0000033213

false

0000033213

2023-08-22

2023-08-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 30, 2023 (August 22, 2023)

EQT CORPORATION

(Exact name of registrant as specified in

its charter)

| Pennsylvania |

|

001-3551 |

|

25-0464690 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

625

Liberty Avenue, Suite 1700, Pittsburgh, Pennsylvania 15222

(Address of principal executive offices,

including zip code)

(412) 553-5700

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

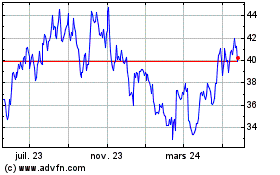

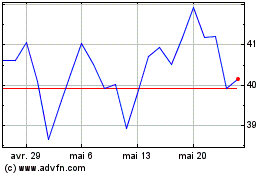

| Common Stock, no par value |

|

EQT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

As previously disclosed in the Current Report on

Form 8-K filed by EQT Corporation (“EQT”) with the Securities and Exchange Commission (the “SEC”) on August 22,

2023 (the “Initial Form 8-K”), on August 22, 2023, EQT and its wholly owned subsidiary, EQT Production Company (the “Buyer”),

consummated the previously announced acquisition of the upstream oil and gas assets of THQ Appalachia I, LLC (the “Upstream Seller”)

and the gathering and processing assets of THQ-XcL Holdings I, LLC (the “Midstream Seller”) through the Buyer’s

acquisition of all of the issued and outstanding membership interests of each of THQ Appalachia I Midco, LLC and THQ-XcL Holdings I Midco,

LLC in exchange for 49,599,796 shares of EQT common stock and approximately $2.4 billion in cash, subject to customary post-closing adjustments.

This Amendment No. 1 to the Initial Form 8-K (this

“Amendment No. 1”) amends the Initial Form 8-K to include the financial statements of a business acquired required by Item

9.01(a) and the pro forma financial information required by Item 9.01(b). Except as provided herein, the disclosures made in the Initial

Form 8-K remain unchanged.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses or funds

acquired.

The audited consolidated financial statements of

the Upstream Seller and subsidiaries as of December 31, 2022 and 2021 and for the years then ended, and the notes related thereto, were

filed as Exhibit 99.2 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023 and are incorporated herein by reference.

The unaudited condensed consolidated financial

statements of the Upstream Seller and subsidiaries as of June 30, 2023 and for the six months ended June 30, 2023 and 2022, and the notes

related thereto, are filed as Exhibit 99.2 to this Amendment No. 1.

The audited consolidated financial statements of

the Midstream Seller and subsidiaries as of December 31, 2022 and 2021 and for the years then ended, and the notes related thereto, were

filed as Exhibit 99.3 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023 and are incorporated herein by reference.

The unaudited condensed consolidated financial

statements of the Midstream Seller and subsidiaries as of June 30, 2023 and for the six months ended June 30, 2023 and 2022, and the notes

related thereto, are filed as Exhibit 99.4 to this Amendment No. 1.

The audit report prepared by Cawley, Gillespie

& Associates, Inc., independent petroleum engineers, relating to the Upstream Seller’s estimated quantities of its proved natural

gas, natural gas liquids and crude oil reserves as of December 31, 2022 was filed as Exhibit 99.5 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023 and is incorporated herein by reference.

(b) Pro forma financial information.

The unaudited pro forma condensed combined balance

sheet of EQT and subsidiaries as of June 30, 2023 and unaudited pro forma condensed combined statements of operations of EQT and subsidiaries

for the six months ended June 30, 2023 and the year ended December 31, 2022, and the notes related thereto, are filed as Exhibit 99.5

to this Amendment No. 1.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 23.1 |

|

Consent of KPMG LLP (independent auditors of THQ Appalachia I, LLC). |

| 23.2 |

|

Consent of KPMG LLP (independent auditors of THQ-XcL Holdings I, LLC). |

| 23.3 |

|

Consent of Cawley, Gillespie & Associates, Inc. |

| 99.1 |

|

Audited consolidated financial statements of THQ Appalachia I, LLC and subsidiaries as of December 31, 2022 and 2021 and for the years then ended, and the notes related thereto (incorporated by reference to Exhibit 99.2 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023). |

| 99.2 |

|

Unaudited condensed financial statements of THQ Appalachia I, LLC and subsidiaries as of June 30, 2023 and for the six months ended June 30, 2023 and 2022, and the notes related thereto. |

| 99.3 |

|

Audited consolidated financial statements of THQ-XcL Holdings I, LLC and subsidiaries as of December 31, 2022 and 2021 and for the years then ended, and the notes related thereto (incorporated by reference to Exhibit 99.3 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023). |

| 99.4 |

|

Unaudited condensed financial statements of THQ-XcL Holdings I, LLC and subsidiaries as of June 30, 2023 and for the six months ended June 30, 2023 and 2022, and the notes related thereto. |

| 99.5 |

|

Unaudited pro forma condensed combined balance sheet of EQT and subsidiaries as of June 30, 2023 and unaudited pro forma condensed combined statements of operations of EQT and subsidiaries for the six months ended June 30, 2023 and the year ended December 31, 2022. |

| 99.6 |

|

Audit report prepared by Cawley, Gillespie & Associates, Inc., dated February 8, 2023, with respect to estimates of reserves and future net revenue of THQ Appalachia I, LLC as of December 31, 2022 (incorporated by reference to Exhibit 99.5 to the Current Report on Form 8-K filed by EQT with the SEC on May 3, 2023). |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EQT CORPORATION |

| |

|

|

| Date: October 30, 2023 |

By: |

/s/ Jeremy T. Knop |

| |

Name: |

Jeremy T. Knop |

| |

Title: |

Chief Financial Officer |

Exhibit 23.1

Consent of Independent Auditors

We consent to the incorporation by reference in the following registration

statements on Form S-3 (333-274147, 333-267475, 333-258135 and 333-158198) and on Form S-8 (333-264424, 333-264423, 333-219508,

333-221529, 333-82193, 333-32410, 333-122382, 333-152044, 333-158682, 333-195625, 333-232657, 333-237953 and 333-230969) of EQT Corporation

of our report dated March 29, 2023, with respect to the consolidated financial statements of THQ Appalachia I, LLC, which report

appears in the Form 8-K of EQT Corporation dated May 3, 2023 and is incorporated by reference into the Form 8-K/A of EQT

Corporation dated October 30, 2023.

/s/ KPMG LLP

Dallas, Texas

October 30, 2023

Exhibit 23.2

Consent of Independent Auditors

We consent to the incorporation by reference in the following registration

statements on Form S-3 (333-274147, 333-267475, 333-258135 and 333-158198) and on Form S-8 (333-264424, 333-264423, 333-219508,

333-221529, 333-82193, 333-32410, 333-122382, 333-152044, 333-158682, 333-195625, 333-232657, 333-237953 and 333-230969) of EQT Corporation

of our report dated March 29, 2023, with respect to the consolidated financial statements of THQ-XcL Holdings I, LLC, which report

appears in the Form 8-K of EQT Corporation dated May 3, 2023 and is incorporated by reference into the Form 8-K/A of EQT

Corporation dated October 30, 2023.

/s/ KPMG LLP

Dallas, Texas

October 30, 2023

Exhibit 23.3

Consent of Independent Petroleum Engineers

As independent petroleum engineers, we hereby consent to the references

to our firm, in the context in which they appear, and to the references to, and the inclusion of, our reserve report and oil, natural

gas and NGL reserves estimates and forecasts of economics as of December 31, 2022, included in or made part of the registration statements

on Form S-3 (Nos. 333-274147, 333-267475, 333-258135 and 333-158198) and on Form S-8 (Nos. 333-264424, 333-264423, 333-219508,

333-221529, 333-82193, 333-32410, 333-122382, 333-152044, 333-158682, 333-195625, 333-232657, 333-237953 and 333-230969) of EQT Corporation,

which is incorporated by reference into this Amendment No. 1 to Current Report on Form 8-K of EQT Corporation.

| |

CAWLEY, GILLESPIE &

ASSOCIATES, INC. |

| |

Texas Registered Engineering Firm |

| |

|

| |

/s/ W. Todd Brooker, P.E. |

| |

W. Todd Brooker, P.E. |

| |

President |

Austin, Texas

October 30, 2023

Exhibit 99.2

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

30,259,038 |

|

|

|

30,103,726 |

|

| Accounts receivable – oil and gas sales |

|

|

77,537,990 |

|

|

|

200,656,364 |

|

| Affiliate receivable |

|

|

904,970 |

|

|

|

1,999,040 |

|

| Accounts receivable other |

|

|

34,893,416 |

|

|

|

902,880 |

|

| Fair market value of derivatives |

|

|

194,746,467 |

|

|

|

237,236,712 |

|

| Prepaid expenses |

|

|

909,015 |

|

|

|

732,673 |

|

| Gas imbalances |

|

|

— |

|

|

|

198,781 |

|

| Total current assets |

|

|

339,250,896 |

|

|

|

471,830,176 |

|

| Property and equipment: |

|

|

|

|

|

|

|

|

| Oil and natural gas properties, at cost, using the successful efforts method, net |

|

|

1,927,028,821 |

|

|

|

1,851,271,986 |

|

| Gathering facilities, net |

|

|

29,158,564 |

|

|

|

19,455,911 |

|

| Other property and equipment, net |

|

|

296,581 |

|

|

|

369,223 |

|

| Total property and equipment, net |

|

|

1,956,483,966 |

|

|

|

1,871,097,120 |

|

| Other noncurrent assets: |

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

13,942,252 |

|

|

|

13,813,919 |

|

| Long-term deposits |

|

|

87,558 |

|

|

|

87,558 |

|

| Right-of-use assets |

|

|

3,298,939 |

|

|

|

3,821,158 |

|

| Fair market value of derivatives |

|

|

19,483,232 |

|

|

|

56,348,640 |

|

| Total other noncurrent assets |

|

|

36,811,981 |

|

|

|

74,071,275 |

|

| Total assets |

|

$ |

2,332,546,843 |

|

|

|

2,416,998,571 |

|

| Liabilities and Members’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

$ |

53,373,620 |

|

|

|

80,012,797 |

|

| Affiliate payables |

|

|

81,657,843 |

|

|

|

114,100,666 |

|

| Litigation accrual |

|

|

22,950,000 |

|

|

|

250,000 |

|

| Revenues payable |

|

|

— |

|

|

|

899,439 |

|

| Fair market value of derivatives |

|

|

249,929,021 |

|

|

|

447,299,358 |

|

| Gas imbalances |

|

|

233,847 |

|

|

|

73,441 |

|

| Lease liabilities |

|

|

1,592,315 |

|

|

|

1,833,168 |

|

| Contingent subordinated loan |

|

|

150,022,398 |

|

|

|

150,017,055 |

|

| Total current liabilities |

|

|

559,759,044 |

|

|

|

794,485,924 |

|

| Revolving credit facility |

|

|

522,541,520 |

|

|

|

508,773,419 |

|

| Fair market value of derivatives |

|

|

46,936,145 |

|

|

|

112,847,733 |

|

| Long-term lease liabilities |

|

|

1,683,634 |

|

|

|

1,937,663 |

|

| Asset retirement obligations |

|

|

18,663,063 |

|

|

|

17,217,634 |

|

| Total liabilities |

|

|

1,149,583,406 |

|

|

|

1,435,262,373 |

|

| Commitments and contingencies (notes 8 and 9) |

|

|

|

|

|

|

|

|

| Members’ equity: |

|

|

|

|

|

|

|

|

| Members’ equity |

|

|

592,925,823 |

|

|

|

592,925,823 |

|

| Retained earnings |

|

|

590,037,614 |

|

|

|

388,810,375 |

|

| Total members’ equity |

|

|

1,182,963,437 |

|

|

|

981,736,198 |

|

| Total liabilities and members’ equity |

|

$ |

2,332,546,843 |

|

|

|

2,416,998,571 |

|

See accompanying notes to condensed consolidated financial statements.

THQ APPALACHIA I, LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Income

(Unaudited)

| | |

Three Months

Ended | | |

Six Months

Ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | | |

June 30,

2023 | | |

June 30,

2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Oil

sales | |

$ | 24,559,550 | | |

| 54,497,676 | | |

| 49,301,141 | | |

| 106,362,377 | |

| Natural gas sales | |

| 78,197,928 | | |

| 338,858,622 | | |

| 216,183,819 | | |

| 532,891,334 | |

| Natural gas liquids sales | |

| 50,098,961 | | |

| 98,317,178 | | |

| 111,268,359 | | |

| 206,481,741 | |

| Net gain (loss) on derivative instruments | |

| 46,548,939 | | |

| (90,279,457 | ) | |

| 137,840,722 | | |

| (528,493,047 | ) |

| Other revenues

(losses) (note 10) | |

| 1,594,955 | | |

| (550,151 | ) | |

| 928,208 | | |

| (514,687 | ) |

| Total revenues | |

| 201,000,333 | | |

| 400,843,868 | | |

| 515,522,249 | | |

| 316,727,718 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Lease operating expenses | |

| 11,422,447 | | |

| 12,274,334 | | |

| 20,836,981 | | |

| 19,230,213 | |

| Midstream operating expenses | |

| (954,952 | ) | |

| — | | |

| 275,899 | | |

| 343,057 | |

| Production taxes | |

| 6,777,925 | | |

| 27,716,414 | | |

| 17,976,355 | | |

| 46,413,561 | |

| Gathering, processing and transportation | |

| 47,809,571 | | |

| 47,209,845 | | |

| 91,536,119 | | |

| 92,992,038 | |

| Exploration expense | |

| 1,730,227 | | |

| 4,296,502 | | |

| 4,930,924 | | |

| 4,490,140 | |

| Depreciation, depletion and amortization | |

| 65,300,037 | | |

| 62,214,003 | | |

| 120,791,149 | | |

| 108,326,628 | |

| General and administrative | |

| 27,961,678 | | |

| 4,319,593 | | |

| 37,445,445 | | |

| 8,128,854 | |

| (Gain) loss on

sale of other property and equipment | |

| — | | |

| (63,874 | ) | |

| (1,008,644 | ) | |

| 19,122 | |

| Total operating

expenses | |

| 160,046,933 | | |

| 157,966,817 | | |

| 292,784,228 | | |

| 279,943,613 | |

| Income from operations | |

| 40,953,400 | | |

| 242,877,051 | | |

| 222,738,021 | | |

| 36,784,105 | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (11,462,661 | ) | |

| (6,546,842 | ) | |

| (22,035,741 | ) | |

| (12,090,986 | ) |

| Interest income | |

| 230,074 | | |

| 32,190 | | |

| 524,959 | | |

| 48,589 | |

| Total other expense | |

| (11,232,587 | ) | |

| (6,514,652 | ) | |

| (21,510,782 | ) | |

| (12,042,397 | ) |

| Net income | |

$ | 29,720,813 | | |

| 236,362,399 | | |

| 201,227,239 | | |

| 24,741,708 | |

See accompanying notes to condensed consolidated financial statements.

THQ APPALACHIA I, LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Changes in Members’ Equity

(Unaudited)

| | |

Members’ | | |

Retained | | |

Total

members’ | |

| | |

equity | | |

earnings | | |

equity | |

| Six Months Ended June 30, 2022 | |

| | | |

| | | |

| | |

| Balance, December 31, 2021 | |

$ | 592,925,823 | | |

| 179,544,904 | | |

| 772,470,727 | |

| Net income | |

| — | | |

| 24,741,708 | | |

| 24,741,708 | |

| Balance, June 30, 2022 | |

$ | 592,925,823 | | |

| 204,286,612 | | |

| 797,212,435 | |

| | |

| | | |

| | | |

| | |

| Six Months Ended June 30, 2023 | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

$ | 592,925,823 | | |

| 388,810,375 | | |

| 981,736,198 | |

| Net income | |

| — | | |

| 201,227,239 | | |

| 201,227,239 | |

| Balance, June 30, 2023 | |

$ | 592,925,823 | | |

| 590,037,614 | | |

| 1,182,963,437 | |

| | |

| | | |

| | | |

| | |

| Three Months Ended June 30, 2022 | |

| | | |

| | | |

| | |

| Balance, March 31, 2022 | |

| 592,925,823 | | |

| (32,075,787 | ) | |

| 560,850,036 | |

| Net income | |

| — | | |

| 236,362,399 | | |

| 236,362,399 | |

| Balance, June 30, 2022 | |

$ | 592,925,823 | | |

| 204,286,612 | | |

| 797,212,435 | |

| | |

| | | |

| | | |

| | |

| Three Months Ended June 30, 2023 | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

$ | 592,925,823 | | |

| 560,316,801 | | |

| 1,153,242,624 | |

| Net income | |

| — | | |

| 29,720,813 | | |

| 29,720,813 | |

| Balance, June 30, 2023 | |

$ | 592,925,823 | | |

| 590,037,614 | | |

| 1,182,963,437 | |

See accompanying notes to condensed consolidated financial statements.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Six Months

Ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 201,227,239 | | |

| 24,741,707 | |

| Adjustments to reconcile net income to

net cash provided by operating activities: | |

| | | |

| | |

| Depreciation, depletion and amortization | |

| 120,791,149 | | |

| 108,326,628 | |

| Amortization of deferred financing costs | |

| 629,740 | | |

| 679,106 | |

| Amortization of right-of-use assets | |

| 27,336 | | |

| — | |

| Exploration expense | |

| 4,930,924 | | |

| 4,490,140 | |

| Net (gain) loss on derivative instruments | |

| (137,840,722 | ) | |

| 528,493,047 | |

| Net cash paid to derivative counterparties | |

| (79,532,226 | ) | |

| (350,020,869 | ) |

| (Gain) loss on sale of other property

and equipment | |

| (1,008,644 | ) | |

| 19,122 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 122,743,514 | | |

| (110,610,396 | ) |

| Accounts receivable – affiliate | |

| 1,094,070 | | |

| 109,502 | |

| Prepaid expenses | |

| (176,342 | ) | |

| (1,582,013 | ) |

| Accounts payable and accrued expenses | |

| 12,567,252 | | |

| 14,665,472 | |

| Affiliate payables | |

| (32,442,823 | ) | |

| (27,313,934 | ) |

| Litigation accrual | |

| 22,700,000 | | |

| — | |

| Revenues payable | |

| (899,439 | ) | |

| (275,027 | ) |

| Gas imbalances | |

| 359,187 | | |

| 1,882,152 | |

| Net cash provided

by operating activities | |

| 235,170,215 | | |

| 193,604,637 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Net cash paid for acquisition of oil

and natural gas properties | |

| (21,071,441 | ) | |

| (18,618,385 | ) |

| Additions to oil and natural gas properties | |

| (228,092,434 | ) | |

| (222,698,812 | ) |

| Proceeds from sale

of other property and equipment | |

| 1,133,600 | | |

| 63,874 | |

| Net cash used in

investing activities | |

| (248,030,275 | ) | |

| (241,253,323 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from revolving credit facility | |

| 15,000,000 | | |

| 50,000,000 | |

| Proceeds from contingent subordinated

loan | |

| 5,343 | | |

| — | |

| Deferred financing

costs | |

| (1,861,638 | ) | |

| (83,951 | ) |

| Net cash provided

by financing activities | |

| 13,143,705 | | |

| 49,916,049 | |

| Net increase in cash, cash equivalents,

and restricted cash | |

| 283,645 | | |

| 2,267,363 | |

| Cash, cash equivalents,

and restricted cash, beginning of period | |

| 43,917,645 | | |

| 34,004,538 | |

| Cash, cash equivalents,

and restricted cash, end of period | |

$ | 44,201,290 | | |

| 36,271,901 | |

| Supplemental disclosure of cash flow

information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 18,523,219 | | |

| 11,212,592 | |

| Noncash investing activities: | |

| | | |

| | |

| Noncash additions to oil and natural

gas properties | |

$ | 30,268,188 | | |

| 56,194,027 | |

See

accompanying notes to condensed consolidated financial statements.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (1) | Organization and Principles of Consolidation |

The accompanying condensed consolidated financial statements

include the accounts of THQ Appalachia I, LLC and its wholly owned subsidiaries THQ Appalachia I Midco, LLC, TH Exploration, LLC, TH

Exploration II, LLC, TH Exploration III, LLC, TH Exploration IV, LLC, CLR Exploration, LLC, and THQ Marketing, LLC. CLR Exploration was

dissolved on May 17, 2022. During interim periods, the Company follows the same accounting policies disclosed in its audited Annual

Financial Statements.

The accompanying unaudited condensed consolidated financial

statements have been prepared by the Company's management in accordance with generally accepted accounting principles in the United States

(“GAAP”) for interim financial information. Accordingly, these financial statements do not include all of the information

required by GAAP for complete financial statements. Therefore, these condensed consolidated financial statements should be read in conjunction

with the audited consolidated financial statements and notes therein for the year ended December 31, 2022. The unaudited condensed

consolidated financial statements included herein contain all adjustments which are, in the opinion of management, necessary to present

fairly the Company's condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022, its condensed consolidated

statements of income and condensed consolidated statements of changes in members’ equity for the quarter and six months ended June 30,

2023 and 2022, and its condensed consolidated statements of cash flows for the six months ended June 30, 2023 and 2022. The condensed

consolidated statements of income for the quarter and six months ended June 30, 2023 are not necessarily indicative of the results

to be expected for future periods.

On September 6, 2022, the Company entered into a purchase

agreement with EQT Corporation and its wholly owned subsidiary EQT Production Corporation, ( together “EQT”) to sell the

Company’s upstream assets along with the gathering and processing assets of affiliate company THQ-XCL Holdings I, LLC for total

consideration of approximately 50 million shares of common stock of EQT and $2.4 billion of cash, subject to customary post-closing adjustments

(“Transaction”). The Company will be selling 100% of its membership interests in THQ Appalachia I Midco, LLC (“THQA

Midco”) along with the 100% membership interests of the subsidiaries of THQA Midco. On December 23, 2022, the parties entered

into an amended and restated purchase agreement to extend the right to terminate the original agreement to December 31, 2023, from

the original termination date of December 31, 2022. This transaction has an effective date of July 1, 2022.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (2) | Relationship with Affiliate |

The Company has an ongoing business relationship with an

affiliate, Tug Hill Operating, LLC (“THO”). THO is responsible for acquisitions, drilling and operation of wells owned by

the Company. As it incurs costs on behalf of the Company for these operations, THO bills the Company through its joint interest billing

(“JIB”) process; and the Company reimburses THO for these costs at least monthly. THO is also responsible for the administration

of the Company’s business. In exchange for these services, the Company pays a quarterly fee that includes (a) THO employees’

time and related expenses charged to the Company for the operation of its oil and natural gas properties, (b) an allocated amount

of THO overhead expense calculated based on the number of hours THO employees spend working on Company projects, and (c) an additional

percentage markup of the overall total of (a) and (b) to cover benefits and other employee-related costs and any unforeseen

or difficult to allocate costs. The Company’s board approves the operating budgets. For the six months ended June 30, 2023,

THO billed the Company $314.9 million through the JIB process. The amount due to THO for these services, which were included in the Company’s

affiliate payables balance was $64.9 million as of June 30, 2023. Allocations consist of $22.6 million relating to acquisition

of oil and natural gas properties, $12.7 million of lease operating expenses, $7.8 million in salaries and bonus for the operation

of its oil and natural gas properties, $0.4 million for overhead expenses, $8.5 million of direct general and administrative

expenses, and $262.9 million of capital expenditures for the six months ended June 30, 2023. For the six months ended June 30,

2022, THO billed the Company $313.0 million through the JIB process. Allocations consist of $18.8 million relating to acquisition

of oil and natural gas properties, $13.3 million of lease operating expenses, $4.8 million in salaries and bonus for the operation

of its oil and natural gas properties, $0.4 million for overhead expenses, $5.5 million of direct general and administrative

expenses, and $270.2 million of capital expenditures for the six months ended June 30, 2022. The amounts due to THO for these services,

which were included in the Company’s affiliate payables balance was $99.8 million as of December 31, 2022.

THO collects certain revenues from customers on behalf

of the Company. The amount due from THO, which is included in the Company’s oil and gas sales accounts receivable balance, was

$44.2 million and $84.6 million as of June 30, 2023 and December 31, 2022, respectively.

The Company incurred $44.9 million and $41.9 million

in gathering, processing and transportation for the six months ended June 30, 2023 and 2022, respectively, and $23.3 million

and $20.7 million in gathering, processing and transportation for the quarter ended June 30, 2023 and 2022, respectively, payable

to XCL.

For the quarter and six months ended June 30, 2023

and 2022, the Company paid lease bonuses income and royalties, to an affiliate, Stone Hill Minerals Holdings I, LLC, a Quantum and R2K

controlled entity as follows:

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2022 | |

| Lease bonuses income | |

$ | 279,764 | | |

| 1,347,949 | | |

| 476,966 | | |

| 1,861,062 | |

| Royalties | |

| 5,421,845 | | |

| 5,367,222 | | |

| 15,635,589 | | |

| 10,147,774 | |

| Total | |

$ | 5,701,609 | | |

| 6,715,171 | | |

| 16,112,555 | | |

| 12,008,836 | |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (3) | Property and Equipment |

| (a) | Oil and Natural Gas Properties |

Since inception, the Company has been involved in acquiring

and leasing oil and natural gas properties in the southwest Appalachian Basin in the Northeastern United States.

Oil and natural gas properties consist of the following

at:

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Proved properties | |

$ | 2,402,543,155 | | |

| 2,220,751,648 | |

| Accumulated depreciation, depletion and amortization | |

| (712,014,713 | ) | |

| (592,534,930 | ) |

| Net | |

| 1,690,528,442 | | |

| 1,628,216,718 | |

| Unproved properties | |

| 241,431,303 | | |

| 239,509,809 | |

| Exploration and impairment | |

| (4,930,924 | ) | |

| (16,454,541 | ) |

| Net | |

| 236,500,379 | | |

| 223,055,268 | |

| Total oil and natural gas properties, at cost, using the successful efforts

method, net | |

$ | 1,927,028,821 | | |

| 1,851,271,986 | |

Depreciation, depletion, and amortization expense for proved

oil and natural gas properties was $64.6 million and $119.5 million for the quarter and six months ended June 30, 2023, respectively,

and $61.7 million and $107.6 million for the quarter and six months ended June 30, 2022, respectively. Exploration and abandonment

write off was $1.7 million and $4.9 million for the quarter and six months ended June 30, 2023, respectively, and $4.3 million and

$4.5 million for the quarter and six months ended June 30, 2022, respectively. The Company had no significant costs which had been

deferred for longer than one year as of June 30, 2023.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (b) | Gathering Facilities and Other Property and

Equipment |

Gathering facilities and other property and equipment consists

of the following at:

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Gathering facilities | |

$ | 30,927,511 | | |

| 20,674,204 | |

| Other property and equipment | |

| 2,204,054 | | |

| 2,146,045 | |

| Total capitalized costs | |

| 33,131,565 | | |

| 22,820,249 | |

| Accumulated depreciation | |

| (3,676,420 | ) | |

| (2,995,115 | ) |

| Total net capitalized costs | |

$ | 29,455,145 | | |

| 19,825,134 | |

Depreciation expense for gathering facilities and other

property and equipment was $0.4 million and $0.7 million for the quarter and six months ended June 30, 2023, respectively,

and $0.3 million and $0.5 million for the quarter and six months ended June 30, 2022.

The Company has operating leases for office space and compressors.

These leases have initial terms ranging from 1 to 5.5 years and include renewal options ranging from 0 to 1 year. The Company does not

include the renewal options in the lease term, as it is not reasonably certain such options will be exercised. Payments are for fixed

amounts as contractually designated in the lease agreements.

The table below presents the lease related assets and liabilities

recorded on our condensed consolidated balance sheet at:

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Right-of-use assets | |

$ | 3,298,939 | | |

$ | 3,821,158 | |

| Total lease assets | |

| 3,298,939 | | |

| 3,821,158 | |

| Liabilities | |

| | | |

| | |

| Current lease liabilities | |

| 1,592,315 | | |

| 1,833,168 | |

| Long-term lease liabilities | |

| 1,683,634 | | |

| 1,937,663 | |

| Total lease liabilities | |

$ | 3,275,949 | | |

$ | 3,770,831 | |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

The components of the Company’s lease costs

are set forth in the table below:

| | |

Three months

ended | | |

Six months

ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | | |

June 30,

2023 | | |

June 30,

2022 | |

| Operating lease costs,

excluding short-term leases (a) | |

$ | 442,499 | | |

| 484,791 | | |

| 996,569 | | |

| 843,684 | |

| Short-term lease costs (b) | |

| 10,891,170 | | |

| 5,880,129 | | |

| 20,387,712 | | |

| 12,185,078 | |

| Variable lease costs

(c) | |

| 30,442 | | |

| 7,169 | | |

| 92,912 | | |

| 31,504 | |

| Total lease costs | |

$ | 11,364,111 | | |

| 6,372,089 | | |

| 21,477,193 | | |

| 13,060,266 | |

| (a) | Operating lease expense reflects a single lease cost, calculated

so that the cost of the lease is allocated over the lease term on a straight-line basis.

The operating lease costs are net of reimbursements from affiliates related to office leases

of $0.1 million and $0.2 million for the quarter and six months ended June 30, 2023,

respectively, and $0.1 million for the quarter and six months ended June 30, 2022. |

| (b) | Short-term lease costs are reported at gross amounts and primarily

represent costs incurred for the Company’s compressors, drilling rigs, and office equipment.

These short-term contracts are not recognized as ROU assets and lease liabilities on the

condensed consolidated balance sheets. The included drilling rig costs are capitalized to

property and equipment of $10.8 million and $20.1 million for the quarter and six months

ended June 30, 2023, respectively, and $5.8 million and $12.1 million for the quarter

and six months ended June 30, 2022, respectively. |

| (c) | Variable lease expenses primarily represent (i) differences

between minimum payment obligations and actual operating charges incurred by the Company

related to its long-term leases and (ii) variable expenses related to the Company’s

office spaces, which include taxes, insurance and other utility and maintenance costs. Variable

lease expenses are not included in the calculation of the Company’s ROU assets and

lease liabilities on the condensed consolidated balance sheets. |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

A maturity analysis of lease payments under the Company’s

long-term operating leases is presented as follows:

| | |

June 30, 2023 | |

| Remaining 2023 | |

$ | 976,400 | |

| 2024 | |

| 1,281,800 | |

| 2025 | |

| 721,550 | |

| 2026 | |

| 300,000 | |

| 2027 | |

| 150,000 | |

| Total future minimum lease payments (undiscounted) | |

| 3,429,750 | |

| Less: interest | |

| 153,801 | |

| Present value of lease liability | |

$ | 3,275,949 | |

As of June 30, 2023 and December 31, 2022, the

weighted average lease term was 2.49 years and 2.7 years, respectively, and the weighted average discount rate was 3.61% for both periods.

The table below presents other supplemental lease information

about the Company’s operating leases for the period presented:

| | |

Six months ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Operating cash outflows from operating leases | |

$ | 1,134,184 | | |

| 1,114,328 | |

| Right-of-use assets obtained in exchange for new operating lease liabilties | |

| 544,597 | | |

| — | |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (5) | Contingent Subordinated Loan |

On December 23, 2022, the Company entered into a senior

unsecured promissory note with EQT under the amended and restated purchase agreement referenced in footnote 1. Per the agreement, the

escrow funds of $150 million plus accrued interest were released to the Company with the stipulation that the funds would be exclusively

used to pay down the current credit facility. The maturity date of the note is one year after the Termination Date, as defined in the

amended and restated purchase agreement. Before the termination date, interest on the note will accrue on the outstanding principal at

0% per year; thereafter, interest will accrue on the outstanding principle at a rate of 10% per year, with the rate increasing in increments

of 0.50% each quarter. Upon the successful close of the acquisition, the note will be applied towards the cash consideration to be paid

by EQT and extinguish the note. As defined in the amended agreement, if the purchase agreement is terminated and the Company is entitled

to retain the escrow funds, the outstanding balance would be applied towards releasing the escrow and extinguishing the note.

Senior Secured Revolving Credit Facility

The Company has a senior secured revolving bank credit

facility (“the Credit Facility”) with a group of large, commercial lenders. Borrowings under the Credit Facility are

subject to borrowing base limitations based on the collateral value of the Company’s proved properties and commodity hedge positions

and are subject to regular semiannual redeterminations or more frequently if requested by the Company. The borrowing base was redetermined

in May 2022 to be $850 million. As of June 30, 2023 and December 31, 2022, the Company had an outstanding balance

under the Credit Facility of $525 million and $510 million, respectively, with a weighted average interest rate of approximately

8.46% and 7.64%, respectively. The amount reflected in the Company’s June 30, 2023 and December 31, 2022 condensed consolidated

balance sheet is shown net of the debt issuance costs of $2.5 million and $1.2 million, respectively. The maturity date of the Credit

Facility is January 1, 2025.

The Credit Facility is secured by liens on substantially

all of the Company’s properties and guarantees from the Company’s restricted subsidiaries, as applicable. The Credit Facility

contains certain covenants, including restrictions on indebtedness and dividends and requirements with respect to working capital and

leverage coverage ratios. Interest is payable at a variable rate based on LIBOR or the prime rate, determined by the Company’s

election at the time of borrowing. The Company was in compliance with all of the financial covenants under the Credit Facility as of

June 30, 2023.

Commitment fees on the unused portion of the Credit Facility

are due quarterly at a rate of 0.50% of the unused portion, based on utilization.

| (7) | Derivative Instruments |

The Company periodically enters into natural gas, NGLs,

and oil derivative contracts with counterparties to hedge the price risk associated with a portion of its production. These derivatives

are not held for trading purposes. To the extent that changes occur in the market prices of natural gas, NGLs, and oil, the Company is

exposed to market risk on these open contracts. This market risk exposure is generally offset by the change in market prices of natural

gas, NGLs, and oil recognized upon the ultimate sale of the Company’s production.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

During the six months ended June 30, 2023 and 2022,

the Company was party to various natural gas fixed price swap contracts and costless collars. When actual commodity prices exceed the

fixed price provided by the swap contracts, the Company pays the excess to the counterparty. When actual commodity prices are below the

contractually provided fixed price, the Company receives the difference from the counterparty. When actual commodity prices fall within

the band provided by the costless collars, the Company receives the actual prices from the counterparty. When actual commodity prices

fall outside the band provided by the costless collars, the Company receives the price provided by the collar from the counterparty and

pays the actual price to the counterparty.

In addition, the Company has entered into basis swap contracts

in order to hedge the difference between the New York Mercantile Exchange (“NYMEX”) index price and a local index price.

The Company’s derivative swap contracts have not been designated as hedges for accounting purposes; therefore, all gains and losses

are recognized in the Company’s condensed consolidated statements of income.

As of June 30, 2023, the Company’s fixed price

natural gas and oil swap positions were as follows:

| | |

2023 | | |

2024 | |

| NYMEX Henry Hub Long Puts: | |

| | | |

| | |

| Volume (MMbtu/day) | |

| 322,500 | | |

| — | |

| Average price ($/MMBtu) | |

$ | 5.00 | | |

| — | |

| | |

| | | |

| | |

| NYMEX Henry Hub Short Calls: | |

| | | |

| | |

| Volume (MMbtu/day) | |

| 322,500 | | |

| — | |

| Average price ($/MMBtu) | |

$ | 6.26 | | |

| — | |

| | |

| | | |

| | |

| Dominion South Basis Swaps: | |

| | | |

| | |

| Volume (MMbtu/day) | |

| 320,000 | | |

| 100,000 | |

| Average price ($/MMBtu) | |

$ | (0.92 | ) | |

| (0.72 | ) |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

The following is a summary of derivative fair value losses

which are recorded in the condensed consolidated statements of income included in net gain (loss) on derivative instruments:

| | |

Three months ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Cash settlement of derivative contracts | |

$ | (4,795,073 | ) | |

| (237,124,719 | ) |

| Noncash change in derivative fair value | |

| 51,344,012 | | |

| 146,845,262 | |

| Net gain (loss) on derivative instruments | |

$ | 46,548,939 | | |

| (90,279,457 | ) |

| | |

Six months ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Cash settlement of derivative contracts | |

$ | (46,085,550 | ) | |

| (350,020,869 | ) |

| Noncash change in derivative fair value | |

| 183,926,272 | | |

| (178,472,178 | ) |

| Net gain (loss) on derivative instruments | |

$ | 137,840,722 | | |

| (528,493,047 | ) |

The following is a summary of the fair values of the Company’s

derivative instruments and where such values are recorded in the condensed consolidated balance sheet as of:

| | |

| |

Fair value | |

| | |

Balance sheet | |

June 30, | | |

December 31, | |

| | |

location | |

2023 | | |

2022 | |

| Commodity derivatives: | |

| |

| | | |

| | |

| Commodity contracts | |

Current assets | |

$ | 194,746,467 | | |

| 237,236,712 | |

| Commodity contracts | |

Long-term assets | |

| 19,483,232 | | |

| 56,348,640 | |

| Total derivative assets | |

| |

| 214,229,699 | | |

| 293,585,352 | |

| Commodity contracts | |

Current liabilities | |

| 249,929,021 | | |

| 447,299,358 | |

| Commodity contracts | |

Long-term liabilities | |

| 46,936,145 | | |

| 112,847,733 | |

| Total derivative liabilities | |

| |

| 296,865,166 | | |

| 560,147,091 | |

| Net derivatives | |

| |

$ | (82,635,467 | ) | |

| (266,561,739 | ) |

The fair value of commodity derivative instruments was

determined using Level 2 inputs. The Company classifies the fair value amounts of derivative financial instruments by commodity

contract as net current or noncurrent assets or liabilities.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

The Company entered into contracts to offset the mark to

market variability of swaps and costless collar contracts in the third quarter of 2022, resulting in deferred premiums and fixed settlements

with the counterparties. The premiums and fixed settlements are included in the fair market value reported on the balance sheet.

The following is a schedule of premiums due as of June 30,

2023:

| | |

Remaining | | |

| | |

| |

| | |

2023 | | |

2024 | | |

Total | |

| Deferred premium payments | |

$ | 104,418,160 | | |

| 61,930,860 | | |

| 166,349,020 | |

| Fixed swap settlement payments | |

| 95,792,226 | | |

| 31,688,110 | | |

| 127,480,336 | |

| Fixed swap settlement receipts | |

| (35,194,696 | ) | |

| (27,445,170 | ) | |

| (62,639,866 | ) |

| Total | |

$ | 165,015,690 | | |

| 66,173,800 | | |

| 231,189,490 | |

The following is a schedule of future minimum payments

for firm transportation, drilling rig and processing, gathering and compression agreements as of June 30, 2023.

| | |

| | |

Processing, | | |

| | |

| |

| | |

| | |

gathering | | |

Drilling | | |

| |

| | |

Firm | | |

and | | |

rigs and | | |

| |

| | |

transportation | | |

compression | | |

completion | | |

| |

| | |

(a) | | |

(b) | | |

(c) | | |

Total | |

| Remaining 2023 | |

$ | 18,400,000 | | |

| — | | |

| 13,078,887 | | |

| 31,478,887 | |

| 2024 | |

| 36,600,000 | | |

| — | | |

| — | | |

| 36,600,000 | |

| 2025 | |

| 36,500,000 | | |

| — | | |

| — | | |

| 36,500,000 | |

| 2026 | |

| 36,500,000 | | |

| — | | |

| — | | |

| 36,500,000 | |

| 2027 | |

| 36,500,000 | | |

| — | | |

| — | | |

| 36,500,000 | |

| Thereafter | |

| 222,300,000 | | |

| — | | |

| — | | |

| 222,300,000 | |

| Total | |

$ | 386,800,000 | | |

| — | | |

| 13,078,887 | | |

| 399,878,887 | |

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

The Company has entered into firm transportation agreements

with a pipeline in order to facilitate the delivery of its production to market. This contract commits the Company to transport minimum

daily natural gas volumes at negotiated rates, or pay for any deficiencies at specified reservation fee rates once the pipeline goes

into service. The amounts in this table represent the Company’s minimum daily volumes at the reservation fee rate. The values in

the table represent the gross amounts that the Company is committed to pay; however, the Company will record in the condensed consolidated

financial statements its proportionate share of costs based on its net revenue interest.

| (b) | Processing, Gathering, and Compression Service

Commitments |

The Company has entered into various long-term gas gathering

and processing agreements for certain of its production that will allow it to realize the value of its NGLs. The minimum payment obligations

under the agreements are presented in the table. Actual payments under these agreements will differ from the amounts shown in the table

above as the Company expects to deliver volumes in excess of the minimum commitment. These commitments have varying fees with escalation

clauses based on annual percentage change in Oil PPI.

| (c) | Drilling Rig and Completion Service Commitments |

The Company has obligations under agreements with service

providers to procure drilling and completion services. The values in the table represent the gross amounts that the Company is committed

to pay; however, the Company will record in the condensed consolidated financial statements its proportionate share of costs based on

its working interest.

Litigation

The Company is subject to a lawsuit wherein plaintiffs

allege that the Company breached its contract by improperly deducting production and post-production costs from the royalties to which

plaintiffs claim they are entitled. The Company has a litigation accrual of $0.3 million at June 30, 2023 for these claims.

A class action lawsuit was filed against Tug Hill et al.,

on June 3, 2021. Plaintiffs alleged improper royalty deductions and that royalty owners have been underpaid. On June 14,

2023, the Court granted Plaintiffs’ Motion for Partial Summary Judgment. The Court’s decision redefined and required

a producer to be burdened with costs after Tug Hill’s sale of hydrocarbons to an unaffiliated third party, which are downstream

of Tug Hill’s point of sale as defined in the contracts. Tug Hill plans to appeal the Court’s ruling. The damages are estimated

to be approximately $22.7 million. This estimate of damages has been accrued at June 30, 2023 and is included in the litigation

liability and general and administrative expense.

Environmental Remediation

Various federal, state, and local laws and regulations

covering the discharge of materials into the environment, or otherwise relating to the protection of the environment, may affect the

Company’s operations and the costs of its crude oil and gas natural exploration, development, and production operations. The Company

does not anticipate that it will be required in the near future to expend significant amounts due to environmental laws and regulations,

and accordingly no reserves have been recorded.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (10) | Other Revenues (Losses) |

The Company experienced a gas imbalance loss of $0.8 million

and $1.5 million for the quarter and six months ended June 30, 2023, respectively, and a loss of $0.9 million and $1.9 million for

the quarter and six months ended June 30, 2022, respectively, which are reflected in other revenues (losses) in the Company’s

condensed consolidated statements of income.

The Company also received fees from third parties for water

transportation services and other asset use agreements of $2.4 million during the quarter and six months ended June 30, 2023, and

$0.3 million and $1.4 million during the quarter and six months ended June 30, 2022, respectively.

There are two classes of membership interest – capital

interests and management incentive interests. Capital interests held by Quantum, R2K and members of management have full voting rights

and rights to share in the distributions of the Company. As described more fully in note 12, management incentive interests can

be issued under the Incentive Pool Plan and are nonvoting with no rights to share in distributions until the capital contributed interests

have earned the full base return.

The members have no liability for the debts, obligations

and liabilities of the Company, except as expressly required in the agreement. The Company shall dissolve and its affairs shall be wound

up upon the earliest to occur of (a) the expiration of its term on December 20, 2025, if not extended by the members, (b) election

by the Board of Directors by majority approval at any time or (c) entry of a decree of judicial dissolution of the Company under

the Delaware Limited Liability Company Act.

The timing and amounts of

distributions, other than tax advances, are determined by the Board of Directors. Capital contributions will receive a base return of

8% on their contributions (“base return”) which continues accruing until distributions exceed the total capital contributions

plus the 8% base return. The first 10% of R2K’s Capital Interest will be treated as un-promoted capital. Distributions to

members’ capital that is promoted is subject to certain distribution flips, whereby, distributions will be made in proportion to

the agreed upon sharing ratios. Tax advances may be made quarterly based on projections of the entity’s taxable income for the

year.

| (12) | Management Incentive Unit Plan |

Effective with the formation of the Company on July 23,

2014, the Company adopted an incentive unit plan, THQ (Appalachia I) Employee Holdings, LLC, to provide profit awards to employees (“management

incentive units”). All of the incentive units are subject to vesting over five years, forfeiture, and termination. The management

incentive units have no voting rights, do not have an exercise price and are automatically forfeited except in extenuating circumstances

if and when such person’s status as an employee is terminated.

Compensation expense for these awards will be recognized

when all performance, market, and service conditions are probable of being satisfied in general upon a vesting event, which is defined

as (i) the sale of all or substantially all of the outstanding capital interests or assets of the Company, (ii) the time of

any distribution by the Company after capital contributions of substantially all of the capital commitments have been made by the capital

members, and the Board has determined that the Company will not raise additional capital, (iii) one year after the expiration of

a lockup period in the event of a transfer of all or substantially all of the outstanding capital interests or assets of the Company

to an individual, estate or a corporation, partnership, joint venture, limited partnership, limited liability company, trust, unincorporated

organization, association or any other entity (“Person”) in exchange for publicly tradable securities of such Person; or

two years after the expiration of a lockup period in the event that securities received in connection with the transfer constitute

15% or more of the total shares of such Person then outstanding.

THQ

APPALACHIA I, LLC AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

On August 16, 2023, the U.S. Federal Trade Commission

resolved its review of the Transaction (note 1). As a result, the closing condition relating to the Hart-Scott-Rodino Act of 1976, as

amended, and the rules and regulations promulgated thereunder, has been satisfied, and the Transaction closed on August 22,

2023.

In preparing the condensed consolidated financial statements,

management has evaluated all subsequent events and transactions for potential recognition or disclosure through August 29, 2023,

the date the condensed consolidated financial statements were available for issuance, and no other items requiring disclosure were identified.

Exhibit 99.4

THQ-XCL HOLDINGS I, LLC AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,512,980 | | |

| 3,483,637 | |

| Affiliate receivables | |

| 16,745,345 | | |

| 14,552,847 | |

| Accounts receivable | |

| 7,544,380 | | |

| 7,128,464 | |

| Prepaid expenditures | |

| 416,497 | | |

| 376,891 | |

| Other current assets | |

| 690,745 | | |

| 1,872,837 | |

| Total current assets | |

| 28,909,947 | | |

| 27,414,676 | |

| Property and equipment: | |

| | | |

| | |

| Land and rights-of-way | |

| 54,685,117 | | |

| 49,139,616 | |

| Gathering and water pipelines and facilities | |

| 534,741,174 | | |

| 505,144,701 | |

| Processing plant and facilities | |

| 148,312,418 | | |

| 148,312,418 | |

| Other property and equipment | |

| 1,339,204 | | |

| 1,377,407 | |

| Accumulated depreciation, depletion, and amortization | |

| (110,606,388 | ) | |

| (93,707,282 | ) |

| Property and equipment, net | |

| 628,471,525 | | |

| 610,266,860 | |

| Right-of-use assets | |

| 1,659,575 | | |

| 2,089,536 | |

| Total assets | |

$ | 659,041,047 | | |

| 639,771,072 | |

| Liabilities and Members’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 18,827,048 | | |

| 21,314,518 | |

| Affiliate payables | |

| 5,313,699 | | |

| 7,578,850 | |

| Lease liabilities | |

| 574,673 | | |

| 715,074 | |

| Total current liabilities | |

| 24,715,420 | | |

| 29,608,442 | |

| Revolving credit facility, net of deferred financing costs | |

| 167,513,918 | | |

| 157,250,782 | |

| Long-term lease liabilities | |

| 1,084,902 | | |

| 1,374,462 | |

| Total liabilities | |

| 193,314,240 | | |

| 188,233,686 | |

| Commitments and contingencies (notes 6 and 7) | |

| | | |

| | |

| Members’ equity: | |

| | | |

| | |

| Members’ equity (note 8) | |

| 342,776,484 | | |

| 344,936,063 | |

| Retained earnings | |

| 122,950,323 | | |

| 106,601,323 | |

| Total members’ equity | |

| 465,726,807 | | |

| 451,537,386 | |

| Total liabilities and members’ equity | |

$ | 659,041,047 | | |

| 639,771,072 | |

See accompanying notes to condensed consolidated financial statements.

THQ-XCL HOLDINGS I, LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Income

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | | |

June 30, 2023 | | |

June 30, 2022 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Midstream revenue | |

$ | 328,952 | | |

| 612,746 | | |

| 603,286 | | |

| 1,587,720 | |

| Midstream revenue – affiliate | |

| 24,059,540 | | |

| 22,706,752 | | |

| 46,775,252 | | |

| 44,536,475 | |

| Processing revenue | |

| 8,229,335 | | |

| 8,205,943 | | |

| 16,138,500 | | |

| 16,259,451 | |

| Other losses | |

| (127,161 | ) | |

| — | | |

| (89,734 | ) | |

| — | |

| Total revenues | |

| 32,490,666 | | |

| 31,525,441 | | |

| 63,427,304 | | |

| 62,383,646 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Midstream operating expenses | |

| 5,045,193 | | |

| 3,588,164 | | |

| 9,955,886 | | |

| 8,694,880 | |

| Processing operating expenses | |

| 1,536,656 | | |

| 1,154,182 | | |

| 2,660,626 | | |

| 2,088,600 | |

| General and administrative | |

| 5,773,607 | | |

| 2,631,713 | | |

| 10,494,522 | | |

| 5,101,739 | |

| Depreciation, depletion, and amortization | |

| 9,015,298 | | |

| 7,604,119 | | |

| 16,938,336 | | |

| 14,876,085 | |

| Total operating expenses | |

| 21,370,754 | | |

| 14,978,178 | | |

| 40,049,370 | | |

| 30,761,304 | |

| Income from operations | |

| 11,119,912 | | |

| 16,547,263 | | |

| 23,377,934 | | |

| 31,622,342 | |

| Other expenses: | |

| | | |

| | | |

| | | |

| | |

| Gain on sale of assets | |

| — | | |

| — | | |

| 36,837 | | |

| — | |

| Interest expense | |

| (3,671,623 | ) | |

| (1,774,531 | ) | |

| (7,065,771 | ) | |

| (3,367,600 | ) |

| Total other expense, net | |

| (3,671,623 | ) | |

| (1,774,531 | ) | |

| (7,028,934 | ) | |

| (3,367,600 | ) |

| Net income | |

$ | 7,448,289 | | |

| 14,772,732 | | |

| 16,349,000 | | |

| 28,254,742 | |

See accompanying notes to condensed consolidated financial statements.

THQ-XCL HOLDINGS I, LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Changes in Members’ Equity

(Unaudited)

| | |

| | |

| | |

Total | |

| | |

Members’ | | |

Retained | | |

members’ | |

| | |

equity | | |

earnings | | |

equity | |

| Six Months Ended June 30, 2022 | |

| | | |

| | | |

| | |

| Balance, December 31, 2021 | |

$ | 347,520,988 | | |

| 60,392,584 | | |

| 407,913,572 | |

| Distribution to members | |

| (2,584,925 | ) | |

| — | | |

| (2,584,925 | ) |

| Net income | |

| — | | |

| 28,254,742 | | |

| 28,254,742 | |

| Balance, June 30, 2022 | |

$ | 344,936,063 | | |

| 88,647,326 | | |

| 433,583,389 | |

| | |

| | | |

| | | |

| | |

| Six Months Ended June 30, 2023 | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

$ | 344,936,063 | | |

| 106,601,323 | | |

| 451,537,386 | |

| Distribution to members | |

| (2,159,579 | ) | |

| — | | |

| (2,159,579 | ) |

| Net income | |

| — | | |

| 16,349,000 | | |

| 16,349,000 | |

| Balance, June 30, 2023 | |

$ | 342,776,484 | | |

| 122,950,323 | | |

| 465,726,807 | |

| | |

| | | |

| | | |

| | |

| Three Months Ended June 30, 2022 | |

| | | |

| | | |

| | |

| Balance, March 31, 2022 | |

$ | 344,936,063 | | |

| 73,874,594 | | |

| 418,810,657 | |

| Net income | |

| — | | |

| 14,772,732 | | |

| 14,772,732 | |

| Balance, June 30, 2022 | |

$ | 344,936,063 | | |

| 88,647,326 | | |

| 433,583,389 | |

| | |

| | | |

| | | |

| | |

| Three Months Ended June 30, 2023 | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

$ | 342,776,484 | | |

| 115,502,034 | | |

| 458,278,518 | |

| Net income | |

| — | | |

| 7,448,289 | | |

| 7,448,289 | |

| Balance, June 30, 2023 | |

$ | 342,776,484 | | |

| 122,950,323 | | |

| 465,726,807 | |

See accompanying notes to condensed consolidated financial statements.

THQ-XCL HOLDINGS I, LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 16,349,000 | | |

| 28,254,742 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation, depletion and amortization | |

| 16,938,336 | | |

| 14,876,085 | |

| Amortization of debt issuance cost | |

| 317,583 | | |

| 310,547 | |

| (Gain) or loss on sale of assets | |

| (36,837 | ) | |

| — | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Affiliate receivables | |

| (2,192,497 | ) | |

| 9,195,630 | |

| Accounts receivable | |

| (415,916 | ) | |

| (494,562 | ) |

| Prepaid expenditures | |

| (39,606 | ) | |

| (1,022,493 | ) |

| Accounts payable and accrued expenses | |

| 1,229,131 | | |

| 7,242,890 | |

| Affiliate payables | |

| (2,265,151 | ) | |

| (3,281,055 | ) |

| Other current assets | |

| 1,182,092 | | |

| — | |

| Net cash provided by operating activities | |

| 31,066,135 | | |

| 55,081,784 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of land and rights of way | |

| (5,592,464 | ) | |

| (6,421,574 | ) |

| Capital expenditures | |

| (33,267,139 | ) | |

| (22,222,860 | ) |

| Sale of assets | |

| 36,837 | | |

| — | |

| Net cash used in investing activities | |

| (38,822,766 | ) | |

| (28,644,434 | ) |

| Cash flows from financing activity: | |

| | | |

| | |

| Members’ distributions | |

| (2,159,579 | ) | |

| (2,584,925 | ) |

| Proceeds from borrowings on credit facility | |

| 10,000,000 | | |

| — | |

| Payments on revolving credit facility | |

| — | | |

| (23,000,000 | ) |

| Debt issuance - commitment fee | |

| (54,447 | ) | |

| — | |

| Net cash provided by (used in) financing activity | |

| 7,785,974 | | |

| (25,584,925 | ) |

| Net increase in cash and cash equivalents | |

| 29,343 | | |

| 852,425 | |

| Cash and cash equivalents, beginning of period | |

| 3,483,637 | | |

| 15,540,976 | |

| Cash and cash equivalents, end of period | |

$ | 3,512,980 | | |

| 16,393,401 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 6,741,133 | | |

| 3,060,763 | |

| Noncash investing activities: | |

| | | |

| | |

| Noncash additions to property | |

$ | 7,085,613 | | |

| 4,644,390 | |

See accompanying notes to condensed consolidated financial statements.

THQ-XCL

HOLDINgS I, LLC and Subsidiaries

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (1) | Organization and Principles of Consolidation |

The accompanying condensed consolidated financial statements

include the accounts of THQ-XcL Holdings I, LLC (“the Company”) and its wholly owned subsidiaries THQ-XcL Holdings I Midco,

LLC, XcL Holdings Corporation, XcL Midstream, LLC, XcL Midstream Operating, LLC, XcL Processing, LLC, and XcL Processing Operating, LLC.

XcL Holdings Corporation was dissolved on May 17, 2022. During interim periods, the Company follows the same accounting policies

disclosed in its audited Annual Financial Statements.

The accompanying unaudited condensed consolidated financial

statements have been prepared by the Company's management in accordance with generally accepted accounting principles in the United States

(“GAAP”) for interim financial information. Accordingly, these financial statements do not include all of the information

required by GAAP for complete financial statements. Therefore, these condensed consolidated financial statements should be read in conjunction

with the audited consolidated financial statements and notes therein for the year ended December 31, 2022. The unaudited condensed

consolidated financial statements included herein contain all adjustments which are, in the opinion of management, necessary to present

fairly the Company's condensed consolidated balance sheets as of June 30, 2023 and December 31, 2022, its condensed consolidated

statements of income and condensed consolidated statements of changes in members’ equity for the quarter and six months ended June 30,

2023 and 2022, and its condensed consolidated statements of cash flows for the six months ended June 30, 2023 and 2022. The condensed

consolidated statements of income for the quarter and six months ended June 30, 2023 are not necessarily indicative of the results

to be expected for future periods.

On September 6, 2022, the Company entered into a purchase

agreement with EQT Corporation and its wholly owned subsidiary EQT Production Corporation, ( together “EQT”) to sell the

Company’s gathering and processing assets along with the upstream assets of affiliate company THQ Appalachia I, LLC for total consideration

of approximately 50 million shares of common stock of EQT and approximately $2.4 billion of cash, subject to customary post-closing adjustments

(“Transaction”). The Company will be selling 100% of its membership interests in THQ-XCL Holdings I Midco, LLC (“THQ-XcL

Midco”) along with the 100% membership interests of the subsidiaries of THQ-XcL Midco. On December 23, 2022, the parties entered

into an amended and restated purchase agreement to extend the right to terminate the original agreement to December 31, 2023, from

the original termination date of December 31, 2022. This transaction has an effective date of July 1, 2022.

| (2) | Relationship with Affiliate |

The Company has an ongoing business relationship with an

affiliate, Tug Hill Operating, LLC (“THO”). THO is responsible for acquisitions, construction and operation of gathering

systems and related facilities owned by the Company. As it incurs costs on behalf of the Company for these operations, THO bills the

Company through its joint interest billing (“JIB”) process; and the Company reimburses THO for these costs at least monthly.

THO is also responsible for the administration of the Company’s business. In exchange for these services, the Company pays a quarterly

fee that includes (a) THO employees’ time and related expenses charged to the Company for the operation of its oil and natural

gas properties, (b) an allocated amount of THO overhead expense calculated based on the number of hours THO employees spend working

on Company projects, and (c) an additional percentage markup of the overall total of (a) and (b) to cover benefits and

other employee-related costs and any unforeseen or difficult to allocate costs. The Company’s board approves the operating budgets.

For the six months ended June 30, 2023, THO billed the Company $12.5 million through the JIB process. The amount due to THO for

these services, which were included in the Company’s affiliate payables balance was $4.5 million as of June 30, 2023. The

remaining affiliate payable balance of $0.8 million as of June 30, 2023 was for revenues received by the Company that were due to

THQA. Allocations consist of $0.1 million of construction expenditures and operating expenses, $7.0 million in salaries and bonus for

the operation of its business, $0.3 million for overhead expenses, and $5.1 million of direct general and administrative expenses

for the six months ended June 30, 2023. For the six months ended June 30, 2022, THO billed the Company $8.6 million, respectively

through the JIB process. Allocations consist of $0.1 million relating to acquisition of surface use agreements and rights-of-way, $1.5

million of construction expenditures and operating expenses, $4.7 million in salaries and bonus for the operation of its business, $0.3

million for overhead expenses, and $2.0 million of direct general and administrative expenses for the six months ended June 30,

2022. The amounts due to THO for these services, which were included in the Company’s affiliate payables balance was $5.7 million

as of December 31, 2022. The remaining affiliate payable balance of $1.9 million as of December 31, 2022 was for revenues received

by the Company that were due to THQA.

THQ-XCL

HOLDINgS I, LLC and Subsidiaries

Notes to Condensed Consolidated Financial Statements

June 30, 2023 and 2022

(Unaudited)

| (3) | Property and Equipment |

Property and equipment consists of the following:

| | |

June 30, 2023 | | |

December 31, 2022 | |