0001840292FALSE00018402922023-08-252023-08-250001840292us-gaap:CommonStockMember2023-08-252023-08-250001840292us-gaap:WarrantMember2023-08-252023-08-250001840292hlg:PreferredSharePurchaseRightMember2023-08-252023-08-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 25, 2023

Heliogen, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-40209 | | 85-4204953 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

130 West Union Street

Pasadena, California 91103

| | |

(Address of Principal Executive Offices) |

Registrant's telephone number, including area code: (626) 720-4530

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | HLGN | | New York Stock Exchange |

| Warrants, each whole warrant exercisable for shares of Common stock at an exercise price of $11.50 per share | | HLGN.W | | New York Stock Exchange |

| Preferred Share Purchase Rights | | N/A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Item 7.01 Regulation FD Disclosure.

On August 25, 2023, Heliogen, Inc., a Delaware corporation (the “Company”), issued a press release announcing that the Company's Board of Directors approved a reverse stock split of the Company’s common stock at a ratio of 1-for-35 (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every 35 shares of the Company’s issued and outstanding common stock as of 5:00 p.m. (Eastern Time) on Thursday, August 31, 2023 will automatically be combined into one issued and outstanding share of common stock, without any change in par value per share. The Company’s common stock will be assigned a new CUSIP number (42329E204) and is expected to begin trading on a split-adjusted basis on Friday, September 1, 2023. The Company’s common stock and publicly traded warrants will continue to trade on the NYSE under their existing ticker symbols "HLGN" and “HLGN.W”, respectively, following the Reverse Stock Split. The CUSIP number for the Company’s public warrants will remain unchanged. The Reverse Stock Split will reduce the number of shares of common stock issuable upon the exercise or vesting of its outstanding stock options and warrants in proportion to the ratio of the Reverse Stock Split and will cause a proportionate increase in the conversion and exercise prices of such stock options and warrants. The Reverse Stock Split will not change the total number of authorized shares of common stock or preferred stock.

No fractional shares of common stock will be issued as a result of the Reverse Stock Split. Stockholders of record who would otherwise be entitled to receive a fractional share will receive a cash payment in lieu thereof. The Reverse Stock Split impacts all holders of the Company’s common stock proportionally and does not impact any stockholder’s percentage ownership of common stock (except to the extent the reverse stock split results in any stockholder owning only a fractional share).

The Reverse Stock Split will be implemented pursuant to a Certificate of Amendment to the Company’s Second Amended and Restated Certificate of Incorporation, The Company will effect the Reverse Stock Split in accordance with the authority granted to the Company’s Board of Directors by the Company’s stockholders at the annual meeting of stockholders held on August 3, 2023.

The Press Release announcing the Reverse Stock Split is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | Heliogen, Inc. |

| | | |

| Dated: | August 25, 2023 | By: | /s/ Christiana Obiaya |

| | | Christiana Obiaya |

| | | Chief Executive Officer |

Heliogen Announces 1-for-35 Reverse Stock Split

PASADENA, Calif, August 25, 2023 – Heliogen, Inc. (“Heliogen”) (NYSE: HLGN), a leading provider of AI-enabled concentrating solar energy technology, announced today that its Board of Directors has approved a 1-for-35 reverse stock split (“Reverse Stock Split”) of Heliogen’s common stock. Heliogen’s stockholders previously approved the Reverse Stock Split at Heliogen’s Annual Meeting of Stockholders held on August 3, 2023 and gave Heliogen’s Board of Directors discretionary authority to select a ratio for the Reverse Stock Split ranging from 1-for-10 shares to 1-for-40 shares.

The Reverse Stock Split is expected to be effective at 5:00 p.m., Eastern Time, on August 31, 2023. Beginning on September 1, 2023, Heliogen’s common stock is expected to begin trading on a split-adjusted basis on the New York Stock Exchange (“NYSE”). Following the Reverse Stock Split, the common stock will continue trading on the NYSE under the symbol “HLGN”, but will trade under a new CUSIP number: 42329E204. Heliogen’s publicly traded warrants will continue to be traded on the NYSE under the symbol “HLGN.W” and the CUSIP number for the warrants will remain unchanged.

Purpose of the Reverse Stock Split

The primary purpose of the reverse stock split is to increase the market price of Heliogen's common stock to regain full compliance with the NYSE share price listing rule and maintain Heliogen’s listing on the NYSE. Heliogen believes that the higher share price resulting from the Reverse Stock Split will also make Heliogen’s shares more attractive to institutional and other investors.

Details of the Reverse Stock Split

Under the terms of the Reverse Stock Split, every 35 shares of Heliogen's issued and outstanding common stock will be automatically combined and converted into one issued and outstanding share of common stock, with no change in the par value per share. This will reduce the number of outstanding shares of Heliogen’s common stock from approximately 205.1 million to approximately 5.9 million. The Reverse Stock Split will not change the authorized number of shares of common stock.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who would otherwise be entitled to receive a fractional share will receive a cash payment in lieu of such fractional share.

As a result of the Reverse Stock Split, proportionate adjustments will be made to the number of shares of Heliogen's common stock underlying Heliogen's outstanding equity awards, warrants and preferred units, as well as the exercise or conversion price, as applicable.

Information for Stockholders

Current stockholders of Heliogen who hold their shares in brokerage accounts or “street name” are not required to take any action, as their brokers will handle the process. Stockholders who hold physical certificates can obtain information about the process for exchanging their shares by contacting Continental Stock Transfer & Trust Company, Heliogen's transfer agent, at 1-800-509-5586 or cstmail@continentalstock.com.

About Heliogen

Heliogen is a renewable energy technology company focused on decarbonizing industry and empowering a sustainable civilization. The company’s concentrating solar energy and thermal storage systems aim to deliver carbon-free heat, steam, power, or green hydrogen at scale to support round-the-clock industrial operations. Powered by AI, computer vision and robotics, Heliogen is focused on providing robust clean energy solutions that accelerate the transition to renewable energy, without compromising reliability, availability, or cost. For more information about Heliogen, please visit heliogen.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding Heliogen’s executive transition and Heliogen’s future financial and operating performance. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our financial and business performance, including risk of uncertainty in our financial projections and business metrics and any underlying assumptions thereunder; (ii) changes in our business and strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; (iii) our ability to execute our business model, including market acceptance of our planned products and services and achieving sufficient production volumes at acceptable quality levels and prices; (iv) our ability to maintain listing on the New York Stock Exchange; (v) our ability to access sources of capital to finance operations, growth and future capital requirements; (vi) our ability to maintain and enhance our products and brand, and to attract and retain customers; (vii) our ability to scale in a cost effective manner; (viii) changes in applicable laws or regulations; (ix) developments and projections relating to our competitors and industry; and (x) our ability to protect our intellectual property. You should carefully consider the foregoing factors and the other risks and uncertainties disclosed in the “Risk Factors” section in Part I, Item 1A in our Annual Report on Form 10-K for the annual period ended December 31, 2022 and other documents filed by Heliogen from time to time with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Heliogen assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Heliogen Investor Contact:

Louis Baltimore

VP, Investor Relations

Louis.Baltimore@Heliogen.com

Heliogen Media Contact:

Cory Ziskind

ICR, Inc.

HeliogenPR@icrinc.com

v3.23.2

Cover

|

Aug. 25, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 25, 2023

|

| Entity Registrant Name |

Heliogen, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40209

|

| Entity Tax Identification Number |

85-4204953

|

| Entity Address, Address Line One |

130 West Union Street

|

| Entity Address, City or Town |

Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91103

|

| City Area Code |

626

|

| Local Phone Number |

720-4530

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Entity Central Index Key |

0001840292

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

HLGN

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for shares of Common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HLGN.W

|

| Security Exchange Name |

NYSE

|

| Preferred Share Purchase Right |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Share Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hlg_PreferredSharePurchaseRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

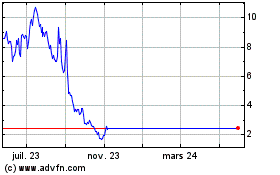

Heliogen (NYSE:HLGN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Heliogen (NYSE:HLGN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024