Maximus Board Authorizes Expansion to Purchase Program of Maximus Common Stock

12 Juin 2024 - 3:15PM

Business Wire

Maximus (NYSE:MMS), a leading employer and provider of

government services worldwide, announced today that its Board of

Directors has authorized an expansion to the purchase program for

Maximus common stock of up to an aggregate of $200 million. This

includes the approximately $6 million of remaining availability

under the existing stock purchase program.

Maximus intends to purchase shares opportunistically at

prevailing market prices in the open market, or in privately

negotiated transactions, with the amount and timing of purchases

depending on market conditions, corporate needs, and other

factors.

“Expansion of this program is consistent with our opportunistic

approach to purchasing our common stock,” commented Bruce Caswell,

President and Chief Executive Officer of Maximus. “Our capital

allocation priorities are unchanged and continue to be based on a

disciplined approach that we believe is most beneficial to our

shareholders.”

Since March 31, 2024, Maximus has purchased 538,978 shares for

approximately $44.5 million.

About Maximus

As a leading strategic partner to governments across the globe,

Maximus helps improve the delivery of public services amid complex

technology, health, economic, environmental, and social challenges.

With a deep understanding of program service delivery, acute

insights that achieve operational excellence, and an extensive

awareness of the needs of the people being served, our employees

advance the critical missions of our partners. Maximus delivers

innovative business process management, impactful consulting

services, and technology solutions that provide improved outcomes

for the public and higher levels of productivity and efficiency of

government-sponsored programs. For more information, visit

maximus.com.

Forward-Looking Statements

Except for historical information, all of the statements,

expectations, and assumptions contained in this press release are

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995, including statements

regarding the Company’s stock purchase program and capital

allocation priorities. Actual results may differ materially from

those explicit or implicit in the forward-looking statements.

Important factors that could cause actual results to differ

materially include, but are not limited to: the fact that common

stock purchases may not be conducted in the timeframe or in the

manner the Company expects, or at all, the Company’s capital

allocation priorities may shift and the other risk factors

disclosed in the Company’s Annual Report on Form 10-K for the year

ended September 30, 2023, as updated by the Company’s other filings

with the Securities and Exchange Commission, copies of which are

available free of charge on the Company’s website at

investor.maximus.com. The Company assumes no obligation and does

not intend to update these forward-looking statements, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240612928037/en/

Investor Relations James Francis Jessica Batt

IR@maximus.com

Media & Public Relations Eileen Cassidy Rivera

media@maximus.com

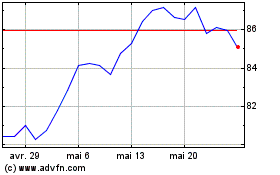

MAXIMUS (NYSE:MMS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

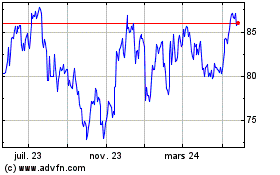

MAXIMUS (NYSE:MMS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024