “Duke Energy expands clean energy action plan,” Duke Energy News Center, February 9, 2022, https://news.duke-energy.com/releases/duke-energy-expands-clean-energy-action-plan

17

Dominion Energy, “Net Zero,” (website), https://www.dominionenergy.com/our-company/netzero,

accessed April 10, 2023 (Dominion Energy has committed to achieving NZE by 2050)

18

Berkshire Hathaway, EEI Financial Conference p. 7

19

Berkshire Hathaway Energy, Gas Company ESG/Sustainability Quantitative Information, April 2022, https://www.brkenergy.com/assets/pdf/sustainability-berkshire-hathaway-energy-aga-2021.pdf

calculated using figures from p. 2

20

IEA, “Methane and climate change”, (website), https://www.iea.org/reports/global-methane-tracker-2022/methane-and-climate-change,

accessed April 10, 2023

21

Climate Action 100+, Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

22

SEC, “Berkshire Hathaway, Inc.”, Schedule 14A (Proxy Statement), 2023, https://www.sec.gov/ix?doc=/Archives/edgar/data/1067983/000119312523073948/d362436ddef14a.htm,

p. 13

23

Berkshire Hathaway, EEI Financial Conference, November 2022, p. 27

24

Climate Action 100+, Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

25

Berkshire Hathaway, EEI Financial Conference, p. 21

26

Berkshire Hathaway, EEI Financial Conference, p. 10

27

Climate Action 100+, Climate Action 100+ Net Zero Company Benchmark, Carbon Tracker data, October 2022, https://www.climateaction100.org/wp-content/uploads/2022/12/Downloadable-Excel_CA100-Benchmark_Dec-2022_CAAA-scores-v1.1.xlsx

28

Insure Our Future, 2022 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, October 2022, https://insure-our-future.com/wp-content/uploads/2023/02/SP-IOF-2022-Scorecard-v0.8-online-3.pdf,

p. 6

29

Insure Our Future, 2022 Scorecard on Insurance, Fossil Fuels and the Climate Emergency, October 2022, https://insure-our-future.com/wp-content/uploads/2023/02/SP-IOF-2022-Scorecard-v0.8-online-3.pdf,

p. 6

30

Chubb, “Chubb Announces New Climate and Conservation-Focused Underwriting Standards for Oil and Gas Extraction,” News

Release, March 22, 2023, https://news.chubb.com/2023-03-22-Chubb-Announces-New-Climate-and-Conservation-Focused-Underwriting-Standards-for-Oil-and-Gas-Extraction

31

InfluenceMap, “Berkshire Hathaway,” LobbyMap, https://lobbymap.org/company/Berkshire-Hathaway/projectlink/Berkshire-Hathaway-In-Climate-Change,

accessed April 10, 2023

32

InfluenceMap, “Berkshire Hathaway,” LobbyMap

33

InfluenceMap, “Berkshire Hathaway,” LobbyMap

34

InfluenceMap, “American Gas Association,” LobbyMap, https://lobbymap.org/influencer/American-Gas-Association-bc1dc2f7fbce7747ce06e6c537cb8fdc,

accessed April 10, 2023

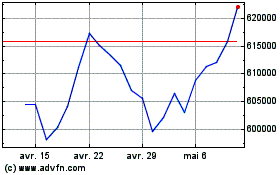

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

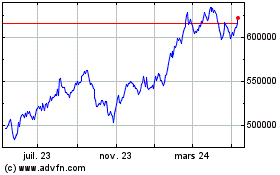

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024