CGGVeritas Provides its Vessel Utilization Update for the Third Quarter 2012

10 Octobre 2012 - 7:30AM

Business Wire

Regulatory News:

CGGVeritas (Paris:GA) (NYSE:CGV) (ISIN: 0000120164 – NYSE: CGV)

provides its vessel utilization and its fleet allocation updates

for the third quarter of 2012.

Vessel utilization for the third quarter 2012:

- The vessel availability

rate1 was 93%. This compares to a 91%

availability rate in the third quarter of 2011 and a 91% rate in

the second quarter of 2012.

- The vessel production

rate2 was 90%. This compares to a 93% production

rate in the third quarter of 2011 and a 91% rate in the second

quarter of 2012.

Fleet allocation update for the third quarter 2012:

During the third quarter of 2012, our 3D vessels were allocated

72% to contract and 28% to multi-client programs.

About CGGVeritas

CGGVeritas (www.cggveritas.com) is a leading international

pure-play geophysical company delivering a wide range of

technologies, services and equipment through Sercel, to its broad

base of customers mainly throughout the global oil and gas

industry.

CGGVeritas is listed on the Euronext Paris (ISIN: 0000120164)

and the New York Stock Exchange (in the form of American Depositary

Shares, NYSE: CGV).

The information included herein contains certain forward-looking

statements within the meaning of Section 27A of the securities act

of 1933 and section 21E of the Securities Exchange Act of 1934.

These forward-looking statements reflect numerous assumptions and

involve a number of risks and uncertainties as disclosed by the

Company from time to time in its filings with the Securities and

Exchange Commission. Actual results may vary materially.

1 - The vessel availability rate, a metric measuring the

structural availability of our vessels to meet demand; this metric

is related to the entire fleet, and corresponds to the total vessel

time reduced by the sum of the standby time, of the shipyard time

and the steaming time (the “available time”), all divided by total

vessel time;

2 - The vessel production rate, a metric measuring the

effective utilization of the vessels once available; this metric is

related to the entire fleet, and corresponds to the available time

reduced by the operational downtime, all then divided by available

time.

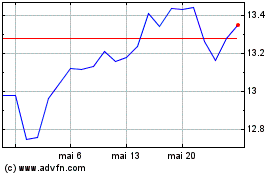

Conductor Global Equity ... (NYSE:CGV)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

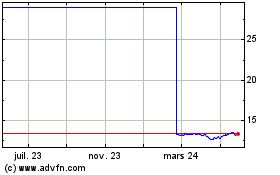

Conductor Global Equity ... (NYSE:CGV)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025

Real-Time news about Conductor Global Equity Value ETF (New York Stock Exchange): 0 recent articles

Plus d'articles sur