BrightView Holdings, Inc. (NYSE: BV) (the “Company” or

“BrightView”), the leading commercial landscaping services company

in the United States, today reported unaudited results for the

second quarter ended March 31, 2024.

SECOND QUARTER FISCAL

2024 SUMMARY

- Total revenue increased 3.5% year-over-year to $672.9

million,

- Net income increased 253% year-over-year to $33.7 million, Net

income margin expansion of 840 basis points,

- Adjusted EBITDA2 increased 38.5% year-over-year to $64.8

million, Adjusted EBITDA margin2 expansion of 240 basis

points,

- Year-to-date Net cash provided by operating activities of

$109.5 million, an increase of $54.5 million,

- Year-to-date free cash flow2 of $89.4 million, an increase of

$73.5 million,

- Recorded $43.9 million gain on divestiture of non-core U.S.

Lawns Business.

COMPANY UPDATES FISCAL

YEAR 2024 GUIDANCE1

Prior Guidance

Updated Guidance

Total Revenue

$2.825 - $2.975 billion

$2.740 - $2.800 billion

Adjusted EBITDA2

$310 - $340 million

$315 - $335 million

Adj. EBITDA Margin2

+40bps to +80bps

+90bps to +130bps

Free Cash Flow2

$45 - $75 million

$55 - $75 million

“During the quarter we continued to advance our strategy on

profitable growth and a unified go-to-market offering under One

BrightView. Our ability to deliver on these key initiatives

resulted in an increase in revenue, and robust EBITDA growth and

margin expansion,” said BrightView President and Chief Executive

Officer Dale Asplund. “I am pleased to report we are reaffirming

our breakthrough EBITDA guidance for fiscal 2024, while raising our

Free Cash Flow guidance. Our ongoing commitment to investing in our

employees, prioritizing the customer, and enhancing our operating

structure, including the unwinding of non-core businesses, is

making BrightView a stronger company that is better positioned to

service our customers.”

_______________

1 For assumptions underlying the prior and

updated fiscal year 2024 guidance, see the Q2 2024 presentation at

investor.brightview.com 2 Adjusted EBITDA, Adjusted EBITDA margin,

and Free cash flow, are non-GAAP measures. Refer to the “Non-GAAP

Financial Measures” section for more information. The Company is

not providing a quantitative reconciliation of its financial

outlook for Adjusted EBITDA to net income (loss), Adjusted EBITDA

margin to net income (loss) margin, or Free cash flows to Cash

flows provided by operating activities, their corresponding GAAP

measures, because the respective GAAP measures that are excluded

from the non-GAAP financial outlook are difficult to reliably

predict or estimate without unreasonable effort due to their

dependence on future uncertainties, such as items discussed below.

Additionally, information that is currently not available to the

Company could have a potentially unpredictable & potentially

significant impact on its future GAAP financial results.

Fiscal 2024 Results – Total

BrightView

Total BrightView - Operating

Highlights

Three Months Ended March

31,

Six Months Ended March

31,

($ in millions, except per share

figures)

2024

2023

Change

2024

2023

Change

Revenue

$

672.9

$

650.4

3.5%

$

1,299.6

$

1,306.3

(0.5%)

Net Income (Loss)

$

33.7

$

(22.0

)

253.2%

$

17.3

$

(40.9

)

142.3%

Net Income (Loss) Margin

5.0

%

(3.4

%)

840 bps

1.3

%

(3.1

%)

440 bps

Adjusted EBITDA

$

64.8

$

46.8

38.5%

$

111.5

$

95.3

17.0%

Adjusted EBITDA Margin

9.6

%

7.2

%

240 bps

8.6

%

7.3

%

130 bps

Adjusted Net Income (Loss)

$

16.9

$

(6.7

)

352.2%

$

20.0

$

(8.0

)

350.0%

Basic Earnings (Loss) per Share

$

0.17

$

(0.23

)

173.9%

$

(0.01

)

$

(0.44

)

97.7%

Weighted average number of common shares

outstanding

94.4

93.5

1.0%

94.2

93.4

0.9%

Adjusted Earnings (Loss) per Share

$

0.11

$

(0.07

)

257.1%

$

0.13

$

(0.09

)

244.4%

Adjusted weighted average number of common

shares outstanding

148.7

93.5

59.0%

148.0

93.4

58.5%

Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Share, and

Adjusted weighted average number of common shares outstanding are

non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and

“Reconciliation of GAAP to Non-GAAP Financial Measures” sections

for more information. Basic Earnings (Loss) per Share is determined

by dividing Net Income (Loss) available to common shareholders by

the Weighted average number of common shares outstanding. Net

income (Loss) available to common shareholders is calculated as Net

Income (Loss) less dividends declared on Series A Convertible

Preferred Shares and Earnings allocated to Convertible Preferred

Shares

For the second quarter of fiscal 2024, total revenue increased

3.5% to $672.9 million driven by a $34.3 million year over year

increase in snow removal revenue, and an $8.8 million of increased

revenue from our development services revenue. These increases were

partially offset by a $21.5 million decrease in our commercial

landscaping business.

For the three months ended March 31, 2024, Adjusted EBITDA

increased by $18.0 million to $64.8 million representing a 240

basis point increase in Adjusted EBITDA margin. The increase was

due to the increased revenue described above combined with

successful cost management due to ongoing cost management

initiatives focused on payroll and overhead costs and reduction in

non-core businesses.

For the six months ended March 31, 2024, total revenue decreased

0.5% to $1,299.6 million driven by a $40.4 million decrease in our

commercial landscaping business. The decrease was partially offset

by an $19.8 million of increased revenue from our development

services revenue and a $12.1 million increase in snow removal

revenue compared to the prior year.

During the first half of 2024, Adjusted EBITDA increased by

$16.2 million to $111.5 representing a 130 basis point expansion of

Adjusted EBITDA margin. The increase was due to successful cost

management initiatives focused on payroll and overhead costs,

partially offset by decreased revenue described above.

Fiscal 2024 Results – Segments

Maintenance Services - Operating

Highlights

Three Months Ended March

31,

Six Months Ended March

31,

($ in millions)

2024

2023

Change

2024

2023

Change

Landscape Maintenance

$

337.4

$

359.0

(6.0%)

$

740.1

$

780.5

(5.2%)

Snow Removal

$

173.1

$

138.8

24.7%

$

212.7

$

200.6

6.0%

Total Revenue

$

510.5

$

497.8

2.6%

$

952.8

$

981.1

(2.9%)

Adjusted EBITDA

$

66.5

$

51.7

28.6%

$

108.5

$

102.2

6.2%

Adjusted EBITDA Margin

13.0

%

10.4

%

260 bps

11.4

%

10.4

%

100 bps

Capital Expenditures

$

8.8

$

12.7

(30.7%)

$

16.5

$

36.7

(55.0%)

For the second quarter of fiscal 2024, revenue in the

Maintenance Services Segment increased by $12.7 million, or 2.6%,

from the 2023 period. The increase was principally driven by a

$34.3 million increase in snow removal services revenue, primarily

due to lower snowfall in the prior period3. Partially offsetting

this was a decrease of $21.6 million, or 6.0%, in underlying

commercial landscape services, underpinned by strategic reductions

of non-core businesses and reduced ancillary services.

Adjusted EBITDA for the Maintenance Services Segment for the

three months ended March 31, 2024 increased by $14.8 million to

$66.5 million from $51.7 million in the 2023 period. Segment

Adjusted EBITDA Margin increased 260 basis points, to 13.0%, in the

three months ended March 31, 2024, from 10.4% in the 2023 period.

The increases in Segment Adjusted EBITDA and Segment Adjusted

EBITDA Margin were principally driven by the increase in revenues

described above and lower labor costs as a result of the Company's

cost management initiatives.

For the six months ended March 31, 2024, Maintenance Services

net service revenues decreased by $28.3 million, or 2.9%, from the

2023 period. The decrease was principally driven by a $40.4

million, or 5.2%, decrease in underlying commercial landscape

services, largely underpinned by a decline in our Ancillary

services business. This was partially offset by a $12.1 million

increase in snow removal services revenue, primarily due to higher

snowfall than in the prior period3.

Adjusted EBITDA for the Maintenance Services Segment for the six

months ended March 31, 2024 increased by $6.3 million to $108.5

million from $102.2 million in the 2023 period. Segment Adjusted

EBITDA Margin increased 100 basis points, to 11.4%, in the six

months ended March 31, 2024, from 10.4% in the 2023 period. The

increases in Segment Adjusted EBITDA and Segment Adjusted EBITDA

Margin were principally driven by lower labor costs as a result of

the Company's cost management initiatives partially offset by the

decrease in maintenance services revenue described above.

_______________

3 As defined by the National Oceanic

Atmospheric Administration, U.S. Department of Commerce (“NOAA”)

for the Company's footprint during the respective three and six

month periods

Development Services - Operating

Highlights

Three Months Ended March

31,

Six Months Ended March

31,

($ in millions)

2024

2023

Change

2024

2023

Change

Revenue

$

164.4

$

155.6

5.7%

$

349.7

$

329.9

6.0%

Adjusted EBITDA

$

14.4

$

13.1

9.9%

$

34.0

$

29.6

14.9%

Adjusted EBITDA Margin

8.8

%

8.4

%

40 bps

9.7

%

9.0

%

70 bps

Capital Expenditures

$

3.1

$

2.7

14.8%

$

4.3

$

4.7

(8.5%)

For the second quarter of fiscal 2024, revenue in the

Development Services Segment increased by $8.8 million, or 5.7%,

compared to the 2023 period. The increase was driven by an increase

in Development Services project volumes.

Adjusted EBITDA for the Development Services Segment for the

three months ended March 31, 2024 increased $1.3 million, to $14.4

million, compared to the 2023 period. Segment Adjusted EBITDA

Margin increased 40 basis points, to 8.8% for the quarter from 8.4%

in the 2023 period. The increases in Segment Adjusted EBITDA and

Segment Adjusted EBITDA Margin were primarily driven by the

increase in revenues described above.

For the six months ended March 31, 2024, revenue in the

Development Services Segment increased $19.8 million, or 6.0%,

compared to the 2023 period. The increase was primarily driven by

an increase in Development Services project volumes.

Adjusted EBITDA for the Development Services Segment for the six

months ended March 31, 2024 increased $4.4 million, to $34.0

million in the 2023 period. Segment Adjusted EBITDA Margin

increased 70 basis points, to 9.7% for the period from 9.0% in the

2023 period. The increases in Segment Adjusted EBITDA and Segment

Adjusted EBITDA Margin were primarily driven by the increase in

revenues described above coupled with savings primarily from the

Company's cost management initiatives.

Total BrightView Cash Flow

Metrics

Six Months Ended March

31,

($ in millions)

2024

2023

Change

Net Cash Provided by Operating

Activities

$

109.5

$

55.0

99.1%

Free Cash Flow

$

89.4

$

15.9

462.3%

Capital Expenditures

$

22.7

$

42.7

(46.8%)

Net cash provided by operating activities for the six months

ended March 31, 2024 increased $54.5 million, to $109.5 million,

from $55.0 million in the 2023 period. This increase was due to

increases in cash provided by accounts receivable and unbilled and

deferred revenue and an increase in net income. This was partially

offset by a decrease in the cash provided by other operating assets

and an increase in cash used by accounts payable and other

operating liabilities.

Free Cash Flow increased $73.5 million to $89.4 million for the

six months ended March 31, 2024 from $15.9 million in the prior

year. The increase in Free Cash Flow was due to an increase in net

cash provided by operating activities coupled with a decrease in

cash used for capital expenditures, as described below.

For the six months ended March 31, 2024, capital expenditures

were $22.7 million, compared with $42.7 million in the prior year.

The Company also generated proceeds from the sale of property and

equipment of $2.6 million and $3.6 million during the six months

ended March 31, 2024 and 2023, respectively. Net of the proceeds

from the sale of property and equipment, net capital expenditures

represented 1.5% of revenue in the six months ended March 31, 2024,

a decrease of 145 bps compared to 3.0% for the six months ended

March 31, 2023.

Total BrightView Balance Sheet

Metrics

($ in millions)

March 31, 2024

September 30, 2023

March 31, 2023

Total Financial Debt1

$

931.2

$

937.5

$

1,409.3

Minus:

Total Cash & Equivalents

177.3

67.0

11.0

Total Net Financial Debt2

$

753.9

$

870.5

$

1,398.8

Total Net Financial Debt to Adjusted

EBITDA ratio3

2.4x

2.9x

5.0x

1Total Financial Debt includes total

long-term debt, net of original issue discount, and finance lease

obligations

2Total Net Financial Debt equals Total

Financial Debt minus Total Cash & Equivalents

3Total Net Financial Debt to Adjusted

EBITDA ratio equals Total Net Financial Debt divided by the

trailing twelve month Adjusted EBITDA.

As of March 31, 2024, the Company’s Total Net Financial Debt was

$753.9 million, a decrease of $116.6 million compared to $870.5 as

of September 30, 2023. The Company’s Total Net Financial Debt to

Adjusted EBITDA ratio was 2.4x as of March 31, 2024, compared to

2.9x as of September 30, 2023.

Conference Call Information

A conference call to discuss the second quarter fiscal 2024

financial results is scheduled for May 2, 2024, at 8:30 a.m. ET.

The U.S. toll free dial-in for the conference call is (833)

470-1428 and the international dial-in is +1 (404) 975-4839. The

Conference Access Code is 145945. A live audio webcast of the

conference call will be available on the Company’s investor website

https://investor.brightview.com, where presentation materials will

be posted prior to the call.

A replay of the call will be available until 11:59 p.m. ET on

May 16, 2024. To access the recording, dial (866) 813-9403 (Access

Code 529187). A link to the current Earnings Call slides can be

found at investor.brightview.com.

About BrightView

BrightView (NYSE: BV), the nation’s largest commercial

landscaper, proudly designs, creates, and maintains some of the

best landscapes on Earth and provides the most efficient and

comprehensive snow and ice removal services. With a dependable

service commitment, BrightView brings brilliant landscapes to life

at premier properties across the United States, including business

parks and corporate offices, homeowners' associations, healthcare

facilities, educational institutions, retail centers, resorts and

theme parks, municipalities, golf courses, and sports venues.

BrightView also serves as the Official Field Consultant to Major

League Baseball. Through industry-leading best practices and

sustainable solutions, BrightView is invested in taking care of our

team members, engaging our clients, inspiring our communities, and

preserving our planet. Visit www.BrightView.com and connect with us

on X (formerly known as Twitter), Facebook, and LinkedIn.

Forward Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provision of the U.S. Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), which are subject to the “safe harbor” created by

those sections. All statements, other than statements of historical

facts included in this press release, including statements

concerning our plans, objectives, goals, beliefs, business outlook,

business trends, expectations regarding our industry, strategy,

future events, future operations, future liquidity and financial

position, future revenues, projected costs, prospects, plans and

objectives of management and other information, may be

forward-looking statements.

Words such as “outlook,” “guidance,” “projects,” “believes,”

“expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,”

“estimates,” “continues,” or “anticipates,” and variations of such

words or similar expressions are intended to identify

forward-looking statements. The forward-looking statements are not

historical facts, or guarantees of future performance and are based

upon our current expectations, beliefs, estimates and projections,

and various assumptions, many of which, by their nature, are

inherently uncertain and beyond our control. Our expectations,

beliefs, and projections are expressed in good faith, and we

believe there is a reasonable basis for them. However, there can be

no assurance that management’s expectations, beliefs and

projections will result or be achieved, and actual results may vary

materially from what is expressed in or indicated by the

forward-looking statements. There are a number of risks,

uncertainties and other important factors, many of which are beyond

our control, that could cause our actual results to differ

materially from the forward-looking statements contained in this

press release. New risk factors and uncertainties may emerge from

time to time, and it is not possible for management to predict all

risk factors and uncertainties. Some of the key factors that could

cause actual results to differ from our expectations include risks

related to: general business, economic, and financial market

conditions; increases in raw material costs, fuel prices, wages and

other operating costs, and changes in our ability to source

adequate supplies and materials in a timely manner; competitive

industry pressures; the failure to retain current customers, renew

existing customer contracts and obtain new customer contracts; the

failure to enter into profitable contracts, or maintaining customer

contracts that are unprofitable; a determination by customers to

reduce their outsourcing or use of preferred vendors; the dispersed

nature of our operating structure; our ability to implement our

business strategies and achieve our growth objectives; the

possibility that the anticipated benefits from our business

acquisitions will not be realized in full or at all or may take

longer to realize than expected; the possibility that costs or

difficulties related to the integration of acquired businesses’

operations will be greater than expected and the possibility that

integration efforts will disrupt our business and strain management

time and resources; the potential impact on revenues and

profitability caused by any disposition of assets or

discontinuation of business lines; the seasonal nature of our

landscape maintenance services; our dependence on weather

conditions and the impact of severe weather and climate change on

our business; disruptions in our supply chain and changes in our

ability to source adequate supplies and materials in a timely

manner; any failure to accurately estimate the overall risk,

requirements, or costs when we bid on or negotiate contracts that

are ultimately awarded to us; the conditions and periodic

fluctuations of real estate markets, including residential and

commercial construction; the level, timing and location of

snowfall; our ability to retain or hire our executive management

and other key personnel, and particularly reflecting competition

for talent in light of non-compete rulemaking and legislation; our

ability to attract and retain field and hourly employees, trained

workers and third-party contractors and re-employ seasonal workers;

any failure to properly verify employment eligibility of our

employees; subcontractors taking actions that harm our business;

our recognition of future impairment charges; laws and governmental

regulations, including those relating to employees, wage and hour,

immigration, human health, safety, transportation and the

associated financial impact of such regulations; environmental,

health and safety laws and regulations, including regulatory costs,

claims and litigation related to the use of chemicals and

pesticides by employees and related third-party claims; the

distraction and impact caused by litigation, adverse litigation

judgments and settlements resulting from legal proceedings; tax

increases and changes in tax rules; increase in on-job accidents

involving employees; any failure, inadequacy, interruption,

security failure or breach of our information technology systems;

compliance with data privacy requirements; our ability to

adequately protect our intellectual property; restrictions imposed

by our debt agreements that limit our flexibility in operating our

business; Increases in interest rates governing our variable rate

indebtedness increasing the cost of servicing our substantial

indebtedness; our ability to generate sufficient cash flow to

satisfy our significant debt service obligations; our ability to

obtain additional financing to fund future working capital, capital

expenditures, investments or acquisitions, or other general

corporate requirements; risks related to counterparty credit

worthiness or non-performance of the derivative financial

instruments we utilize; any future sales, or the perception of

future sales, by us or our affiliates, which could cause the market

price for our common stock to decline; the ability of KKR

BrightView Aggregator L.P., Birch-OR Equity Holdings, LLC and Birch

Equity Holdings, LP, which collectively hold approximately 70.5% of

our shares as of March 31, 2024, to exert significant influence

over us; the fact that the holders of our Series A Preferred Stock

may have different interests from and vote their shares in a manner

deemed adverse to, holders of our common stock; the dividend,

liquidation, and redemption rights of the holders of our Series A

Preferred Stock; occurrence of natural disasters, terrorist

attacks, or other external events; occurrence of a pandemic or

other public health emergency; inflation, geopolitical conflicts,

recession, financial market disruptions and other economic

conditions; our ability to pursue and achieve our environmental,

social and corporate governance goals and targets and the

possibility that complying with such standards and meeting our

goals may be significantly more costly than anticipated; and costs

and requirements imposed as a result of maintaining compliance with

the requirements of being a public company.

Additional factors that could cause our results to differ

materially from those described in the forward-looking statements

can be found under “Item 1A. Risk Factors” in our Form 10-K for the

fiscal year ended September 30, 2023, and such factors may be

updated from time to time in our periodic filings with the

Securities and Exchange Commission, which are accessible on the

SEC’s website at www.sec.gov. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. These

factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this release and in our filings with the SEC. Any

forward-looking statement made in this press release speaks only as

of the date on which it was made. We undertake no obligation to

publicly update or revise any forward-looking statements to reflect

subsequent events or circumstances, any change in assumptions,

beliefs or expectations or any change in circumstances upon which

any such forward-looking statements are based, except as required

by law.

Non-GAAP Financial Measures

To supplement the Company’s financial information presented in

accordance with GAAP and aid understanding of the Company’s

business performance, the Company uses certain non-GAAP financial

measures, namely “Adjusted EBITDA”, “Adjusted EBITDA Margin”,

“Adjusted Net Income (Loss)”, “Adjusted Earnings (Loss) per Share”,

“Free Cash Flow”, “Total Financial Debt”, “Total Net Financial

Debt” and “Total Net Financial Debt to Adjusted EBITDA ratio”. We

believe Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net

Income (Loss), Adjusted Earnings (Loss) per Share, Free Cash Flow,

Total Financial Debt, Total Net Financial Debt, and Total Net

Financial Debt to Adjusted EBITDA ratio assist investors in

comparing our results across reporting periods on a consistent

basis by excluding items that we do not believe are indicative of

our core operating performance. Management believes these non-GAAP

financial measures are useful to investors in highlighting trends

in our operating performance, while other measures can differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which we operate and

capital investments. Management regularly uses these measures as

tools in evaluating our operating performance, financial

performance and liquidity. Management uses Adjusted EBITDA,

Adjusted EBITDA Margin, Adjusted Net Income (Loss), Adjusted

Earnings (Loss) per Share, Free Cash Flow, Total Financial Debt,

Total Net Financial Debt, and Total Net Financial Debt to Adjusted

EBITDA ratio to supplement comparable GAAP measures in the

evaluation of the effectiveness of our business strategies, to make

budgeting decisions, to establish discretionary annual incentive

compensation and to compare our performance against that of other

peer companies using similar measures. In addition, we believe that

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income

(Loss), Adjusted Earnings (Loss) per Share, Free Cash Flow, Total

Financial Debt, Total Net Financial Debt, and Total Net Financial

Debt to Adjusted EBITDA ratio are frequently used by investors and

other interested parties in the evaluation of issuers, many of

which also present Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Share,

Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and

Total Net Financial Debt to Adjusted EBITDA ratio when reporting

their results in an effort to facilitate an understanding of their

operating and financial results and liquidity. Management

supplements GAAP results with non-GAAP financial measures to

provide a more complete understanding of the factors and trends

affecting the business than GAAP results alone.

Adjusted EBITDA: We define Adjusted EBITDA as net income (loss)

before interest, taxes, depreciation and amortization, as further

adjusted to exclude certain non-cash, non-recurring and other

adjustment items.

Adjusted EBITDA Margin: We define Adjusted EBITDA Margin as

Adjusted EBITDA, defined above, divided by Net Service

Revenues.

Adjusted Net Income (Loss): We define Adjusted Net Income (Loss)

as net income (loss) including interest and depreciation, and

excluding other items used to calculate Adjusted EBITDA and further

adjusted for the tax effect of these exclusions and the removal of

the discrete tax items.

Adjusted Earnings (Loss) per Share: We define Adjusted Earnings

(Loss) per Share as Adjusted Net Income (Loss) divided by the

Adjusted Weighted Average Number of Common Shares Outstanding for

the period.

Adjusted Weighted Average Number of Common Shares Outstanding:

We define Adjusted Weighted Average Number of Common Shares

Outstanding as the weighted average number of common shares

outstanding used in the calculation of basic earnings per share

plus shares of common stock related to the Series A Preferred Stock

on an as-converted basis, assumed to be converted for the entire

period. The addition of shares of common stock related to the

Series A Convertible Preferred Stock on an as-converted basis

reflects the dilutive impact of the potential conversion of the

Series A Preferred Stock and is expected to provide comparability

in future periods.

Free Cash Flow: We define Free Cash Flow as cash flows from

operating activities less capital expenditures, net of proceeds

from the sale of property and equipment.

Total Financial Debt: We define Total Financial Debt as total

long-term debt, net of original issue discount, and finance lease

obligations.

Total Net Financial Debt: We define Total Net Financial Debt as

Total Financial Debt minus total cash and cash equivalents.

Total Net Financial Debt to Adjusted EBITDA ratio: We define

Total Net Financial Debt to Adjusted EBITDA ratio as Total Net

Financial Debt divided by the trailing twelve month Adjusted

EBITDA.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income

(Loss), Adjusted Earnings (Loss) per Share, Free Cash Flow, Total

Financial Debt, Total Net Financial Debt, and Total Net Financial

Debt to Adjusted EBITDA ratio are not recognized terms under GAAP

and should not be considered as an alternative to net income (loss)

or the ratio of net income (loss) to net revenue as a measure of

financial performance, cash flows provided by operating activities

as a measure of liquidity, or any other performance measure derived

in accordance with GAAP. Additionally, these measures are not

intended to be a measure of free cash flow available for

management’s discretionary use as they do not consider certain cash

requirements such as interest payments, tax payments and debt

service requirements. The presentations of these measures have

limitations as analytical tools and should not be considered in

isolation, or as a substitute for analysis of our results as

reported under GAAP. Because not all companies use identical

calculations, the presentations of these measures may not be

comparable to the same or other similarly titled measures of other

companies and can differ significantly from company to company.

BrightView Holdings,

Inc.

Consolidated Balance

Sheets

(Unaudited)

(in millions)*

March 31, 2024

September 30, 2023

Assets

Current assets:

Cash and cash equivalents

$

177.3

$

67.0

Accounts receivable, net

420.8

442.3

Unbilled revenue

112.2

143.5

Other current assets

88.3

89.3

Total current assets

798.6

742.1

Property and equipment, net

304.0

315.2

Intangible assets, net

112.7

132.3

Goodwill

2,015.7

2,021.4

Operating lease assets

84.2

86.1

Other assets

46.4

55.1

Total assets

$

3,361.6

$

3,352.2

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

131.4

$

136.2

Deferred revenue

103.5

68.2

Current portion of self-insurance

reserves

52.6

54.8

Accrued expenses and other current

liabilities

164.4

180.2

Current portion of operating lease

liabilities

25.3

27.3

Total current liabilities

477.2

466.7

Long-term debt, net

880.4

888.1

Deferred tax liabilities

43.1

51.1

Self-insurance reserves

108.3

105.1

Long-term operating lease liabilities

65.2

65.1

Other liabilities

36.4

34.6

Total liabilities

1,610.6

1,610.7

Mezzanine equity:

Series A convertible preferred shares,

$0.01 par value, 7% cumulative dividends; 500,000 shares issued and

outstanding as of March 31, 2024 and September 30, 2023, aggregate

liquidation preference of $512.0 and $503.2 as of March 31, 2024

and September 30, 2023, respectively

507.1

498.2

Stockholders’ equity:

Preferred stock, $0.01 par value;

50,000,000 shares authorized; no shares issued or outstanding as of

March 31, 2024 and September 30, 2023

—

—

Common stock, $0.01 par value; 500,000,000

shares authorized; 107,900,000 and 106,600,000 shares issued and

94,500,000 and 93,600,000 shares outstanding as of March 31, 2024

and September 30, 2023, respectively

1.1

1.1

Treasury stock, at cost; 13,400,000 and

13,000,000 shares as of March 31, 2024 and September 30, 2023,

respectively

(172.9

)

(170.4

)

Additional paid-in capital

1,523.4

1,530.8

Accumulated deficit

(118.0

)

(135.3

)

Accumulated other comprehensive income

10.3

17.1

Total stockholders’ equity

1,243.9

1,243.3

Total liabilities, mezzanine equity and

stockholders’ equity

$

3,361.6

$

3,352.2

(*) Amounts may not total due to

rounding.

BrightView Holdings,

Inc.

Consolidated Statements of

Operations

(Unaudited)

Three Months Ended March

31,

Six Months Ended March

31,

2024

2023

2024

2023

(in millions)*

Net service revenues

$

672.9

$

650.4

$

1,299.6

$

1,306.3

Cost of services provided

520.9

503.3

1,013.7

1,011.6

Gross profit

152.0

147.1

285.9

294.7

Selling, general and administrative

expense

125.0

138.7

255.0

276.4

(Gain) on divestiture

(43.9

)

-

(43.9

)

-

Amortization expense

8.7

11.0

18.8

22.9

Income (loss) from operations

62.2

(2.6

)

56.0

(4.6

)

Other (income)

(0.8

)

(0.6

)

(1.9

)

(1.4

)

Interest expense, net

16.0

27.7

33.0

50.9

Income (loss) before income taxes

47.0

(29.7

)

24.9

(54.1

)

Income tax expense (benefit)

13.3

(7.7

)

7.6

(13.2

)

Net income (loss)

$

33.7

$

(22.0

)

$

17.3

$

(40.9

)

Less: dividends on Series A convertible

preferred shares

8.9

-

17.8

-

Net income (loss) attributable to common

stockholders

$

24.8

$

(22.0

)

$

(0.5

)

$

(40.9

)

Earnings (loss) per share:

Basic and diluted earnings (loss) per

share

$

0.17

$

(0.23

)

$

(0.01

)

$

(0.44

)

BrightView Holdings,

Inc.

Segment Reporting

(Unaudited)

Three Months Ended March

31,

Six Months Ended March

31,

2024

2023

2024

2023

(in millions)*

Maintenance Services

$

510.5

$

497.8

$

952.8

$

981.1

Development Services

164.4

155.6

349.7

329.9

Eliminations

(2.0

)

(3.0

)

(2.9

)

(4.7

)

Net Service Revenues

$

672.9

$

650.4

$

1,299.6

$

1,306.3

Maintenance Services

$

66.5

$

51.7

$

108.5

$

102.2

Development Services

14.4

13.1

34.0

29.6

Corporate

(16.1

)

(18.0

)

(31.0

)

(36.5

)

Adjusted EBITDA

$

64.8

$

46.8

$

111.5

$

95.3

Maintenance Services

$

8.8

$

12.7

$

16.5

$

36.7

Development Services

3.1

2.7

4.3

4.7

Corporate

0.7

0.1

1.9

1.3

Capital Expenditures

$

12.6

$

15.5

$

22.7

$

42.7

(*) Amounts may not total due to

rounding.

BrightView Holdings,

Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

Six Months Ended March

31,

2024

2023

(in millions)*

Cash flows from operating activities:

Net income (loss)

$

17.3

$

(40.9

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation

51.7

54.5

Amortization of intangible assets

18.8

22.9

Amortization of financing costs and

original issue discount

1.3

1.8

Deferred taxes

(7.2

)

(17.2

)

Equity-based compensation

10.0

11.9

Realized (gain) on hedges

(5.6

)

(4.3

)

Gain on divestiture

(43.9

)

—

Other non-cash activities

2.1

0.9

Change in operating assets and

liabilities:

Accounts receivable

16.8

(17.2

)

Unbilled and deferred revenue

67.4

37.5

Other operating assets

4.3

23.3

Accounts payable and other operating

liabilities

(23.5

)

(18.2

)

Net cash provided by operating

activities

109.5

55.0

Cash flows from investing activities:

Purchase of property and equipment

(22.7

)

(42.7

)

Proceeds from sale of property and

equipment

2.6

3.6

Business acquisitions, net of cash

acquired

—

(13.8

)

Proceeds from divestiture

51.6

—

Other investing activities

0.8

1.1

Net cash provided (used) by investing

activities

32.3

(51.8

)

Cash flows from financing activities:

Repayments of finance lease

obligations

(15.5

)

(14.7

)

Repayments of term loan

—

(6.0

)

Repayments of receivables financing

agreement

(9.5

)

(279.5

)

Repayments of revolving credit

facility

—

(33.5

)

Proceeds from receivables financing

agreement, net of issuance costs

0.5

298.0

Proceeds from revolving credit

facility

—

33.5

Debt issuance and prepayment costs

(0.4

)

—

Proceeds from issuance of common stock,

net of share issuance costs

0.6

0.7

Repurchase of common stock and

distributions

(2.5

)

(1.2

)

Contingent business acquisition

payments

(4.7

)

(9.6

)

Net cash (used) by financing

activities

(31.5

)

(12.3

)

Net change in cash and cash

equivalents

110.3

(9.1

)

Cash and cash equivalents, beginning of

period

67.0

20.1

Cash and cash equivalents, end of

period

$

177.3

$

11.0

Supplemental Cash Flow

Information:

Cash (received) paid for income taxes,

net

$

4.1

$

(21.8

)

Cash paid for interest

$

35.3

$

37.2

Non-cash Series A Preferred Stock

dividends

$

8.9

$

—

(*) Amounts may not total due to

rounding.

BrightView Holdings,

Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(Unaudited)

Three Months Ended March

31,

Six Months Ended March

31,

(in millions)*

2024

2023

2024

2023

Adjusted EBITDA

Net income (loss)

$

33.7

$

(22.0

)

$

17.3

$

(40.9

)

Plus:

Interest expense, net

16.0

27.7

33.0

50.9

Income tax expense (benefit)

13.3

(7.7

)

7.6

(13.2

)

Depreciation expense

26.1

27.4

51.7

54.5

Amortization expense

8.7

11.0

18.8

22.9

Business transformation and integration

costs (a)

6.1

4.1

16.9

8.7

Gain on divestiture (b)

(43.9

)

—

(43.9

)

—

Equity-based compensation (c)

4.8

6.3

10.1

12.0

COVID-19 related expenses (d)

—

—

—

0.4

Adjusted EBITDA

$

64.8

$

46.8

$

111.5

$

95.3

Adjusted Net Income (Loss)

Net income (loss)

$

33.7

$

(22.0

)

$

17.3

$

(40.9

)

Plus:

Amortization expense

8.7

11.0

18.8

22.9

Business transformation and integration

costs (a)

6.1

4.1

16.9

8.7

Gain on divestiture (b)

(43.9

)

—

(43.9

)

—

Equity-based compensation (c)

4.8

6.3

10.1

12.0

COVID-19 related expenses (d)

—

—

—

0.4

Income tax adjustment (e)

7.5

(6.1

)

0.8

(11.1

)

Adjusted Net Income (Loss)

$

16.9

$

(6.7

)

$

20.0

$

(8.0

)

Free Cash Flow

Cash flows provided by operating

activities

$

83.2

$

84.6

$

109.5

$

55.0

Minus:

Capital expenditures

12.6

15.5

22.7

42.7

Plus:

Proceeds from sale of property and

equipment

1.4

2.3

2.6

3.6

Free Cash Flow

$

72.0

$

71.4

$

89.4

$

15.9

Adjusted Earnings per Share

Numerator:

Adjusted Net Income (Loss)

$

16.9

$

(6.7

)

$

20.0

$

(8.0

)

Denominator:

—

—

—

—

Weighted average number of common shares

outstanding – basic

94,436,000

93,475,000

94,210,000

93,362,000

Plus:

Dilutive impact of Series A convertible

preferred stock as-converted

54,242,000

—

53,774,000

—

Adjusted weighted average number of common

shares outstanding

148,678,000

93,475,000

147,984,000

93,362,000

Adjusted Earnings per Share

$

0.11

$

(0.07

)

$

0.13

$

(0.09

)

(*) Amounts may not total due to

rounding.

BrightView Holdings,

Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(Unaudited)

(a)

Business transformation and integration

costs consist of (i) severance and related costs; (ii) business

integration costs and (iii) information technology infrastructure,

transformation costs, and other.

Three Months Ended March

31,

Six Months Ended March

31,

(in millions)*

2024

2023

2024

2023

Severance and related costs

$

3.7

$

1.8

$

6.2

$

1.9

Business integration (f)

(1.5

)

—

(0.9

)

2.5

IT infrastructure, transformation, and

other (g)

3.9

2.3

11.6

4.3

Business transformation and integration

costs

$

6.1

$

4.1

$

16.9

$

8.7

(b)

Represents the realized gain on sale and

transaction related expenses related to the divestiture of U.S.

Lawns on January 12, 2024.

(c)

Represents equity-based compensation

expense and related taxes recognized for equity incentive plans

outstanding.

(d)

Represents expenses related to the

Company’s response to the COVID-19 pandemic, principally temporary

and incremental salary and related expenses, personal protective

equipment and cleaning and supply purchases, and other.

(e)

Represents the tax effect of pre-tax items

excluded from Adjusted Net Income and the removal of the applicable

discrete tax items, which collectively result in a reduction of

income tax (benefit). The tax effect of pre-tax items excluded from

Adjusted Net Income is computed using the statutory rate related to

the jurisdiction that was impacted by the adjustment after taking

into account the impact of permanent differences and valuation

allowances. Discrete tax items include changes in laws or rates,

changes in uncertain tax positions relating to prior years and

changes in valuation allowances.

Three Months Ended March

31,

Six Months Ended March

31,

(in millions)*

2024

2023

2024

2023

Tax impact of pre-tax income

adjustments

$

4.8

$

6.8

$

12.2

$

12.8

Discrete tax items

(12.3

)

(0.7

)

(13.0

)

(1.7

)

Income tax adjustment

$

(7.5

)

$

6.1

$

(0.8

)

$

11.1

(f)

Represents isolated expenses specifically

related to the integration of acquired companies such as one-time

employee retention costs, employee onboarding and training costs,

fleet and uniform rebranding costs, and adjustments to performance

based contingent consideration. The Company excludes Business

integration costs from the measures disclosed above since such

expenses vary in amount due to the number of acquisitions and size

of acquired companies as well as factors specific to each

acquisition, and as a result lack predictability as to occurrence

and/or timing, and create a lack of comparability between

periods.

(g)

Represents expenses related to distinct

initiatives, typically significant enterprise-wide changes. Such

expenses are excluded from the measures disclosed above since such

expenses vary in amount based on occurrence as well as factors

specific to each of the activities, are outside of the normal

operations of the business, and create a lack of comparability

between periods.

Total Financial Debt and Total Net

Financial Debt

(in millions)*

March 31, 2024

September 30, 2023

March 31, 2023

Long-term debt, net

$

880.4

$

888.1

$

1,344.9

Plus:

Current portion of long term debt

—

—

12.0

Financing costs, net

5.8

6.6

9.7

Present value of net minimum payment -

finance lease obligations (h)

45.0

42.8

42.7

Total Financial Debt

931.2

937.5

1,409.3

Less: Cash and cash equivalents

(177.3

)

(67.0

)

(11.0

)

Total Net Financial Debt

$

753.9

$

870.5

$

1,398.8

Total Net Financial Debt to Adjusted

EBITDA ratio

2.4x

2.9x

5.0x

(h)

Balance is presented within Accrued

expenses and other current liabilities and Other liabilities in the

Consolidated Balance Sheet.

(*)

Amounts may not total due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501525497/en/

For More Information: Investor Relations Chris

Stoczko, Vice President of Finance IR@BrightView.com

News Media David Freireich, Vice President of

Communications & Public Affairs

David.Freireich@BrightView.com

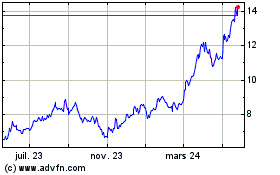

BrightView (NYSE:BV)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

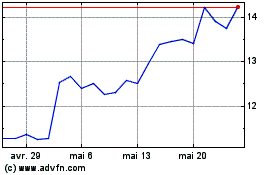

BrightView (NYSE:BV)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025