Heliogen, Inc. (“Heliogen”) (OTCQB: HLGN), a leading provider of

AI-enabled concentrating solar energy technology, today provided

its third quarter 2023 financial and operational results.

Third Quarter 2023 Highlights

- $73 million contracted revenue backlog driven by a diverse set

of projects ranging from Generation 3 concentrated solar power

(“CSP”) to green hydrogen to sustainable aviation fuel

- Recognized revenue of $2.3 million, bringing year-to-date

revenue to $5.6 million

- Ended the quarter with $91.6 million in available

liquidity

Operating Highlights

- 1.8 gigawatts (“GW”) in opportunity pipeline, an increase of

over 1.0 GW since August 2023

- Initiated construction in October 2023 on the Heliogen steam

plant in the Permian Basin after executing a land lease in Plains,

TX

- Developed and executed on an $8 million annual operating cost

reduction plan in October 2023, forecasted to fund both investment

and operating needs of Heliogen through the end of 2024

- Completed design verification of the particle receiver for the

world’s first fully integrated Generation 3 CSP plant and deployed

it for on-sun testing

Executive Commentary

“During the third quarter of 2023, we continued to translate

Heliogen’s strategic vision into tangible achievements, advancing

our mission to decarbonize industry,” said Christie Obiaya,

Heliogen’s Chief Executive Officer. “We believe our expanding

opportunity pipeline underscores the market’s interest in our

solutions. Furthermore, our recent milestones in the deployment of

our Generation 3 CSP product mark a breakthrough in solar thermal

technology.”

Ms. Obiaya added, “We’re not just innovating; we’re scaling and

optimizing. Our proactive cost reduction strategy positions

Heliogen to continue our pioneering work through the end of 2024

based on our current business plan and assumptions. Our commitment

to our shareholders, customers and the planet remains as steadfast

as ever, as we push the boundaries of what’s possible in renewable

energy.”

Third Quarter 2023 Financial Results

For the third quarter 2023, Heliogen reported total revenue of

$2.3 million and net loss of $18.6 million. Heliogen’s revenue was

driven primarily by continued execution on its Capella project.

Heliogen’s Adjusted EBITDA was negative $19.0 million for third

quarter 2023.

As of September 30, 2023, the Company had liquidity of $91.6

million, consisting of $63.4 million of cash and cash equivalents

and $28.2 million of investments, and no substantial debt.

Conference Call Information

The Heliogen management team will host a conference call to

discuss its third quarter 2023 financial results on Tuesday,

November 14, 2023, at 10:00 a.m. EST. The call can be accessed via

a live webcast accessible on the Events & Presentations page in

the Investor Relations section of Heliogen’s website at

www.heliogen.com. The call can also be accessed live via telephone

by dialing 1-877-407-0789 (1-201-689-8562 for international

callers) and referencing Heliogen.

An archive of the webcast will also be available shortly after

the call on the Investor Relations section of Heliogen’s

website.

Open Conference Call Question Submission

Members of the investor community may submit questions before

the start of the conference call for consideration via email to

louis.baltimore@heliogen.com.

About Heliogen

Heliogen is a renewable energy technology company focused on

decarbonizing industry and empowering a sustainable civilization.

The company’s concentrating solar energy and thermal storage

systems aim to deliver carbon-free heat, steam, power, or green

hydrogen at scale to support round-the-clock industrial operations.

Powered by AI, computer vision and robotics, Heliogen is focused on

providing robust clean energy solutions that accelerate the

transition to renewable energy, without compromising reliability,

availability, or cost. For more information about Heliogen, please

visit heliogen.com.

Backlog

Contracted revenue backlog represents contracted revenue with

customers and government entities we expect to realize for the

construction of facilities, engineering services agreements,

operating agreements, and products delivered under purchase

agreements. We cannot guarantee that our revenue projected in our

backlog will be realized or, if realized, will result in profits.

In addition, project cancellations or scope adjustments may occur

with respect to contracts reflected in our backlog. Accordingly,

our backlog as of any particular date is an uncertain indicator of

future earnings.

Non-GAAP Financial Information

Management uses certain financial measures, including EBITDA and

Adjusted EBITDA, to evaluate our financial and operating

performance that are calculated and presented on the basis of

methodologies other than in accordance with generally accepted

accounting principles in the United States of America (“GAAP”). We

believe these non-GAAP financial measures are useful to investors

and analysts to assess our ongoing financial performance because

they provide improved comparability between periods through the

exclusion of certain items that we believe are not indicative of

our core operating performance, enhance the overall understanding

of our past financial performance and future prospects, and remove

items that may obscure our underlying business results and trends.

These measures should not be considered a substitute for, or

superior to, measures of financial performance prepared in

accordance with GAAP, and our calculations thereof may not be

comparable to similarly titled measures reported by other

companies.

EBITDA represents consolidated net loss before (i) interest

(income) expense, net, (ii) income tax expense (benefit) and (iii)

depreciation and amortization expense. We define Adjusted EBITDA as

EBITDA adjusted for certain significant non-cash items and items

that management believes are not attributable to or indicative of

our on-going operations or that may obscure our underlying results

and trends. Please see the accompanying tables for a reconciliation

of net loss to EBITDA and Adjusted EBITDA.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Statements that are not historical in nature, including

the words “anticipate,” “expect,” “suggests,” “plan,” “believe,”

“intend,” “estimates,” “targets,” “projects,” “should,” “could,”

“would,” “may,” “will,” “forecast” and other similar expressions

are intended to identify forward-looking statements. These

forward-looking statements include, but are not limited to,

statements regarding our expectation that our cost reduction

strategy will position us to continue our work through the end of

2024, achieving our commitment to shareholders and our expanding

opportunity pipeline. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this press release, including but not limited to: (i)

our financial and business performance, including risk of

uncertainty in our financial projections and business metrics and

any underlying assumptions thereunder; (ii) the delisting of our

common stock on the New York Stock Exchange; (iii) changes in our

business and strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects and

plans; (iv) our ability to execute our business model, including

market acceptance of our planned products and services and

achieving sufficient production volumes at acceptable quality

levels and prices; (v) our ability to access sources of capital to

finance operations, growth and future capital requirements; (vi)

our ability to maintain and enhance our products and brand, and to

attract and retain customers; (vii) our ability to scale in a cost

effective manner; (viii) changes in applicable laws or regulations;

(ix) developments and projections relating to our competitors and

industry; (x) unexpected adjustments and cancellations related to

our backlog; and (xi) our ability to protect our intellectual

property. You should carefully consider the foregoing factors and

the other risks and uncertainties disclosed in the “Risk Factors”

section in Part I, Item 1A in our Annual Report on Form 10-K for

the year ended December 31, 2022, as supplemented in our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2023, and other

documents filed by Heliogen from time to time with the Securities

and Exchange Commission. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Heliogen assumes

no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Heliogen, Inc.

Condensed Consolidated

Statements of Operations

($ in thousands, except per share

and share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Revenue

$

2,273

$

3,100

$

5,604

$

9,031

Cost of revenue

1,859

3,423

5,763

44,061

Gross profit (loss)

414

(323)

(159)

(35,030)

Operating expenses:

Selling, general and administrative

14,997

18,268

36,814

60,733

Research and development

5,162

11,168

15,368

26,448

Impairment charges

—

—

1,008

—

Total operating expenses

20,159

29,436

53,190

87,181

Operating loss

(19,745)

(29,759)

(53,349)

(122,211)

Interest income, net

335

259

888

666

Gain on warrant remeasurement

74

369

326

12,679

Other income, net

767

1,256

1,341

1,071

Net loss before taxes

(18,569)

(27,875)

(50,794)

(107,795)

(Provision) benefit for income taxes

(1)

46

(3)

781

Net loss

$

(18,570)

$

(27,829)

$

(50,797)

$

(107,014)

Loss per share:

Loss per share – Basic and Diluted (1)

$

(3.13)

$

(5.06)

$

(8.81)

$

(19.82)

Weighted average number of shares

outstanding – Basic and Diluted (1)

5,935,823

5,502,183

5,765,356

5,398,872

________________

(1) Periods presented have been adjusted to reflect the 1-for-35

reverse stock split on August 31, 2023.

Heliogen, Inc.

Condensed Consolidated Balance

Sheets

($ in thousands)

(unaudited)

September 30, 2023

December 31, 2022

ASSETS

Cash and cash equivalents

$

63,386

$

45,719

Investments

28,236

97,504

Other current assets

14,664

15,598

Total current assets

106,286

158,821

Non-current assets

29,613

32,798

Total assets

$

135,899

$

191,619

LIABILITIES AND SHAREHOLDERS’

EQUITY

Trade payables

$

1,795

$

6,921

Contract liabilities

13,170

10,348

Contract loss provisions

26,648

28,418

Other current liabilities

9,440

5,602

Total current liabilities

51,053

51,289

Long-term liabilities

14,746

15,006

Total liabilities

65,799

66,295

Shareholders’ equity

70,100

125,324

Total liabilities and shareholders’

equity

$

135,899

$

191,619

Heliogen, Inc.

Reconciliation of Net Loss to

EBITDA and Adjusted EBITDA

($ in thousands)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net loss

$

(18,570)

$

(27,829)

$

(50,797)

$

(107,014)

Interest income, net

(335)

(259)

(888)

(666)

Provision (benefit) for income taxes

1

(46)

3

(781)

Depreciation and amortization

499

1,111

1,692

2,289

EBITDA

$

(18,405)

$

(27,023)

$

(49,990)

$

(106,172)

Impairment charges (1)

—

—

1,008

—

Gain on warrant remeasurement (2)

(74)

(369)

(326)

(12,679)

Share-based compensation (3)

305

10,052

(6,078)

34,612

Contract loss (adjustments) provisions

(4)

(538)

—

(148)

33,737

Contract losses incurred (4)

(304)

(342)

(1,628)

(3,502)

Change in fair value of contingent

consideration (5)

52

(1,116)

1,289

(1,063)

Employee retention credit (6)

—

—

(41)

—

Adjusted EBITDA

$

(18,964)

$

(18,798)

$

(55,914)

$

(55,067)

________________

(1)

Represents the impairment of goodwill

associated with the acquisition of HelioHeat GmbH (the “HelioHeat

Acquisition”).

(2)

Represents the change in fair value on our

outstanding warrant liabilities.

(3)

Share-based compensation for the nine

months ended September 30, 2023 includes a net reduction of

$12.5 million of expense as a result of stock options forfeited in

connection with the termination of our former Chief Executive

Officer.

(4)

Represents contract loss (adjustments)

provisions with customers for which estimated costs to satisfy

performance obligations exceeded considerations expected to be

realized. The contract loss (adjustment) provision is reduced and

recognized in cost of revenue as expenditures are incurred and

related revenue is recognized.

(5)

Represents the change in fair value of our

contingent consideration related to the HelioHeat Acquisition.

(6)

Represents an adjustment to the employee

tax credit to the Coronavirus Aid, Relief, and Economic Security

Act (CARES Act) recorded as grant revenue in the fourth quarter of

2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231113102504/en/

Heliogen Investors Contact: Louis Baltimore VP, Strategic

Finance & Investor Relations Louis.Baltimore@heliogen.com

Heliogen Media Contact: Sam Padreddii Manager, Corporate

Communications media@heliogen.com

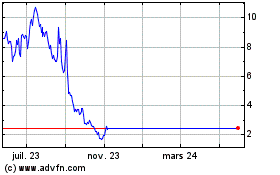

Heliogen (NYSE:HLGN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Heliogen (NYSE:HLGN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025