Shareholders to Receive $49 Per Share in

Cash

CIRCOR International, Inc. (“CIRCOR” or the “Company”) (NYSE:

CIR), one of the world’s leading providers of mission critical flow

control products and services for the Industrial and Aerospace

& Defense markets, today announced that it has entered into a

definitive agreement to be acquired by investment funds managed by

KKR, a leading global investment firm, in an all cash transaction

valued at approximately $1.6 billion, including the assumption of

debt.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230604005097/en/

Under the terms of the agreement, KKR will acquire all

outstanding shares of CIRCOR common stock for $49 per share in

cash, representing a 55% premium to the Company’s closing stock

price on June 2, 2023.

“Our agreement with KKR marks the successful culmination of a

strategic review process conducted by the Board, supported by

external advisors and the management team,” said Helmuth Ludwig,

CIRCOR’s Board Chair. “As part of our comprehensive strategic

review, initiated in March 2022, we engaged in extensive dialogue

with a number of parties that expressed interest in acquiring all

or parts of the Company. We believe that this transaction and the

immediate cash value it will provide to CIRCOR’s stockholders best

achieves the Board’s goal of unlocking the significant incremental

value within CIRCOR for its stockholders. This transaction is a

testament to the dedication of CIRCOR’s talented team and we are

grateful for their tireless efforts and commitment to making CIRCOR

an industry leader.”

“This transaction will create significant value to our

stockholders, reflecting the dedication of our team in executing on

our strategic priorities, the strength of our family of brands and

the deep relationships we have built with our customers,” said Tony

Najjar, President and Chief Executive Officer of CIRCOR. “We

believe that having the support and resources of an experienced

investor like KKR will help us expand our presence in the flow

control space and support our mission to deliver the

highest-quality products and services to our customers, many of

which play a critical role in protecting national security.”

“CIRCOR stands out as an innovative and trusted solution

provider, manufacturing mission-critical flow control products for

industrials, aerospace and defense customers. We believe the

Company is in a strong position to grow and benefit from the

attractive tailwinds in those markets. We look forward to working

closely with Tony and his talented team to drive further growth and

value through new product development, aftermarket expansion,

strategic acquisitions and allowing all CIRCOR employees to have

the opportunity to participate in the benefits of ownership of the

Company,” said Josh Weisenbeck, a KKR Partner who leads KKR’s

Industrials investment team.

KKR is making its investment in CIRCOR through its North America

Fund XIII. The investment builds on KKR’s recent experience

investing in flow control technologies and aerospace and defense

industry suppliers globally, including Ingersoll Rand (formerly

known as Gardner Denver), Flow Control Group, Hensoldt, and Novaria

Group.

Following the close of the transaction, KKR will support CIRCOR

in expanding its equity ownership program to allow all employees to

have the opportunity to participate in the benefits of ownership of

the Company. This strategy is based on the belief that employee

engagement is a key driver in building stronger companies. Since

2011, KKR portfolio companies have awarded billions of dollars of

total equity value to over 50,000 non-management employees across

nearly 30 companies.

Transaction Approvals and Timing

The Board of Directors of CIRCOR (the “Board”) has unanimously

approved the transaction and recommends that CIRCOR shareholders

vote in favor of the transaction. The transaction is expected to

close in the fourth quarter of 2023, subject to the receipt of

approval from the Company’s shareholders and certain required

regulatory approvals, as well as the satisfaction of other

customary closing conditions.

The Board will have the right to terminate the merger agreement

to enter into a superior proposal, subject to the terms and

conditions of the merger agreement.

Once the transaction is complete, CIRCOR will be a privately

held company wholly owned by KKR’s investment funds and will no

longer have its common stock listed on any public market.

Advisors

Evercore, J.P. Morgan Securities LLC, and Ropes & Gray LLP

are serving as advisors to CIRCOR. KKR is advised by Citi and

Kirkland & Ellis LLP.

About CIRCOR International, Inc.

CIRCOR International, Inc. is one of the world’s leading

providers of mission critical flow control products and services

for the Industrial and Aerospace & Defense markets. The Company

has a product portfolio of market-leading brands serving its

customers’ most demanding applications. CIRCOR markets its

solutions directly and through various sales partners to more than

14,000 customers in approximately 100 countries. The Company has a

global presence with approximately 3,100 employees and is

headquartered in Burlington, Massachusetts. For more information,

visit the Company’s investor relations website at

http://investors.circor.com.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people and supporting growth in its portfolio companies

and communities. KKR sponsors investment funds that invest in

private equity, credit and real assets and has strategic partners

that manage hedge funds. KKR’s insurance subsidiaries offer

retirement, life and reinsurance products under the management of

Global Atlantic Financial Group. References to KKR’s investments

may include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

Additional Information and Where to Find it

This press release relates to the proposed acquisition of CIRCOR

by Cube BidCo, Inc. (“Parent”). This press release does not

constitute a solicitation of any vote or approval. In connection

with the proposed transaction, CIRCOR plans to file with the U.S.

Securities and Exchange Commission (the “SEC”) and mail or

otherwise provide to its stockholders a proxy statement regarding

the proposed transaction. CIRCOR may also file other documents with

the SEC regarding the proposed transaction. This document is not a

substitute for the proxy statement or any other document that may

be filed by CIRCOR with the SEC.

BEFORE MAKING ANY VOTING DECISION, CIRCOR’S STOCKHOLDERS ARE

URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES

AVAILABLE AND ANY OTHER DOCUMENTS FILED BY CIRCOR WITH THE SEC IN

CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY

REFERENCE THEREIN BEFORE MAKING ANY VOTING OR INVESTMENT DECISION

WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE

PARTIES TO THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at a CIRCOR

stockholder meeting to approve the proposed transaction or related

matters, or other responses in relation to the proposed

transaction, should be made only on the basis of the information

contained in CIRCOR’s proxy statement. Stockholders may obtain a

free copy of the proxy statement and other documents CIRCOR files

with the SEC (when available) through the website maintained by the

SEC at www.sec.gov. CIRCOR makes available free of charge on its

investor relations website at investors.circor.com copies of

materials it files with, or furnishes to, the SEC.

The proposed transaction will be implemented solely pursuant to

the Agreement and Plan of Merger, by and among CIRCOR, Cube Merger

Sub, Inc. and Parent, dated as of June 5, 2023 (the “Merger

Agreement”), which contains the full terms and conditions of the

proposed transaction.

Participants in the Solicitation

CIRCOR and certain of its directors, executive officers and

certain employees and other persons may be deemed to be

participants in the solicitation of proxies from CIRCOR’s

stockholders in connection with the proposed transaction. Security

holders may obtain information regarding the names, affiliations

and interests of CIRCOR’s directors and executive officers in

CIRCOR’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, which was filed with the SEC on March 15, 2023.

To the extent the holdings of CIRCOR’s securities by CIRCOR’s

directors and executive officers have changed since the amounts set

forth in CIRCOR’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Investors may obtain additional information regarding the

interests of participants in the solicitation of proxies from

CIRCOR’s stockholders in connection with the proposed transaction,

which may, in some cases, be different than those of CIRCOR’s

stockholders generally, by reading the proxy statement relating to

the proposed transaction when it is filed with the SEC and other

materials that may be filed with the SEC in connection with the

proposed transaction when they become available. These documents

(when available) may be obtained free of charge from the SEC’s

website at www.sec.gov and the investor relations page of the

CIRCOR’s website at investors.circor.com.

Cautionary Statement Regarding Forward Looking

Statements

This press release includes forward-looking statements that are

subject to risks, uncertainties and other factors that could cause

actual results to differ materially from those implied by the

forward-looking statements. All statements other than statements of

historical fact are statements that could be deemed forward-looking

statements, including all statements regarding the intent, belief

or current expectation of the Company and members of its senior

management team and can typically be identified by words such as

“believe,” “expect,” “estimate,” “predict,” “target,” “potential,”

“likely,” “continue,” “ongoing,” “could,” “should,” “intend,”

“may,” “might,” “plan,” “seek,” “anticipate,” “project” and similar

expressions, as well as variations or negatives of these words.

Forward-looking statements include, without limitation, statements

regarding the proposed transaction, similar transactions,

prospective performance, future plans, events, expectations,

performance, objectives and opportunities and the outlook for the

Company’s business; the commercial success and potential growth of

the Company’s products; the Company’s ability to expand its

presence in the flow control space; the timing of and receipt of

required regulatory filings and approvals relating to the

transaction; the expected timing of the completion of the

transaction; the ability to complete the transaction considering

the various closing conditions; and the accuracy of any assumptions

underlying any of the foregoing. Investors are cautioned that any

such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties and are cautioned

not to place undue reliance on these forward-looking statements.

Actual results may differ materially from those currently

anticipated due to a number of risks and uncertainties. Risks and

uncertainties that could cause the actual results to differ from

expectations contemplated by forward-looking statements include:

uncertainties as to the timing of the merger; uncertainties as to

how many of the Company’s stockholders will vote their stock in

favor of the transaction; the occurrence of any event, change or

other circumstance that could give rise to the termination of the

Merger Agreement, including circumstances requiring a party to pay

the other party a termination fee pursuant to the Merger Agreement;

the ability of the parties to consummate the proposed transaction

on a timely basis or at all; the satisfaction of the conditions

precedent to the consummation of the proposed transaction,

including the ability to secure regulatory approvals and

stockholder approval on the terms expected, at all or in a timely

manner; the effects of the transaction (or the announcement or

pendency thereof) on relationships with associates, customers,

manufacturers, suppliers, employees (including the risks relating

to the ability to retain or hire key personnel), other business

partners or governmental entities; transaction costs; the risk that

the merger will divert management’s attention from the Company’s

ongoing business operations or otherwise disrupts the Company’s

ongoing business operations; changes in the Company’s businesses

during the period between now and the closing; certain restrictions

during the pendency of the proposed transaction that may impact the

Company’s ability to pursue certain business opportunities or

strategic transactions; risks associated with litigation relating

to the proposed transaction; inability to achieve expected results

in pricing and cost cut actions and the related impact on margins

and cash flow; the effectiveness of the Company’s internal control

over financial reporting and disclosure controls and procedures;

the remediation of the material weaknesses in the Company’s

internal controls over financial reporting or other potential

weaknesses of which the Company is not currently aware or which

have not been detected; the uncertainty associated with the current

worldwide economic conditions and the continuing impact on economic

and financial conditions in the United States and around the world,

including as a result of COVID-19, rising inflation, increasing

interest rates, natural disasters, military conflicts, including

the conflict between Russia and Ukraine, terrorist attacks and

other similar matters, and other risks and uncertainties detailed

from time to time in documents filed with the SEC by the Company,

including current reports on Form 8-K, quarterly reports on Form

10-Q and annual reports on Form 10-K. All forward-looking

statements are based on information currently available to the

Company and the Company assumes no obligation to update any

forward-looking statements, whether as a result of new information,

future developments or otherwise, except as may be required by

applicable law. The information set forth herein speaks only as of

the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230604005097/en/

For CIRCOR Scott Solomon Senior Vice President Sharon

Merrill Associates, Inc. (857) 383-2409

CIR@investorrelations.com

For KKR Julia Kosygina (212) 750-8300 media@kkr.com

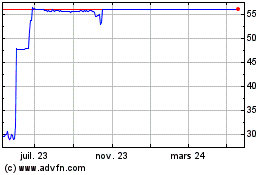

CIRCOR (NYSE:CIR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

CIRCOR (NYSE:CIR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025