MFS High Income Municipal Trust, MFS High Yield Municipal Trust, and MFS Investment Grade Municipal Trust Announce Optional Partial Redemption of Preferred Shares

05 Octobre 2023 - 10:18PM

Business Wire

MFS® High Income Municipal Trust (NYSE: CXE), MFS® High Yield

Municipal Trust (NYSE: CMU), and MFS® Investment Grade Municipal

Trust (NYSE: CXH) announced today that each fund will complete an

optional partial redemption of its Remarketable Variable Rate

MuniFund Term Preferred Shares, Series 2051 ("Series 2051 RVMTP

Shares") on November 3, 2023 (the “Redemption Date”).

On the Redemption Date, CXE will redeem up to 50 of the 865

Series 2051 RVMTP Shares and CXH will redeem up to 50 of the 488

Series 2051 RVMTP Shares, each at a redemption price equal to the

liquidation preference of $100,000 per share plus unpaid dividends

and other distributions accumulated from the original issue date

to, but excluding, the Redemption Date. Additionally, on the

Redemption Date, CMU will redeem up to 100 of the 700 Series 2051

RVMTP Shares at a redemption price equal to the liquidation

preference of $100,000 per share plus unpaid dividends and other

distributions accumulated from the original issue date to, but

excluding, the Redemption Date. The redemption of a portion of each

fund’s Series 2051 RVMTP Shares will reduce the amount of each

fund's leverage attributable to preferred shares.

All regulatory requirements relating to the redemption of each

fund’s Series 2051 RVMTP Shares have been satisfied by MFS

Investment Management. The Tender and Paying Agent is The Bank of

New York Mellon and its address is: 101 Barclay Street, Floor 7E,

New York, New York 10286. Payment of the redemption price for each

fund's Series 2051 RVMTP Shares will be sent to the holder by the

Tender and Paying Agent on the Redemption Date.

Cautionary Statement Regarding

Forward-Looking Statements

This press release may contain statements regarding plans and

expectations for the future that constitute forward-looking

statements within The Private Securities Litigation Reform Act of

1995. All statements other than statements of historical fact are

forward-looking and can be identified by the use of words such as

"may," "will," "expect," "anticipate," "estimate," "believe,"

"continue," or other similar words. Such forward-looking statements

are based on the funds' current plans and expectations, are not

guarantees of future results or performance, and are subject to

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

All forward-looking statements are as of the date of this release

only; the funds undertake no obligation to update or review any

forward-looking statements. You are urged to carefully consider all

such factors.

About the Funds

MFS® High Income Municipal Trust, MFS® High Yield Municipal

Trust, and MFS® Investment Grade Municipal Trust are closed-end

investment company products advised by MFS Investment Management.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and once issued,

common shares of the funds are bought and sold in the open market

through a stock exchange. Shares may trade at a discount to the net

asset value per share. Shares of the funds are not FDIC-insured and

are not deposits or other obligations of, or guaranteed by, any

bank. Shares of the funds involve investment risk, including

possible loss of principal.

About MFS Investment

Management®

In 1924, MFS® launched the first US open-end mutual fund,

opening the door to the markets for millions of everyday investors.

Today, as a full-service global investment manager serving

financial advisors, intermediaries and institutional clients, MFS

still serves a single purpose: to create long term value for

clients by allocating capital responsibly. That takes our powerful

investment approach combining collective expertise, thoughtful risk

management and long-term discipline. Supported by our culture of

shared values and collaboration, our teams of diverse thinkers

actively debate ideas and assess material risks to uncover what we

believe are the best investment opportunities in the market. As of

September 30, 2023, MFS manages $555.9 billion in assets under

management. Please visit mfs.com for more information.

MFS Investment Management 111

Huntington Ave., Boston, MA 02199

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231005473161/en/

Dan Flaherty, +1 617.954.4256

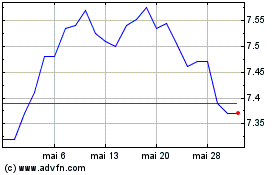

MFS Investment Grade Mun... (NYSE:CXH)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

MFS Investment Grade Mun... (NYSE:CXH)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025