Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Juillet 2023 - 5:48PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

95

.7

%

Australia

:

3

.2

%

57,801

Ampol

Ltd.

$

1,180,773

0.3

145,899

ANZ

Group

Holdings

Ltd.

2,170,181

0.5

575,491

Aurizon

Holdings

Ltd.

1,332,070

0.3

14,716

BHP

Group

Ltd.

-

Class

DI

402,675

0.1

151,683

Brambles

Ltd.

1,354,287

0.3

68,601

Computershare

Ltd.

995,958

0.2

142,505

Insurance

Australia

Group

Ltd.

480,582

0.1

590,032

Medibank

Pvt

Ltd.

1,369,455

0.3

89,290

National

Australia

Bank

Ltd.

1,503,895

0.3

238,257

Scentre

Group

419,853

0.1

260,378

Telstra

Group

Ltd.

738,391

0.2

232,399

Transurban

Group

2,241,717

0.5

14,189,837

3.2

Austria

:

0

.2

%

18,799

OMV

AG

839,725

0.2

Canada

:

3

.7

%

48,284

BCE,

Inc.

2,178,204

0.5

56,059

Canadian

Imperial

Bank

of

Commerce

-

XTSE

2,311,324

0.5

35,328

Cenovus

Energy,

Inc.

564,467

0.1

56,905

Element

Fleet

Management

Corp.

863,112

0.2

26,394

iA

Financial

Corp.,

Inc.

1,682,216

0.4

32,901

Rogers

Communications,

Inc.

-

Class

B

1,450,552

0.3

23,336

Royal

Bank

of

Canada

2,087,433

0.5

47,224

Suncor

Energy,

Inc.

1,322,968

0.3

19,412

TC

Energy

Corp.

755,602

0.2

49,400

TELUS

Corp.

935,962

0.2

18,154

Thomson

Reuters

Corp.

2,308,467

0.5

16,460,307

3.7

China

:

0

.2

%

465,000

SITC

International

Holdings

Co.

Ltd.

807,802

0.2

Denmark

:

0

.4

%

293

AP

Moller

-

Maersk

A/S

-

Class

B

493,116

0.1

70,513

(1)

Danske

Bank

A/S

1,438,059

0.3

1,931,175

0.4

Finland

:

0

.1

%

141,242

Nokia

Oyj

571,385

0.1

France

:

3

.6

%

13,621

Air

Liquide

SA

2,282,239

0.5

85,265

AXA

SA

2,417,324

0.5

24,038

BNP

Paribas

SA

1,397,530

0.3

3,399

Dassault

Aviation

SA

576,543

0.1

29,471

Edenred

1,897,025

0.4

6,410

Eiffage

SA

684,543

0.2

17,178

(2)

La

Francaise

des

Jeux

SAEM

664,122

0.1

240,644

Orange

SA

2,874,086

0.6

15,746

Sanofi

1,606,520

0.4

12,312

Thales

SA

1,716,092

0.4

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

France:

(continued)

58,853

Vivendi

SE

$

522,853

0.1

16,638,877

3.6

Germany

:

0

.7

%

28,511

BASF

SE

1,355,932

0.3

39,609

(1)

Commerzbank

AG

400,669

0.1

17,916

GEA

Group

AG

755,087

0.2

5,580

Symrise

AG

597,578

0.1

3,109,266

0.7

Hong

Kong

:

1

.3

%

224,000

CK

Asset

Holdings

Ltd.

1,207,396

0.3

177,500

CK

Hutchison

Holdings

Ltd.

1,070,092

0.2

25,700

Jardine

Matheson

Holdings

Ltd.

1,223,937

0.3

151,200

Link

REIT

879,228

0.2

144,000

MTR

Corp.

Ltd.

662,848

0.1

206,500

Power

Assets

Holdings

Ltd.

1,111,965

0.2

6,155,466

1.3

Israel

:

0

.2

%

128,732

Bank

Leumi

Le-Israel

BM

902,775

0.2

Italy

:

1

.3

%

210,297

Eni

SpA

2,798,374

0.6

109,518

(2)

Poste

Italiane

SpA

1,138,420

0.3

303,731

Snam

SpA

1,592,147

0.4

5,528,941

1.3

Japan

:

7

.6

%

4,700

Hirose

Electric

Co.

Ltd.

636,255

0.1

81,600

Honda

Motor

Co.

Ltd.

2,321,906

0.5

376,800

Japan

Post

Holdings

Co.

Ltd.

2,656,872

0.6

157,300

Japan

Tobacco,

Inc.

3,429,853

0.8

34,000

KDDI

Corp.

1,048,272

0.2

34,500

McDonald's

Holdings

Co.

Japan

Ltd.

1,418,877

0.3

84,700

Mitsubishi

UFJ

Financial

Group,

Inc.

563,237

0.1

46,800

NEC

Corp.

2,196,358

0.5

134,600

Oji

Holdings

Corp.

517,976

0.1

24,700

Ono

Pharmaceutical

Co.

Ltd.

461,867

0.1

51,800

ORIX

Corp.

880,510

0.2

6,000

Rohm

Co.

Ltd.

506,345

0.1

39,200

Secom

Co.

Ltd.

2,567,268

0.6

50,300

Sekisui

Chemical

Co.

Ltd.

693,299

0.2

118,400

Sekisui

House

Ltd.

2,310,785

0.5

27,600

Sompo

Holdings,

Inc.

1,122,002

0.3

155,000

Sumitomo

Chemical

Co.

Ltd.

461,549

0.1

94,400

Sumitomo

Mitsui

Financial

Group,

Inc.

3,830,910

0.9

20,800

Taisei

Corp.

660,929

0.1

101,200

Takeda

Pharmaceutical

Co.

Ltd.

3,220,800

0.7

112,000

Tokio

Marine

Holdings,

Inc.

2,507,324

0.6

34,013,194

7.6

Netherlands

:

1

.2

%

271,650

Koninklijke

KPN

NV

934,544

0.2

63,828

NN

Group

NV

2,302,740

0.5

20,058

Wolters

Kluwer

NV

2,291,113

0.5

5,528,397

1.2

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

New

Zealand

:

0

.1

%

170,583

Spark

New

Zealand

Ltd.

$

529,457

0.1

Puerto

Rico

:

0

.3

%

21,849

Popular,

Inc.

1,249,326

0.3

Singapore

:

0

.5

%

887,000

Genting

Singapore

Ltd.

662,222

0.1

243,100

Keppel

Corp.

Ltd.

1,133,615

0.3

113,800

Singapore

Airlines

Ltd.

539,211

0.1

2,335,048

0.5

Spain

:

1

.8

%

46,097

ACS

Actividades

de

Construccion

y

Servicios

SA

1,538,304

0.3

127,640

Banco

Bilbao

Vizcaya

Argentaria

SA

839,194

0.2

57,006

Industria

de

Diseno

Textil

SA

1,907,182

0.4

70,718

Red

Electrica

Corp.

SA

1,199,255

0.3

194,706

Repsol

SA

2,638,743

0.6

8,122,678

1.8

Switzerland

:

2

.2

%

20,357

Novartis

AG,

Reg

1,951,152

0.4

4,599

Roche

Holding

AG

1,464,822

0.3

4,273

Swisscom

AG,

Reg

2,706,931

0.6

8,672

Zurich

Insurance

Group

AG

4,060,075

0.9

10,182,980

2.2

United

Kingdom

:

4

.4

%

285,520

BAE

Systems

PLC

3,299,914

0.7

348,487

BP

PLC

1,957,811

0.4

86,274

British

American

Tobacco

PLC

2,730,971

0.6

109,723

British

Land

Co.

PLC

469,516

0.1

21,380

DCC

PLC

1,225,148

0.3

148,336

GSK

PLC

2,489,707

0.6

115,825

Imperial

Brands

PLC

2,441,702

0.5

830,333

Lloyds

Banking

Group

PLC

457,488

0.1

436,161

NatWest

Group

PLC

1,413,243

0.3

224,920

Sage

Group

PLC

2,437,441

0.5

43,202

Smiths

Group

PLC

864,415

0.2

155,932

Tesco

PLC

506,688

0.1

20,294,044

4.4

United

States

:

62

.7

%

28,928

3M

Co.

2,699,272

0.6

47,190

(1)

AbbVie,

Inc.

6,510,332

1.4

2,472

Acuity

Brands,

Inc.

372,506

0.1

17,999

AECOM

1,404,822

0.3

11,858

Air

Products

and

Chemicals,

Inc.

3,191,462

0.7

10,835

Allison

Transmission

Holdings,

Inc.

512,495

0.1

85,809

Altria

Group,

Inc.

3,811,636

0.8

251,852

Amcor

PLC

2,427,853

0.5

26,479

Amdocs

Ltd.

2,493,527

0.6

35,856

American

Electric

Power

Co.,

Inc.

2,980,351

0.7

25,086

American

International

Group,

Inc.

1,325,293

0.3

1,483

Ameriprise

Financial,

Inc.

442,631

0.1

3,188

AMETEK,

Inc.

462,483

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States:

(continued)

18,591

(1)

Amgen,

Inc.

$

4,102,104

0.9

7,360

Aon

PLC

-

Class

A

2,269,014

0.5

7,951

AptarGroup,

Inc.

894,408

0.2

14,445

Assurant,

Inc.

1,733,256

0.4

11,024

Automatic

Data

Processing,

Inc.

2,303,906

0.5

21,251

Avnet,

Inc.

931,644

0.2

35,127

Axis

Capital

Holdings

Ltd.

1,823,091

0.4

41,301

Bank

OZK

1,428,189

0.3

72,637

(1)

Bristol-Myers

Squibb

Co.

4,680,728

1.0

36,771

Cardinal

Health,

Inc.

3,026,253

0.7

15,370

Cheniere

Energy,

Inc.

2,148,265

0.5

9,365

Cigna

Group

2,316,995

0.5

126,033

Cisco

Systems,

Inc.

6,260,059

1.4

21,722

Citizens

Financial

Group,

Inc.

559,993

0.1

26,298

Coca-Cola

Co.

1,568,939

0.4

24,212

Colgate-Palmolive

Co.

1,800,889

0.4

29,488

Commerce

Bancshares,

Inc.

1,413,950

0.3

26,768

Consolidated

Edison,

Inc.

2,497,454

0.6

61,678

CSX

Corp.

1,891,664

0.4

18,528

Cullen/Frost

Bankers,

Inc.

1,856,506

0.4

32,014

CVS

Health

Corp.

2,177,912

0.5

62,381

Dow,

Inc.

3,042,945

0.7

49,002

DT

Midstream,

Inc.

2,227,631

0.5

22,687

DTE

Energy

Co.

2,441,121

0.5

38,137

Duke

Energy

Corp.

3,405,253

0.8

29,018

Edison

International

1,959,295

0.4

24,909

Electronic

Arts,

Inc.

3,188,352

0.7

4,533

Elevance

Health,

Inc.

2,029,968

0.5

38,417

Emerson

Electric

Co.

2,984,233

0.7

8,522

EOG

Resources,

Inc.

914,325

0.2

214,554

Equitrans

Midstream

Corp.

1,830,146

0.4

6,990

Erie

Indemnity

Co.

-

Class

A

1,496,559

0.3

7,410

Everest

Re

Group

Ltd.

2,519,548

0.6

41,318

Evergy,

Inc.

2,390,246

0.5

35,010

First

Hawaiian,

Inc.

577,315

0.1

103,157

Flowers

Foods,

Inc.

2,576,862

0.6

5,820

FMC

Corp.

605,746

0.1

147,805

FNB

Corp.

1,624,377

0.4

22,691

Fortive

Corp.

1,477,411

0.3

40,833

Gaming

and

Leisure

Properties,

Inc.

1,965,701

0.4

41,953

General

Mills,

Inc.

3,530,764

0.8

23,268

General

Motors

Co.

754,116

0.2

54,072

Genpact

Ltd.

1,988,768

0.4

69,484

Gentex

Corp.

1,824,650

0.4

17,812

Genuine

Parts

Co.

2,652,741

0.6

52,285

Gilead

Sciences,

Inc.

4,022,808

0.9

61,119

H&R

Block,

Inc.

1,824,402

0.4

9,411

Hancock

Whitney

Corp.

343,784

0.1

12,780

Hanover

Insurance

Group,

Inc.

1,424,459

0.3

40,428

Hartford

Financial

Services

Group,

Inc.

2,770,127

0.6

19,641

Highwoods

Properties,

Inc.

406,176

0.1

3,219

Humana,

Inc.

1,615,520

0.4

17,882

International

Bancshares

Corp.

763,919

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States:

(continued)

8,526

International

Business

Machines

Corp.

$

1,096,358

0.2

18,080

Iridium

Communications,

Inc.

1,085,523

0.2

45,634

Iron

Mountain,

Inc.

2,437,768

0.5

61,308

Johnson

&

Johnson

9,506,418

2.1

7,045

Johnson

Controls

International

PLC

420,587

0.1

91,707

Juniper

Networks,

Inc.

2,785,142

0.6

23,550

(1)

Kellogg

Co.

1,572,433

0.4

52,508

Keurig

Dr

Pepper,

Inc.

1,634,049

0.4

37,903

Kilroy

Realty

Corp.

1,028,687

0.2

25,516

Kimberly-Clark

Corp.

3,426,288

0.8

28,298

Leidos

Holdings,

Inc.

2,208,942

0.5

16,619

LKQ

Corp.

876,652

0.2

30,370

Loews

Corp.

1,700,720

0.4

27,166

Marathon

Petroleum

Corp.

2,849,985

0.6

17,768

Marsh

&

McLennan

Cos.,

Inc.

3,077,062

0.7

17,333

McDonald's

Corp.

4,941,812

1.1

6,732

McKesson

Corp.

2,631,135

0.6

67,865

Merck

&

Co.,

Inc.

7,492,975

1.7

29,919

MetLife,

Inc.

1,482,486

0.3

47,802

MGIC

Investment

Corp.

722,766

0.2

4,978

Mid-America

Apartment

Communities,

Inc.

732,065

0.2

33,350

Mondelez

International,

Inc.

-

Class

A

2,448,223

0.5

14,191

Morgan

Stanley

1,160,256

0.3

14,068

MSC

Industrial

Direct

Co.,

Inc.

-

Class

A

1,264,995

0.3

31,387

National

Fuel

Gas

Co.

1,597,912

0.4

59,263

National

Retail

Properties,

Inc.

2,521,048

0.6

25,665

NetApp,

Inc.

1,702,873

0.4

78,972

(1)

New

Fortress

Energy,

Inc.

2,074,594

0.5

74,517

NiSource,

Inc.

2,003,762

0.4

112,979

Old

Republic

International

Corp.

2,766,856

0.6

14,672

ONE

Gas,

Inc.

1,187,552

0.3

29,925

ONEOK,

Inc.

1,695,550

0.4

12,264

Packaging

Corp.

of

America

1,521,104

0.3

47,470

Patterson

Cos.,

Inc.

1,243,239

0.3

33,744

PepsiCo,

Inc.

6,153,218

1.4

98,076

Pfizer,

Inc.

3,728,850

0.8

51,509

Philip

Morris

International,

Inc.

4,636,325

1.0

33,023

Phillips

66

3,025,237

0.7

98,394

PPL

Corp.

2,577,923

0.6

7,604

Procter

&

Gamble

Co.

1,083,570

0.2

35,597

Prosperity

Bancshares,

Inc.

2,035,436

0.5

11,092

QUALCOMM,

Inc.

1,257,944

0.3

214,288

Rithm

Capital

Corp.

1,744,304

0.4

39,016

Rollins,

Inc.

1,534,109

0.3

15,512

Sempra

Energy

2,226,437

0.5

9,364

Sensata

Technologies

Holding

PLC

388,793

0.1

2,034

Sherwin-Williams

Co.

463,305

0.1

14,414

Silgan

Holdings,

Inc.

648,486

0.1

10,369

Snap-on,

Inc.

2,580,429

0.6

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States:

(continued)

33,720

Sonoco

Products

Co.

$

2,018,479

0.4

18,011

Targa

Resources

Corp.

1,225,649

0.3

18,823

Texas

Instruments,

Inc.

3,272,943

0.7

18,775

Travelers

Cos.,

Inc.

3,177,481

0.7

11,392

UMB

Financial

Corp.

645,243

0.1

2,641

UnitedHealth

Group,

Inc.

1,286,801

0.3

63,340

Unum

Group

2,752,123

0.6

73,121

US

Bancorp

2,186,318

0.5

10,251

Valero

Energy

Corp.

1,097,267

0.2

140,827

(1)

Verizon

Communications,

Inc.

5,017,666

1.1

39,293

Virtu

Financial,

Inc.

-

Class

A

691,164

0.2

20,281

Washington

Federal,

Inc.

527,509

0.1

20,945

Wells

Fargo

&

Co.

833,820

0.2

83,773

Wendy's

Co.

1,843,844

0.4

11,434

Westinghouse

Air

Brake

Technologies

Corp.

1,059,131

0.2

22,671

Westrock

Co.

635,015

0.1

70,810

Williams

Cos.,

Inc.

2,029,415

0.5

4,079

Willis

Towers

Watson

PLC

892,689

0.2

281,673,890

62.7

Total

Common

Stock

(Cost

$428,975,103)

431,064,570

95.7

EXCHANGE-TRADED

FUNDS

:

2

.2

%

66,877

iShares

MSCI

EAFE

Value

ETF

3,183,345

0.7

44,043

iShares

Russell

1000

Value

ETF

6,545,671

1.5

9,729,016

2.2

Total

Exchange-Traded

Funds

(Cost

$9,891,825)

9,729,016

2.2

PREFERRED

STOCK

:

0

.1

%

Germany

:

0

.1

%

4,585

Volkswagen

AG

574,417

0.1

Total

Preferred

Stock

(Cost

$594,561)

574,417

0.1

Total

Long-Term

Investments

(Cost

$439,461,489)

441,368,003

98.0

SHORT-TERM

INVESTMENTS

:

1

.2

%

Mutual

Funds:

1.2%

5,201,000

(3)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.000%

(Cost

$5,201,000)

5,201,000

1.2

Total

Short-Term

Investments

(Cost

$5,201,000)

5,201,000

1.2

Total

Investments

in

Securities

(Cost

$444,662,489)

$

446,569,003

99.2

Assets

in

Excess

of

Other

Liabilities

3,753,192

0.8

Net

Assets

$

450,322,195

100.0

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

(1)

Non-income

producing

security.

(2)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(3)

Rate

shown

is

the

7-day

yield

as

of

May

31,

2023.

Sector

Diversification

Percentage

of

Net

Assets

Financials

21

.0

%

Health

Care

15

.0

Industrials

12

.4

Consumer

Staples

9

.6

Energy

7

.4

Utilities

6

.5

Information

Technology

5

.8

Consumer

Discretionary

5

.6

Communication

Services

5

.1

Materials

4

.7

Real

Estate

2

.7

Exchange-Traded

Funds

2

.2

Short-Term

Investments

1

.2

Assets

in

Excess

of

Other

Liabilities

0

.8

Net

Assets

100

.0

%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

May

31,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

May

31,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

14,189,837

$

—

$

14,189,837

Austria

—

839,725

—

839,725

Canada

16,460,307

—

—

16,460,307

China

—

807,802

—

807,802

Denmark

—

1,931,175

—

1,931,175

Finland

—

571,385

—

571,385

France

—

16,638,877

—

16,638,877

Germany

—

3,109,266

—

3,109,266

Hong

Kong

1,223,937

4,931,529

—

6,155,466

Israel

—

902,775

—

902,775

Italy

—

5,528,941

—

5,528,941

Japan

1,418,877

32,594,317

—

34,013,194

Netherlands

—

5,528,397

—

5,528,397

New

Zealand

—

529,457

—

529,457

Puerto

Rico

1,249,326

—

—

1,249,326

Singapore

—

2,335,048

—

2,335,048

Spain

—

8,122,678

—

8,122,678

Switzerland

—

10,182,980

—

10,182,980

United

Kingdom

—

20,294,044

—

20,294,044

United

States

281,673,890

—

—

281,673,890

Total

Common

Stock

302,026,337

129,038,233

—

431,064,570

Exchange-Traded

Funds

9,729,016

—

—

9,729,016

Preferred

Stock

—

574,417

—

574,417

Short-Term

Investments

5,201,000

—

—

5,201,000

Total

Investments,

at

fair

value

$

316,956,353

$

129,612,650

$

—

$

446,569,003

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

—

1,461,345

—

1,461,345

Total

Assets

$

316,956,353

$

131,073,995

$

—

$

448,030,348

Liabilities

Table

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

$

—

$

(

332,235

)

$

—

$

(

332,235

)

Written

Options

—

(

610,009

)

—

(

610,009

)

Total

Liabilities

$

—

$

(

942,244

)

$

—

$

(

942,244

)

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

T

At

May

31,

2023,

the

following

forward

foreign

currency

contracts

were

outstanding

for

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund:

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

10,259,938

GBP

8,400,000

Barclays

Bank

PLC

06/13/23

$

(

191,780

)

USD

498,287

GBP

400,000

Brown

Brothers

Harriman

&

Co.

06/13/23

586

USD

8,173,882

CAD

11,200,000

Brown

Brothers

Harriman

&

Co.

06/13/23

(

79,081

)

USD

338,306

AUD

500,000

Citibank

N.A.

06/13/23

12,942

USD

371,756

CAD

500,000

Citibank

N.A.

06/13/23

3,320

USD

337,438

CHF

300,000

Morgan

Stanley

&

Co.

International

PLC

06/13/23

7,602

USD

16,827,089

JPY

2,193,300,000

Standard

Chartered

Bank

06/13/23

1,057,111

USD

7,133,578

AUD

10,600,000

Standard

Chartered

Bank

06/13/23

235,857

USD

1,539,782

EUR

1,400,000

Standard

Chartered

Bank

06/13/23

42,332

USD

4,789,288

CHF

4,400,000

Standard

Chartered

Bank

06/13/23

(

48,308

)

USD

20,275,746

EUR

18,900,000

State

Street

Bank

and

Trust

Co.

06/13/23

60,184

USD

741,684

JPY

98,800,000

The

Bank

of

New

York

Mellon

06/13/23

31,306

USD

703,228

JPY

96,400,000

The

Bank

of

New

York

Mellon

06/13/23

10,105

GBP

300,000

USD

374,794

The

Bank

of

New

York

Mellon

06/13/23

(

1,518

)

CAD

300,000

USD

223,188

The

Bank

of

New

York

Mellon

06/13/23

(

2,126

)

EUR

600,000

USD

651,185

The

Bank

of

New

York

Mellon

06/13/23

(

9,422

)

$

1,129,110

At

May

31,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund:

Description

Counterparty

Put/Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Consumer

Staples

Select

Sector

SPDR

Fund

BNP

Paribas

Call

06/02/23

USD

77.340

265,117

USD

19,266,052

$

223,308

$

—

Financial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

06/16/23

USD

32.650

1,481,596

USD

47,055,489

1,214,761

(

252,483

)

FTSE

100

Index

Barclays

Bank

PLC

Call

06/30/23

GBP

7,834.440

5,776

GBP

43,132,280

474,113

(

28,963

)

Health

Care

Select

Sector

SPDR

Fund

BNP

Paribas

Call

06/16/23

USD

134.930

229,808

USD

29,376,357

458,972

(

575

)

Industrial

Select

Sector

SPDR

Fund

UBS

AG

Call

06/02/23

USD

101.620

548,653

USD

53,137,043

995,805

(

853

)

Nikkei

225

Index

UBS

AG

Call

06/30/23

JPY

31,116.430

93,399

JPY

2,884,897,104

397,259

(

327,135

)

$

3,764,218

$

(

610,009

)

Currency

Abbreviations:

AUD

Australian

Dollar

CAD

Canadian

Dollar

CHF

Swiss

Franc

EUR

EU

Euro

GBP

British

Pound

JPY

Japanese

Yen

USD

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

33,684,892

Gross

Unrealized

Depreciation

(

31,778,378

)

Net

Unrealized

Appreciation

$

3,813,028

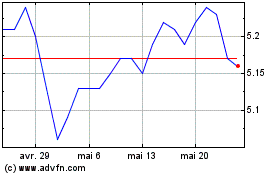

Voya Global Equity Divid... (NYSE:IGD)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Voya Global Equity Divid... (NYSE:IGD)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024