FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated April

11, 2023

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro

– Brazilian Agricultural Real Estate Company

(Translation

of Registrant’s Name)

1309

Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address

of principal executive offices)

Gustavo

Javier Lopez,

Administrative

Officer and Investor Relations Officer,

Tel.

+55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309

Av. Brigadeiro Faria Lima, 5th floor

São

Paulo, São Paulo 01452-002, Brazil

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not

applicable.

Material

Fact

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

Publicly-Held

Company with Authorized Capital

Corporate

Taxpayer’s ID (CNPJ/MF) No. 07.628.528/0001-59

State

Registry (NIRE) 35.300.326.237

Farm

Sale

BrasilAgro

– Companhia Brasileira de Propriedades Agrícolas (B3: AGRO3) (NYSE:LND), complying with the provisions of Article 157,

Paragraph 4 of Law 6404/76 and of Instruction No. 358/02 of the Brazilian Securities and Exchange Commission (“CVM”), informs

its shareholders and the market in general that it has sold the entire remaining area of Fazenda Araucária, a rural property located

in Mineiros in the state of Goiás. The sold area was subject of two contracts, as follows:

Sale

1: 332 hectares (215 arable ha) of Baixadai Area for 297 soybeans bags per arable hectare, or R$8.5 million

(~R$39,558/arable ha). The buyer has already made an initial payment of R$1.6 million. The duration of this sale is 2.07 years.

From the accounting perspective, the value of this area of the Farm

in the company's books is R$1.9 million (acquisition + investments net of depreciation). The expected IRR (Internal Rate of Return),

in Reais, in this transaction is 13.6% per year.

Sale

2: 5,185 hectares (3,796 arable ha) of Mixed Area (Baixadai and Plateau areas) for 790 soybeans bags per

arable hectare, or R$409.3 million (~R$107,816/arable ha). The buyer has already made an initial payment of R$78.7 million. The duration

of this sale is 1.99 years.

From the accounting perspective, the value of

this area of the Treasury in the company's books is R$59.0 million (acquisition + investments net of depreciation). The expected IRR

(Internal Rate of Return), in Reais, in this transaction is 14.5% per year.

The

two sales add up to a total area of 5,517 hectares (4,011 arable ha) and

a total value of R$417.8 million, equivalent to 3,075,278 soybeans bag.

It

is important to note that the sold areas have distinct topography and soil content. The Plateau Areas are more profitable, as they are

flat and have higher percentage of clay compared to the Baixada Areas and, therefore, worth more. The Baixada Areas have less clay and

limited suitability for second crop.

The

Araucaria Farm

Fazenda

Araucária, located in Mineiros in the state of Goiás, was acquired in April 2007 for R$76.0 million and had a total area

of 9.665 hectares (7.012 arable ha). At the time of purchase, the property was practically all in operation and, therefore, required

little CAPEX for transformation of the areas, which have different characteristics of topography and soil, divided between Baixada

and Plateau areas, with aptitude for grain crops (crop and second crop) and sugarcane.

The

areas were sold in 7 different contracts, the first sale was in May 2013 and the last one this year. The sales face value of the property

was R$602.0 millionii. The expected Consolidated IRR, in Reais, for this farm is 16.2% per year.

| i | Consists

in Areas with limited suitability for second crop and low clay levels. |

| ii | Considers

the amount received up to date and projections of receivables from this farm sales. |

A

BrasilAgro

This

sales are another major milestone for the Company, as it closes the cycle of this property within our portfolio, and confirms our ability

to generate and capture value in the development of agricultural properties, optimizing operating and real estate returns.

Since

the beginning of operations in May 2006, these were the main highlights related to real estate activities:

| ● | We

bought 320,000 hectares (211,000 arable ha) and developed more than 140,000 hectares. |

| ● | We

invested more than R$1.2 billion in the acquisitions and development of the properties. |

| ● | We

have made 26 property sales (103,000 total ha/ 69,000 arable ha) a total of R$2.2

billioniii. |

| ● | Sales

generated unleveraged IRRs between 13.6% and 56.5%. |

| ● | The

Company started the portfolio turnover in 2012 and to date, the average annual sale value

is R$199.0 million and in the past 5 years it was R$317.5 million. |

We

remain confident in our strategy and our ability to deliver results and find innovative and efficient solutions to continue growing consistently,

adding value to our shareholders.

São

Paulo, April 11, 2023.

Gustavo

Javier Lopez

IRO

& CFO

Investor

Relations:

Phone:

+55 (11) 3035-5374

Email:

ri@brasil-agro.com

| iii | Considers

the face value on the date of sales. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date: April

11, 2023 |

By: |

/s/

Gustavo Javier Lopez |

| |

|

Name: |

Gustavo

Javier Lopez |

| |

|

Title: |

Administrative

Officer and

Investor

Relations Officer |

3

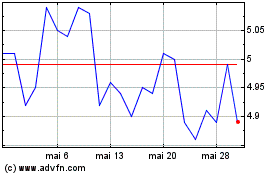

Brasilagro Cia Brasileir... (NYSE:LND)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Brasilagro Cia Brasileir... (NYSE:LND)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025