FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated September

27, 2021

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro

– Brazilian Agricultural Real Estate Company

(Translation

of Registrant’s Name)

1309

Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address

of principal executive offices)

Gustavo

Javier Lopez,

Administrative

Officer and Investor Relations Officer,

Tel.

+55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309

Av. Brigadeiro Faria Lima, 5th floor

São

Paulo, São Paulo 01452-002, Brazil

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not

applicable.

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES

AGRÍCOLAS

Publicly-Held Company with Authorized Capital

Corporate Taxpayer’s ID (CNPJ/MF) No. 07.628.528/0001-59

State Registry (NIRE) 35.300.326.237

CALL NOTICE

ORDINARY AND EXTRAORDINARY SHAREHOLDERS’

MEETING

The Shareholders of BrasilAgro - Companhia Brasileira

de Propriedades Agrícolas (“Company”) are invited, pursuant to article 124 of Law No. 6,404, dated December 15, 1976,

as amended (“Corporations Act”), and articles 3 and 5 of CVM Instruction No. 481, dated December 17, 2009, as amended (“ICVM

481”), and CVM Instruction No. 622/2020 (“ICVM 622”), to attend the Ordinary and Extraordinary Shareholders’ Meeting

of the Company, to be held using an online only format, on October 27, 2021, at 2 p.m., on first notice, (“Meeting”)

in order to resolve on the following Agenda:

1.1. To examine the management accounts,

analyze, discuss and, when applicable, vote on the Management’s Annual Report and the Company’s Financial Statements, including

the Independent Auditors’ opinion and the Fiscal Council Report, relating to the fiscal year ended on June 30, 2021.

1.2. To resolve on the allocation of the

net profits reported for the fiscal year ended on June 30, 2021, and the consequent distribution of dividends.

1.3. To resolve on the determination of

the number of the members to comprise the Company’s Board of Directors, pursuant to the Company’s Bylaws, as well as on the

election of the members (sitting members and alternates) of the Board of Directors.

1.4. To establish the Company’s management

annual global compensation limit for the fiscal year initiated on July 1, 2021.

1.5. To resolve on the election of the

sitting members and the alternate members of the Company´s Fiscal Council, as well as to establish the global annual compensation

of the elected members that, pursuant to the third paragraph of Article 162 of the Corporations Act, shall not be less, for each member,

than ten percent (10%) of the average compensation assigned to the Company’s executive officers.

2. Extraordinary Meeting:

2.1. To decide on the amendment of Article

6 of the Company's Bylaws and its consolidation, in order to reflect the capital increases approved by the Board of Directors at meetings

held on February 3, 2021 and May 14, 2021.

General Information:

Shareholders or their legal representatives are

required to present copies of the following documents to take part in and/or vote at the Meeting: (i) natural persons: (a)

photo ID, (b) if represented by proxy, the power of attorney granting special powers, and, if applicable (c) a photo ID of the proxy;

(ii) legal entities: (a) the most recent restated Bylaws or Articles of Incorporation, (b) corporate documents proving powers

of representation, (c) photo ID of the SP - 28693169v1 legal representative(s), (d) if represented by proxy, the power of attorney granting

special powers, and, if applicable, (e) a photo ID of the proxy; and (iii) investment funds: (a) the most recent restated

fund regulations, (b) the most recent restated Bylaws or Articles of Incorporation of the portfolio manager or administrator, subject

to the fund’s voting policy, (c) corporate documents proving powers of representation, (d) photo ID of the portfolio manager’s

or administrator’s legal representative(s), (e) if represented by proxy, the power of attorney granting special powers, and, if

applicable (f) a photo ID of the proxy. In any of the above cases, the relevant person shall present evidence of its capacity as shareholder

of the Company, issued within the last 5 (five) days by the financial institution responsible for the bookkeeping of the shares (Itaú

Corretora de Valores S.A.). Shareholders may appoint a proxy to represent them at the Meeting pursuant to article 126 of the Corporations

Act and paragraph 2, article 10, of the Company’s Bylaws.

In line with article 4th of the CVM Rule No. 481/09

and according to the CVM Rule No. 165/91, as amended by CVM Rule No. 282/98, the minimum equity interest in the voting capital of the

Company required for a shareholder to request the multiple vote procedure for the election of the members of the Board of Directors is

five per cent (5%). Pursuant to article 141, §1º, of LSA, this right shall be exercised by the shareholders not later than forty-eight

(48) hours before the Meeting.

The Company notes that, in relation to the documents

above, in light of the current restrictions imposed or recommended due to the COVID-19 pandemic, on a strictly exceptional basis, (i)

it will not require a sworn translation of documents originally issued in Portuguese, English or Spanish, or which are accompanied by

the relevant translation into these languages, and (ii) it will accept those documents without signature notarization or authentication

of copies, and each shareholder shall be responsible for the accuracy and integrity of any such documents presented.

|

|

|

Attendance via Digital Platform: Pursuant

to article 5 of ICVM 481, as amended by ICVM 622, in order to participate online in the Meeting using the “Zoom” electronic

platform, up to 2 (two) business days prior to the Meeting (i.e., October 25, 2021), shareholders, their representative or attorneys-in-fact

shall send an email to the Company at (ri@brasil-agro.com) requesting to attend the Meeting. Those who fail to submit a request and the

required documents to participate online by the aforementioned deadline shall not be allowed to attend online the Meeting. The request

to participate shall be accompanied by a document identifying the shareholder, their legal representative or appointed proxy, accompanied

by the documentation described in the “General Information” item in this Call Notice, as well as the Meeting participant’s

telephone number and email address to where the Company will send the link to access the Meeting. Upon receiving a request to attend the

Meeting accompanied by the necessary documents prior to the deadline and in accordance with the conditions above, the Company shall send

a message containing a link and credentials for accessing the “Zoom” electronic platform to the email address the shareholder,

their legal representative or proxy indicated in the request to attend the Meeting. The link and access credentials provided by the Company

are personal and non-transferable, and should not be shared. The Company will not be liable for any operational or connection problems

participants might encounter or any other event or situation outside the Company’s control that might affect or prevent attendance

at the Meeting.

Participation by Remote Voting Card:

Pursuant to ICVM 481, shareholders may also exercise their voting rights by completing remote voting card and submitting it to their respective

custody agents, the bookkeeping agent responsible for the Company’s shares or directly to the Company itself, pursuant to the instructions

in the Management’s Proposal and, in the latter case, the completed card must be received by the Company no later than 7 (seven)

days prior to the Meeting date, i.e., by October 20, 2021 (inclusive). The Company has made remote voting cards available on the CVM’s

and B3 S.A. - Brasil, Bolsa, Balcão’s (“B3”) websites, with instructions explaining how to fill out the card

and the required documentation.

Copies of the documents and proposals related

to Meeting agenda are available to shareholders at the Company’s headquarters and on its website (www.brasil-agro.com), as well

as on the websites of B3 S.A. – Brasil, Bolsa, Balcão (“B3”) (http://www.b3.com.br/pt_br/) and Brazilian Securities

and Exchange Comission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br).

In order to contact the Investor Relations Department,

please dial (55 11) 3035-5350 or e-mail ri@brasil-agro.com.

São Paulo, September 27, 2021.

Eduardo S. Elsztain

Chairman of the Board of Directors

Investor Relations:

Phone: +55 (11) 3035-5374

E-mail: ri@brasil-agro.com

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

Date: September

27, 2021

|

By:

|

/s/

Gustavo Javier Lopez

|

|

|

|

Name:

|

Gustavo

Javier Lopez

|

|

|

|

Title:

|

Administrative

Officer and

Investor

Relations Officer

|

4

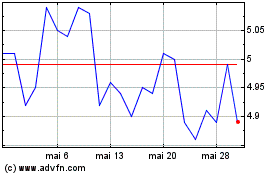

Brasilagro Cia Brasileir... (NYSE:LND)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brasilagro Cia Brasileir... (NYSE:LND)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025