The boards of directors (the “Board”) of the BlackRock

closed-end funds listed in the below table (each a “Fund” and

collectively, the “Funds”) announced that each Fund has elected to

be subject to the Maryland Control Share Acquisition Act (the

“MCSAA”), effective immediately.

Fund

Ticker

CUSIP

BlackRock Investment Quality

Municipal Trust, Inc.

BKN

09247D105

BlackRock Income Trust, Inc.

BKT

09247F100

BlackRock Enhanced Capital and

Income Fund, Inc.

CII

09256A109

BlackRock Debt Strategies Fund,

Inc.

DSU

09255R202

BlackRock Enhanced Government

Fund, Inc.

EGF

09255K108

BlackRock Floating Rate Income

Strategies Fund, Inc.

FRA

09255X100

BlackRock Corporate High Yield

Fund, Inc.

HYT

09255P107

BlackRock MuniYield California

Quality Fund, Inc.

MCA

09254N103

BlackRock MuniHoldings New York

Quality Fund, Inc.

MHN

09255C106

BlackRock MuniYield Michigan

Quality Fund, Inc.

MIY

09254V105

BlackRock MuniYield Quality Fund

II, Inc.

MQT

09254G108

BlackRock MuniAssets Fund,

Inc.

MUA

09254J102

BlackRock MuniHoldings California

Quality Fund, Inc.

MUC

09254L107

BlackRock MuniHoldings Quality

Fund II, Inc.

MUE

09254C107

BlackRock Muni Intermediate

Duration Fund, Inc.

MUI

09253X102

BlackRock MuniHoldings New Jersey

Quality Fund, Inc.

MUJ

09254X101

BlackRock MuniVest Fund, Inc.

MVF

09253R105

BlackRock MuniVest Fund II,

Inc.

MVT

09253T101

BlackRock MuniYield California

Fund, Inc.

MYC

09254M105

BlackRock MuniYield Fund,

Inc.

MYD

09253W104

BlackRock MuniYield Quality Fund

III, Inc.

MYI

09254E103

BlackRock MuniYield New Jersey

Fund, Inc.

MYJ

09254Y109

BlackRock MuniYield New York

Quality Fund, Inc.

MYN

09255E102

The Board believes that electing to be subject to the MCSAA

protects the interests of the Funds. Maryland lawmakers instituted

the MCSAA to limit the ability of any single stockholder to exert

undue influence in pursuit of short-term gains at the expense of

long-term value for Fund stockholders and the Fund’s ability to

achieve its investment objective.

The election to become subject to the MCSAA limits the ability

of holders of “control shares” to vote those shares above various

threshold levels that start at 10% unless the other stockholders of

a Fund reinstate those voting rights at a meeting of stockholders

as provided in the MCSAA. The bylaws for each Fund provide that the

provisions of the MCSAA do not apply to the voting rights of the

holders of any shares of preferred stock of the Fund (but only with

respect to such preferred stock).

The above description of the MCSAA is only a high-level summary

and does not purport to be complete. Investors should refer to the

actual provisions of the MCSAA and each Fund’s bylaws for more

information, including definitions of key terms, various exclusions

and exemptions from the statute’s scope, and the procedures by

which stockholders may approve the reinstatement of voting rights

to holders of “control shares.”

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, our clients turn to us for the

solutions they need when planning for their most important goals.

As of September 30, 2020, the firm managed approximately $7.81

trillion in assets on behalf of investors worldwide. For additional

information on BlackRock, please visit www.blackrock.com/corporate

| Twitter: @blackrock | LinkedIn:

www.linkedin.com/company/blackrock

Availability of Fund Updates

BlackRock will update performance and certain other data for the

Funds on a monthly basis on its website in the “Closed-end Funds”

section of www.blackrock.com as well as certain other material

information as necessary from time to time. Investors and others

are advised to check the website for updated performance

information and the release of other material information about the

Funds. This reference to BlackRock’s website is intended to allow

investors public access to information regarding the Funds and does

not, and is not intended to, incorporate BlackRock’s website in

this release.

Forward-Looking Statements

This press release, and other statements that BlackRock or a

Fund may make, may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act, with

respect to a Fund’s or BlackRock’s future financial or business

performance, strategies or expectations. Forward-looking statements

are typically identified by words or phrases such as “trend,”

“potential,” “opportunity,” “pipeline,” “believe,” “comfortable,”

“expect,” “anticipate,” “current,” “intention,” “estimate,”

“position,” “assume,” “outlook,” “continue,” “remain,” “maintain,”

“sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may”

or similar expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

With respect to the Funds, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes and volatility in

political, economic or industry conditions, the interest rate

environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for the Funds or

in a Fund’s net asset value; (2) the relative and absolute

investment performance of a Fund and its investments; (3) the

impact of increased competition; (4) the unfavorable resolution of

any legal proceedings; (5) the extent and timing of any

distributions or share repurchases; (6) the impact, extent and

timing of technological changes; (7) the impact of legislative and

regulatory actions and reforms, including the Dodd-Frank Wall

Street Reform and Consumer Protection Act, and regulatory,

supervisory or enforcement actions of government agencies relating

to a Fund or BlackRock, as applicable; (8) terrorist activities,

international hostilities and natural disasters, which may

adversely affect the general economy, domestic and local financial

and capital markets, specific industries or BlackRock; (9)

BlackRock’s ability to attract and retain highly talented

professionals; (10) the impact of BlackRock electing to provide

support to its products from time to time; and (11) the impact of

problems at other financial institutions or the failure or negative

performance of products at other financial institutions.

Annual and Semi-Annual Reports and other regulatory filings of

the Funds with the Securities and Exchange Commission (“SEC”) are

accessible on the SEC's website at www.sec.gov and on

BlackRock’s website at www.blackrock.com, and may discuss

these or other factors that affect the Funds. The information

contained on BlackRock’s website is not a part of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201019005817/en/

BlackRock Closed-End Funds 1-800-882-0052

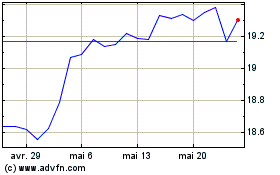

BlackRock Enhanced Capit... (NYSE:CII)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

BlackRock Enhanced Capit... (NYSE:CII)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024