false

0001307954

0001307954

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 21, 2024

Huntsman Corporation

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-32427 |

|

42-1648585 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 10003 Woodloch Forest Drive |

|

|

| The Woodlands, Texas |

|

77380 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code:

(281) 719-6000

Not applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered pursuant to Section 12(b) of

the Act:

| Registrant |

|

Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

Huntsman Corporation

|

|

Common Stock, par value $0.01 per

share |

|

HUN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On February 21, 2024, we issued a press release

announcing our results the three months and year ended December 31, 2023. The press release is furnished herewith as Exhibit 99.1.

We will hold a conference call to discuss our fourth

quarter and full year 2023 financial results on Thursday, February 22, 2024, at 10:00 a.m. ET.

Webcast link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=4YckWj4j

Participant dial-in numbers:

Domestic callers: (877)

402-8037

International callers: (201)

378-4913

The conference call will be accompanied by presentation slides that

will be accessible via the webcast link and Huntsman’s investor relations website, www.huntsman.com/investors. Upon conclusion of

the call, the webcast replay will be accessible via Huntsman’s website.

Information with respect to the conference call, together with a copy of the press release

furnished herewith as Exhibit 99.1, is available on the investor relations page of our website at www.huntsman.com/investors.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

HUNTSMAN CORPORATION |

| |

|

| |

/s/

IVAN MARCUSE |

| |

Vice President, Investor

Relations and Corporate Development |

Dated: February 21, 2024

Exhibit 99.1

|

News Release |

|

| FOR IMMEDIATE RELEASE |

Media: |

Investor

Relations: |

| February 21, 2024 |

Kevin Gundersen |

Ivan Marcuse |

| The Woodlands, TX |

(281) 719-4627 |

(281) 719-4637 |

| NYSE: HUN |

Huntsman Announces

Fourth Quarter 2023 Earnings

Fourth Quarter

Highlights

| · | Fourth quarter 2023 net loss

attributable to Huntsman of $71 million compared to a net loss of $91 million in the prior year period; fourth quarter 2023 diluted loss

per share of $0.41 compared to a diluted loss per share $0.48 in the prior year period. |

| · | Fourth quarter 2023 adjusted

net loss attributable to Huntsman of $36 million compared to adjusted net income of $8 million in the prior year period; fourth quarter

2023 adjusted diluted loss per share of $0.21 compared to adjusted diluted income per share of $0.04 in the prior year period. |

| · | Fourth quarter 2023 adjusted

EBITDA of $44 million compared to $87 million in the prior year period. |

| · | Fourth quarter 2023 net cash provided by operating activities from continuing

operations was $166 million. Free cash flow from continuing operations was $83 million for the fourth quarter 2023 compared to $211 million

in the prior year period. |

| · | Repurchased approximately 2.1 million shares for approximately $50 million

in the fourth quarter 2023. |

| · | The Board of Directors approved a 5% increase to the quarterly dividend. |

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| In millions, except per share amounts | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 1,403 | | |

$ | 1,650 | | |

$ | 6,111 | | |

$ | 8,023 | |

| Net (loss) income attributable to Huntsman Corporation | |

$ | (71 | ) | |

$ | (91 | ) | |

$ | 101 | | |

$ | 460 | |

| Adjusted net (loss) income (1) | |

$ | (36 | ) | |

$ | 8 | | |

$ | 67 | | |

$ | 636 | |

| Diluted (loss) income per share | |

$ | (0.41 | ) | |

$ | (0.48 | ) | |

$ | 0.57 | | |

$ | 2.27 | |

| Adjusted diluted (loss) income per share(1) | |

$ | (0.21 | ) | |

$ | 0.04 | | |

$ | 0.37 | | |

$ | 3.13 | |

| Adjusted EBITDA(1) | |

$ | 44 | | |

$ | 87 | | |

$ | 472 | | |

$ | 1,155 | |

| Net cash provided by operating activities from continuing operations | |

$ | 166 | | |

$ | 297 | | |

$ | 251 | | |

$ | 892 | |

| Free cash flow from continuing operations(2) | |

$ | 83 | | |

$ | 211 | | |

$ | 21 | | |

$ | 620 | |

See end of press release for footnote explanations and reconciliations of non-GAAP measures.

THE WOODLANDS, Texas – Huntsman Corporation (NYSE: HUN)

today reported fourth quarter 2023 results with revenues of $1,403 million, net loss attributable to Huntsman of $71 million, adjusted

net loss attributable to Huntsman of $36 million and adjusted EBITDA of $44 million.

Peter R. Huntsman, Chairman, President, and CEO,

commented:

“In early 2024 we have seen a

moderate improvement from the lows experienced in the fourth quarter 2023, and while we are yet to see a clear inflexion point in demand,

we remain positive about the future. We are well positioned to benefit significantly from volume leverage once our end markets improve

and as we continue to control our cost base. While the exact timing of a recovery remains uncertain, we are confident that construction

spending and industrial activity in our core markets will return to past cycle averages and the world will continue to value energy

efficiency and light weighting which impacts two-thirds of our total sales.

“The portfolio changes we have

made over the past several years have placed Huntsman in a position to withstand one of the toughest demand environments we have seen

in well over a decade. The financial strength of our Company remains our priority as we consider both internal and external investments

as well as returning cash to shareholders through our dividend and buybacks.”

Segment Analysis for 4Q23 Compared to 4Q22

Polyurethanes

The decrease in revenues in our Polyurethanes segment for the three

months ended December 31, 2023 compared to the same period of 2022 was primarily due to lower MDI average selling prices and lower sales

volumes combined with an adverse sales mix. MDI average selling prices decreased due to less favorable supply and demand dynamics. Sales

volumes decreased primarily due to an unplanned outage impact in our Rotterdam facility. The decrease in segment adjusted EBITDA was primarily

due to lower MDI margins.

Performance Products

The decrease in revenues in our Performance Products segment for the

three months ended December 31, 2023 compared to the same period of 2022 was primarily due to lower average selling prices. Sales volumes

decreased slightly primarily due to slow construction activity and weak demand in fuel and lubes and other industrial markets. The decrease

in segment adjusted EBITDA was primarily due to lower margins.

Advanced Materials

The decrease in revenues in our Advanced Materials segment for the

three months ended December 31, 2023 compared to the same period of 2022 was primarily due to lower sales volumes and lower average selling

prices. Sales volumes decreased primarily due to reduced customer demand in our industrial and commodity markets. Selling prices decreased

in response to lower raw material costs. The decrease in segment adjusted EBITDA was primarily due to lower sales volumes.

Corporate, LIFO and other

For the three months ended December 31, 2023, adjusted EBITDA

from Corporate and other was a loss of $35 million as compared to a loss of $52 million for the same period of 2022 due to a decrease

in corporate overhead and minority interest expense.

Liquidity and Capital Resources

During the three months ended December 31, 2023, our free cash flow

from continuing operations was $83 million as compared to $211 million in the same period of 2022. As of December 31, 2023, we had approximately

$1.7 billion of combined cash and unused borrowing capacity.

During the three months ended December 31, 2023, we spent $83 million

on capital expenditures from continuing operations as compared to $86 million in the same period of 2022. During 2024, we expect to spend

approximately $200 million on capital expenditures.

Income Taxes

In 2023, our effective tax rate was 65% and our adjusted effective

tax rate was 34%. We expect our 2024 adjusted effective tax rate to be approximately 34% to 37%. We expect our long-term adjusted effective

tax rate to be approximately 22% to 24%.

Earnings Conference Call Information

We will hold a conference call to discuss our fourth quarter 2023 financial

results on Thursday, February 22, 2024, at 10:00 a.m. ET.

Webcast link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=4YckWj4j

Participant dial-in numbers:

| Domestic callers: |

(877) 402-8037 |

| International callers: |

(201) 378-4913 |

The conference call will be accompanied by presentation slides that

will be accessible via the webcast link and Huntsman’s investor relations website, www.huntsman.com/investors. Upon conclusion

of the call, the webcast replay will be accessible via Huntsman’s website.

Upcoming Conferences

During the first quarter 2024, a member of management is expected to

present at:

Alembic Materials and Industrials Conference on February 29, 2024

A webcast of the presentation, if applicable, along with accompanying

materials will be available at www.huntsman.com/investors.

Table 1 – Results of Operations

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| In millions, except per share amounts | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 1,403 | | |

$ | 1,650 | | |

$ | 6,111 | | |

$ | 8,023 | |

| Cost of goods sold | |

| 1,251 | | |

| 1,460 | | |

| 5,205 | | |

| 6,477 | |

| Gross profit | |

| 152 | | |

| 190 | | |

| 906 | | |

| 1,546 | |

| Operating expenses, net | |

| 195 | | |

| 167 | | |

| 804 | | |

| 788 | |

| Restructuring, impairment and plant closing costs | |

| 11 | | |

| 50 | | |

| 18 | | |

| 86 | |

| Operating (loss) income | |

| (54 | ) | |

| (27 | ) | |

| 84 | | |

| 672 | |

| Interest expense, net | |

| (17 | ) | |

| (16 | ) | |

| (65 | ) | |

| (62 | ) |

| Equity in income of investment in unconsolidated affiliates | |

| 13 | | |

| 12 | | |

| 83 | | |

| 67 | |

| Other (expense) income, net | |

| (1 | ) | |

| 6 | | |

| (3 | ) | |

| 20 | |

| (Loss) income from continuing operations before income taxes | |

| (59 | ) | |

| (25 | ) | |

| 99 | | |

| 697 | |

| Income tax benefit (expense) | |

| 2 | | |

| (31 | ) | |

| (64 | ) | |

| (186 | ) |

| (Loss) income from continuing operations | |

| (57 | ) | |

| (56 | ) | |

| 35 | | |

| 511 | |

| (Loss) income from discontinued operations, net of tax(3) | |

| (2 | ) | |

| (18 | ) | |

| 118 | | |

| 12 | |

| Net (loss) income | |

| (59 | ) | |

| (74 | ) | |

| 153 | | |

| 523 | |

| Net income attributable to noncontrolling interests | |

| (12 | ) | |

| (17 | ) | |

| (52 | ) | |

| (63 | ) |

| Net (loss) income attributable to Huntsman Corporation | |

$ | (71 | ) | |

$ | (91 | ) | |

$ | 101 | | |

$ | 460 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA(1) | |

$ | 44 | | |

$ | 87 | | |

$ | 472 | | |

$ | 1,155 | |

| Adjusted net (loss) income (1) | |

$ | (36 | ) | |

$ | 8 | | |

$ | 67 | | |

$ | 636 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic (loss) income per share | |

$ | (0.41 | ) | |

$ | (0.48 | ) | |

$ | 0.57 | | |

$ | 2.29 | |

| Diluted (loss) income per share | |

$ | (0.41 | ) | |

$ | (0.48 | ) | |

$ | 0.57 | | |

$ | 2.27 | |

| Adjusted diluted (loss) income per share(1) | |

$ | (0.21 | ) | |

$ | 0.04 | | |

$ | 0.37 | | |

$ | 3.13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Common share information: | |

| | | |

| | | |

| | | |

| | |

| Basic weighted average shares | |

| 172 | | |

| 189 | | |

| 177 | | |

| 201 | |

| Diluted weighted average shares | |

| 172 | | |

| 189 | | |

| 177 | | |

| 203 | |

| Diluted shares for adjusted diluted (loss) income per share | |

| 172 | | |

| 190 | | |

| 179 | | |

| 203 | |

See end of press release for footnote explanations.

Table 2 – Results of Operations

by Segment

| | |

Three months ended | | |

| | |

Twelve months ended | | |

| |

| | |

December 31, | | |

Better / | | |

December 31, | | |

Better / | |

| In millions | |

2023 | | |

2022 | | |

(Worse) | | |

2023 | | |

2022 | | |

(Worse) | |

| Segment Revenues: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Polyurethanes | |

$ | 895 | | |

$ | 1,071 | | |

| (16 | )% | |

$ | 3,865 | | |

$ | 5,067 | | |

| (24 | )% |

| Performance Products | |

| 260 | | |

| 307 | | |

| (15 | )% | |

| 1,178 | | |

| 1,713 | | |

| (31 | )% |

| Advanced Materials | |

| 251 | | |

| 278 | | |

| (10 | )% | |

| 1,092 | | |

| 1,277 | | |

| (14 | )% |

| Total Reportable Segments' Revenues | |

| 1,406 | | |

| 1,656 | | |

| (15 | )% | |

| 6,135 | | |

| 8,057 | | |

| (24 | )% |

| Intersegment Eliminations | |

| (3 | ) | |

| (6 | ) | |

| n/m | | |

| (24 | ) | |

| (34 | ) | |

| n/m | |

| Total Revenues | |

$ | 1,403 | | |

$ | 1,650 | | |

| (15 | )% | |

$ | 6,111 | | |

$ | 8,023 | | |

| (24 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment Adjusted EBITDA(1): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Polyurethanes | |

$ | 13 | | |

$ | 37 | | |

| (65 | )% | |

$ | 248 | | |

$ | 628 | | |

| (61 | )% |

| Performance Products | |

| 28 | | |

| 61 | | |

| (54 | )% | |

| 201 | | |

| 469 | | |

| (57 | )% |

| Advanced Materials | |

| 38 | | |

| 41 | | |

| (7 | )% | |

| 186 | | |

| 233 | | |

| (20 | )% |

| Total Reportable Segments' Adjusted EBITDA(1) | |

| 79 | | |

| 139 | | |

| (43 | )% | |

| 635 | | |

| 1,330 | | |

| (52 | )% |

| Corporate, LIFO and other | |

| (35 | ) | |

| (52 | ) | |

| 33 | % | |

| (163 | ) | |

| (175 | ) | |

| 7 | % |

| Total Adjusted EBITDA(1) | |

$ | 44 | | |

$ | 87 | | |

| (49 | )% | |

$ | 472 | | |

$ | 1,155 | | |

| (59 | )% |

n/m = not meaningful

Table 3 – Factors Impacting

Sales Revenue

| | |

Three months ended | |

| | |

December 31, 2023 vs. 2022 | |

| | |

Average Selling Price(a) | | |

| | |

| | |

| |

| | |

Local | | |

Exchange | | |

Sales | | |

Sales Mix | | |

| |

| | |

Currency | | |

Rate | | |

Volume(b) | | |

& Other | | |

Total | |

| Polyurethanes | |

| (15 | )% | |

| 1 | % | |

| (1 | )% | |

| (1 | )% | |

| (16 | )% |

| Performance Products | |

| (17 | )% | |

| 1 | % | |

| (1 | )% | |

| 2 | % | |

| (15 | )% |

| Advanced Materials | |

| (4 | )% | |

| 2 | % | |

| (5 | )% | |

| (3 | )% | |

| (10 | )% |

| | |

Twelve months ended | |

| | |

December 31, 2023 vs. 2022 | |

| | |

Average Selling Price(a) | | |

| | |

| | |

| |

| | |

Local | | |

Exchange | | |

Sales | | |

Sales Mix | | |

| |

| | |

Currency | | |

Rate | | |

Volume(b) | | |

& Other | | |

Total | |

| Polyurethanes | |

| (10 | )% | |

| (1 | )% | |

| (10 | )% | |

| (3 | )% | |

| (24 | )% |

| Performance Products | |

| (8 | )% | |

| 0 | % | |

| (24 | )% | |

| 1 | % | |

| (31 | )% |

| Advanced Materials | |

| 1 | % | |

| 0 | % | |

| (18 | )% | |

| 3 | % | |

| (14 | )% |

(a) Excludes sales from tolling arrangements, by-products and raw materials.

(b) Excludes sales from by-products and raw materials.

Table 4 –

Reconciliation of U.S. GAAP to Non-GAAP Measures

| | |

| | |

| | |

Income

Tax | | |

Net | | |

Diluted

(Loss) Income | |

| | |

EBITDA | | |

Benefit | | |

(Loss)

Income | | |

Per

Share | |

| | |

Three

months ended | | |

Three

months ended | | |

Three

months ended | | |

Three

months ended | |

| | |

December

31, | | |

December

31, | | |

December

31, | | |

December

31, | |

| In

millions, except per share amounts | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net

Loss | |

$ | (59 | ) | |

$ | (74 | ) | |

| | | |

| | | |

$ | (59 | ) | |

$ | (74 | ) | |

$ | (0.34 | ) | |

$ | (0.39 | ) |

| Net

income attributable to noncontrolling interests | |

| (12 | ) | |

| (17 | ) | |

| | | |

| | | |

| (12 | ) | |

| (17 | ) | |

| (0.07 | ) | |

| (0.09 | ) |

| Net

loss attributable to Huntsman Corporation | |

| (71 | ) | |

| (91 | ) | |

| | | |

| | | |

| (71 | ) | |

| (91 | ) | |

| (0.41 | ) | |

| (0.48 | ) |

| Interest

expense, net from continuing operations | |

| 17 | | |

| 16 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income

tax (benefit) expense from continuing operations | |

| (2 | ) | |

| 31 | | |

$ | 2 | | |

$ | (31 | ) | |

| | | |

| | | |

| | | |

| | |

| Income

tax expense from discontinued operations(3) | |

| 3 | | |

| 5 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation

and amortization from continuing operations | |

| 70 | | |

| 74 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation

and amortization from discontinued operations(3) | |

| - | | |

| 1 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Business

acquisition and integration expenses and purchase accounting inventory adjustments | |

| 1 | | |

| 1 | | |

| (1 | ) | |

| 1 | | |

| - | | |

| 2 | | |

| - | | |

| 0.01 | |

| EBITDA

/ (Income) loss from discontinued operations(3) | |

| (1 | ) | |

| 12 | | |

| N/A

| | |

| N/A

| | |

| 2 | | |

| 18 | | |

| 0.01 | | |

| 0.10 | |

| Establishment

of significant deferred tax asset valuation allowance | |

| - | | |

| - | | |

| 14 | | |

| 49 | | |

| 14 | | |

| 49 | | |

| 0.08 | | |

| 0.26 | |

| Loss

(gain) on sale of business/assets | |

| 1 | | |

| (27 | ) | |

| - | | |

| 6 | | |

| 1 | | |

| (21 | ) | |

| 0.01 | | |

| (0.11 | ) |

| Fair

value adjustments to Venator investment, net | |

| - | | |

| 3 | | |

| - | | |

| - | | |

| - | | |

| 3 | | |

| - | | |

| 0.02 | |

| Certain

legal and other settlements and related expenses (income) | |

| 2 | | |

| (8 | ) | |

| (1 | ) | |

| 2 | | |

| 1 | | |

| (6 | ) | |

| 0.01 | | |

| (0.03 | ) |

| Certain

non-recurring information technology project implementation costs | |

| - | | |

| 1 | | |

| (1 | ) | |

| - | | |

| (1 | ) | |

| 1 | | |

| (0.01 | ) | |

| 0.01 | |

| Amortization

of pension and postretirement actuarial losses | |

| 12 | | |

| 17 | | |

| (4 | ) | |

| (4 | ) | |

| 8 | | |

| 13 | | |

| 0.05 | | |

| 0.07 | |

| Restructuring,

impairment and plant closing and transition costs | |

| 12 | | |

| 52 | | |

| (2 | ) | |

| (12 | ) | |

| 10 | | |

| 40 | | |

| 0.06 | | |

| 0.21 | |

| Adjusted(1) | |

$ | 44 | | |

$ | 87 | | |

$ | 7 | | |

$ | 11 | | |

| (36 | ) | |

| 8 | | |

$ | (0.21 | ) | |

$ | 0.04 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

income tax benefit(1) | |

| | | |

| | | |

| | | |

| | | |

| (7 | ) | |

| (11 | ) | |

| | | |

| | |

| Net

income attributable to noncontrolling interests | |

| | | |

| | | |

| | | |

| | | |

| 12 | | |

| 17 | | |

| | | |

| | |

| Adjusted

pre-tax (loss) income (1) | |

| | | |

| | | |

| | | |

| | | |

$ | (31 | ) | |

$ | 14 | | |

| | | |

| | |

| Adjusted

effective tax rate(4) | |

| | | |

| | | |

| | | |

| | | |

| 23 | % | |

| n/m | | |

| | | |

| | |

| Effective

tax rate | |

| | | |

| | | |

| | | |

| | | |

| 3 | % | |

| n/m | | |

| | | |

| | |

| | |

| | |

| | |

Income

Tax | | |

| | |

| | |

Diluted

Income | |

| | |

EBITDA | | |

Expense | | |

Net

Income | | |

Per

Share | |

| | |

Twelve

months ended | | |

Twelve

months ended | | |

Twelve

months ended | | |

Twelve

months ended | |

| | |

December

31, | | |

December

31, | | |

December

31, | | |

December

31, | |

| In

millions, except per share amounts | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net

income | |

$ | 153 | | |

$ | 523 | | |

| | | |

| | | |

$ | 153 | | |

$ | 523 | | |

$ | 0.86 | | |

$ | 2.58 | |

| Net

income attributable to noncontrolling interests | |

| (52 | ) | |

| (63 | ) | |

| | | |

| | | |

| (52 | ) | |

| (63 | ) | |

| (0.29 | ) | |

| (0.31 | ) |

| Net

income attributable to Huntsman Corporation | |

| 101 | | |

| 460 | | |

| | | |

| | | |

| 101 | | |

| 460 | | |

| 0.57 | | |

| 2.27 | |

| Interest

expense, net from continuing operations | |

| 65 | | |

| 62 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income

tax expense from continuing operations | |

| 64 | | |

| 186 | | |

$ | (64 | ) | |

$ | (186 | ) | |

| | | |

| | | |

| | | |

| | |

| Income

tax expense from discontinued operations(3) | |

| 17 | | |

| 19 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation

and amortization from continuing operations | |

| 278 | | |

| 281 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation

and amortization from discontinued operations(3) | |

| - | | |

| 12 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Business

acquisition and integration expenses and purchase accounting inventory adjustments | |

| 4 | | |

| 12 | | |

| (1 | ) | |

| (2 | ) | |

| 3 | | |

| 10 | | |

| 0.02 | | |

| 0.05 | |

| Costs

associated with the Albemarle Settlement, net | |

| - | | |

| 3 | | |

| - | | |

| (1 | ) | |

| - | | |

| 2 | | |

| - | | |

| 0.01 | |

| EBITDA

/ Income from discontinued operations(3) | |

| (135 | ) | |

| (43 | ) | |

| N/A | | |

| N/A | | |

| (118 | ) | |

| (12 | ) | |

| (0.66 | ) | |

| (0.06 | ) |

| Establishment

of significant deferred tax asset valuation allowance | |

| - | | |

| - | | |

| 14 | | |

| 49 | | |

| 14 | | |

| 49 | | |

| 0.08 | | |

| 0.24 | |

| Income

from transition services arrangements | |

| - | | |

| (2 | ) | |

| - | | |

| - | | |

| - | | |

| (2 | ) | |

| - | | |

| (0.01 | ) |

| Fair

value adjustments to Venator investment, net | |

| 5 | | |

| 12 | | |

| - | | |

| - | | |

| 5 | | |

| 12 | | |

| 0.03 | | |

| 0.06 | |

| Certain

legal and other settlements and related expenses | |

| 6 | | |

| 7 | | |

| (1 | ) | |

| (2 | ) | |

| 5 | | |

| 5 | | |

| 0.03 | | |

| 0.02 | |

| Certain

non-recurring information technology project implementation costs | |

| 5 | | |

| 5 | | |

| (1 | ) | |

| (1 | ) | |

| 4 | | |

| 4 | | |

| 0.02 | | |

| 0.02 | |

| Amortization

of pension and postretirement actuarial losses | |

| 37 | | |

| 49 | | |

| (6 | ) | |

| (11 | ) | |

| 31 | | |

| 38 | | |

| 0.17 | | |

| 0.19 | |

| Restructuring,

impairment and plant closing and transition costs | |

| 25 | | |

| 96 | | |

| (3 | ) | |

| (23 | ) | |

| 22 | | |

| 73 | | |

| 0.12 | | |

| 0.36 | |

| Plant

incident remediation credits | |

| - | | |

| (4 | ) | |

| - | | |

| 1 | | |

| - | | |

| (3 | ) | |

| - | | |

| (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted(1) | |

$ | 472 | | |

$ | 1,155 | | |

$ | (62 | ) | |

$ | (176 | ) | |

| 67 | | |

| 636 | | |

$ | 0.37 | | |

$ | 3.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

income tax expense(1) | |

| | | |

| | | |

| | | |

| | | |

| 62 | | |

| 176 | | |

| | | |

| | |

| Net

income attributable to noncontrolling interests | |

| | | |

| | | |

| | | |

| | | |

| 52 | | |

| 63 | | |

| | | |

| | |

| Adjusted

pre-tax income(1) | |

| | | |

| | | |

| | | |

| | | |

$ | 181 | | |

$ | 875 | | |

| | | |

| | |

| Adjusted

effective tax rate(4) | |

| | | |

| | | |

| | | |

| | | |

| 34 | % | |

| 20 | % | |

| | | |

| | |

| Effective

tax rate | |

| | | |

| | | |

| | | |

| | | |

| 65 | % | |

| 27 | % | |

| | | |

| | |

n/m = not meaningful

See end of press release for footnote explanations.

Table 5 – Balance

Sheets

| | |

December 31, | | |

December 31, | |

| In millions | |

2023 | | |

2022 | |

| Cash | |

$ | 540 | | |

$ | 654 | |

| Accounts and notes receivable, net | |

| 753 | | |

| 834 | |

| Inventories | |

| 867 | | |

| 995 | |

| Other current assets | |

| 154 | | |

| 190 | |

| Current assets held for sale(3) | |

| - | | |

| 472 | |

| Property, plant and equipment, net | |

| 2,376 | | |

| 2,377 | |

| Other noncurrent assets | |

| 2,558 | | |

| 2,698 | |

| Total assets | |

$ | 7,248 | | |

$ | 8,220 | |

| | |

| | | |

| | |

| Accounts payable | |

$ | 719 | | |

$ | 961 | |

| Other current liabilities | |

| 441 | | |

| 480 | |

| Current portion of debt | |

| 12 | | |

| 66 | |

| Current liabilities held for sale(3) | |

| - | | |

| 194 | |

| Long-term debt | |

| 1,676 | | |

| 1,671 | |

| Other noncurrent liabilities | |

| 922 | | |

| 1,008 | |

| Huntsman Corporation stockholders’ equity | |

| 3,251 | | |

| 3,624 | |

| Noncontrolling interests in subsidiaries | |

| 227 | | |

| 216 | |

| Total liabilities and equity | |

$ | 7,248 | | |

$ | 8,220 | |

Table 6 – Outstanding Debt

| | |

December 31, | | |

December 31, | |

| In millions | |

2023 | | |

2022 | |

| Debt: | |

| | | |

| | |

| Revolving credit facility | |

$ | - | | |

$ | 55 | |

| Accounts receivable programs | |

| 169 | | |

| 166 | |

| Senior notes | |

| 1,471 | | |

| 1,455 | |

| Variable interest entities | |

| 26 | | |

| 35 | |

| Other debt | |

| 22 | | |

| 26 | |

| Total debt - excluding affiliates | |

| 1,688 | | |

| 1,737 | |

| Total cash | |

| 540 | | |

| 654 | |

| Net debt - excluding affiliates(5) | |

$ | 1,148 | | |

$ | 1,083 | |

See end of press release for footnote explanations.

Table 7 – Summarized Statements

of Cash Flows

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| In millions | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Total cash at beginning of period | |

$ | 496 | | |

$ | 515 | | |

$ | 654 | | |

$ | 1,041 | |

| Net cash provided by operating activities from continuing operations | |

| 166 | | |

| 297 | | |

| 251 | | |

| 892 | |

| Net cash (used in) provided by operating activities from discontinued operations(3) | |

| (2 | ) | |

| 13 | | |

| (42 | ) | |

| 22 | |

| Net cash (used in) provided by investing activities from continuing operations | |

| (86 | ) | |

| (84 | ) | |

| 309 | | |

| (260 | ) |

| Net cash used in investing activities from discontinued operations(3) | |

| - | | |

| (7 | ) | |

| (4 | ) | |

| (19 | ) |

| Net cash used in financing activities | |

| (39 | ) | |

| (89 | ) | |

| (620 | ) | |

| (994 | ) |

| Effect of exchange rate changes on cash | |

| 5 | | |

| 9 | | |

| (8 | ) | |

| (28 | ) |

| Total cash at end of period | |

$ | 540 | | |

$ | 654 | | |

$ | 540 | | |

$ | 654 | |

| | |

| | | |

| | | |

| | | |

| | |

| Free cash flow from continuing operations(2): | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operating activities from continuing operations | |

$ | 166 | | |

$ | 297 | | |

$ | 251 | | |

$ | 892 | |

| Capital expenditures | |

| (83 | ) | |

| (86 | ) | |

| (230 | ) | |

| (272 | ) |

| Free cash flow from continuing operations(2) | |

$ | 83 | | |

$ | 211 | | |

$ | 21 | | |

$ | 620 | |

| | |

| | | |

| | | |

| | | |

| | |

| Supplemental cash flow information: | |

| | | |

| | | |

| | | |

| | |

| Cash paid for interest | |

$ | (25 | ) | |

$ | (25 | ) | |

$ | (68 | ) | |

$ | (66 | ) |

| Cash paid for income taxes | |

| (15 | ) | |

| (23 | ) | |

| (97 | ) | |

| (194 | ) |

| Cash paid for restructuring and integration | |

| (8 | ) | |

| (13 | ) | |

| (59 | ) | |

| (56 | ) |

| Cash paid for pensions | |

| (9 | ) | |

| (13 | ) | |

| (50 | ) | |

| (48 | ) |

| Depreciation and amortization from continuing operations | |

| 70 | | |

| 74 | | |

| 278 | | |

| 281 | |

| | |

| | | |

| | | |

| | | |

| | |

| Change in primary working capital: | |

| | | |

| | | |

| | | |

| | |

| Accounts and notes receivable | |

$ | 86 | | |

$ | 206 | | |

$ | 103 | | |

$ | 146 | |

| Inventories | |

| 92 | | |

| 122 | | |

| 125 | | |

| (6 | ) |

| Accounts payable | |

| (15 | ) | |

| 29 | | |

| (224 | ) | |

| (84 | ) |

| Total change in primary working capital | |

$ | 163 | | |

$ | 357 | | |

$ | 4 | | |

$ | 56 | |

See end of press release for footnote explanations.

Footnotes

| (1) | We use adjusted EBITDA to measure the operating performance of our business and for planning and evaluating the performance of our

business segments. We provide adjusted net income (loss) because we feel it provides meaningful insight for the investment community into

the performance of our business. We believe that net income (loss) is the performance measure calculated and presented in accordance with

generally accepted accounting principles in the U.S. (“GAAP”) that is most directly comparable to adjusted EBITDA and adjusted

net income (loss). Additional information with respect to our use of each of these financial measures follows: |

Adjusted EBITDA, adjusted net income (loss) and adjusted

diluted income (loss) per share, as used herein, are not necessarily comparable to other similarly titled measures of other companies.

Adjusted EBITDA is computed by eliminating the following

from net income (loss): (a) net income attributable to noncontrolling interests; (b) interest expense, net; (c) income taxes; (d) depreciation

and amortization; (e) amortization of pension and postretirement actuarial losses; (f) restructuring, impairment and plant closing and

transition costs; and further adjusted for certain other items set forth in the reconciliation of net income (loss) to adjusted EBITDA

in Table 4 above.

Adjusted net income (loss) and adjusted diluted income (loss)

per share are computed by eliminating the after tax impact of the following items from net income (loss): (a) net income attributable

to noncontrolling interests; (b) amortization of pension and postretirement actuarial losses; (c) restructuring, impairment and plant

closing and transition costs; and further adjusted for certain other items set forth in the reconciliation of net income (loss) to adjusted

net income (loss) in Table 4 above. The income tax impacts, if any, of each adjusting item represent a ratable allocation of the total

difference between the unadjusted tax expense and the total adjusted tax expense, computed without consideration of any adjusting items

using a with and without approach.

We may disclose forward-looking adjusted EBITDA because

we cannot adequately forecast certain items and events that may or may not impact us in the near future, such as business acquisition

and integration expenses and purchase accounting inventory adjustments, certain legal and other settlements and related expenses, gains

on sale of businesses/assets and certain tax only items, including tax law changes not yet enacted. Each of such adjustment has not yet

occurred, is out of our control and/or cannot be reasonably predicted. In our view, our forward-looking adjusted EBITDA represents the

forecast net income on our underlying business operations but does not reflect any adjustments related to the items noted above that may

occur and can cause our adjusted EBITDA to differ.

| (2) | Management internally uses free cash flow measure: (a) to evaluate our liquidity, (b) evaluate strategic investments, (c) plan stock

buyback and dividend levels and (d) evaluate our ability to incur and service debt. Free cash flow is defined as net cash provided by

operating activities less capital expenditures. Free cash flow is not a defined term under U.S. GAAP, and it should not be inferred that

the entire free cash flow amount is available for discretionary expenditures. |

| (3) | During the first quarter 2023, we completed the divestiture of our Textile Effects business, which is reported as discontinued operations

on the income and cash flow statements and held for sale on the December 31, 2022 balance sheet. |

| (4) | We believe the adjusted effective tax rate provides improved

comparability between periods through the exclusion of certain items that management believes are not indicative of the businesses’

operational profitability and that may obscure underlying business results and trends. In our view, effective tax rate is the performance

measure calculated and presented in accordance with U.S. GAAP that is most directly comparable to adjusted effective tax rate. The reconciliation

of historical adjusted effective tax rate and effective tax rate is set forth in Table 4 above. Please see the reconciliation of our

net income to adjusted net income in Table 4 for details regarding the tax impacts of our non-GAAP adjustments. |

Our forward-looking adjusted effective tax rate is calculated

based on our forecast effective tax rate, and the range of our forward-looking adjusted effective tax rate equals the range of our forecast

effective tax rate. We disclose forward-looking adjusted effective tax rate because we cannot adequately forecast certain items and events

that may or may not impact us in the near future, such as business acquisition and integration expenses and purchase accounting inventory

adjustments, certain legal and other settlements and related expenses, gains on sale of businesses/assets and certain tax only items,

including tax law changes not yet enacted. Each of such adjustment has not yet occurred, is out of our control and/or cannot be reasonably

predicted. In our view, our forward-looking adjusted effective tax rate represents the forecast effective tax rate on our underlying business

operations but does not reflect any adjustments related to the items noted above that may occur and can cause our effective tax rate to

differ.

| (5) | Net debt is a measure we use to monitor how much debt we have

after taking into account our total cash. We use it as an indicator of our overall financial position, and calculate it by taking our

total debt, including the current portion, and subtracting total cash. |

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and

marketer of differentiated and specialty chemicals with 2023 revenues of approximately $6 billion from our continuing operations.

Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer

and industrial end markets. We operate more than 60 manufacturing, R&D and operations facilities in approximately 25 countries and

employ approximately 6,000 associates within our continuing operations. For more information about Huntsman, please visit the company's

website at www.huntsman.com.

Social Media:

Twitter: www.twitter.com/Huntsman_Corp

Facebook: www.facebook.com/huntsmancorp

LinkedIn: www.linkedin.com/company/huntsman

Forward-Looking Statements:

This press release includes "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking

statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital

expenditures, financing needs, plans or intentions relating to acquisitions, divestitures or strategic transactions, business trends and

any other information that is not historical information. When used in this press release, the words "estimates," "expects,"

"anticipates," "likely," "projects," "outlook," "plans," "intends," "believes,"

"forecasts," or future or conditional verbs, such as "will," "should," "could" or "may,"

and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements,

including, without limitation, management's examination of historical operating trends and data, are based upon our current expectations

and various assumptions and beliefs. In particular, such forward-looking statements are subject to uncertainty and changes in circumstances

and involve risks and uncertainties that may affect the Company's operations, markets, products, prices and other factors as discussed

in the Company's filings with the Securities and Exchange Commission (the "SEC"). Significant risks and uncertainties may relate

to, but are not limited to, increased energy costs in Europe, inflation and resulting monetary tightening in the US, geopolitical instability,

volatile global economic conditions, cyclical and volatile product markets, disruptions in production at manufacturing facilities, reorganization

or restructuring of the Company's operations, including any delay of, or other negative developments affecting the ability to implement

cost reductions and manufacturing optimization improvements in the Company's businesses and to realize anticipated cost savings, and other

financial, operational, economic, competitive, environmental, political, legal, regulatory and technological factors. Any forward-looking

statement should be considered in light of the risks set forth under the caption "Risk Factors" in our Annual Report on Form

10-K for the year ended December 31, 2023, which may be supplemented by other risks and uncertainties disclosed in any subsequent reports

filed or furnished by the Company from time to time. All forward-looking statements apply only as of the date made. Except as required

by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect events or circumstances that arise

after the date made or to reflect the occurrence of unanticipated events.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

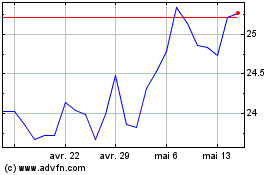

Huntsman (NYSE:HUN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Huntsman (NYSE:HUN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025