Genie Energy Closes on Solar Generation Project Financing

19 Novembre 2024 - 2:30PM

Genie Energy Ltd., (NYSE: GNE), a retail energy and renewable

energy solutions provider, today announced that it has closed on a

loan financing on a portfolio of operating solar generation assets.

The $7.4 million fixed rate term loan secured

through National Cooperative Bank (NCB) provides project financing

for a solar array portfolio rated for an aggregate 10MW. The

arrays, which Genie purchased through its Sunlight Energy

subsidiary during the past year, provide power to educational

facilities in three Midwestern states through direct fixed-price

solar power purchase agreements (PPAs).

Michael Stein, CEO of Genie Energy, commented,

“I am very pleased to complete the financing of this portfolio.

These assets have generated revenue and profitability in line with

expectations since we acquired them. The financing provided by NCB

increases the arrays’ return on equity and more broadly, represents

a key element of our solar generation strategy within our Genie

Renewables division. We expect to continue to utilize project

financing to optimize our capital structure, maximize equity

returns, increase capacity for new product development and enhance

profitability for projects we develop or acquire going

forward.”

At September 30, 2024, Genie Renewable's

development pipeline of 96 MW comprised two utility-scale projects

under construction and an additional 17 projects in various stages

of pre-construction development.

In this press release, all statements that are

not purely about historical facts, including, but not limited to,

those in which we use the words “believe,” “anticipate,” “expect,”

“plan,” “intend,” “estimate, “target” and similar expressions, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. While these

forward-looking statements represent our current judgment of what

may happen in the future, actual results may differ materially from

the results expressed or implied by these statements due to

numerous important factors, including, but not limited to, those

described in our most recent report on SEC Form 10-K (under the

headings “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations”), which may be

revised or supplemented in subsequent reports on SEC Forms 10-Q and

8-K. We are under no obligation, and expressly disclaim any

obligation, to update the forward-looking statements in this press

release, whether as a result of new information, future events or

otherwise.

About Genie Energy Ltd.:

Genie Energy Ltd., (NYSE: GNE) is a leading

retail energy and renewable energy solutions provider. The Genie

Retail Energy division (GRE) supplies electricity, including

electricity from renewable resources, and natural gas to

residential and small business customers in the United States. The

Genie Renewables division's (GREW) holdings include Genie Solar, a

vertically-integrated provider of community and utility-scale solar

energy solutions, and Diversegy, an energy procurement advisor. For

more information, visit Genie.com.

ContactGenie Energy Investor RelationsBill

UlreyP. (973) 738-3848E-mail: invest@genie.com

# # #

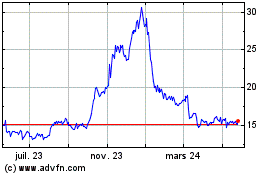

Genie Energy (NYSE:GNE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

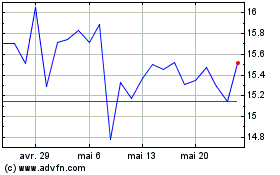

Genie Energy (NYSE:GNE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025