0001819438False00018194382023-11-072023-11-070001819438wk:CommonStock0.0001ParValuePerShareMember2023-11-072023-11-070001819438wk:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member2023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2023

ESS TECH, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39525 | | 98-1550150 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

26440 SW Parkway Ave., Bldg. 83 Wilsonville, Oregon | | 97070 |

| (Address of principal executive offices) | | (Zip code) |

(855) 423-9920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GWH | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 | | GWH.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2023, ESS Tech, Inc. (the “Company”) issued a press release announcing financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 2.02 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit No. | | |

| 99.1 | | |

| 104 | | Cover page interactive data file |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: November 7, 2023

| | | | | |

| ESS TECH, INC. |

| |

| By: | /s/ Anthony Rabb |

| Name: | Anthony Rabb |

| Title: | Chief Financial Officer |

Exhibit 99.1

ESS Tech, Inc. Announces Third Quarter 2023 Financial Results

Announced Strategic Partnership with Honeywell

WILSONVILLE, Ore. – November 7, 2023 – ESS Tech, Inc. (“ESS,” “ESS, Inc.” or the “Company”) (NYSE: GWH), a leading manufacturer of long-duration energy storage systems for commercial and utility-scale applications, today announced financial results for its third quarter ended September 30, 2023.

“In the third quarter, ESS again made significant progress executing on improving our internal operations, commissioning units at existing customer sites, strengthening our balance sheet, and broadening customer traction. This progress with our customers and operations is reflected in our year to date revenue of $4.7 million, which is an increase of nearly 700% from last year. I’m also pleased to share that we successfully completed commissioning of a number of Energy Warehouses, including the six we delivered to Sacramento Municipal Utility District last quarter,” said Eric Dresselhuys, CEO of ESS.

“Worldwide demand for reliable, safe, energy storage technology is growing rapidly and is reflected in the solid customer demand we’re seeing in the market. We continue to expect a material increase in revenue in the fourth quarter, which should lead to $9 million in revenue for the full year. Furthermore, our transformative partnership with Honeywell serves as a tremendous validation of the unique value proposition of our iron flow battery and our position in the market. The collaboration between ESS and Honeywell will not only strengthen our technology, operations and go-to-market, but the cash infusion from Honeywell also bolsters our balance sheet and extends our cash runway well into 2025. In addition, we’re well underway in building our first Energy Center with Portland General Electric and expect it to be operational this year, which should translate to shipping commercial units in the second half of 2024. Combined, these drivers in our business positions ESS for long-term growth and profitability expansion.”

Recent Business Highlights

•In September 2023, ESS entered into a strategic collaboration with Honeywell to advance technology development and market adoption of iron flow battery energy storage systems. Honeywell has made an investment in ESS as part of this collaboration, adding $42.5 million to our balance sheet, and will incorporate ESS technology in their clean energy go-to-market efforts, with an initial target to purchase $300 million of ESS product in the coming years. ESS will also integrate Honeywell’s flow-battery IP with its own extensive IP portfolio.

•ESS is finalizing its agreement with LEAG, a major German energy provider, for the first phase of their multi-year project targeting commissioning in 2027 to build a 500 MWh iron flow battery system at the LEAG Boxberg Power Plant site in Germany. This installation, when complete, will create a repeatable building block to support LEAG’s objective to create up to 20GWh of storage to be paired with solar and local hydrogen production, creating the largest green-energy hub in Europe.

•In Q3, ESS completed commissioning of six Energy Warehouse™ systems that were delivered to the Sacramento Municipal Utility District (SMUD) last quarter for the first phase of our relationship to support SMUD’s 2030 Zero Carbon Plan. As previously announced, ESS has agreed to supply up to 2 GWh of long-duration energy storage over the next four years in the form of Energy Warehouses™ and Energy Centers™. As part of this multi-year agreement, ESS also intends to set up facilities for battery system assembly, operations and maintenance support and project delivery in Sacramento, creating local, high-paying jobs. In addition, ESS and SMUD plan to team up with local colleges and universities to establish a

Center of Excellence to expand and train the workforce that will be needed to support long-duration energy storage technology.

•In September 2023, ESS was awarded an Export Achievement Certificate by the United States Department of Commerce for expanding global deployment of its American-made, innovative long-duration energy storage technology. The Export Achievement Certificate is presented by the U.S. Department of Commerce to American companies making significant contributions to exports. Exports of ESS’ iron flow battery systems have increased significantly over the past year as global demand for long-duration energy storage continues to grow.

•In August 2023, Stanwell Corporation, a major electricity generator owned by the Queensland government, and Energy Storage Industries Asia Pacific (ESI), our Australian partner, unveiled an initial iron flow battery energy storage system pilot project at the Stanwell Power Station. Subsequently, in October, the Premier of Queensland announced that the state government plans to expand this project to a 150 MW installation and Stanwell has taken an option to purchase up to 200 MW of storage per year thereafter.

•On August 17, 2023 Jeff Loebbaka was named Chief Commercial Officer of ESS.

•On August 29, 2023, ESS announced the appointment of Harry Quarls to its Board of Directors as Chairman. Michael Niggli, the ESS Founding Board Chairman, will remain on the board to assist with this transition. Harry Quarls has over four decades of energy experience and brings considerable strategic, financial, transactional, and energy investing experience to ESS.

Conference Call Details

ESS will hold a webcast conference call on Tuesday, November 7, 2023 at 5:00 p.m. EST to discuss financial results for its third quarter 2023 ended September 30, 2023. Interested parties may join the conference call beginning at 5:00 p.m. EST on Tuesday, November 7, 2023 via telephone by calling (833) 927-1758 in the U.S., or for international callers, by calling +1 (929) 526-1599 and entering conference ID 307911. A telephone replay will be available until November 14, 2023, by dialing (866) 813-9403 in the U.S., or for international callers, +44 (204) 525-0658 with conference ID 679393. A live webcast of the conference call will be available on ESS’ Investor Relations website at http://investors.essinc.com/.

A replay of the call will be available via the web at http://investors.essinc.com/.

About ESS, Inc.

At ESS (NYSE: GWH), our mission is to accelerate global decarbonization by providing safe, sustainable, long-duration energy storage that powers people, communities and businesses with clean, renewable energy anytime and anywhere it’s needed. As more renewable energy is added to the grid, long-duration energy storage is essential to providing the reliability and resiliency we need when the sun is not shining and the wind is not blowing.

Our technology uses earth-abundant iron, salt and water to deliver environmentally safe solutions capable of providing up to 12 hours of flexible energy capacity for commercial and utility-scale energy storage applications. Established in 2011, ESS enables project developers, independent power producers, utilities and other large energy users to deploy reliable, sustainable long-duration energy storage solutions. For more information visit www.essinc.com.

Energy Warehouses and Energy Centers are trademarks of ESS Tech, Inc. Any third-party trademarks are property of their respective owners and any usage herein does not suggest or imply any relationship between ESS and the third party unless expressly stated.

Use of Non-GAAP Financial Measures

In this press release and the accompanying earnings call, the Company includes Non-GAAP Operating Expenses and Adjusted EBITDA, which are non-GAAP performance measures that the Company uses to supplement its results presented in accordance with U.S. GAAP. As required by the rules of the Securities and Exchange Commission (“SEC”), the Company has provided herein a reconciliation of the non-GAAP financial measures contained in this press release and the accompanying earnings call to the most directly comparable measures under GAAP. The Company’s management believes Non-GAAP Operating Expenses and Adjusted EBITDA are useful in

evaluating its operating performance and are similar measures reported by publicly-listed U.S. companies, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s profitability for the periods presented. Adjusted EBITDA is not intended to be a substitute for net income/loss or any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. Further, Non-GAAP Operating Expenses are not intended to be a substitute for GAAP Operating Expenses or any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

The Company defines and calculates Non-GAAP Operating Expenses as GAAP Operating Expenses adjusted for stock-based compensation and other special items determined by management as they are not indicative of business operations. The Company defines and calculates Adjusted EBITDA as net loss before interest, other non-operating expense or income, (benefit) provision for income taxes, and depreciation, and further adjusted for stock-based compensation and other special items determined by management, including, but not limited to, fair value adjustments for certain financial liabilities associated with debt and equity transactions as they are not indicative of business operations.

Forward-Looking Statements

This communication contains certain forward-looking statements, including statements regarding ESS and its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “will” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Examples of forward-looking statements include, among others, statements regarding revenue expectations, the Company’s manufacturing plans, the Company’s order and sales pipeline, the Company’s ability to execute on orders, the Company’s ability to effectively manage costs, and the Company’s partnerships with third parties such as Honeywell, LEAG, ESI and Sacramento Municipal Utility District. These forward-looking statements are based on ESS’ current expectations and beliefs concerning future developments and their potential effects on ESS. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication. There can be no assurance that the future developments affecting ESS will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond ESS’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, which include, but are not limited to, continuing supply chain issues; delays, disruptions, or quality control problems in the Company’s manufacturing operations; the Company’s ability to hire, train and retain an adequate number of manufacturing employees; issues related to the shipment and installation of the Company’s products; issues related to customer acceptance of the Company’s products; issues related to the Company’s partnerships with third parties; inflationary pressures; risk of loss of government funding for customer projects; and the Company’s need to achieve significant business growth to achieve sustained, long-term profitability; as well as those risks and uncertainties set forth in the section entitled “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2023, to be filed with the SEC on November 14, 2023, and its other filings filed with the SEC. Except as required by law, ESS is not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Contacts

Investors:

Erik Bylin

investors@essinc.com

Media:

Morgan Pitts

+1 (503) 568-0755

Morgan.Pitts@essinc.com

Source: ESS Tech, Inc.

ESS Tech, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| Revenue | | $ | 1,544 | | | $ | 191 | | | $ | 4,741 | | | $ | 595 | |

| Revenue - related parties | | 1 | | | 1 | | | 3 | | | $ | 283 | |

| Total revenue | | 1,545 | | | 192 | | | 4,744 | | | $ | 878 | |

| Cost of revenue | | 10,183 | | | — | | | 10,183 | | | — | |

| Gross profit (loss) | | (8,638) | | | 192 | | | (5,439) | | | 878 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 1,609 | | | 20,127 | | | 38,790 | | | 49,190 | |

| Sales and marketing | | 2,056 | | | 1,815 | | | 5,648 | | | 5,217 | |

| General and administrative | | 5,831 | | | 5,981 | | | 16,963 | | | 20,567 | |

| Total operating expenses | | 9,496 | | | 27,923 | | | 61,401 | | | 74,974 | |

| Loss from operations | | (18,134) | | | (27,731) | | | (66,840) | | | (74,096) | |

| Other income (expenses), net: | | | | | | | | |

| Interest income, net | | 1,155 | | | 781 | | | 3,737 | | | 999 | |

| Gain (loss) on revaluation of common stock warrant liabilities | | 344 | | | (4,585) | | | 917 | | | 20,515 | |

| Other income (expense), net | | 17 | | | (62) | | | 738 | | | (312) | |

| Total other income (expenses), net | | 1,516 | | | (3,866) | | | 5,392 | | | 21,202 | |

| Net loss and comprehensive loss to common stockholders | | $ | (16,618) | | | $ | (31,597) | | | $ | (61,448) | | | $ | (52,894) | |

| | | | | | | | |

| Net loss per share - basic and diluted | | $ | (0.11) | | | $ | (0.21) | | | $ | (0.40) | | | $ | (0.35) | |

| | | | | | | | |

| Weighted-average shares used in per share calculation - basic and diluted | | 157,076,260 | | | 152,861,300 | | | 155,377,648 | | | 152,427,346 | |

ESS Tech, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands, except share data)

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 37,173 | | | $ | 34,767 | |

| Restricted cash, current | 1,373 | | | 1,213 | |

| Accounts receivable, net | 1,265 | | | 4,952 | |

| Short-term investments | 87,329 | | | 105,047 | |

| Inventory | 2,256 | | | — | |

| Prepaid expenses and other current assets | 2,035 | | | 5,657 | |

| Total current assets | 131,431 | | | 151,636 | |

| Property and equipment, net | 17,986 | | | 17,570 | |

| Intangible assets, net | 4,990 | | | — | |

| Operating lease right-of-use assets | 2,485 | | | 3,401 | |

| Restricted cash, non-current | 945 | | | 675 | |

| Other non-current assets | 824 | | | 271 | |

| Total assets | $ | 158,661 | | | $ | 173,553 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 3,192 | | | $ | 3,036 | |

| Accrued and other current liabilities | 9,846 | | | 14,125 | |

| Accrued product warranties | 2,636 | | | 1,643 | |

| Operating lease liabilities, current | 1,541 | | | 1,421 | |

| Deferred revenue | 1,424 | | | 6,168 | |

| Notes payable, current | — | | | 1,600 | |

| Total current liabilities | 18,639 | | | 27,993 | |

| Notes payable, non-current | — | | | 315 | |

| Operating lease liabilities, non-current | 1,365 | | | 2,535 | |

| Deferred revenue, non-current | 19,905 | | | 2,442 | |

| Common stock warrant liabilities | 2,292 | | | 3,209 | |

| Other non-current liabilities | — | | | 85 | |

| Total liabilities | 42,201 | | | 36,579 | |

| Stockholders' equity: | | | |

Preferred stock ($0.0001 par value; 200,000,000 shares authorized, none issued and outstanding as of September 30, 2023 and December 31, 2022) | — | | | — | |

Common stock ($0.0001 par value; 2,000,000,000 shares authorized, 173,007,592 and 153,821,339 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively) | 18 | | | 16 | |

| Additional paid-in capital | 796,469 | | | 755,537 | |

| Accumulated deficit | (680,027) | | | (618,579) | |

| Total stockholders' equity | 116,460 | | | 136,974 | |

| Total liabilities and stockholders' equity | $ | 158,661 | | | $ | 173,553 | |

ESS Tech, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (61,448) | | | $ | (52,894) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 3,187 | | | 828 | |

| Non-cash interest income | (2,438) | | (527) | |

| Non-cash lease expense | 916 | | 841 | |

| Stock-based compensation expense | 7,673 | | | 8,703 | |

| Inventory write-downs and losses on noncancellable purchase commitments | 11,422 | | | — | |

| Change in fair value of common stock warrant liabilities | (917) | | | (20,515) | |

| Other non-cash (income) expenses, net | (34) | | | 306 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 3,874 | | | 437 | |

| Inventory | (13,132) | | | — | |

| Prepaid expenses and other assets | 3,701 | | | 1,497 | |

| Accounts payable | 275 | | | (1,604) | |

| Accrued and other current liabilities | (4,305) | | | 5,525 | |

| Accrued product warranties | 993 | | | 1,148 | |

| Deferred revenue | 12,532 | | | (117) | |

| Operating lease liabilities | (1,050) | | | (248) | |

| Net cash used in operating activities | (38,751) | | | (56,620) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (4,209) | | | (11,186) | |

| Maturities and purchases of short-term investments, net | 20,208 | | | (123,467) | |

| Net cash provided by (used in) investing activities | 15,999 | | | (134,653) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common stock and common stock warrants, net of issuance costs | 27,132 | | | — | |

| Payments on notes payable | (1,733) | | | (1,500) | |

| Proceeds from stock options exercised | 236 | | | 102 | |

| Proceeds from contributions to Employee Stock Purchase Plan | 332 | | | — | |

| Repurchase of shares from employees for income tax withholding purposes | (165) | | | (2,808) | |

| Other, net | (214) | | | (15) | |

| Net cash provided by (used in) financing activities | 25,588 | | | (4,221) | |

| | | |

| Net change in cash, cash equivalents and restricted cash | 2,836 | | | (195,494) | |

| Cash, cash equivalents and restricted cash, beginning of period | 36,655 | | | 240,232 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 39,491 | | | $ | 44,738 | |

ESS Tech, Inc.

Condensed Consolidated Statements of Cash Flows (continued)

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for operating leases included in cash used in operating activities | $ | 1,246 | | | $ | 1,213 | |

| Non-cash investing and financing transactions: | | | |

| Purchase of property and equipment included in accounts payable and accrued and other current liabilities | 747 | | | 1,718 | |

| Right-of-use operating lease assets obtained in exchange for lease obligations | — | | | 4,534 | |

| Right-of-use finance lease assets obtained in exchange for lease obligations | — | | | 123 | |

| Common stock warrants issued for the acquisition of intangible assets | 4,990 | | | — | |

| | | |

| Cash and cash equivalents | $ | 37,173 | | | $ | 42,896 | |

| Restricted cash, current | 1,373 | | | 1,167 | |

| Restricted cash, non-current | 945 | | | 675 | |

| Total cash, cash equivalents and restricted cash shown in the condensed consolidated statements of cash flows | $ | 39,491 | | | $ | 44,738 | |

ESS Tech, Inc.

Reconciliation of GAAP to Non-GAAP Operating Expenses

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Research and development | | $ | 1,609 | | | $ | 20,127 | | | $ | 38,790 | | | $ | 49,190 | |

| Less: stock-based compensation | | (278) | | | (767) | | | (2,401) | | | (1,941) | |

| Non-GAAP research and development | | $ | 1,331 | | | $ | 19,360 | | | $ | 36,389 | | | $ | 47,249 | |

| | | | | | | | |

| Sales and marketing | | $ | 2,056 | | | 1,815 | | | $ | 5,648 | | | $ | 5,217 | |

| Less: stock-based compensation | | (211) | | | (127) | | | (526) | | | (306) | |

| Non-GAAP sales and marketing | | $ | 1,845 | | | $ | 1,688 | | | $ | 5,122 | | | $ | 4,911 | |

| | | | | | | | |

| General and administrative | | $ | 5,831 | | | $ | 5,981 | | | $ | 16,963 | | | $ | 20,567 | |

| Less: stock-based compensation | | (1,522) | | | (2,104) | | | (3,868) | | | (6,456) | |

| Non-GAAP general and administrative | | $ | 4,309 | | | $ | 3,877 | | | $ | 13,095 | | | $ | 14,111 | |

| | | | | | | | |

| Total operating expenses | | $ | 9,496 | | | $ | 27,923 | | | $ | 61,401 | | | $ | 74,974 | |

| Less: stock-based compensation | | (2,011) | | | (2,998) | | | (6,795) | | | (8,703) | |

| Non-GAAP total operating expenses | | $ | 7,485 | | | $ | 24,925 | | | $ | 54,606 | | | $ | 66,271 | |

ESS Tech, Inc.

Reconciliation of GAAP Net Loss to Adjusted EBITDA

(unaudited)

(in thousands)

| | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 |

| Net loss | | $ | (16,618) | | | $ | (61,448) | |

| Interest income, net | | (1,155) | | | (3,737) | |

| Stock-based compensation | | 2,889 | | | 7,673 | |

| Depreciation | | 1,082 | | | 3,180 | |

| Gain (loss) on revaluation of common stock warrant liabilities | | (344) | | | (917) | |

| Other income (expense), net | | (17) | | | (738) | |

| Adjusted EBITDA | | $ | (14,163) | | | $ | (55,987) | |

v3.23.3

Cover

|

Nov. 07, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity Registrant Name |

ESS TECH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39525

|

| Entity Tax Identification Number |

98-1550150

|

| Entity Address, Address Line One |

26440 SW Parkway Ave.

|

| Entity Address, Address Line Two |

Bldg. 83

|

| Entity Address, City or Town |

Wilsonville

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97070

|

| City Area Code |

855

|

| Local Phone Number |

423-9920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819438

|

| Amendment Flag |

false

|

| Common Stock 0.0001 Par Value Per Share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GWH

|

| Security Exchange Name |

NYSE

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

GWH.W

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

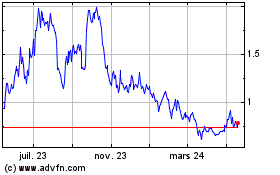

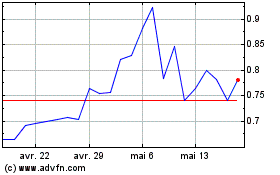

ESS Tech (NYSE:GWH)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

ESS Tech (NYSE:GWH)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024