0001816613false0001816613mkfg:CommonStock0.0001ParValuePerShare2Member2024-07-262024-07-260001816613mkfg:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStock0.0001ParValue1Member2024-07-262024-07-2600018166132024-07-262024-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 26, 2024

Markforged Holding Corporation

(Exact name of registrant as specified in its charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

|

|

|

001-39453 |

|

92-3037714 |

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

60 Tower Road Waltham, MA |

|

02451 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(866) 496-1805

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class: |

|

Trading Symbol: |

|

Name of Each Exchange on Which Registered: |

Common Stock, $0.0001 par value per share |

|

MKFG |

|

New York Stock Exchange |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock, $0.0001 par value |

|

MKFG.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

On July 26, 2024, Markforged Holding Corporation, through its wholly-owned subsidiary, MarkForged, Inc. (the “Company”), entered into a Lease Termination Agreement (the “Termination Agreement”), effective as of July 24, 2024 (the “Effective Date”), with GRE Riverworks, LLC, a Delaware limited liability company (the “Landlord”), in connection with the termination of the Office Lease, dated July 29, 2020, by and between the Company, as tenant, and the Landlord (the “Lease Agreement”), for certain premises in the building known as Riverworks Innovation Center and located at 480 Pleasant Street, Watertown, Massachusetts 02472 (the “Premises”) and consisting of 36,291 square feet of office space. The Lease Agreement was originally expected to expire on July 31, 2028. Pursuant to the Termination Agreement, the Company and the Landlord agreed to terminate the Lease Agreement, effective as of August 31, 2024 (the “Early Termination Date”), subject to the terms and conditions therein. The Termination Agreement provides that the Company will surrender the Premises on or prior to the Early Termination Date and will have no further rent obligations after the Early Termination Date.

As consideration for the Landlord’s agreement to terminate the Lease Agreement as of the Early Termination Date, the Company agreed to pay the Landlord, as an additional fee (the “Termination Fee”), funds in the amount of $2,750,000.

The Landlord holds a Letter of Credit in the amount of $625,415 per the terms and conditions of the Lease Agreement and will initiate the return of the Letter of Credit to the Company by September 30, 2024 pursuant to the terms of the Termination Agreement.

The foregoing description of the Termination Agreement is not complete and is qualified in its entirety by reference to the full text of the Termination Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MARKFORGED HOLDING CORPORATION |

|

|

|

|

Date: July 30, 2024 |

|

|

|

By: |

|

/s/ Stephen Karp |

|

|

|

|

|

|

Stephen Karp |

|

|

|

|

|

|

General Counsel and Secretary |

LEASE TERMINATION AGREEMENT

THIS LEASE TERMINATION AGREEMENT (“Agreement”) is made and entered into as of day of July 24, 2024 by and between GRE RIVERWORKS, LLC, a Delaware limited liability

company (“Landlord”) and MARKFORGED, INC., a Delaware corporation (“Tenant”).

WITNESSETH:

A.Landlord and Tenant have heretofore entered into that certain Office Lease dated July 29, 2020 (which lease, together with any and all amendments, assignments and extensions is hereinafter referred to as the “Lease”) for premises commonly known as Suite C-10 consisting of approximately 36,291 rentable square feet (the “Premises”) in the building (the “Building”) known as Riverworks Innovation Center and located at 480 Pleasant Street, Watertown, Massachusetts 02472.

B.Landlord and Tenant desire to terminate the Lease, all on and subject to the terms and conditions hereof.

NOW, THEREFORE, in consideration of the mutual terms and conditions herein contained, the parties hereby agree as follows:

1.Termination. The Term of the Lease shall terminate and expire on August 31, 2024 (the “Early Termination Date”). The Premises shall be surrendered by Tenant no later than the Early Termination Date, and Tenant shall have until 5:00 p.m. on the Early Termination Date to remove all of Tenant's cabling, wiring, telecommunication equipment, and personal property. Tenant shall comply with its surrender obligations under Section 2.04 and all other applicable sections of the Lease. Without limitation to the foregoing, on or prior to the Early Termination Date, Tenant shall remove (i) the Exterior Sign pursuant to Section 5.05(b) of the Lease, (ii) any Generator (and screening around the same) pursuant to Section 3(b) of Exhibit D attached to the Lease, (iii) the Dish pursuant to Section 5(h) of Exhibit D attached to the Lease, and (iv) any Supplemental HVAC pursuant to Section 6 of Exhibit D attached to the Lease. Additionally, Tenant shall fully comply with all obligations under the Lease through and including the Early Termination Date.

2.Rent Payments. Tenant shall continue to be responsible for all sums due under the Lease through the Early Termination Date. Notwithstanding anything in the Lease or this Agreement to the contrary, provided the terms and conditions of this Agreement are satisfied and the Lease is terminated on the Early Termination Date, Tenant shall not be responsible for payment of any underpayment, and Landlord shall not be responsible for reimbursement of any overpayment, of the Tax Payment and Expense Payment payable with respect to Calendar Year 2024 following the reconciliation of the estimated and the actual Tax Payment and Expense Payment for Calendar Year 2024.

3.Termination Fee. As a condition to the effectiveness of this Agreement, Tenant shall pay Landlord a non-refundable lease termination fee in the amount of $2,750,000.00 (“Termination Fee”) contemporaneously with Tenant’s execution and delivery of this Agreement. The Termination Fee must be paid in immediately available funds.

4.Letter of Credit. Landlord holds a Letter of Credit in the amount of $625,415.00 pursuant to the terms and conditions of Article 4 of the Lease. Landlord shall initiate issuance for

the return of the Letter of Credit (or any unapplied proceeds therefrom) in Landlord’s possession to Tenant by September 30, 2024.

5.Access to the Premises. Notwithstanding anything to the contrary in the Lease, from and after the date of this Agreement, Landlord and its employees, agents, contractors, and representatives shall have the right to enter the Premises for any purpose, including, without limitation, to show the Premises to prospective tenants and to permit inspection of the Premises by space planners, contractors and other parties in connection with improvements which may be constructed in the Premises.

6.Representations. Each party represents to the other that it has full power and authority to execute this Agreement. Each party represents to the other that it has not made any assignment, sublease, transfer, conveyance or other disposition of the Lease or any interest in the Lease or the Premises. Tenant represents that Tenant has not, at any time, done or suffered, and will not do or suffer, any act or thing whereby the Premises or any part thereof are or may be in any way charged, affected or covered by any lien or claim, and shall indemnify and hold Landlord harmless from all liability, expenses, damages or costs arising from same, including without limitation attorneys’ fees. Tenant hereby further represents, warrants and agrees that: to the best of Tenant's knowledge as of the date of this Agreement, (i) there exists no breach, default or event of default by Landlord under the Lease, or any event or condition which,with the giving of notice or passage of time or both, would constitute a breach, default or event of default by Landlord under the Lease; and (ii) Tenant has no current offset or defense to its performance or obligations under the Lease. Tenant hereby waives and releases all demands, charges, claims, accounts or causes of action of any nature against Landlord or Landlord's employees or agents, including without limitation, both known and unknown demands, charges, claims, accounts, and causes of action that have previously arisen out of or in connection with the Lease.

7.Holding Over. Tenant shall pay Landlord 200% of the amount of Rent otherwise then applicable under the Lease, or the highest rate permitted by law, whichever shall be less, prorated on a per diem basis, for each day that Tenant (or any subtenants or other occupants of the Premises) retains possession of the Premises or any part thereof after the Early Termination Date, together with all damages sustained by Landlord on account thereof. The foregoing provisions shall not serve to extend the Term (although Tenant shall be bound to comply with all provisions of the Lease until Tenant vacates the Premises).

8.No Disclosure. Tenant agrees that it shall not disclose any of the matters set forth in this Agreement or disseminate or distribute any information concerning the terms, details or conditions hereof to any person, firm or entity without obtaining the express written approval of Landlord.

9.No Offer. This Agreement shall not be binding until executed and delivered by both parties. This Agreement shall not be relied upon by any other party, individual, corporation, partnership or other entity as a basis for terminating its lease with Landlord.

10.Entire Agreement. The mutual obligations of the parties as provided herein are the sole consideration for this Agreement, and no representations, promises or inducements have been made by the parties other than as appear in this Agreement. This Agreement may not be amended except in writing signed by both parties

11.Miscellaneous. Warranties, representations, agreements and obligations contained in this Agreement shall survive the execution and delivery of this Agreement and shall survive any and all performances in accordance with this Agreement. This Agreement may be executed in any number of counterparts which together shall constitute the Agreement. If any party obtains a

judgment against the other party by reason of breach of this Agreement, reasonable attorneys’ fees as fixed by the court shall be included in such judgment. This Agreement and the terms and provisions hereof shall inure to the benefit of and be binding upon the heirs, successors and assigns of the parties. This Agreement shall be construed and enforced in accordance with the laws of the State of Massachusetts. Facsimile or electronic signatures shall constitute original signatures. Capitalized terms used but not defined herein shall have the same meaning ascribed to them in the Lease.

12.Preferential Rights. Any and all preferential rights in the Lease such as renewal/extension options, exclusive use provisions, restrictions on Landlord’s ability to lease, termination options, rights of first refusal, rights of first offer, and expansion options, are hereby deleted. The extension option set forth in Section 1 of Exhibit D attached to the Lease and the right of first offer set forth in Section 2 of Exhibit D attached to the Lease are null, void, and of no force and effect.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

|

|

|

LANDLORD: |

GRE RIVERWORKS, LLC, |

a Delaware limited liability company |

By: |

/s/ Jake Lewis |

|

Name: |

Jake Lewis |

|

Title: |

Vice President |

|

|

|

TENANT: |

MARKFORGED, INC., |

a Delaware corporation |

By: |

/s/ Assaf Zipori |

|

Name: |

Assaf Zipori |

|

Title: |

CFO |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mkfg_CommonStock0.0001ParValuePerShare2Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mkfg_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStock0.0001ParValue1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

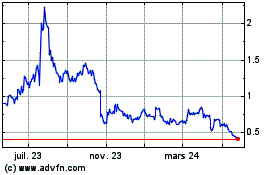

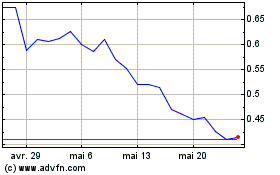

Markforged (NYSE:MKFG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Markforged (NYSE:MKFG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024