Report of Foreign Issuer (6-k)

07 Juin 2018 - 12:05PM

Edgar (US Regulatory)

FORM

6-K

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of

Foreign Issuer

Pursuant to Rule

13a-16

or

15d-16

of

the Securities Exchange Act of 1934

For the month of June, 2018

Commission File Number:

001-37723

Enel Chile S.A.

(Translation of Registrant’s Name into English)

Santa Rosa 76

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form

20-F

or Form

40-F:

Form

20-F

☒ Form

40-F

☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate

by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission

pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule

12g3-2(b):

N/A

FORWARD-LOOKING STATEMENTS

This Report on

Form 6-K (this

“Report”) of Enel Chile S.A. (“Enel Chile”)

contains statements that are or may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements

appear throughout this Report and include statements regarding Enel Chile’s intent, belief or current expectations, including but not limited to any statements concerning:

|

|

•

|

|

Enel Chile’s capital investment program;

|

|

|

•

|

|

trends affecting our financial condition or results from operations;

|

|

|

•

|

|

Enel Chile’s dividend policy;

|

|

|

•

|

|

the future impact of competition and regulation;

|

|

|

•

|

|

political and economic conditions in the countries in which Enel Chile’s or its related companies operate or may operate in the future;

|

|

|

•

|

|

any statements preceded by, followed by or that include the words “believes,” “expects,” “predicts,” “anticipates,” “intends,” “estimates,” “should,”

“may” or similar expressions; and

|

|

|

•

|

|

other statements contained or incorporated by reference in this Report regarding matters that are not historical facts.

|

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to:

|

|

•

|

|

demographic developments, political events, economic fluctuations and interventionist measures by authorities in Chile;

|

|

|

•

|

|

water supply, droughts, flooding and other weather conditions;

|

|

|

•

|

|

changes in Chilean environmental regulations and the regulatory framework of the electricity industry;

|

|

|

•

|

|

our ability to implement proposed capital expenditures, including Enel Chile’s ability to arrange financing where required;

|

|

|

•

|

|

the nature and extent of future competition in our principal markets;

|

|

|

•

|

|

integration of Enel Green Power Latin América S.A. may not be successful or Enel Chile may not realize the business growth opportunities, revenue benefits or other benefits; and

|

|

|

•

|

|

the factors discussed under Risk Factors in the Annual Report on

Form 20-F of

Enel Chile for the year ended December 31, 2017, as amended.

|

You should not place undue reliance on such statements, which speak only as of the date that they were made. Enel Chile’s independent

registered public accounting firm has not examined or compiled the forward-looking statements and, accordingly, does not provide any assurance with respect to such statements. You should consider these cautionary statements together with any written

or oral forward-looking statements that we may issue in the future. Enel Chile does not undertake any obligation to release publicly any revisions to forward-looking statements contained in this Report to reflect later events or circumstances or to

reflect the occurrence of unanticipated events.

For all these forward-looking statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Enel Chile is incorporating by reference the information set forth in this Report

on Form 6-K into

Enel Chile’s Registration Statement on Form

F-3

(Registration

No. 333-223044),

as amended.

The table in Item 5.F. of Enel Chile’s Annual Report on Form

20-F

for the year ended

December 31, 2017, as amended, which discloses the cash payment obligations of Enel Chile as of December 31, 2017, is updated in its entirety with the following:

|

F.

|

Tabular Disclosure of Contractual Obligations.

|

The table below sets forth our cash payment obligations

as of December 31, 2017:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments due by Period

|

|

|

Ch$ billion

|

|

Total

|

|

|

2018

|

|

|

2019-2020

|

|

|

2021-2022

|

|

|

After 2022

|

|

|

Purchase

obligations

(1)

|

|

|

19,560

|

|

|

|

1,197

|

|

|

|

2,529

|

|

|

|

2,456

|

|

|

|

13,378

|

|

|

Interest

expense

(2)

|

|

|

495

|

|

|

|

45

|

|

|

|

85

|

|

|

|

76

|

|

|

|

288

|

|

|

Yankee bonds

|

|

|

441

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

441

|

|

|

Local

bonds

(3)

|

|

|

327

|

|

|

|

6

|

|

|

|

56

|

|

|

|

60

|

|

|

|

205

|

|

|

Pension and post-retirement obligations

(4)

|

|

|

57

|

|

|

|

7

|

|

|

|

8

|

|

|

|

8

|

|

|

|

34

|

|

|

Financial leases

|

|

|

17

|

|

|

|

2

|

|

|

|

5

|

|

|

|

5

|

|

|

|

5

|

|

|

Total contractual obligations

|

|

|

20,897

|

|

|

|

1,257

|

|

|

|

2,683

|

|

|

|

2,605

|

|

|

|

14,351

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Includes generation and distribution business purchase obligations, which are comprised mainly of energy purchases, operating and maintenance contracts, and other services. Of the total contractual obligations of

Ch$ 19,560 billion, 64.2% corresponds to energy purchased for distribution, 31.2% corresponds primarily to fuel supply, maintenance of medium and low voltage lines, supplies of cable and utility poles, and energy purchased for

generation, and the remaining 4.6% corresponds to miscellaneous services, such as LNG regasification, fuel transportation and coal handling.

|

|

(2)

|

Interest expense includes the interest payments for all outstanding financial obligations, calculated as principal multiplied by the interest rate, presented according to when the interest payment comes due.

|

|

(3)

|

Hedging instruments included might substantially affect the outstanding amount of debt.

|

|

(4)

|

We have funded and unfunded pension and post-retirement benefit plans. Our funded plans have contractual annual commitments for contributions, which do not change based on funding status. Cash flow estimates in the

table are based on such annual contractual commitments including certain estimable variable factors such as interest. Cash flow estimates in the table relating to our unfunded plans are based on future discounted payments necessary to meet all of

our pension and post-retirement obligations.

|

The table under the heading “Pro Forma Consolidated Statement of

Financial Position Information” on page

S-15

of Enel Chile’s preliminary prospectus supplement dated May 30, 2018 is updated in its entirety with the following:

|

|

|

|

|

|

|

|

|

As of December 31, 2017

|

|

|

|

|

(in thousands of Ch$)

|

|

|

Pro Forma Consolidated Statement of Financial Position Information:

|

|

|

|

|

|

Total assets

|

|

|

7,311,577,549

|

|

|

Total non-current liabilities

|

|

|

2,862,654,348

|

|

|

Total current liabilities

|

|

|

949,622,433

|

|

|

Equity attributable to owners of parent company

|

|

|

3,260,904,884

|

|

|

Non-controlling interests

|

|

|

238,395,884

|

|

|

Total equity

|

|

|

3,499,300,768

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enel Chile S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By

|

|

/s/ Nicola Cotugno

|

|

|

|

|

|

|

|

|

|

Name: Nicola Cotugno

|

|

|

|

|

|

|

|

|

|

Title: Chief Executive Officer

|

|

Date:

|

|

June 6, 2018

|

|

|

|

|

|

|

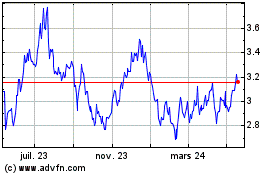

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

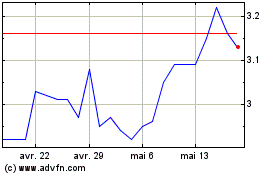

Enel Chile (NYSE:ENIC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025