As filed with the Securities and Exchange Commission on November 29, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

F&G Annuities & Life, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 6311 | 85-2487422 |

(State or other jurisdiction of

incorporation or organization) | (Primary Standard Industrial Classification Code

Number) | (I.R.S. Employer

Identification Number) |

801 Grand Avenue, Suite 2600

Des Moines, Iowa 50309

(515) 330-3340

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jodi Ahlman

F&G Annuities & Life, Inc.

801 Grand Avenue, Suite 2600

Des Moines, Iowa 50309

(515) 330-3340

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | |

Dwight S. Yoo

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, New York 10001

(212) 735-3000 | Jeffrey J. Delaney Stephanie J. Langan Pillsbury Winthrop Shaw Pittman LLP 31 W. 52nd St. New York, New York 10019 (212) 858-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☒ 333-275750

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

This registration statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b) under the Securities Act of 1933.

TABLE OF ADDITIONAL REGISTRANTS

| | | | | | | | | | | | | | | | | | | | |

Exact name of registrant as specified in its charter* | | State or other

jurisdiction of

incorporation or

organization | | Primary Standard

Industrial

Classification Code

Number | | I.R.S. Employer

Identification

Number |

CF Bermuda Holdings Limited | | Bermuda | | 6311 | | |

FGL US Holdings Inc. | | Delaware | | 6311 | | 82-2796563 |

Fidelity & Guaranty Life Business Services, Inc. | | Delaware | | 6311 | | 43-1914674 |

Fidelity & Guaranty Life Holdings, Inc. | | Delaware | | 6311 | | 48-1245662 |

__________________

*The address and telephone number of each additional registrant is c/o F&G Annuities & Life, Inc., 801 Grand Avenue, Suite 2600, Des Moines, Iowa 50309, tel. (515) 330-3340.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

Pursuant to Rule 462(b) under the Securities Act of 1933, as amended, F&G Annuities & Life, Inc., CF Bermuda Holdings Limited, FGL US Holdings Inc., Fidelity & Guaranty Life Business Services, Inc. and Fidelity & Guaranty Life Holdings, Inc (collectively, the “Registrants”) are filing this registration statement with the Securities and Exchange Commission (the “Commission”). This registration statement relates to the public offering of securities contemplated by the Registration Statement on Form S-1 (File No. 333-275750), which the Registrants originally filed on November 27, 2023 (the “Prior Registration Statement”), and which the Commission declared effective on November 29, 2023.

The Registrants are filing this registration statement for the sole purpose of increasing the aggregate principal amount of the senior notes offered by F&G Annuities & Life, Inc. by $57,500,000. The additional securities that are being registered for sale are in an amount that represents no more than 20% of the maximum aggregate principal amount set forth in the Prior Registration Statement. The required opinion of counsel and related consent and accountant’s consent are attached hereto and filed herewith. Pursuant to Rule 462(b), the contents of the Prior Registration Statement, including the exhibits thereto, are incorporated by reference into this registration statement.

EXHIBIT INDEX

| | | | | | | | |

| Number | | Description |

| | |

5.1 | | |

| | |

5.2* | | |

| | |

23.1 | | |

| | |

23.2 | | |

| | |

23.3 | | |

| | |

24.1 | | |

| | |

107 | | |

*Incorporated by reference to the Exhibit of the same number to the Prior Registration Statement.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Des Moines, Iowa, on November 29, 2023.

| | | | | | | | |

| F&G ANNUITIES & LIFE, INC. |

| | |

| By: | /s/ Jodi Ahlman |

| | Jodi Ahlman |

| | General Counsel & Secretary |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

* | | President & Chief Executive Officer (Principal Executive Officer); Director | | November 29, 2023 |

| Christopher O. Blunt | | | |

| | | | |

* | | Chief Financial Officer (Principal Financial and Accounting Officer) | | November 29, 2023 |

| Wendy J.B. Young | | | |

| | | | |

* | | Chairman of the Board | | November 29, 2023 |

| William P. Foley, II | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| Douglas K. Ammerman | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| Celina J. Wang Doka | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| Douglas Martinez | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| Michael Nolan | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| Raymond Quirk | | | | |

| | | | |

* | | Director | | November 29, 2023 |

| John D. Rood | | | | |

| | | | | |

*By: | /s/ Jodi Ahlman |

| Jodi Ahlman |

| Attorney-in-Fact |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Des Moines, Iowa on November 29, 2023.

| | | | | | | | |

| CF BERMUDA HOLDINGS LIMITED |

| | |

| By: | /s/ Jodi Ahlman |

| | Jodi Ahlman |

| | Senior Vice President, General Counsel & Secretary |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

* | | President & Chief Executive Officer (Principal Executive Officer); Director | | November 29, 2023 |

| Christopher O. Blunt | | | |

* | | Executive Vice President, Chief Financial Officer (Principal Financial and Accounting Officer); Director | | November 29, 2023 |

| Wendy J.B. Young | | | |

| | | | |

* | | Director | | November 29, 2023 |

| John D. Currier | | | | |

| | | | | |

*By: | /s/ Jodi Ahlman |

| Jodi Ahlman |

| Attorney-in-Fact |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Des Moines, Iowa on November 29, 2023.

| | | | | | | | |

| FGL US HOLDINGS INC. |

| | |

| By: | /s/ Jodi Ahlman |

| | Jodi Ahlman |

| | Senior Vice President, General Counsel & Secretary |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

* | | President & Chief Executive Officer (Principal Executive Officer); Director | | November 29, 2023 |

| Christopher O. Blunt | | | |

| | Executive Vice President, Chief Financial Officer (Principal Financial and Accounting Officer); Director | | |

* | | | November 29, 2023 |

| Wendy J.B. Young | | | |

| | | | |

* | | Director | | November 29, 2023 |

| John D. Currier | | | | |

| | | | | |

*By: | /s/ Jodi Ahlman |

| Jodi Ahlman |

| Attorney-in-Fact |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Des Moines, Iowa on November 29, 2023.

| | | | | | | | |

| FIDELITY & GUARANTY LIFE BUSINESS

SERVICES, INC. |

| | |

| By: | /s/ Jodi Ahlman |

| | Jodi Ahlman |

| | Senior Vice President, General Counsel & Secretary |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

* | | President & Chief Executive Officer (Principal Executive Officer); Director | | November 29, 2023 |

| Christopher O. Blunt | | | |

| | | | |

* | | Executive Vice President, Chief Financial Officer (Principal Financial and Accounting Officer) | | November 29, 2023 |

| Wendy J.B. Young | | | |

| | | | |

* | | Director | | November 29, 2023 |

| John D. Currier | | | | |

| | | | |

* | | Director | | November 29, 2023 |

Marie Norcia | | | | |

| | | | | |

*By: | /s/ Jodi Ahlman |

| Jodi Ahlman |

| Attorney-in-Fact |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Des Moines, Iowa on November 29, 2023.

| | | | | | | | |

| FIDELITY & GUARANTY LIFE HOLDINGS, INC. |

| | |

| By: | /s/ Jodi Ahlman |

| | Jodi Ahlman |

| | Senior Vice President, General Counsel & Secretary |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

* | | President & Chief Executive Officer (Principal Executive Officer); Director | | November 29, 2023 |

| Christopher O. Blunt | | | |

| | | | |

* | | Executive Vice President, Chief Financial Officer (Principal Financial and Accounting Officer); Director | | November 29, 2023 |

| Wendy J.B. Young | | | |

| | | | |

* | | Director | | November 29, 2023 |

| John D. Currier | | | | |

| | | | | |

*By: | /s/ Jodi Ahlman |

| Jodi Ahlman |

| Attorney-in-Fact |

Calculation of Filing Fee Tables

Form S-1

(Form Type)

Issuer:

F&G Annuities & Life, Inc.

Guarantors:

CF Bermuda Holdings Limited

FGL US Holdings Inc.

Fidelity & Guaranty Life Business Services, Inc.

Fidelity & Guaranty Life Holdings, Inc.

(Exact Name of Registrants as Specified in their Charters)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation or Carry Forward Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Newly Registered Securities |

| Fees to be Paid | Debt | [ ]% Senior Notes due 2053 | Rule 457(o) | $57,500,000 | 100% | $57,500,000 (1) | 0.0001476 | $8,487(2) |

| Debt | Guarantees of [ ]% Senior Notes due 2053(3) | Other | __ | __ | __ | __ | __(4) |

| Fees Previously Paid | Debt | [ ]% Senior Notes due 2053 | Rule 457(o) | $287,500,000 | 100% | $287,500,000 | 0.0001476 | $42,435 |

| Debt | Guarantees of [ ]% Senior Notes due 2053(3) | Other | __ | __ | __ | __ | __(4) |

| Carry Forward Securities |

| Carry Forward Securities | Debt | [ ]% Senior Notes due 2053 | Rule 457(o) | $287,500,000 | 100% | $287,500,000 | 0.0001476 | $42,435 |

| Debt | Guarantees of [ ]% Senior Notes due 2053(3) | Other | __ | __ | __ | __ | __(4) |

| Total Offering Amounts | | $345,000,000 (1) | | $50,922 |

| Total Fees Previously Paid | | $287,500,000 | | $42,435 |

| Total Fee Offsets | | $287,500,000 | | $42,435 |

| Net Fee Due | | $8,487 | | $8,487 |

(1)Represents the maximum aggregate principal amount of the notes to be offered in the offering to which the registration statement relates.

(2)Calculated in accordance with Rule 457(o) under the Securities Act of 1933.

(3)No separate consideration will be received for the guarantees.

(4)Pursuant to Rule 457(n) under the Securities Act of 1933, no additional registration fee is due for the guarantees.

SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

| | | | | | | | | | | | | | |

| | ONE MANHATTAN WEST | | FIRM/AFFILIATE OFFICES -------- BOSTON CHICAGO HOUSTON LOS ANGELES PALO ALTO WASHINGTON, D.C. WILMINGTON -------- BEIJING BRUSSELS FRANKFURT HONG KONG LONDON MUNICH PARIS SAO PAULO SEOUL SHANGHAI SINGAPORE TOKYO TORONTO |

| | NEW YORK, NY 10001 | |

| | | |

| | TEL: (212) 735-3000 | |

| | FAX: (212) 735-2000 | |

| | www.skadden.com | |

| | | |

| | November 29, 2023 |

| | | |

F&G Annuities & Life, Inc.

801 Grand Avenue, Suite 2600

Des Moines, Iowa 50309

| | | | | |

| Re: | F&G Annuities & Life, Inc. |

| Registration Statement on Form S-1 |

Ladies and Gentlemen:

We have acted as special United States counsel to F&G Annuities & Life, Inc., a Delaware corporation (the “Company”), in connection with the public offering by the Company of (i) Senior Notes due 2053 (the “Initial Notes” and, together with the Guarantees (as defined below) thereof by the Guarantors (as defined below), the “Initial Securities”) under the Initial Registration Statement (as defined below) and (ii) additional Senior Notes due 2053 (the “Additional Notes” and, together with the Guarantees thereof by the Guarantors, the “Additional Securities”) under the Abbreviated Registration Statement (as defined below). The Initial Notes together with the Additional Notes are herein referred to as the “Notes”. The Notes are to be issued under the Indenture, dated as of January 13, 2023 (the “Base Indenture”), among the Company, the entities identified on Schedule 1 hereto (collectively, the “Delaware Guarantors”; the Delaware Guarantors, together with the Company, the “Specified Opinion Parties”) and Citibank, N.A., as trustee (the “Trustee”), as supplemented by the Second Supplemental Indenture, dated as of January 26, 2023 (the “Second Supplemental Indenture”), between CF Bermuda Holdings Limited (“CF Bermuda” and, together with the Delaware Guarantors, the “Guarantors”; the Guarantors collectively with the Company, the “Opinion Parties” and each, an “Opinion Party”) and the Trustee, and the Third Supplemental Indenture (the “Third Supplemental Indenture” and, together with the Base Indenture and the Second Supplemental Indenture, the “Indenture”), among the Company, the Guarantors and the Trustee. The Indenture provides for the guarantee of the Notes by the Guarantors.

F&G Annuities & Life, Inc.

November 29, 2023

Page 2

This opinion is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act of 1933 (the “Securities Act”).

In rendering the opinions stated herein, we have examined and relied upon the following:

(a)the registration statement on Form S-1 of the Company and the Guarantors relating to the Initial Securities filed on November 27, 2023 with the Securities and Exchange Commission (the “Commission”) under the Securities Act, including the information deemed to be a part of the registration statement pursuant to Rule 430A of the General Rules and Regulations under the Securities Act (the “Rules and Regulations”) (such registration statement, as so amended, being hereinafter referred to as the “Initial Registration Statement”);

(b)the registration statement on Form S-1 of the Company and the Guarantors relating to the Additional Securities to be filed on the date hereof with the Commission under the Securities Act, to register additional securities for an offering pursuant to Rule 462(b) of the Rules and Regulations (such registration statement, as so amended, being hereinafter referred to as the “Abbreviated Registration Statement”);

(b)the form of the Underwriting Agreement (the “Underwriting Agreement”) proposed to be entered into among the Company, the Guarantors and Wells Fargo Securities, LLC, BofA Securities, Inc., Morgan Stanley & Co. LLC, RBC Capital Markets, LLC and UBS Securities LLC, as representatives (the “Representatives”) of the several underwriters (the “Underwriters”) named therein, relating to the sale by the Company to the Underwriters of the Notes, filed as Exhibit 1.1 to the Initial Registration Statement;

(c)an executed copy of the Base Indenture, including Article 10 thereof containing the guaranty obligations of the Delaware Guarantors of the Notes (the “Delaware Guarantor Guarantees”);

(d)an executed copy of the Second Supplemental Indenture, including Section 2.1 thereof containing the guaranty obligations of CF Bermuda of the Notes on the terms and subject to the conditions set forth in the Base Indenture, including, but not limited to, Article 10 thereof (the “CF Bermuda Guarantee” and, together with the Delaware Guarantor Guarantees, the “Guarantees”);

(e)the Third Supplemental Indenture;

(f)the form of global certificate evidencing the Notes to be registered in the name of Cede & Co. and included as an exhibit to the Initial Registration Statement (the “Note Certificate”);

(g)an executed copy of a certificate of Jodi Ahlman, General Counsel and Secretary of the Company, dated the date hereof (the “Issuer Secretary’s Certificate”);

(h)executed copies of the certificates of Jodi Ahlman, Secretary of each of the Delaware Guarantors, each dated the date hereof (together with the Issuer Secretary’s Certificate, the “Secretaries’ Certificates” and each, a “Secretary’s Certificate”);

(i)copies of each Specified Opinion Party’s Certificate of Incorporation, as amended and in effect as of the date specified on Schedule 2 hereto, and certified by the Secretary of State

F&G Annuities & Life, Inc.

November 29, 2023

Page 3

of the State of Delaware as of the date specified on Schedule 2 hereto and certified pursuant to the applicable Secretary’s Certificate;

(j)copies of each Specified Opinion Party’s Bylaws, as amended and in effect as of the date specified on Schedule 2 hereto, and certified pursuant to the applicable Secretary’s Certificate; and

(k)copies of certain resolutions adopted by the Board of Directors (or committee thereof) of each Specified Opinion Party, as of the date specified on Schedule 2 hereto, certified pursuant to the applicable Secretary’s Certificate.

We have also examined originals or copies, certified or otherwise identified to our satisfaction, of such records of the Opinion Parties and such agreements, certificates and receipts of public officials, certificates of officers or other representatives of the Opinion Parties and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinions stated below.

In our examination, we have assumed the genuineness of all signatures, including electronic signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified or photocopied copies, and the authenticity of the originals of such copies. As to any facts relevant to the opinions stated herein that we did not independently establish or verify, we have relied upon statements and representations of officers and other representatives of the Opinion Parties and others and of public officials, including the facts and conclusions set forth in the Secretary’s Certificates and the factual representations and warranties contained in the Transaction Documents (as defined below).

We do not express any opinion with respect to the laws of any jurisdiction other than (i) the laws of the State of New York and (ii) the General Corporation Law of the State of Delaware (the “DGCL”) (all of the foregoing being referred to as the “Opined-on Law”).

As used herein, “Transaction Documents” means the Indenture (including the Guarantees provided for therein), and the Note Certificate.

Based upon the foregoing and subject to the qualifications and assumptions stated herein, we are of the opinion that:

1.When (i) the Abbreviated Registration Statement, as finally amended (including all necessary post-effective amendments), has become effective under the Securities Act; (ii) the Underwriting Agreement has been duly authorized, executed and delivered by the Company and the other parties thereto; (iii) the Third Supplemental Indenture has been duly authorized, executed and delivered by the Company and the other parties thereto; and (iv) the Note Certificate, in the form examined by us has been duly authorized by all requisite corporate action on the part of the Company under the DGCL and, when executed by the Company and duly authenticated by the Trustee and issued and delivered by the Company against payment therefor

F&G Annuities & Life, Inc.

November 29, 2023

Page 4

in accordance with the terms of the Underwriting Agreement and the Indenture, the Note Certificate will constitute the valid and binding obligation of the Company, entitled to the benefits of the Indenture and enforceable against the Company in accordance with its terms under the laws of the State of New York.

2.The Guarantee of each Delaware Guarantor has been duly authorized by all requisite corporate action on the part of such Delaware Guarantor under the DGCL and, when the Note Certificate is executed by the Company and duly authenticated by the Trustee and issued and delivered by the Company against payment therefor in accordance with the terms of the Underwriting Agreement and the Indenture, the Guarantee of each Guarantor will constitute the valid and binding obligation of such Guarantor, enforceable against such Guarantor in accordance with its terms under the laws of the State of New York.

The opinions stated herein are subject to the following qualifications:

(a)we do not express any opinion with respect to the effect on the opinions stated herein of any bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer, preference and other similar laws or governmental orders affecting creditors’ rights generally, and the opinions stated herein are limited by such laws and orders and by general principles of equity (regardless of whether enforcement is sought in equity or at law);

(b)we do not express any opinion with respect to the effect on the opinions stated herein of (i) the compliance or non-compliance of any party to any of the Transaction Documents with any laws, rules or regulations applicable to such party or (ii) the legal status or legal capacity of any party to any of the Transaction Documents;

(c)we do not express any opinion with respect to any law, rule or regulation that is applicable to any party to any of the Transaction Documents or the transactions contemplated thereby solely because such law, rule or regulation is part of a regulatory regime applicable to any such party or any of its affiliates as a result of the specific assets or business operations of such party or such affiliates;

(d)except to the extent expressly stated in the opinions contained herein, we have assumed that each of the Transaction Documents constitutes the valid and binding obligation of each party to such Transaction Document, enforceable against such party in accordance with its terms;

(e)the opinions stated herein are limited to the agreements and documents specifically identified in the opinions contained herein without regard to any agreement or other document referenced in such agreement or document (including agreements or other documents incorporated by reference or attached or annexed thereto);

(f)we do not express any opinion with respect to the enforceability of any provision contained in any Transaction Document relating to any indemnification, contribution, non-reliance, exculpation, release, limitation or exclusion of remedies, waiver or other provisions having similar effect that may be contrary to public policy or violative of federal or state

F&G Annuities & Life, Inc.

November 29, 2023

Page 5

securities laws, rules or regulations, or to the extent any such provision purports to, or has the effect of, waiving or altering any statute of limitations;

(g)we do not express any opinion with respect to the enforceability of any provision contained in any Transaction Document purporting to prohibit, restrict or condition the assignment of rights under such Transaction Document to the extent that such prohibition, restriction or condition on assignability is ineffective pursuant to the Uniform Commercial Code;

(h)to the extent that any opinion relates to the enforceability of the choice of New York law and choice of New York forum provisions contained in any Transaction Document, the opinions stated herein are subject to the qualification that such enforceability may be subject to, in each case, (i) the exceptions and limitations in New York General Obligations Law sections 5-1401 and 5-1402 and (ii) principles of comity and constitutionality;

(i)we do not express any opinion with respect to Section 12.9 of the Base Indenture to the extent that such section provides for a waiver of trial by jury;

(j)we call to your attention that irrespective of the agreement of the parties to any Transaction Document, a court may decline to hear a case on grounds of forum non conveniens or other doctrine limiting the availability of such court as a forum for resolution of disputes; in addition, we call to your attention that we do not express any opinion with respect to the subject matter jurisdiction of the federal courts of the United States of America in any action arising out of or relating to any Transaction Document;

(k)we do not express any opinion with respect to the enforceability of Section 10.1 of the Base Indenture and Section 2.1 of the Second Supplemental Indenture to the extent that such sections provide that the obligations of the Guarantors are absolute and unconditional irrespective of the enforceability or genuineness of the Indenture or the effect thereof on the opinions herein stated;

(l)we do not express any opinion with respect to the enforceability of the provisions contained in Section 10.2 of the Base Indenture to the extent that such provisions limit the obligation of the Guarantors under the Indenture or any right of contribution of any party with respect to the obligations under the Indenture;

(m)we call to your attention that the opinions stated herein are subject to possible judicial action giving effect to governmental actions or laws of jurisdictions other than those with respect to which we express our opinion;

(n)we do not express any opinion with respect to the enforceability of any provision contained in any Transaction Document providing for indemnity by any party thereto against any loss in obtaining the currency due to such party under any Transaction Document from a court judgment in another currency;

(o)we do not express any opinion whether the execution or delivery of any Transaction Document by any Opinion Party, or the performance by any Opinion Party of its

F&G Annuities & Life, Inc.

November 29, 2023

Page 6

obligations under any Transaction Document to which such Opinion Party is a party will constitute a violation of, or a default under, any covenant, restriction or provision with respect to financial ratios or tests or any aspect of the financial condition or results of operations of any Opinion Party or any of its subsidiaries; and

(p)we have assumed that subsequent to the effectiveness of the Base Indenture, the Base Indenture has not been modified, amended, restated, supplemented or terminated, other than by the First Supplemental Indenture, the Second Supplemental Indenture and the Third Supplemental Indenture, and that the Indenture will constitute the valid and binding obligation of the Opinion Parties immediately prior to the issuance of the Note Certificate and the Guarantees.

In addition, in rendering the foregoing opinions we have assumed that:

(a)CF Bermuda (i) is duly organized and is validly existing and in good standing, (ii) has requisite legal status and legal capacity under the laws of the jurisdiction of its organization and (iii) has complied and will comply with all aspects of the laws of the jurisdiction of its organization in connection with the transactions contemplated by, and the performance of its obligations under, the Transaction Documents to which CF Bermuda is a party;

(b)CF Bermuda has the corporate power and authority to execute, deliver and perform all its obligations under each of the Transaction Documents to which CF Bermuda is a party;

(c)each of the Transaction Documents to which CF Bermuda is a party has been duly authorized, executed and delivered by all requisite corporate action on the part of CF Bermuda;

(d)neither the execution and delivery by each Opinion Party of the Transaction Documents to which it is a party nor the performance by such Opinion Party of its obligations under each of the Transaction Documents to which it is a party, including the issuance of the Notes and the Guarantees: (i) conflicts or will conflict with the organizational documents of CF Bermuda, (ii) constitutes or will constitute a violation of, or a default under, any lease, indenture, agreement or other instrument to which any Opinion Party or its property is subject (except that we do not make the assumption set forth in this clause (ii) with respect to those agreements or instruments expressed to be governed by the laws of the State of New York which are filed in Part II of the Initial Registration Statement or the Company’s Annual Report on Form 10-K for the year ended December 31, 2022), (iii) contravenes or will contravene any order or decree of any governmental authority to which any Opinion Party or its property is subject, or (iv) violates or will violate any law, rule or regulation to which any Opinion Party or its property is subject (except that we do not make the assumption set forth in this clause (iv) with respect to the Opined-on Law); and

(e)neither the execution and delivery by each Opinion Party of the Transaction Documents to which it is a party nor the performance by each Opinion Party of its obligations under each of the Transaction Documents to which it is a party, including the issuance of the Notes and the Guarantees, requires or will require the consent, approval, licensing or authorization of, or any filing, recording or registration with, any governmental authority under any law, rule or regulation of any jurisdiction.

F&G Annuities & Life, Inc.

November 29, 2023

Page 7

We hereby consent to the filing of this opinion with the Commission as an exhibit to the Abbreviated Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the General Rules and Regulations under the Securities Act. This opinion is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable law.

| | | | | |

| Very truly yours, |

| |

| /s/ Skadden, Arps, Slate, Meagher & Flom LLP |

| |

| DSY | |

Schedule 1

Delaware Guarantors

1.FGL US Holdings Inc., a Delaware corporation

2.Fidelity & Guaranty Life Business Services, Inc., a Delaware corporation

3.Fidelity & Guaranty Life Holdings, Inc., a Delaware corporation

Schedule 2

Resolutions, Certification and Governance Documents of the Specified Opinion Parties

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Date of Charter Certification by Delaware Secretary of State | | Description of Certified Charter | | Description of Bylaws | | Date of Adoption of Resolutions |

| F&G Annuities & Life, Inc. | | November 20, 2023 | | Amended and Restated Certificate of Incorporation dated as of November 30, 2022 | | Amended and Restated Bylaws dated as of November 30, 2022 | | November 7, 2023 |

| FGL US Holdings Inc. | | November 20, 2023 | | Certificate of Incorporation dated as of May 19, 2017 | | Bylaws dated as of May 19, 2017 | | November 27, 2023 |

| Fidelity & Guaranty Life Business Services, Inc. | | November 20, 2023 | | Certificate of Incorporation dated as of February 8, 2001, as amended on September 11, 2001, March 3, 2004 and April 11, 2011 | | Bylaws dated as of February 8, 2001 | | November 27, 2023 |

| Fidelity & Guaranty Life Holdings, Inc. | | November 20, 2023 | | Certificate of Incorporation dated as of January 25, 2001, as amended on March 15, 2001, April 11, 2011, May 16, 2012 and December 27, 2012 | | Bylaws dated as of November 1, 2001 | | November 27, 2023 |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement on Form S-1 filed pursuant to Rule 462(b) of the Securities Act of 1933 of the reference to our firm under the caption “Experts” and to the incorporation by reference of our report dated February 27, 2023 (except for the adoption of ASU No. 2018-12 disclosed in Note W as to which the date is July 13, 2023) with respect to the consolidated financial statements of F&G Annuities & Life, Inc. included in its current report on Form 8-K dated July 13, 2023, and incorporated by reference in the Registration Statement (Form S-1 No. 333-275750) and related Prospectus of F&G Annuities & Life, Inc. for the registration of its senior notes.

| | |

| /s/ Ernst & Young LLP |

|

| Des Moines, Iowa |

| November 29, 2023 |

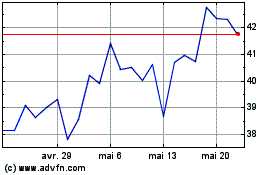

FGL (NYSE:FG)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

FGL (NYSE:FG)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025