Community Health Systems, Inc. Announces Pricing of $1,225.0 Million Tack-On Offering of 10.875% Senior Secured Notes Due 2032

21 Mai 2024 - 10:34PM

Business Wire

Community Health Systems, Inc. (the “Company”) (NYSE: CYH) today

announced that its wholly owned subsidiary, CHS/Community Health

Systems, Inc. (the “Issuer”), has priced an offering of an

additional $1,225.0 million aggregate principal amount of its

outstanding 10.875% Senior Secured Notes due 2032 (the “Tack-On

Notes”) at an issue price of 102.000%, plus accrued and unpaid

interest from December 22, 2023 to the closing date (the “Notes

Offering”). This represents an increase of $100.0 million in

aggregate principal amount in the offering size of the Tack-On

Notes. The Tack-On Notes will be part of the same series as, and

rank equally with, the Issuer’s 10.875% Senior Secured Notes due

2032 issued in December 2023. After giving effect to this offering,

the Issuer will have $2,225.0 million aggregate principal amount of

outstanding 10.875% Senior Secured Notes due 2032. The sale of the

Tack-On Notes is expected to be consummated on or about June 5,

2024, subject to customary closing conditions.

The Issuer intends to use the net proceeds of the Notes Offering

to redeem all of its outstanding 8.000% Senior Secured Notes due

2026 (the “2026 Notes”) at par plus accrued and unpaid interest to,

but excluding the redemption date, to fund $100 million of

repurchases of the Issuer’s other outstanding notes, to pay related

fees and expenses and for general corporate purposes, which may

include the repayment of a portion of our ABL Facility. This press

release shall not constitute a notice of redemption for the 2026

Notes.

The Tack-On Notes are being offered in the United States to

persons reasonably believed to be qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”), and outside the United States pursuant to

Regulation S under the Securities Act. The Tack-On Notes have not

been registered under the Securities Act and may not be offered or

sold in the United States absent registration or an applicable

exemption from the registration requirements.

This press release is neither an offer to sell nor a

solicitation of an offer to buy any securities, nor shall there be

any offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale would be unlawful. Any offers of the

Tack-On Notes will be made only by means of a private offering

memorandum. This notice is being issued pursuant to and in

accordance with Rule 135(c) under the Securities Act.

Forward-Looking Statements

This press release may include information that could constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements involve

risk and uncertainties. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise, except as otherwise

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521655842/en/

Investor Contacts: Kevin J. Hammons, 615-465-7000

President and Chief Financial Officer or Anton Hie, 615-465-7012

Vice President – Investor Relations

Media Contact: Tomi Galin, 615-628-6607 Executive Vice

President, Corporate Communications, Marketing and Public

Affairs

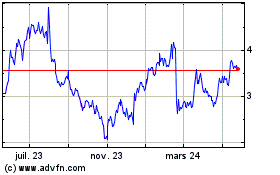

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

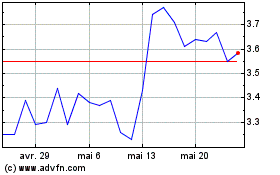

Community Health Systems (NYSE:CYH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024