CooperCompanies (NYSE: COO) today announced financial results for

its fiscal third quarter ended July 31, 2023.

- Revenue increased 10% year-over-year

to $930.2 million. CooperVision (CVI) revenue up 11% to $630.2

million, and CooperSurgical (CSI) revenue up 8% to $300.0

million.

- GAAP diluted earnings per share

(EPS) of $1.71, down $0.27 or 14% from last year's third

quarter.

- Non-GAAP diluted EPS of $3.35, up

$0.16 or 5% from last year's third quarter. See "Reconciliation of

Selected GAAP Results to Non-GAAP Results" below.

Commenting on the results, Al White, Cooper's President and CEO

said, "We're very pleased to report another strong quarter with

record quarterly revenues at both CooperVision and CooperSurgical.

Our performance reflects the successful execution of our strategic

growth initiatives which would not be possible without the

dedication and incredible hard work of our Cooper teams around the

world."

Third Quarter Operating

Results

- Revenue of $930.2 million, up 10%

from last year’s third quarter, up 11% in constant currency, up 12%

organically.

- Gross margin of 66% compared with

65% in last year’s third quarter. On a non-GAAP basis, gross margin

was similar to last year at 66%.

- Operating margin of 16% compared

with 17% in last year’s third quarter. On a non-GAAP basis,

operating margin was 24%, up from 23% last year driven primarily by

operating expense leverage.

- Interest expense of $26.8 million up

from $17.1 million in last year's third quarter driven by higher

interest rates.

- Net debt outstanding at quarter end

was $2.5 billion (total debt excluding unamortized debt issuance

costs less cash and cash equivalents).

- Cash provided by operations of $142.5 million offset by

capital expenditures of $90.9 million resulted in free cash

flow of $51.6 million.

Third Quarter CooperVision (CVI)

Revenue

- Revenue of $630.2 million, up 11%

from last year’s third quarter, up 12% in constant currency, up 13%

organically.

- Revenue by category:

| |

|

|

|

|

|

Constant Currency |

|

Organic |

| |

|

(In millions) |

|

% chg |

|

% chg |

|

% chg |

| |

|

3Q23 |

|

y/y |

|

y/y |

|

y/y |

|

|

Toric |

$ |

215.7 |

|

16% |

|

16% |

|

16% |

| |

Multifocal |

|

80.8 |

|

20% |

|

19% |

|

19% |

| |

Single-use sphere |

|

187.5 |

|

14% |

|

16% |

|

16% |

| |

Non single-use sphere,

other |

|

146.2 |

|

(2)% |

|

(1)% |

|

3% |

| |

Total |

$ |

630.2 |

|

11% |

|

12% |

|

13% |

| |

| |

|

|

|

|

|

Constant Currency |

|

Organic |

| |

|

(In millions) |

|

% chg |

|

% chg |

|

% chg |

| |

|

3Q23 |

|

y/y |

|

y/y |

|

y/y |

|

|

Americas |

$ |

248.6 |

|

13% |

|

13% |

|

12% |

| |

EMEA |

|

242.2 |

|

10% |

|

9% |

|

13% |

| |

Asia Pacific |

|

139.4 |

|

11% |

|

15% |

|

16% |

| |

Total |

$ |

630.2 |

|

11% |

|

12% |

|

13% |

| |

Third Quarter CooperSurgical (CSI)

Revenue

- Revenue of $300.0 million, up 8%

from last year's third quarter, up 9% in constant currency, up 9%

organically.

- Revenue by category:

| |

|

|

|

|

|

Constant Currency |

|

Organic |

| |

|

(In millions) |

|

% chg |

|

% chg |

|

% chg |

| |

|

3Q23 |

|

y/y |

|

y/y |

|

y/y |

|

|

Office and surgical |

$ |

178.4 |

|

8% |

|

8% |

|

8% |

| |

Fertility |

|

121.6 |

|

9% |

|

11% |

|

11% |

| |

Total |

$ |

300.0 |

|

8% |

|

9% |

|

9% |

| |

Fiscal Year 2023 Financial GuidanceThe Company

updated its fiscal year 2023 financial guidance. Details are

summarized as follows:

- Fiscal 2023 total

revenue of $3,578 - $3,595 million (organic growth of 9% to 10%)

- CVI revenue of

$2,414 - $2,425 million (organic growth of 10% to 11%)

- CSI revenue of

$1,164 - $1,170 million (organic growth of 7% to 8%)

- Fiscal 2023 non-GAAP

diluted earnings per share of $12.72 - $12.90

- Fiscal fourth

quarter 2023 total revenue of $912 - $929 million (organic growth

of 7% to 9%)

- CVI revenue of $613

- $624 million (organic growth of 8% to 10%)

- CSI revenue of $299

- $305 million (organic growth of 5% to 7%)

- Fiscal fourth

quarter 2023 non-GAAP diluted earnings per share of $3.39 -

$3.57

Non-GAAP diluted earnings per share guidance excludes

amortization and impairment of intangible assets, and other

exceptional or unusual income or gains and charges or expenses

including acquisition and integration costs which we may incur as

part of our continuing operations.

With respect to the Company’s guidance expectations, the Company

has not reconciled non-GAAP diluted earnings per share guidance to

GAAP diluted earnings per share due to the inherent difficulty in

forecasting acquisition-related, integration and restructuring

charges and expenses, which are reconciling items between the

non-GAAP and GAAP measure. Due to the unknown effect, timing and

potential significance of such charges and expenses that impact

GAAP diluted earnings per share, the Company is not able to provide

such guidance.

Reconciliation of Selected GAAP Results to Non-GAAP

ResultsTo supplement our financial results and guidance

presented on a GAAP basis, we use non-GAAP measures that we believe

are helpful in understanding our results. The non-GAAP measures

exclude costs which we generally would not have otherwise incurred

in the periods presented as a part of our continuing operations.

Our non-GAAP financial results and guidance are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Management uses supplemental non-GAAP financial measures internally

to understand, manage and evaluate our business and make operating

decisions. These non-GAAP measures are among the factors management

uses in planning and forecasting for future periods. We believe it

is useful for investors to understand the effects of these items on

our consolidated operating results. Our non-GAAP financial results

may include the following adjustments, and as appropriate, the

related income tax effects and changes in income attributable to

noncontrolling interests:

- We exclude the effect of

amortization and impairment of intangible assets from our non-GAAP

financial results. Amortization of intangible assets will recur in

future periods; however, the amounts are affected by the timing and

size of our acquisitions. Impairment of intangible assets is a

non-recurring cost.

- We exclude the effect of acquisition

and integration expenses and restructuring expenses from our

non-GAAP financial results. We incurred significant expenses in

connection with our acquisitions and also incurred certain other

operating expenses or income, which we generally would not have

otherwise incurred in the periods presented as a part of our

continuing operations. Such expenses generally diminish over time

with respect to past acquisitions; however, we generally will incur

similar expenses in connection with any future acquisitions.

Acquisition and integration expenses include direct effects of

acquisition accounting, such as inventory fair value step-up and

items such as personnel costs for transitional employees, other

acquired employee related costs, integration related professional

services and other costs. In addition, our acquisition expenses for

the second quarter of 2023 included an accrual for probable payment

of a termination fee in connection with an asset purchase

agreement, which was paid in August 2023. Restructuring expenses

include items such as employee severance, product rationalization,

facility and other exit costs.

- We exclude other exceptional or

unusual charges or expenses and gains or income. These can be

variable and difficult to predict, such as COVID related charges,

certain litigation expenses, the gain or loss on deconsolidation of

our subsidiaries, changes in fair value of contingent

considerations and product transition costs, impact of certain

charges related to initial compliance with European Union Medical

Device Regulation (MDR), and are not what we consider as typical of

our continuing operations.

- We exclude unrealized and realized

gains and losses on our minority investments as we do not believe

that these components of income or expense have a direct

correlation to our ongoing operations.

- We exclude the effects of non-cash

deferred tax assets related to intra-group transfer of

non-inventory assets.

We also report revenue growth using the non-GAAP financial

measure of constant currency so that revenue results may be

evaluated excluding the effect of foreign currency rate

fluctuations. To present this information, current period revenue

for entities reporting in currencies other than the United States

dollar are converted into United States dollars at the average

foreign exchange rates for the corresponding period in the prior

year. We also report revenue growth using the non-GAAP financial

measure of organic so that revenue results may be evaluated over a

comparable period by excluding the effect of foreign currency

fluctuations, and excluding the impact of any acquisitions,

divestitures and discontinuations that occurred in the comparable

period.

We define the non-GAAP measure of free cash flow as cash

provided by operating activities less capital expenditures. We

believe free cash flow is useful for investors as an additional

measure of liquidity because it represents cash that is available

to grow the business, make strategic acquisitions, repay debt,

buyback common stock or to fund dividend payments. Management uses

free cash flow internally to understand, manage, make operating

decisions and evaluate our business. In addition, we use free cash

flow to help plan and forecast future periods.

We define the non-GAAP measure of net debt as total debt less

cash and cash equivalents. We believe net debt is useful for

investors to be helpful in evaluating our financial leverage.

Management uses net debt as a measure of our financial leverage.

Net debt should not be considered as an alternative to debt

determined in accordance with GAAP and should be reviewed in

conjunction with our consolidated condensed balance sheets.

Investors should consider non-GAAP financial measures in

addition to, and not as replacements for, or superior to, measures

of financial performance prepared in accordance with GAAP.

|

THE COOPER COMPANIES, INC. AND

SUBSIDIARIESReconciliation of Selected GAAP

Results to Non-GAAP Results(In millions, except

per share amounts)(Unaudited) |

|

|

|

Three Months Ended July 31, |

|

|

|

2023 |

|

|

|

2023 |

|

2022 |

|

|

|

2022 |

|

|

|

GAAP |

|

Adjustment |

|

Non-GAAP |

|

GAAP |

|

Adjustment |

|

Non-GAAP |

|

Cost of sales |

|

$ |

320.2 |

|

$ |

(5.2 |

) |

A |

$ |

315.0 |

|

$ |

291.3 |

|

$ |

(5.2 |

) |

A |

$ |

286.1 |

| Operating

expense excluding amortization |

|

$ |

411.7 |

|

$ |

(19.1 |

) |

B |

$ |

392.6 |

|

$ |

371.4 |

|

$ |

(11.3 |

) |

B |

$ |

360.1 |

|

Amortization of intangibles |

|

$ |

46.7 |

|

$ |

(46.7 |

) |

C |

$ |

— |

|

$ |

40.1 |

|

$ |

(40.1 |

) |

C |

$ |

— |

| Other

expense, net |

|

$ |

6.0 |

|

$ |

(1.5 |

) |

D |

$ |

4.5 |

|

$ |

6.2 |

|

$ |

(2.6 |

) |

D |

$ |

3.6 |

| Provision

for income taxes |

|

$ |

33.5 |

|

$ |

(9.4 |

) |

E |

$ |

24.1 |

|

$ |

18.9 |

|

$ |

(0.8 |

) |

E |

$ |

18.1 |

| Diluted

earnings per share (1) |

|

$ |

1.71 |

|

$ |

1.64 |

|

|

$ |

3.35 |

|

$ |

1.98 |

|

$ |

1.21 |

|

|

$ |

3.19 |

|

Weighted average diluted shares used |

|

|

49.9 |

|

|

|

|

49.9 |

|

|

49.6 |

|

|

|

|

49.6 |

|

A |

Fiscal 2023 GAAP cost of sales included $5.2 million of costs

primarily related to integration activities, resulting in fiscal

2023 GAAP gross margin of 66% as compared to fiscal 2023 non-GAAP

gross margin of 66%. Fiscal 2022 GAAP cost of sales included $5.2

million of costs primarily related to exit costs of the contact

lens care business and integration costs, resulting in fiscal 2022

GAAP gross margin of 65% as compared to fiscal 2022 non-GAAP gross

margin of 66%. |

| B |

Fiscal 2023 GAAP operating

expense included $19.1 million of costs, primarily related to

acquisition and integration activities and European Medical Devices

Regulation costs. Fiscal 2022 GAAP operating expense included $11.3

million of costs primarily related to acquisition and integration

activities and exit costs of the contact lens care business. |

| C |

Amortization expense was $46.7

million and $40.1 million for the fiscal 2023 and 2022 periods,

respectively. Items A, B, and C resulted in fiscal 2023 GAAP

operating margin of 16% as compared to fiscal 2023 non-GAAP

operating margin of 24%, and fiscal 2022 GAAP operating margin of

17% as compared to fiscal 2022 non-GAAP operating margin of

23%. |

| D |

Fiscal 2023 other expense were

primarily related to loss on minority investments. Fiscal 2022

other expense primarily related to gains and losses on minority

investments. |

| E |

Adjustments to provision for

income taxes were primarily from the above items and intra-entity

asset transfers. |

| (1) |

QTD non-GAAP adjustments or

diluted non-GAAP EPS may not sum to YTD non-GAAP adjustments or YTD

diluted non-GAAP EPS due to rounding |

|

THE COOPER COMPANIES, INC. AND

SUBSIDIARIESReconciliation of Selected GAAP

Results to Non-GAAP Results(In millions, except

per share amounts)(Unaudited) |

|

|

|

Nine Months Ended July 31, |

|

|

|

2023 |

|

|

|

2023 |

|

2022 |

|

|

|

|

2022 |

|

|

|

GAAP |

|

Adjustment |

|

Non-GAAP |

|

GAAP |

|

Adjustment |

|

Non-GAAP |

|

Cost of sales |

|

$ |

914.7 |

|

$ |

(16.8 |

) |

A |

$ |

897.9 |

|

$ |

857.3 |

|

|

$ |

(34.1 |

) |

A |

$ |

823.2 |

| Operating

expense excluding amortization |

|

$ |

1,214.3 |

|

$ |

(70.4 |

) |

B |

$ |

1,143.9 |

|

$ |

1,065.4 |

|

|

$ |

(22.4 |

) |

B |

$ |

1,043.0 |

|

Amortization of intangibles |

|

$ |

139.7 |

|

$ |

(139.7 |

) |

C |

$ |

— |

|

$ |

133.5 |

|

|

$ |

(133.5 |

) |

C |

$ |

— |

| Other

expense (income), net |

|

$ |

11.9 |

|

$ |

(4.7 |

) |

D |

$ |

7.2 |

|

$ |

(33.3 |

) |

|

$ |

43.7 |

|

D |

$ |

10.4 |

| Provision

for income taxes |

|

$ |

96.8 |

|

$ |

(23.8 |

) |

E |

$ |

73.0 |

|

$ |

82.7 |

|

|

$ |

(14.4 |

) |

E |

$ |

68.3 |

| Diluted

earnings per share (1) |

|

$ |

4.21 |

|

$ |

5.13 |

|

|

$ |

9.34 |

|

$ |

6.44 |

|

|

$ |

3.23 |

|

|

$ |

9.67 |

|

Weighted average diluted shares used |

|

|

49.8 |

|

|

|

|

49.8 |

|

|

49.7 |

|

|

|

|

|

49.7 |

|

A |

Fiscal 2023 GAAP cost of sales included $16.8 million of costs

primarily related to exit costs of the contact lens care business

and integration activities, resulting in fiscal 2023 GAAP gross

margin of 66% as compared to fiscal 2023 non-GAAP gross margin of

66%. Fiscal 2022 GAAP cost of sales included $34.1 million of costs

primarily related to exit costs of the contact lens care business,

resulting in fiscal 2022 GAAP gross margin of 65% as compared to

fiscal 2022 non-GAAP gross margin of 67%. |

| B |

Fiscal 2023 GAAP operating

expense included $70.4 million costs, consisting primarily of an

accrual of $45.0 million associated with the payment in August 2023

of a termination fee under an asset purchase agreement related to

Cook Medical’s reproductive health business. Fiscal 2022 GAAP

operating expense included $22.4 million of costs primarily related

to acquisition and integration activities and exit costs of the

contact lens care business, partially offset by net decrease in

fair value of contingent consideration. |

| C |

Amortization expense was $139.7

million and $133.5 million for the fiscal 2023 and 2022,

respectively. Items A, B, and C resulted in fiscal 2023 GAAP

operating margin of 15% as compared to fiscal 2023 non-GAAP

operating margin of 23%, and fiscal 2022 GAAP operating margin of

16% as compared to fiscal 2022 non-GAAP operating margin of

24%. |

| D |

Fiscal 2023 other expense

(income) primarily consists of loss on minority investments. Fiscal

2022 other expense (income) primarily consists of a gain on

deconsolidation of SightGlass Vision (SGV). |

| E |

Adjustments to provision for

income taxes were primarily from the above items and intra-entity

asset transfers. |

| (1) |

QTD non-GAAP adjustments or

diluted non-GAAP EPS may not sum to YTD non-GAAP adjustments or YTD

diluted non-GAAP EPS due to rounding |

| |

|

Conference Call and Webcast The Company will

host a conference call today at 5:00 PM ET to discuss the results

and current corporate developments. The dial-in number for the call

is 800-715-9871 and the conference ID is 5988827. A simultaneous

audio webcast can be accessed on CooperCompanies' investor

relations website at investor.coopercos.com and a replay will

be available shortly after the call on the same website.

About

CooperCompaniesCooperCompanies ("Cooper") is a global

medical device company publicly traded on the NYSE (NYSE: COO).

Cooper operates through two business units, CooperVision and

CooperSurgical. CooperVision brings a refreshing perspective on

vision care with a commitment to developing a wide range of

high-quality products for contact lens wearers and providing

focused practitioner support. CooperSurgical is committed to

advancing the health of women, babies and families with its

diversified portfolio of products and services focusing on medical

devices and fertility & genomics. Headquartered in San Ramon,

Calif., Cooper has a workforce of more than 15,000 with products

sold in over 130 countries. For more information, please

visit www.coopercos.com.

Forward-Looking Statements This earnings

release contains "forward-looking statements" as defined by the

Private Securities Litigation Reform Act of 1995. Statements

relating to guidance, plans, prospects, goals, strategies, future

actions, events or performance and other statements of which are

other than statements of historical fact, including our fiscal year

2023 financial guidance, are forward looking. In addition, all

statements regarding anticipated growth in our revenues,

anticipated market conditions, planned product launches,

restructuring or business transition expectations, regulatory

plans, and expected results of operations are forward-looking. To

identify these statements look for words like "believes,"

"outlook," "probable," "expects," "may," "will," "should," "could,"

"seeks," "intends," "plans," "estimates" or "anticipates" and

similar words or phrases. Forward-looking statements necessarily

depend on assumptions, data or methods that may be incorrect or

imprecise and are subject to risks and uncertainties.

Among the factors that could cause our actual results and future

actions to differ materially from those described in

forward-looking statements are: adverse changes in the global or

regional general business, political and economic conditions

including the impact of continuing uncertainty and instability of

certain countries, man-made or natural disasters and pandemic

conditions, that could adversely affect our global markets, and the

potential adverse economic impact and related uncertainty caused by

these items; the impact of Russia's invasion of Ukraine and the

global response to this invasion on the global economy, European

economy, financial markets, energy markets, currency rates and our

ability to supply product to, or through, affected countries; our

substantial and expanding international operations and the

challenges of managing an organization spread throughout multiple

countries and complying with a variety of international legal,

compliance and regulatory requirements; foreign currency exchange

rate and interest rate fluctuations including the risk of

fluctuations in the value of foreign currencies or interest rates

that would decrease our net sales and earnings; our existing and

future variable rate indebtedness and associated interest expense

is impacted by rate increases, which could adversely affect our

financial health or limit our ability to borrow additional funds;

changes in tax laws, examinations by tax authorities, and changes

in our geographic composition of income; acquisition-related

adverse effects; compliance costs and potential liability in

connection with U.S. and foreign laws and health care regulations

pertaining to privacy and security of personal information; a major

disruption in the operations of our manufacturing, accounting and

financial reporting, research and development, distribution

facilities or raw material supply chain; market consolidation of

large customers globally through mergers or acquisitions resulting

in a larger proportion or concentration of our business being

derived from fewer customers; disruptions in supplies of raw

materials, particularly components used to manufacture our silicone

hydrogel lenses; new U.S. and foreign government laws and

regulations, and changes in existing laws, regulations and

enforcement guidance, which affect areas of our operations

including, but not limited to, those affecting the health care

industry, including the contact lens industry specifically and the

medical device or pharmaceutical industries generally, including

but not limited to the EU Medical Devices Regulation (MDR), and the

EU In Vitro Diagnostic Medical Devices Regulation (IVDR); legal

costs, insurance expenses, settlement costs and the risk of an

adverse decision, prohibitive injunction or settlement related to

product liability, patent infringement, contractual disputes, or

other litigation; limitations on sales following product

introductions due to poor market acceptance; new competitors,

product innovations or technologies, including but not limited to,

technological advances by competitors, new products and patents

attained by competitors, and competitors' expansion through

acquisitions; reduced sales, loss of customers and costs and

expenses related to product recalls and warning letters; failure to

receive, or delays in receiving, regulatory approvals or

certifications for products; failure of our customers and end users

to obtain adequate coverage and reimbursement from third-party

payors for our products and services; the requirement to provide

for a significant liability or to write off, or accelerate

depreciation on, a significant asset, including goodwill, other

intangible assets and idle manufacturing facilities and equipment;

the success of our research and development activities and other

start-up projects; dilution to earnings per share from acquisitions

or issuing stock; impact and costs incurred from changes in

accounting standards and policies; risks related to environmental

laws and requirements applicable to our facilities and products,

including evolving regulations regarding the use of hazardous

substances or chemicals in our products; risks related to

environmental, social and corporate governance (ESG) issues,

including those related to climate change and sustainability; and

other events described in our Securities and Exchange Commission

filings, including the “Business”, “Risk Factors” and "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" sections in the Company’s Annual Report on Form 10-K

for the fiscal year ended October 31, 2022, as such Risk

Factors may be updated in annual and quarterly filings.

We caution investors that forward-looking statements reflect our

analysis only on their stated date. We disclaim any intent to

update them except as required by law.

Contact:

Kim DuncanVice President, Investor Relations and Risk

Management925-460-3663ir@cooperco.com

|

THE COOPER COMPANIES, INC. AND SUBSIDIARIES |

|

Consolidated Condensed Balance Sheets |

|

(In millions) |

|

(Unaudited) |

| |

| |

July 31, 2023 |

|

October 31, 2022 |

|

ASSETS |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

117.3 |

|

|

$ |

138.2 |

|

|

Trade receivables, net |

|

629.9 |

|

|

|

557.8 |

|

|

Inventories |

|

723.6 |

|

|

|

628.7 |

|

|

Prepaid expense and other current assets |

|

240.2 |

|

|

|

208.9 |

|

|

Total current assets |

|

1,711.0 |

|

|

|

1,533.6 |

|

| Property, plant and equipment,

net |

|

1,535.0 |

|

|

|

1,432.9 |

|

| Goodwill |

|

3,683.1 |

|

|

|

3,609.7 |

|

| Other intangibles, net |

|

1,770.6 |

|

|

|

1,885.1 |

|

| Deferred tax assets |

|

2,369.4 |

|

|

|

2,443.1 |

|

| Other assets |

|

628.2 |

|

|

|

587.9 |

|

|

Total assets |

$ |

11,697.3 |

|

|

$ |

11,492.3 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: |

|

|

|

|

Short-term debt |

$ |

79.6 |

|

|

$ |

412.6 |

|

|

Accounts Payable |

|

226.7 |

|

|

|

248.8 |

|

|

Employee compensation and benefits |

|

154.6 |

|

|

|

152.1 |

|

|

Deferred revenue |

|

122.8 |

|

|

|

93.6 |

|

|

Other current liabilities |

|

409.9 |

|

|

|

373.1 |

|

|

Total current liabilities |

|

993.6 |

|

|

|

1,280.2 |

|

| Long-term debt |

|

2,514.7 |

|

|

|

2,350.8 |

|

| Deferred tax liabilities |

|

137.6 |

|

|

|

149.9 |

|

| Long-term tax payable |

|

90.5 |

|

|

|

113.2 |

|

| Deferred revenue |

|

185.5 |

|

|

|

198.3 |

|

| Accrued pension liability and

other |

|

246.9 |

|

|

|

225.2 |

|

|

Total liabilities |

|

4,168.8 |

|

|

|

4,317.6 |

|

| Stockholders’ equity |

|

7,528.5 |

|

|

|

7,174.7 |

|

|

Total liabilities and stockholders' equity |

$ |

11,697.3 |

|

|

$ |

11,492.3 |

|

|

|

|

THE COOPER COMPANIES, INC. AND SUBSIDIARIES |

|

Consolidated Statements of Income |

|

(In millions, except per share amounts) |

|

(Unaudited) |

| |

| |

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net sales |

$ |

930.2 |

|

|

$ |

843.4 |

|

|

$ |

2,666.1 |

|

|

$ |

2,460.3 |

|

| Cost of sales |

|

320.2 |

|

|

|

291.3 |

|

|

|

914.7 |

|

|

|

857.3 |

|

| Gross profit |

|

610.0 |

|

|

|

552.1 |

|

|

|

1,751.4 |

|

|

|

1,603.0 |

|

| Selling, general and

administrative expense |

|

375.2 |

|

|

|

342.7 |

|

|

|

1,113.6 |

|

|

|

984.2 |

|

| Research and development

expense |

|

36.5 |

|

|

|

28.7 |

|

|

|

100.7 |

|

|

|

81.2 |

|

| Amortization of

intangibles |

|

46.7 |

|

|

|

40.1 |

|

|

|

139.7 |

|

|

|

133.5 |

|

| Operating income |

|

151.6 |

|

|

|

140.6 |

|

|

|

397.4 |

|

|

|

404.1 |

|

| Interest expense |

|

26.8 |

|

|

|

17.1 |

|

|

|

79.0 |

|

|

|

34.5 |

|

| Other expense (income),

net |

|

6.0 |

|

|

|

6.2 |

|

|

|

11.9 |

|

|

|

(33.3 |

) |

| Income before income

taxes |

|

118.8 |

|

|

|

117.3 |

|

|

|

306.5 |

|

|

|

402.9 |

|

| Provision for income

taxes |

|

33.5 |

|

|

|

18.9 |

|

|

|

96.8 |

|

|

|

82.7 |

|

| Net income |

$ |

85.3 |

|

|

$ |

98.4 |

|

|

$ |

209.7 |

|

|

$ |

320.2 |

|

| |

|

|

|

|

|

|

|

| Earnings per share -

diluted |

$ |

1.71 |

|

|

$ |

1.98 |

|

|

$ |

4.21 |

|

|

$ |

6.44 |

|

| |

|

|

|

|

|

|

|

| Number of shares used to

compute diluted earnings per share |

|

49.9 |

|

|

|

49.6 |

|

|

|

49.8 |

|

|

|

49.7 |

|

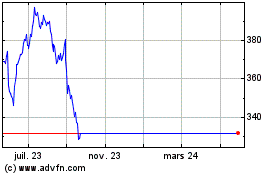

Cooper Companies (NYSE:COO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Cooper Companies (NYSE:COO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025