AG Mortgage Investment Trust, Inc. (NYSE: MITT) (the “Company”)

announced today that it has priced an underwritten public offering

of $30 million aggregate principal amount of its 9.500% senior

notes due 2029 (the “Notes”). The Company has granted the

underwriters a 30-day option to purchase up to an additional $4.5

million aggregate principal amount of the Notes to cover

over-allotments. The offering is expected to close on January 26,

2024, subject to the satisfaction of customary closing

conditions.

The Company intends to apply to list the Notes on the New York

Stock Exchange under the symbol “MITN” and, if the application is

approved, expects trading in the Notes on the New York Stock

Exchange to begin within 30 days after the Notes are first issued.

The Notes have received an investment grade rating of BBB- from

Egan-Jones Ratings Company, an independent, unaffiliated rating

agency.

The Company plans to use the net proceeds from the offering for

general corporate purposes, which may include acquisition of

Residential Investments and Agency RMBS, subject to the Company’s

investment guidelines, and to the extent consistent with

maintaining its REIT qualification and exemption from registration

under the Investment Company Act of 1940, as amended, and for

working capital, which may include, among other things, the

repayment of existing indebtedness, including the repurchase or

repayment of a portion of the 6.75% Convertible Senior Notes due

2024 (the “Convertible Notes”), which were assumed by a subsidiary

of the Company in connection with the Company’s recently completed

acquisition of Western Asset Mortgage Capital Corporation. The

Convertible Notes can be redeemed at the Company's option on or

after June 15, 2024 and mature on September 15, 2024.

The Notes will be senior unsecured obligations of the Company,

and pay interest quarterly in cash on February 15, May 15, August

15 and November 15 of each year, commencing May 15, 2024. The Notes

will mature on February 15, 2029, and may be redeemed, in whole or

in part, at any time, or from time to time, at the Company’s option

on or after February 15, 2026.

Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, UBS

Securities LLC, Keefe, Bruyette & Woods, Inc. and Piper Sandler

& Co. are serving as joint book-running managers for the

offering.

The offering will be made pursuant to the Company’s currently

effective shelf registration statement filed with the Securities

and Exchange Commission (the “SEC”).

The offering of these Notes will be made only by means of a

prospectus and a related prospectus supplement, a copy of which may

be obtained by contacting

Morgan Stanley & Co. LLC 180 Varick St., 2nd Floor, New

York, NY 10014 Attn: Prospectus Department Toll-Free:

1-800-584-6837

RBC Capital Markets, LLC Brookfield Place, 200 Vesey Street, 8th

Floor, New York, NY 10281-8098 Attn: Transaction Management

Telephone: 1-866-375-6829 Email:

rbcnyfixedincomeprospectus@rbccm.com

UBS Securities LLC 1285 Avenue of the Americas, New York, NY

10019 Attn: Prospectus Department Toll-Free: 1-888-827-7275

Keefe, Bruyette & Woods, Inc. 787 Seventh Avenue, 4th Floor,

New York, NY 10019 Attn: Capital Markets Toll-Free:

1-800-966-1559

Piper Sandler & Co. 1251 Avenue of the Americas, 6th Floor,

New York, NY 10020 Attn: Debt Capital Markets Email:

fsg-dcm@psc.com

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes or any other securities,

nor shall there be any sale of such Notes or any other securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or other

jurisdiction.

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a diversified credit and real

estate investing platform within TPG.

Additional information can be found on the Company’s website at

www.agmit.com.

About TPG Angelo Gordon

Founded in 1988, Angelo, Gordon & Co., L.P. (“TPG Angelo

Gordon”) is a diversified credit and real estate investing platform

within TPG. The platform currently manages approximately $76

billion across a broad range of credit and real estate strategies.

For more information, visit www.angelogordon.com.

*TPG Angelo Gordon’s currently stated assets under management

(“AUM”) of approximately $76 billion as of September 30, 2023

reflects fund-level asset-related leverage. Prior to May 15, 2023,

TPG Angelo Gordon calculated its AUM as net assets under management

excluding leverage, which resulted in TPG Angelo Gordon AUM of

approximately $53 billion as of December 31, 2022. The difference

reflects a change in TPG Angelo Gordon’s AUM calculation

methodology and not any material change to TPG Angelo Gordon’s

investment advisory business. For a description of the factors TPG

Angelo Gordon considers when calculating AUM, please see the

disclosure at www.angelogordon.com/disclaimers/.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The Company intended such statements to be covered by the

safe harbor provisions for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995 and includes

this statement for purposes of complying with the safe harbor

provisions. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,”

“projects,” “could,” “estimates” or variations of such words and

other similar expressions are intended to identify such

forward-looking statements, which generally are not historical in

nature, but not all forward-looking statements include such

identifying words. Forward-looking statements regarding the Company

include, but are not limited to, statements regarding the offering

and the intended use of proceeds. These forward-looking statements

are subject to various risks and uncertainties. Accordingly, there

are or will be important factors that could cause actual outcomes

or results to differ materially from those indicated in these

statements. The Company believes these factors include, without

limitation, the risk factors contained in the Company’s filings

with the SEC, including those described in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

the Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023, the joint proxy statement/prospectus declared

effective by the SEC on September 29, 2023, and in other reports

and documents filed by the Company with the SEC from time to time.

Copies are available free of charge on the SEC’s website,

http://www.sec.gov/. Moreover, other risks and uncertainties of

which the Company is not currently aware may also affect the

Company’s forward-looking statements and may cause actual results

and the timing of events to differ materially from those

anticipated. The forward-looking statements made in this press

release are made only as of the date of this press release or as of

the dates indicated in the forward-looking statements, even if they

are subsequently made available by the Company on its websites or

otherwise. The Company undertakes no obligation to update or

supplement any forward-looking statements to reflect any change in

our expectations or any change in events, conditions or

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240123192837/en/

Investors AG Mortgage Investment Trust, Inc. Investor Relations

(212) 692-2110 ir@agmit.com

Media AG Mortgage Investment Trust, Inc.

media@angelogordon.com

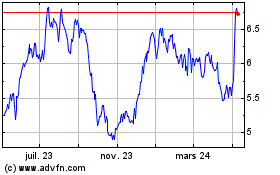

AG Mortgage Investment (NYSE:MITT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

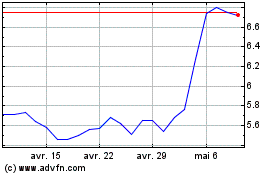

AG Mortgage Investment (NYSE:MITT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024