Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

04 Janvier 2024 - 7:03PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN ISSUER

PURSUANT

TO RULE 13a-16 OR 15b-16 OF

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of January, 2024

IRSA

Inversiones y Representaciones Sociedad Anonima

(Exact name of Registrant as specified in its charter)

IRSA

Investments and Representations Inc.

(Translation of registrant´s name into English)

Republic

of Argentina

(Jurisdiction of incorporation or organization)

Carlos

Della Paolera 261 9th Floor

(C1001ADA)

Buenos

Aires, Argentina

(Address of principal

executive offices)

Form 20-F ⌧ Form

40-F ☐

Indicate by

check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐ No

x

IRSA

INVERSIONES Y REPRESENTACIONES SOCIEDAD ANONIMA

(THE

“COMPANY”)

REPORT

ON FORM 6-K

Buenos

Aires, January 4, 2024 – IRSA Inversiones y Representaciones

S.A. (NYSE:IRS;BYMA:IRSA), the Company

reported that its Board of Directors has decided to establish the

terms and conditions for the acquisition of the common shares

issued by the Company under the provisions of Section 64 of Law

Nº 26,831 and the Rules of the Comision Nacional de Valores

(“CNV”).

To make

such decision, the Board of Directors has considered the economic

and market situation, as well as the discount of the current share

price in relation to the fair value of the assets, determined by

independent appraisers, and its objective is to strengthen the

shares and reduce the fluctuations in the market value, that does

not reflect the real economic value of the assets.

Consequently,

the Board of Directors based on the aforementioned arguments, with

no objections from the Audit Committee and the favorable opinion of

the Supervisory Committee and independent accountant, has arranged

for the Company to acquire its own shares under the terms of

Article 64 of the Law Nº 26,831 and the CNV Regulations. In

line with this, the Board of Directors has established the

following terms and conditions for the acquisition of own shares

issued by the Company:

(i)

Maximum amount of

the investment: Up to ARS 6,500,000,000.

(ii)

Maximum number of

shares to be acquired: Up to 10% of the capital stock of the

Company, as established by the applicable laws and

regulations.

(iii)

Daily limitation on

market transactions: In accordance with the applicable regulation,

the limitation will be up to 25% of the average volume of the daily

transactions for the Shares and ADS in the markets during the

previous 90 days.

(iv)

Payable

Price: Up to USD 10.00 per GDS and up to a maximum value in Pesos

of ARS 1,200 per Share. The maximum price

may be modified by the Board of Directors, and both the National

Securities Commission (“CNV”) and the market must be

informed.

(v)

Period

in

which the acquisitions will take place: until 180 days, beginning

the day following to the date of publication of the information in

the Daily Bulletin of the Buenos Aires Stock Exchange ("BCBA"), by

account and order of Bolsas y Mercados Argentinos SA ("BYMA") in

accordance with the delegation of powers established in Resolution

No. 18,629 of the CNV, subject to any renewal or extension of the

term, which will be reported to the investing public.

(vi)

Origin

of the

Funds: The acquisitions will be made with realized and liquid

earnings pending of distribution of the Company and/or freely

available reserves and/or facultative reserves. The Company has the

liquidity to make the acquisitions without affecting its solvency

as follows from the quarterly financial statements of the Company

as of September 30, 2023, and the reports of the independent

accountant and the Supervisory Committee, made for this

purpose.

(vii)

Outstanding

Shares: For informational

purposes, it is reported that as of September 30, 2023, the Company

had issued 736,421,306 ordinary shares with ARS 10.00 nominal

value, with the right to one vote per share totaling a capital sock

of ARS 7,364,213,060. Subsequently, and pursuant to the exercise of

warrants in the period

between November 17 and 25, 2023, 401,518 book-entry ordinary

shares with a nominal value of ARS 10 were issued, bringing the

number of shares issued to 736,822,824 ordinary shares of VN ARS

10.00, and the stock capital of the Company amounts to ARS

7,368,228,240, leaving a total of 79,319,038 warrants

outstanding.

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of

Buenos Aires, Argentina.

|

|

IRSA Inversiones y Representaciones Sociedad

Anónima

|

|

|

|

|

|

|

|

January 4,

2024

|

By:

|

/s/ Saúl

Zang

|

|

|

|

|

Saúl

Zang

|

|

|

|

|

Responsible for the

Relationship with the Markets

|

|

|

|

|

|

|

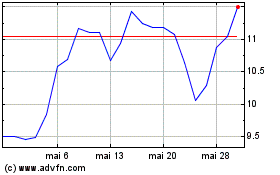

IRSA Inversiones and Rep... (NYSE:IRS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

IRSA Inversiones and Rep... (NYSE:IRS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024