false

0000043196

0000043196

2024-02-23

2024-02-23

0000043196

gtn:ClassACommonStockNoParValueCustomMember

2024-02-23

2024-02-23

0000043196

gtn:CommonStockNoParValueCustomMember

2024-02-23

2024-02-23

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 23, 2024 (February 23, 2024)

Gray Television, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Georgia

(State or Other Jurisdiction of Incorporation)

|

001-13796

|

|

58-0285030

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

4370 Peachtree Road, NE, Atlanta, Georgia

|

|

30319

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

404-504-9828

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the act:

|

Title of each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock (no par value)

|

GTN.A

|

New York Stock Exchange

|

|

common stock (no par value)

|

GTN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On February 23, 2024, Gray Television, Inc. issued a press release reporting its financial results for the three-month and full-year periods ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information set forth under this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Gray Television, Inc.

|

|

| |

|

|

|

February 23, 2024

|

By:

|

/s/ James C. Ryan

|

|

| |

|

Name:

|

James C. Ryan

|

|

| |

|

Title:

|

Executive Vice President and

Chief Financial Officer

|

|

Exhibit 99.1

NEWS RELEASE

Gray Finishes 2023 In A Strong Position and Issues Positive Outlook for 2024

Atlanta, Georgia –February 23, 2024. . . Gray Television, Inc. (“Gray,” “we,” “us” or “our”) (NYSE: GTN) today announced strong financial results for the fourth quarter ended December 31, 2023, including total revenue of $864 million, which was in-line with the high end of our revenue guidance and total operating expenses (before depreciation, amortization, impairment and loss on disposal of assets) of $664 million, which was below the low end of our expense guidance for the quarter.

Gray continued to execute across its portfolio of high-quality television stations and digital platforms as it combines its market-leading local news with strong network programming to deliver unparalleled reach for advertisers. In the fourth quarter of 2023, Gray’s total revenue increased by $143 million or 20% compared to 2021, our most recent non-political year.

We are particularly pleased with the performance of our television stations during the quarter, whose core advertising revenue increased 2% on a year-over-year basis. We saw continued improvement in the automobile advertising category with a 16% year-over-year increase. In addition, political advertising revenues in a non-political year were relatively strong at $33 million.

In the fourth quarter, NBCUniversal completed its initial move-in activities and began its lease with us for the soundstages, offices, warehouses, mill spaces, parking and related facilities in our Assembly Studios real estate complex located in the Atlanta metro area. We are continuing to evaluate opportunities to maximize the value of the undeveloped portion of this unique real estate development. We currently anticipate that the mixed-use complex will be fully constructed by 2030. Based on current expectations, we anticipate capital expenditures of $52 million in 2024 to complete the studio complex and certain infrastructure projects at the complex. In addition, we anticipate receiving $31 million of proceeds from certain incentive payments that reimburse us for a portion of prior and planned 2024 capital projects at the complex.

On February 8, 2024, we received $110 million in pre-tax cash proceeds from the closing of the previously announced sale of Broadcast Music, Inc. (“BMI”) to a shareholder group led by New Mountain Capital, LLC. $50 million of the net proceeds from the sale of BMI were used to pay in full the amount then outstanding under our Revolving Credit Facility. We intend to use the remaining proceeds for general corporate purposes.

On February 16, 2024, we completed the extension and upsizing of our revolving credit facility. Due to strong demand, our banking group increased their commitments to our revolving credit facilities to $625 million, which includes a new $552.5 million revolving credit facility maturing on December 31, 2027, and $72.5 million facility maturing on December 1, 2026.

On February 20, 2024, we announced that our Chief Financial Officer, Jim Ryan has notified us of his voluntary decision to transition into retirement after 2025. We also announced the hiring of Jeff Gignac, who currently serves as a Managing Director and Head of Media & Telecom Investment Banking at Wells Fargo Securities. Mr. Gignac will join us initially as Executive Vice President, Finance, on April 1, 2024, and he will step into Mr. Ryan’s role as Executive Vice President, Chief Financial Officer on July 1, 2024. Mr. Ryan will work closely with Mr. Gignac and our entire executive team until he retires at the end of 2025.

Summary of Fourth Quarter Operating Results

Operating Highlights (the respective 2023 periods reflect the “off-year” of the two-year political advertising cycle):

|

●

|

Total revenue was $864 million, a decrease of 19% from the fourth quarter of 2022, entirely as a result of the decrease in political advertising revenue in this off-year of the two-year political advertising cycle.

|

4370 Peachtree Road, NE, Atlanta, GA 30319 | P 404.504.9828 F 404.261.9607 | www.gray.tv

|

●

|

Core Advertising Revenue was $415 million, an increase of 2% from the fourth quarter of 2022.

|

|

●

|

Retransmission revenue was $365 million, an increase of 3% from the fourth quarter of 2022.

|

|

●

|

Net loss attributable to common stockholders was $22 million, or $0.24 per share.

|

|

●

|

Broadcast Cash Flow was $245 million, a decrease of 49% from the fourth quarter of 2022, due primarily to the decrease in political advertising.

|

Other Key Metrics

|

●

|

As of December 31, 2023, our Total Leverage Ratio, Net of all Cash, was 5.60 times on a trailing eight-quarter basis, netting our total cash balance of $21 million and giving effect to all Transaction Related Expenses, which is calculated as set forth in our Senior Credit Facility.

|

|

●

|

Non-cash stock compensation was $6 million and $5 million during the fourth quarters of 2023 and 2022, respectively.

|

Taxes

|

●

|

During 2023 and 2022, we made aggregate federal and state income tax payments of $50 million and $180 million, respectively. Based on current forecasts, during 2024, we anticipate making income tax payments within a range of $190 million to $210 million.

|

|

●

|

As of December 31, 2023, we have an aggregate of $299 million of various state operating loss carryforwards, of which we expect that approximately one-third will be utilized.

|

| |

|

| ● |

During 2020, we carried back certain net operating losses, resulting in a refund of $21 million, excluding interest, that is outstanding. |

Guidance for the Three-Months Ending March 31, 2024

Based on our current forecasts for the quarter ending March 31, 2024, we anticipate the following key financial results, as outlined below in approximate ranges. We present revenue net of agency commissions. We present operating expenses excluding depreciation, amortization and gain/loss on disposal of assets.

| |

o

|

Total Core Revenue of $365 million to $375 million, up low to mid-single digit percentage increases.

|

| |

■

|

In the three months ended March 31, 2024, we anticipate approximately $18 million of net revenue from the broadcast of the Super Bowl on our 49 CBS channels compared to an aggregate of $6 million of net revenue relating to the broadcast of the Super Bowl on our 27 FOX channels during the three months ended March 31, 2023.

|

| |

o

|

Retransmission revenue of $375 million to $380 million.

|

| |

o

|

Political revenue of $30 million to $33 million.

|

| |

o

|

Production company revenue of $23 million to $24 million.

|

| |

o

|

Total revenue of $810 million to $830 million.

|

| |

o

|

Broadcasting expenses of $585 million to $595 million, including retransmission expense of approximately $235 million and non-cash stock-based compensation expense of approximately $1 million.

|

| |

o

|

Production company expenses of approximately $21 million to $22 million.

|

| |

o

|

Corporate expenses of $35 million to $40 million, including non-cash stock-based compensation expense of approximately $4 million.

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 2 of 11 |

|

Selected Operating Data (Unaudited)

|

| |

|

Three Months Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

% Change 2023 to 2022

|

|

|

2021

|

|

|

% Change 2023 to 2021

|

|

| |

|

(dollars in millions)

|

|

|

Revenue (less agency commissions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core advertising

|

|

$ |

415 |

|

|

$ |

406 |

|

|

|

2 |

% |

|

$ |

359 |

|

|

|

16 |

% |

|

Political advertising

|

|

|

33 |

|

|

|

255 |

|

|

|

(87 |

)% |

|

|

20 |

|

|

|

65 |

% |

|

Retransmission consent

|

|

|

365 |

|

|

|

353 |

|

|

|

3 |

% |

|

|

294 |

|

|

|

24 |

% |

|

Other

|

|

|

19 |

|

|

|

21 |

|

|

|

(10 |

)% |

|

|

19 |

|

|

|

0 |

% |

|

Total broadcasting revenue

|

|

|

832 |

|

|

|

1,035 |

|

|

|

(20 |

)% |

|

|

692 |

|

|

|

20 |

% |

|

Production companies

|

|

|

32 |

|

|

|

37 |

|

|

|

(14 |

)% |

|

|

29 |

|

|

|

10 |

% |

|

Total revenue

|

|

$ |

864 |

|

|

$ |

1,072 |

|

|

|

(19 |

)% |

|

$ |

721 |

|

|

|

20 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Station expenses

|

|

$ |

371 |

|

|

$ |

343 |

|

|

|

8 |

% |

|

$ |

274 |

|

|

|

35 |

% |

|

Retransmission expense

|

|

|

232 |

|

|

|

225 |

|

|

|

3 |

% |

|

|

171 |

|

|

|

36 |

% |

|

Transaction Related Expenses

|

|

|

- |

|

|

|

1 |

|

|

|

(100 |

)% |

|

|

3 |

|

|

|

(100 |

)% |

|

Non-cash stock-based compensation

|

|

|

1 |

|

|

|

1 |

|

|

|

0 |

% |

|

|

1 |

|

|

|

0 |

% |

|

Total broadcasting expense

|

|

$ |

604 |

|

|

$ |

570 |

|

|

|

6 |

% |

|

$ |

449 |

|

|

|

35 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production companies

|

|

$ |

27 |

|

|

$ |

27 |

|

|

|

0 |

% |

|

$ |

23 |

|

|

|

17 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and administrative

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate expenses

|

|

$ |

28 |

|

|

$ |

19 |

|

|

|

47 |

% |

|

$ |

29 |

|

|

|

(3 |

)% |

|

Transaction Related Expenses

|

|

|

- |

|

|

|

1 |

|

|

|

(100 |

)% |

|

|

52 |

|

|

|

(100 |

)% |

|

Non-cash stock-based compensation

|

|

|

5 |

|

|

|

4 |

|

|

|

25 |

% |

|

|

3 |

|

|

|

67 |

% |

|

Total corporate and administrative expense

|

|

$ |

33 |

|

|

$ |

24 |

|

|

|

38 |

% |

|

$ |

84 |

|

|

|

(61 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(9 |

) |

|

$ |

186 |

|

|

|

(105 |

)% |

|

$ |

29 |

|

|

|

(131 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Cash Flow (2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcast Cash Flow

|

|

$ |

245 |

|

|

$ |

485 |

|

|

|

(49 |

)% |

|

$ |

258 |

|

|

|

(5 |

)% |

|

Broadcast Cash Flow Less Cash Corporate Expenses

|

|

$ |

216 |

|

|

$ |

465 |

|

|

|

(54 |

)% |

|

$ |

177 |

|

|

|

22 |

% |

|

Free Cash Flow (3)(4)

|

|

$ |

43 |

|

|

$ |

242 |

|

|

|

(82 |

)% |

|

$ |

59 |

|

|

|

(27 |

)% |

| |

|

Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

% Change 2023 to 2022

|

|

|

2021

|

|

|

% Change 2023 to 2021

|

|

| |

|

(dollars in millions)

|

|

|

Revenue (less agency commissions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core advertising

|

|

$ |

1,514 |

|

|

$ |

1,496 |

|

|

|

1 |

% |

|

$ |

1,190 |

|

|

|

27 |

% |

|

Political advertising

|

|

|

79 |

|

|

|

515 |

|

|

|

(85 |

)% |

|

|

44 |

|

|

|

80 |

% |

|

Retransmission consent

|

|

|

1,532 |

|

|

|

1,496 |

|

|

|

2 |

% |

|

|

1,049 |

|

|

|

46 |

% |

|

Other

|

|

|

70 |

|

|

|

76 |

|

|

|

(8 |

)% |

|

|

57 |

|

|

|

23 |

% |

|

Total broadcasting revenue

|

|

|

3,195 |

|

|

|

3,583 |

|

|

|

(11 |

)% |

|

|

2,340 |

|

|

|

37 |

% |

|

Production companies

|

|

|

86 |

|

|

|

93 |

|

|

|

(8 |

)% |

|

|

73 |

|

|

|

18 |

% |

|

Total revenue

|

|

$ |

3,281 |

|

|

$ |

3,676 |

|

|

|

(11 |

)% |

|

$ |

2,413 |

|

|

|

36 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Station expenses

|

|

$ |

1,326 |

|

|

$ |

1,252 |

|

|

|

6 |

% |

|

$ |

928 |

|

|

|

43 |

% |

|

Retransmission expense

|

|

|

937 |

|

|

|

903 |

|

|

|

4 |

% |

|

|

615 |

|

|

|

52 |

% |

|

Transaction Related Expenses

|

|

|

- |

|

|

|

6 |

|

|

|

(100 |

)% |

|

|

3 |

|

|

|

(100 |

)% |

|

Non-cash stock-based compensation

|

|

|

5 |

|

|

|

4 |

|

|

|

25 |

% |

|

|

2 |

|

|

|

150 |

% |

|

Total broadcasting expense

|

|

$ |

2,268 |

|

|

$ |

2,165 |

|

|

|

5 |

% |

|

$ |

1,548 |

|

|

|

47 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production companies

|

|

$ |

115 |

|

|

$ |

83 |

|

|

|

39 |

% |

|

$ |

62 |

|

|

|

85 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and administrative

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate expenses

|

|

$ |

97 |

|

|

$ |

84 |

|

|

|

15 |

% |

|

$ |

76 |

|

|

|

28 |

% |

|

Transaction Related Expenses

|

|

|

- |

|

|

|

2 |

|

|

|

(100 |

)% |

|

|

71 |

|

|

|

(100 |

)% |

|

Non-cash stock-based compensation

|

|

|

15 |

|

|

|

18 |

|

|

|

(17 |

)% |

|

|

12 |

|

|

|

25 |

% |

|

Total corporate and administrative expense

|

|

$ |

112 |

|

|

$ |

104 |

|

|

|

8 |

% |

|

$ |

159 |

|

|

|

(30 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(76 |

) |

|

$ |

455 |

|

|

|

(117 |

)% |

|

$ |

90 |

|

|

|

(184 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Cash Flow (2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcast Cash Flow

|

|

$ |

912 |

|

|

$ |

1,440 |

|

|

|

(37 |

)% |

|

$ |

813 |

|

|

|

12 |

% |

|

Broadcast Cash Flow Less Cash Corporate Expenses

|

|

$ |

815 |

|

|

$ |

1,354 |

|

|

|

(40 |

)% |

|

$ |

666 |

|

|

|

22 |

% |

|

Free Cash Flow (3)(4)

|

|

$ |

141 |

|

|

$ |

581 |

|

|

|

(76 |

)% |

|

$ |

238 |

|

|

|

(41 |

)% |

|

1)

|

Excludes depreciation, amortization, impairment and loss (gain) on disposal of assets, net.

|

|

2)

|

See definition of non-GAAP terms and a reconciliation of the non-GAAP amounts to net income (loss) included herein.

|

|

3)

|

Excludes deductions, net of reimbursements, for purchase of property, plant and equipment related to the Assembly Atlanta project of $3 million, $85 million and $18 million for the 2023, 2022 and 2021 three-month periods, respectively; and excludes $176 million, $264 million and $109 million for the 2023, 2022 and 2021 years, respectively.

|

|

4)

|

Excludes $17 million and $89 million of income tax payments in the 2021 three-month and full-year periods, respectively, related to our Acquisitions.

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 3 of 11 |

|

Detail Table of Operating Results (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(in millions, except for net income per share data)

|

|

|

Revenue (less agency commissions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting

|

|

$ |

832 |

|

|

$ |

1,035 |

|

|

$ |

3,195 |

|

|

$ |

3,583 |

|

|

Production companies

|

|

|

32 |

|

|

|

37 |

|

|

|

86 |

|

|

|

93 |

|

|

Total revenue (less agency commissions)

|

|

|

864 |

|

|

|

1,072 |

|

|

|

3,281 |

|

|

|

3,676 |

|

|

Operating expenses before depreciation, amortization, impairment and gain on disposal of assets, net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broadcasting

|

|

|

604 |

|

|

|

570 |

|

|

|

2,268 |

|

|

|

2,165 |

|

|

Production companies

|

|

|

27 |

|

|

|

27 |

|

|

|

115 |

|

|

|

83 |

|

|

Corporate and administrative

|

|

|

33 |

|

|

|

24 |

|

|

|

112 |

|

|

|

104 |

|

|

Depreciation

|

|

|

39 |

|

|

|

33 |

|

|

|

145 |

|

|

|

129 |

|

|

Amortization of intangible assets

|

|

|

47 |

|

|

|

51 |

|

|

|

194 |

|

|

|

207 |

|

|

Impairment of goodwill and other intangible assets

|

|

|

- |

|

|

|

- |

|

|

|

43 |

|

|

|

- |

|

|

Loss (gain) on disposal of assets, net

|

|

|

1 |

|

|

|

4 |

|

|

|

21 |

|

|

|

(2 |

) |

|

Operating expenses

|

|

|

751 |

|

|

|

709 |

|

|

|

2,898 |

|

|

|

2,686 |

|

|

Operating income

|

|

|

113 |

|

|

|

363 |

|

|

|

383 |

|

|

|

990 |

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous income (expense), net

|

|

|

12 |

|

|

|

(1 |

) |

|

|

7 |

|

|

|

(4 |

) |

|

Impairment of investments

|

|

|

(21 |

) |

|

|

(18 |

) |

|

|

(29 |

) |

|

|

(18 |

) |

|

Interest expense

|

|

|

(116 |

) |

|

|

(100 |

) |

|

|

(440 |

) |

|

|

(354 |

) |

|

Loss on early extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

(3 |

) |

|

|

- |

|

|

Income before income tax

|

|

|

(12 |

) |

|

|

244 |

|

|

|

(82 |

) |

|

|

614 |

|

|

Income tax (benefit) expense

|

|

|

(3 |

) |

|

|

58 |

|

|

|

(6 |

) |

|

|

159 |

|

|

Net income (loss)

|

|

|

(9 |

) |

|

|

186 |

|

|

|

(76 |

) |

|

|

455 |

|

|

Preferred stock dividends

|

|

|

13 |

|

|

|

13 |

|

|

|

52 |

|

|

|

52 |

|

|

Net (loss) income attributable to common stockholders

|

|

$ |

(22 |

) |

|

$ |

173 |

|

|

$ |

(128 |

) |

|

$ |

403 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic per share information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to common stockholders

|

|

$ |

(0.24 |

) |

|

$ |

1.90 |

|

|

$ |

(1.39 |

) |

|

$ |

4.38 |

|

|

Weighted-average shares outstanding

|

|

|

93 |

|

|

|

91 |

|

|

|

92 |

|

|

|

92 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted per share information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to common stockholders

|

|

$ |

(0.24 |

) |

|

$ |

1.88 |

|

|

$ |

(1.39 |

) |

|

$ |

4.33 |

|

|

Weighted-average shares outstanding

|

|

|

93 |

|

|

|

92 |

|

|

|

92 |

|

|

|

93 |

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 4 of 11 |

|

Other Financial Data (Unaudited)

|

| |

|

Year Ended December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities

|

|

$ |

648 |

|

|

$ |

829 |

|

|

Net cash used in investing activities

|

|

|

(291 |

) |

|

|

(503 |

) |

|

Net cash used in financing activities

|

|

|

(397 |

) |

|

|

(454 |

) |

|

Net decrease in cash

|

|

$ |

(40 |

) |

|

$ |

(128 |

) |

| |

|

As of December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

21 |

|

|

$ |

61 |

|

|

Long-term debt, including current portion, less deferred

|

|

|

|

|

|

|

|

|

|

financing costs

|

|

$ |

6,160 |

|

|

$ |

6,455 |

|

|

Series A Perpetual Preferred Stock

|

|

$ |

650 |

|

|

$ |

650 |

|

|

Borrowing availability under Revolving Credit Facility

|

|

$ |

494 |

|

|

$ |

496 |

|

The Company

We are a multimedia company headquartered in Atlanta, Georgia and the nation’s largest owner of top-rated local television stations and digital assets in the United States. Our television stations serve 113 television markets that collectively reach approximately 36 percent of US television households. This portfolio includes 79 markets with the top-rated television station and 102 markets with the first and/or second highest rated television station. We also own video program companies Raycom Sports, Tupelo Media Group, and PowerNation Studios, as well as the studio production facilities Assembly Atlanta and Third Rail Studios. Gray owns a majority interest in Swirl Films. For more information, please visit www.gray.tv.

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 5 of 11 |

Cautionary Statements for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act

This press release contains certain forward-looking statements that are based largely on our current expectations and reflect various estimates and assumptions by us. These statements are statements other than those of historical fact and may be identified by words such as “estimates,” “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties, which in some instances are beyond our control, include: estimates of future revenue, future expenses, future tax payments and utilization of various state operating loss carryforwards, future proceeds from Assembly Atlanta property sales, future proceeds from any quasi-governmental entities related to Assembly Atlanta and other future events. We are subject to additional risks and uncertainties described in our quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections contained therein, which reports are made publicly available via our website, www.gray.tv. Any forward-looking statements in this press release should be evaluated in light of these important risk factors. This press release reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this press release beyond the published date, whether as a result of new information, future events or otherwise. Information about certain potential factors that could affect our business and financial results and cause actual results to differ materially from those expressed or implied in any forward-looking statements are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in our Annual Report on Form 10-K for the year ended December 31, 2023, and may be contained in reports subsequently filed with the U.S. Securities and Exchange Commission and available at www.sec.gov.

Conference Call Information

We will host a conference call to discuss our fourth quarter operating results on February 23, 2024. The call will begin at 11:00 a.m. Eastern Time. The live dial-in number is 1 (800) 285-6670. The call will be webcast live and available for replay at www.gray.tv. The taped replay of the conference call will be available at 1 (888) 556-3470, Confirmation Code: 898476 until March 22, 2024.

Gray Contacts:

Web-site: www.gray.tv

Hilton H. Howell, Jr., Executive Chairman and Chief Executive Officer, (404) 266-5513

Pat LaPlatney, President and Co-Chief Executive Officer, (334) 206-1400

Jim Ryan, Executive Vice President and Chief Financial Officer, (404) 504-9828

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, (404) 266-8333

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 6 of 11 |

Effects of Acquisitions and Divestitures on Our Results of Operations and Non-GAAP Terms

During 2020 and 2021, we completed several acquisition and divestiture transactions. As more fully described in our Form 10-K, to be filed with the Securities and Exchange Commission today, and in our prior disclosures, these transactions materially affected our operations. We refer to all television stations acquired or divested in these transactions as the “Acquisitions”. Related to the Acquisitions, we incurred certain specified transaction costs including legal, consulting, accounting, contract modification and employee-related expenses that we refer to as “Transaction Related Expenses”.

From time to time, we supplement our financial results prepared in accordance with GAAP by disclosing the non-GAAP financial measures Broadcast Cash Flow, Broadcast Cash Flow Less Cash Corporate Expenses, Operating Cash Flow as defined in the Senior Credit Agreement, Free Cash Flow and Total Leverage Ratio, Net of All Cash. These non-GAAP amounts are used by us to approximate amounts used to calculate key financial performance covenants contained in our debt agreements and are used with our GAAP data to evaluate our results and liquidity.

We define Broadcast Cash Flow as net income or loss plus loss on early extinguishment of debt, non-cash corporate and administrative expenses, non-cash stock-based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Broadcast Transactions Related Expenses and broadcast other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights.

We define Broadcast Cash Flow Less Cash Corporate Expenses as net income or loss plus loss on early extinguishment of debt, non-cash stock-based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Transaction Related Expenses and other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights.

We define Operating Cash Flow as defined in our Senior Credit Agreement as net income or loss plus loss on early extinguishment of debt, non-cash stock-based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, Transaction Related Expenses, other adjustments, certain pension expenses, synergies and other adjustments less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights, pension income and contributions to pension plans.

We define Free Cash Flow as net income or loss, plus loss on early extinguishment of debt, non-cash stock-based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, any income tax expense, non-cash 401(k) expense, Transactions Related Expenses, broadcast other adjustments, certain pension expenses, synergies, other adjustments and amortization of deferred financing costs less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights, pension income, contributions to pension plans, preferred and common dividends, purchase of property and equipment (net of reimbursements and certain defined purchases) and income taxes paid (net of any refunds).

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 7 of 11 |

Operating Cash Flow as defined in our Senior Credit Agreement gives effect to the revenue and broadcast expenses of all completed acquisitions and divestitures as if they had been acquired or divested, respectively, on January 1, 2022. It also gives effect to certain operating synergies expected from the acquisitions and related financings and adds back professional fees incurred in completing the acquisitions. Certain of the financial information related to the acquisitions has been derived from, and adjusted based on, unaudited, un-reviewed financial information prepared by other entities, which Gray cannot independently verify. We cannot assure you that such financial information would not be materially different if such information were audited or reviewed and no assurances can be provided as to the accuracy of such information, or that our actual results would not differ materially from this financial information if the acquisitions had been completed on the stated date. In addition, the presentation of Operating Cash Flow as defined in the Senior Credit Agreement and the adjustments to such information, including expected synergies resulting from such transactions, may not comply with GAAP or the requirements for pro forma financial information under Regulation S-X under the Securities Act of 1933. Our Total Leverage Ratio, Net of All Cash is determined by dividing our Adjusted Total Indebtedness, Net of All Cash, by our Operating Cash Flow as defined in our Senior Credit Agreement, divided by two. Our Adjusted Total Indebtedness, Net of All Cash, represents the total outstanding principal of our long-term debt, plus certain other obligations as defined in our Senior Credit Agreement, less all cash (excluding restricted cash). Our Operating Cash Flow, as defined in our Senior Credit Agreement, divided by two, represents our average annual Operating Cash Flow as defined in our Senior Credit Agreement for the preceding eight quarters.

These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore may not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to, and in conjunction with, results presented in accordance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP.

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 8 of 11 |

|

Reconciliation of Non-GAAP Terms (Unaudited):

|

| |

|

Three Months Ended

|

|

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(9 |

) |

|

$ |

186 |

|

|

$ |

29 |

|

|

Adjustments to reconcile from net (loss) income to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

39 |

|

|

|

33 |

|

|

|

28 |

|

|

Amortization of intangible assets

|

|

|

47 |

|

|

|

51 |

|

|

|

36 |

|

|

Non-cash stock-based compensation

|

|

|

6 |

|

|

|

5 |

|

|

|

4 |

|

|

Non-cash 401(k) expense, excluding corporate portion

|

|

|

10 |

|

|

|

9 |

|

|

|

7 |

|

|

Loss (gain) on disposal of assets, net

|

|

|

1 |

|

|

|

4 |

|

|

|

(4 |

) |

|

Miscellaneous (income) expense, net

|

|

|

(12 |

) |

|

|

1 |

|

|

|

1 |

|

|

Impairment of investments

|

|

|

21 |

|

|

|

18 |

|

|

|

- |

|

|

Interest expense

|

|

|

116 |

|

|

|

100 |

|

|

|

62 |

|

|

Income tax (benefit) expense

|

|

|

(3 |

) |

|

|

58 |

|

|

|

13 |

|

|

Amortization of program broadcast rights

|

|

|

8 |

|

|

|

12 |

|

|

|

12 |

|

|

Payments for program broadcast rights

|

|

|

(8 |

) |

|

|

(12 |

) |

|

|

(11 |

) |

|

Corporate and administrative expenses before depreciation, amortization of intangible assets and non-cash stock-based compensation

|

|

|

29 |

|

|

|

20 |

|

|

|

81 |

|

|

Broadcast Cash Flow

|

|

|

245 |

|

|

|

485 |

|

|

|

258 |

|

|

Corporate and administrative expenses excluding depreciation, amortization of intangible assets and non-cash stock-based compensation

|

|

|

(29 |

) |

|

|

(20 |

) |

|

|

(81 |

) |

|

Broadcast Cash Flow Less Cash Corporate Expenses

|

|

|

216 |

|

|

|

465 |

|

|

|

177 |

|

|

Pension income

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

- |

|

|

Interest expense

|

|

|

(116 |

) |

|

|

(100 |

) |

|

|

(62 |

) |

|

Amortization of deferred financing costs

|

|

|

2 |

|

|

|

3 |

|

|

|

2 |

|

|

Preferred stock dividends

|

|

|

(13 |

) |

|

|

(13 |

) |

|

|

(13 |

) |

|

Common stock dividends

|

|

|

(8 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

|

Purchase of property and equipment (1)

|

|

|

(30 |

) |

|

|

(53 |

) |

|

|

(35 |

) |

|

Reimbursements of property and equipment purchases (2)

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

Income taxes paid, net of refunds (3)

|

|

|

(7 |

) |

|

|

(52 |

) |

|

|

(3 |

) |

|

Free Cash Flow

|

|

$ |

43 |

|

|

$ |

242 |

|

|

$ |

59 |

|

|

(1)

|

Excludes $29 million, $85 million and $18 million related to the Assembly Atlanta project in 2023, 2022 and 2021, respectively.

|

|

(2)

|

Excludes approximately $26 million related to the Assembly Atlanta project in 2023.

|

|

(3)

|

Excludes approximately $17 million of income tax payments in 2021, resulting from the divestitures of certain television stations related to our Acquisitions.

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 9 of 11 |

|

Reconciliation of Non-GAAP Terms (Unaudited):

|

| |

|

Year Ended

|

|

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(76 |

) |

|

$ |

455 |

|

|

$ |

90 |

|

|

Adjustments to reconcile from net (loss) income to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

145 |

|

|

|

129 |

|

|

|

104 |

|

|

Amortization of intangible assets

|

|

|

194 |

|

|

|

207 |

|

|

|

117 |

|

|

Impairment of goodwill and other intangible assets

|

|

|

43 |

|

|

|

- |

|

|

|

- |

|

|

Non-cash stock-based compensation

|

|

|

20 |

|

|

|

22 |

|

|

|

14 |

|

|

Non-cash 401(k) expense, excluding corporate portion

|

|

|

10 |

|

|

|

9 |

|

|

|

8 |

|

|

Loss (gain) on disposal of assets, net

|

|

|

21 |

|

|

|

(2 |

) |

|

|

42 |

|

|

Miscellaneous (income) expense, net

|

|

|

(7 |

) |

|

|

4 |

|

|

|

8 |

|

|

Impairment of investments

|

|

|

29 |

|

|

|

18 |

|

|

|

- |

|

|

Interest expense

|

|

|

440 |

|

|

|

354 |

|

|

|

205 |

|

|

Loss on early extinguishment of debt

|

|

|

3 |

|

|

|

- |

|

|

|

- |

|

|

Income tax (benefit) expense

|

|

|

(6 |

) |

|

|

159 |

|

|

|

78 |

|

|

Amortization of program broadcast rights

|

|

|

37 |

|

|

|

48 |

|

|

|

38 |

|

|

Payments for program broadcast rights

|

|

|

(38 |

) |

|

|

(49 |

) |

|

|

(38 |

) |

|

Corporate and administrative expenses before depreciation, amortization of intangible assets and non-cash stock-based compensation

|

|

|

97 |

|

|

|

86 |

|

|

|

147 |

|

|

Broadcast Cash Flow

|

|

|

912 |

|

|

|

1,440 |

|

|

|

813 |

|

|

Corporate and administrative expenses before depreciation, amortization of intangible assets and non-cash stock-based compensation

|

|

|

(97 |

) |

|

|

(86 |

) |

|

|

(147 |

) |

|

Broadcast Cash Flow Less Cash Corporate Expenses

|

|

|

815 |

|

|

|

1,354 |

|

|

|

666 |

|

|

Pension income

|

|

|

(2 |

) |

|

|

(3 |

) |

|

|

- |

|

|

Contributions to pension plans

|

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(4 |

) |

|

Interest expense

|

|

|

(440 |

) |

|

|

(354 |

) |

|

|

(205 |

) |

|

Amortization of deferred financing costs

|

|

|

12 |

|

|

|

15 |

|

|

|

11 |

|

|

Preferred stock dividends

|

|

|

(52 |

) |

|

|

(52 |

) |

|

|

(52 |

) |

|

Common stock dividends

|

|

|

(30 |

) |

|

|

(30 |

) |

|

|

(31 |

) |

|

Purchase of property and equipment (1)

|

|

|

(108 |

) |

|

|

(172 |

) |

|

|

(98 |

) |

|

Reimbursements of property and equipment purchases (2)

|

|

|

- |

|

|

|

7 |

|

|

|

11 |

|

|

Income taxes paid, net of refunds (3)

|

|

|

(50 |

) |

|

|

(180 |

) |

|

|

(60 |

) |

|

Free Cash Flow

|

|

$ |

141 |

|

|

$ |

581 |

|

|

$ |

238 |

|

|

(1)

|

Excludes approximately $240 million, $264 million and $109 million related to the Assembly Atlanta project in 2023, 2022 and 2021, respectively.

|

|

(2)

|

Excludes approximately $64 million related to the Assembly Atlanta project in 2023.

|

|

(3)

|

Excludes $89 million of income tax payments in 2021, resulting from the divestitures of certain television stations related to our Acquisitions.

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 10 of 11 |

|

Reconciliation of Total Leverage Ratio, Net of All Cash (Unaudited):

|

| |

|

Eight Quarters Ended

|

|

| |

|

December 31, 2023

|

|

| |

|

(in millions)

|

|

|

Net income

|

|

$ |

379 |

|

|

Adjustments to reconcile from net income to operating cash flow as defined in our Senior Credit Agreement:

|

|

|

|

|

|

Depreciation

|

|

|

274 |

|

|

Amortization of intangible assets

|

|

|

401 |

|

|

Impairment of goodwill and other intangible assets

|

|

|

43 |

|

|

Non-cash stock-based compensation

|

|

|

42 |

|

|

Non-cash 401(k) expense

|

|

|

19 |

|

|

Loss on disposal of assets, net

|

|

|

19 |

|

|

Impairment of investments

|

|

|

47 |

|

|

Interest expense

|

|

|

794 |

|

|

Loss on early extinguishment of debt

|

|

|

3 |

|

|

Income tax expense

|

|

|

153 |

|

|

Amortization of program broadcast rights

|

|

|

85 |

|

|

Payments for program broadcast rights

|

|

|

(87 |

) |

|

Pension gain

|

|

|

(5 |

) |

|

Contributions to pension plan

|

|

|

(7 |

) |

|

Adjustments for unrestricted subsidiaries

|

|

|

45 |

|

|

Adjustments for stations acquired or divested, financings and expected synergies during the eight quarter period

|

|

|

(2 |

) |

|

Transaction Related Expenses

|

|

|

9 |

|

|

Other

|

|

|

1 |

|

|

Operating Cash Flow, as defined in our Senior Credit Agreement

|

|

$ |

2,213 |

|

|

Operating Cash Flow, as defined in our Senior Credit Agreement, divided by two

|

|

$ |

1,107 |

|

| |

|

December 31, 2023

|

|

|

Adjusted Total Indebtedness:

|

|

|

|

|

|

Total outstanding principal

|

|

$ |

6,210 |

|

|

Letters of credit outstanding

|

|

|

5 |

|

|

Cash

|

|

|

(21 |

) |

|

Adjusted Total Indebtedness, Net of All Cash

|

|

$ |

6,194 |

|

| |

|

|

|

|

|

Total Leverage Ratio, Net of All Cash

|

|

|

5.60 |

|

| Gray Television, Inc. |

|

| Earnings Release for the three-months and year ended December 31, 2023 |

Page 11 of 11 |

v3.24.0.1

Document And Entity Information

|

Feb. 23, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Gray Television, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 23, 2024

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, File Number |

001-13796

|

| Entity, Tax Identification Number |

58-0285030

|

| Entity, Address, Address Line One |

4370 Peachtree Road, NE

|

| Entity, Address, City or Town |

Atlanta

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30319

|

| City Area Code |

404

|

| Local Phone Number |

504-9828

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000043196

|

| ClassACommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock (no par value)

|

| Trading Symbol |

GTN.A

|

| Security Exchange Name |

NYSE

|

| CommonStockNoParValue Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

common stock (no par value)

|

| Trading Symbol |

GTN

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_ClassACommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_CommonStockNoParValueCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

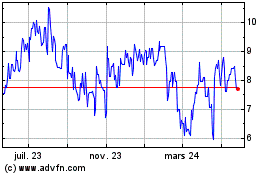

Gray Television (NYSE:GTN.A)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

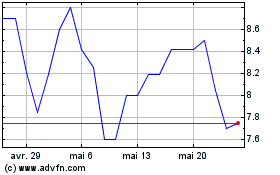

Gray Television (NYSE:GTN.A)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024