Ferguson Prices $750 Million of Senior Unsecured Notes

01 Octobre 2024 - 10:49PM

Business Wire

On October 1, 2024, Ferguson Enterprises Inc. (“Ferguson”)

(NYSE: FERG; LSE: FERG) announced that it has priced a public

offering (the “Offering”) of $750 million in aggregate principal

amount of 5.000% senior unsecured notes due 2034 (the “Notes”). The

obligations of Ferguson under the Notes will be fully and

unconditionally guaranteed (the “Guarantee”) by Ferguson UK

Holdings Limited, an indirect subsidiary of Ferguson (the

“Guarantor”). Ferguson expects that the closing of the Offering

will occur on October 3, 2024, subject to the satisfaction of

customary closing conditions.

Ferguson intends to use a portion of the net proceeds from the

sale of the Notes to prepay certain outstanding term loans, with

the remaining proceeds to be used for general corporate purposes.

BofA Securities, Inc., J.P. Morgan Securities LLC and RBC Capital

Markets, LLC are acting as joint book-running managers for the

Offering.

The Offering of the Notes and the related Guarantee is being

made pursuant to an effective shelf registration statement

(including a prospectus and preliminary prospectus supplement)

(File Nos. 333-282398 and 333-282398-01) filed with the U.S.

Securities and Exchange Commission (the “SEC”). You may get these

documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, any underwriter or any dealer

participating in the Offering will arrange to send you the

prospectus and the preliminary prospectus supplement (or, if

available, the prospectus supplement) if you request it by

contacting BofA Securities, Inc. at 1-800-294-1322, J.P. Morgan

Securities LLC at 1-212-834-4533 or RBC Capital Markets, LLC at

1-866-375-6829.

This press release shall not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, the

Notes, the Guarantee or any other security. No offer, solicitation,

purchase or sale will be made in any jurisdiction in which such an

offer, solicitation or sale would be unlawful.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this announcement is forward-looking

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the terms of the Notes,

the anticipated use of the net proceeds from the Offering of the

Notes, and the expected closing date of the Offering.

Forward-looking statements cover all matters which are not

historical facts and speak only as of the date on which they are

made. Forward-looking statements can be identified by the use of

forward-looking terminology, such as “intends,” “expects,”

“anticipates,” “will,” or, in each case, their negative or other

variations or comparable terminology. Many factors could cause

actual results to differ materially from those in such

forward-looking statements, including, but not limited to: the

conditions to the completion of the Notes offering may not be

satisfied; uncertainty and other conditions in the markets in which

we operate, and other factors beyond our control, including

disruption in the financial markets and any macroeconomic or other

consequences of political unrest, disputes or war; and other risks

and uncertainties set forth under the heading “Risk Factors” in the

Annual Report on Form 10-K filed by Ferguson with the SEC on

September 25, 2024, and in other filings Ferguson makes with the

SEC in the future. Forward-looking statements regarding past trends

or activities should not be taken as a representation that such

trends or activities will continue in the future. Other than in

accordance with our legal or regulatory obligations, we undertake

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

About Ferguson

Ferguson (NYSE: FERG; LSE: FERG) is the largest value-added

distributor serving the specialized professional in our $340B

residential and non-residential North American construction market.

We help make our customers’ complex projects simple, successful and

sustainable by providing expertise and a wide range of products and

services from plumbing, HVAC, appliances, and lighting to PVF,

water and wastewater solutions, and more. Headquartered in Newport

News, Va., Ferguson has sales of $29.6 billion (FY’24) and

approximately 35,000 associates in nearly 1,800 locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001402250/en/

Investor Inquiries Brian Lantz Vice President, IR and

Communications +1 224 285 2410

Pete Kennedy Director of Investor Relations +1 757 603 0111

Media inquiries Christine Dwyer Senior Director,

Communications and Public Relations +1 757 469 5813

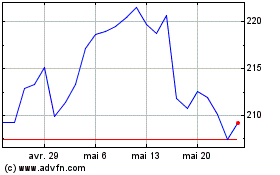

Ferguson Enterprises (NYSE:FERG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Ferguson Enterprises (NYSE:FERG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024