Virtus Stone Harbor Emerging Markets Total Income Fund Provides Update on Reorganization and Announces Monthly Distribution

16 Novembre 2023 - 11:48PM

Business Wire

Virtus Stone Harbor Emerging Markets Total Income Fund (NYSE:

EDI) announced today its reorganization with and into Virtus Stone

Harbor Emerging Markets Income Fund (NYSE: EDF) is currently

scheduled as of the close of business of the New York Stock

Exchange on December 15, 2023.

The reorganization had been delayed pending regulatory approval

related to the transfer or sale of certain foreign assets, which

has since been resolved. The reorganized fund will retain the EDF

ticker symbol and CUSIP 86164T107.

EDI also announced today the following monthly distribution:

Amount of Distribution

Ex-Date

Record Date

Payable Date

$0.07

December 7, 2023

December 8, 2023

December 13, 2023

EDI’s board of trustees has voted to discontinue the dividend

reinvestment program in advance of the last monthly distribution

prior to the reorganization, which means that the December

distribution will be paid in cash only.

EDI intends to distribute on the dates noted above the greater

of $0.07 per share or all available net investment income and net

short- and long-term capital gains prior to the reorganization

date, in accordance with requirements under the Internal Revenue

Code of 1986, as amended. The amount of any supplemental

distribution, if needed, will be announced on December 5, 2023.

The amounts of distributions reported in this notice are

estimates only and are not being provided for tax reporting

purposes. The actual amounts and sources of the distributions for

tax purposes may be subject to changes based on tax regulations.

The Fund or your broker will send you a Form 1099-DIV for the

calendar year that will tell you what distributions to report for

federal income tax purposes.

About the Fund Virtus Stone Harbor Emerging Markets Total

Income Fund (EDI) is a non-diversified, closed-end management

investment company that is managed by Stone Harbor Investment

Partners. The Fund’s primary investment objective is to maximize

total return, which consists of income and capital appreciation on

its investments in emerging markets securities. There is no

assurance that the Fund will achieve its investment objective.

For more information on the Fund, contact shareholder services

at (866) 270-7788, by email at closedendfunds@virtus.com, or

through the Closed-End Funds section of virtus.com.

Fund Risks An investment in a fund is subject to risk,

including the risk of possible loss of principal. A fund’s shares

may be worth less upon their sale than what an investor paid for

them. Shares of closed-end funds may trade at a premium or discount

to their net asset value. For more information about the Fund’s

investment objective and risks, please see the Fund’s most recent

annual report, a copy of which may be obtained free of charge by

contacting “Shareholder Services” as set forth at the end of this

press release.

About Stone Harbor Stone Harbor Investment Partners is a

global institutional fixed-income investment manager specializing

in credit and asset allocation strategies. The firm manages

institutional clients’ assets in a range of investment strategies

including emerging markets debt, global high yield, bank loans, as

well as multi-sector credit products including unconstrained and

total return approaches. Stone Harbor Investment Partners is a

division of Virtus Fixed Income Advisers, LLC, a registered

investment adviser affiliated with Virtus Investment Partners. For

more information, visit shipemd.com.

About Virtus Investment Partners, Inc. Virtus Investment

Partners (NASDAQ: VRTS) is a distinctive partnership of boutique

investment managers singularly committed to the long-term success

of individual and institutional investors. We provide investment

management products and services from our affiliated managers, each

with a distinct investment style and autonomous investment process,

as well as select subadvisers. Investment solutions are available

across multiple disciplines and product types to meet a wide array

of investor needs. Additional information about our firm,

investment partners, and strategies is available at virtus.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231116719535/en/

For Further Information:

Shareholder Services (866) 270-7788 closedendfunds@virtus.com

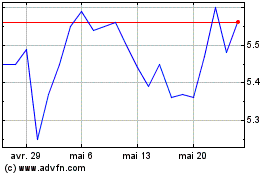

Virtus Stone Harbor Emer... (NYSE:EDF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Virtus Stone Harbor Emer... (NYSE:EDF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025