Dreyfus Strategic Municipals, Inc. (LEO) Releases Fund Statistics

26 Avril 2010 - 7:15PM

Business Wire

The following information for Dreyfus Strategic Municipals, Inc.

(NYSE: LEO) is as of March 31, 2010 (except as otherwise noted),

and is subject to change at any time. All percentages are based on

total net assets (except as otherwise noted).

Dreyfus Strategic Municipals,

Inc.

Symbol : “LEO”

As of March 31, 2010

Portfolio Overview

Sector Distribution (Top Five)

Subject to AMT 17% Health Care 12% Number of Issues 167

Transportation 11% Average maturity 20yrs Prerefunded 9% Effective

maturity 9yrs Electric 8% Duration 5.93 Education 7% Average coupon

5.90% Average dollar price $101.293

State Distribution (Top Five)

Pre-refunded securities 9% California 15% Leverage 37% Texas 10%

Michigan 8%

Market Summary

Wisconsin 5% Market price range (52 weeks) $8.72-$6.57 Arizona 4%

NAV range (52 weeks) $8.53-$7.22 Market price $8.50

Call Schedule (Through 2014)

NAV $8.30 2010 14% Premium/(discount) 2.410 2011 3% Average daily

volume (52 weeks) 83,265 2012 10% Shares outstanding 60.77MM 2013

3% Net assets $773,768,408 2014 2%

Portfolio Quality*

Market Yield and Dividend

Rate**

AAA 29% Current market yield 6.38% AA 16% Current dividend rate

$0.049 A 21% BBB 20% BB 2% B

CCC

Not Rated

2%

1%

9%

* The percentages of these ratings are calculated based on

the higher of Standard & Poor's or Moody's for individual

issues.

** The market yield is calculated

by multiplying the current market distribution by 12 and dividing

by the market price per share of $8.50 as of March 31, 2010. Past

Performance is no guarantee of future performance and price and

yield will vary.

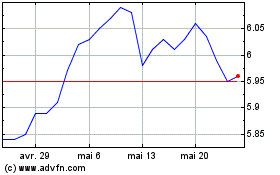

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024